Every seller wants to sell their home as soon as possible, for the best price, and with the fewest hassles. Likely, you're not much different.

However, did you realize that the asking price for your house is one of the main factors that could put your success in jeopardy? One of the most important aspects of selling your home is setting a fair price.

So how can you tell if you're falling short? Here are four indications that buyers may be turned off by your high asking price, along with the reason why consulting your real estate agent is the best course of action.

A lack of showings is one of the most obvious indicators that your home might be overpriced. It may be a glaring sign that the pricing isn't what buyers are expecting if it's been on the market for a few weeks and very few people have gone to look at it, or worse, you haven't had any bids.

Since long-term buyers can quickly identify—and discount—a home that appears to be overvalued.

You may rely on your real estate agent's experience to guide you through this process and get advice on potential strategies to attract more buyers, such as lowering your asking price.

You might need to change directions if the remarks from the prospective purchasers you do have after the showings aren't too positive. Remarks from viewings are a crucial component of knowing how potential buyers view your home.

If customers frequently comment that it's too expensive in comparison to other properties they've visited, you should reevaluate your pricing approach.

For you, your realtor will compile and evaluate this input so you may see how your home compares to others on the market. To better support your asking price, they can also recommend staging adjustments or particular enhancements, or they can suggest one that is in line with what buyers demand these days.

As the National Association of Realtors (NAR) explains: “Based on all the data gathered, agents may make adjustments to the initial price recommendation. This could involve adjusting for market conditions, property uniqueness, or other factors that may impact the property’s value.”

In the end, this lack of interest will cause it to remain on the market without receiving any significant bites. Buyers are more likely to have concerns about it and wonder whether there is a problem with it the longer it remains on the market.

A lengthy listing duration indicates that your home is stale, which makes it even more difficult to sell, especially in the current market with rising inventory.

In addition to showing you what strategies have worked for past sellers, your real estate agent can offer you insight into how quickly other homes in your neighborhood are selling. In this manner, you can jointly determine whether there is anything you would like to change.

According to a Bankrate article: “Check with your agent about the average number of days homes spend on the market in your area. If your listing has been up significantly longer than average, that may be a sign to reduce the price.”

This is the final one to be cautious with. Similar homes in the neighborhood selling more quickly than yours are a dead giveaway that something is wrong. This may be the result of factors like antiquated features, a less appealing location, or a lack of updates -- or simply because the price is too high.

Your realtor will inform you of any changes necessary to make your home more competitive, as well as information about your competitors. They'll provide guidance on minor improvements that can improve the curb appeal of your house or how to modify your approach to take into account the current state of the market.

Pricing your home correctly is crucial, and a realtor is your best ally for getting it right. Here's why:

With a realtor's expertise, you can confidently price your home to sell fast and at the best value.

Appropriately pricing a house is a combination of science and art. It requires a thorough comprehension of consumer psychology and the market.

Your agent is the best person to consult when the price isn't attracting buyers for advice on what to do next.

And when you want the best, our team at RE/MAX Advanced Realty is one call away. Dial 317-316-8224 so we can assist you today!

For those who have started to browse our website on homes for sale, as well as properties in the surrounding area, there are massive advantages to viewing homes that you are considering in person. Although virtual tours and online profiles can provide exceptional detail regarding the homes you view, they cannot reveal everything. Instead, getting an up-close look at a single-family house or luxury townhome can paint a picture of what it would be like to live on the property.

You have two choices for in-person property viewing: private tours and open houses. Each has its own set of advantages and disadvantages. To help you know which suits your current needs, we've provided the main pros and cons below.

PRO: You'll be able to see the neighborhood up close

The chance to tour the area is one of the key benefits of going to an open house. Realtors frequently invite neighbors and other community members to open house events.

This allows potential buyers to interact with possible neighbors and obtain unbiased perspectives about what it's like to live in the community. The number of residents who attended but are not interested in purchasing the property can vary depending on the area's size and layout. There is very little likelihood of meeting your new neighbors on a private tour.

There's freedom to come and go during the designated event times at open houses. You are free to take a break, go for a tour of the area, and then return to speak with the realtor. On the other hand, private tours are by appointment only, therefore this is not a possibility.

CON: The event can be super busy

There are advantages to meeting possible new neighbors, but there are drawbacks to large gatherings. This is particularly true for properties in high demand since they can draw dozens of potential buyers to a single open house.

Private tours are frequently the better option if you are someone who doesn't like crowds. On the other hand, if a private tour isn't offered for a certain house, make an effort to go to weeknight open houses. These only draw serious purchasers and are typically less crowded than weekend open houses.

PRO: No pressure to make an offer

Attending an open house is a low-stress endeavor. There are a lot of people there, so it's easy to come and go without getting seen (if desired). You can feel much less anxious about the scenario because you do not receive the personalized attention that you would in a private tour.

This is particularly beneficial for those who are just beginning the home-buying process and are unsure of their future residence. You made up your mind not to like the house? Not an issue. There will be many other people there who will probably fall in love with the property.

Ask questions as they come up during your self-guided tour, which you can take at your own speed.

PRO: Receive one-on-one attention the entire time

When it comes to house tours, are you the type of person who prefers a more exclusive, posh experience? Making reservations for private property visits is, without a doubt, your best option.

You will have one-on-one attention from an agent the entire time your reservation is made. You can ask as many questions as you'd like, and there's no danger of getting lost in the crowd. To increase your chances of having your offer accepted while you are contemplating a home, it is essential to arrange a private tour.

If you don't like the feeling of being rushed, private tours offer a laid-back setting where you can examine each area at your leisure, pose questions, and get a sense of the overall design.

In the end, choosing a proactive tour will help you feel less stressed during this hectic period of your life. During a private tour, a professional real estate agent will never make you feel rushed or constrained by their schedule.

Cons: Not ideal for first-time homebuyers

Have you just started looking for a place to buy? If so, there's a chance you don't currently have an agent you can work with to arrange a private trip. You need to make an appointment with an agent for a private home tour before you are allowed to visit the property.

Taking a personalized tour could seem like a high-pressure commitment, even if you have an agent already. People who are just beginning the process of becoming homeowners might want greater liberty and flexibility to come and go as they choose, without having to respond.

Pro: Establish a connection with your realtor

Having the chance to get to know your realtor is just another fantastic advantage of setting up one or more private visits. You can begin establishing a rapport with your selected real estate agent after just one trip.

This will help your realtor understand your tastes and personality better, which will ultimately help them choose the kind of house you are most interested in. You will consequently be matched with your ideal Indiana home faster.

If you're looking for the best realtor in your area, we have one for you! Just let us know where you're from and your concern -- buying or selling a home and we'll guide you.

Leave a comment or send us an email to get started: dennis@indyhomepros.com

The number of multigenerational households in our nation has steadily increased over the past several years. This lifestyle is becoming a popular long-term choice for families as more multigenerational floor plan options become available. The majority of families think that splitting household expenses is advantageous, in addition to making purchases easier in the current market. Choosing the right property is the first step in preparing for a multigenerational lifestyle, which is necessary for a successful long-term scenario.

For the greatest experience, we have compiled a list of the most crucial factors to consider when choosing and personalizing your new custom home.

But before that, here are some facts regarding the increase in multigenerational living in America:

One in four Americans currently reside in a multigenerational household, according to a recent survey. Seventy percent of those Americans say they want to do so in the long run. The advantages of cohabitation as a family are as follows:

Going back, here are six essential design concepts to bear in mind if you're prepared to begin creating your own multigenerational house.

Fostering close family ties is one of the primary advantages of living in a multigenerational house, and this typically takes place in a great room.

Families will get together in the great room throughout the day, so having adequate space is crucial. Large great room designs with adjacent outdoor living spaces and spacious kitchens are among our most popular open-concept floor plans. These layouts are excellent since they have a kitchen island and the extra perk of formal and/or informal dining. When necessary, these areas frequently serve as private or work areas.

For multigenerational households, having a master (principal suite) on the main floor is the ideal choice due to the privacy it provides for adult household members.

It would be advantageous to choose a layout with a primary suite on the main level if your family includes taking care of an elderly parent.

This feature is built into the majority of our multigenerational plans, but if you choose a plan without it, we can customize it for you.

Everyone needs privacy occasionally, regardless of how much they love their family. Whether you're on a video call for work or just chatting privately with a friend, your plan should have specific areas for these kinds of interactions.

Adding a separate entrance is a simple approach to foster independence in your shared home if your Primary Suite is on the main floor. For adult family members who might have different schedules than the rest of the family, it also provides an additional degree of seclusion.

Make sure your home is accessible if you live with people who have mobility issues and your family is multi-generational. Keep in mind that even though your elderly parents can currently climb stairs and move around with ease, that might not be the case in the future.

The secret to making all of this work is communication. Get your family together and discuss what is most important to each of you. It can be thrilling to build a custom dream home for several generations, but it's crucial to ensure that everyone's needs are met within realistic limits.

The deciding members of the family should be happy with the final layout, even though it's likely that they won't agree on every aspect.

Need help looking or building your multi-generational home? Our team at RE/MAX Advanced Realty is here to assist you. Call us at 317-316-8224 today and we’ll guide you all through the process.

As summer draws to a close, the country's housing market, which has recently favored sellers, shifts into a "neutral" state as October approaches, placing buyers and sellers on an even playing field. Orphe Divounguy, Senior Economist at Zillow®, says that a more balanced market would probably have fewer buyers. If you want to sell in the fall, you might wonder what constitutes a "neutral market."

According to him, the type of market highlights how crucial it is to determine the ideal list price because, in contrast to other listings, those that are priced competitively and effectively advertised get under contract in an average of just eighteen days.

Setting a price for a property that will sell strategically is never simple, but it can be particularly difficult in the fall when buyers with financial difficulties still struggle with affordability. In July, over 25% of sellers nationwide (i.e., the greatest percentage in the last five years) lowered their prices for the spring-summer selling season.

Divounguy claims that sellers "haven't gotten the memo quite yet." He also said that: "They're still listing their homes too high. That's why you're seeing more price cuts on these homes. And the homes that are mispriced are staying on the market longer."

In addition to learning how much to charge for a home, sellers and prospective buyers have a lot to consider this autumn, from the very variable local market circumstances to concerns about the direction of mortgage rates. Here are our predictions for the fall selling season of 2024:

Fall is typically the slowest season for house sales, partly because parents with young children tend to put off house hunting after the school year begins. According to Zillow data, consumers withdrew from house hunting earlier this year than usual. This decreased competition across the country and forced sellers to lower their asking prices and make concessions to draw in buyers.

The retreat affects inventories, which rose in July in all but five of the major metro areas that Zillow economists examined. It's also having an impact on property values, which just marginally increased in July, per a recent Zillow research.

According to Zillow's projection, home values will rise by 1% nationally over the next 12 months, which is a significant deceleration from previous years, according to Divounguy.

"While price growth could continue to ease somewhat, I don't expect big price declines," Divounguy says. "TWe’ll need to see a big increase in inventory to see a large decline in home values. Recent small improvements in affordability could bring back more buyers than sellers, which could slow the increase in housing inventory, and prevent the market from cooling further."

The number of available homes in the US will drop by 4.5 million in 2022, per Zillow research. Apart from their scarcity, the annual production of new residences has not kept pace with the rate of construction. Even while buyers find it difficult to pay, sellers should expect steady home values for the foreseeable future as a result of the shortage.

It is generally anticipated that the Federal Reserve Board will lower its main policy rate in September and maybe later. The Fed's projections may already be reflected in current mortgage rates, though.

He believes that long-term economic variables like inflation and the state of the economy as a whole are often taken into account by lenders when setting interest rates. Therefore, even while the expectation of Fed rate cuts may be influencing mortgage rates at the moment, additional declines in mortgage rates are unlikely if economic growth continues to be robust.

Despite a decline from the 2.8% seasonally adjusted rate seen in the second quarter, the US economy's third-quarter seasonally adjusted annual growth rate is 2%.

Although it has somewhat improved, most prospective purchasers still face significant barriers due to housing affordability. Home prices may rise as more purchasers try to take advantage of the recent rate reduction.

Additionally, since interest rates aren't going to continue dropping, buyers will probably continue to feel pressured by the combination of high house prices, higher-than-usual interest rates, and the necessity of saving money for a down payment.

Because of the budget issue, consumers are searching for the greatest offers.

