As we reach the midpoint of the year, the Central Indiana single-family homes market continues to display dynamic shifts across its counties. From the bustling urban landscapes of Hamilton County to the scenic retreats of Brown County, each area offers a distinct perspective on the current housing market. This is our interpretation based on the data provided by MIBOR Market Insights, examining trends observed from May 2024 to June 2024 and providing a comparative look at year-over-year data from June 2023 to June 2024. Whether you're a prospective buyer or seller, understanding these trends is essential for making informed real estate decisions in today's evolving market.

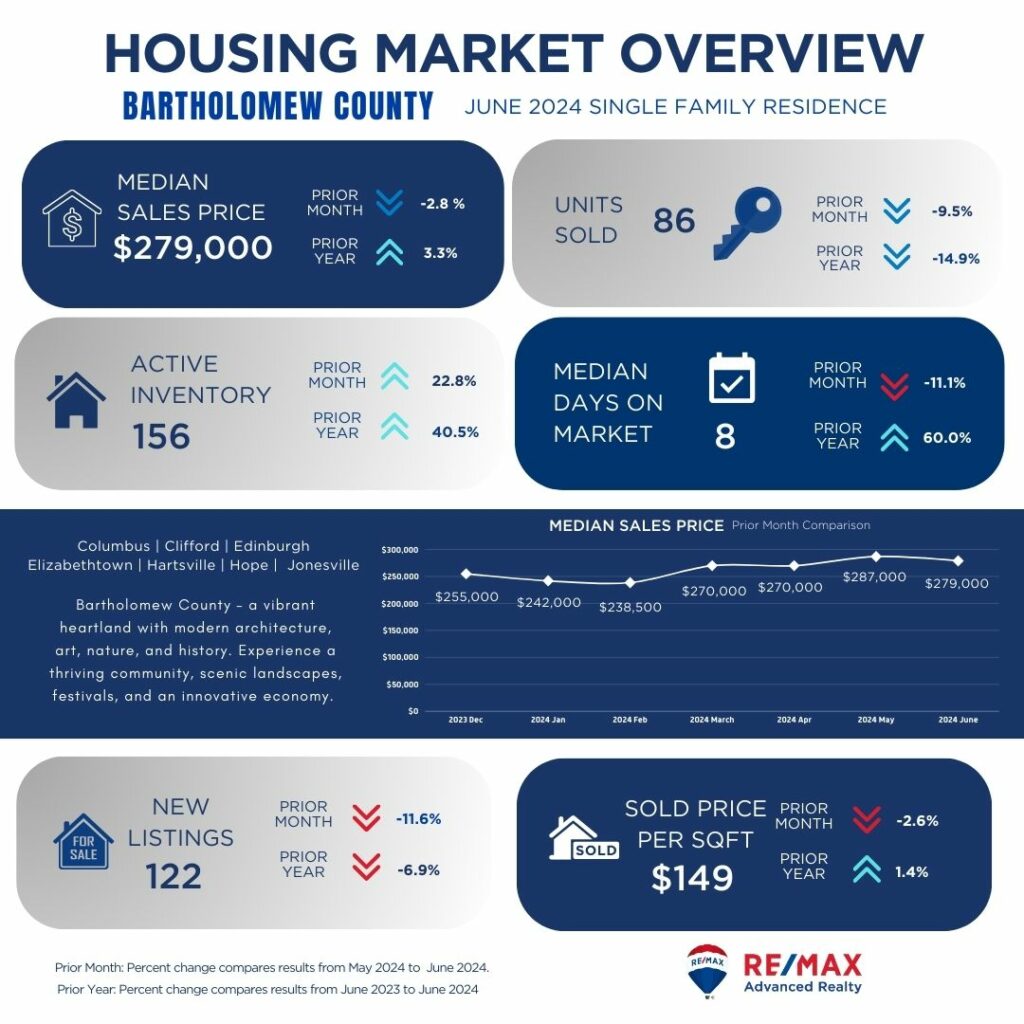

Bartholomew County shows a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The decrease in units sold suggests a slower market pace, providing buyers with more negotiating power. Active inventory has increased, offering buyers more choices, although fewer new listings may limit options. Properties are selling quickly with a low median days on market, indicating continued demand despite some price fluctuations.

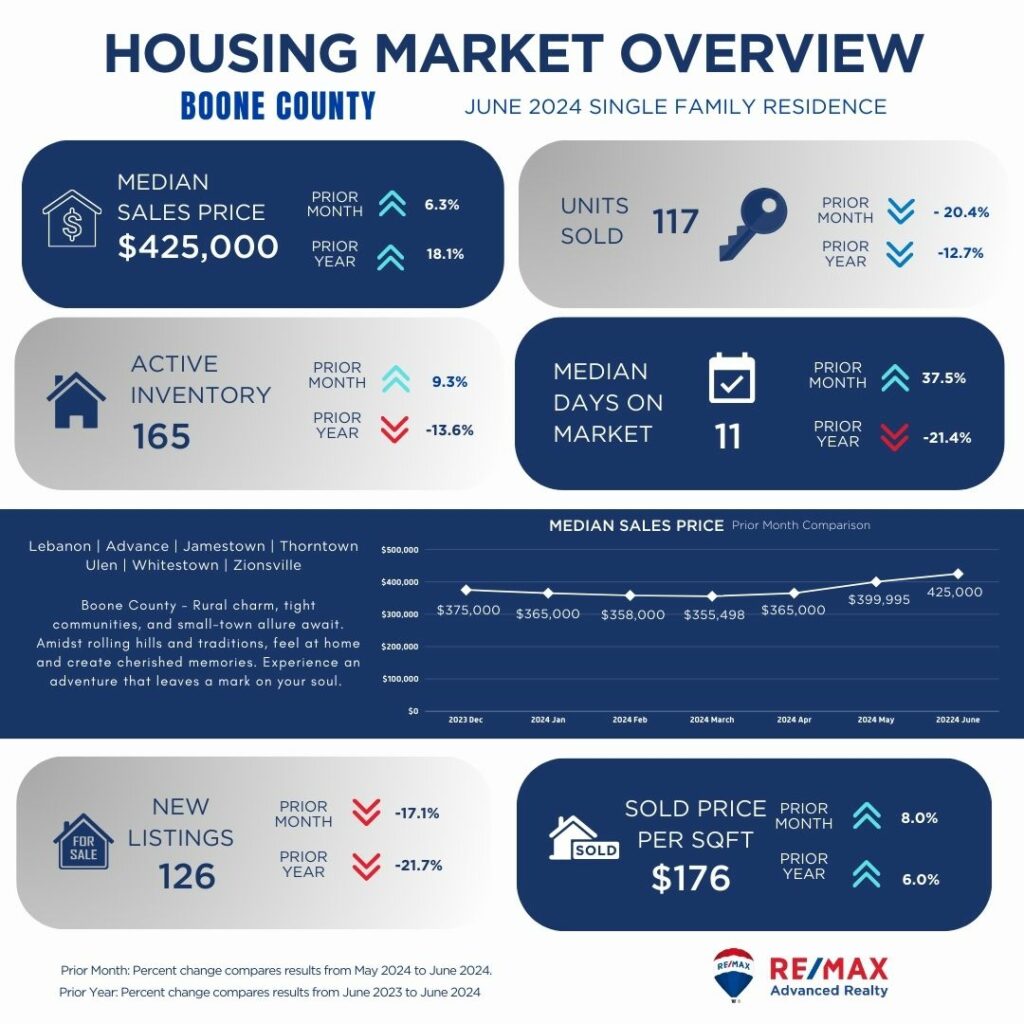

Boone County demonstrates a strong market with a significant increase in median sales price month-over-month and year-over-year, reflecting rising property values. However, the decrease in units sold indicates a slower market pace, potentially due to increased prices and limited inventory growth. Active inventory has risen slightly, but fewer new listings may constrain buyer options. Properties are selling quickly with a low median days on market and an uptick in price per square foot, suggesting continued demand in a competitive market.

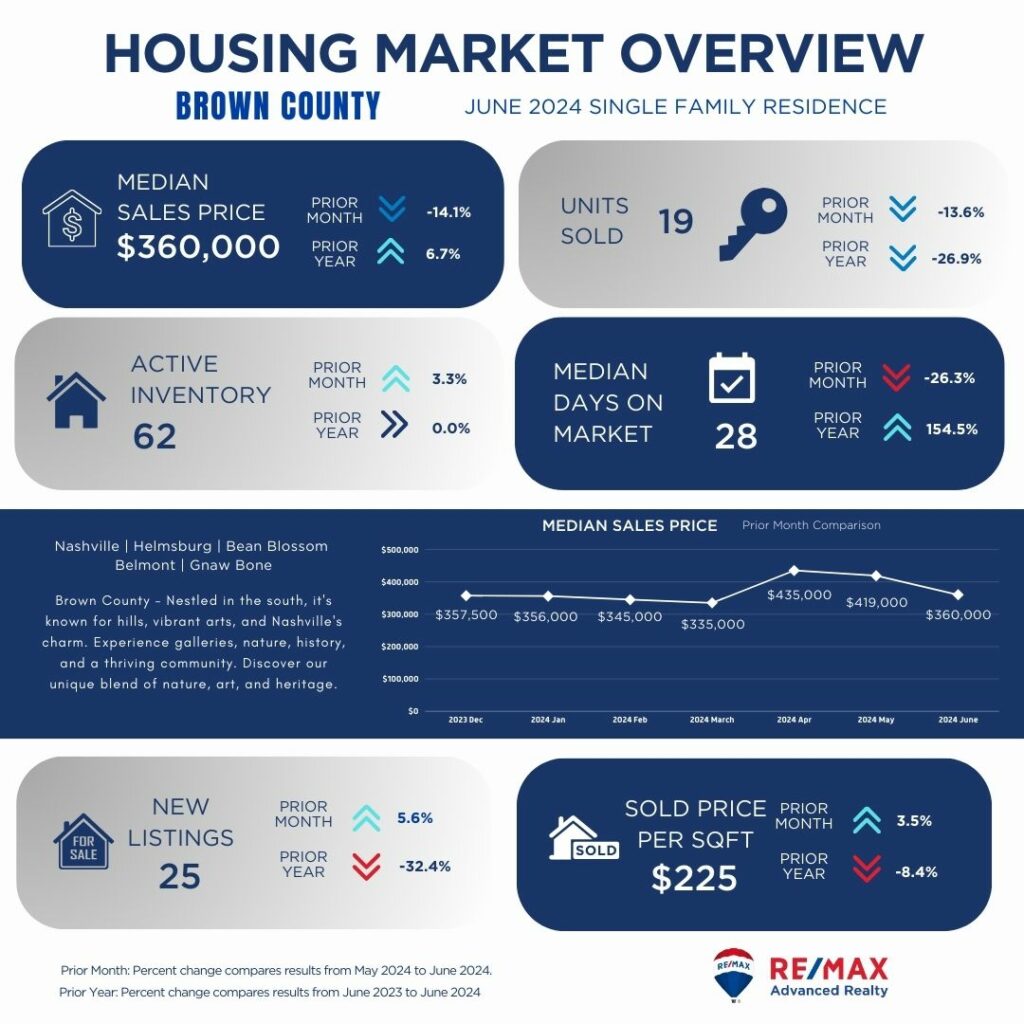

Brown County shows a mixed market with a notable decrease in median sales price compared to the previous month but an increase year-over-year. The decline in units sold suggests a slower market pace, which could provide buyers with more negotiating opportunities despite a stable inventory. Median days on market have decreased significantly, indicating properties are selling faster, but fewer new listings may limit buyer choices. Price per square foot has also decreased slightly, potentially offering buyers more affordable options in this market.

