When selling your home, timing is crucial. Although spring and summer are often the busiest times for house sales, October still presents a distinct set of opportunities and difficulties.

However, is it really a wise decision to sell your house in the fall?

To help you with this, we've gathered all the pros and cons and other necessary details you need when listing your home during this time of year.

The fact that purchasers are typically more serious is one of the main advantages of selling in the fall. At this point in the year, buyers are frequently keen to get a deal before the holidays or the new year. These driven customers are more inclined to act quickly, which could lead to a quicker sale.

The real estate market tends to cool off in the fall, as opposed to the spring and summer. Your property is more likely to stand out when there are fewer houses for sale. For sellers hoping to draw in serious purchasers, this decrease in competition might be a big benefit.

Beautiful curb appeal is naturally complemented by the fall season. Cooler weather and the rich hues of fall foliage may create a welcoming and comfortable house atmosphere. Your home's overall appeal can be improved during this time with small details like warm lighting, seasonal decorations, and a well-kept yard.

You might discover that you have more negotiating power because there are fewer houses for sale. Given their restricted options, buyers in the fall might be more accommodating with bids. Better terms and conditions for your sale may result from this.

There are often fewer buyers searching in the fall, even though they could be motivated. Your pool of possible purchasers may be reduced because many are busy with back-to-school activities, impending holidays, and winter preparations.

Depending on where you live, the fall weather can be erratic and possibly start to snow before your house sells. The presence of rain, wind, or chilly weather can dissuade potential buyers from viewing your home by making open houses and showings less inviting.

There may be less natural light available during showings because the days are shorter in the fall when daylight savings time ends. Potential buyers could not fully appreciate your home's best qualities if they are visiting in the evening or after work. To make up for the shortened daylight hours, make sure your house has adequate lighting.

As the fall season moves into the holidays, many shoppers shift their attention to family gatherings, holiday shopping, and travel arrangements. This might cause delays in decision-making, with some consumers waiting until after the holidays to make a purchase.

Here are some pointers to think about to increase your chances of a successful fall house sale:

Take advantage of the fall season by arranging your house to create the warm, inviting ambiance that prospective buyers frequently seek at this time of year. Warm colors, comfortable textures, and seasonal décor can help prospective buyers picture themselves living in your house and make it feel welcoming.

Your yard may suffer from falling leaves and colder temperatures. Be sure to maintain a clean and debris-free yard. To make a visually appealing façade that attracts buyers, rake leaves, trim bushes, and think about adding fall flowers.

Setting your home's price correctly from the start is critical because there are fewer buyers on the market. Together with your real estate agent, determine a fair price for your house based on current market conditions. In the fall market, overpricing may make your house sit on the market for longer than anticipated.

Due to their hectic schedules, buyers might not be able to visit homes as often in the fall. To draw in more buyers, be adaptable with showings, provide virtual tours if you can, or allow weekend and nighttime visits.

Bottom Line

Selling a home in the fall has its own advantages and disadvantages. Those who are looking for properties are frequently more driven to close before the holidays, even if there may be fewer buyers on the market. Additionally, you may benefit from less competition, which helps your listing stand out easily.

However, if you want a quick sale, it might be hampered by inclement weather, shortened days, and holiday diversions. You may maximize the fall real estate market and possibly secure a successful sale by being aware of these elements and preparing your house appropriately.

As always, we're more than happy to assist you whether you're buying or selling a home in the fall. Just leave a comment or email us at dennis@indyhomepros.com today!

Every seller wants to sell their home as soon as possible, for the best price, and with the fewest hassles. Likely, you're not much different.

However, did you realize that the asking price for your house is one of the main factors that could put your success in jeopardy? One of the most important aspects of selling your home is setting a fair price.

So how can you tell if you're falling short? Here are four indications that buyers may be turned off by your high asking price, along with the reason why consulting your real estate agent is the best course of action.

A lack of showings is one of the most obvious indicators that your home might be overpriced. It may be a glaring sign that the pricing isn't what buyers are expecting if it's been on the market for a few weeks and very few people have gone to look at it, or worse, you haven't had any bids.

Since long-term buyers can quickly identify—and discount—a home that appears to be overvalued.

You may rely on your real estate agent's experience to guide you through this process and get advice on potential strategies to attract more buyers, such as lowering your asking price.

You might need to change directions if the remarks from the prospective purchasers you do have after the showings aren't too positive. Remarks from viewings are a crucial component of knowing how potential buyers view your home.

If customers frequently comment that it's too expensive in comparison to other properties they've visited, you should reevaluate your pricing approach.

For you, your realtor will compile and evaluate this input so you may see how your home compares to others on the market. To better support your asking price, they can also recommend staging adjustments or particular enhancements, or they can suggest one that is in line with what buyers demand these days.

As the National Association of Realtors (NAR) explains: “Based on all the data gathered, agents may make adjustments to the initial price recommendation. This could involve adjusting for market conditions, property uniqueness, or other factors that may impact the property’s value.”

In the end, this lack of interest will cause it to remain on the market without receiving any significant bites. Buyers are more likely to have concerns about it and wonder whether there is a problem with it the longer it remains on the market.

A lengthy listing duration indicates that your home is stale, which makes it even more difficult to sell, especially in the current market with rising inventory.

In addition to showing you what strategies have worked for past sellers, your real estate agent can offer you insight into how quickly other homes in your neighborhood are selling. In this manner, you can jointly determine whether there is anything you would like to change.

According to a Bankrate article: “Check with your agent about the average number of days homes spend on the market in your area. If your listing has been up significantly longer than average, that may be a sign to reduce the price.”

This is the final one to be cautious with. Similar homes in the neighborhood selling more quickly than yours are a dead giveaway that something is wrong. This may be the result of factors like antiquated features, a less appealing location, or a lack of updates -- or simply because the price is too high.

Your realtor will inform you of any changes necessary to make your home more competitive, as well as information about your competitors. They'll provide guidance on minor improvements that can improve the curb appeal of your house or how to modify your approach to take into account the current state of the market.

Pricing your home correctly is crucial, and a realtor is your best ally for getting it right. Here's why:

With a realtor's expertise, you can confidently price your home to sell fast and at the best value.

Appropriately pricing a house is a combination of science and art. It requires a thorough comprehension of consumer psychology and the market.

Your agent is the best person to consult when the price isn't attracting buyers for advice on what to do next.

And when you want the best, our team at RE/MAX Advanced Realty is one call away. Dial 317-316-8224 so we can assist you today!

