The housing market in Central Indiana for September 2024 shows a mixed yet steady landscape compared to the same period last year. According to data from MIBOR BLC®, the median sales price remained unchanged at $300,000, reflecting stability in home values across the region. While this price point held steady year-over-year, it did show a slight decline from August, signaling a brief pause in upward trends observed earlier in the year.

Sales Activity and Inventory Shifts

Closed sales saw a modest uptick compared to September 2023, indicating continued buyer interest despite market fluctuations. New listings, however, experienced a small dip, suggesting that fewer homes were being put on the market as sellers may be taking a more cautious approach. This decrease in new inventory, paired with relatively steady prices, points to a market where demand is still robust but options for buyers are slightly more limited.

County-by-County Breakdown

In a closer look at county data, many areas in Central Indiana saw notable shifts:

What’s Ahead for the Market?

According to MIBOR CEO Shelley Specchio, favorable mortgage rates have fueled buyer interest since the start of the summer, with the market showing signs of resilience. However, recent economic reports suggest continued unpredictability in the months ahead. As mortgage rates adjust based on broader economic factors, potential buyers and sellers will need to remain agile.

The market's path toward more favorable conditions remains in flux, but with inventory slowly increasing and demand holding steady, the outlook for Central Indiana real estate remains cautiously optimistic as we approach the end of 2024.

For more detailed insights or personalized market advice, reach out to RE/MAX Advanced Realty's local experts to guide you through the current housing trends in your area.

Fall is officially here, and with it comes the excitement of pumpkin patches, hayrides, and family adventures! If you're searching for the best pumpkin patches in the Indianapolis area or nearby, you're in for a treat. These local farms offer more than just pumpkins—they provide a full experience of outdoor fun, learning, and memory-making. Whether you're taking in a hayride, getting lost in a corn maze, or enjoying homemade fall treats, these pumpkin patches are the perfect way to embrace the season.

Lark Ranch – Greenfield & Loogootee Locations: 1611 N Meridian Road, Greenfield | 3145 Killion Mill Road, Loogootee

With two locations, Lark Ranch is a fall favorite for families. Besides its pumpkin patch, visitors can enjoy attractions like pony rides, a giant slide, barrel train, corn maze, and much more. From gem mining to pedal cars, there’s a whole day of fun activities waiting to be explored.

Piney Acres Farm – Fortville Location: 1115 E 1000 N, Fortville

This 73-acre farm in Hancock County offers a wide range of hands-on activities, perfect for a fun day out. Families can enjoy hayrides, corn mazes, barnyard animal visits, and even gem mining. Piney Acres is all about connecting with nature while having some good old-fashioned fall fun.

Tuttle Orchards – Greenfield Location: 5717 N 300 W, Greenfield

Known affectionately as "Tuttles" by locals, this family-owned farm has been an Indianapolis staple for nearly 100 years. Visit for a pumpkin patch experience, apple orchard, wagon rides, and over 30 fun farmyard activities for kids. Whether it's fresh produce or a good ol' fashioned hayride, Tuttles is a fall must-visit.

Fair Oaks Farms – Fair Oaks Location: 856 N 600 E, Fair Oaks

Fair Oaks Farms goes beyond pumpkins by offering a full harvest experience, complete with farm activities that are both educational and entertaining. It’s a great place for families to explore, with plenty of interactive experiences that celebrate the season's bounty.

Driving Wind Farm – Indianapolis Location: 6410 Michigan Rd, Indianapolis

An urban oasis located in the heart of the city, Driving Wind Farm started out as a berry farm but has since expanded into pumpkins! Families can take a hayride around the farm, pick their perfect pumpkin, and enjoy locally made seasonal treats at the café.

Waterman’s Family Farm – Indianapolis Location: 7010 E Raymond Street, Indianapolis

For kids who love dinosaurs, Waterman’s Family Farm offers a special treat—a pumpkin-chomping dino! In addition to the corn maze and petting zoo, there's a wide array of fall activities to enjoy, including games, rides, and a giant slide. Be sure to visit for a family-friendly day packed with excitement.

Appleworks – Trafalgar Location: 8157 S 250 W, Trafalgar

Appleworks is the perfect spot for those who love both apples and pumpkins. While the farm is best known for its apple orchards, their pumpkin patch is also a fall favorite. Kids can explore the bamboo maze, visit the free petting zoo, or enjoy live music on weekends.

Dull’s Tree Farm – Thorntown Location: 1765 W Blubaugh Avenue, Thorntown

Dull's Pumpkin Harvest has something for everyone, from a 5-acre corn maze to freshly made apple cider donuts. The farm offers 45 different activities, including slides, sling shots, face painting, and more. It’s an ideal place to create lasting memories with your family.

Stuckey Farm – Sheridan Location: 19975 Hamilton Boone County Rd, Sheridan

Fall festival weekends at Stuckey Farm are a beloved tradition. Families can pick pumpkins, enjoy fresh cider, and feast on apple cider donuts. Purchase a wristband for unlimited access to the hayrides, corn maze, and Adventure Acres play area.

Beasley’s Orchard – Danville Location: 2304 E Main Street, Danville

Beasley’s Orchard is famous for its apple cider and fall festivities. In addition to pumpkin picking, visitors can try out the Apple Cannon, tour the farm on a hayride, or navigate the corn maze. The farm also features live entertainment on weekends and plenty of treats to enjoy!

Hogan Farms – Brownsburg Location: 8900 E County Road 1000 N, Brownsburg

Hogan Farms offers a diverse selection of pumpkins along with other activities like a petting zoo, corn maze, and hayrides. On weekends, visitors can enjoy food trucks, live music, and a farmers’ market. It's a cozy spot to take in the fall atmosphere while picking out your perfect pumpkin.

Harvest Tyme – Lowell Location: 17904 Grant St, Lowell

Just a couple of hours north of Indianapolis, Harvest Tyme is a family farm offering a range of fall festivities. Visitors can enjoy carnival rides, explore the Pumpkin Glow Trail, and take part in themed events throughout the season. With something for everyone, it’s worth the drive.

Whether you're planning a short trip or a weekend outing, Indianapolis and its surrounding areas offer some fantastic pumpkin patches and fall festivals that will help you and your family enjoy the best of the season. Grab your favorite flannel and head out for some unforgettable fall fun!

As the crisp autumn air settles in and the leaves turn vibrant shades of red and gold, Indiana transforms into a hub of festive excitement. From pumpkin festivals to historic reenactments, the state's fall events capture its unique charm and traditions. Whether you're in Indianapolis or exploring the surrounding areas, there's something for everyone to enjoy this season. Here’s a look at some of the top fall festivals happening across Indiana in 2024, conveniently organized by their proximity to Indianapolis.

Harvest Nights (Sept. 29 – Nov. 2)

Get into the fall spirit at Newfields, where glowing jack-o-lanterns light up the gardens. With seasonal food offerings and whimsical displays, this event is a must-see for both kids and adults looking to embrace the magic of autumn.

Heartland International Film Festival (Oct. 10-20)

Celebrate storytelling with this renowned film festival, showcasing over 100 local and international films. Movie lovers can enjoy a wide variety of genres, from heartfelt documentaries to riveting dramas, all in the heart of Indianapolis.

Autumntidings Fall Fest (Oct. 19)

Hosted by Ash & Elm Cider Co., this festival highlights local cideries, breweries, and artisan vendors. With great food and drinks in a cozy autumn setting, it’s the perfect way to spend a fall afternoon.

Locally Made: Indy’s Fall Fest (Oct. 19)

Located at the Indianapolis Art Center, this free event offers interactive art displays, food trucks, and live entertainment. It's a great opportunity to support local artists and vendors while soaking in the fall vibes.

Irvington Halloween Festival (Oct. 19-26)

As one of the oldest neighborhoods in Indianapolis, Irvington’s annual Halloween Festival is a beloved event filled with spooky street fairs, haunted tours, and costume parades. Perfect for Halloween enthusiasts of all ages!

Riley Festival (Greenfield, Oct. 3-6)

Just east of Indianapolis, this festival celebrates the life of poet James Whitcomb Riley with a mix of craft exhibits, food vendors, and a grand parade. A quintessential small-town fall festival experience.

Potter’s Bridge Fall Festival (Noblesville, Oct. 5)

Head to Noblesville for a family-friendly festival featuring over 100 arts and crafts vendors along the scenic White River. It’s a great way to explore the local creative scene while enjoying the beautiful fall foliage.

Headless Horseman Festival (Fishers, Oct. 3-27)

Conner Prairie’s annual Headless Horseman Festival features haunted hayrides, spooky storytelling, and carnival games. It’s a mix of historical reenactment and Halloween fun—an autumn highlight for the whole family.

Franklin Fall Vintage Fest (Franklin, Oct. 5)

This one-day vintage market is a treasure hunter’s dream. With over 100 antique dealers and food trucks filling downtown Franklin, it’s the perfect event for those who love uncovering hidden gems.

Festival of the Turning Leaves (Thorntown, Sept. 27-29)

Just northwest of Indianapolis, this community festival offers a blend of small-town charm with a 5K run, local crafts, and a parade. It’s a great spot for families to enjoy a relaxing fall weekend.

Morgan County Fall Foliage Festival (Martinsville, Oct. 10-13)

Celebrate the beauty of autumn in Martinsville with carnival rides, food vendors, and a family-friendly parade. It’s a quintessential fall festival where you can make memories with your loved ones.

Hope Heritage Days (Hope, Sept. 27-29)

The 56th annual Heritage Days offers live music, food vendors, and over 125 booths filled with crafts and unique items. As the largest fall event in Bartholomew County, it's worth the trip to experience this local tradition.

Atlanta New Earth Festival (Atlanta, Sept. 28-29)

This festival attracts over 100,000 visitors each year and offers everything from food trucks and live music to an impressive array of handmade crafts. It’s one of Indiana’s biggest fall festivals, located just north of Indy.

Hippie Fest (Tipton, Sept. 28-29)

Looking for something a little different? Head to Tipton for Hippie Fest, a family-friendly celebration of peace and love. With tie-dye workshops, arts and crafts, and live music, it’s a unique way to enjoy the season.

Feast of the Hunters’ Moon (West Lafayette, Oct. 5-6)

Travel back to the 18th century at this historic reenactment in West Lafayette. From military drills to authentic food, this festival offers a unique way to experience Indiana’s rich history, while surrounded by stunning fall scenery.

Covered Bridge Festival (Parke County, Oct. 11-20)

Explore Indiana’s largest fall festival with historic bridge tours, local crafts, and stunning autumn foliage. With over 31 covered bridges in the area, it’s a photographer’s dream and a perfect escape into Indiana’s natural beauty.

Soup Stew Chili & Brew Festival (Madison, Oct. 12)

If you're a fan of hearty comfort food, the Soup Stew Chili & Brew Festival in Madison is worth the drive. Sample delicious local dishes while enjoying live music and family-friendly activities in a picturesque riverfront town.

West Side Nut Club Fall Festival (Evansville, Oct. 3-12)

As one of the largest street festivals in Indiana, the West Side Nut Club Fall Festival offers carnival rides, food booths, and free entertainment. The excitement and energy make it a must-visit event, even if it’s a bit of a journey.

James Dean Festival and Ducktail Run (Fairmount/Gas City, Sept. 27 – Sept. 29)

Classic cars, live music, and a 1950s vibe take over Fairmount and Gas City as they celebrate Indiana’s own James Dean. It's the perfect destination for those who love vintage Americana.

From quaint small-town festivals to grand celebrations, Indiana’s fall festivals offer something for everyone. Whether you stay close to Indianapolis or take a road trip across the state, these events will help you make the most of the fall season. So, grab your sweater, plan your weekends, and enjoy the best of what Indiana has to offer this autumn!

And while you're out enjoying the festivities, consider exploring the local real estate market. Fall is a fantastic time to buy or sell a home, with many buyers looking to settle before the holidays and sellers benefiting from less competition. At RE/MAX Advanced Realty, we’re here to help you find your dream home or get the best value for your current property. Contact us today to learn more about available listings and how we can assist with all your real estate needs.

As the leaves start to turn and the crisp air of fall rolls in, Indianapolis comes alive with seasonal activities perfect for all ages. Whether you're a fan of outdoor adventures, family-friendly festivals, or simply love taking in the beauty of autumn, the Circle City has something for everyone. Here’s your master guide to making the most of fall fun in the Indianapolis area.

A quintessential fall experience, visiting pumpkin patches and navigating through corn mazes can make for a fun-filled day with family or friends. A few local favorites include:

A thriving orchard and cider mill, Stuckey Farm offers 37 varieties of U-pick apples. With annual fall festivals and a wide range of family-friendly activities, it’s the perfect autumn destination for all ages. Enjoy tractor rides, fresh cider, and a stroll through their 8-acre corn maze.

For over 90 years, this family-owned farm has provided top-quality produce and authentic agricultural experiences. Tuttle Orchards, now run by the fourth generation, is open year-round, but the fall season is a favorite for apple picking, hayrides, and fresh cider. Their dedication to local produce, agricultural education, and family history makes Tuttles a unique fall destination for families.

Piney Acres offers tons of family-friendly activities each fall, including a huge corn maze, tractor-driven wagon rides, farm animals, a massive play area, bounce pillow, gem mining, and old-fashioned farm games. Visitors can explore a wide selection of pumpkins, squash, corn, and sunflowers in all shapes and sizes for every price range. The farm also has carving tools and patterns available in the Farm Store. (Please note: Pumpkins are grown off-site and pre-picked.)

Fall wouldn’t be complete without attending one of the many vibrant festivals happening around Indianapolis. Here are a few you shouldn’t miss:

If you're looking to escape the city and immerse yourself in nature, Indianapolis has plenty of scenic spots to enjoy the fall foliage.

If you’re in the mood for some spine-tingling fun, the Indianapolis area offers plenty of haunted houses and ghost tours:

'

'

As we transition into cooler weather, local farmers' markets continue to offer a bounty of fall produce. You can find fresh apples, squash, pumpkins, and more at markets like:

Whether you're looking to explore nature, get into the spooky spirit, or simply savor the flavors of the season, the Indianapolis area has something for everyone. So grab your scarf, sip on some hot apple cider, and dive into the joys of fall!

In today’s fast-paced real estate market, attending an Open House can be a game-changer for both buyers and sellers. If you’re in the market for a new home, you may be asking, “Why should I take time out of my weekend to visit an Open House?” The answer is simple: Open Houses offer unique opportunities that can help you make informed decisions and, potentially, land your dream home.

While online listings are great for an initial search, nothing compares to walking through a home yourself. Open Houses give you a firsthand look at the property, allowing you to explore each room, assess the layout, and envision how the space fits your lifestyle. Pictures and virtual tours can only show so much—being there in person gives you the full experience.

At an Open House, you have the advantage of meeting the listing agent in person. This provides a perfect opportunity to ask questions about the property, the neighborhood, and even the home-buying process. You'll get real-time answers, helping you make a more confident decision.

An Open House is not just about the home; it’s also a great way to explore the surrounding area. While you’re there, take some time to drive around the neighborhood to see local amenities, schools, and parks. You’ll get a better sense of whether the location meets your needs.

Open Houses can give you insight into how much interest a property is generating. Seeing other potential buyers walking through the home can give you a sense of how competitive the market might be for that specific property. If you’re serious about buying, this can be valuable information as you prepare to make an offer.

Open Houses provide a casual setting to view a property without the pressure of scheduling a private showing. You can browse at your own pace and take the time to consider if the home is the right fit for you. It’s a low-stress way to kickstart your home-buying journey.

Even if the Open House you attend doesn’t end up being “the one,” it’s a valuable experience. Touring different homes helps refine your preferences and gives you a better idea of what you truly want in a property. You’ll become a more informed buyer, ready to jump when the right house comes along.

Upcoming RE/MAX Advanced Realty Open Houses

Ready to explore some amazing properties? Check out these Open Houses coming up this weekend!

Join us at one of these RE/MAX Advanced Realty Open Houses this weekend and take the next step toward finding your dream home!

As we move into August, it’s a great time to look back and analyze the real estate trends from July. The summer months have provided us with valuable insights into the Indiana housing market, revealing patterns that could influence your real estate decisions. Whether you’re planning to buy, sell, or simply keep an eye on the market, here’s a snapshot of how key Indiana counties performed in July, offering valuable insights into the trends that shaped the market last month.

Comparison Note: Percent change comparisons reflect results from June 2024 to July 2024 for the prior month, and from July 2023 to July 2024 for the prior year. Data provided by MIBOR Listing Cooperative, compiled on August 11, 2024.

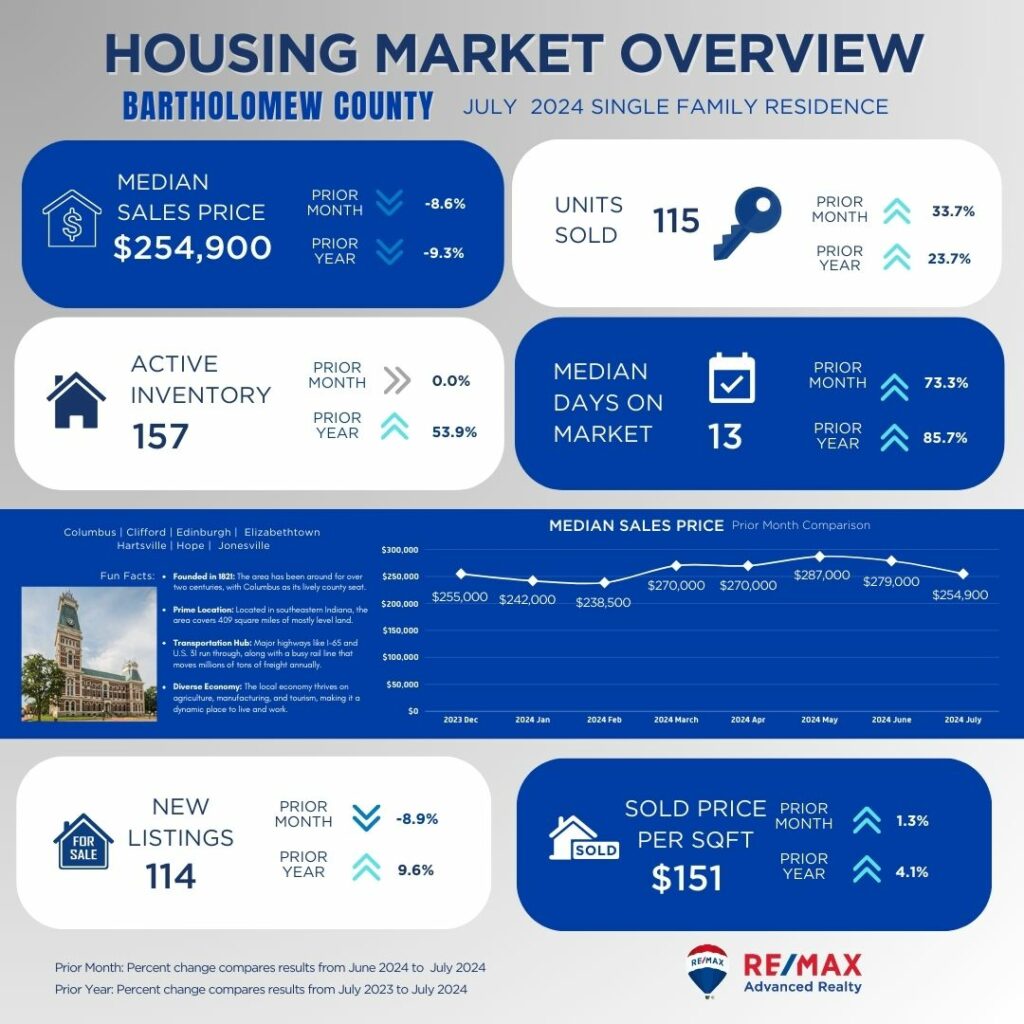

Bartholomew County

In Bartholomew County, the median sales price has dipped to $254,900, marking a notable decline of 8.6% from last month and 9.3% from last year. This drop in prices might suggest a cooling market, but it's worth noting that the number of units sold has increased significantly by 33.7% compared to the previous month. This rise in sales could indicate that despite lower prices, buyers are actively seizing opportunities. The inventory levels remain stable with 157 active listings, while new listings have slightly decreased, down 8.9% from the prior month.