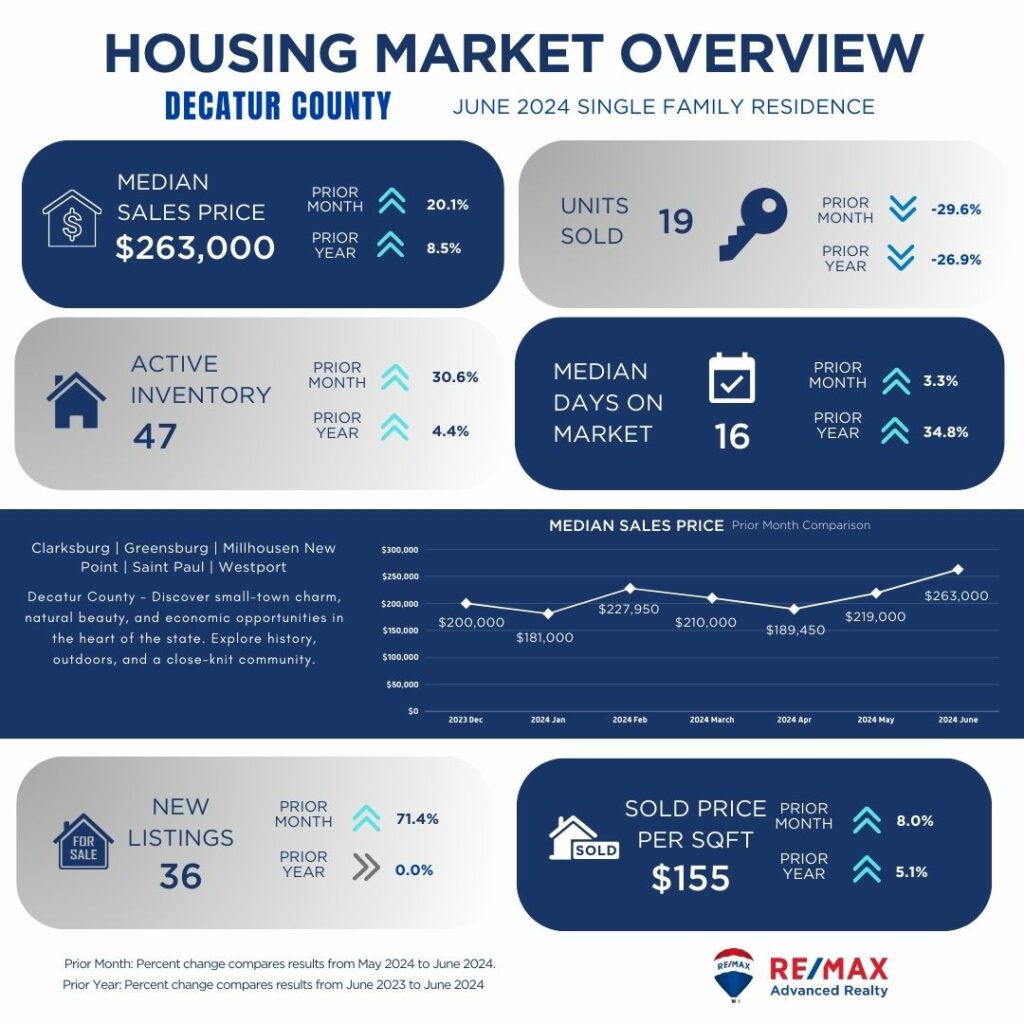

Decatur County displays a strengthening market with a substantial increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The increase in new listings further supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

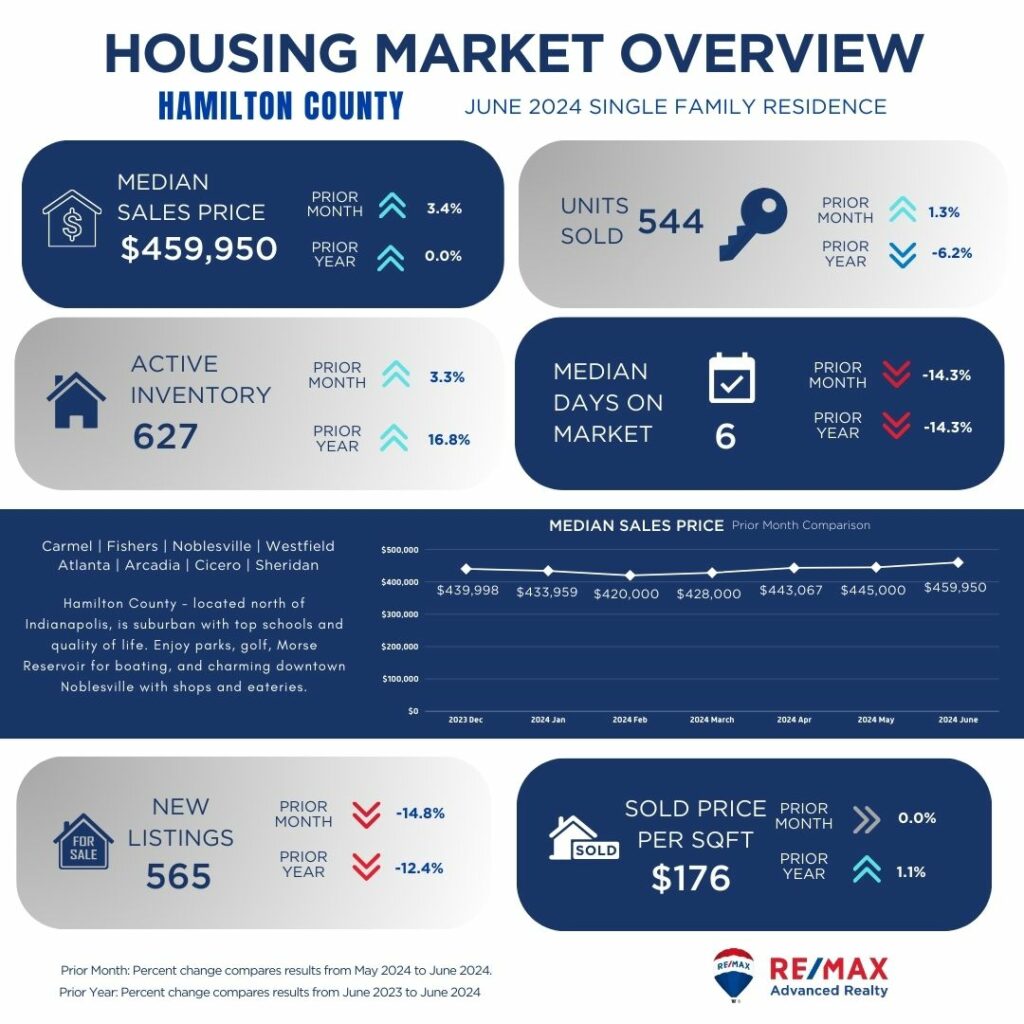

Hamilton County maintains a robust market with a slight increase in median sales price compared to the previous month and stable growth year-over-year. Despite a modest decrease in units sold, active inventory has grown, giving buyers more choices. Properties are selling quickly with a low median days on market, reflecting continued demand. However, fewer new listings may limit buyer options despite a stable price per square foot, indicating a balanced market with steady growth in property values.