For those who have started to browse our website on homes for sale, as well as properties in the surrounding area, there are massive advantages to viewing homes that you are considering in person. Although virtual tours and online profiles can provide exceptional detail regarding the homes you view, they cannot reveal everything. Instead, getting an up-close look at a single-family house or luxury townhome can paint a picture of what it would be like to live on the property.

You have two choices for in-person property viewing: private tours and open houses. Each has its own set of advantages and disadvantages. To help you know which suits your current needs, we've provided the main pros and cons below.

PRO: You'll be able to see the neighborhood up close

The chance to tour the area is one of the key benefits of going to an open house. Realtors frequently invite neighbors and other community members to open house events.

This allows potential buyers to interact with possible neighbors and obtain unbiased perspectives about what it's like to live in the community. The number of residents who attended but are not interested in purchasing the property can vary depending on the area's size and layout. There is very little likelihood of meeting your new neighbors on a private tour.

There's freedom to come and go during the designated event times at open houses. You are free to take a break, go for a tour of the area, and then return to speak with the realtor. On the other hand, private tours are by appointment only, therefore this is not a possibility.

CON: The event can be super busy

There are advantages to meeting possible new neighbors, but there are drawbacks to large gatherings. This is particularly true for properties in high demand since they can draw dozens of potential buyers to a single open house.

Private tours are frequently the better option if you are someone who doesn't like crowds. On the other hand, if a private tour isn't offered for a certain house, make an effort to go to weeknight open houses. These only draw serious purchasers and are typically less crowded than weekend open houses.

PRO: No pressure to make an offer

Attending an open house is a low-stress endeavor. There are a lot of people there, so it's easy to come and go without getting seen (if desired). You can feel much less anxious about the scenario because you do not receive the personalized attention that you would in a private tour.

This is particularly beneficial for those who are just beginning the home-buying process and are unsure of their future residence. You made up your mind not to like the house? Not an issue. There will be many other people there who will probably fall in love with the property.

Ask questions as they come up during your self-guided tour, which you can take at your own speed.

PRO: Receive one-on-one attention the entire time

When it comes to house tours, are you the type of person who prefers a more exclusive, posh experience? Making reservations for private property visits is, without a doubt, your best option.

You will have one-on-one attention from an agent the entire time your reservation is made. You can ask as many questions as you'd like, and there's no danger of getting lost in the crowd. To increase your chances of having your offer accepted while you are contemplating a home, it is essential to arrange a private tour.

If you don't like the feeling of being rushed, private tours offer a laid-back setting where you can examine each area at your leisure, pose questions, and get a sense of the overall design.

In the end, choosing a proactive tour will help you feel less stressed during this hectic period of your life. During a private tour, a professional real estate agent will never make you feel rushed or constrained by their schedule.

Cons: Not ideal for first-time homebuyers

Have you just started looking for a place to buy? If so, there's a chance you don't currently have an agent you can work with to arrange a private trip. You need to make an appointment with an agent for a private home tour before you are allowed to visit the property.

Taking a personalized tour could seem like a high-pressure commitment, even if you have an agent already. People who are just beginning the process of becoming homeowners might want greater liberty and flexibility to come and go as they choose, without having to respond.

Pro: Establish a connection with your realtor

Having the chance to get to know your realtor is just another fantastic advantage of setting up one or more private visits. You can begin establishing a rapport with your selected real estate agent after just one trip.

This will help your realtor understand your tastes and personality better, which will ultimately help them choose the kind of house you are most interested in. You will consequently be matched with your ideal Indiana home faster.

If you're looking for the best realtor in your area, we have one for you! Just let us know where you're from and your concern -- buying or selling a home and we'll guide you.

Leave a comment or send us an email to get started: dennis@indyhomepros.com

The housing market in Central Indiana for September 2024 shows a mixed yet steady landscape compared to the same period last year. According to data from MIBOR BLC®, the median sales price remained unchanged at $300,000, reflecting stability in home values across the region. While this price point held steady year-over-year, it did show a slight decline from August, signaling a brief pause in upward trends observed earlier in the year.

Sales Activity and Inventory Shifts

Closed sales saw a modest uptick compared to September 2023, indicating continued buyer interest despite market fluctuations. New listings, however, experienced a small dip, suggesting that fewer homes were being put on the market as sellers may be taking a more cautious approach. This decrease in new inventory, paired with relatively steady prices, points to a market where demand is still robust but options for buyers are slightly more limited.

County-by-County Breakdown

In a closer look at county data, many areas in Central Indiana saw notable shifts:

What’s Ahead for the Market?

According to MIBOR CEO Shelley Specchio, favorable mortgage rates have fueled buyer interest since the start of the summer, with the market showing signs of resilience. However, recent economic reports suggest continued unpredictability in the months ahead. As mortgage rates adjust based on broader economic factors, potential buyers and sellers will need to remain agile.

The market's path toward more favorable conditions remains in flux, but with inventory slowly increasing and demand holding steady, the outlook for Central Indiana real estate remains cautiously optimistic as we approach the end of 2024.

For more detailed insights or personalized market advice, reach out to RE/MAX Advanced Realty's local experts to guide you through the current housing trends in your area.

As summer draws to a close, the country's housing market, which has recently favored sellers, shifts into a "neutral" state as October approaches, placing buyers and sellers on an even playing field. Orphe Divounguy, Senior Economist at Zillow®, says that a more balanced market would probably have fewer buyers. If you want to sell in the fall, you might wonder what constitutes a "neutral market."

According to him, the type of market highlights how crucial it is to determine the ideal list price because, in contrast to other listings, those that are priced competitively and effectively advertised get under contract in an average of just eighteen days.

Setting a price for a property that will sell strategically is never simple, but it can be particularly difficult in the fall when buyers with financial difficulties still struggle with affordability. In July, over 25% of sellers nationwide (i.e., the greatest percentage in the last five years) lowered their prices for the spring-summer selling season.

Divounguy claims that sellers "haven't gotten the memo quite yet." He also said that: "They're still listing their homes too high. That's why you're seeing more price cuts on these homes. And the homes that are mispriced are staying on the market longer."

In addition to learning how much to charge for a home, sellers and prospective buyers have a lot to consider this autumn, from the very variable local market circumstances to concerns about the direction of mortgage rates. Here are our predictions for the fall selling season of 2024:

Fall is typically the slowest season for house sales, partly because parents with young children tend to put off house hunting after the school year begins. According to Zillow data, consumers withdrew from house hunting earlier this year than usual. This decreased competition across the country and forced sellers to lower their asking prices and make concessions to draw in buyers.

The retreat affects inventories, which rose in July in all but five of the major metro areas that Zillow economists examined. It's also having an impact on property values, which just marginally increased in July, per a recent Zillow research.