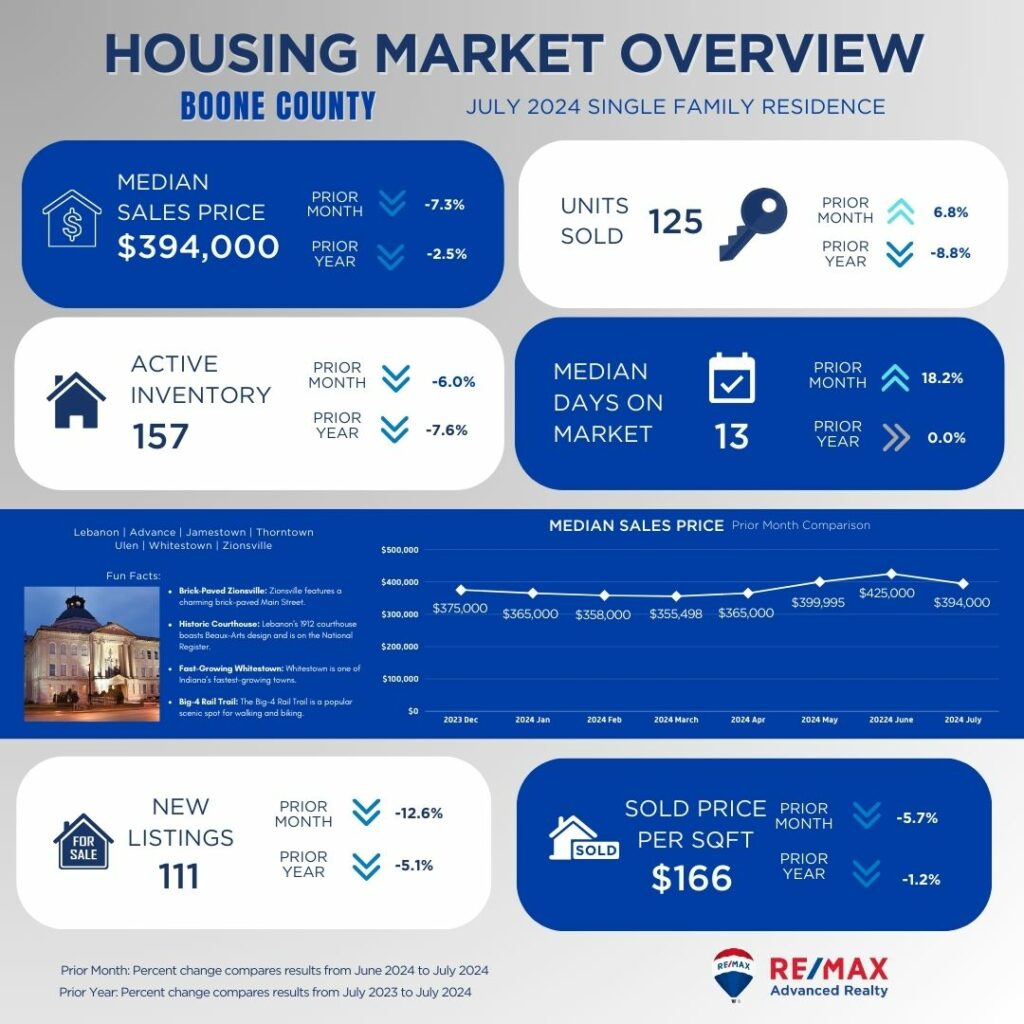

Boone County is seeing a more complex picture. The median sales price of $394,000 represents a decrease of 7.3% from last month, though it’s only a slight drop of 2.5% year-over-year. The number of units sold has seen a 6.8% increase from last month, which might suggest that despite falling prices, the market remains dynamic and active. However, with new listings falling by 12.6%, the active inventory of 157 homes has slightly decreased. The consistent median days on market of 13 days may indicate that well-priced homes are still attracting buyers relatively quickly.

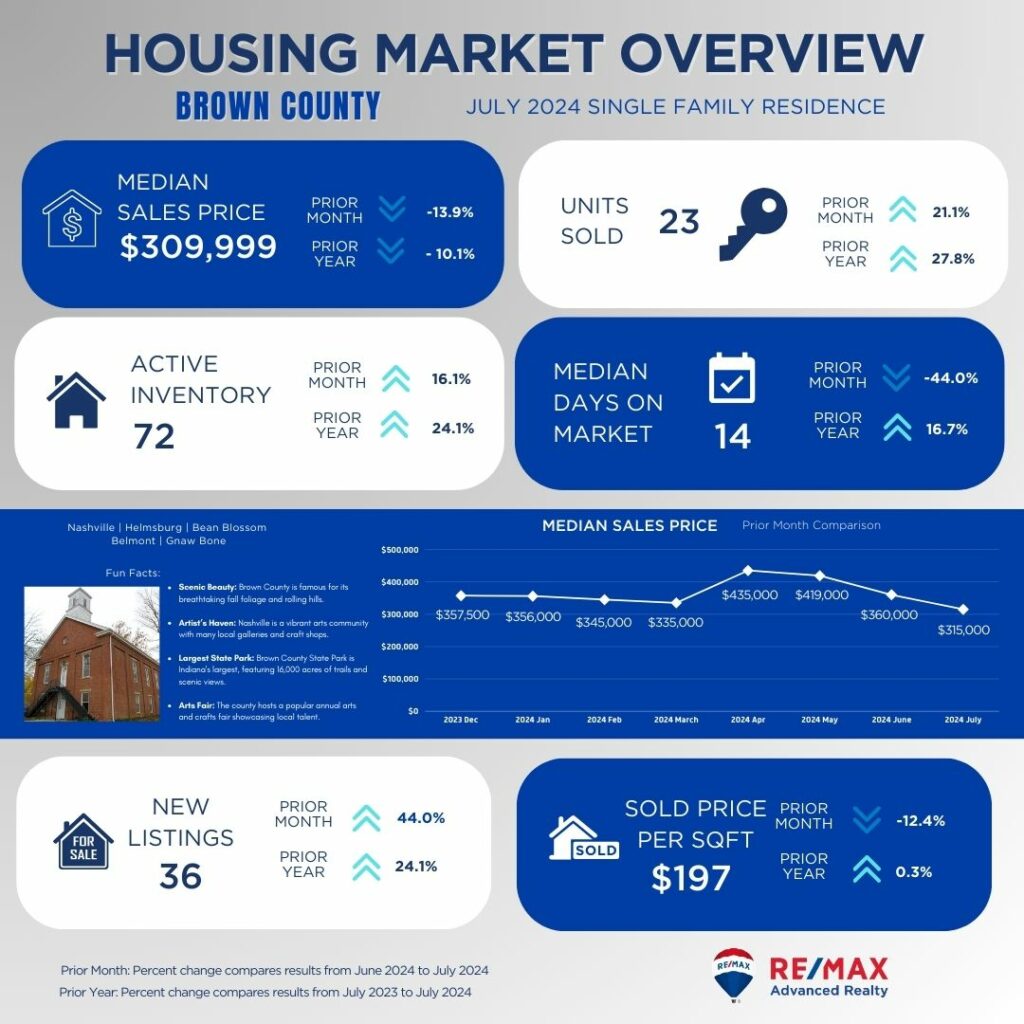

Brown County

Brown County is experiencing a significant drop in median sales prices, down 13.9% to $309,999. Despite this, units sold have increased by 21.1%, showing a positive trend in sales activity. The rising inventory levels, up 16.1%, might be contributing to this price reduction, providing buyers with more choices. The median days on market have decreased substantially, suggesting a faster-moving market despite the drop in prices.

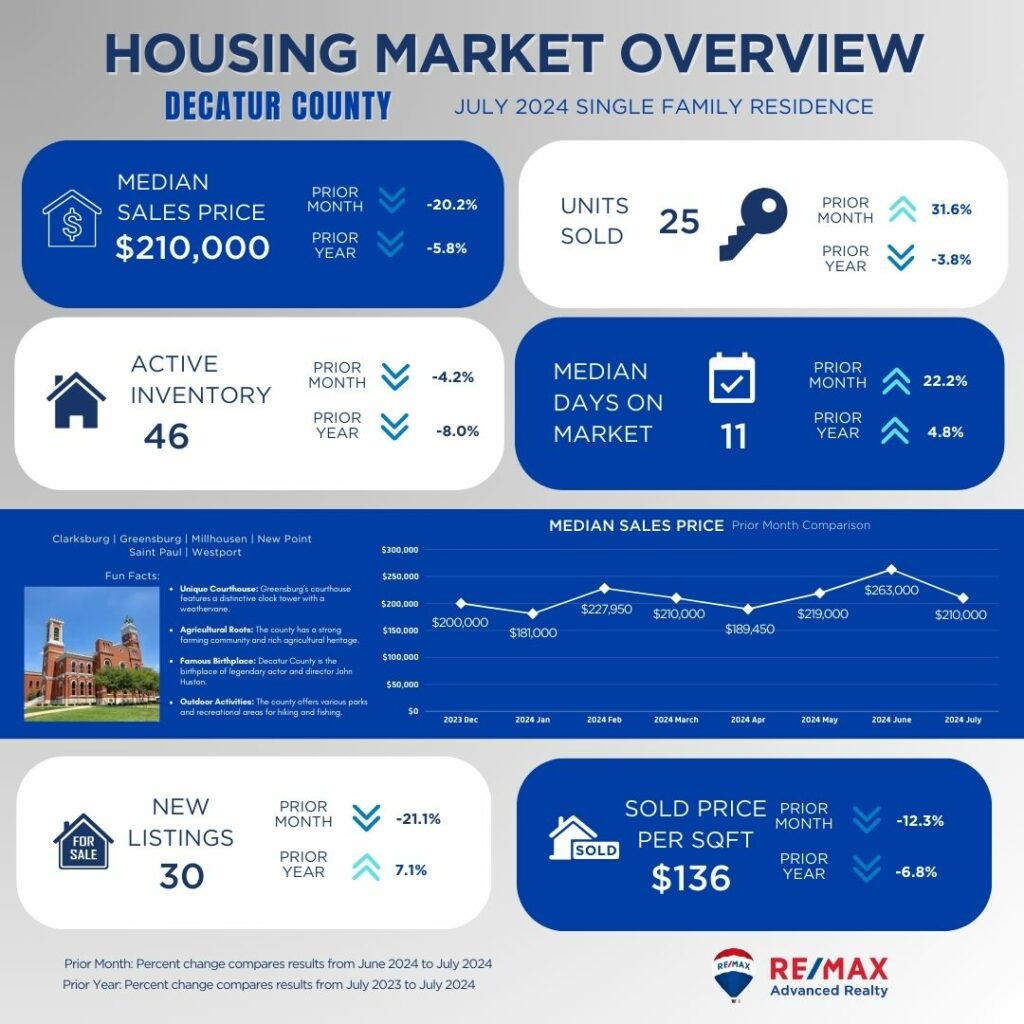

Decatur County

Decatur County presents a different scenario with a dramatic 20.2% drop in median sales price to $210,000. However, the number of units sold has increased by 31.6%, which could indicate that lower prices are driving higher sales volumes. Inventory levels are down slightly, and with a decrease in new listings, the market might be adjusting to these price changes. The reduced median days on market to 11 days shows that homes are selling quicker in this lower-price bracket.

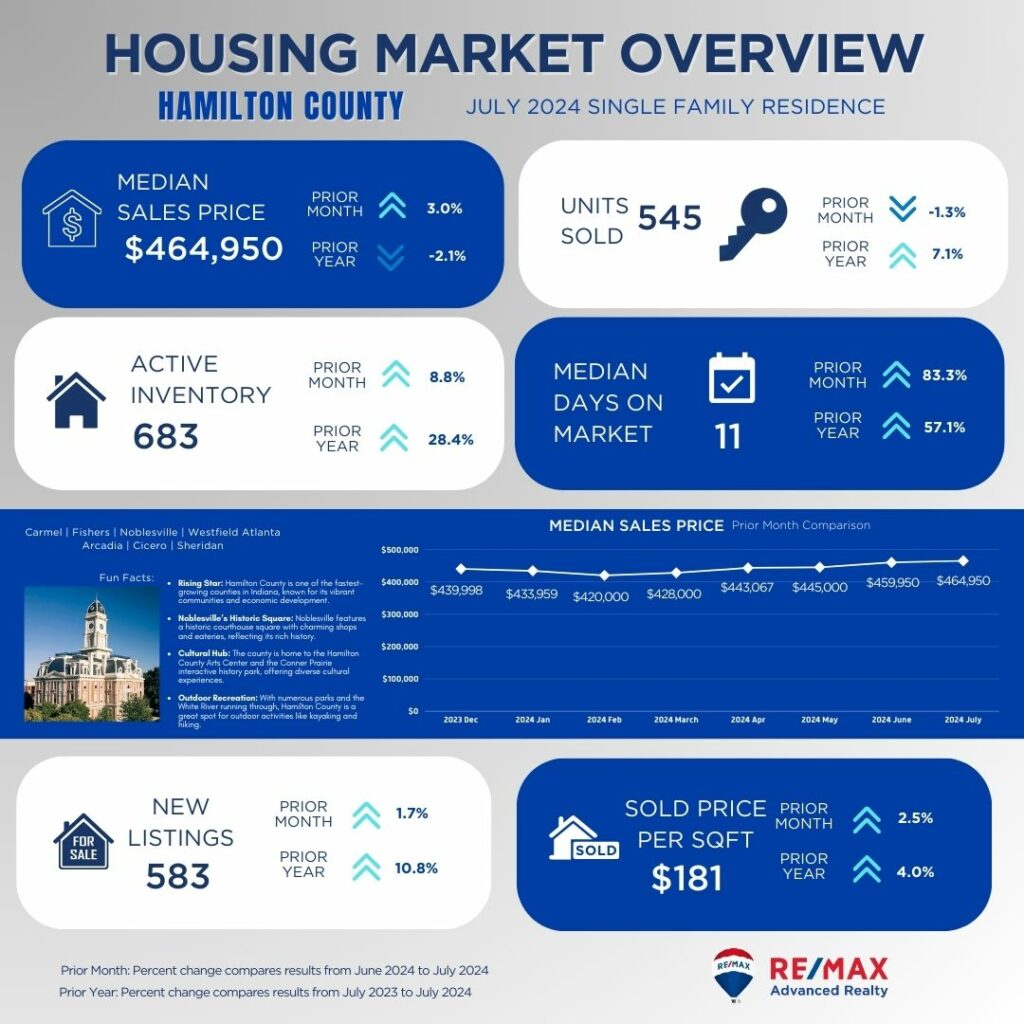

Hamilton County

Hamilton County’s market shows resilience with a median sales price of $464,950, up 3.0% from last month. The number of units sold has decreased slightly by 1.3%, but the increase in active inventory and new listings suggests a more balanced market. The median days on market have increased significantly to 11 days, which could be a sign that higher-priced homes are taking a bit longer to sell, possibly due to the higher inventory levels.

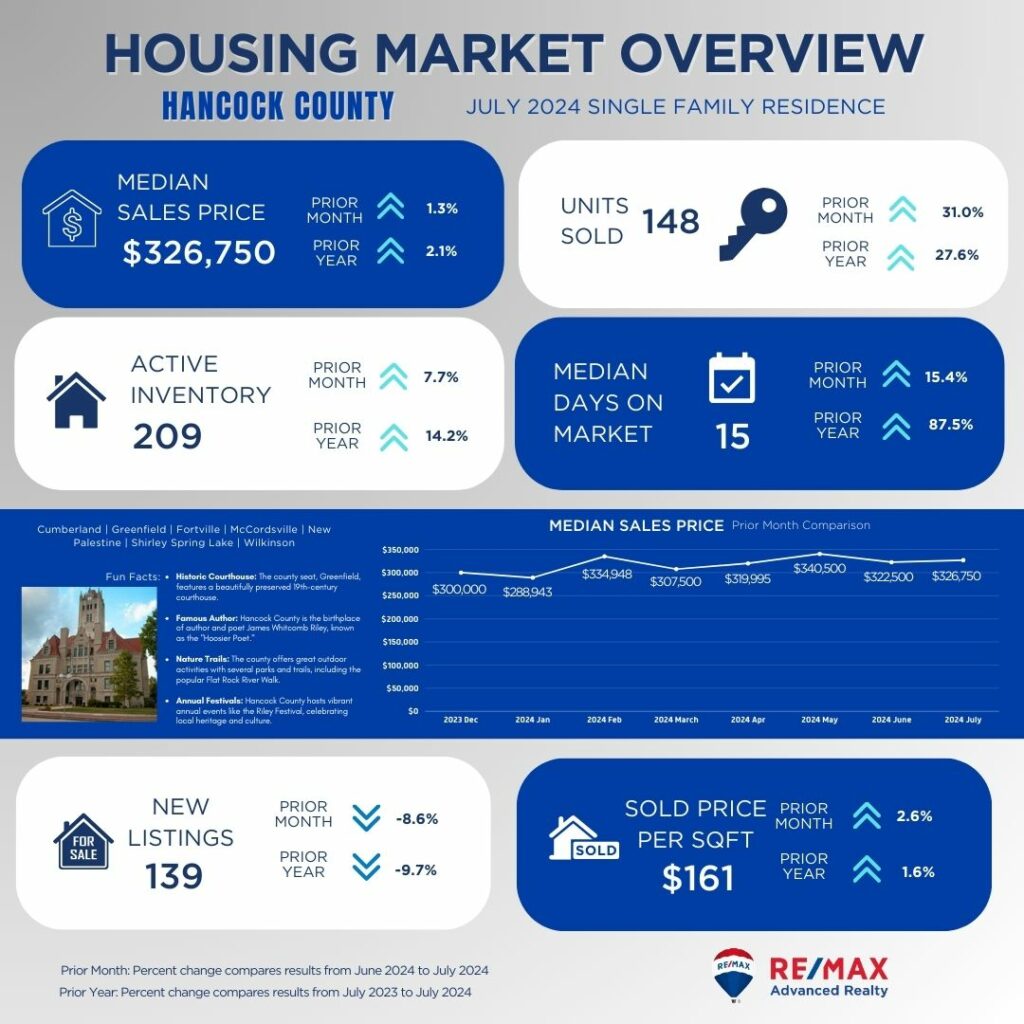

Hancock County

Hancock County is seeing a modest increase in median sales price to $326,750, up 1.3% from last month. Sales activity is strong with a 31.0% increase in units sold, indicating a vibrant market. Despite a slight decrease in new listings, the median days on market is stable, suggesting a healthy demand for homes in this area.