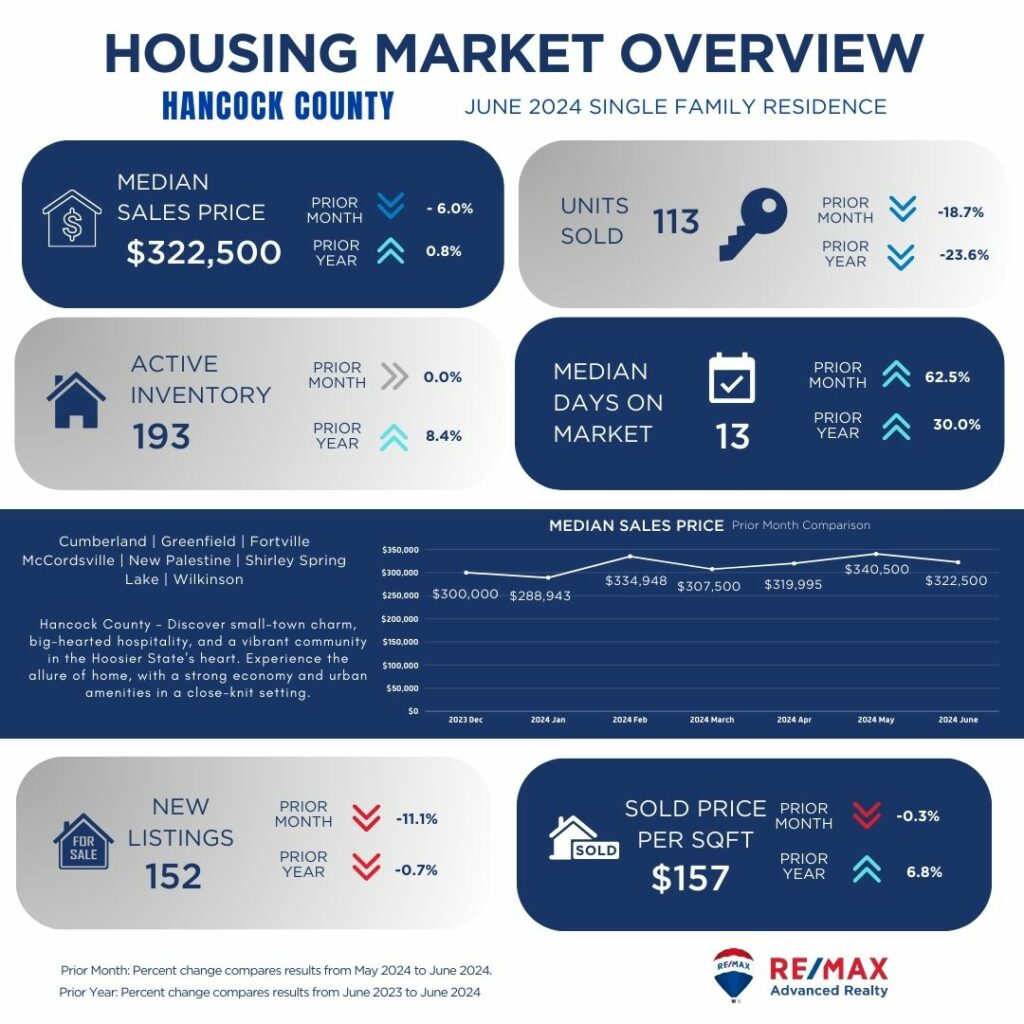

Hancock County shows a steady market with a decrease in median sales price compared to the previous month but a slight increase year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating power despite stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may limit buyer choices, although the slight decrease in price per square foot could offer opportunities for affordability.

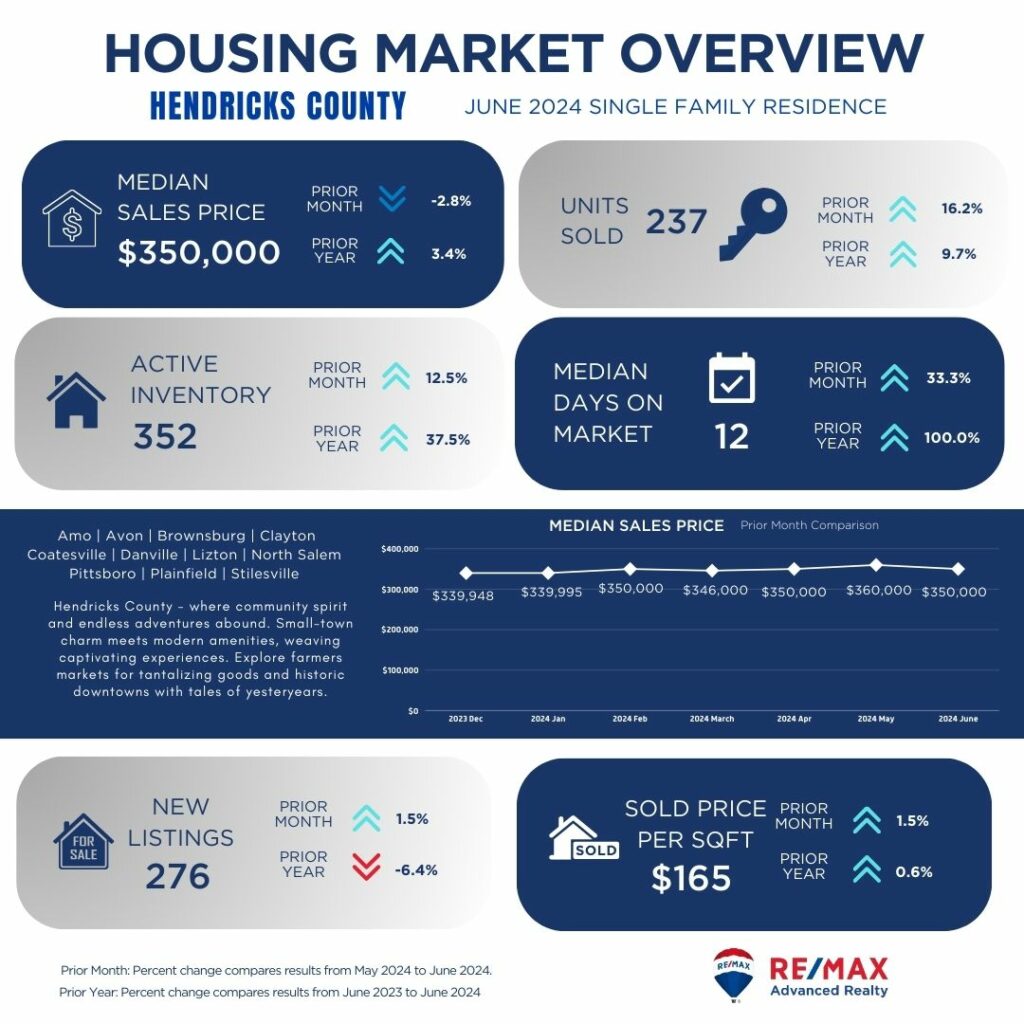

Hendricks County demonstrates a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The increase in units sold suggests continued demand, supported by a growing active inventory. Properties are selling quickly with a low median days on market, indicating a competitive market environment. The slight increase in price per square foot reflects rising property values, potentially benefiting sellers despite fewer new listings limiting buyer options.

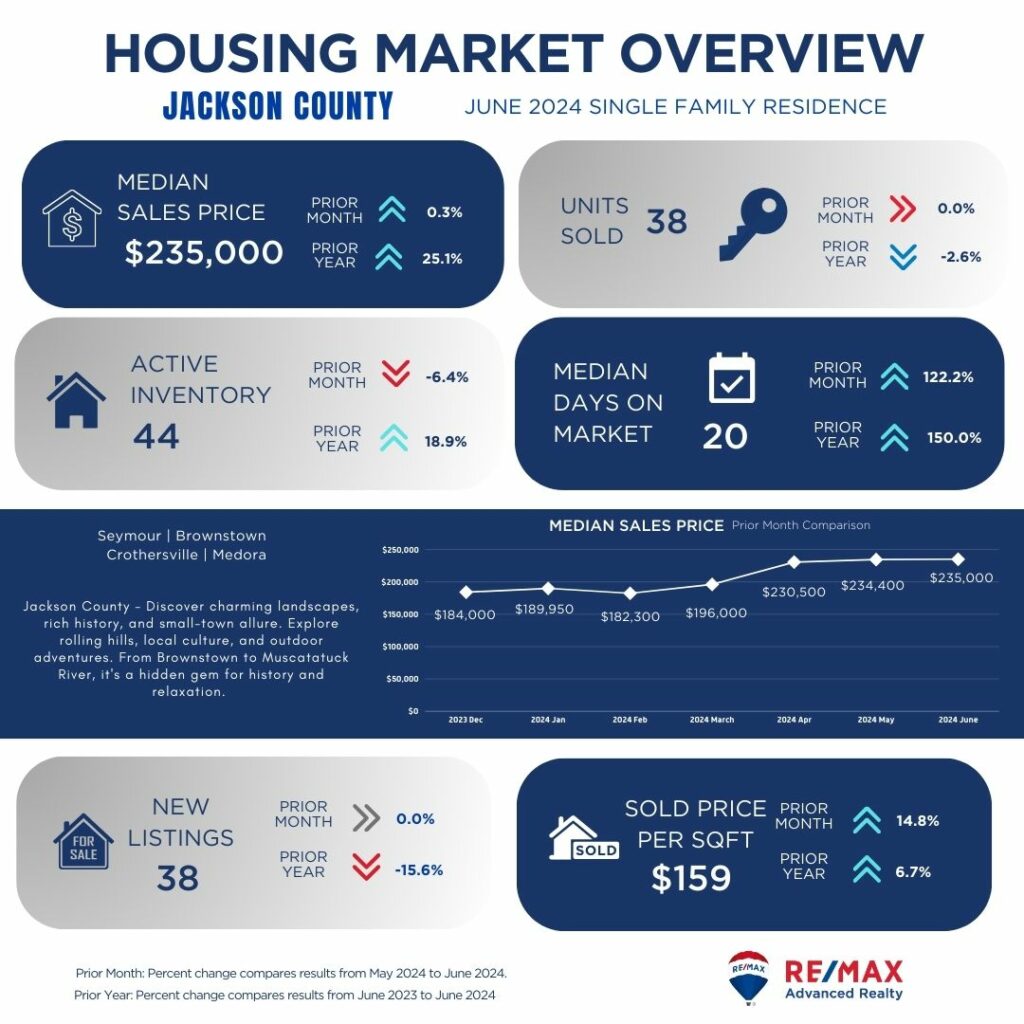

Jackson County shows a resilient market with a stable median sales price compared to the previous month and significant growth year-over-year. Despite a slight decrease in units sold, active inventory has remained stable, providing consistent buyer options. Properties are selling relatively quickly with a moderate median days on market, suggesting steady demand. However, fewer new listings may restrict buyer choices, although the increase in price per square foot indicates rising property values, benefiting sellers.