According to Zillow's projection, home values will rise by 1% nationally over the next 12 months, which is a significant deceleration from previous years, according to Divounguy.

"While price growth could continue to ease somewhat, I don't expect big price declines," Divounguy says. "TWe’ll need to see a big increase in inventory to see a large decline in home values. Recent small improvements in affordability could bring back more buyers than sellers, which could slow the increase in housing inventory, and prevent the market from cooling further."

The number of available homes in the US will drop by 4.5 million in 2022, per Zillow research. Apart from their scarcity, the annual production of new residences has not kept pace with the rate of construction. Even while buyers find it difficult to pay, sellers should expect steady home values for the foreseeable future as a result of the shortage.

It is generally anticipated that the Federal Reserve Board will lower its main policy rate in September and maybe later. The Fed's projections may already be reflected in current mortgage rates, though.

He believes that long-term economic variables like inflation and the state of the economy as a whole are often taken into account by lenders when setting interest rates. Therefore, even while the expectation of Fed rate cuts may be influencing mortgage rates at the moment, additional declines in mortgage rates are unlikely if economic growth continues to be robust.

Despite a decline from the 2.8% seasonally adjusted rate seen in the second quarter, the US economy's third-quarter seasonally adjusted annual growth rate is 2%.

Although it has somewhat improved, most prospective purchasers still face significant barriers due to housing affordability. Home prices may rise as more purchasers try to take advantage of the recent rate reduction.

Additionally, since interest rates aren't going to continue dropping, buyers will probably continue to feel pressured by the combination of high house prices, higher-than-usual interest rates, and the necessity of saving money for a down payment.

Because of the budget issue, consumers are searching for the greatest offers.

Well-priced and well-marketed properties continue to sell quickly, even if the majority of listings decline. Properties that sold in July took just 18 days to go pending, which is six days less than a year ago but still quicker than before the outbreak.

Zillow data also indicates that greater sale premiums are associated with contemporary characteristics that distinguish a home as either brand new or recently updated. Small upgrades that give your house a "new construction" appearance, marketing resources like virtual floor plans and 3D home tours on your listing, and well-thought-out pricing may make a big impact.

The local situation is contradictory, even though the national market is no longer a seller's market. Certain markets still favor sellers, while others favor buyers.

Discuss the plan of action based on the state of the local market with a real estate agent.

An experienced real estate agent in your area may assess your house to see what it might bring in light of the neighborhood's characteristics and the prices at which previously sold comparable properties in the area.

Take note of the cost.

As mentioned above, well-priced and well-maintained homes still sell rapidly, but if there aren't many sales in your region to compare prices to, it may be difficult to determine the proper price.

Think about making accommodations.

If sellers make accommodations that enable purchasers to reduce their monthly mortgage payments, they could do so faster. According to the National Association of Home Builders, 61% of builders make compromises to succeed in this market without having to lower costs.

“If builders are offering incentives to buyers, then sellers should probably do the same to keep well-priced homes moving,’’ advises Divounguy.

What are your thoughts? Feel free to share them in the comments!

In today’s fast-paced real estate market, attending an Open House can be a game-changer for both buyers and sellers. If you’re in the market for a new home, you may be asking, “Why should I take time out of my weekend to visit an Open House?” The answer is simple: Open Houses offer unique opportunities that can help you make informed decisions and, potentially, land your dream home.

While online listings are great for an initial search, nothing compares to walking through a home yourself. Open Houses give you a firsthand look at the property, allowing you to explore each room, assess the layout, and envision how the space fits your lifestyle. Pictures and virtual tours can only show so much—being there in person gives you the full experience.

At an Open House, you have the advantage of meeting the listing agent in person. This provides a perfect opportunity to ask questions about the property, the neighborhood, and even the home-buying process. You'll get real-time answers, helping you make a more confident decision.

An Open House is not just about the home; it’s also a great way to explore the surrounding area. While you’re there, take some time to drive around the neighborhood to see local amenities, schools, and parks. You’ll get a better sense of whether the location meets your needs.

Open Houses can give you insight into how much interest a property is generating. Seeing other potential buyers walking through the home can give you a sense of how competitive the market might be for that specific property. If you’re serious about buying, this can be valuable information as you prepare to make an offer.

Open Houses provide a casual setting to view a property without the pressure of scheduling a private showing. You can browse at your own pace and take the time to consider if the home is the right fit for you. It’s a low-stress way to kickstart your home-buying journey.

Even if the Open House you attend doesn’t end up being “the one,” it’s a valuable experience. Touring different homes helps refine your preferences and gives you a better idea of what you truly want in a property. You’ll become a more informed buyer, ready to jump when the right house comes along.

Upcoming RE/MAX Advanced Realty Open Houses

Ready to explore some amazing properties? Check out these Open Houses coming up this weekend!

Join us at one of these RE/MAX Advanced Realty Open Houses this weekend and take the next step toward finding your dream home!

As we move into August, it’s a great time to look back and analyze the real estate trends from July. The summer months have provided us with valuable insights into the Indiana housing market, revealing patterns that could influence your real estate decisions. Whether you’re planning to buy, sell, or simply keep an eye on the market, here’s a snapshot of how key Indiana counties performed in July, offering valuable insights into the trends that shaped the market last month.

Comparison Note: Percent change comparisons reflect results from June 2024 to July 2024 for the prior month, and from July 2023 to July 2024 for the prior year. Data provided by MIBOR Listing Cooperative, compiled on August 11, 2024.