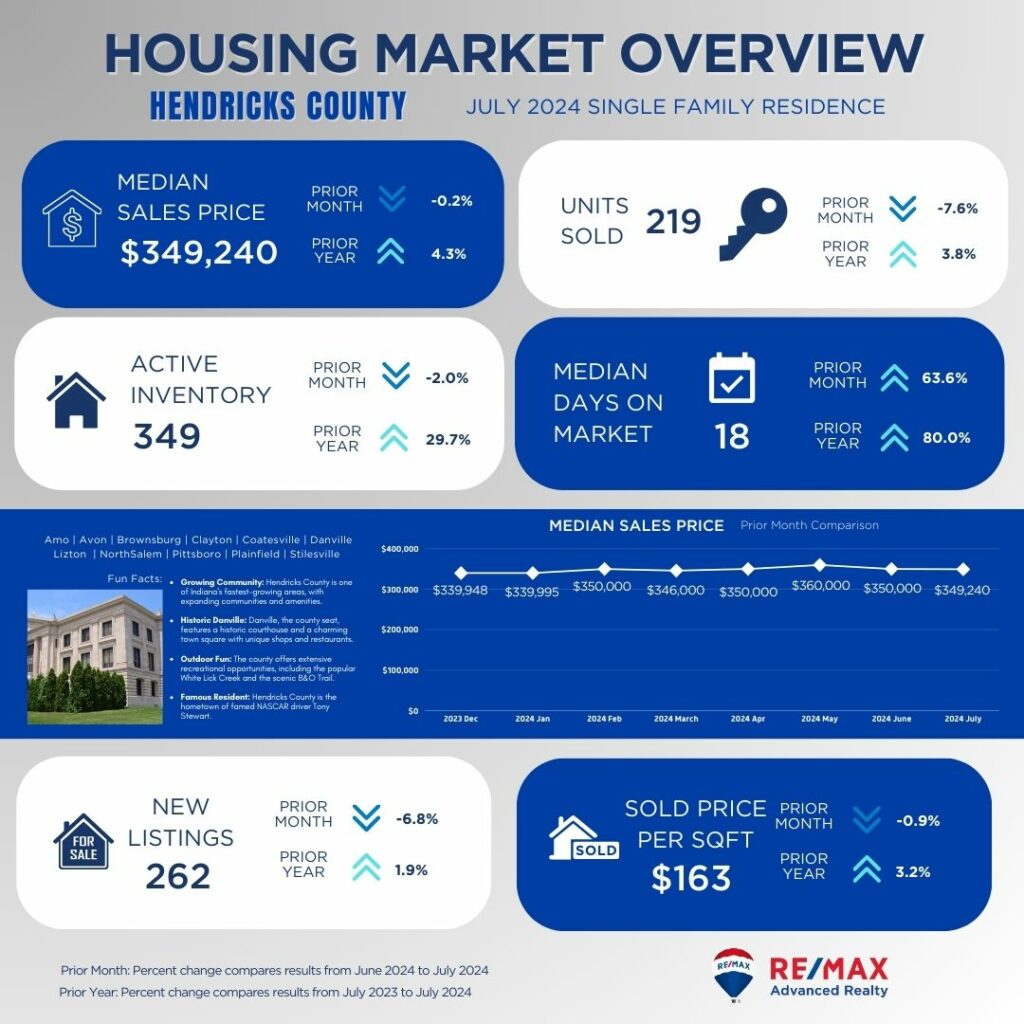

Hendricks County

In Hendricks County, the median sales price has remained relatively stable at $349,240, with a slight 0.2% decrease from last month. Sales have slightly decreased by 7.6%, yet the inventory remains manageable with a slight decrease in new listings. The increase in median days on market indicates that while homes are still selling, they may be taking a bit longer to find the right buyer.

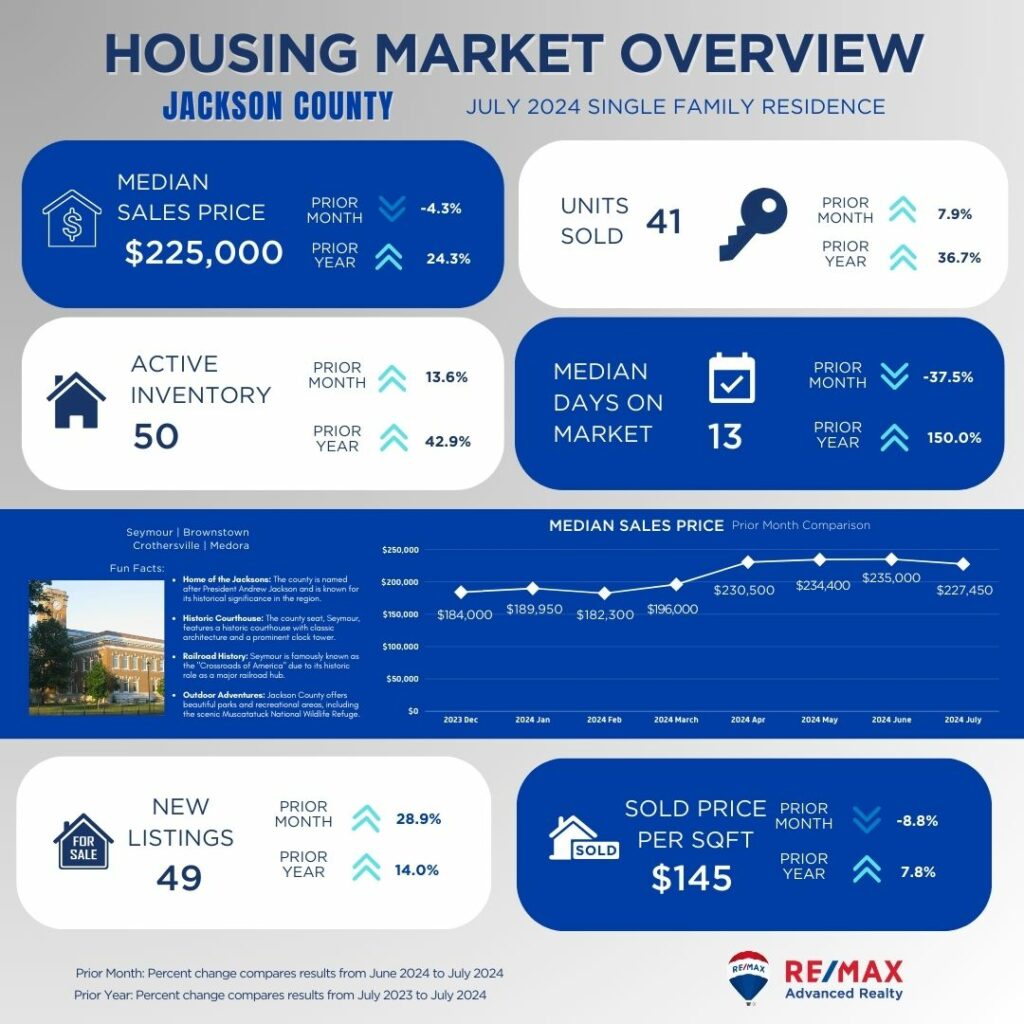

Jackson County has experienced a 4.3% drop in median sales price to $225,000. Despite this, sales activity has increased by 7.9%, and the median days on market have decreased significantly. This suggests that lower prices might be stimulating buyer interest and quicker sales.

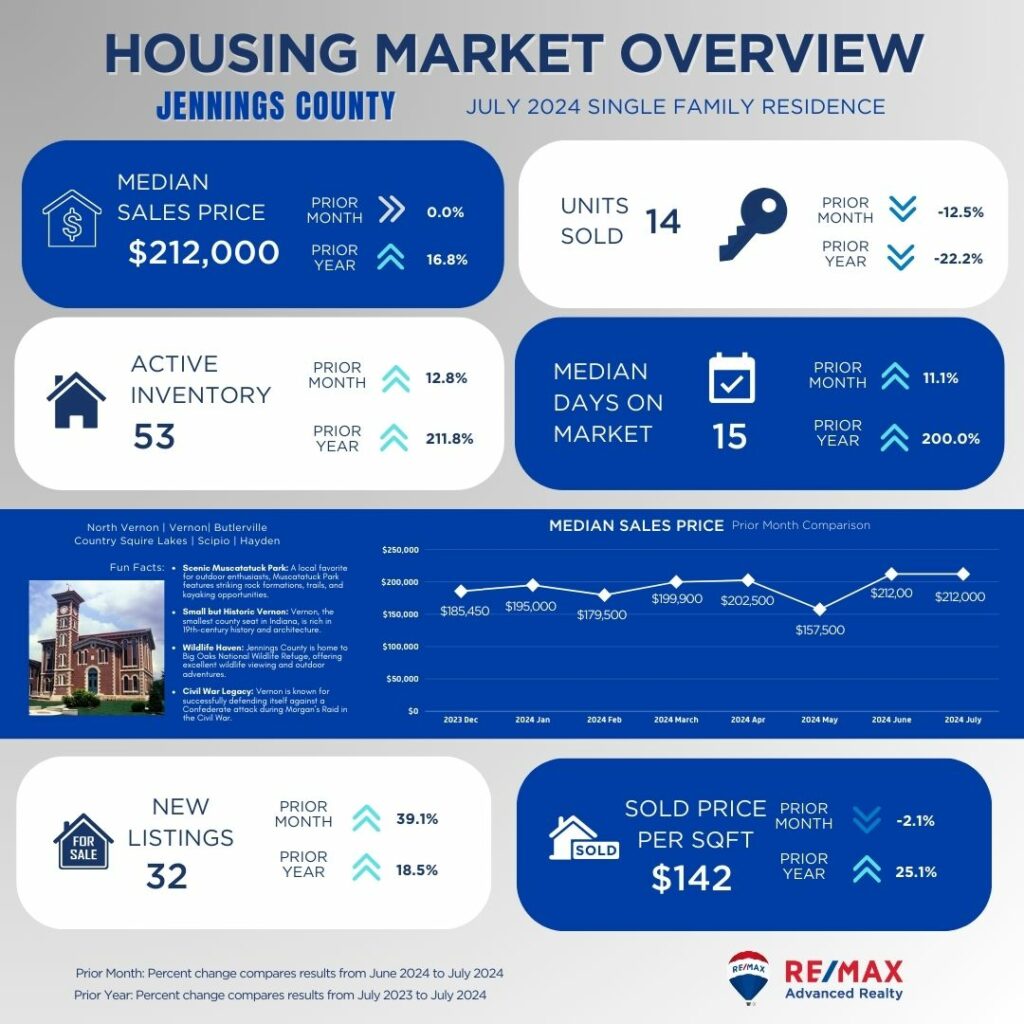

Jennings County

Jennings County’s median sales price has remained steady at $212,000, with no change from the previous month. However, the number of units sold has decreased, suggesting a potential softening in demand. The increase in active inventory and median days on market might indicate a shift toward a more buyer-friendly market.

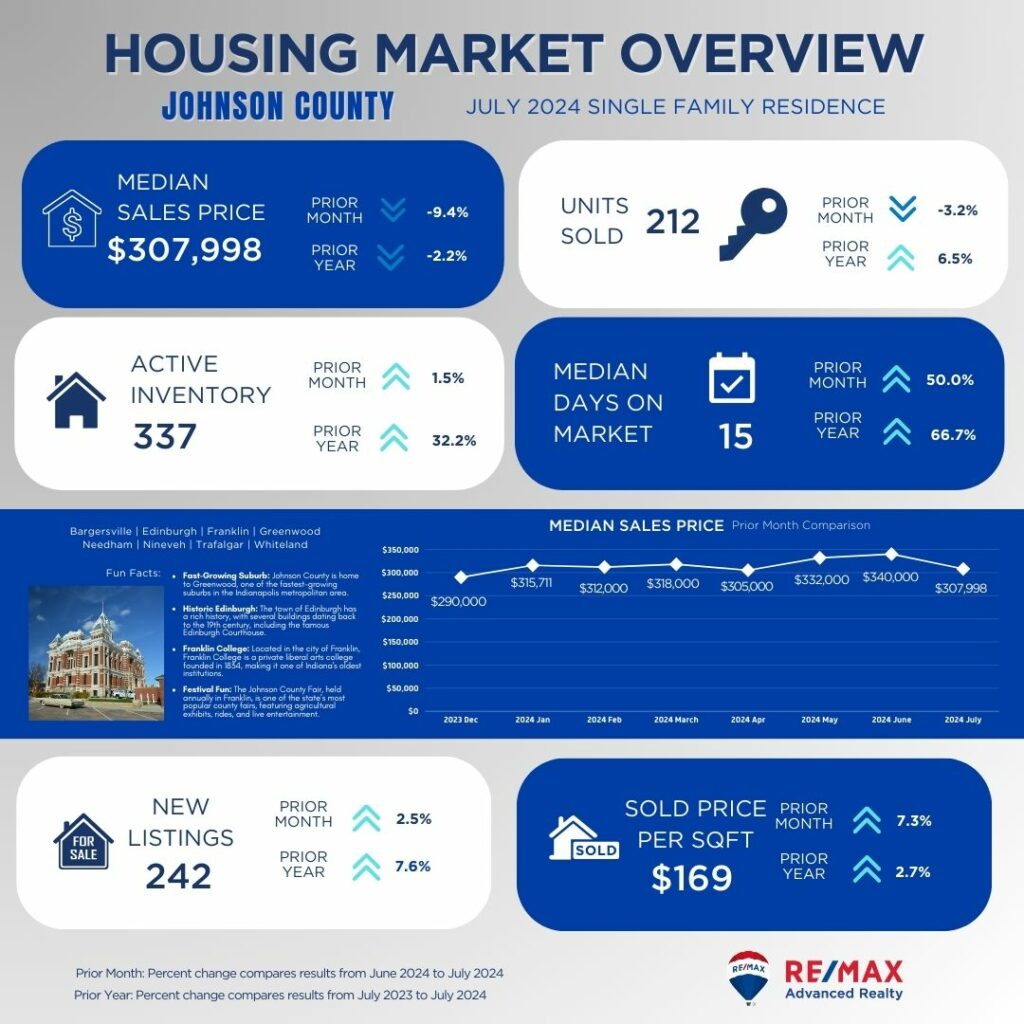

Johnson County

Johnson County’s market shows a decrease in median sales price to $307,998, down 9.4% from last month. Despite this, sales activity remains strong with a decrease in median days on market, indicating that homes are still selling relatively quickly. New listings have slightly increased, suggesting a steady flow of new properties coming onto the market.

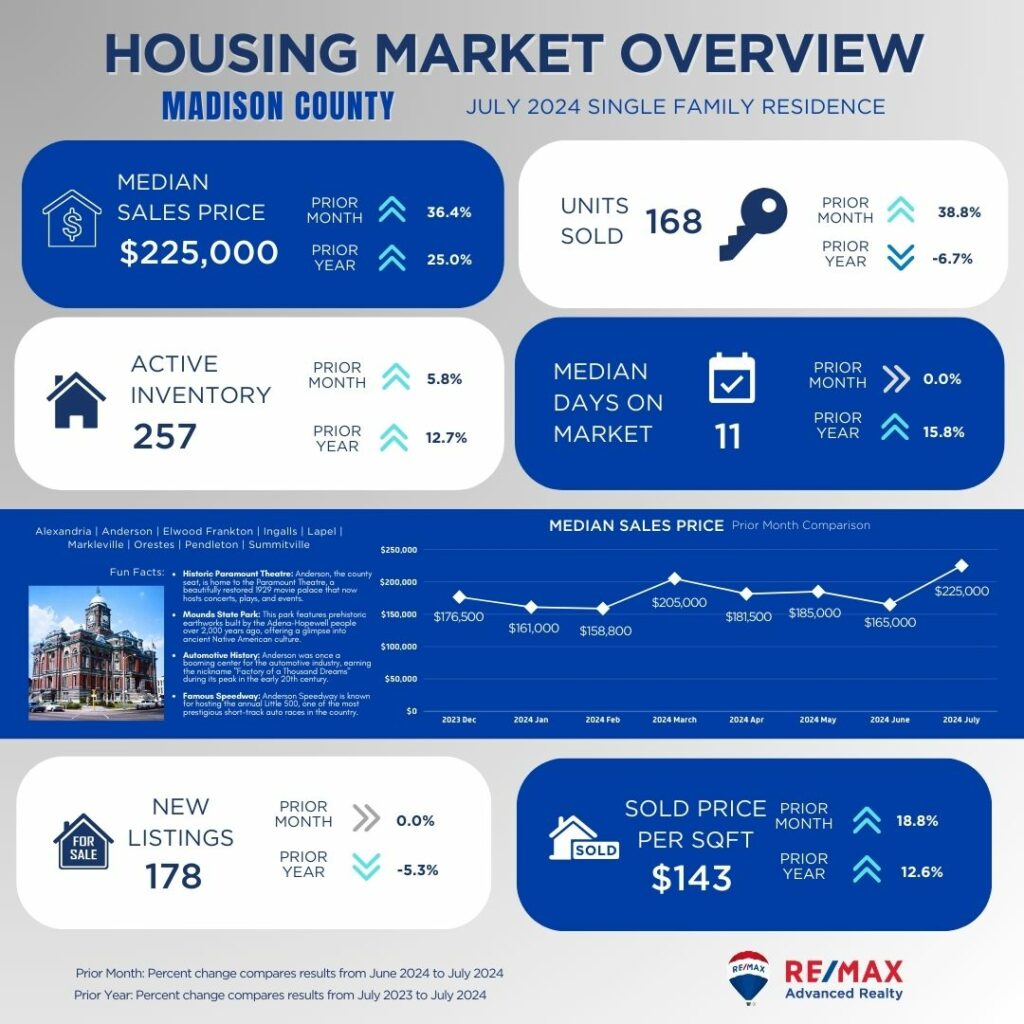

Madison County

Madison County is experiencing a strong market with a 36.4% increase in median sales price to $225,000. The number of units sold has also increased significantly, suggesting high buyer demand. The stable median days on market indicates that homes are selling at a consistent pace despite the rising prices.