Well-priced and well-marketed properties continue to sell quickly, even if the majority of listings decline. Properties that sold in July took just 18 days to go pending, which is six days less than a year ago but still quicker than before the outbreak.

Zillow data also indicates that greater sale premiums are associated with contemporary characteristics that distinguish a home as either brand new or recently updated. Small upgrades that give your house a "new construction" appearance, marketing resources like virtual floor plans and 3D home tours on your listing, and well-thought-out pricing may make a big impact.

The local situation is contradictory, even though the national market is no longer a seller's market. Certain markets still favor sellers, while others favor buyers.

Discuss the plan of action based on the state of the local market with a real estate agent.

An experienced real estate agent in your area may assess your house to see what it might bring in light of the neighborhood's characteristics and the prices at which previously sold comparable properties in the area.

Take note of the cost.

As mentioned above, well-priced and well-maintained homes still sell rapidly, but if there aren't many sales in your region to compare prices to, it may be difficult to determine the proper price.

Think about making accommodations.

If sellers make accommodations that enable purchasers to reduce their monthly mortgage payments, they could do so faster. According to the National Association of Home Builders, 61% of builders make compromises to succeed in this market without having to lower costs.

“If builders are offering incentives to buyers, then sellers should probably do the same to keep well-priced homes moving,’’ advises Divounguy.

What are your thoughts? Feel free to share them in the comments!

Are you planning to move and want to sell your home quickly in Indianapolis? Buying and selling a house involves several steps, and having thorough preparation can make these transactions easier. So if you sell your current one before moving to your new home, sit back, relax, and enjoy reading.

Sell your Indiana home quickly and seamlessly with these steps:

Research the market first before selling your home and moving into a new location. This simplifies dealing with agents and buyers and can help you adjust expectations.

These are some things to think about when conducting your research:

The next action you should take is to learn everything you can about your own property. You can work out your house's price with the assistance of a reliable Indiana real estate agent. However, you will have an advantage with customers if you have hard data upfront. Additionally, since your agent won't need to do as much legwork, the sale of your home will proceed more quickly.

Having an appraisal of your home helps you determine a fair price for it. Pre-approved loan buyers will be fully aware of the price range they can afford. Thus, they will find this information to be quite beneficial. Furthermore, having an inspection completed will expedite the negotiation process because buyers—and you—will already be aware of all the issues with the property.

Knowing why you want to sell your house will help you decide what to compromise during the selling and purchasing. You should tell your realtor about your needs, but not sellers, when you look at homes to buy. People who know what you can concede may not offer you the greatest offer.

Choose an agent who is prepared to listen to you and knows what you want. Make sure they understand the importance of timing and know where you plan to buy and your neighborhood.

You should be clear about what needs to be fixed and what can wait after your inspection. Your agent can also assist you in selecting the repairs that will yield the most value for your money, if any. Inquire with your realtor about the repairs that will add the most value to the home and those that, if neglected, won't significantly impact the sale price.

Repairs, interior staging, and landscaping are necessary to sell a house. This is often mentioned, but it's worth repeating. Consider neutral painting and carpeting. Keep your home clean and organized if you can't hire a stager. Some home sellers stage their homes professionally. Use every inch of space with your furniture, especially in unexpected spaces.

Here are some smart sales tactics to consider if you want to sell your home quickly:

Timing is the hardest part of selling and buying a home. Though unexpected events sometimes occur, both closings should happen on the same day or within a few days—delay signing for your new home until someone has done so for your old one. Renting a hotel for a few nights or weeks is cheaper than two mortgage payments. Bridge financing is one option to own two homes at once.

Conclusion

There are many ways to sell a home to consider quickly. It's a common task for individuals like yourself, so your agent will be familiar with it. Even if you might not receive the entire asking price, you won't have to worry about paying for agents, repairs, or staging, and you'll know with certainty when the house will close.

In addition, you will have guaranteed funds at closing, so you won't need to worry about the buyer's finances falling through.

You will need to prepare or have already started saving, for a down payment to move from renter to homeowner. A down payment typically consists of three to twenty percent of the overall cost of the house; but, if you're a successful buyer, like the median, it may be as high as nineteen to twenty percent. If you're just starting, it could seem intimidating, but with time and with proper planning, you can find innovative methods to save money. According to a 2022 Zillow analysis, 63% of recent mortgage recipients made at least some use of savings as their down payment.

How much you plan to spend on a down payment will determine exactly how much you save each month; if you're having trouble, don't be afraid to contact a lender. They can assist you in crunching the statistics, and from there, you can figure out how much you'll need to be saved once you've determined an approximate moving date.

It's a terrific start if you already have a set-aside amount for savings each month. Naturally, the more you can save, the quicker you'll be able to pay off your house. Here are 21 suggestions to assist in achieving that.

Engaged couples are more likely than ever to request cash contributions from friends and family instead of customary wedding presents. According to research from The Knot, the percentage of couples who include a "home fund" in their wedding register has gone up by 55% in the last five years. About 20% of couples who have registered on The Knot currently have down payment funds; in 2022, they were the second most popular cash fund, only surpassed by the treasured honeymoon fund.

"Marriage empowers couples to customize their registries to their unique aspirations," says The Knot deputy editor and wedding specialist Esther Lee. Even though some guests might rather spend their cash contributions on a celebratory dinner or honeymoon getaway, there's something very unique about a wedding gift assisting the newlyweds in achieving another significant life milestone: becoming homeowners.

As Lee notes, "approaching a down payment registry option requires some additional thought when it comes to etiquette," so keep that in mind if you're thinking about establishing a home fund. This includes letting go of the notion that the down payment will be covered in whole by wedding presents. Furthermore, it is not appropriate for couples to assume that they will get the entire amount of gifts before the wedding.

Choose "new home fund" from The Knot Registry's pre-selected selection of cash funds, or come up with a unique name for your own, to get started. From there, you can include the requested sum and inform visitors of your plans for the donated money in a brief note. Here, clarity is key since it will enable you to achieve your goals. For your loved ones to carefully evaluate their contribution and celebratory present for your future trip, Lee thinks it does well to include the down payment amount on your registry.

"Remember that this is a wedding gift over a simple down payment contribution, which should also help you approach the thank you note process with grace and care," is Lee's advice when it comes to expressing thanks.

With a side gig, you can find many inventive methods to save and make extra money if you're ready to work a bit more on the weekends or after work. You might consider home-sitting, babysitting, dog walking, or waiting tables. You can even pursue an artistic pastime of selling homemade goods to friends and coworkers or online.

'A side hustle doesn't have to take up a lot of time,' states Bill Promes, a financial advisor with Mill Valley, California's Austin Creek Capital. It's simpler to keep on course when you add a new revenue stream with a clear goal.

If you now commute alone by car, think about your other options. If public transportation is available where you live, that may require using it. If it's not possible, consider bicycling, carpooling, or asking your employer if you may work from home a few days a week. You can transfer those costs to your savings for a down payment on a house when you get creative with your commute.

If you have exceptionally high commuting costs, you might think about finding a position that allows you to work from home or reduce your commute. Having said that, before moving to employment, you might wish to check with your loan officer if you intend to purchase a home within the next two years. A recent change in your profession or a move to self-employment may make it more difficult for you to get a mortgage.

If you have to spend a lot of money every month to pay off your car loan and owning a car is your only alternative, take a close look at your finances. If you have the money, consider using cash to buy a less expensive car. Naturally, a lot of this depends on how dependent you are on your vehicle, and gas mileage is a significant consideration. You don't want to replace your existing car with a more expensive, gas-guzzler.

Additionally, it's critical to ensure that the car you choose won't wind up costing you much more than your prior vehicle. You won't be able to accumulate enough cash for a down payment if you fall into a routine of having your automobile fixed all the time.

If you realize you have extra money in savings or receive a bonus, think about applying it to your debt. Paying off debt with a high annual percentage rate (APR) might help you raise your down payment savings by lowering or eliminating your monthly interest expense, which, considering that you wish to save money for a mortgage, can appear paradoxical. Your ability to save for a down payment on a house will increase as you pay off more debt.

Performing some spring cleaning is usually a good idea, regardless of the season. You can be motivated to acquire fewer things and just invest in those that you truly need if you set yourself the challenge of maintaining a minimalist wardrobe. In addition, you can clean your home and possibly earn money for your down payment by selling the clothes you no longer wear. Many websites, such as Depop, Poshmark, and ThredUp, can facilitate this process. Alternatively, you might organize a garage or yard sale that may bring in a lot of money, or you could drop off items for sale at a nearby consignment store.

Consider this inventive method of making and saving money if you have any experience with refurbishing, artistic talent, or interest in the creative arts: restoring used furniture. When you're selling your unwanted items on internet marketplaces, keep an eye out for deals on old furniture that you can paint or reupholster to make it seem nicer and then resell for a profit. You can rely on online tutorials to get you started, even though this isn't one of the simpler ways to make some additional money.

Whether you're shopping for furniture or clothing, try to buy used items or sign up for a "Buy Nothing" organization so you may trade items with neighbors. You might be shocked by what you can find for free or at a reduced price, whether you search online or in person at a thrift store.

Do an "edit" of your house, closet, or garage before making any unnecessary purchases to make sure you're not buying anything you already own, don't need, or, in the case of clothing, might not wear frequently enough to warrant. Unsubscribe from email lists and automatic purchases that try to get you to buy items you might not need.

Employ the "envelope system," sometimes referred to as "cash-stuffing," as a way to reduce your expenditures. It involves depositing predetermined sums of cash into envelopes labeled with various expenditure categories on the first of the month. This strategy became widespread on social media. You can't spend any more money on a category until the next month once an envelope is empty. Remaining cash? You can either use it as funds for your down payment or carry it over to the following month.

Applying for cash-back rewards credit cards and setting aside that money for a down payment on a home are wise decisions if you're a prudent credit card user.

To find out more about how to take advantage of your credit card benefits, research your credit card programs. Credit card points, for instance, can be converted into airline miles, allowing you to reduce or even completely avoid the cost of flying tickets.

Until you believe you have saved enough money for your down payment, cut out any needless travel. Even though it doesn't seem like much fun and can mean skipping a well-earned holiday, reevaluating pointless travel arrangements is a terrific method to reduce expenses and save money. If you want to continue taking vacations, try to find a happy medium ground. Maybe think about traveling for a shorter period, saving money, and paying using credit card points rather than cash.

In 2022, Zillow researchers conducted a buyer survey and found that 41% of potential buyers postponed their vacation plans to save money for a down payment on a home.

Consider your savings target as a monthly expense. Establish an automated transfer from your checking account to the savings account you set up for your down payment. Setting aside a portion of your income for savings automatically makes saving money easier and reduces the urge to squander it.

Raise the ante and be inventive in how you choose to save. With greater interest rates than a standard savings account, high-yield savings accounts, bank certificates of deposit (CDs), and certain Treasury bonds can help you turbocharge your money. As money remains in your account, your savings will increase.

"Series I Treasury Bonds are a great place to put some of your cash, especially for a down payment on a house," says Jovan Johnson, co-owner of Piece of Wealth Planning in Decatur, Georgia. "There are some rules to be aware of, though." Furthermore, interest on other kinds of savings may also be subject to state-level taxes. "And, the interest is taxed only at the federal level." That reduces your returns by a further chunk.

Downsizing your existing place may help you save more money each month for the down payment on your future house, but it may be a difficult decision. In 2022, Zillow researchers conducted a buyer survey and found that approximately 21% of potential buyers lived in a smaller home than their preferences due to cost concerns. Your savings might mount up faster than you might imagine if you can downsize from a rental house to a smaller rental unit or from a one-bedroom apartment to a studio.

The extra expenses will also decrease. "You can save money on rent and utilities by moving to a smaller apartment," advises Ryan Graves, president of Bemiston Asset Management in St. Louis, Missouri. You can also save money by filling a smaller space with fewer items. It's also much simpler to go from a little space to a larger one when the time comes, filling it up gradually, he added.

Living alone is an opulent experience, and sharing a place with roommates can significantly reduce living expenses. Rent can be halved by taking on even one more tenant. Consider asking a relative or friend to let you stay with them temporarily in exchange for assisting with housework or other chores if you're truly committed to saving money and feel comfortable with this choice.