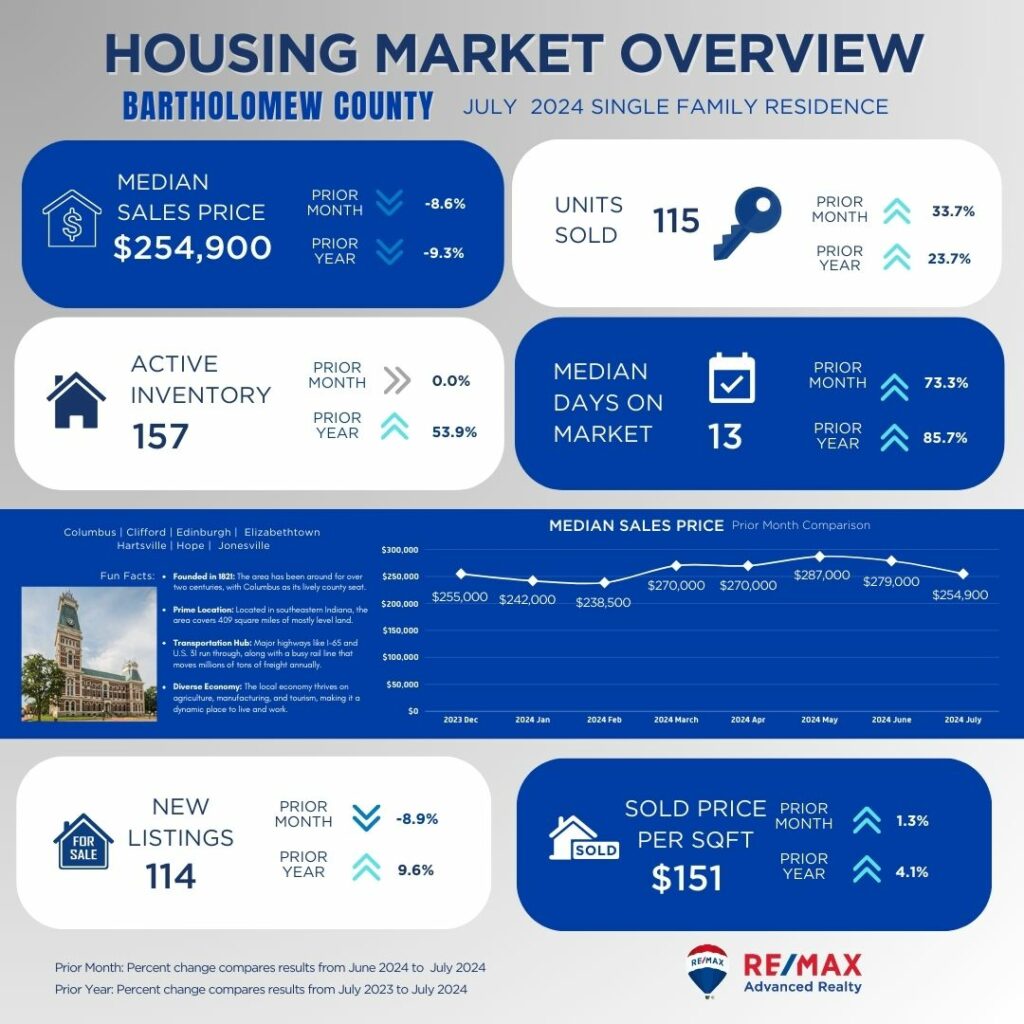

Bartholomew County

In Bartholomew County, the median sales price has dipped to $254,900, marking a notable decline of 8.6% from last month and 9.3% from last year. This drop in prices might suggest a cooling market, but it's worth noting that the number of units sold has increased significantly by 33.7% compared to the previous month. This rise in sales could indicate that despite lower prices, buyers are actively seizing opportunities. The inventory levels remain stable with 157 active listings, while new listings have slightly decreased, down 8.9% from the prior month.

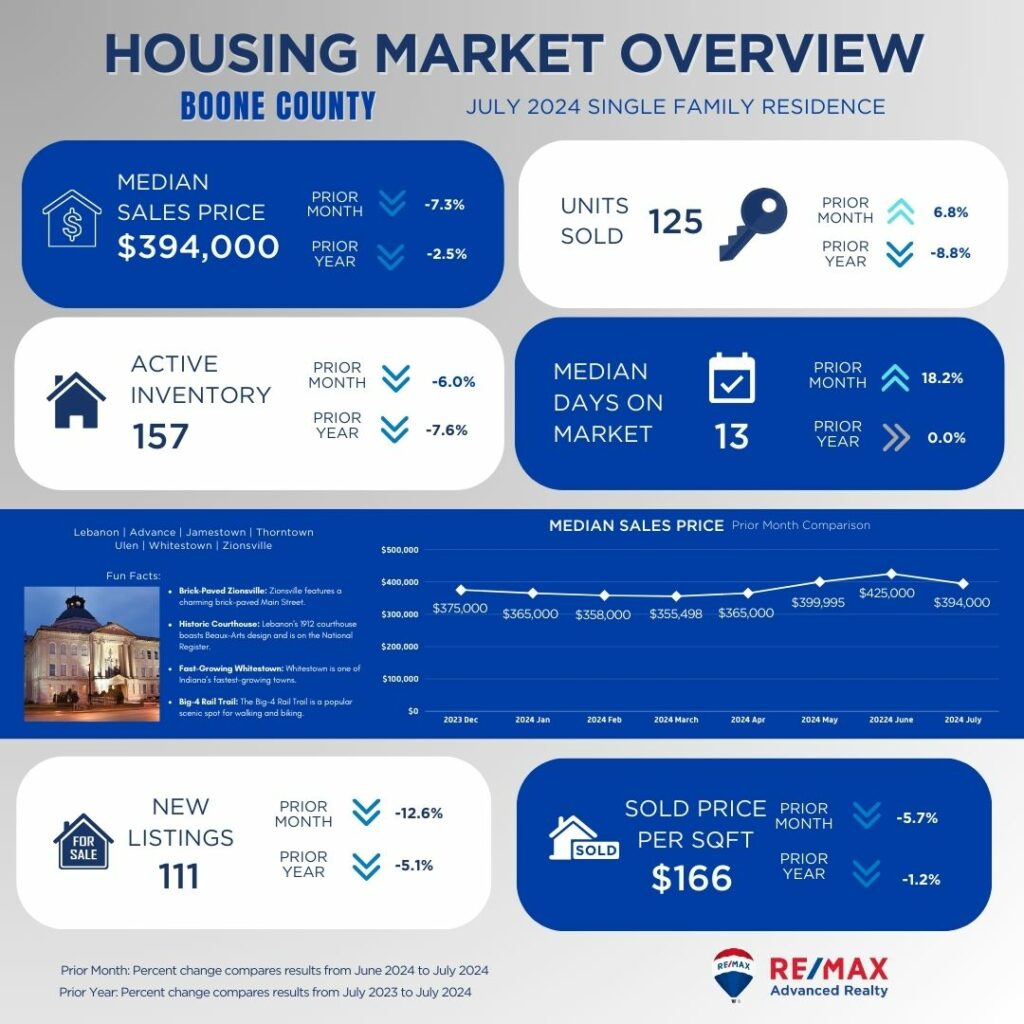

Boone County is seeing a more complex picture. The median sales price of $394,000 represents a decrease of 7.3% from last month, though it’s only a slight drop of 2.5% year-over-year. The number of units sold has seen a 6.8% increase from last month, which might suggest that despite falling prices, the market remains dynamic and active. However, with new listings falling by 12.6%, the active inventory of 157 homes has slightly decreased. The consistent median days on market of 13 days may indicate that well-priced homes are still attracting buyers relatively quickly.