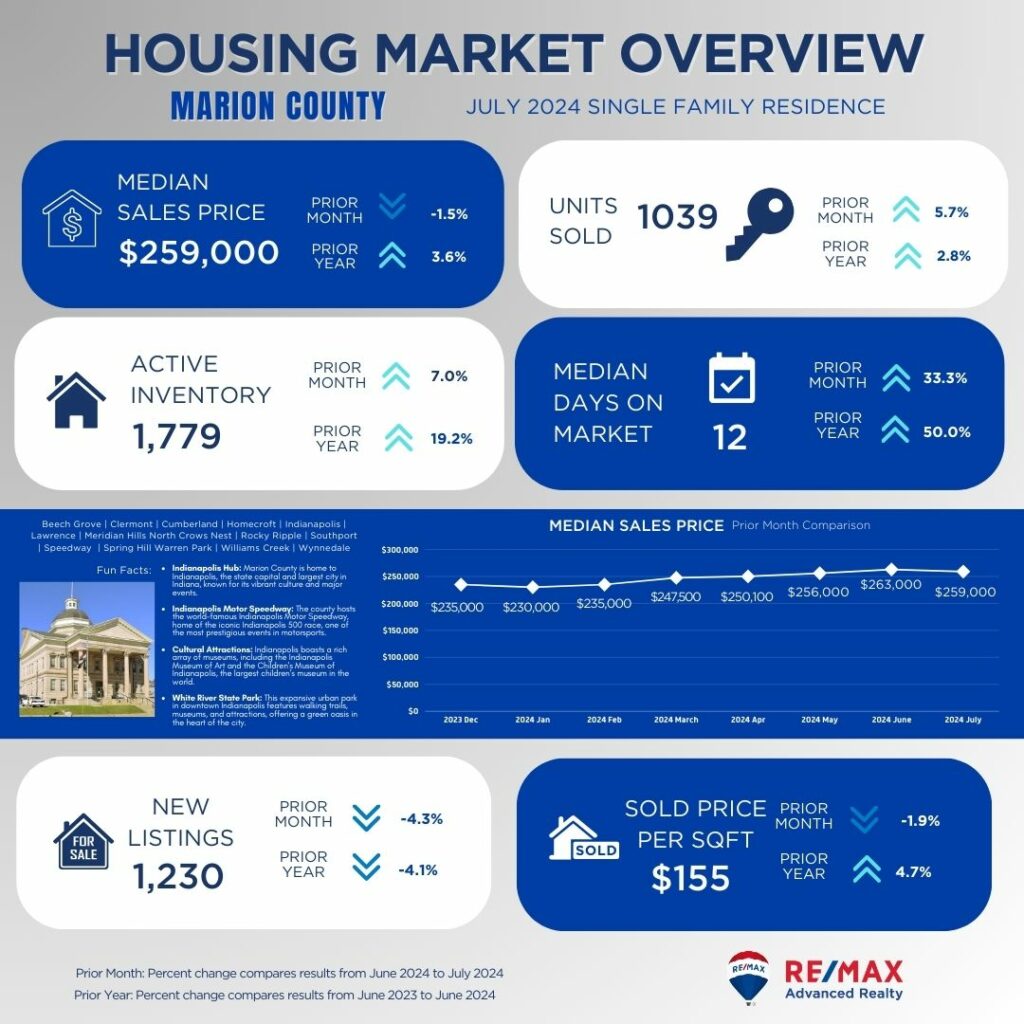

Marion County

Marion County’s median sales price is $259,000, showing a slight decrease from last month but an increase from last year. The large number of units sold and the increase in active inventory suggest a robust and active market. The decrease in median days on market to 12 days indicates that homes are selling relatively quickly in this large and diverse market.

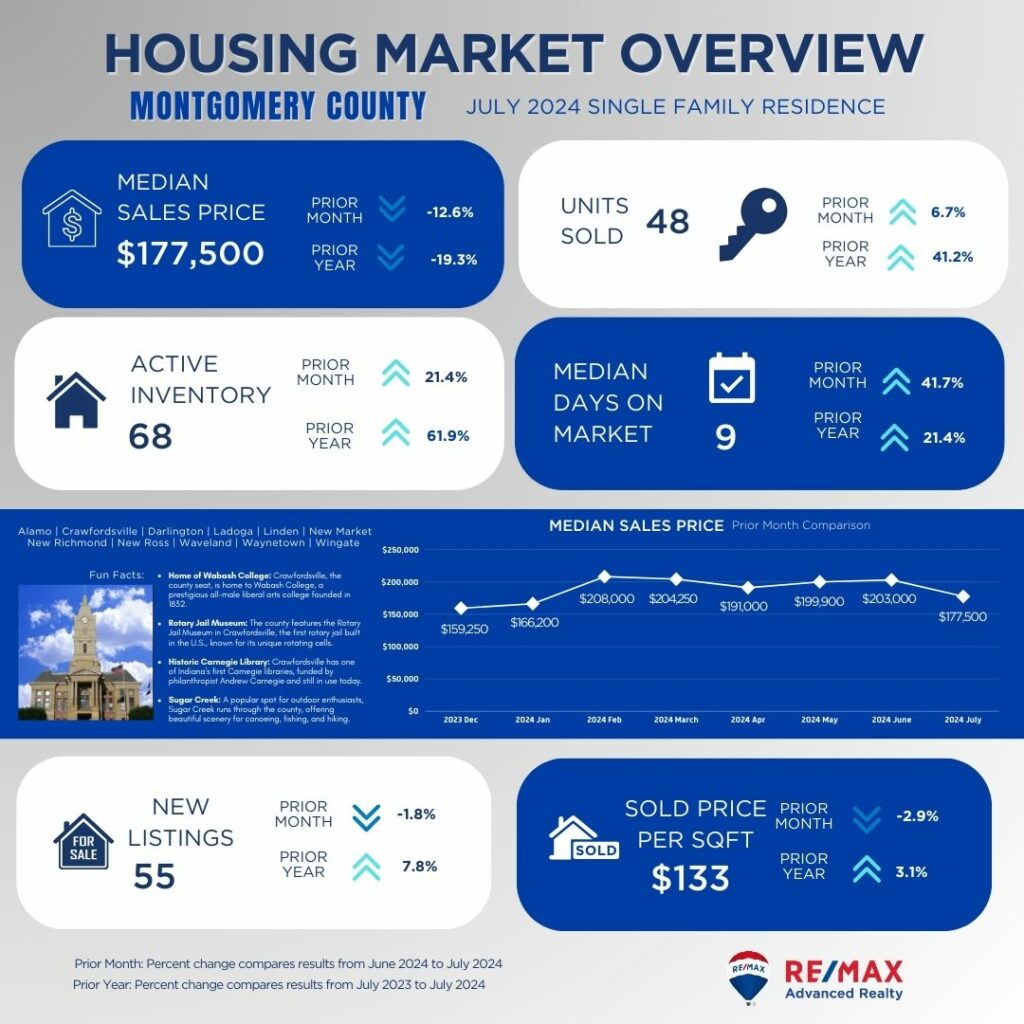

Montgomery County

Montgomery County shows a significant decrease in median sales price to $177,500, down 12.6%. Despite this, the number of units sold has increased, suggesting that lower prices are attracting more buyers. The decrease in median days on market indicates that homes are selling faster, likely due to the more attractive pricing.

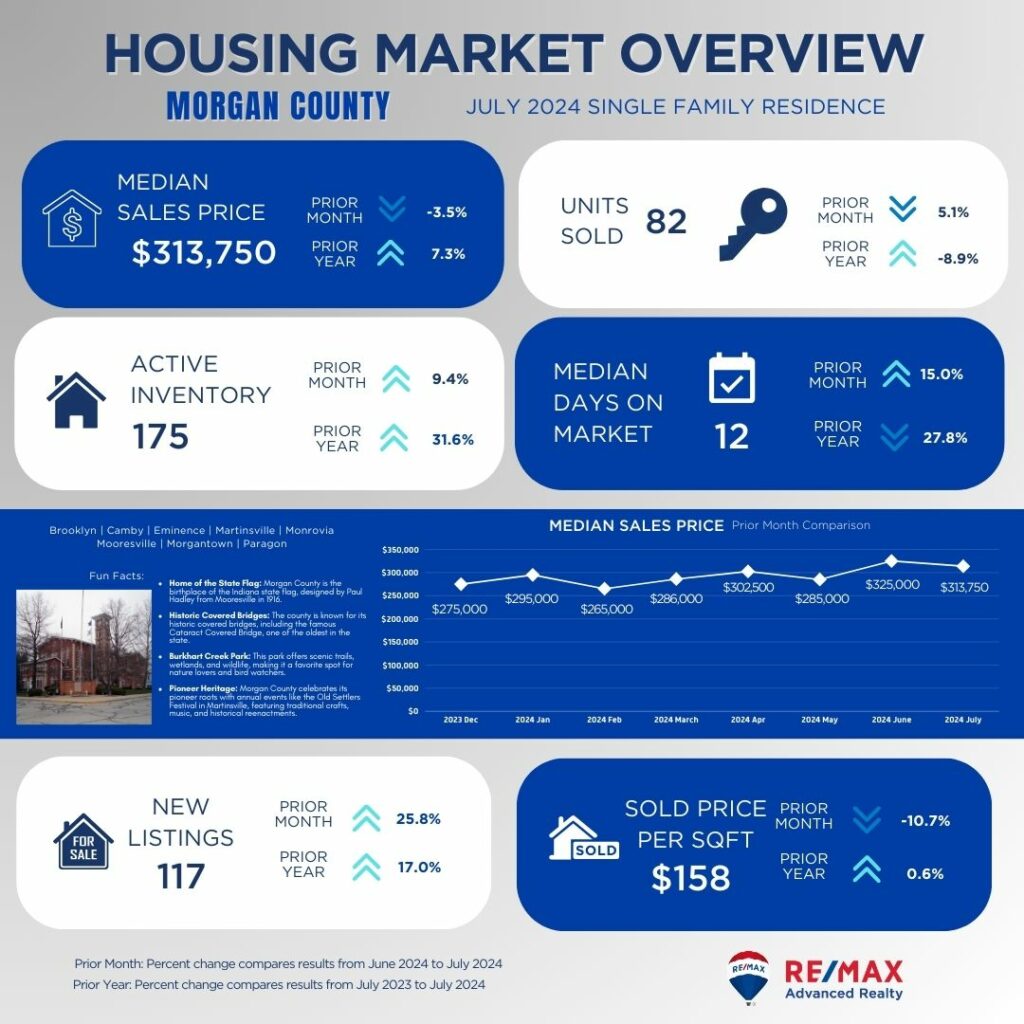

Morgan County

Morgan County has seen a decrease in median sales price to $313,750, down 3.5%. However, sales activity remains strong, and the decrease in median days on market suggests a quick turnover for homes in this area. The increase in active inventory and new listings may offer more options for buyers.

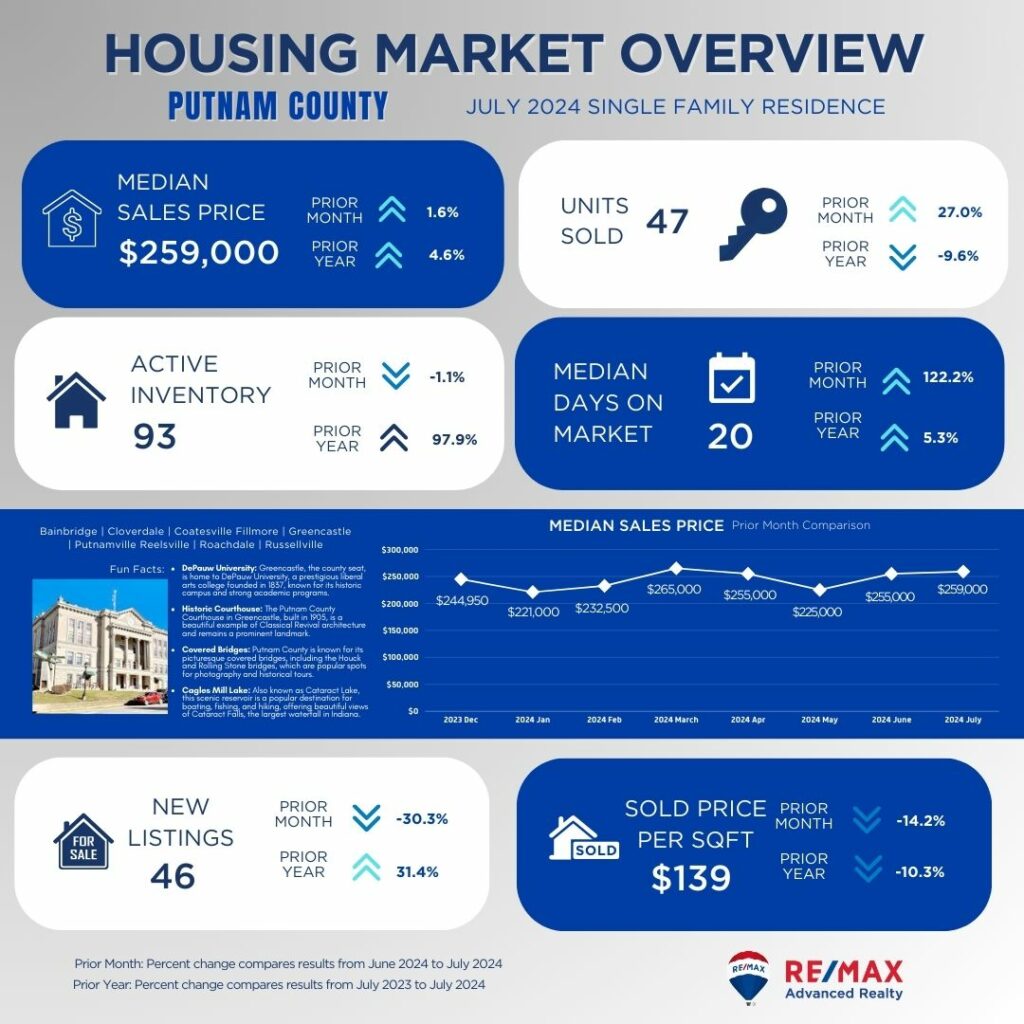

Putnam County

In Putnam County, the median sales price has increased slightly to $259,000. However, the significant decrease in new listings and increase in active inventory suggest a market adjusting to changes. The longer median days on market may indicate that homes are taking a bit longer to sell.

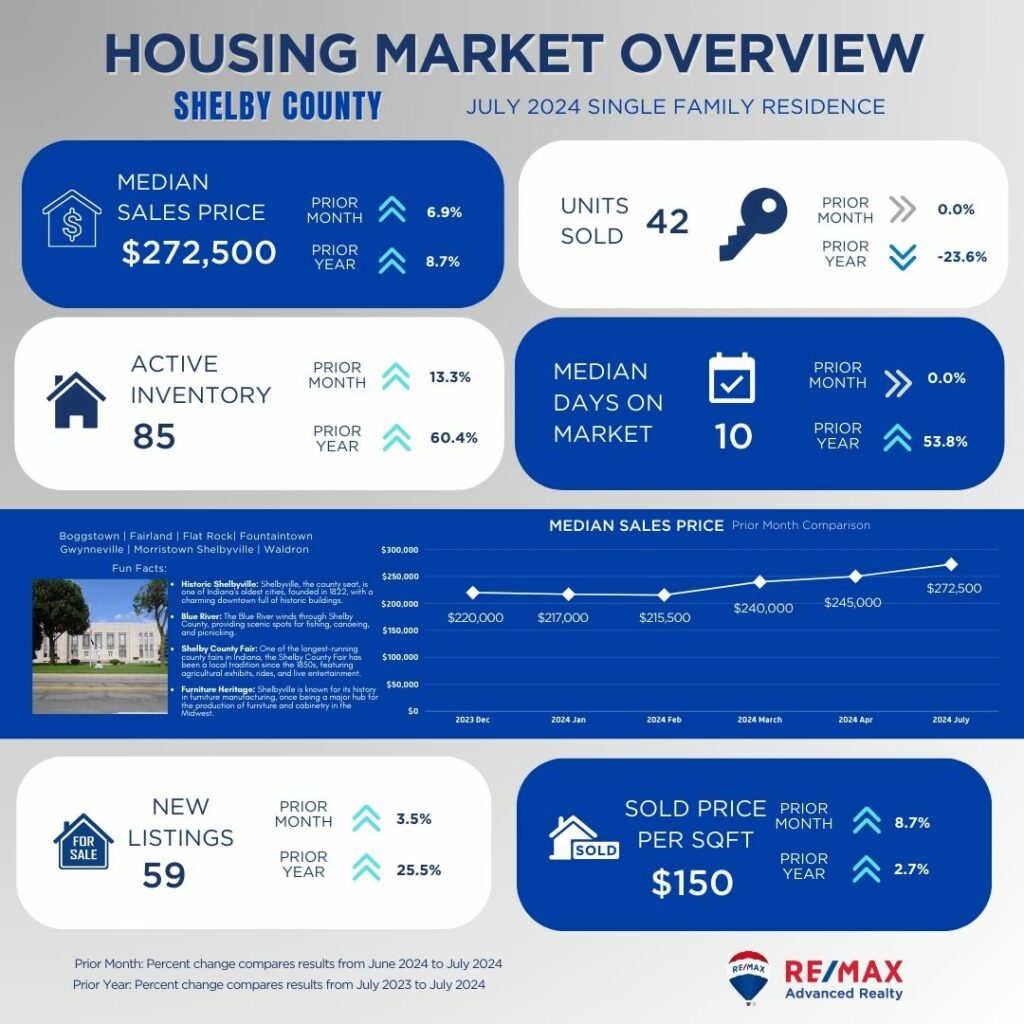

Shelby County

Shelby County has seen an increase in median sales price to $272,500, with a 6.9% rise from last month. Despite a slight decrease in the number of units sold, the increase in median days on market suggests that while prices are rising, homes are taking longer to sell.

As you consider these insights, remember that local market conditions can vary widely. If you’re thinking about buying or selling, it’s always a good idea to consult with a local real estate expert who can provide personalized advice based on your specific needs and goals. Reach out to Indy’s leading brokerage, RE/MAX Advanced Realty, at 317-298-0961 (West Office) and 317-881-3700 (Greenwood Office) to connect with experienced professionals who can help you navigate the current market trends and make informed decisions.

Indianapolis, the capital of the Hoosier state, is a dynamic city full of enjoyable surprises and one of the Midwest's most underappreciated travel destinations. With its stunning artwork, mouthwatering cuisine (don't miss the Indianapolis City Market), extensive history, and varied entertainment choices, the "Circle City" offers something exciting for every kind of traveler.

Discover the city's pulse through our curated guide to the best things to do in Indianapolis, Indiana, from iconic landmarks to hidden gems.

Whether you’re on a vacation or you just want to explore this beautiful city even more, here are activities, places, and many more you can add to your bucket list in Indianapolis.

1. Visit Monument Circle To See The Buzz

The limestone memorial is the city's focal point, hosting local food trucks and sunset light performances from its observation deck overlooking a traffic circle.

2. Families Should Visit The Indianapolis Children's Museum

Visit the Dinosaur Park, experience water, Dale Chihuly's Fireworks of Glass, and Riley Children's Health Sports Legends Experience. Don’t forget to see the Treasures of the Earth to learn about geology or watch a live, hilarious, informative theatrical presentation.

3. Ride The Indianapolis Cultural Trail

You may rent or ride a bike on Indy's Cultural Trail, an eight-mile paved path that passes some of the city's most famous sites. This tourist itinerary through six unique areas will highlight your trip whether you prefer art galleries, parks, monuments, museums, or gardens.

4. Discover Indiana's Rich History At The Indiana State Museum

Because of its popularity, the Indiana State Museum moved from Indianapolis City Hall to White River State Park. Its three floors exhibit ancient, contemporary, and natural science displays.

5. Visit The Indianapolis Zoo And Meet Some Wonderful Animals

Over 3,800 beautiful animals draw over a million visitors to White River State Park in Indianapolis. The Indianapolis Zoo transports you to childhood with its water lily pond, tranquil walks, and trainer shows.