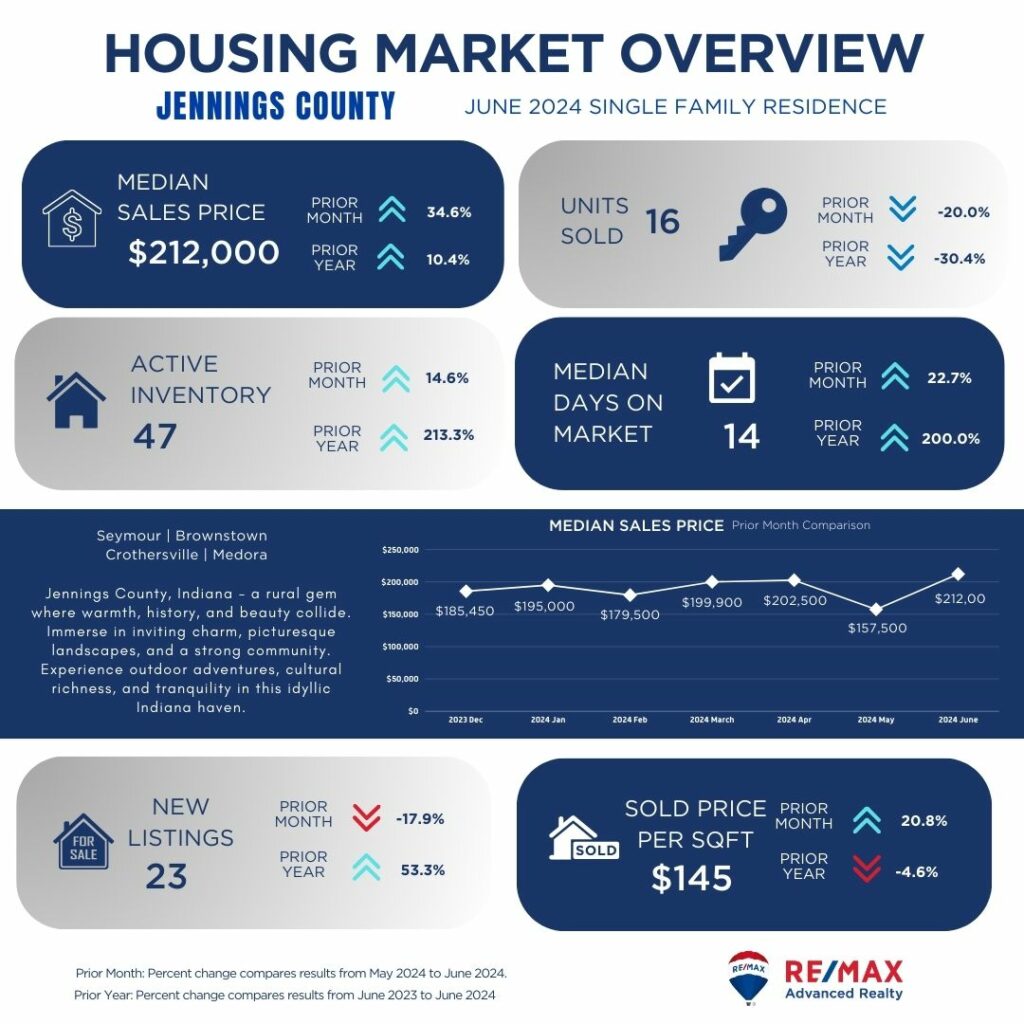

Jennings County displays a strengthening market with a notable increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded significantly, offering buyers more choices. Properties are selling relatively quickly with a moderate median days on market, indicating strong demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

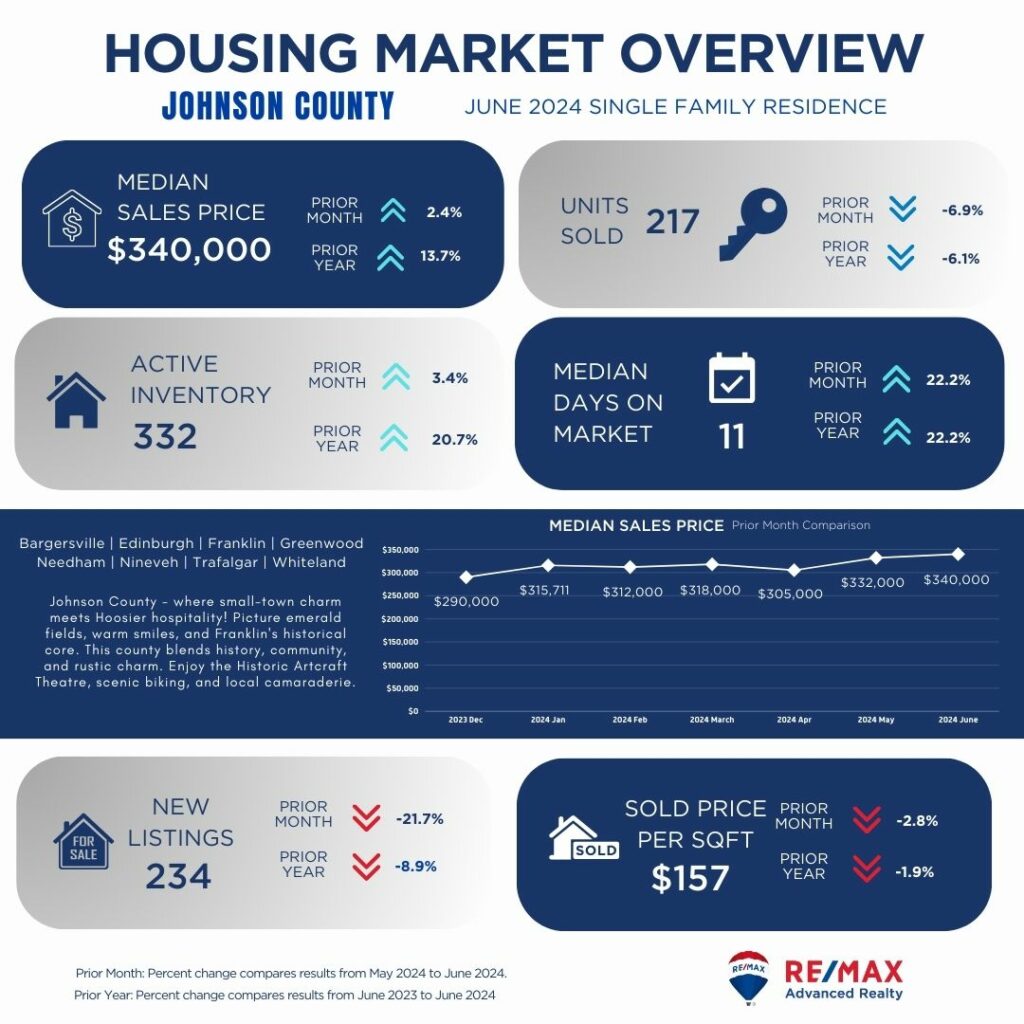

Johnson County maintains a stable market with a slight increase in median sales price compared to the previous month and steady growth year-over-year. Despite a decrease in units sold, active inventory has grown moderately, providing buyers with more options. Properties are selling quickly with a low median days on market, reflecting continued demand. Fewer new listings may limit buyer choices, although the stable price per square foot indicates a balanced market with steady property values.

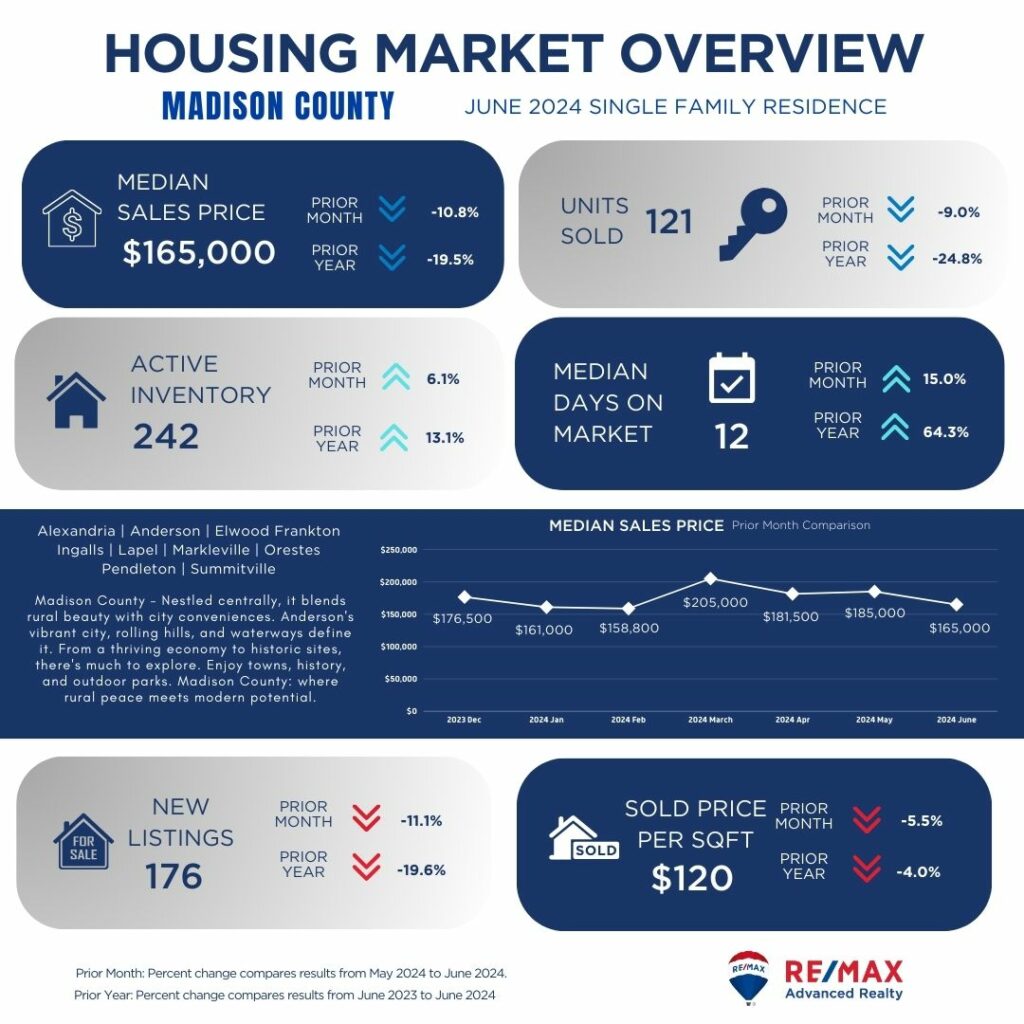

Madison County shows a varied market with a decrease in median sales price compared to the previous month and year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating opportunities despite a stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may constrain buyer options, although the slight decrease in price per square foot could offer affordability in this market.