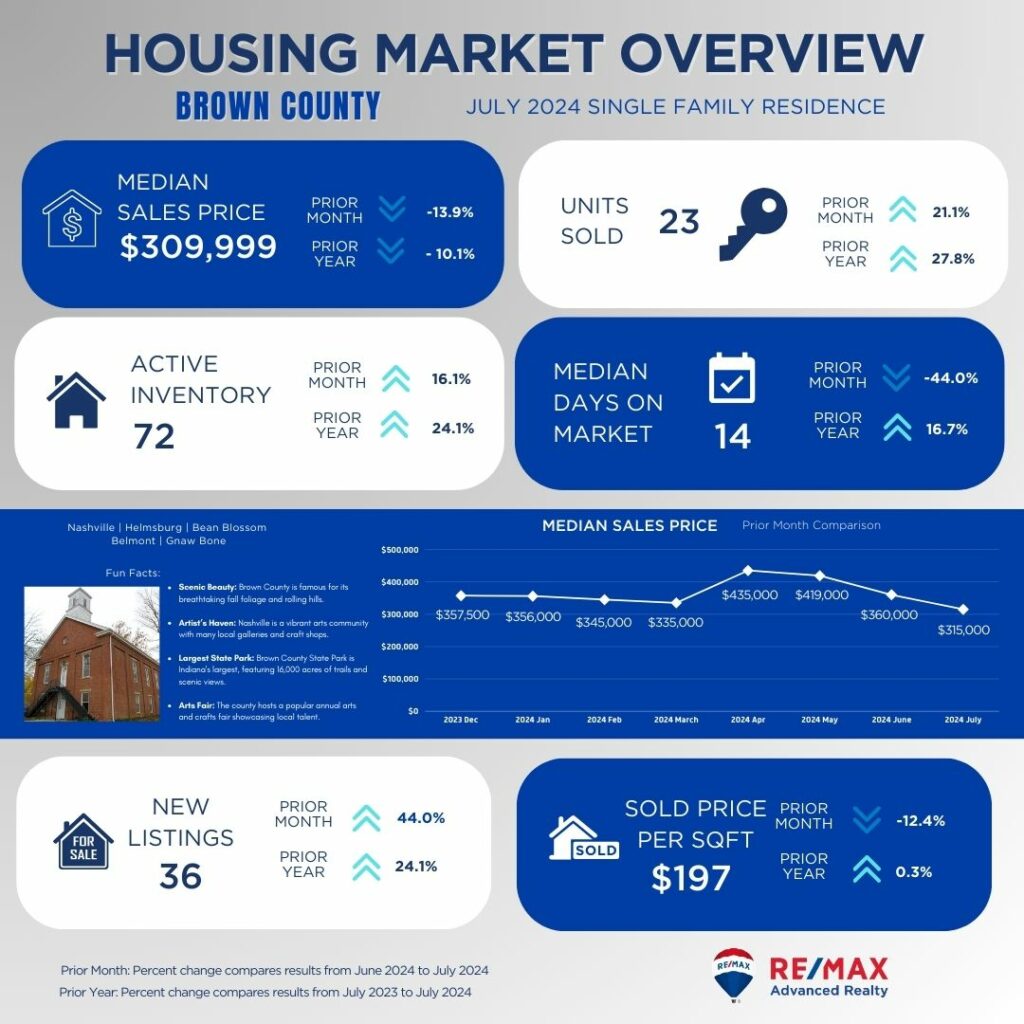

Brown County

Brown County is experiencing a significant drop in median sales prices, down 13.9% to $309,999. Despite this, units sold have increased by 21.1%, showing a positive trend in sales activity. The rising inventory levels, up 16.1%, might be contributing to this price reduction, providing buyers with more choices. The median days on market have decreased substantially, suggesting a faster-moving market despite the drop in prices.