6. Check Out The Museum At Indianapolis Motor Speedway

Fast-and-furious fans must visit the Indianapolis Motor Speedway Museum, the racing capital. The 2.5-mile oval track museum displays hundreds of late 1800s cars, motorcycles, engines, and artifacts on two floors.

7. Embrace The Fast Lane With An Indianapolis Motor Speedway Experience

After studying racing history, it's time to experience driving an open-wheel chassis Indycar. Race around the Oval or other city circuits at 180 mph on race day weekends and hold on.

8. Go To A Candlelight Concert For An Unforgettable Musical Experience

Book tickets to a fantastic Candlelit Concert to enter one of Indianapolis' top music venues and be dazzled by thousands of candles as the music engages the audience. Enjoy this date even if you're not traveling with your partner.

9. Visit The Lilly House And Gardens To Go Back In Time

Antique furnishings, classic artworks, and Victorian decor complement the majestic exterior of this French chateau-style early 20th-century country residence. To learn about living 100 years ago, join a guided tour of the meticulously restored Lilly House, a National Historic Landmark.

10. Visit The Kurt Vonnegut Museum And Library To Learn About A Fantastic Writer

Near the Canal Walk, this overlooked site examines the life, work, and times of one of America's best satirical novelists. Even if you're not a fan, an expert-led tour of the Kurt Vonnegut Museum and Library is the most excellent way to see its fascinating souvenirs and personal artifacts.

© my-indiana-home.com/indiana/discover-indianapolis-kurt-vonnegut-museum-and-library/

11. Visit The Indiana War Memorial To Pay Your Respects

The 1924 Indiana War Memorial Museum and Shrine honors World War I veterans and is another Downtown Indianapolis must-see. The Monument's 30,000-square-foot museum displays Revolutionary War military artifacts.

12. Discover The Thrill Of Sky Zone Trampoline Park

Hop around in the Freestyle Jump section as an adult to unwind. There are activities for everyone in your party, whether you'll be spending time with friends or family.

13. Explore The Arts At The Indianapolis Art Center

For over 100 years, this neighborhood gallery has collected the best modern and contemporary art and hosted seminars, workshops, and events. Check out the sculpture garden or a quiet cafe for lunch while seeing these pieces.

14. Challenge Yourself With Ax-Throwing

Like darts or bowling, Bad Axe Throwing Indy teaches hatchet throwing at wooden targets in a safe and fun environment. Safety-focused instructors can teach and organize competitive activities for a fun day with friends or a quirky date night. After reaching the bullseye, you can enjoy wines and refreshments.

15. The Natural Valley Ranch Is The Place To Saddle Up

Natural Valley Ranch in Hendricks County, a short drive from Indianapolis, includes different equestrian riding paths and a campground for city escapes. Summer offers guided woodland rides, first-timer teaching, White Lick Creek trots, and birthday celebrations.

16. Play And Fun Roller Skating

The Fun Factory is a beautiful destination for skating with friends, reliving nostalgia, and letting youngsters run off energy on one of their numerous themed nights. Arcade games, pizza nights, and skating lessons are available in addition to all-ages skating.

17. Explore Every Corner Of The Indianapolis Museum Of Art

Indianapolis Museum of Art has hosted unique exhibitions since 1883, delighting local art fans. Egyptian mummies, impressionist works, and the surrounding gardens can be explored for days by yourself or a guide.

18. Visit The Indiana Farmers Coliseum For Many Events And Sporting Contests

Sports, livestock, music, vehicle exhibits, and more are held at the Indiana Farmers Coliseum on the Indiana State Fairgrounds. Events await you whether you're traveling with friends or family.

19. Take A Stroll Beside The Central Canal

Central Canal runs through Downtown Indy and to the north, making it a popular workout and people-watching spot. The canal's view of downtown Indianapolis, the romantic sunset walk, and the many charming boutiques and restaurants off the main route make it a must-see for a late afternoon promenade.

20. Discover The Thrill Of Dragster Driving

Visit Lucas Oil Raceway to test your 2-seated Dragsters at over 140 mph. You'll have lifelong memories whether you choose the passenger or driver package or the 1/4 mile runs.

21. See Western Art And American Indian Art At The Eiteljorg Museum

This distinctive downtown Indianapolis museum showcases Native American paintings, sculptures, and jewelry on Washington Street near Military Park. The award-winning Eiteljorg Museum of American Indians and Western Art has something for everyone, from small children who love vibrant fine art to history lovers who love American forefathers' exciting stories.

22. Go Around Curves At K1 Speed

All go-kart fans can enjoy K-Speed Indy's indoor racing. With racing memorabilia, comfortable couches, and lots of food and drink, this venue is the most accessible place to get behind the wheel and the perfect place to bring friends and family for a day of high-speed fun. Go-karts can reach speeds over 45 mph.

23. Experience A Thrilling Journey In A Hot Air Balloon

You'll experience Monument Circle and Eagle Creek Park in a new light as you soar over the city skyline, the perfect mix of thrills and leisure. It may be hard to wake up before sundown, but as you fly across the sky and the urban environment turns into rolling fields and forests, you'll be glad you did.

© indyschild.com/indiana-hot-air-balloon-festivals/

24. Enjoy A Game Of Bowling

Bowling is a fun indoor sport for rainy days or hanging out with friends. With hundreds of lanes across the city, arcade games, and retro soundtracks, this iconic American sport offers limitless fun. Action Duckpin Bowl at Fountain Square has eight old-school duckpin lanes and a large restaurant.

25. View Outdated Treatments At The Indiana Medical History Museum

The Indiana Medical History Museum has some of the most bizarre medical artifacts and a crazy history. Autopsy tables, iron lungs, and chemical laboratory equipment are among the 15,000 exhibits about psychiatric care in this exhibition, and if that’s not enough to convince you to visit this place, we don’t know what else will.

26. Greatimes Family Fun Park Is A Must-See

On sunny days in Indianapolis, take kids to Greatimes Family Fun Park 15 minutes down I-65 from Downtown Indianapolis. This amusement park has bumper cars, go-karts, mini-golf, arcade games, and a large restaurant.

27. Make A Raucous At Lucas Oil Stadium

Downtown Indy's Lucas Oil Stadium is home to the Indianapolis Colts and a popular performance venue. Some of the nation's top football venues are in Indiana. Guided tours of the sport and stadium year-round and sell-out audiences draw many fans every match day.

28. Best Venues Serving The Best Live Music

If you want bands ranging from country to indie rock, check out the Emerson Theater's main stage performances. Visit Hi-Fi for a quiet musical evening, regardless of the style of music. If you want dance parties, burlesque performances, and live music, the Vogue Theatre is the place to go!

Other venues to check out include:

29. Visit Royal Pin To Play Laser Tag

Royal Pin sports ten pin lanes and a multi-level, black-lit Pirate's Quest Laser Tag. Two hours of competitive fun is accessible wherever you stay, with arcades, birthday parties, bookable corporate events, and three sites in Woodville, Western, Castlewood, and Beech Grove.

30. Ride the Indiana State Fair Midway Ferris Wheel

Usually running from July to late August, thrill-seeking families and individuals can visit the Indiana State Fair Midway near The Track of Champions from late July to late August. This famous fairground has amused travelers with over 100 rides on 11 acres, including roller coasters and Ferris wheels, since the mid-1800s. It's renowned for deep-fried food, carnival games, candy apples, and more.

31. Explore All Newfields Attractions

Newfields is "a place for nature and the arts," and Winterlights is a great place to stroll. Indianapolis has a beer garden, the Indianapolis Museum of Art, Lily House, Fairbanks Park, and numerous well-kept gardens.

32. Visit Victory Field To See A Baseball Game

The Indianapolis Indians play at Victory Field, a local landmark. West of downtown, White River State Park is accessible, a short walk from the canal, and usually entertaining.

33. Treat Yourself To A Spa Day

At Europe Day Spa, music and fragrance instantly relax clients for a 60-minute oil massage, exfoliating facial, or Sweden massage. Transformations Salon and Spa have the greatest facials, hair treatments, and European manicures. Give yourself a makeover to appear your best.

34. Zip Line At Go Ape

Eagle Creek Park's Go Ape high-ropes course, zip lines, swings, and obstacles 40 feet up in the deep woodland canopy are excellent for testing your boundaries.

© www.goape.com/go-ape-coming-to-arlington/

35. Escape To Eagle Creek Park And Nature Preserve

You can do more than Escape at Eagle Creek Park and Nature Preserve. Its 3,900 acres of lush woodlands make it one of the nation's largest city parks for animal viewing. Enjoy Rick's Boatyard Café after visiting the pool, dog park, golf course, and sailing club.

36. Experience The Thrill Of An NBA Game At Gainbridge Fieldhouse

Indy's family-friendly sports arenas are undiscovered gems. Well-deservedly, the Fieldhouse in Indianapolis' most famous building is the Pacers' home court. The 20,000-seat venue roars with Pacers yells and A-list musicians.

37. Discover Local History At The Indiana Historical Society

Discover Holocaust survivors, notable figures, and Indiana's role in shaping the nation at the Indiana Historical Society in the afternoon. Explore social services, women in Indiana, and Indianapolis' history.

38. Set Out For A Game Of Golf

Golf courses are within driving distance of most Indianapolis locations, offering plenty of beautiful fairways. Get your clubs and head to one of the city's top-class courses, such as The Brickyard Crossing, which overlooks Indy's racetrack, Highland Park Golf Course, Greenwood Hills, Maplewood, or South Grove.

39. Drumming At Rhythm! Discovery Center

As the world's largest interactive drum and percussion exhibit, Rhythm! Discovery Center guarantees family fun. With a few friendly educational sessions to augment the hands-on exhibits and musical instrument displays Downtown, you'll be banging and tapping away in no time.

40. Drive To historic Conner Prairie

The beloved Living History Museum in Indianapolis, Conner Prairie, is only 40 minutes away by vehicle in picturesque Hamilton County. There's always something going on there. This 800-acre National Historic Landmark has the William Conner residence, Indian campgrounds, a corn maze, and a petting zoo.

41. Scavenger Hunt Around Town

A fun method to discover the city and many hidden gems that other tourists overlook is through scavenger hunts. They check off Indianapolis's attractions, raise your heart rate, and put your problem-solving abilities to the test. By deciphering hints and puzzles on your phone, you can find photo ops, interesting competitions, and local knowledge.

42. Shiver During An Indiana Ghost Walk

If you like ghosts and scary stories, visit one of Indianapolis' ghost walks to explore the city's dark side. With many weekly tours available, visitors can explore the ghostly past at their leisure, from the Allison Mansion and Central State Hospital to the Indianapolis Athletic Club.

43. Annual Indiana State Fair Monster Truck Show

At the August Indiana State Fair, witness the best monster trucks. These gigantic animals dominate the dirt with roaring motors, shredding tires, and mud-flying. The adrenaline rush at a monster truck exhibition is tremendous, whether it's your first or fifth.

44. Visit Holliday Park

The trees, paths, and wildlife of Holliday Park make it a great place to wander on a warm afternoon. Visitors to this urban park on the White River enjoy its 95 acres of wooded walks, child-friendly playgrounds, and 13,000-square-foot Nature Center year-round. The 19th-century ruins draw history buffs and photographers year-round, but the fall hues are stunning.

© polis.indianapolis.iu.edu/holliday-park/

45. Go To The Catacombs

An exclusive underground tour of this historic high-trafficked path, now a maze of tunnels and chambers accessible from Market and Delaware streets' northeast corner, reveals the city's hidden mysteries. In the late 1880s, catacombs were used to convey and store items from the above market before being abandoned.

46. Enjoy One Of The Area's Many Waterparks

Freedom Springs Water Park in Greenwood offers a lazy river, three water slides, and a kiddie play zone. Slides, an obstacle course, an adults-only hot tub, and a water playground are at Big Splash Adventure Water Park & Hotel. Splashin' Safari Water Park at Holiday World offers roller coasters and a wave pool, while Kokomo Beach Family Aquatic Center is a local favorite.

47. Discover College Spirit At The NCAA Hall Of Champions

America loves college sports, and White River State Park is the most fantastic place to learn about All 24. You may witness the tremendous tales and artifacts that made these universities and colleges renowned. Famous collegiate sports teams, players, mascots, and more are displayed in the Hall.

48. Visit Indianapolis City Market For Food And Souvenirs

In Indianapolis City Market, you can grab a beer and enjoy live music, shop for fresh meats and soaps from local artisans, buy flowers, or try international cuisine from food stands. Friendly locals lead group tours of this historic monument, teaching visitors about the Market's rich history and revealing hidden jewels.

49. Get A New Craft With GRT Glass Design

GRT Glass Design makes functional and beautiful hand-blown glass art. They offer workshops for all ages and experience levels to participate in the process, not just a gallery and workshop. You may always examine their unique finished creations at the on-site shop.

50. Booking A Beef & Boards Dinner Theatre Table

At Beef & Boards Dinner Theatre, you may enjoy comedy, drama, and more. Try Broadway classics like Kinky Boots, Phantom of the Opera, or holiday shows like It's A Beef & Boards Christmas.

51. Attend Ruoff Music Center Concerts

Ruoff Music Center, a 6,000-seat theater, attracts residents and celebrities in country, rock, pop, and R&B music. Locals prefer lawn seating for theater shows for many reasons, including the significant price drop and more room to dance and leap to your favorite songs.

52. Eat At Harry And Izzy's Steakhouse

Harry and Izzy's Steakhouse has three locations and a rotating menu. Its 1930s speakeasy vibe makes every visit a delicious new experience. The restaurant serves fresh food in every dish, including fried ravioli, sliders, creme brûlée, and a delightful steak menu.

53. Wine-Taste To Get Buzzed

Visitors may not know that Indiana has over 30 wineries, but residents are glad to tell them. Vet-owned B Legendary Wine Boutique and Peace Water Winery are popular. Try Urban Vines Winery & Brewery for tastings of their best, organic, and award-winning wines. Easley Winery offers white, sparkling, and rose wines. Buck Creek Winery is an award-winning winery.

These are just some of the weirdest, craziest, yet most exciting things you can do at the beautiful Indianapolis. Feel free to share with us if you’ve done any of these or if you have other recommended places we can add to this list.

In Indiana, there is one city where the population is growing faster than the others. Can you figure out which one it is?

In this post, we'll talk about not one, not two, but 10 cities in Indiana that are rapidly growing. This will help you choose which places to consider if you move to the Hoosier State.

The history of "The Hoosier State" is primarily associated with farming, motor racing, and basketball. This state is home to about 6.7 million people, so you might end up joining the crowd. We can help if you are having trouble deciding which city to call home.

1. Westfield, Indiana

First on our list is Indianapolis' northernmost suburb, Westfield, IN. There are currently 50,650 people living in the city, a 28% growth from 2017.

The number of wonderful parks in Westfield, such as Quaker Park, Macgregor Park, and Asa Bales Park, is only one of the numerous reasons why people are relocating there. Locals can also discover a wide variety of eateries in the city, such as The Mill Tavern, Grindstone on the Monon, and The Italian House on Park.

2. Noblesville In Indiana

The second-fastest-growing city in Indiana is Noblesville. Its population increased by 15%, reaching a current estimate of 70,950.

Noblesville, Indiana is renowned for its numerous parks and trails, antique stores, and historic downtown. The Noblesville Farmers Market and the Noblesville Street Fair are two of the city's yearly festivities.

Noblesville offers a variety of exciting activities, including sports at Dr. James A. Dillon Park and Finch Creek Park, dining at Chuy's, Aspen Creek Grill, and Grindstone Public House, and attending concerts at Ruoff Music Center.

3. Greenwood In Indiana

The charming downtown area and spacious, historic residences in Greenwood, IN are its most notable features. Its population has increased by 13% to approximately 64,950.

Try something to eat at one of the neighborhood's favorite spots, The Yard Cafe, Valhalla Sandwiches, or Baranof Restaurant, to get a taste of what it's like to live in Greenwood.

After that, you can take a leisurely stroll through one of the many parks, such as Old City Park. And finally, do not miss a performance at the Greenwood Performing Arts Center.

4. Fishers In Indiana

Ranking fourth on our list of Indiana cities with the quickest rate of growth in Fishers, IN.

Fishers is a thriving, growing city that has won awards for entrepreneurship and livability across the country. The population of the city increased by 10% to approximately 101,200 people today.

Living in Fishers offers a plethora of fantastic things to do, including visiting Roy G. Holland Memorial Park, Billericay Park, and Cumberland Park, or stopping by Paterson's, Sahm's Restaurant, or City Barbeque for a quick bite.

5. Columbus In Indiana

Are you considering relocating to Columbus? The city is mostly renowned for its distinctive architecture, which consists of thousands of architectural treasures dispersed throughout the entire area. Columbus now has about 50,600 people living there, a 7% rise in population. It's among the more reasonably priced areas of Indiana to call home.

Searching for things to do in Columbus? Try jogging at Freedom Field, Mill Race Park, and Clifty Park; viewing art at the Atterbury Bakalar Air Museum; attending a performance at the Mishawaka or Midway Tavern; or indulging in delectable cuisine at Amazing Joe's Grill, Taku Stead House, and Henry Social Club.

6. Jeffersonville In Indiana

Ranking sixth, Jeffersonville, IN is mostly recognized for its picturesque Ohio River vistas and close proximity to Louisville, KY. The city's population of approximately 50,300 has increased by 6% in the past year.

There are many interesting things to do in Jeffersonville, like having a picnic in Bob Hedge Park, Warder Park, or Chapel Lake Park, seeing a performance at Jeffersonville Riverstage, or dining at one of the neighborhood's eateries, The Red Yeti, Pearl Street Taphouse, or Parlour.

7. Mishawaka In Indiana

Are you considering moving to Mishawaka, Indiana? The city's riverfront parks, growing downtown, and frequent events are its most notable features. It is where the famous University of Notre Dame is also located. Mishawaka now has 51,100 residents, a 4% increase.

You might be wondering what living in Mishawaka, IN is like. There are plenty of things to do, like dining at Doc Pierce's Restaurant, Evil Czech Brewery and Public House, and Papa Vinos Italian Kitchen, or just lounging around Battell Park, Central Park, and Merrifield Park.

8. Carmel In Indiana

Located at number eight on our list, Carmel, IN is most recognized for its abundance of roundabouts. Since the 1990s, the city has been installing roundabouts, and as of right now, Carmel has more than 100. Its population, which is currently estimated to be around 100,800, increased by 3%.

Check out one of the many fantastic parks in Carmel, Indiana, including Flowing Well Park, Founders Park, and Carey Grove Park, as well as places like The Center for the Performing Arts, Booth Tarkington Civic Theatre, and The Cat, if you're wondering what to do there. For a taste of everything the city has to offer, don't miss a visit to some of the local favorites, Charleston's Restaurant, Muldoon's on Main, and Bub's Burgers & Ice Cream. See the Museum of Miniature Houses and Other Collections after that. Living in Carmel offers something for everyone.

9. Kokomo In Indiana

Kokomo, sometimes known as the "City of Firsts," was the first American city to employ rolling mill technology to create steel and to install electric street lights. It is Indiana's ninth-fastest-growing city. The city now has 59,700 residents, representing a 3.17% increase.