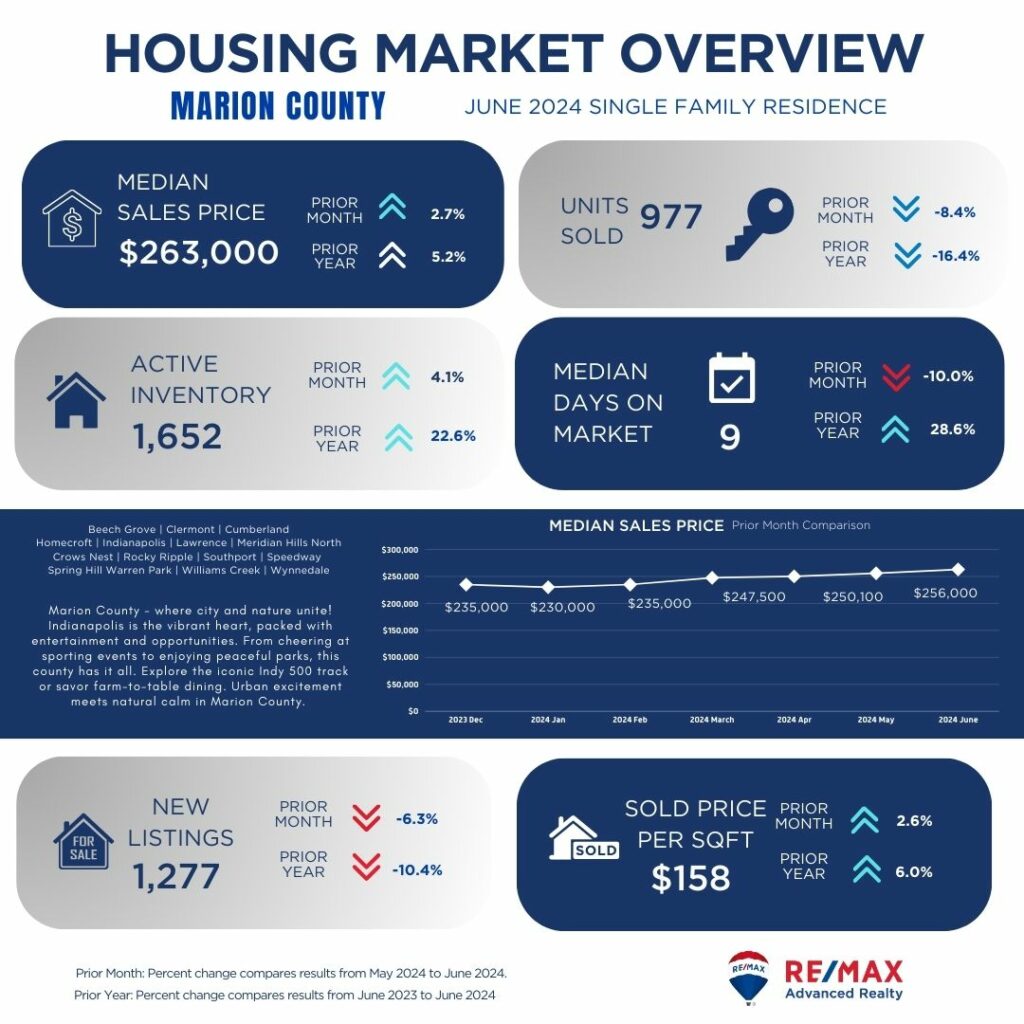

Marion County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, reflecting consistent demand. However, fewer new listings may limit buyer options, although the stable price per square foot indicates a balanced market with steady property values.

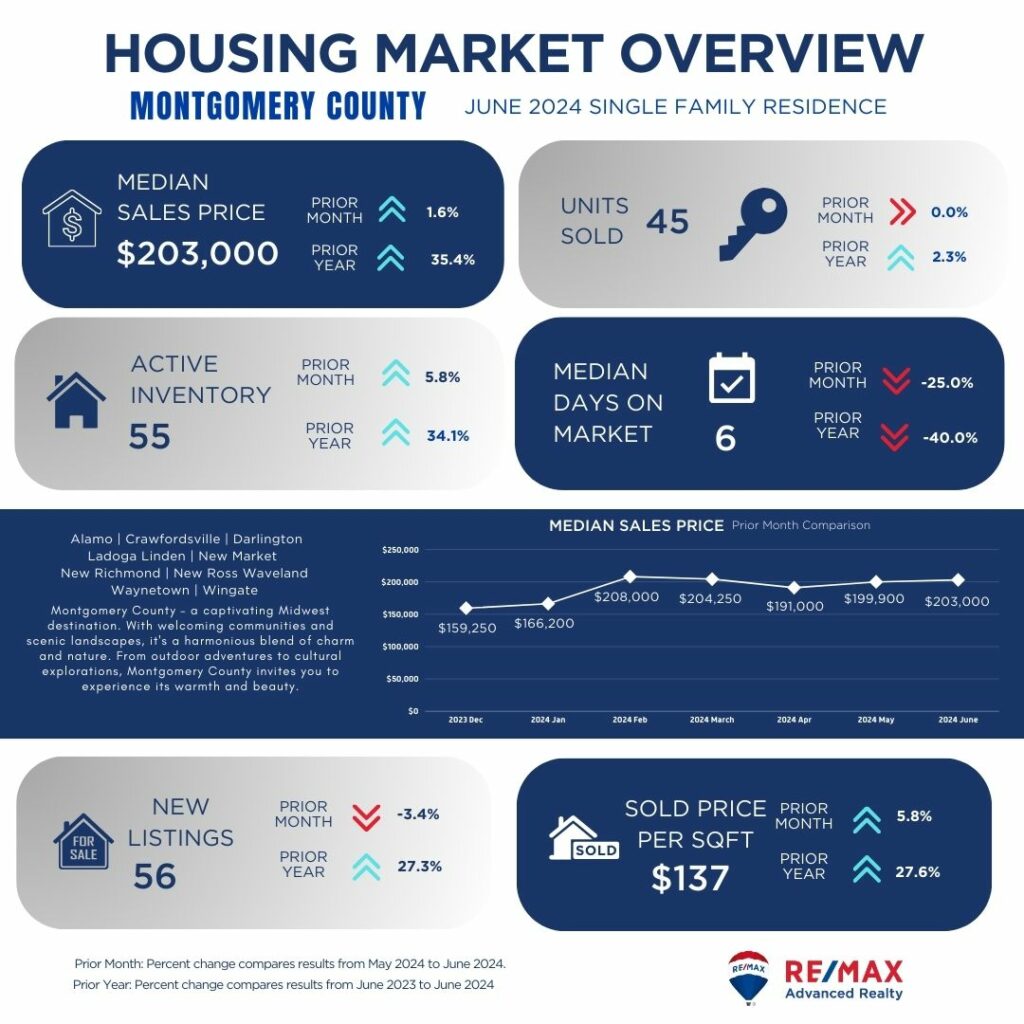

Montgomery County shows a stable market with a slight increase in median sales price compared to the previous month and strong growth year-over-year. Despite a slight decrease in units sold, active inventory has grown, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating steady demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

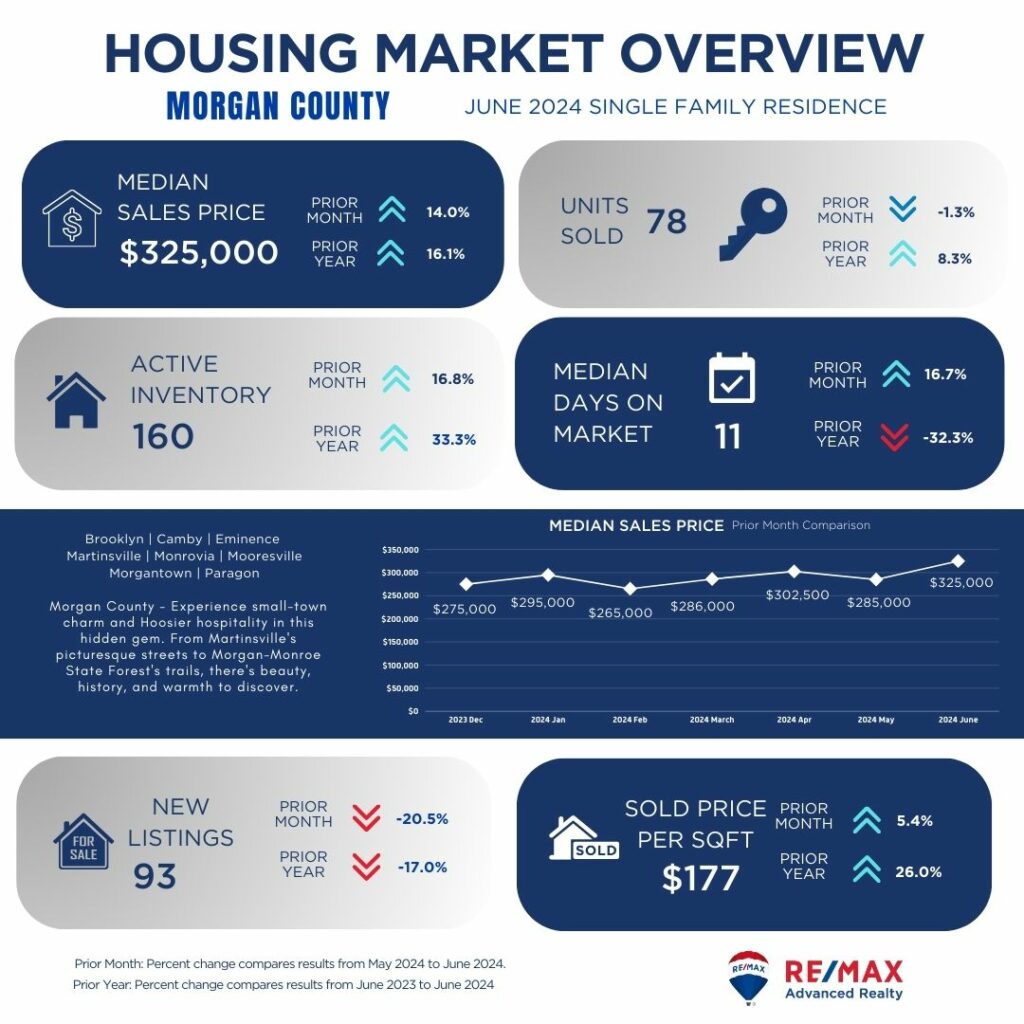

Morgan County displays a robust market with a notable increase in median sales price month-over-month and year-over-year. Despite a slight decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The decrease in new listings may limit buyer options, although the increase in price per square foot reflects rising property values, potentially benefiting sellers.