Are twelve distinct streaming services really necessary? Are there any apps or subscriptions that you don't need? Limit your streaming to just one service. About one-third (33%) of respondents to Zillow's 2022 survey of potential homeowners said they had canceled their internet, phone, cable, and streaming subscriptions to save more money for a down payment. These savings can be considerably more achievable than you think.

Using the wealth of free resources available at libraries can help you save money that you can apply to a down payment. The next time you're in the market for a book, think about checking your local library to see whether they already have it in stock.

However, some libraries allow cardholders to borrow special things in addition to books. For instance, you can borrow telescopes, tackle boxes, and fishing poles at certain St. Louis Public Library branches. Visit the library in your area. When you learn what they have to offer, you may be shocked.

Budgeting is required for everyday necessities like auto insurance, Internet access, and cell phone bills. Having said that, there are ways to save money on these payments by comparing prices.

"Perhaps your provider doesn't offer many discounts, or you're overpaying for auto insurance," Johnson suggests. To reduce your monthly premium, you might be able to bear a larger deductible for a year or two.

It's not simple to save, but you don't have to do it by yourself. As you work toward your savings objectives, talking to your partner or a friend helps you feel more accountable. Set up regular time to talk with your pal or partner about your finances. As you work together to identify methods to save money and prepare your monthly budgets, you may support one another. Remember to monitor your development and acknowledge your "victories."

While going to a movie on the weekend or to happy hour after work is enjoyable, cutting back on extracurricular activities is a simple method to increase your income. Instead of going out, have a fun movie night at home or invite friends over for a game night.

Frequent dining out can also develop into a costly habit. If you work in an office, try packing a lunch to bring to work instead of purchasing one. Going grocery shopping and making your lunch at home is very reasonably priced. Look out for recipes online for meals that are affordable.

You won't be traveling alone as you try to save lives. A 2022 Zillow study found that 48% of would-be homeowners reduced their recreational spending, such as going out to eat, attending concerts, and watching movies, to put money down for a down payment. Do you want an extra tip for cutting costs? Plan to spend nothing on weekends. Try not to spend a single dime on one weekend a month. How much you can save may surprise you.

Unbelievably, no matter where you reside, there are free activities nearby. Create a calendar or list of inexpensive or free entertainment options. Having fun doesn't have to cost money. Try going for a stroll with a buddy, playing games at the neighborhood park, or signing up for a free yoga or fitness class.

Spending your tax refund as soon as you receive it can be tempting. But you might want to put money aside for a down payment on a home.

Add the entire amount of any refund you get when you file your income tax returns to your savings. Alternatively, you might apply it to your highest APR debt by making an additional payment. You can receive more interest income the more you save. The more debt you pay off, the less interest you'll pay.

Homebuyers may be eligible for down payment assistance programs under certain mortgage types. These programs are typically supported by grants or loans from local governments or nonprofits. For more information, check out the Down Payment Resource Center or speak with your mortgage lender or real estate agent.

Make an appointment to speak with a home mortgage lender and a real estate agent before deciding on a goal savings amount for a down payment on a house.

As you save, keep checking for properties on the internet and updating your lists of requirements, wants, and wishes. It might not take you as long as you think to locate and purchase the house of your dreams.

The real estate industry is only one of the many industries artificial intelligence (AI) has changed. AI is becoming a vital tool for real estate agents, investors, buyers, sellers, and other stakeholders due to its capacity to analyze enormous volumes of data, automate procedures, and offer insightful analysis.

However, there’s still an unanswered question going on for a long time: will AI replace realtors and their services? The short answer is no.

Instead, AI complements what they offer, thus providing a positive effect on both the real estate industry and customers.

The capacity of AI to process and analyze enormous volumes of data is one of its most important benefits in the real estate industry.

AI algorithms can be used by real estate brokers to gather and evaluate demographic data, property data, market trends, and other pertinent information. They obtain important knowledge about pricing, demand trends, investment possibilities, and property comparisons by doing this.

To determine a property's fair market value, artificial intelligence can gather enormous volumes of data from a variety of sources, including past transactions, the characteristics of the property, and the state of the market.

AI-enabled tools can spot developing markets, forecast changes in real estate values, and make data-driven investment choices. Artificial intelligence can be useful in predicting future trends in the residential and commercial real estate markets, even though it is not a crystal ball.

Platforms with AI capabilities have greatly enhanced the home-search experience for investors and buyers alike. These services generate individualized property recommendations based on local data, historical trends, and user preferences through machine learning algorithms.

To make the process of finding a property easier, artificial intelligence can consider a variety of aspects, including location preferences, desired amenities, budget, and more. For buyers, investors, homeowners, and even real estate brokers helping their customers, this new technology saves time and effort.

AI is not the enemy in real estate. Artificial intelligence can be a huge asset in giving investors, house sellers, and purchasers a more accurate and tailored experience. Furthermore, artificial intelligence can be used by real estate firms to customize their services to meet the unique needs of each customer.

The way properties are marketed using augmented reality (AR) and virtual reality (VR) technologies has been completely transformed by artificial intelligence. By using virtual tours, potential investors and purchasers can inspect homes from a distance, which can save time and money.

Using floor plans and other information, AI technology can also create 3D models and renderings of properties, providing investors and buyers with a realistic representation of the area. Before in-person visits, this immersive experience helps you refine possibilities and make educated judgments during the home hunt.

When looking for a home in a new real estate market, prospective buyers from out of state can benefit greatly from virtual tours. While taking a virtual tour of the property cannot substitute seeing it in person, AI can assist prospective buyers learn about the essential features of the house.

Accurate property pricing is essential for real estate agents and sellers. To identify the best pricing tactics, AI algorithms can examine past data, market trends, property features, and regional considerations.

Before the development of artificial intelligence, property values were manually determined using data from previous sales in the area. However, AI in real estate can produce more accurate property prices, benefiting both buyers and sellers, thanks to machine learning and predictive modeling.

Real estate experts and agents may forecast property demand, find possible buyers, and suggest competitive prices by leveraging predictive analytics technologies. Sellers can improve their listings, draw in more potential customers, and close deals more quickly with the help of AI-powered pricing tools.

AI is automating a lot of the work in property management and making it more efficient. Intelligent systems are capable of optimizing building operations, detecting maintenance difficulties, and monitoring and controlling energy consumption. This not only saves money but also makes the occupants happier.

AI-powered software simplifies administrative work, keeps track of lease agreements, oversees maintenance, and offers individualized tenant services to real estate brokers handling numerous properties.

These astute technological developments free up professionals' time and resources so they can concentrate on higher-value tasks.

Although artificial intelligence (AI) has great promise for the future of many industries, including real estate, it is unlikely to displace the real estate industry entirely for several reasons.

Complex decision-making procedures involving real estate transactions call on human judgment and experience.

Artificial Intelligence (AI) might be able to evaluate data and offer insights, but it is unable to comprehend the complex desires and feelings of consumers and sellers. AI cannot easily replace the individualized counsel, bargaining skills, and recommendations that real estate brokers provide.

Property transactions are frequently emotional and private affairs. Consumers like the personal touch and credibility that real estate brokers provide.

An AI system won't be able to build the same kind of connection or offer the emotional support that customers frequently need in these kinds of interactions.

The real estate markets in different places differ significantly. Real estate brokers are extremely knowledgeable about local amenities, zoning laws, market trends, and particular communities.

To give clients reliable counsel and guidance, localized expertise is essential. Without access to complete and current data, AI systems may find it difficult to reproduce this expertise.

Outstanding communication and negotiating abilities are necessary while negotiating the parameters of a real estate transaction. Real estate brokers are skilled negotiators who can speak up for the interests of their clients.

Even if AI is capable of using data analysis to recommend negotiation tactics, it might not have the interpersonal abilities needed to handle difficult discussions.

Both substantial financial outlays and legal requirements are present in real estate purchases. Real estate brokers are frequently relied upon by clients to guarantee a seamless and compliant transaction.

Real estate agents have a fiduciary commitment to their customers. This entails controlling any risks, maintaining confidentiality, and safeguarding their interests. In these transactions, the human aspect fosters confidence and establishes accountability.

Artificial Intelligence (AI) has revolutionized the real estate industry, offering advantages to consumers, sellers, investors, and professionals alike.

Artificial intelligence (AI)-powered technologies have completely changed the real estate industry, from data analysis and market insights to virtual tours and predictive analytics. Even if artificial intelligence (AI) makes decisions easier, increases productivity, and streamlines procedures, it is unlikely to completely replace the function of real estate experts.

After all, nothing beats an amazing real estate agent.

As the leaves start to turn and the crisp air of fall rolls in, Indianapolis comes alive with seasonal activities perfect for all ages. Whether you're a fan of outdoor adventures, family-friendly festivals, or simply love taking in the beauty of autumn, the Circle City has something for everyone. Here’s your master guide to making the most of fall fun in the Indianapolis area.

A quintessential fall experience, visiting pumpkin patches and navigating through corn mazes can make for a fun-filled day with family or friends. A few local favorites include:

A thriving orchard and cider mill, Stuckey Farm offers 37 varieties of U-pick apples. With annual fall festivals and a wide range of family-friendly activities, it’s the perfect autumn destination for all ages. Enjoy tractor rides, fresh cider, and a stroll through their 8-acre corn maze.

For over 90 years, this family-owned farm has provided top-quality produce and authentic agricultural experiences. Tuttle Orchards, now run by the fourth generation, is open year-round, but the fall season is a favorite for apple picking, hayrides, and fresh cider. Their dedication to local produce, agricultural education, and family history makes Tuttles a unique fall destination for families.

Piney Acres offers tons of family-friendly activities each fall, including a huge corn maze, tractor-driven wagon rides, farm animals, a massive play area, bounce pillow, gem mining, and old-fashioned farm games. Visitors can explore a wide selection of pumpkins, squash, corn, and sunflowers in all shapes and sizes for every price range. The farm also has carving tools and patterns available in the Farm Store. (Please note: Pumpkins are grown off-site and pre-picked.)

Fall wouldn’t be complete without attending one of the many vibrant festivals happening around Indianapolis. Here are a few you shouldn’t miss:

If you're looking to escape the city and immerse yourself in nature, Indianapolis has plenty of scenic spots to enjoy the fall foliage.

If you’re in the mood for some spine-tingling fun, the Indianapolis area offers plenty of haunted houses and ghost tours:

'

'

As we transition into cooler weather, local farmers' markets continue to offer a bounty of fall produce. You can find fresh apples, squash, pumpkins, and more at markets like:

Whether you're looking to explore nature, get into the spooky spirit, or simply savor the flavors of the season, the Indianapolis area has something for everyone. So grab your scarf, sip on some hot apple cider, and dive into the joys of fall!