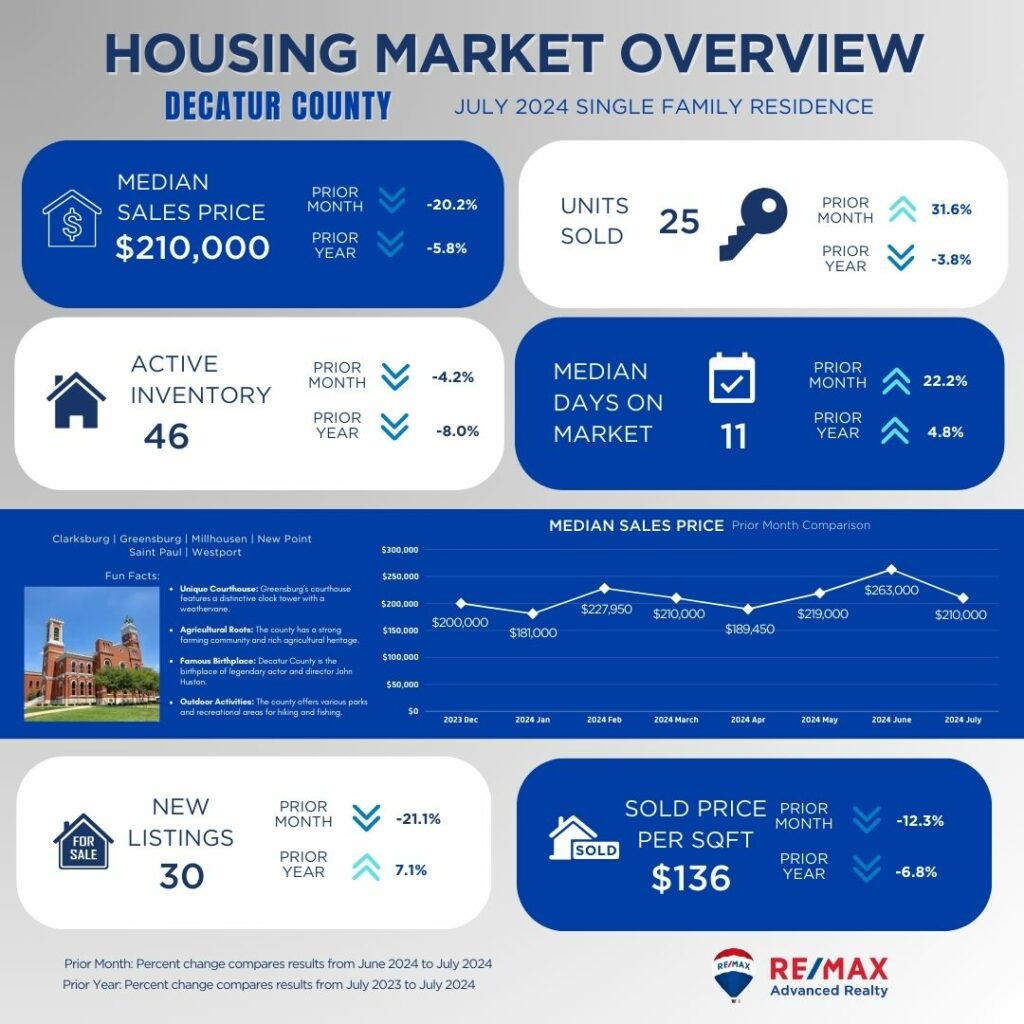

Decatur County

Decatur County presents a different scenario with a dramatic 20.2% drop in median sales price to $210,000. However, the number of units sold has increased by 31.6%, which could indicate that lower prices are driving higher sales volumes. Inventory levels are down slightly, and with a decrease in new listings, the market might be adjusting to these price changes. The reduced median days on market to 11 days shows that homes are selling quicker in this lower-price bracket.

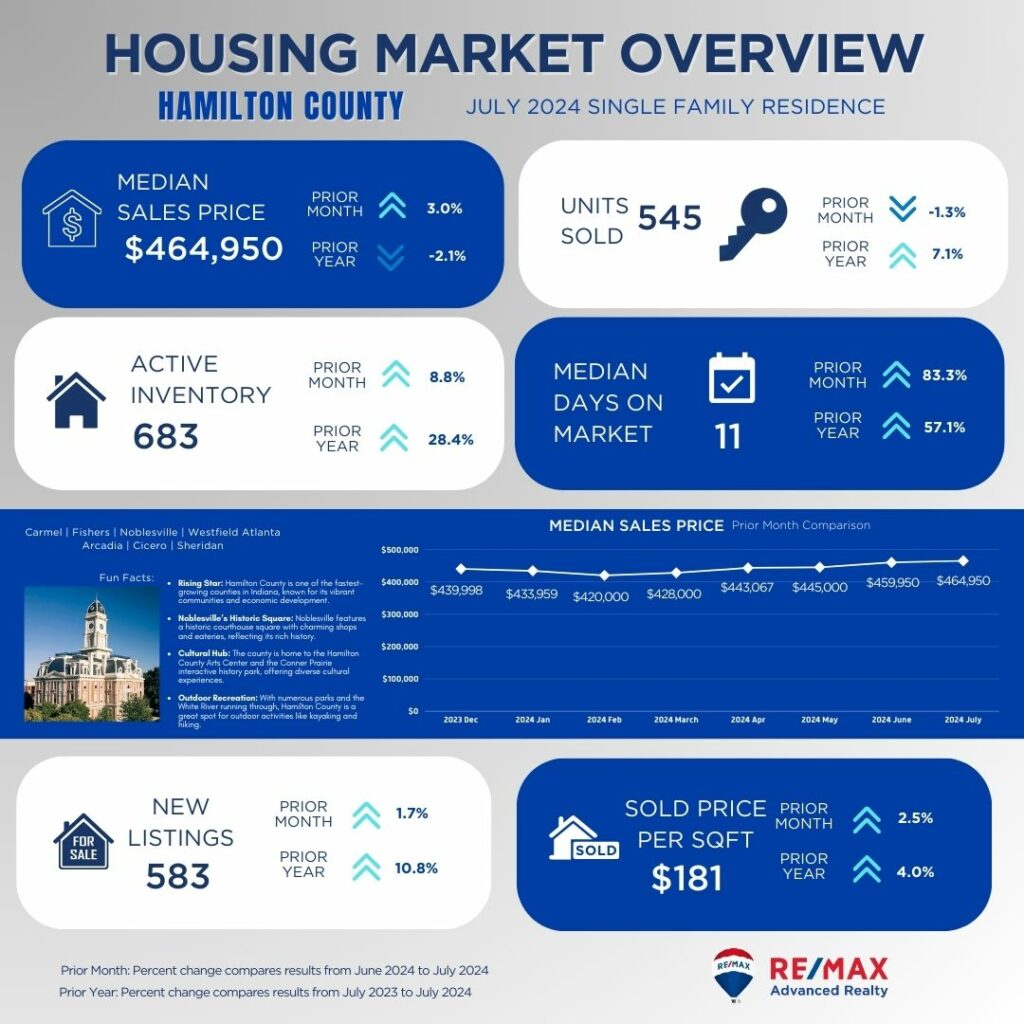

Hamilton County

Hamilton County’s market shows resilience with a median sales price of $464,950, up 3.0% from last month. The number of units sold has decreased slightly by 1.3%, but the increase in active inventory and new listings suggests a more balanced market. The median days on market have increased significantly to 11 days, which could be a sign that higher-priced homes are taking a bit longer to sell, possibly due to the higher inventory levels.