Are you curious about life in Kokomo? Well, there are plenty of enjoyable things to explore. Jackson Morrow Park, Foster Park, and Highland Park are good places to enjoy the outdoors. Windmill Grill, Half Moon Restaurant & Brewery, and Choo Choo McGoo's are great places to try if you enjoy dining out. Make sure to visit The Kokomo Country Palace and Seiberling Mansion if you're looking to explore the local arts and entertainment scene

10. Elkhart In Indiana

Elkhart, Indiana, which has a long history in the RV and musical instrument manufacturing industries, comes in at number 10. To reach its current population of around 54,000, there was a 3.01% population decrease.

There are plenty of things to do in Elkhart, like visiting museums like the National New York Central Railroad Museum and the Hall of Heroes Superhero Museum and strolling through parks like Studebaker Park and Island Park. Take a look at Chubby Trout, The Vine, and Cappy's Northside Tavern and Restaurant for some of Elkhart's best cuisine. You can see a performance at Five Star Dive Bar and The Lerner Theatre later on.

Many cities in Indiana are growing, each with its charm and attractions. The city listed in Indiana above has growing populations, vibrant cultures, and many recreational options. A rich history and modern amenities draw inhabitants to Indiana's various communities.

If you want to know which cities in Indiana suit your needs and preferences, our team at RE/MAX Advanced Realty is here to help you!

Send us a message or leave a comment below to get started.

As we reach the midpoint of the year, the Central Indiana single-family homes market continues to display dynamic shifts across its counties. From the bustling urban landscapes of Hamilton County to the scenic retreats of Brown County, each area offers a distinct perspective on the current housing market. This is our interpretation based on the data provided by MIBOR Market Insights, examining trends observed from May 2024 to June 2024 and providing a comparative look at year-over-year data from June 2023 to June 2024. Whether you're a prospective buyer or seller, understanding these trends is essential for making informed real estate decisions in today's evolving market.

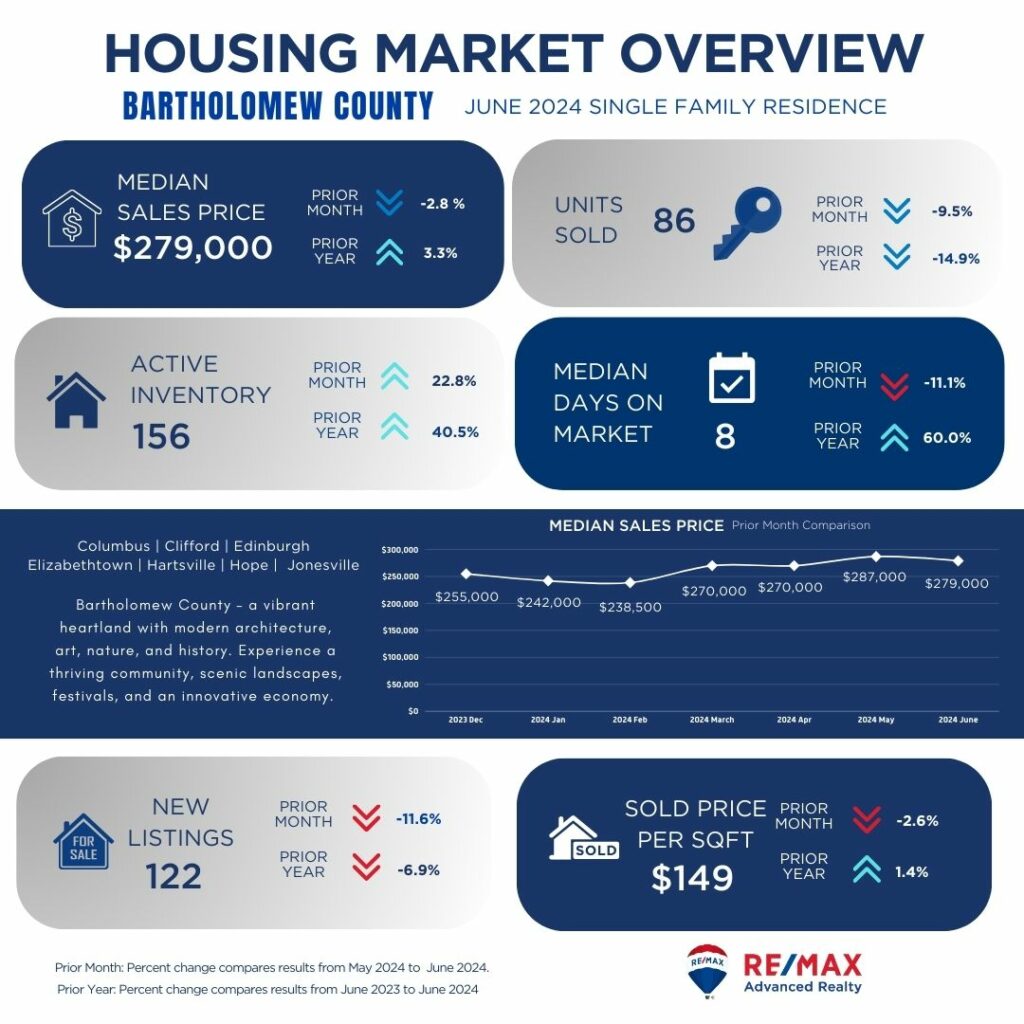

Bartholomew County shows a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The decrease in units sold suggests a slower market pace, providing buyers with more negotiating power. Active inventory has increased, offering buyers more choices, although fewer new listings may limit options. Properties are selling quickly with a low median days on market, indicating continued demand despite some price fluctuations.

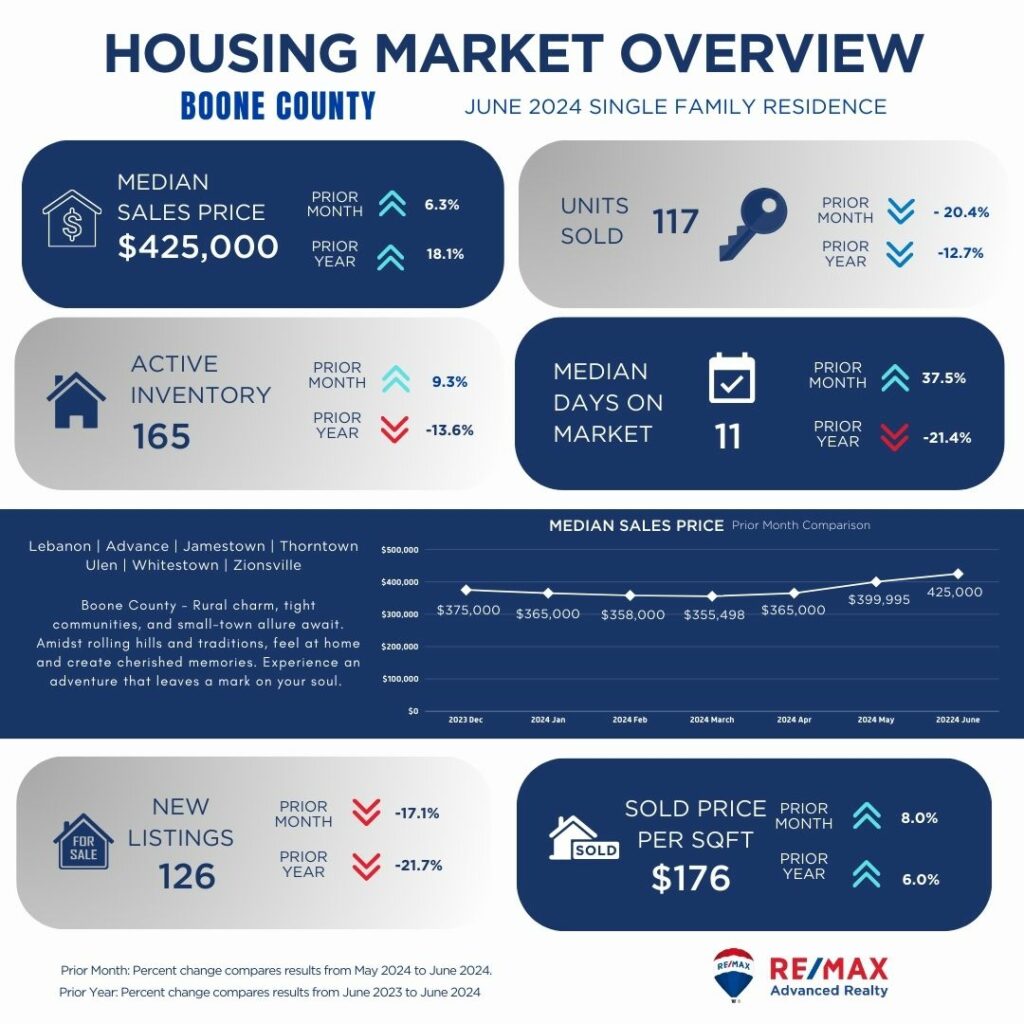

Boone County demonstrates a strong market with a significant increase in median sales price month-over-month and year-over-year, reflecting rising property values. However, the decrease in units sold indicates a slower market pace, potentially due to increased prices and limited inventory growth. Active inventory has risen slightly, but fewer new listings may constrain buyer options. Properties are selling quickly with a low median days on market and an uptick in price per square foot, suggesting continued demand in a competitive market.

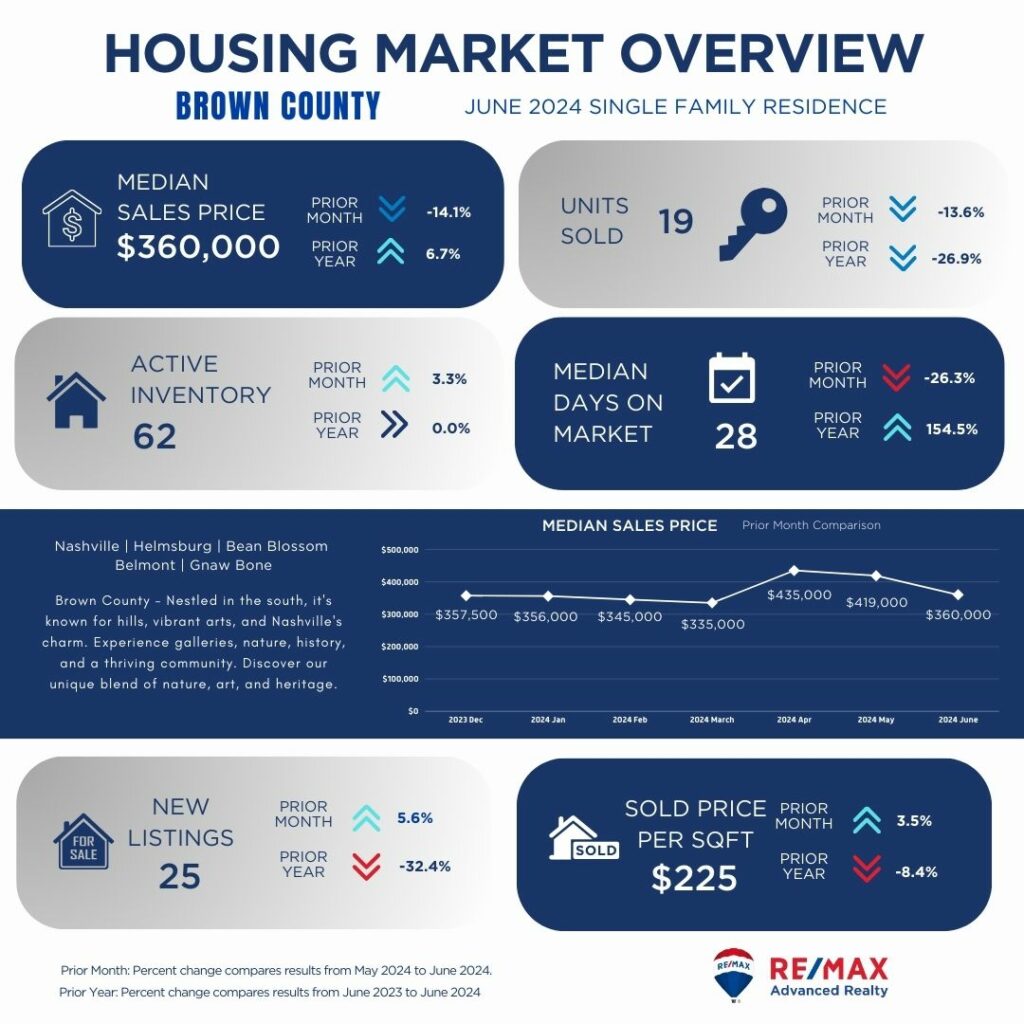

Brown County shows a mixed market with a notable decrease in median sales price compared to the previous month but an increase year-over-year. The decline in units sold suggests a slower market pace, which could provide buyers with more negotiating opportunities despite a stable inventory. Median days on market have decreased significantly, indicating properties are selling faster, but fewer new listings may limit buyer choices. Price per square foot has also decreased slightly, potentially offering buyers more affordable options in this market.

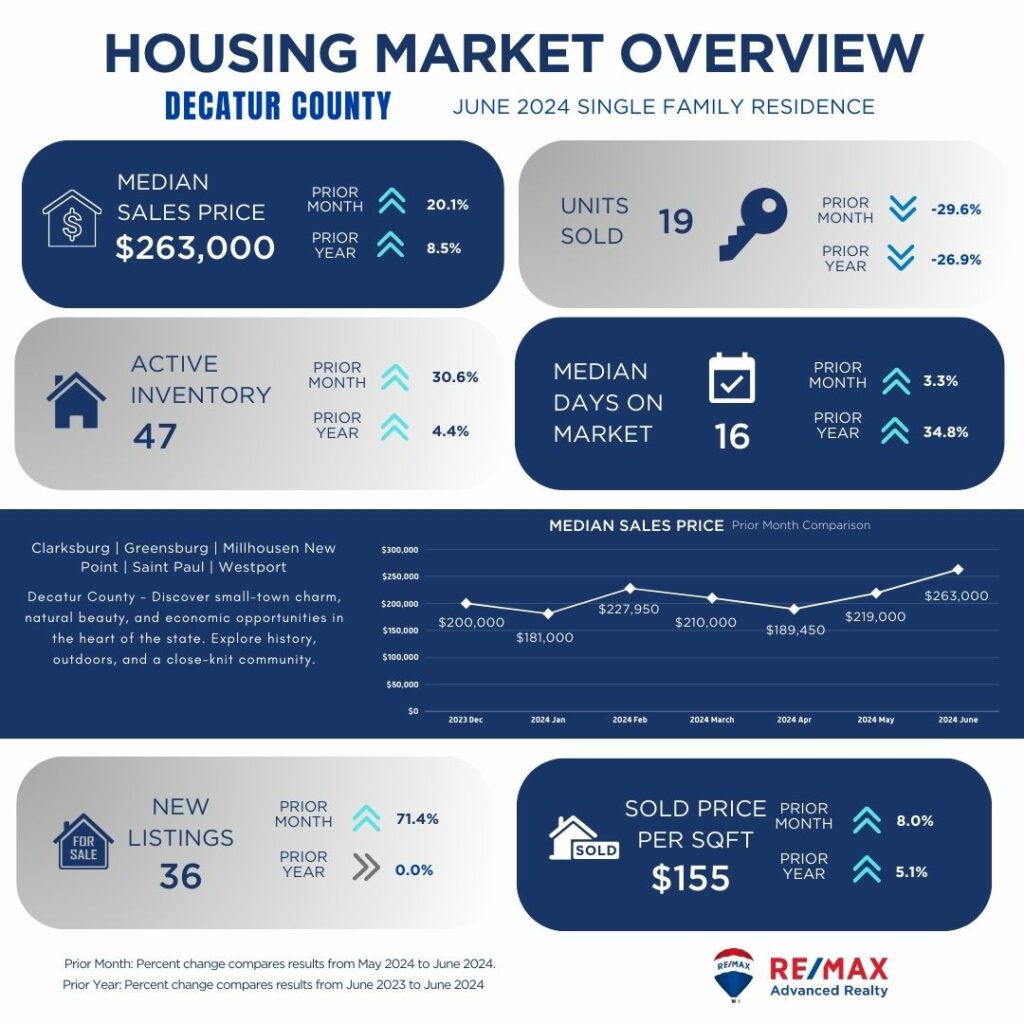

Decatur County displays a strengthening market with a substantial increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The increase in new listings further supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

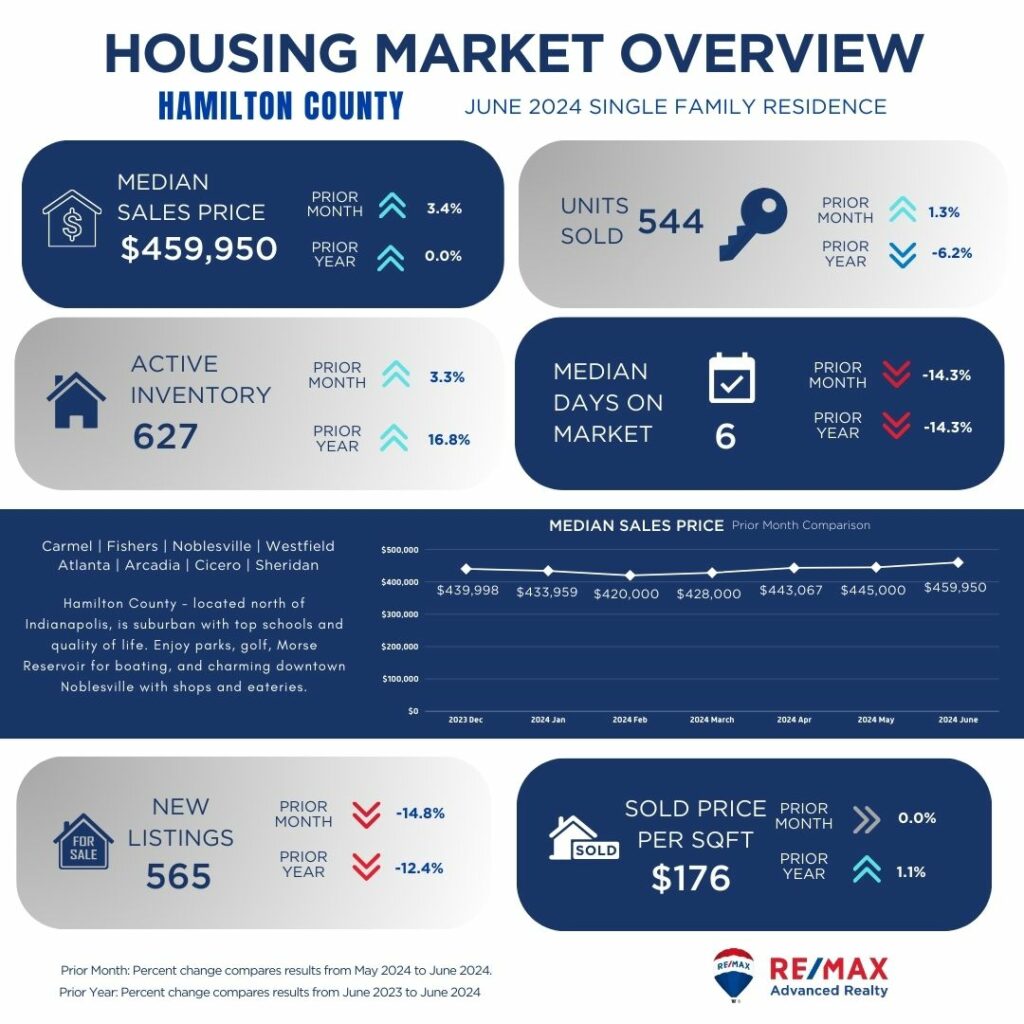

Hamilton County maintains a robust market with a slight increase in median sales price compared to the previous month and stable growth year-over-year. Despite a modest decrease in units sold, active inventory has grown, giving buyers more choices. Properties are selling quickly with a low median days on market, reflecting continued demand. However, fewer new listings may limit buyer options despite a stable price per square foot, indicating a balanced market with steady growth in property values.