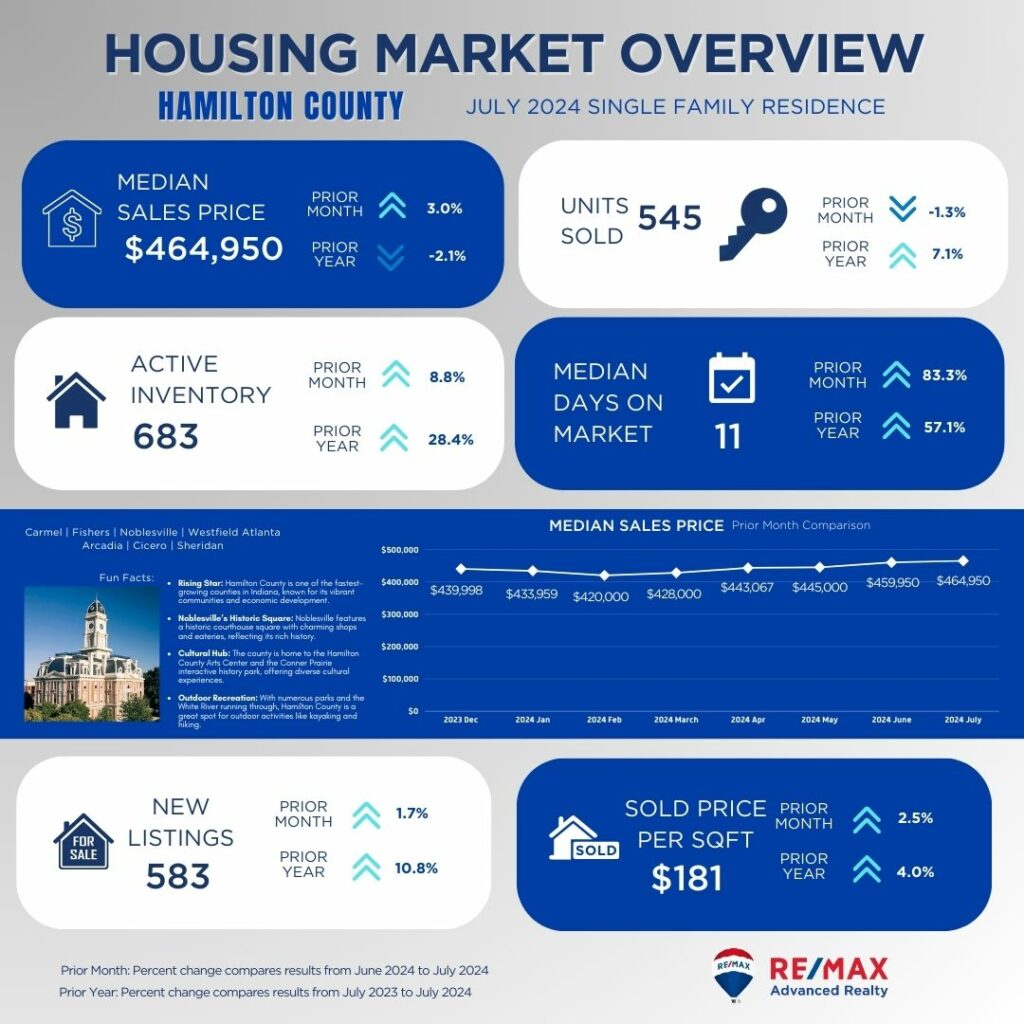

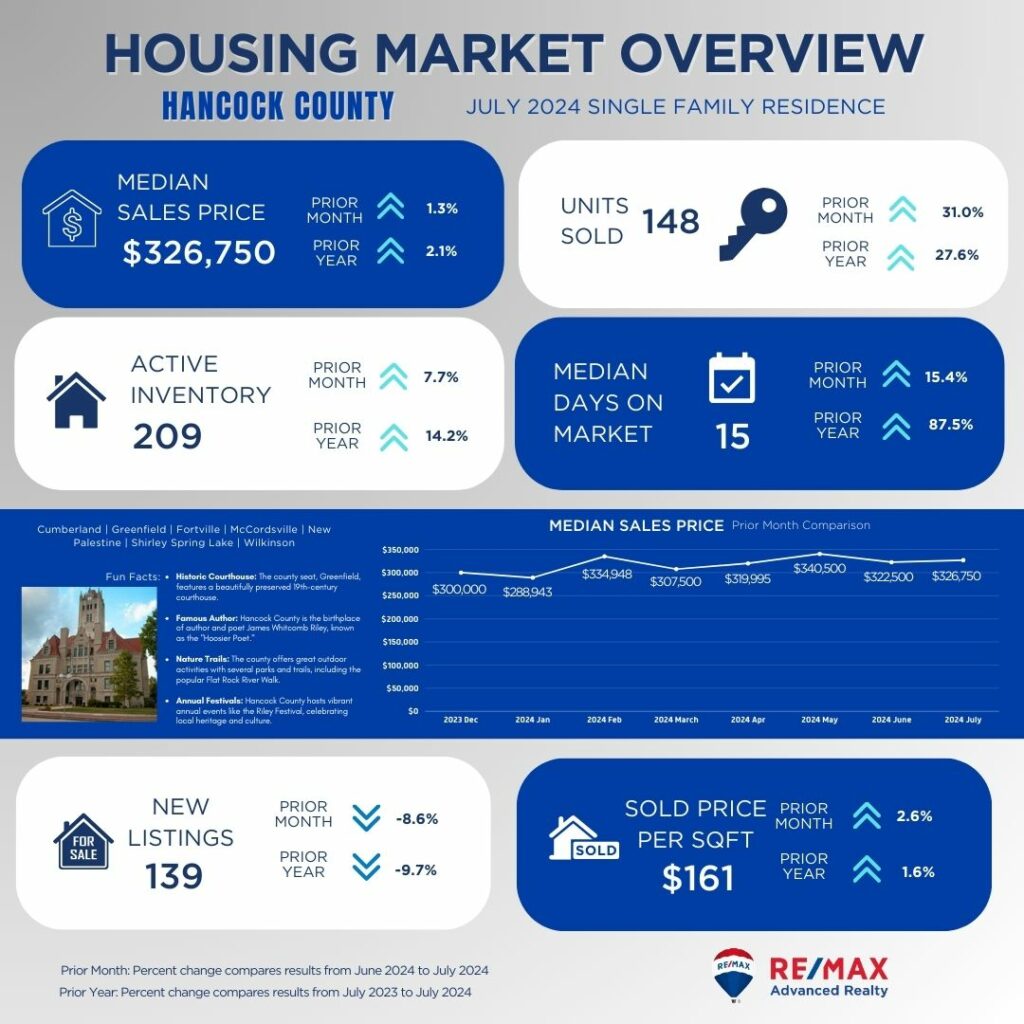

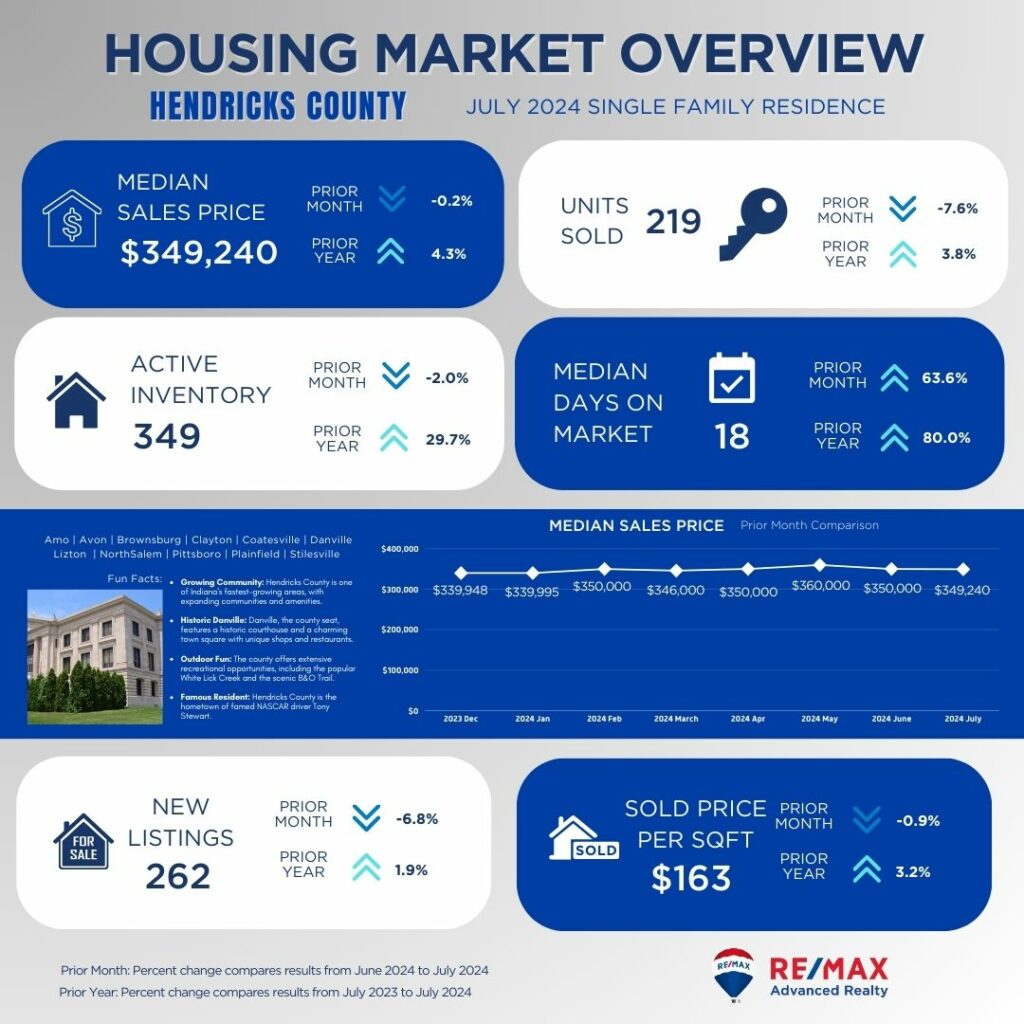

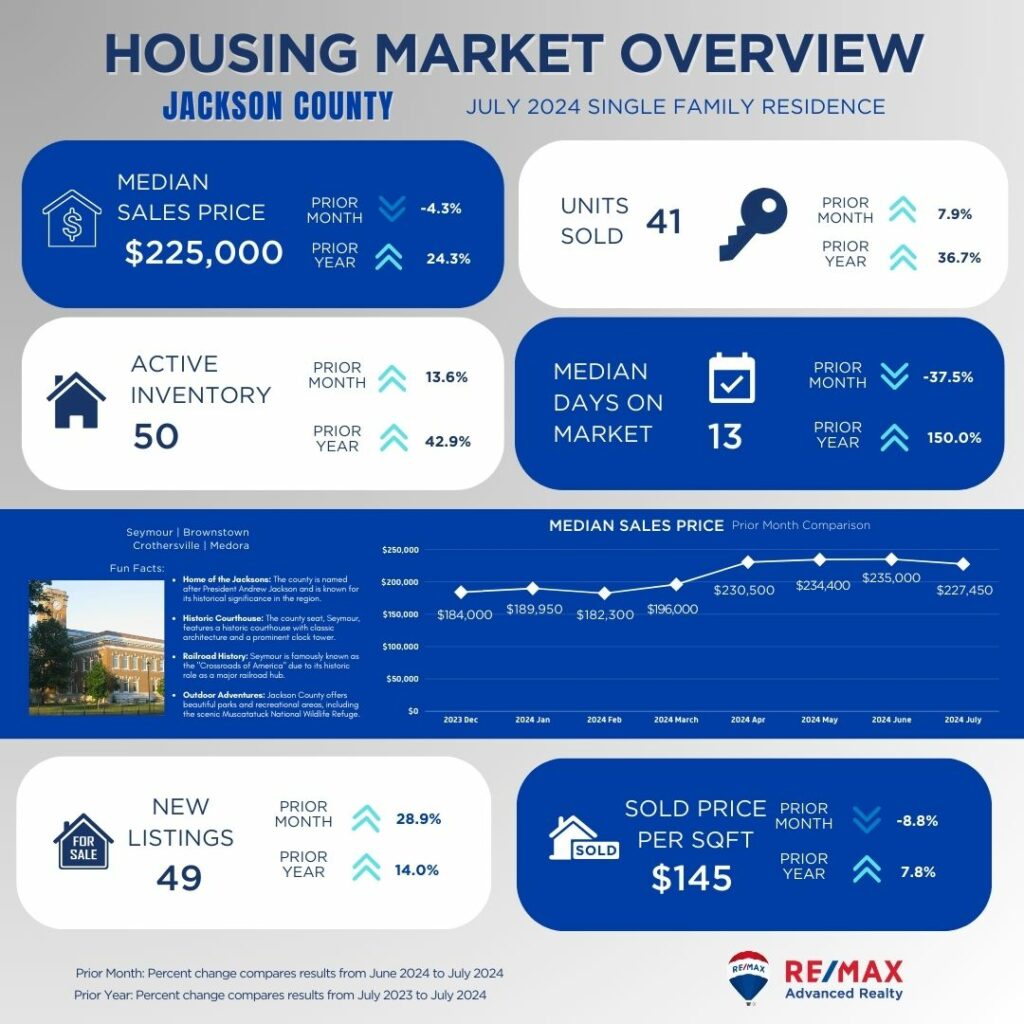

As we move into August, it’s a great time to look back and analyze the real estate trends from July. The summer months have provided us with valuable insights into the Indiana housing market, revealing patterns that could influence your real estate decisions. Whether you’re planning to buy, sell, or simply keep an eye on the market, here’s a snapshot of how key Indiana counties performed in July, offering valuable insights into the trends that shaped the market last month.

Comparison Note: Percent change comparisons reflect results from June 2024 to July 2024 for the prior month, and from July 2023 to July 2024 for the prior year. Data provided by MIBOR Listing Cooperative, compiled on August 11, 2024.