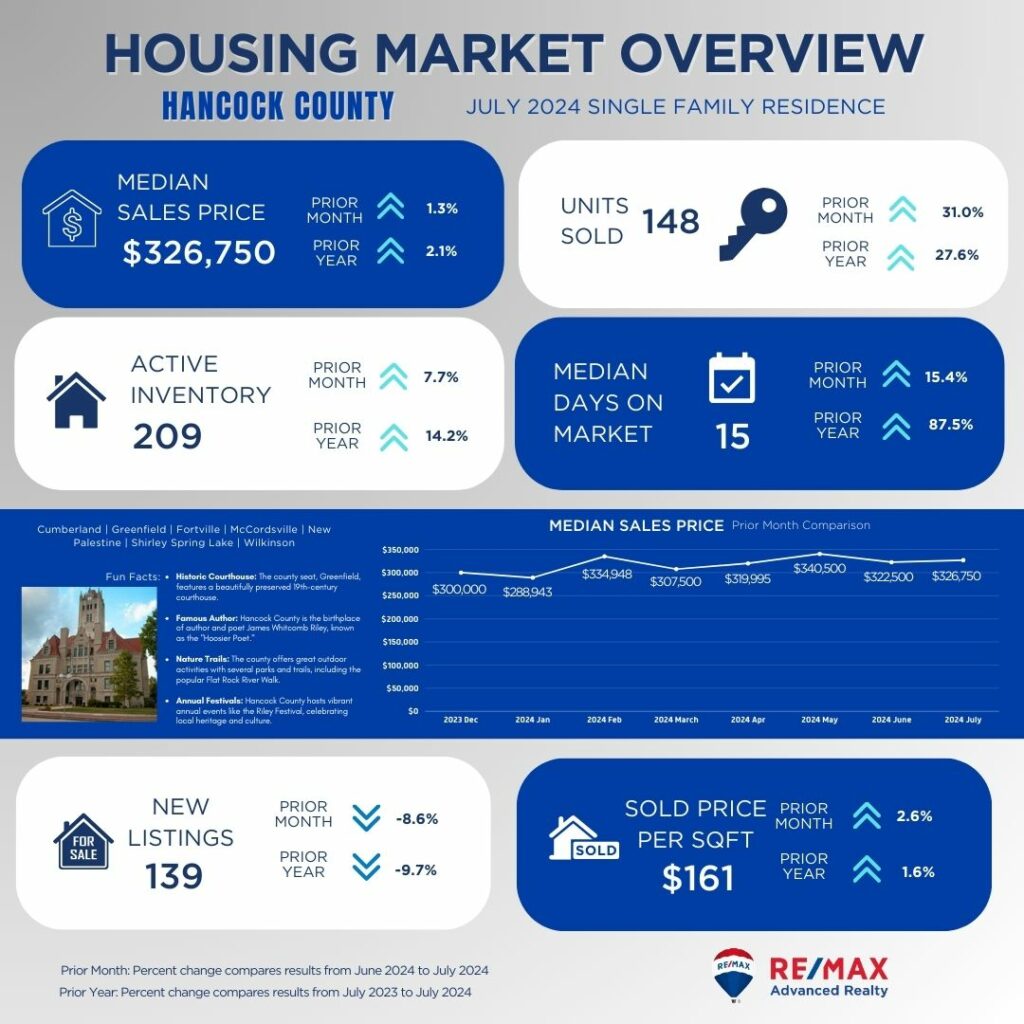

Hancock County

Hancock County is seeing a modest increase in median sales price to $326,750, up 1.3% from last month. Sales activity is strong with a 31.0% increase in units sold, indicating a vibrant market. Despite a slight decrease in new listings, the median days on market is stable, suggesting a healthy demand for homes in this area.

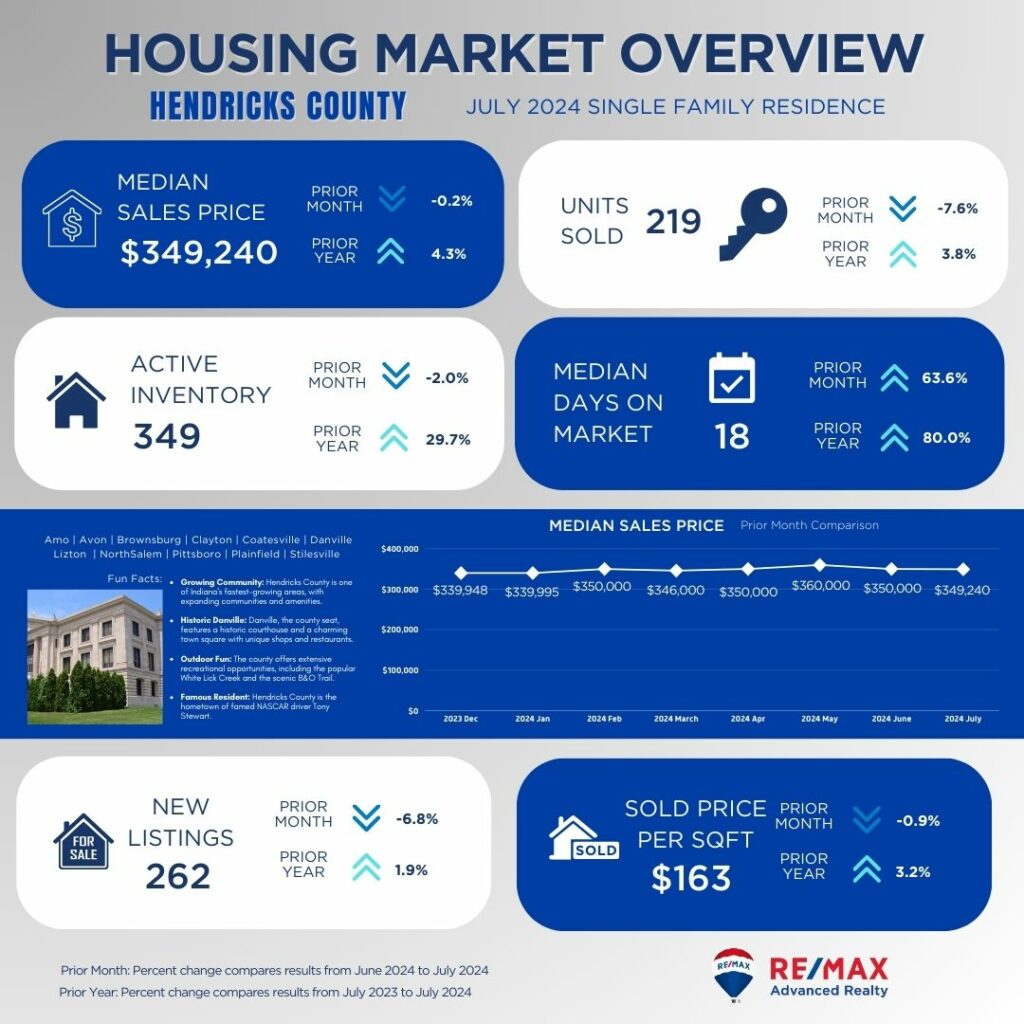

Hendricks County

In Hendricks County, the median sales price has remained relatively stable at $349,240, with a slight 0.2% decrease from last month. Sales have slightly decreased by 7.6%, yet the inventory remains manageable with a slight decrease in new listings. The increase in median days on market indicates that while homes are still selling, they may be taking a bit longer to find the right buyer.