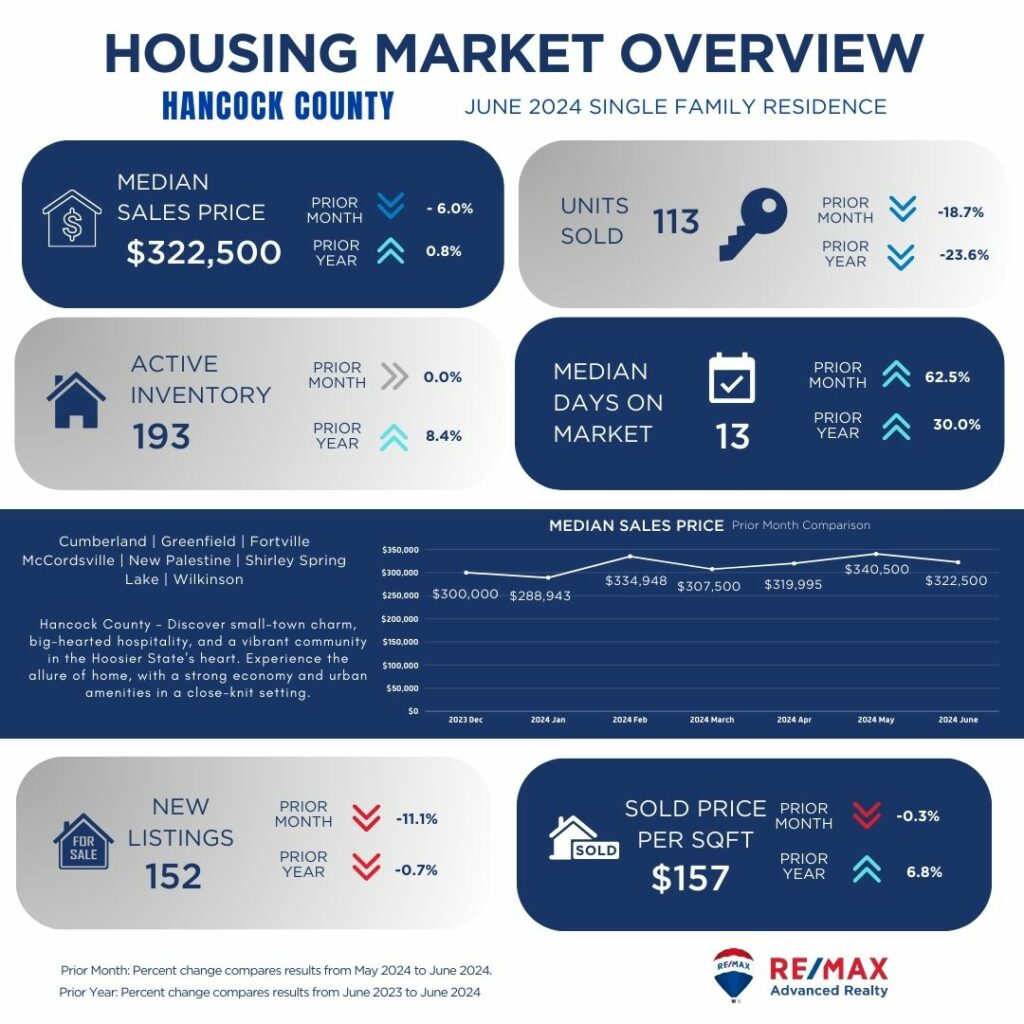

Hancock County shows a steady market with a decrease in median sales price compared to the previous month but a slight increase year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating power despite stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may limit buyer choices, although the slight decrease in price per square foot could offer opportunities for affordability.

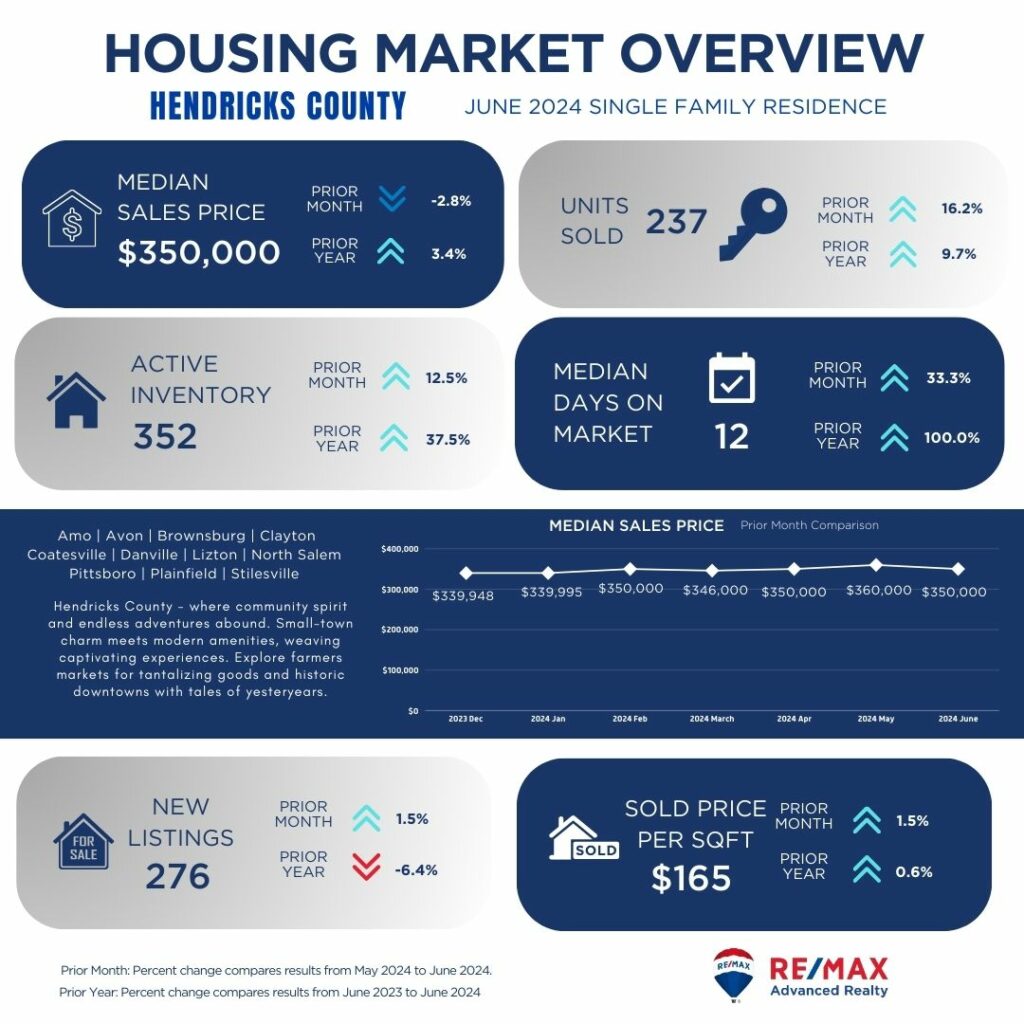

Hendricks County demonstrates a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The increase in units sold suggests continued demand, supported by a growing active inventory. Properties are selling quickly with a low median days on market, indicating a competitive market environment. The slight increase in price per square foot reflects rising property values, potentially benefiting sellers despite fewer new listings limiting buyer options.

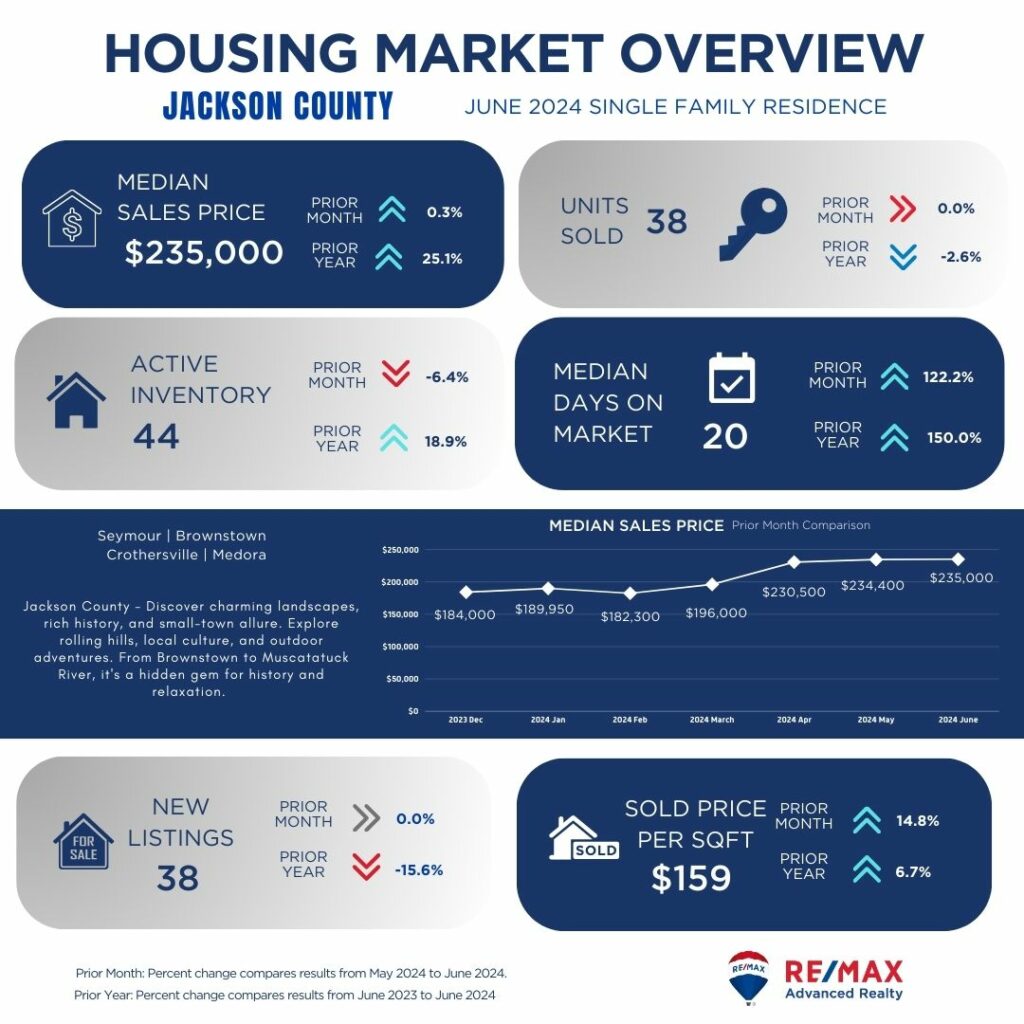

Jackson County shows a resilient market with a stable median sales price compared to the previous month and significant growth year-over-year. Despite a slight decrease in units sold, active inventory has remained stable, providing consistent buyer options. Properties are selling relatively quickly with a moderate median days on market, suggesting steady demand. However, fewer new listings may restrict buyer choices, although the increase in price per square foot indicates rising property values, benefiting sellers.

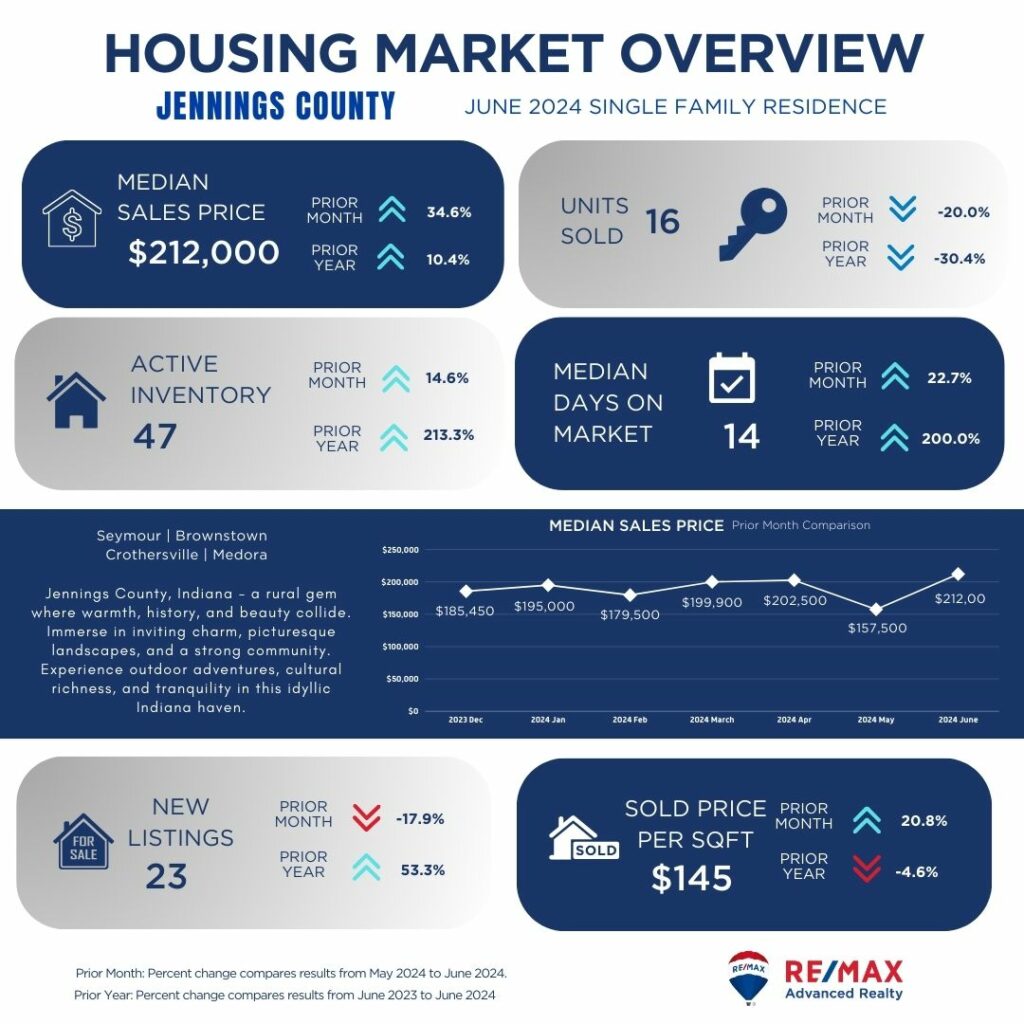

Jennings County displays a strengthening market with a notable increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded significantly, offering buyers more choices. Properties are selling relatively quickly with a moderate median days on market, indicating strong demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

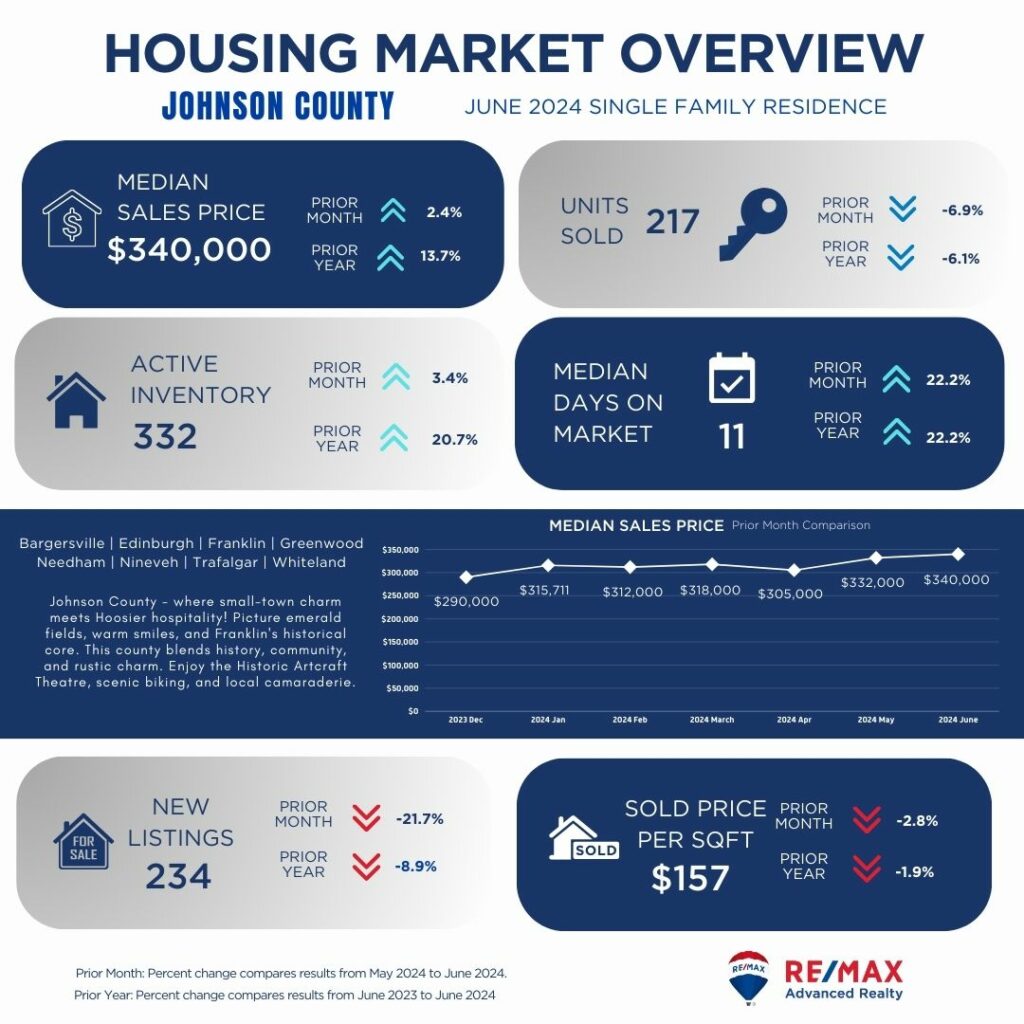

Johnson County maintains a stable market with a slight increase in median sales price compared to the previous month and steady growth year-over-year. Despite a decrease in units sold, active inventory has grown moderately, providing buyers with more options. Properties are selling quickly with a low median days on market, reflecting continued demand. Fewer new listings may limit buyer choices, although the stable price per square foot indicates a balanced market with steady property values.