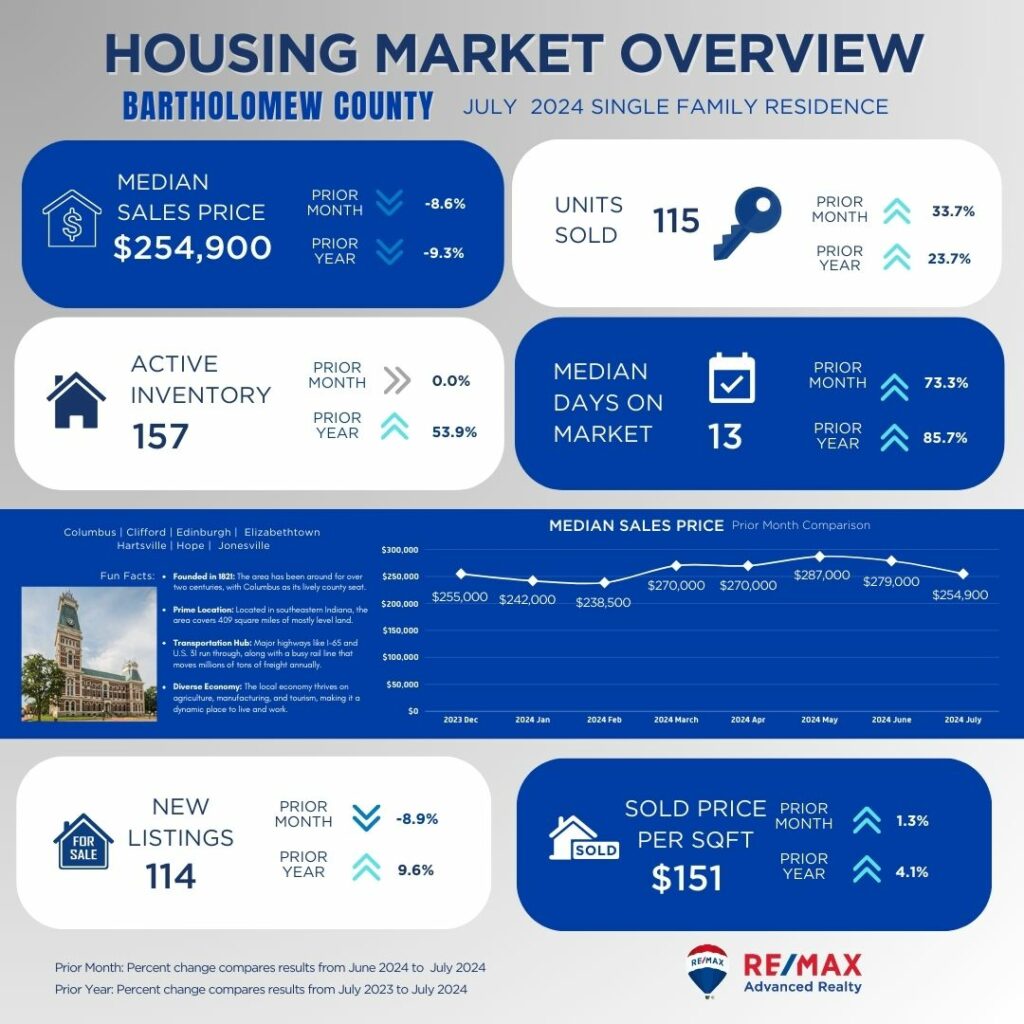

Bartholomew County

In Bartholomew County, the median sales price has dipped to $254,900, marking a notable decline of 8.6% from last month and 9.3% from last year. This drop in prices might suggest a cooling market, but it's worth noting that the number of units sold has increased significantly by 33.7% compared to the previous month. This rise in sales could indicate that despite lower prices, buyers are actively seizing opportunities. The inventory levels remain stable with 157 active listings, while new listings have slightly decreased, down 8.9% from the prior month.

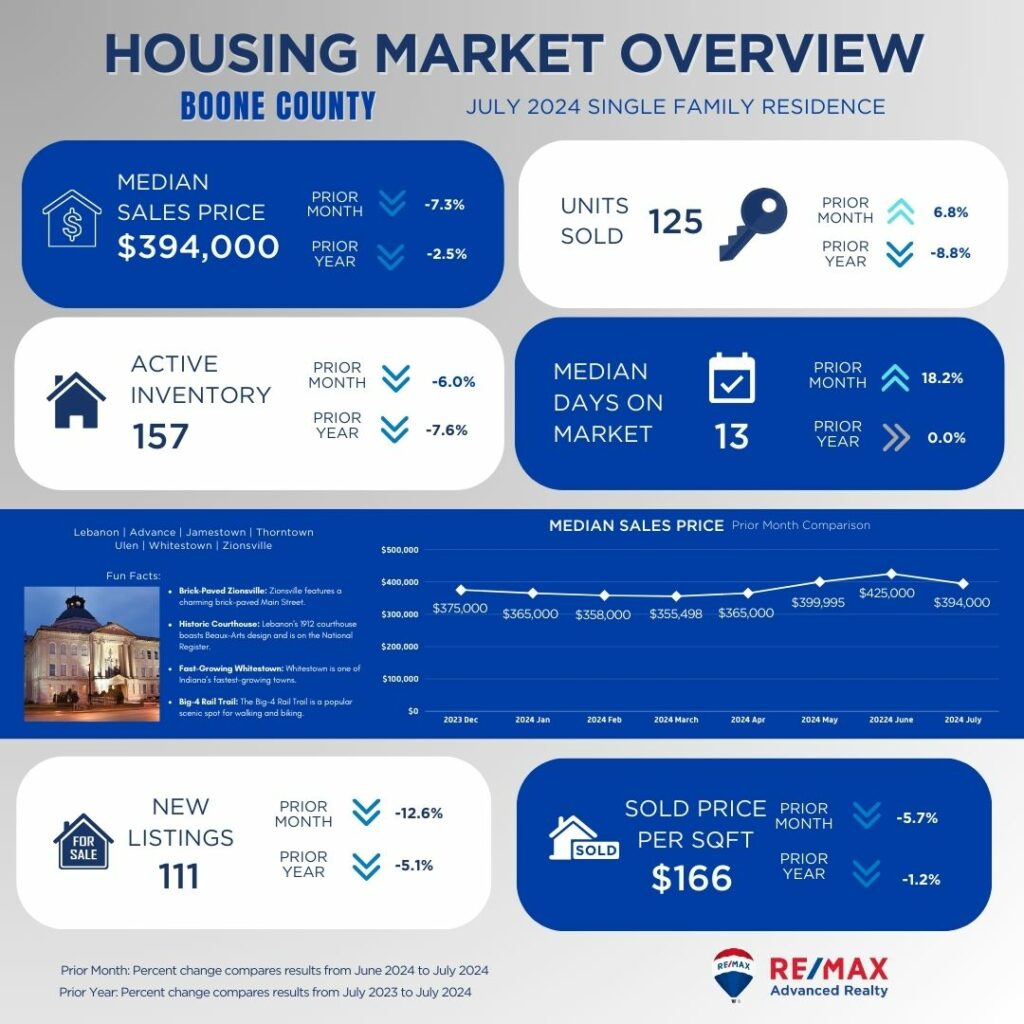

Boone County is seeing a more complex picture. The median sales price of $394,000 represents a decrease of 7.3% from last month, though it’s only a slight drop of 2.5% year-over-year. The number of units sold has seen a 6.8% increase from last month, which might suggest that despite falling prices, the market remains dynamic and active. However, with new listings falling by 12.6%, the active inventory of 157 homes has slightly decreased. The consistent median days on market of 13 days may indicate that well-priced homes are still attracting buyers relatively quickly.

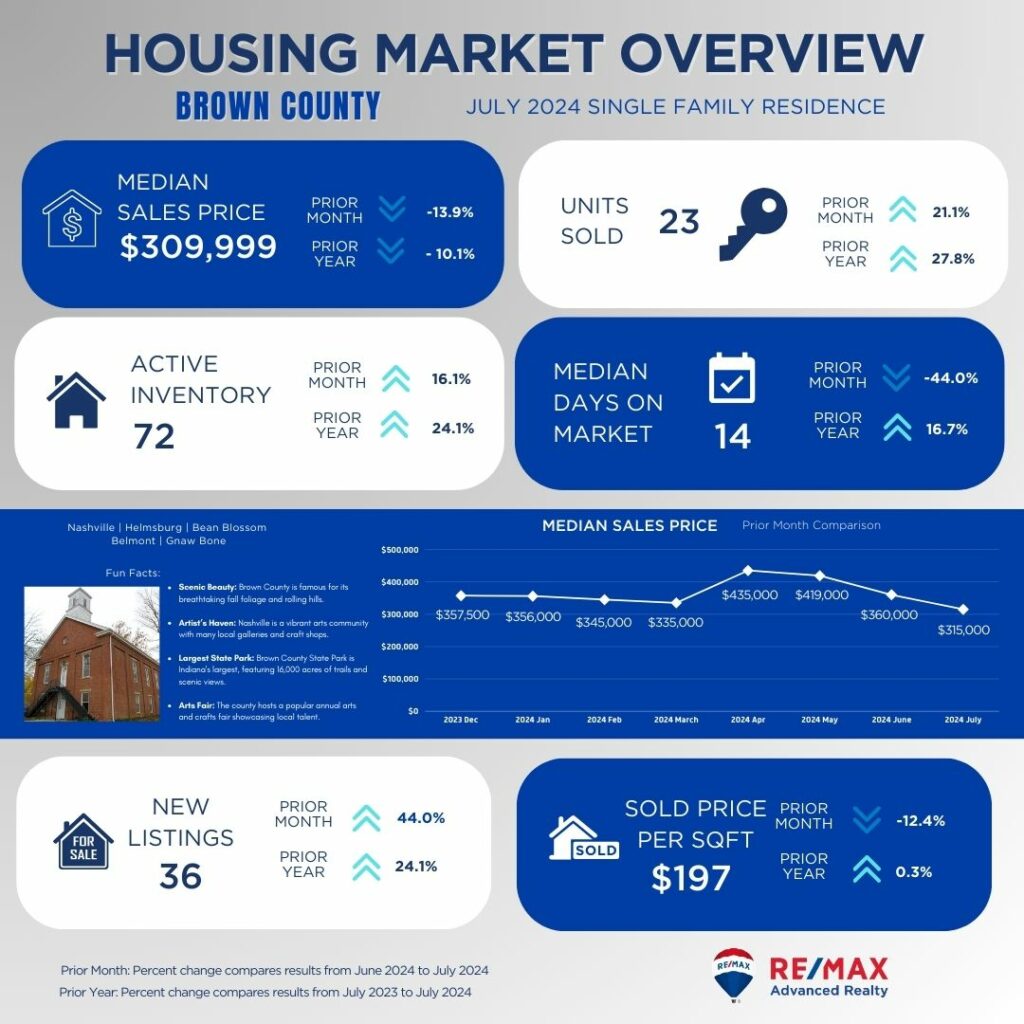

Brown County

Brown County is experiencing a significant drop in median sales prices, down 13.9% to $309,999. Despite this, units sold have increased by 21.1%, showing a positive trend in sales activity. The rising inventory levels, up 16.1%, might be contributing to this price reduction, providing buyers with more choices. The median days on market have decreased substantially, suggesting a faster-moving market despite the drop in prices.