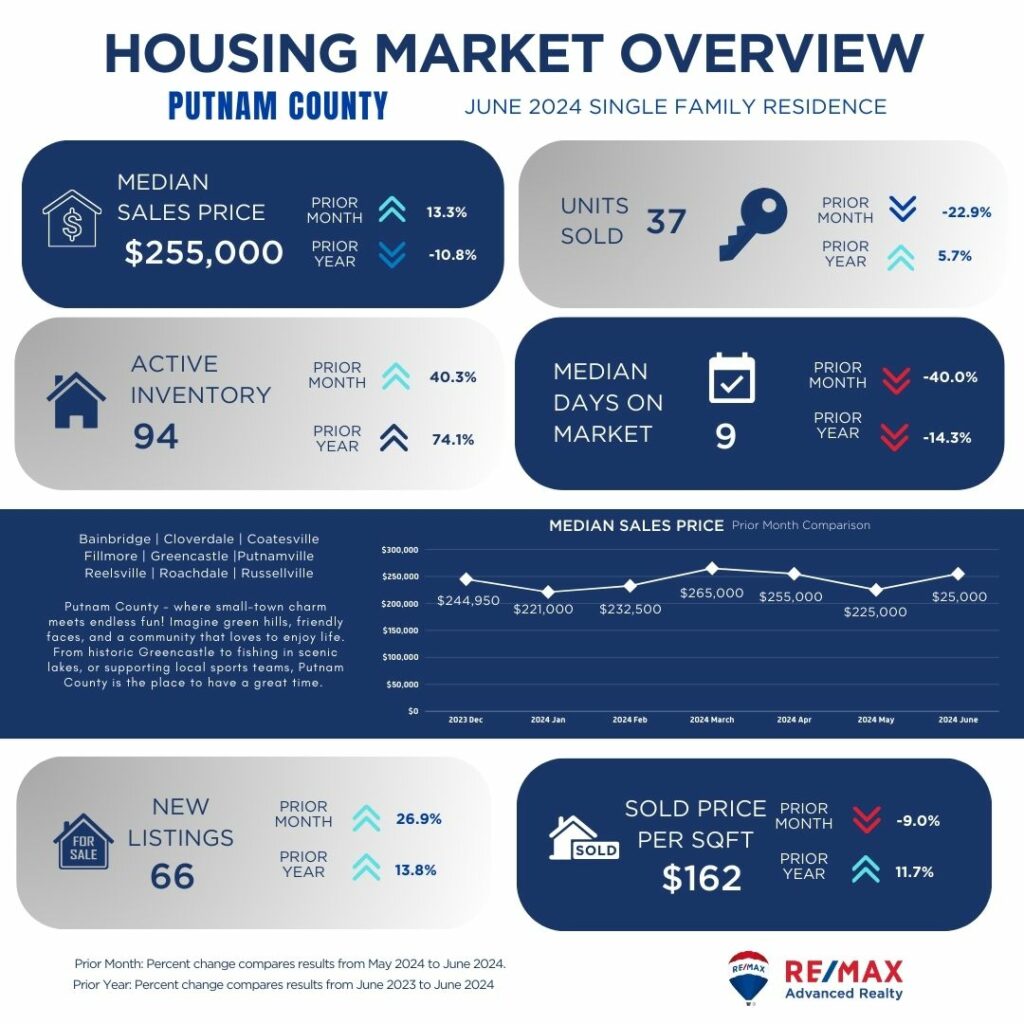

Putnam County shows a stable market with a slight increase in median sales price compared to the previous month and a decrease year-over-year. Despite a decrease in units sold, active inventory has grown significantly, offering buyers more options. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially attracting buyers.

Shelby County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a moderate median days on market, reflecting steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially benefiting buyers.

As we conclude our county-by-county analysis of the Central Indiana single-family homes market, it's evident that each area presents unique opportunities and challenges for buyers and sellers alike. From the rapid pace of Hamilton County to the steady resilience of Boone County and beyond, understanding these trends is crucial in navigating your real estate journey.

Looking ahead, the remainder of the year promises to be dynamic, with shifting market conditions influenced by economic factors and buyer-seller dynamics. Whether you're considering buying, selling, or investing in Central Indiana real estate, our team at RE/MAX Advanced Realty is here to provide expert guidance and support.

Explore our listings, connect with our experienced agents, and let us help you achieve your real estate goals in this competitive market. Contact us today to schedule a consultation and take the next step towards finding your dream home or maximizing your property's value. Trust RE/MAX Advanced Realty for insightful market analysis and personalized service, ensuring a smooth and successful real estate experience.

We are thrilled to invite you to a series of Open House events this weekend, where you can explore stunning homes in some of Indiana's most desirable neighborhoods. Whether you are looking for historic charm, modern amenities, or serene lakefront living, we have something special for you. Join us and discover the perfect home for you and your family. Here are the details of our Open Houses:

919 Broadway St Unit D, Indianapolis, IN 46202

Time: 12 PM - 3 PM

Hosted by: Jessica Montalvo | 317-912-3730

Own a piece of history with this stunning condo in the heart of Historic Chatham Arch Neighborhood. Built in 1890, this home seamlessly blends timeless elegance with contemporary city living. Positioned on a prized corner lot, you're just steps away from the new BottleWorks District and the vibrant atmosphere of Mass Avenue. Enjoy the variety of dining, shopping, and entertainment options right outside your door. This meticulously maintained home features beautiful hardwood floors, grand windows flooding the living room with natural light, and contemporary upgrades in the kitchen with stainless steel appliances and sleek granite countertops. Don't miss this exceptional condo in one of Indianapolis's most sought-after neighborhoods!

9049 W Forest Dr, Elwood, IN 46036

Time: 1 PM - 3 PM

Hosted by: Lori McCord | 317-258-9904

Welcome to the Forest Hills subdivision with no HOA and a private entry into the neighborhood. This beautiful home offers 4 bedrooms, 2 full bathrooms, a mud room, and a bonus room upstairs, with an additional living room in the basement. The property boasts hardwood floors, a great front porch, new windows, a water heater, a sewer pump, and a heated garage with A/C. With recent updates and a large yard, this home is perfect for families. The seller is providing an $800 flooring credit for the 2 bedrooms downstairs. Don't miss this opportunity!

1029 Pine Hill Way, Carmel, IN 46032

Time: 12 PM - 2 PM

Hosted by: Tony Sowers | 317-694-2940

Step into luxury with this immaculate 6-bedroom, 5.5-bath custom home in Cheswick Place. A grand 2-story entry welcomes you into a living room with soaring 14 ft ceilings, brand new hardwood floors, and a 2-sided fireplace. The updated kitchen is a chef's dream with ample prep space, a center island, and stainless steel appliances. The huge main level primary suite features a spa-like bath and walk-in closet. The lower level is perfect for entertaining with a home gym, theatre area, bar/kitchenette, storage, and an additional bedroom and full bathroom. Enjoy your private backyard with a large deck, fire pit, and plenty of green space. Recent improvements make this home truly move-in ready!

Discover this completely updated ranch home in the Center Grove school district. This home features a brand new roof, new engineered hardwood flooring, freshly painted interiors, and updated lighting fixtures. The kitchen boasts new cabinets, granite countertops, a new center island, and stainless steel appliances. The primary bathroom offers a glass walk-in shower with a luxury rainfall shower head. The nearly 1/2 acre yard is fully fenced with new landscaping and a newly painted storage shed. The garage is fully finished and freshly painted. Join us to see all the updates and enjoy the open house!

8360 S Indian Ridge Dr, Trafalgar, IN 46181

Time: 1 PM - 3 PM

Hosted by: The Rob Campbell Team

Rob Campbell | 317-695-1315 & Joyce Campbell | 317-691-4627

Experience lakefront living at its finest with this beautiful log home on Lamb Lake. With over 100 feet of lakefront, a boat dock, and spectacular views, this home offers the perfect blend of rustic charm and modern amenities. The main level features cozy hardwood peg flooring, a wood-burning fireplace, and an updated kitchen with quartz counters and new appliances. The primary bedroom opens to a private deck overlooking the lake. The walkout basement includes a second kitchen, bar, living room with a fireplace, and a bonus room. Enjoy the best of lake living with water-skiing, boating, fishing, and more, all just 30 minutes from Greenwood and 45 minutes from Indianapolis.

Don't miss your chance to find your dream home this weekend! For the latest updates and to be notified as soon as new homes hit the market, sign up on our website to receive your free list of exclusive property listings. We look forward to welcoming you at our Open House Extravaganza! See you there!

We are thrilled to announce and celebrate the incredible achievements of our Top 10 Agents in Sales for May 2024. These dedicated professionals have demonstrated exceptional commitment, expertise, and service to their clients, making them stand out in the competitive real estate market. Join us in congratulating our top producers!

Scott Chain brings a unique blend of expertise to real estate, combining his academic background in psychology and business with extensive experience in manufacturing operations. Known for his unwavering dedication and resilience, Scott excels in understanding and meeting his clients' needs, making him a top performer in the industry.

Rob Ertel has over two decades of experience transforming houses into dream homes and properties into valuable investments. His keen eye for design and commitment to exceptional service ensures outstanding results, making luxury living accessible to all.

Brian Lunsford is a highly organized and detail-oriented professional with strengths in analytical thinking, interpersonal communication, and leadership. His extensive experience in property management, leasing administration, and marketing drives successful ventures and high client satisfaction.

Cate-Waggoner Lee is an accomplished real estate agent, coach, and broker with over 20 years of experience. Her background in psychology from Franklin College, combined with her passion for training peers and creating raving fans, has made her a prominent figure in the industry.

Jun Liu has been a licensed realtor since 2010, specializing in commercial real estate and residential investments. His fluency in Mandarin Chinese and English, along with his strong academic background in finance and business administration, makes him an invaluable asset to his clients.

Katrin Teverbaugh brings her organizational skills, attention to detail, and multitasking abilities from her years as a teacher and coach to her real estate career. Katrin’s commitment to quality service ensures prompt communication and proactive representation.

Josh Latham combines his experience in home remodeling, finance, and insurance to provide comprehensive real estate services. Specializing in clients aged 50+ and relocations, Josh's expertise and hands-on approach make him a trusted advisor in the industry.

Russ Burk brings over 20 years of business ownership and a family background in the building industry to his real estate career. His dedication to handling transactions with diligence and integrity sets him apart in the field.

Nate Elkins has lived in Indianapolis since 2004 and has a unique understanding of the city and its surrounding neighborhoods. Specializing in helping first-time buyers and move-up buyers, Nate combines his extensive experience and superior negotiating skills to ensure smooth transactions.

