RE/MAX Advanced Realty presents a compiled Housing Market Report for April 2023 in the State of Indiana based on the data presented by MIBOR. This report provides an overview of the real estate market for single-family homes, condominiums, townhouses, farms, residential, and manufactured homes covering all 16 counties in the Hoosier State for the month of April.

The data presented in this report includes key metrics such as median sales price, closed sales, days on the market, list price received, the median sold price per sqft, new listings, active inventory, and months' supply of inventory. By analyzing these metrics, we can gain insight into the current state of the real estate market and make informed predictions about future market conditions.

This report will explore the trends observed in the real estate market for the month of April and compare them to the same period in the previous year, as well as the previous month. By providing this analysis of the market, we hope to help buyers, sellers, and investors make informed decisions about their real estate transactions.

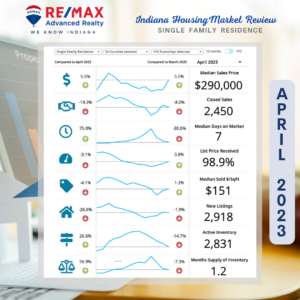

SINGLE FAMILY HOMES

Based on the data gathered, the real estate market for single-family homes in April 2023 experienced mixed results compared to the same month in the previous year and the previous month.

The median sales price in April 2023 increased by 5.5% compared to April 2022 and by the same percentage compared to March 2023, indicating a steady upward trend in housing prices. However, the closed sale price in April 2023 decreased significantly by -19.3% compared to April 2022 and by -8.0% compared to March 2023. This suggests that while homes are being listed at higher prices, they are ultimately selling for much less than they did a year ago.

The median days on the market for homes in April 2023 increased significantly by 75.0% compared to April 2022 but decreased by -30.0% compared to March 2023. This means that homes were taking longer to sell in April 2023 than in the same month in the previous year but were selling more quickly compared to the previous month.

The list price received for homes in April 2023 decreased by -3.1% compared to April 2022 but increased by 0.8% compared to March 2023, indicating some volatility in the market.

The median sold price per square foot in April 2023 decreased by -4.1% compared to April 2022 but increased by 1.3% compared to March 2023. This suggests that homes are selling for less per square foot compared to the same month last year but are selling for more compared to the previous month.

New listings for April 2023 decreased by -26.6% compared to April 2022 and by -1.9% compared to March 2023. This indicates a significant decline in the number of homes being listed for sale.

Active inventory for April 2023 increased by 26.6% compared to April 2022 but decreased by -14.7% compared to March 2023, indicating that while there were more homes available for sale compared to the same month last year, there were fewer homes on the market compared to the previous month.

Finally, the month's supply of inventory increased by 56.9% compared to April 2022 but decreased by -7.3% compared to March 2023. This metric measures the number of months it would take to sell all of the homes on the market based on the current rate of sales. The increase compared to April 2022 indicates that the supply of homes for sale is outpacing the demand, while the decrease compared to March 2023 suggests a potential increase in demand.

Overall, the data suggest that for single-family homes, the market is still experiencing some volatility, with some metrics showing upward trends and others showing declines. However, the steady increase in median sales price and median sold price per square foot compared to the previous month indicate that home prices are still trending upwards. The decrease in closed sale price and new listings, as well as the increase in median days on the market and months' supply of inventory compared to April 2022, suggest a potential slowdown in demand, while the decrease in active inventory compared to March 2023 indicates a possible increase in demand.

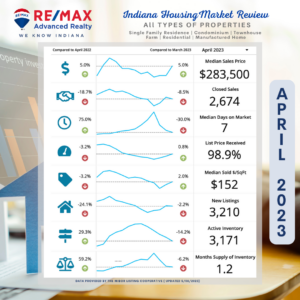

ALL TYPES OF PROPERTIES

The data above suggests that the overall real estate market for single-family residences, condominiums, townhouses, farms, residential, and manufactured homes in April 2023 experienced mixed results compared to the same month in the previous year and the previous month.

The median sales price for April 2023 increased by 5.0% compared to both April 2022 and March 2023, indicating a steady increase in housing prices. However, closed sales decreased significantly by -18.7% compared to the previous year and by -8.5% compared to the previous month, suggesting that fewer homes were sold in April 2023.

The median days on the market for April 2023 increased significantly by 75.0% compared to April 2022 but decreased by -30% compared to March 2023, indicating volatility in the market. The list price received decreased by -3.2% compared to April 2022 but increased by 0.8% compared to March 2023. The median sold price per square foot for April 2023 decreased by -3.2% compared to April 2022 but increased by 2.0% compared to March 2023.

New listings for April 2023 decreased significantly by -24.1% compared to April 2022 and by -2.2% compared to March 2023. However, active inventory increased by 29.3% compared to April 2022, but decreased by -14.2% compared to March 2023. The months supply of inventory increased by 59.2% compared to April 2022 but decreased by -6.2% compared to March 2023.

Overall, the market for single-family residences, condominiums, townhouses, farms, residential and manufactured homes appears to be in a state of flux, with some metrics trending upward and others trending downward. The steady increase in median sales prices is a positive sign for sellers, but the significant decrease in closed sales suggests a potential slowdown in the market. The decrease in new listings and the increase in active inventory suggest that supply may be outpacing demand, while the volatility in median days on the market indicates uncertainty in the market.

With the data presented above, it is important to keep in mind that real estate markets are cyclical and tend to go through periods of growth and decline. Over the long term, real estate has historically been a sound investment, short-term fluctuations in the market are to be expected.

To give you a better understanding of the housing market, it is important to speak to a trusted real estate professional with RE/MAX Advanced Realty. Get in touch with Indy’s Leading Brokerage today and have our real estate experts answer any questions you might have.