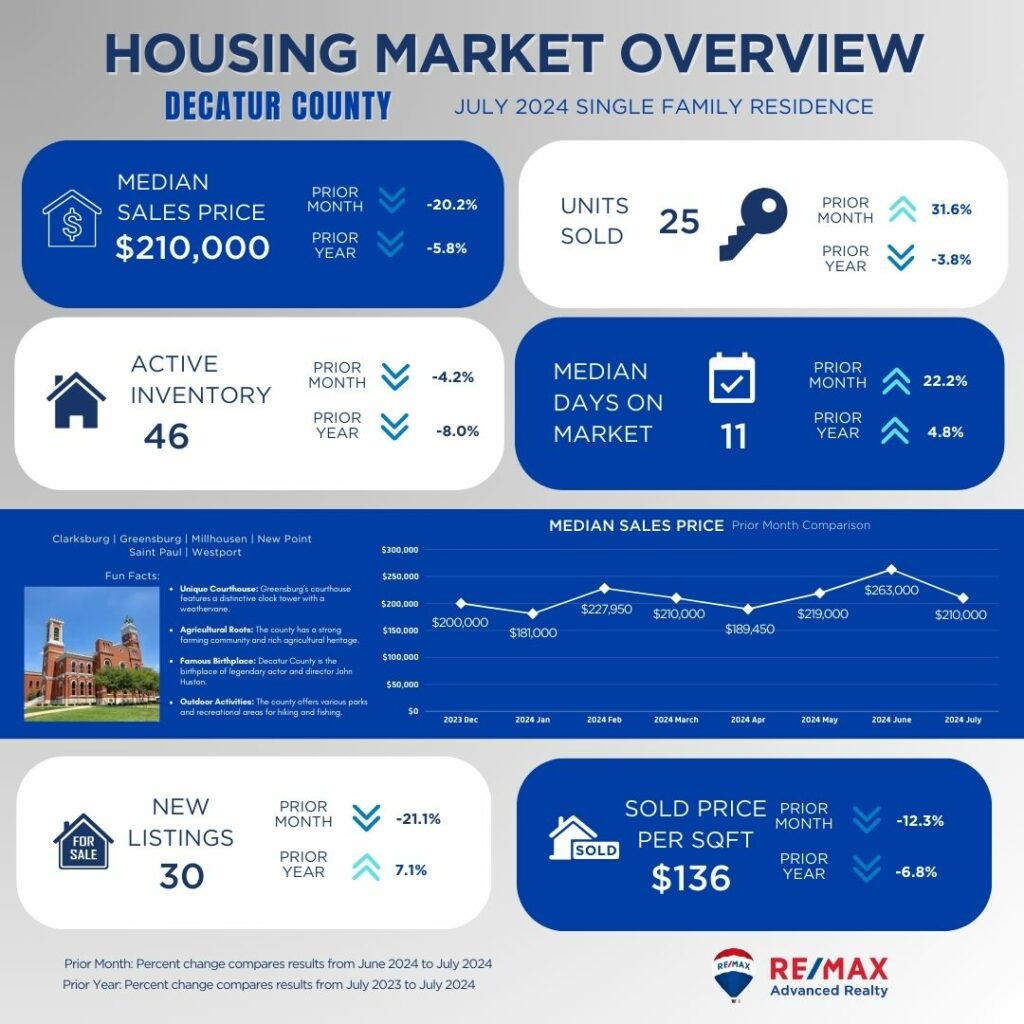

Decatur County

Decatur County presents a different scenario with a dramatic 20.2% drop in median sales price to $210,000. However, the number of units sold has increased by 31.6%, which could indicate that lower prices are driving higher sales volumes. Inventory levels are down slightly, and with a decrease in new listings, the market might be adjusting to these price changes. The reduced median days on market to 11 days shows that homes are selling quicker in this lower-price bracket.

Hamilton County

Hamilton County’s market shows resilience with a median sales price of $464,950, up 3.0% from last month. The number of units sold has decreased slightly by 1.3%, but the increase in active inventory and new listings suggests a more balanced market. The median days on market have increased significantly to 11 days, which could be a sign that higher-priced homes are taking a bit longer to sell, possibly due to the higher inventory levels.

Hancock County

Hancock County is seeing a modest increase in median sales price to $326,750, up 1.3% from last month. Sales activity is strong with a 31.0% increase in units sold, indicating a vibrant market. Despite a slight decrease in new listings, the median days on market is stable, suggesting a healthy demand for homes in this area.

Hendricks County

In Hendricks County, the median sales price has remained relatively stable at $349,240, with a slight 0.2% decrease from last month. Sales have slightly decreased by 7.6%, yet the inventory remains manageable with a slight decrease in new listings. The increase in median days on market indicates that while homes are still selling, they may be taking a bit longer to find the right buyer.

Jackson County has experienced a 4.3% drop in median sales price to $225,000. Despite this, sales activity has increased by 7.9%, and the median days on market have decreased significantly. This suggests that lower prices might be stimulating buyer interest and quicker sales.

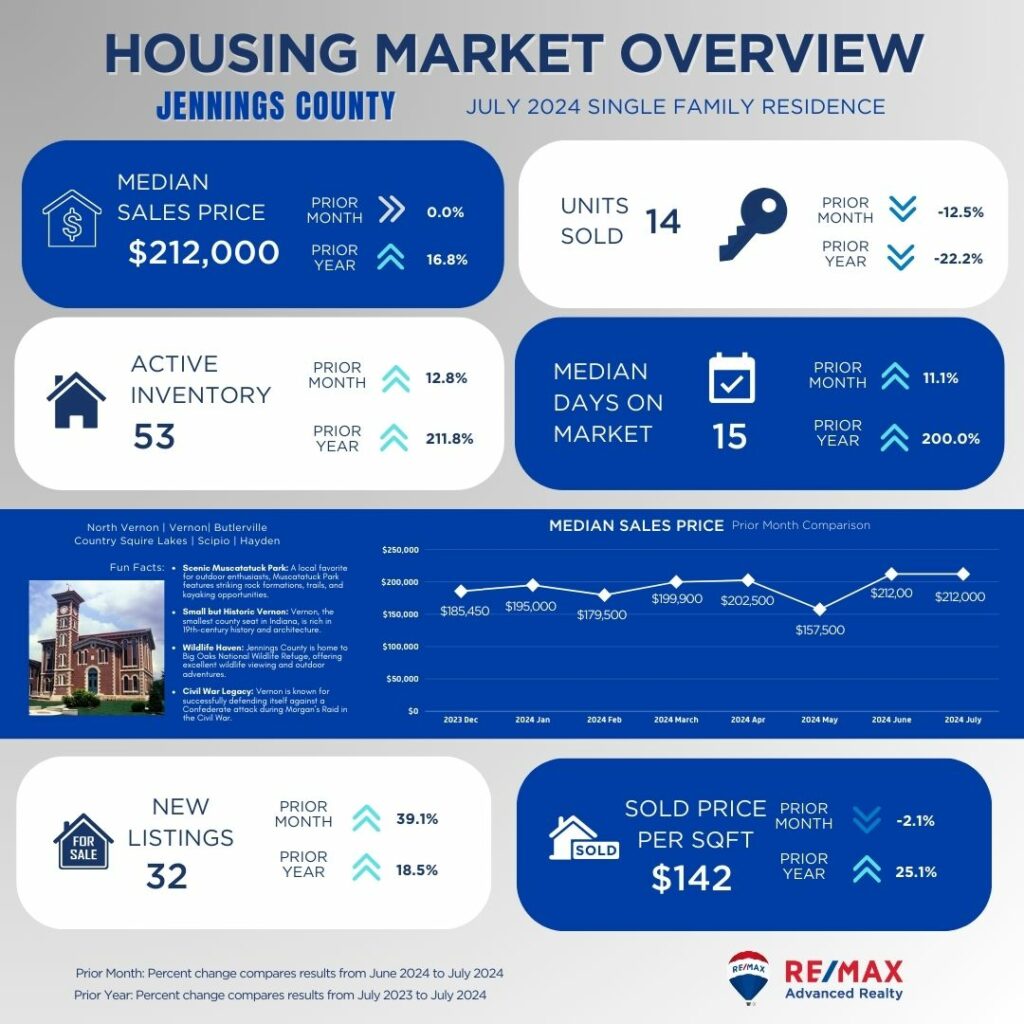

Jennings County

Jennings County’s median sales price has remained steady at $212,000, with no change from the previous month. However, the number of units sold has decreased, suggesting a potential softening in demand. The increase in active inventory and median days on market might indicate a shift toward a more buyer-friendly market.

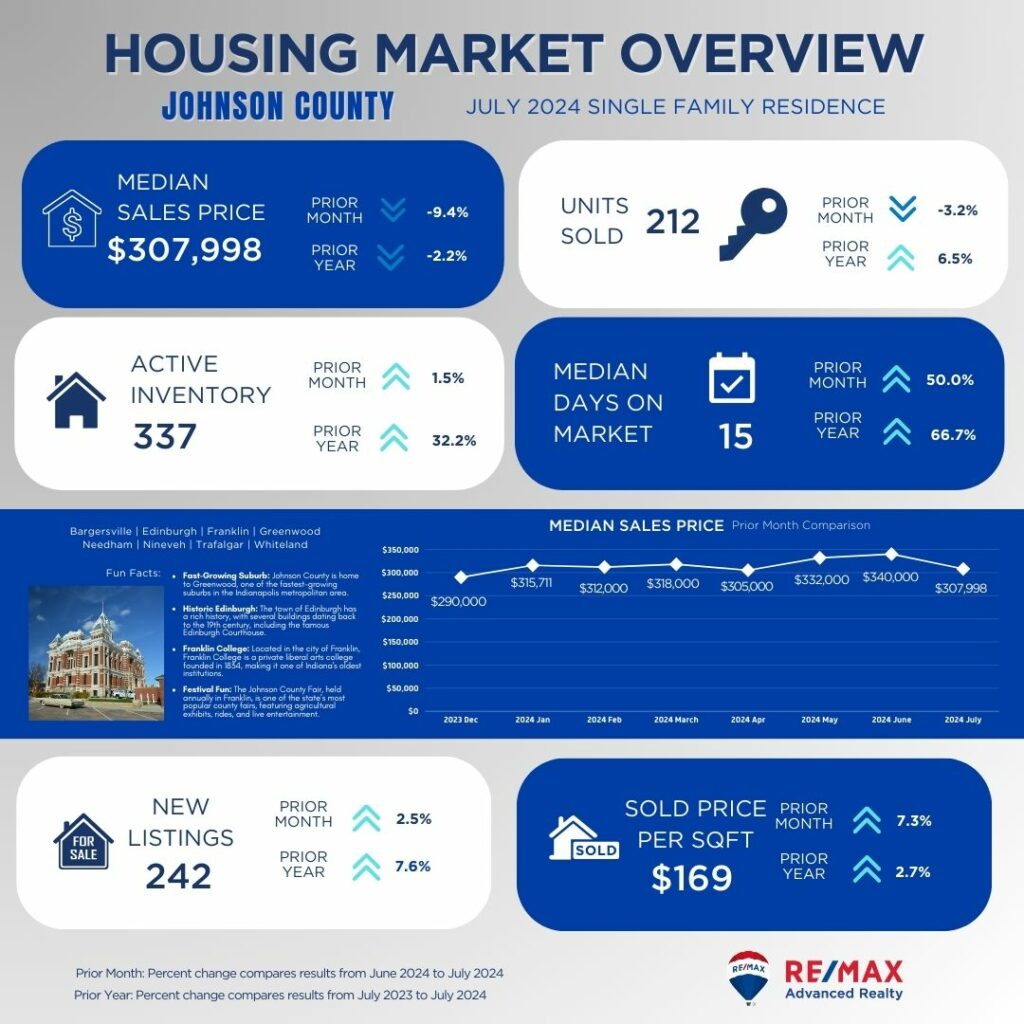

Johnson County

Johnson County’s market shows a decrease in median sales price to $307,998, down 9.4% from last month. Despite this, sales activity remains strong with a decrease in median days on market, indicating that homes are still selling relatively quickly. New listings have slightly increased, suggesting a steady flow of new properties coming onto the market.