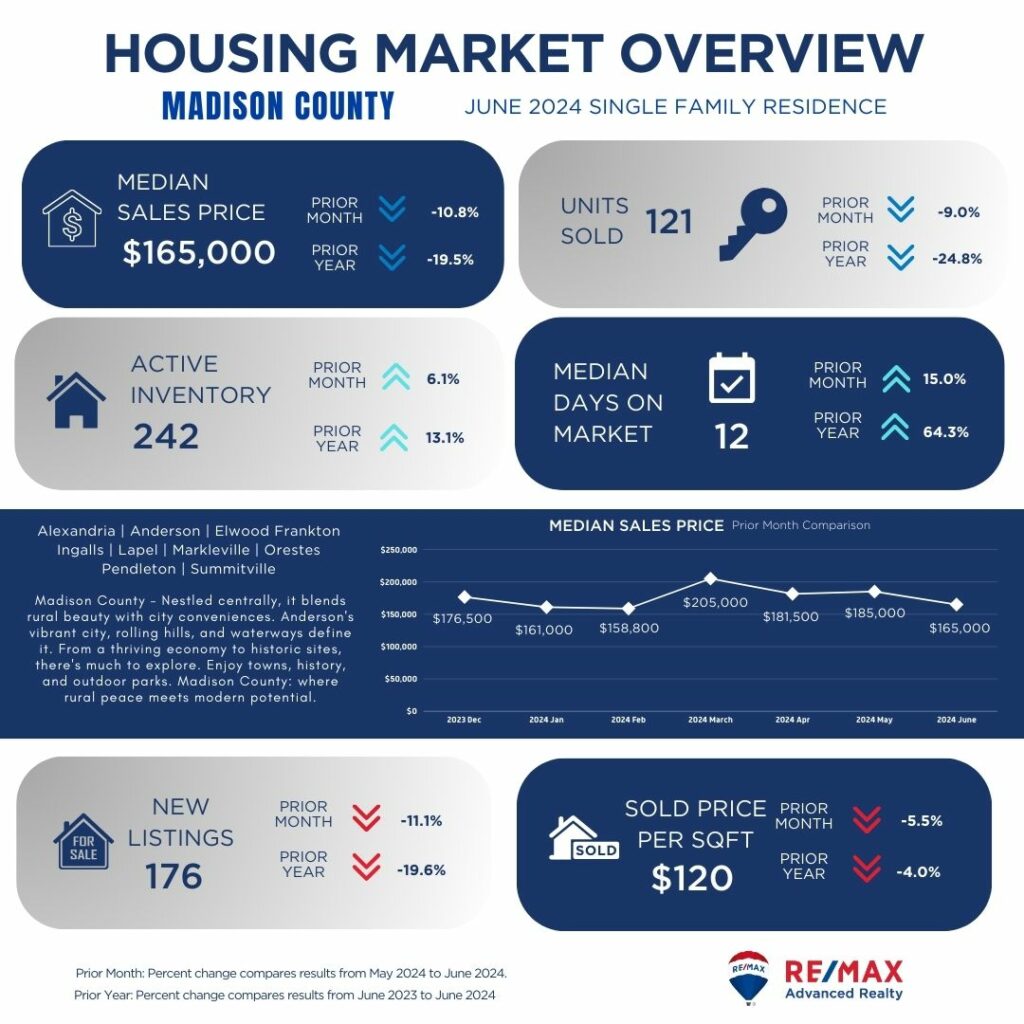

Madison County shows a varied market with a decrease in median sales price compared to the previous month and year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating opportunities despite a stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may constrain buyer options, although the slight decrease in price per square foot could offer affordability in this market.

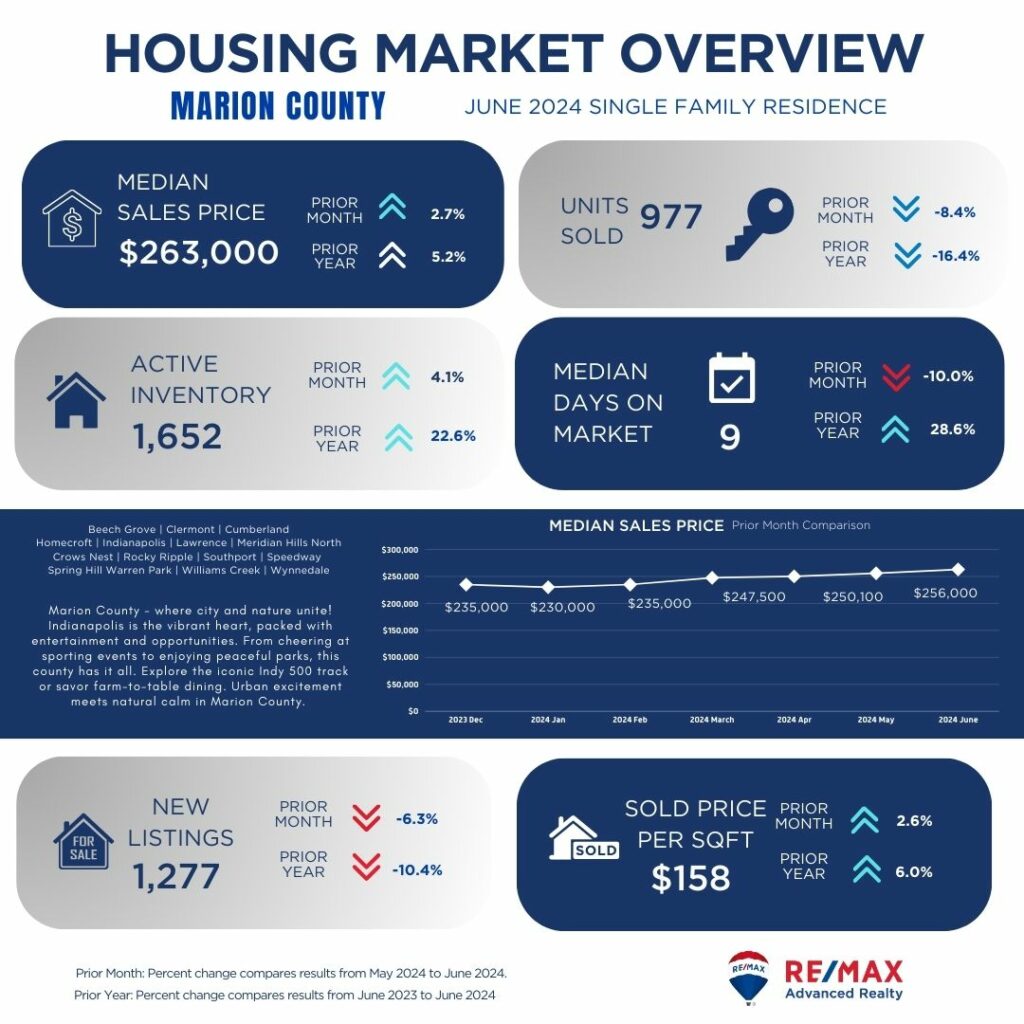

Marion County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, reflecting consistent demand. However, fewer new listings may limit buyer options, although the stable price per square foot indicates a balanced market with steady property values.

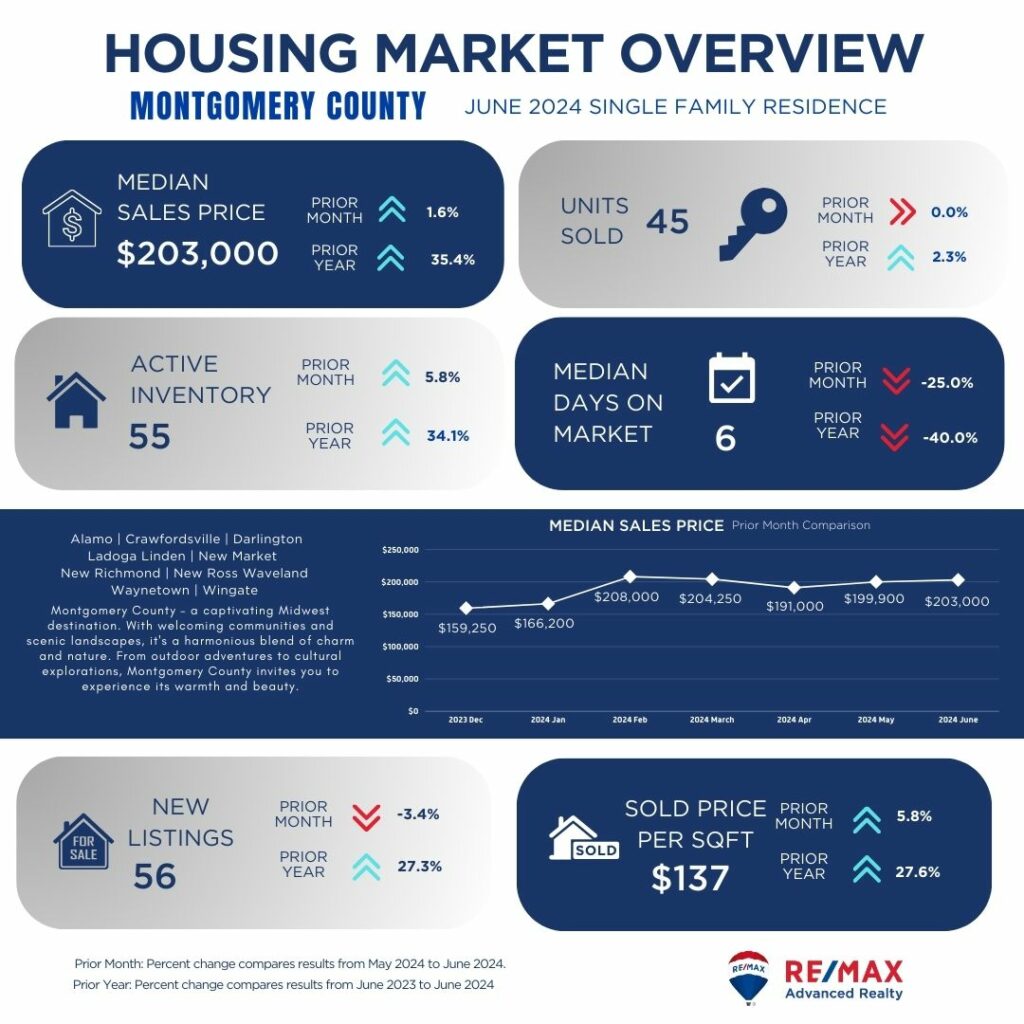

Montgomery County shows a stable market with a slight increase in median sales price compared to the previous month and strong growth year-over-year. Despite a slight decrease in units sold, active inventory has grown, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating steady demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

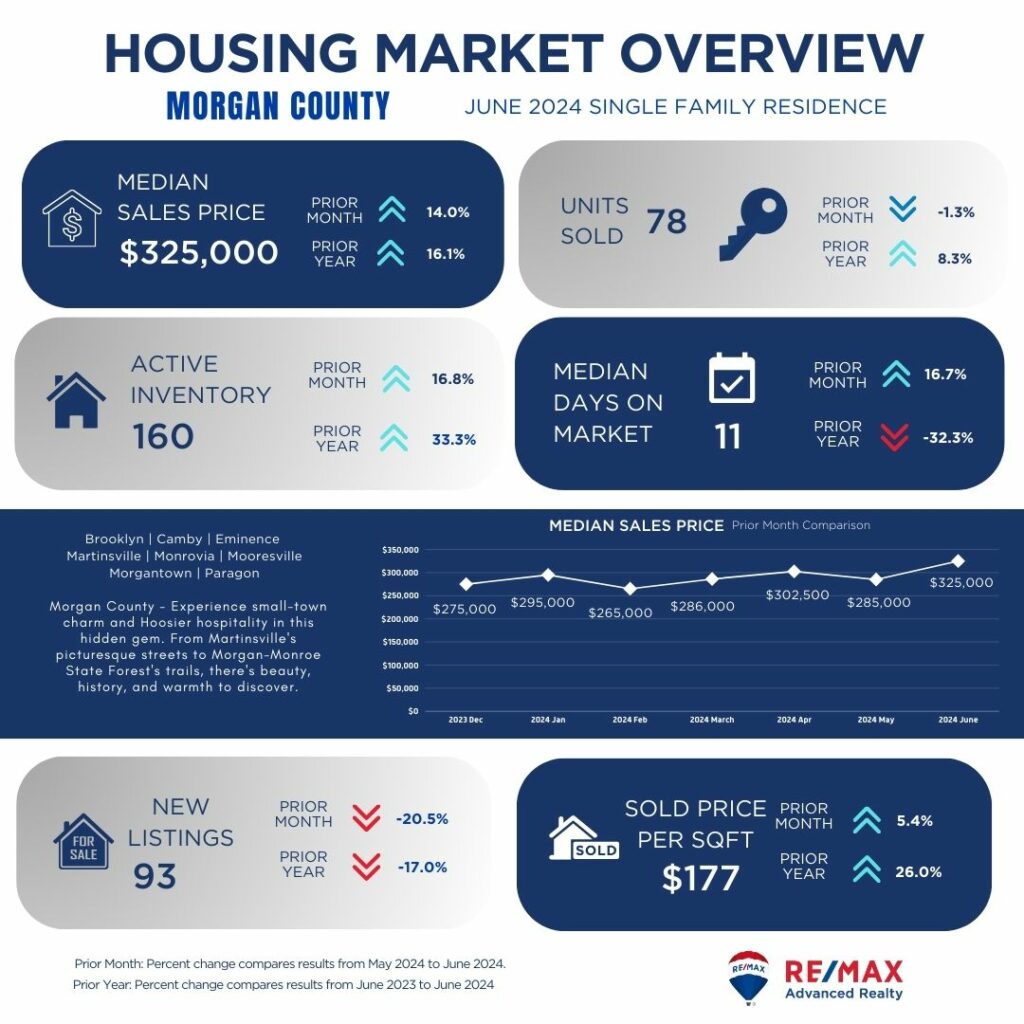

Morgan County displays a robust market with a notable increase in median sales price month-over-month and year-over-year. Despite a slight decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The decrease in new listings may limit buyer options, although the increase in price per square foot reflects rising property values, potentially benefiting sellers.

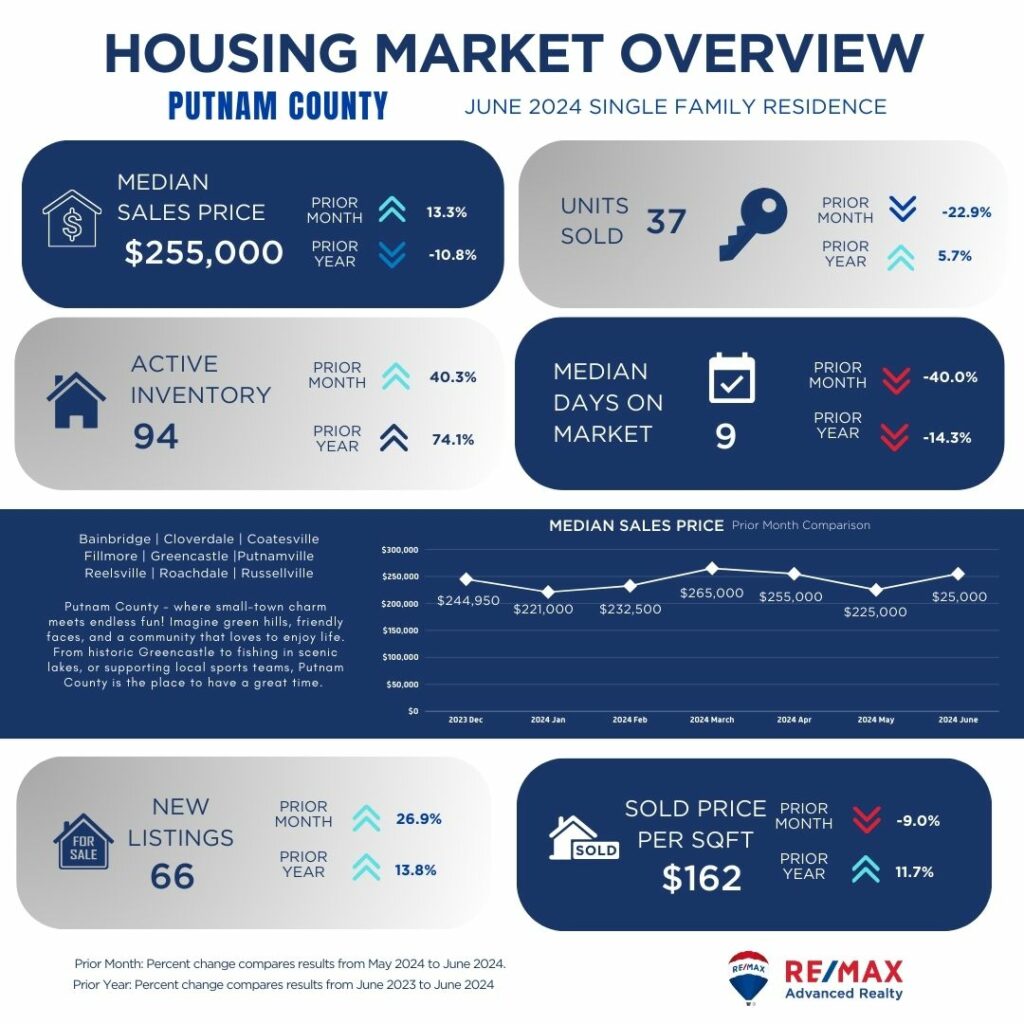

Putnam County shows a stable market with a slight increase in median sales price compared to the previous month and a decrease year-over-year. Despite a decrease in units sold, active inventory has grown significantly, offering buyers more options. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially attracting buyers.

Shelby County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a moderate median days on market, reflecting steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially benefiting buyers.

As we conclude our county-by-county analysis of the Central Indiana single-family homes market, it's evident that each area presents unique opportunities and challenges for buyers and sellers alike. From the rapid pace of Hamilton County to the steady resilience of Boone County and beyond, understanding these trends is crucial in navigating your real estate journey.

Looking ahead, the remainder of the year promises to be dynamic, with shifting market conditions influenced by economic factors and buyer-seller dynamics. Whether you're considering buying, selling, or investing in Central Indiana real estate, our team at RE/MAX Advanced Realty is here to provide expert guidance and support.

Explore our listings, connect with our experienced agents, and let us help you achieve your real estate goals in this competitive market. Contact us today to schedule a consultation and take the next step towards finding your dream home or maximizing your property's value. Trust RE/MAX Advanced Realty for insightful market analysis and personalized service, ensuring a smooth and successful real estate experience.

As we gear up for the 4th of July, Central Indiana is ready to light up the sky with dazzling fireworks displays to honor our nation's independence. Whether you're seeking family-friendly festivals or vibrant fireworks shows, there's something for everyone to enjoy this Independence Day. Here's your guide to the top events happening around Central Indiana.

Bartholomew County (Columbus)

Boone County (Whitestown, Zionsville)

Delaware County (Muncie)

Hamilton County (Carmel, Fishers, Noblesville)

Hendricks County (Plainfield, Danville)

Johnson County (Greenwood, Franklin, Bargersville)

Madison County (Frankton, Alexandria, Chesterfield, Pendleton, Anderson)

Marion County (Indianapolis, Beech Grove, Lawrence)

Monroe County (Bloomington)

Wayne County (Richmond, Cambridge City, Hagerstown)

White County (Monticello)

Family-Friendly Entertainment

Out to the Bars

As we gather to celebrate our nation's independence, we wish everyone a safe and joyful 4th of July. Remember to cherish these moments with your loved ones, and if you're considering a new home in Central Indiana, our team is here to help you find the perfect place to create more wonderful memories.

Happy Independence Day from all of us at RE/MAX Advanced Realty!

Disclaimer: Please check the official event pages for any possible schedule changes and announcements.

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224