Carol Bullock is a Real Estate Broker Associate at RE/MAX Advanced Realty in Greenwood, Indiana. She specializes in various property types and is dedicated to helping clients find their dream homes. Her local market knowledge, award-winning service, and commitment to excellence make her a standout agent.

We are incredibly proud of our top producers for their dedication and outstanding achievements. Their hard work and commitment to excellence continue to inspire us all.

2024 Survey Confirms High Productivity of RE/MAX Agents and Teams

In a significant testament to their dedication and expertise, RE/MAX professionals have once again demonstrated exceptional performance in the real estate industry. The 2024 RealTrends Verified agent and team rankings highlight nearly 2,500 RE/MAX pros for their outstanding productivity based on home sales in 2023. Notably, our brokerage proudly celebrates the achievement of two of our stellar teams making it to this prestigious list.

The RealTrends Verified rankings, previously known as “America’s Best,” identify the top U.S.-based real estate agents and teams who have significantly exceeded national production norms. Out of nearly 22,000 qualified professionals, almost one of every eight is a RE/MAX affiliate, showcasing the broad impact and reach of RE/MAX in the real estate market.

To earn a spot on this list, individual agents needed to close at least $16 million in sales volume or 40 transaction sides in 2023. Teams qualified by achieving a minimum of $24 million in sales volume or 60 transaction sides.

RE/MAX Agents and Teams: Excellence in Action

Amy Lessinger, President of RE/MAX, lauds the continuous success of RE/MAX agents, attributing it to their commitment to high standards and professional excellence. “RE/MAX agents continue to succeed in part because of the high standards and values they set for themselves. They are committed to providing their clients with unparalleled service and expertise, and this recognition underscores that dedication to professional excellence,” she states.

Lessinger further emphasizes the local market knowledge and personalized solutions that RE/MAX agents bring to their clients. “RE/MAX agents understand their local markets and have the skills to offer personalized solutions and strategic advice to their clients,” she continues. “As these reports illustrate, RE/MAX affiliates are a great choice for buyers and sellers who value experience, productivity, and results.”

We are thrilled to congratulate two remarkable teams from our brokerage who have earned their place in the 2024 RealTrends Verified rankings:

These achievements reflect the hard work, dedication, and superior service that our teams provide to their clients. We are incredibly proud of their accomplishments and their contribution to the overall success of our brokerage.

As we celebrate these significant achievements, we remain committed to supporting our agents and teams in their pursuit of excellence. Congratulations once again to The Craftsman Group and The Indy Home Pros Team for their impressive rankings in the 2024 RealTrends Verified list. Here’s to continued success and many more milestones ahead!

All sellers have in mind just one thing - how to sell their home at the highest possible price. We are not the only ones trying to sell Indianapolis homes. Each neighborhood has several houses for sale like the one we do. Competition is not always a bad thing, especially if it is healthy.

Let’s do a walk-through…

Take a pen and paper and go outside of the house. Write down everything that you would like to change in your garden. Old baskets should be replaced, chairs repainted and some sprinkles fixed. Take a walk through your home and try to notice all the things that you would otherwise notice if this is your first time visiting this place. We all get used to our living environment, so we no longer see old, rusty, broken things around us that will decrease the overall value of the property even if those things are not going to be sold with the house itself.

To make sure that you are 100% ready before selling your property, here are detailed steps you can consider for a successful home-selling transaction.

When opting to sell your house quickly while you're in the process of moving, the first thing you should do is research the current real estate market. You have an edge because of this while interacting with buyers and agents. You'll also be able to appropriately adjust your expectations. As you look into it, keep the following in mind:

Cost: How much do comparable homes in your neighborhood sell for? When looking into comparable homes, take into account the neighborhood, the house's age and condition, and other features like restaurants, schools, and other facilities. By calculating the price per square foot of comparable homes that have previously sold, you may determine the worth of your own house.

Time On The Market: You must be aware of how long it typically takes for a house in your community to sell. The amount of time a house is posted for sale until it sells is referred to as its "time on the market." You can better plan for the date of your simultaneous move and sale if you are aware of the market time.

What Kind Of Market Is It In Your Area: Is it a seller's or a buyer's market? You have to know this because your sales strategy will be influenced by the market type. You would have the most advantages when selling your house in a seller's market. A seller's market may result from a high level of demand and little availability. However, more variables might also be involved. There will be less time on the market and higher housing prices in a seller's market. But there are benefits to a buyer's market as well, given that you are selling as well as moving. Sellers are more eager to sell when the market is in their favor. Additionally, you'll have more wiggle flexibility to bargain for a lower cost.

The next action you should take is to learn everything you can about your property. You can work out your house's price by working with a real estate agent. You will have an advantage with customers if you have hard data upfront. Additionally, since your agent won't need to do as much legwork, the sale of your home will proceed more quickly.

Having an appraisal of your home helps you determine a fair price for it. Pre-approved loan buyers will be fully aware of the price range they can afford. Thus, they will find this information to be quite beneficial. Furthermore, having an inspection completed will expedite the negotiation process because buyers—and you—will already be aware of all the issues with the property.

Knowing your purpose in selling your home will help you decide what you can live without during the selling and purchase process. While sharing this information with your realtor can help them better understand your unique requirements, you should not disclose this information to sellers when you are viewing homes for purchase. It's possible you won't receive the best bargain if they know what you can settle for.

Make sure the agent you choose is open to listening to you and comprehending what you are looking for. Go with someone knowledgeable about your community and the neighborhood you wish to move in.

Following your assessment, you ought to have a clear understanding of what needs to be fixed and what can wait. Additionally, your agent may assist you in determining which repairs, if any, will yield the best return on your investment. Find out from your agent which repairs will add the most value to the home and which, if skipped, won't have a significant impact on the sale price.

Repairs are an integral part of getting your home in Indianapolis ready for sale, and so are interior staging and landscaping. When staging, keep it simple and clutter-free. Anything overly imaginative or detailed could make it harder for your buyers to envision themselves living there; instead, provide them with a blank canvas! Also for unique areas, make sure your furniture is positioned to use every available space.

Being a wise home seller means:

The timing of selling your old house and purchasing a new one is the most difficult component. Although it is ideal for both closings to occur on the same day or within a few days of one another, this is certainly not always the case. For this reason, we suggest not signing on to your new home until after someone has signed to your previous one. From a financial standpoint, it makes more sense to book a hotel room for a few days or weeks rather than making two mortgage payments at once, etc. If there is no other means to own two residences at the same time, bridge financing is one alternative.

This might be a lot, especially when it’s your first time selling your home; however, as long as you are working with the right real estate agent, you can make the entire home-selling transaction easier and faster.

Contact us to learn how we can help put property on the market! Call us at 317-316-8224 today!

If you want to remodel your home by taking a loan, make sure to spread payments according to your paying-off capability.

After you decide that it’s time to look into some home improvements as well as upgrading your living environment, you can do so in many ways, from bathroom repairs to adding an extension to your current space of living.

But first, let's tackle the basics.

A home improvement loan is a type of personal loan specifically used for repairs, home maintenance, and other esthetic or functional enhancements.

Loans for home renovations can be used for everything -- from minor upgrades like changing the kitchen sink to major renovations like redoing every room. For homeowners, obtaining a home repair loan is a desirable alternative since it typically has fixed interest rates and repayment schedules. While keeping up with your loan repayments, you can forecast and control your monthly financial flow.

Like other kinds of loans, you get a lump sum that you can use for renovation-related expenses, such as:

You will then repay it with a fixed interest rate over some time. That said, you have to know if borrowing a home improvement loan is what you need at the moment. It can be expensive, depending on the interest rate you'll get, but if it will improve your quality of life, it can be worth it.

Remodeling is not just a small change that is going to make you temporarily happy, but a strategic step towards raising the value of your home, especially if you are planning to sell your property shortly.

We should notice the difference when it comes to the financial side of home improvement. While decorating the home can be done without so much financial investment, some major technical improvements such as central heating could cost you significant investment.

So before signing up for a home improvement loan, figure out how much you need first. Make sure that the amount you’re going to borrow is enough to cover your estimated expenses; however, don’t go more than what you need or can afford to avoid being trapped into debt.

If you have some experience in home remodeling that would be beneficial in the sense of saving some money, while it is highly advised to hire a good tradesman and have a walk-through with him to see what needs to be done in the house.

He will be able to provide you with a quote for the job that you guys are planning to get done. It is also important to know the difference between a “quote” and an “estimate”. Quotes are a more set type of investment evaluation, with précised amounts for each part of the job, including material and labor, while estimates can only give you an approximate amount. Do not limit yourself to only one tradesman, but have at least a few of them come over and give you their offers.

Once you have offers from contractors in writing and you know how much it takes to get the job done - it is time to look for funding. Since most of us do not have substantial savings for these types of projects, we decided to go with loan providers that offer loans that are going to be put toward home improvements.

As well all know, they do not work for free, so interest will be applicable in this case. Since this is going to be an important financial decision, make sure you can afford the loan before you take one on. While there are many different types of loans available on the market, when it comes to a home improvement loan, it is typical that this type of loan is an unsecured personal loan, which means that is not secured against an asset such as your property and most of the time should be repaid within 24 to 48 Months.

For larger home improvements that need an increased amount of funding, some homeowners consider tapping into their property’s equity to fund home improvement.

When you apply, lenders will check your employment status and income. Having the necessary paperwork together in advance helps expedite the application process. Unlike a home equity loan or home equity line of credit, a home renovation loan does not require a home evaluation because there is no home equity involved.

Once you’re done selecting a lender, you must fill out an official application. While most loan providers allow you to apply online, you may need to apply in person at smaller banks or credit unions. After submitting your application, you can hear back the same day and get funded in as little as one to seven business days.

A home repair loan typically does not qualify for tax deductions for interest paid.

On the other hand, you might be able to lower your tax liability by updating your home with energy-efficient improvements. A 30% tax credit, up to $1,200 a year, is offered to homeowners who upgrade their homes with energy-efficient features including windows, doors, and central air conditioning as part of the Inflation Reduction Act of 2022, or IRA. A 30% extra tax credit is available for the purchase and installation of solar panels.

These are the basic things you need to know about home improvement loans. If you have more questions on this topic or any home-related inquiries, we are more than happy to answer them. Leave a comment or send us an email at dennis@indyhomepros.com so we can assist you!