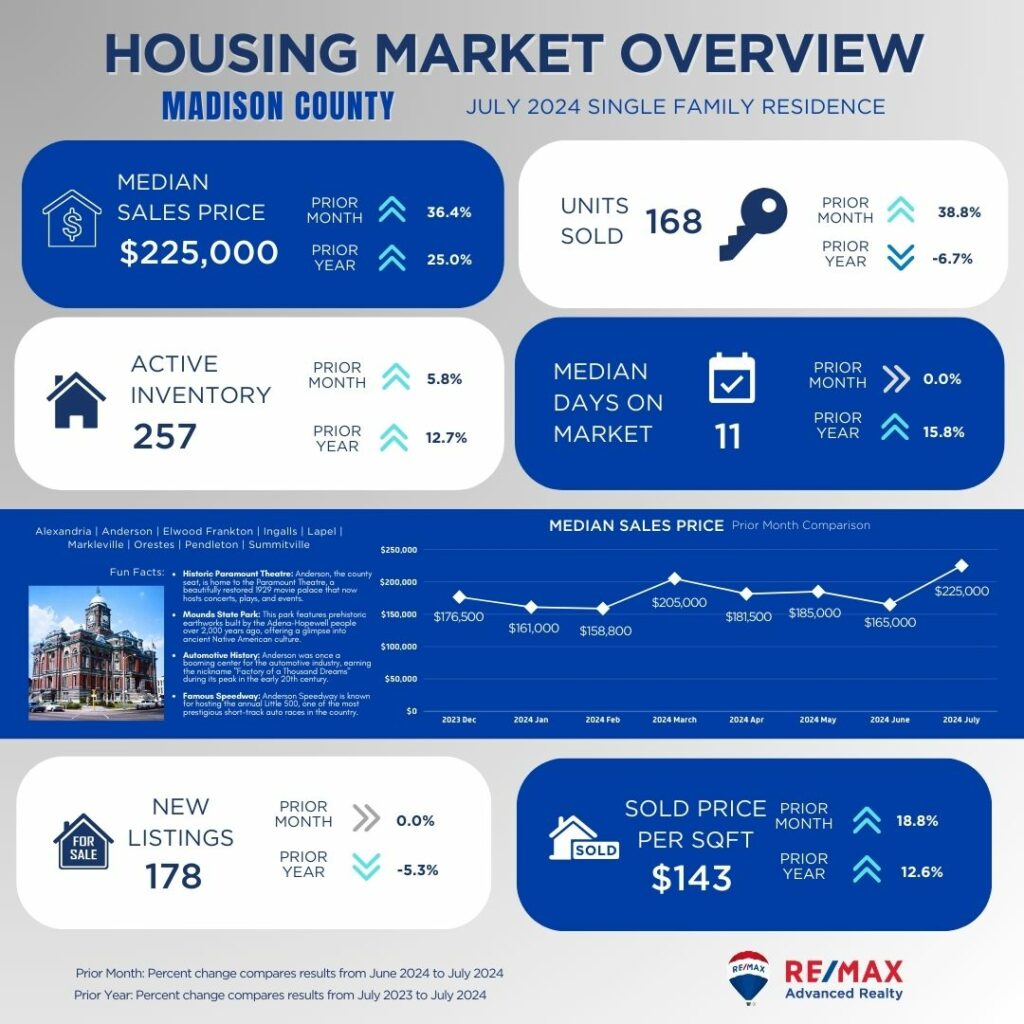

Madison County

Madison County is experiencing a strong market with a 36.4% increase in median sales price to $225,000. The number of units sold has also increased significantly, suggesting high buyer demand. The stable median days on market indicates that homes are selling at a consistent pace despite the rising prices.

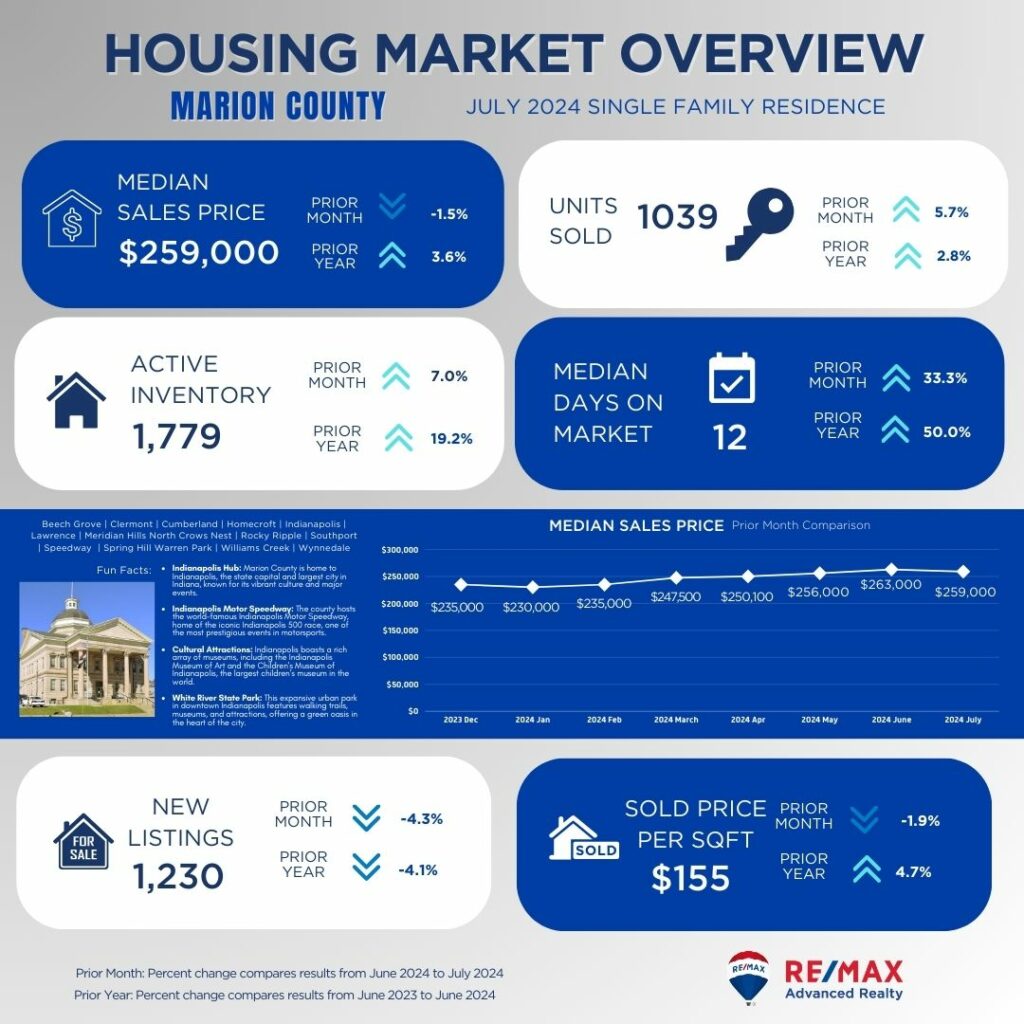

Marion County

Marion County’s median sales price is $259,000, showing a slight decrease from last month but an increase from last year. The large number of units sold and the increase in active inventory suggest a robust and active market. The decrease in median days on market to 12 days indicates that homes are selling relatively quickly in this large and diverse market.

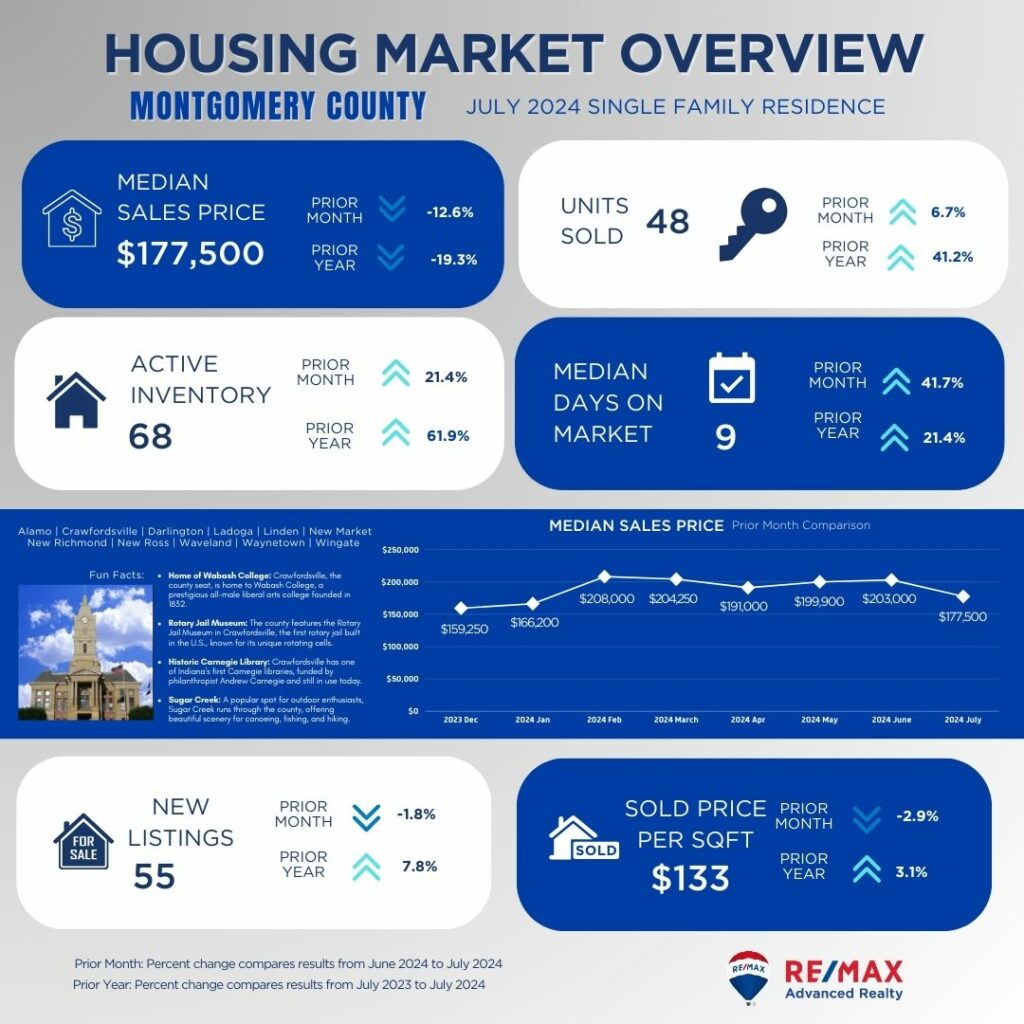

Montgomery County

Montgomery County shows a significant decrease in median sales price to $177,500, down 12.6%. Despite this, the number of units sold has increased, suggesting that lower prices are attracting more buyers. The decrease in median days on market indicates that homes are selling faster, likely due to the more attractive pricing.

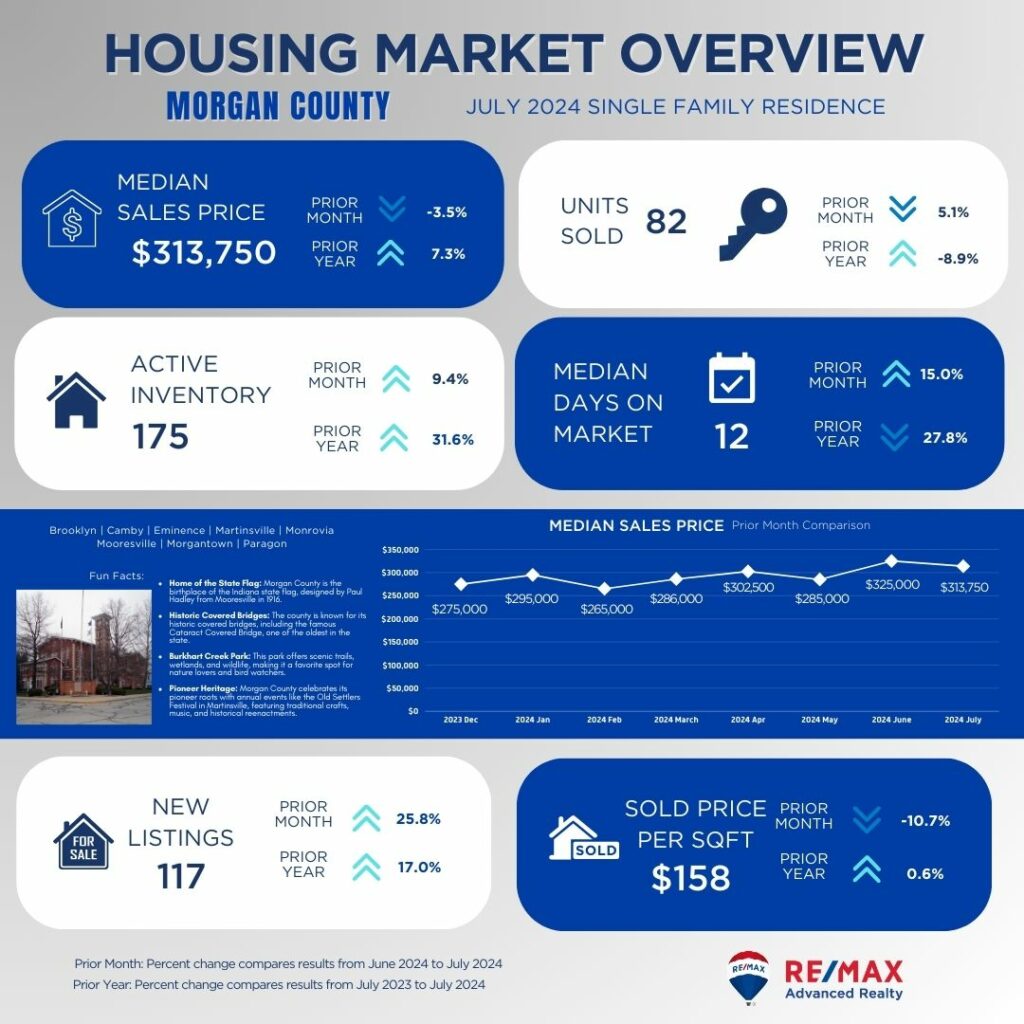

Morgan County

Morgan County has seen a decrease in median sales price to $313,750, down 3.5%. However, sales activity remains strong, and the decrease in median days on market suggests a quick turnover for homes in this area. The increase in active inventory and new listings may offer more options for buyers.

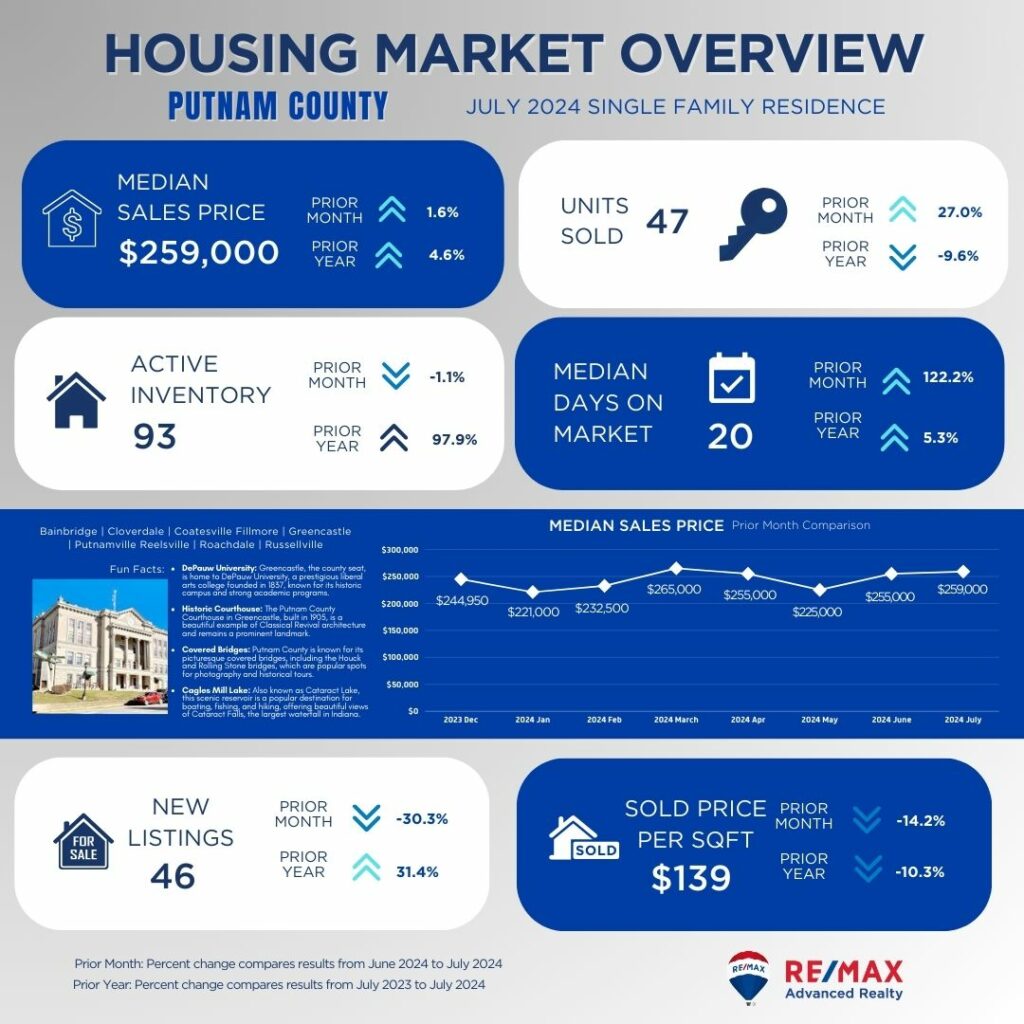

Putnam County

In Putnam County, the median sales price has increased slightly to $259,000. However, the significant decrease in new listings and increase in active inventory suggest a market adjusting to changes. The longer median days on market may indicate that homes are taking a bit longer to sell.

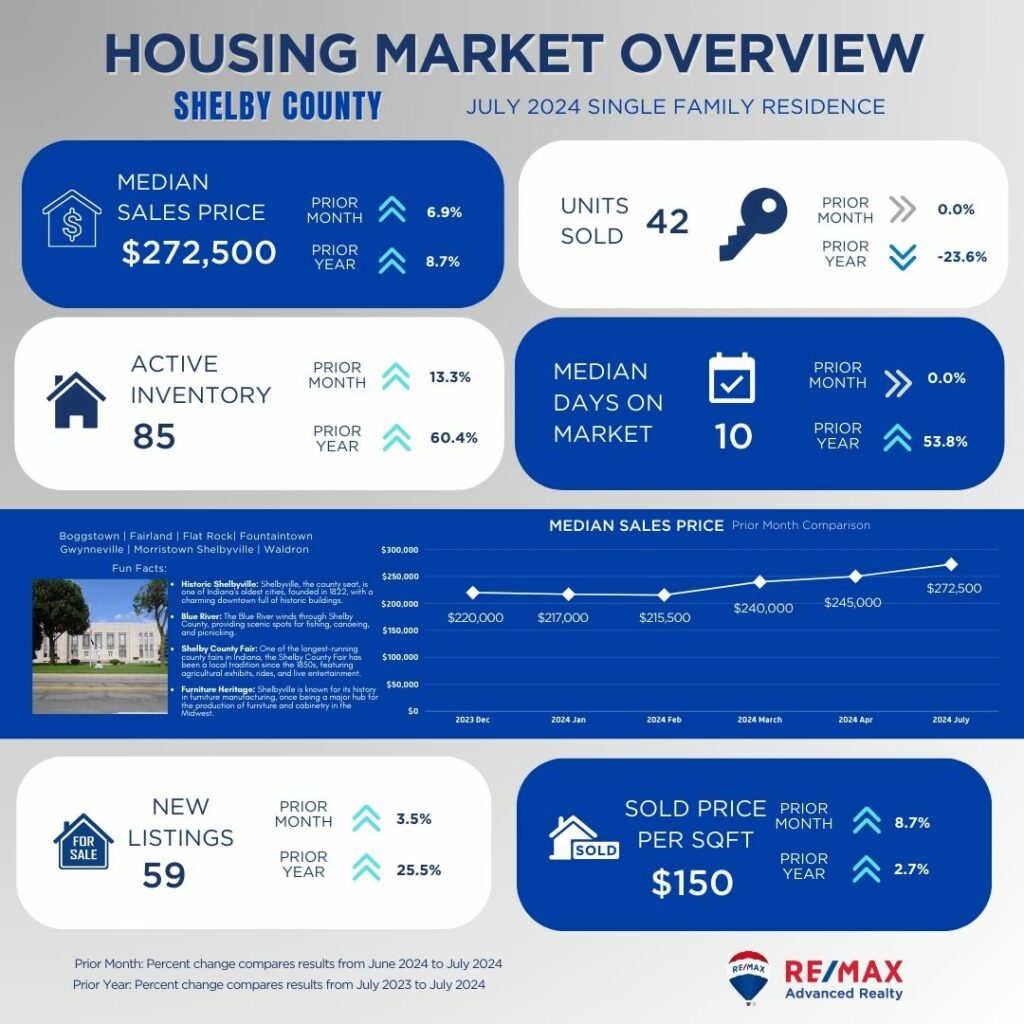

Shelby County

Shelby County has seen an increase in median sales price to $272,500, with a 6.9% rise from last month. Despite a slight decrease in the number of units sold, the increase in median days on market suggests that while prices are rising, homes are taking longer to sell.

As you consider these insights, remember that local market conditions can vary widely. If you’re thinking about buying or selling, it’s always a good idea to consult with a local real estate expert who can provide personalized advice based on your specific needs and goals. Reach out to Indy’s leading brokerage, RE/MAX Advanced Realty, at 317-298-0961 (West Office) and 317-881-3700 (Greenwood Office) to connect with experienced professionals who can help you navigate the current market trends and make informed decisions.

The living room is frequently called the "heart" of the home, and there is a good reason for this perception. It is the focus for friends and family get-togethers and fulfills several functions. A friendly and well-arranged living room may create an excellent first impression on visitors and help them feel at home.

The living room has many uses because it is such a flexible area. Its design and decor affect the home's overall appeal. A well-planned living room may give the entire home feel cozy, while a poorly constructed one does the opposite.

There are many things you can do in the living room, which can also serve as a workspace, a reading area, or a music room. Thus, giving it the right attention as well as an upgrade is always a good idea. Here are ways how to make this room more welcoming and elegant.

A lighting source, whether it be a floor, table, or ceiling lamp, may also make a statement. Consider using dramatic lighting accents like large lampshades, a glitzy gold lamp base, or a contemporary crystal chandelier. A space can have a high-style focal point with a shining finish or an enormous size.

The brass chandelier and table lamps in this room lend the black-and-yellow color scheme a striking, opulent radiance.

Budget Tip: Budget-friendly glamorous lighting choices are undoubtedly possible. You may find crystal ceiling fittings that cost less than $200. For elegant floor and table lamps, check big-box stores for striking designs that cost less than $100.

Mirrors are the ideal piece of furniture to add light, create the appearance of greater space, and give off a glitzy, luxurious vibe. A huge mirror over a sofa, credenza, or focal point, like a fireplace, should be hung.

In this white living room, a collection of simple, large mirrors creates a chic background for the white couches. It gives just the appropriate amount of glitz without giving the room the appearance of an ostentatious jewel box.

Budget Tip: Oversized mirrors don't need to be elaborate to look opulent. If a large mirror isn't available, consider clustering smaller mirrors to achieve a like look.

The larger the canvas or framed piece of art in the living room, the more upscale the space will appear. Large artwork gives an expensive-looking gallery appearance.

A regular white cabinet in this room becomes the focal point of the room thanks to a giant artwork painted in metallic gold. The striking black lamp adds even more drama to the wall.

Budget Tip: It can be difficult to choose affordable art that has a high-end appearance. It's challenging since art is individualized and subjective. Look through your local flea markets or online marketplaces like Chairish and Etsy for reasonably priced solutions. A huge original painted canvas or framed print usually looks more upscale than a giclée or printed canvas. Your living space can have a gallery-like atmosphere by using basic shapes and forms that you like, that provide drama, or a flash of color.

Your space will appear larger with a rug that can comfortably fit beneath all of your key pieces of furniture, including the coffee table, sofa, and armchairs. When trying to elevate the standard of design and elegance in a living room, this is crucial.

This area's huge carpeting highlights every piece of furniture. Its vastness allows the eye to move about and take in the room's expanse, which includes the colorful pouf and chic accent chair. This is how the room would appear if there was just a tiny rug beneath the coffee table. A modest size would resemble a bath mat and give the impression that the room is smaller.

Budget Tip: While sisal and jute are natural fiber carpets, they might be more affordable than large rugs. To give them a softer feel, they are occasionally woven with other materials. As an alternative, search for cozy-textured indoor-outdoor rugs.

Hang window coverings from the ceiling or as high up on the wall as you can. Elevated placement, a common characteristic in luxury living rooms, adds volume and offers the illusion of a higher ceiling.

Budget Tip: If you can't afford pricey curtain panels, you may still give your space a more upscale appearance by hanging more of them, or doubling up on the panels. Most curtain materials appear more opulent when they have thicker bunched panels. You can also hide any subpar detailing or quality in your drapes by doubling the number. Even less expensive curtains typically look more expensive when they have a consistent hue and some texture.

It is possible to make your living room feel more inviting and comfortable without spending so much. All you have to do is add in a little creativity along with research.

As always, you can check our website to see more design inspirations.

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224