As Memorial Day approaches, communities across Indiana are gearing up to honor the brave men and women who have made the ultimate sacrifice for our country. While some may see the holiday weekend as an opportunity for leisure and celebration, it’s essential to remember the true meaning behind Memorial Day: paying tribute to our fallen heroes.

Memorial Day Parade and Ceremony in Allen County

In Allen County, the annual Memorial Day Parade is set to take place on Monday, May 27, 2024. Sponsored by the Allen County Council of Veterans Organizations, this solemn procession serves as a poignant reminder of the sacrifices made by our servicemen and women. The parade will commence at 11:00 a.m. on Parnell Avenue, with a ceremony immediately following at the Memorial Coliseum. Wreaths will be laid, taps will be played, and fallen comrades will be honored.

Memorial Day Weekend in Indianapolis

While Indianapolis is known for hosting the iconic Indy 500 during Memorial Day weekend, there’s much more to the city’s festivities than just racing. From the AES 500 Festival Parade to Firestone Legends Day concerts, downtown Indy is buzzing with activity. Tour groups from around the world flock to witness the spectacle, adding to the city’s vibrant atmosphere.

Sports enthusiasts can catch the Pacers in action at Gainbridge Fieldhouse, while soccer fans can enjoy "Racing Night" with the Indy Eleven. And for those seeking intellectual stimulation, the 2024 Indiana Global Economic Summit offers a platform for discussions on international commerce and diplomacy.

Memorial Day Ceremonies Across Indiana

Beyond the hustle and bustle of Indianapolis, communities across Indiana are holding their own Memorial Day ceremonies. From Munster to Crown Point, residents are coming together to honor veterans and fallen heroes alike. The Community Veterans Memorial in Munster will host a ceremony featuring a 21-minute gun salute, while Crown Point will hold a parade followed by solemn remembrance at Maplewood Cemetery.

Honoring Our Military with Discounts and Specials

In addition to traditional ceremonies, businesses throughout Northwest Indiana are showing their appreciation for military members and veterans with special discounts and offers. From free admission to the Mascot Hall of Fame to discounted rates at Deep River Waterpark, there are plenty of ways for military families to enjoy the holiday weekend.

Remembering Our Heroes in Fishers

In Fishers, the spirit of remembrance extends beyond Memorial Day. The city hosts various events throughout the year to honor veterans, including the annual Veterans Day Ceremony and National Vietnam War Veterans Day. These events serve as opportunities for reflection and gratitude, reminding us of the sacrifices made by those who serve.

As we enjoy the long weekend with family and friends, let’s not forget the true meaning of Memorial Day. It’s not just a day off from work or a time for barbecues—it’s a solemn occasion to honor the courage, sacrifice, and legacy of our nation’s heroes. So, as you celebrate, take a moment to reflect on the freedoms we enjoy and the price paid by those who came before us.

Are you considering buying available Indianapolis foreclosures?

Or are you just interested to know what foreclosure homes are about?

Whatever your reason is, we hope that this blog can help you.

In this post, we’ll talk about:

First of all, you have to understand what foreclosure means.

Foreclosure is when a lender seizes a home. A house that is listed as foreclosed indicates that the lender is the owner.

A lien is placed on a property by every mortgage deal. If a homeowner defaults on their mortgage, a lien enables the lender to take back their property. Homeowners who are unable to make their mortgage payments often face foreclosure.

Purchasing a foreclosed property is different from buying a typically resold house. That is because the foreclosed homes are categorized as distressed properties. With too many options available, prospective buyers could find it a little confusing to decide which house to choose.

If a buyer buys impulsively, he might actually end up buying a property that needs major renovations. Thus, it is imperative to always be more careful and discerning when considering buying Indianapolis foreclosures. On the upside, the price tags of the foreclosed homes could logically be very attractive.

If a buyer gets luckier, he could possibly find and buy a home at a cost that is much cheaper even compared to the actual valuation of the house. Another advantage is that foreclosed homes are mostly vacant before they are put up for sale. This means that any buyer could instantly and easily move in after the sale is finalized.

The specific stage of the foreclosure procedure determines where to find a foreclosed property. A bank or the government may still possess properties that are being offered for a short sale or that are in the early stages of foreclosure.

Here are five categories of foreclosures and purchasing strategies for each:

When a mortgage lender notifies debtors of their default but before the property is put up for auction, it is said to be in pre-foreclosure. A homeowner may be able to escape an actual foreclosure process and the harm it would do to their credit history and future opportunities if they can sell the property during this period.

Pre-foreclosures are usually registered in courthouse buildings, both municipal and county. Furthermore, pre-foreclosure properties are listed on several websites, such as Foreclosure.com.

After the lender notifies the borrower of default and grants a grace period for the borrower to make up missed mortgage payments, a sheriff's sale auction takes place. The purpose of an auction is to assist a lender in receiving prompt repayment for a delinquent loan.

These auctions, which are overseen by local law enforcement, frequently take place on the steps of the city's courtroom. The location, date, and time of the property auction are made public, and the property is sold to the highest bidder.

Notifications are published online and in regional newspapers.

A lender will take less for a property in a short sale than what is owed on the mortgage. Lenders are not required to approve a short sale in order for borrowers to be in default. But usually, clients have to demonstrate some kind of financial hardship—like losing their job—that will probably lead to default.

Underwater refers to a situation when the home's value is less than the remaining mortgage balance. The house must be offered for sale and the lender must consent to "sell the property short" by taking less than is owing for it to be considered a short sale.

Usually, these homes are listed as "pending bank approval" short sales.

The process of buying a short-sale property is essentially the same as a regular purchase, but the contracts will have different wording indicating that the terms are contingent upon the lender's approval. A short-sale offer may require a bank to react for several months, thus the procedure may take much longer than for a conventional transaction.

It's common to find a real estate website with the ability to search by short-sale status, including listing services and individual businesses.

Properties that go back to the bank are those that don't sell at auction. In other words, they turn into real estate-owned (REO) assets.

The institution's REO department frequently oversees these assets. Bank-owned properties can be found in large listings on websites like RealtyTrac, which allows users to search by city, state, or ZIP code.

Certain residences are bought with loans guaranteed by the Department of Veterans Affairs (VA) or the Federal Housing Administration (FHA) of the United States government. Brokers acting on behalf of the federal agency reclaim these homes from the bank when they go into foreclosure.

Acquiring a government-owned property requires contacting a broker who is registered with the government. A registered broker can be located by buyers on the U.S. Housing and Urban Development Department (HUD)

Locating foreclosures can be profitable, resulting in real estate fortunes sold for less than market value or diamonds in the rough. These are a few methods for locating foreclosed homes:

For those who are unfamiliar with such transactions, it could be a challenge to know where to possibly find and purchase foreclosed properties in Indianapolis.

The first stop should be the local property listings, where there usually are sections for foreclosures. Local government agencies also hold regular biddings for foreclosed or repossessed homes at much cheaper price tags.

Of course, many lenders and banks also sell pre-owned or foreclosed properties. It is ideal to hire a real estate agent, who is more familiar with the market. The professional could take care of the legwork and pave the smoother way to finalizing the transaction. He may also assist in finding and processing mortgages if financing is needed to fund the purchase.

There is a need to meticulously inspect any of the available Indianapolis foreclosures before moving to close the transaction. Most of the time, the price tag is fixed and non-negotiable. If that is the case, the buyer has to agree to the asking price. Once payments are made, all other steps in the process can follow smoothly.

After the sale, the buyer may eventually realize the need for renovations or repairs. At this point, he has no other choice but to shoulder the costs of the activity to improve the condition of the house. Any buyer could opt to live in the house or lease it for rental income.

We hope we helped you understand what foreclosed properties are and what to expect when you purchase them. If you have questions, feel free to drop them below or send us a message!

In the dynamic world of real estate, success isn't just measured in numbers; it's a testament to dedication, expertise, and unwavering commitment to clients. As the first quarter of 2024 draws to a close, RE/MAX Advanced Realty proudly celebrates the outstanding achievements of our teams and agents, who have once again demonstrated excellence in their field.

With great pleasure, we congratulate the Indy Home Pros Team for maintaining their #1 positions across multiple categories. Their consistent dedication to excellence has earned them the top spots in Team RESCOM Combined, Team Commercial Only, and among the Top 50 Teams by Transactions. Their unwavering commitment to delivering exceptional service has solidified their position as leaders in the industry.

The Craftsman Group has also showcased their prowess in the Q1 2024 rankings, securing impressive placements in several categories. Ranked #15 in Team RESCOM Combined and #19 among the Top 50 Teams by Transactions, The Craftsman Group continues to impress with their expertise and efficiency in delivering results for their clients.

Additionally, we extend our congratulations to Team-Results for their notable achievements in Q1 2024. With their strong performance, they have secured the #31 position in Team RESCOM Combined and #38 among the Top 50 Teams by Transactions. Their dedication to excellence and client satisfaction has been instrumental in their success.

Individual excellence is also celebrated at RE/MAX Advanced Realty, and we commend Keith Turnbill for his outstanding performance. Ranking #37 in the Individual RESCOM category, Keith's dedication and expertise have been instrumental in delivering exceptional results for his clients.

These achievements not only reflect the talent and dedication of our teams and agents but also underscore our commitment to providing unparalleled service to our clients. At RE/MAX Advanced Realty, we are proud to have such exceptional individuals and teams who consistently go above and beyond to exceed expectations.

As we move forward into the next quarter, we remain dedicated to upholding the highest standards of professionalism, integrity, and service excellence. Congratulations once again to all our teams and agents for their outstanding performance in Q1 2024. We look forward to continued success and making a difference in the lives of our clients in the months to come.

Success is a journey marked by dedication, hard work, and passion. As we reflect on the achievements of March, we take pride in extending our heartfelt congratulations to the outstanding efforts of our top performers at RE/MAX Advanced Realty. Let's shine the spotlight on these remarkable individuals who are turning dreams into keys! 🌟🏡

In March 2024, these agents went above and beyond, setting new standards of excellence and making significant strides in the real estate industry. Join us in celebrating their dedication, perseverance, and commitment to providing exceptional service to their clients. Here are our top producers for March:

As we celebrate the achievements of our top producers for March, we look forward to another month of setting new benchmarks and creating more success stories together. Here's to turning dreams into keys and making homeownership a reality for all! 🚀👏

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224