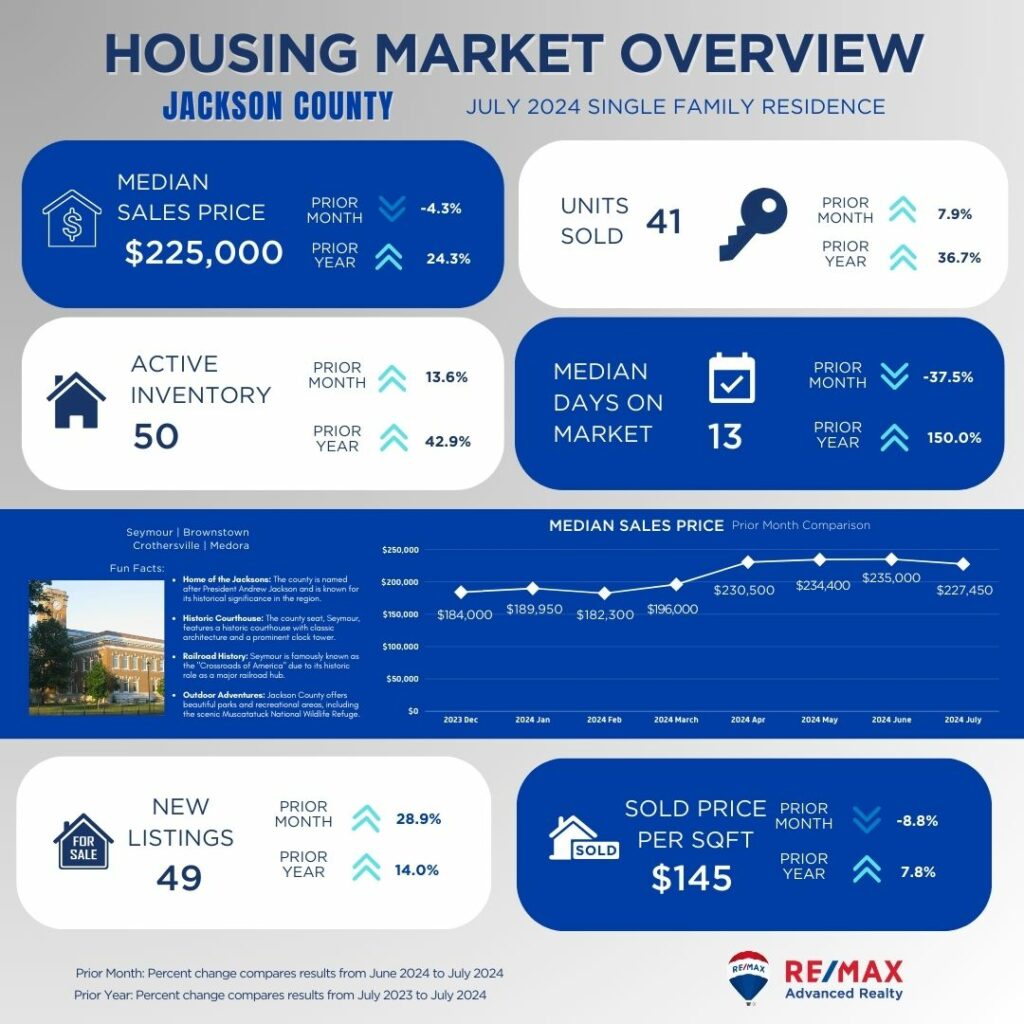

Jackson County has experienced a 4.3% drop in median sales price to $225,000. Despite this, sales activity has increased by 7.9%, and the median days on market have decreased significantly. This suggests that lower prices might be stimulating buyer interest and quicker sales.

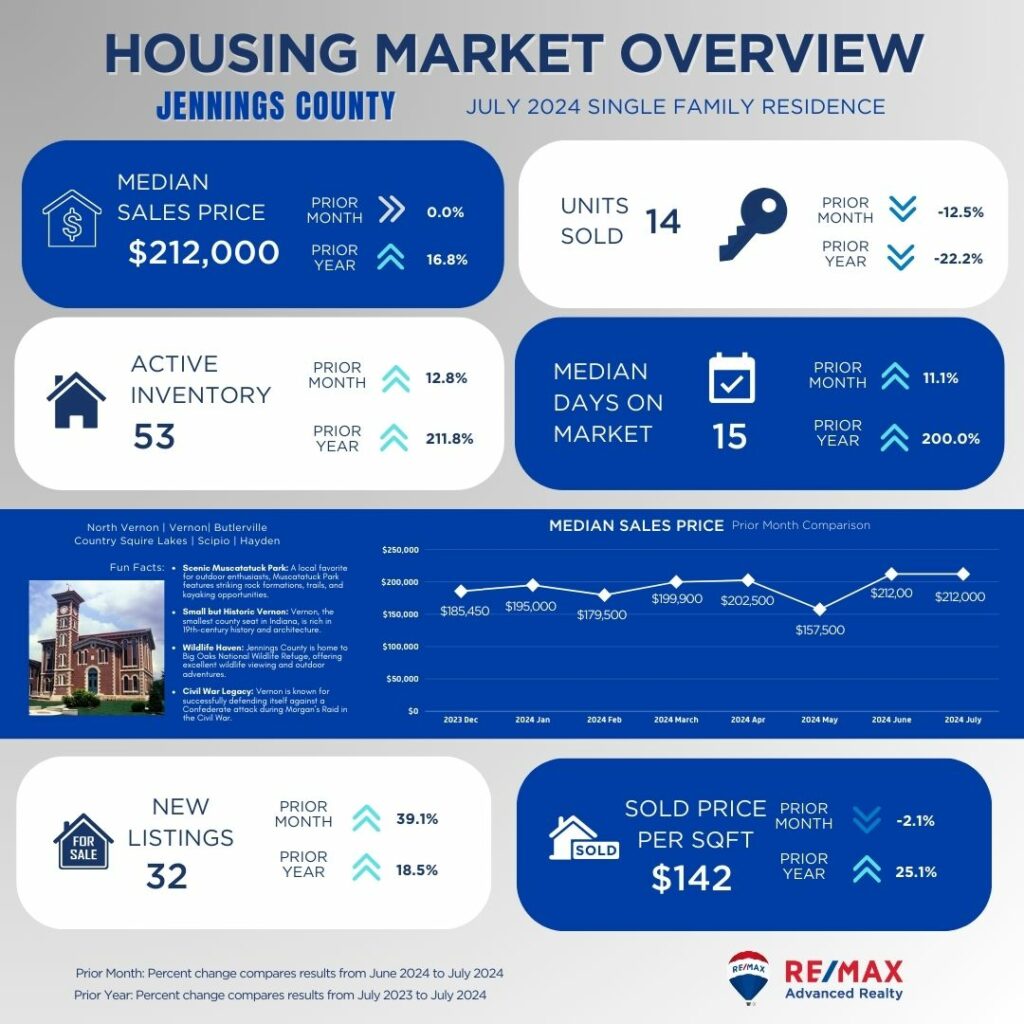

Jennings County

Jennings County’s median sales price has remained steady at $212,000, with no change from the previous month. However, the number of units sold has decreased, suggesting a potential softening in demand. The increase in active inventory and median days on market might indicate a shift toward a more buyer-friendly market.

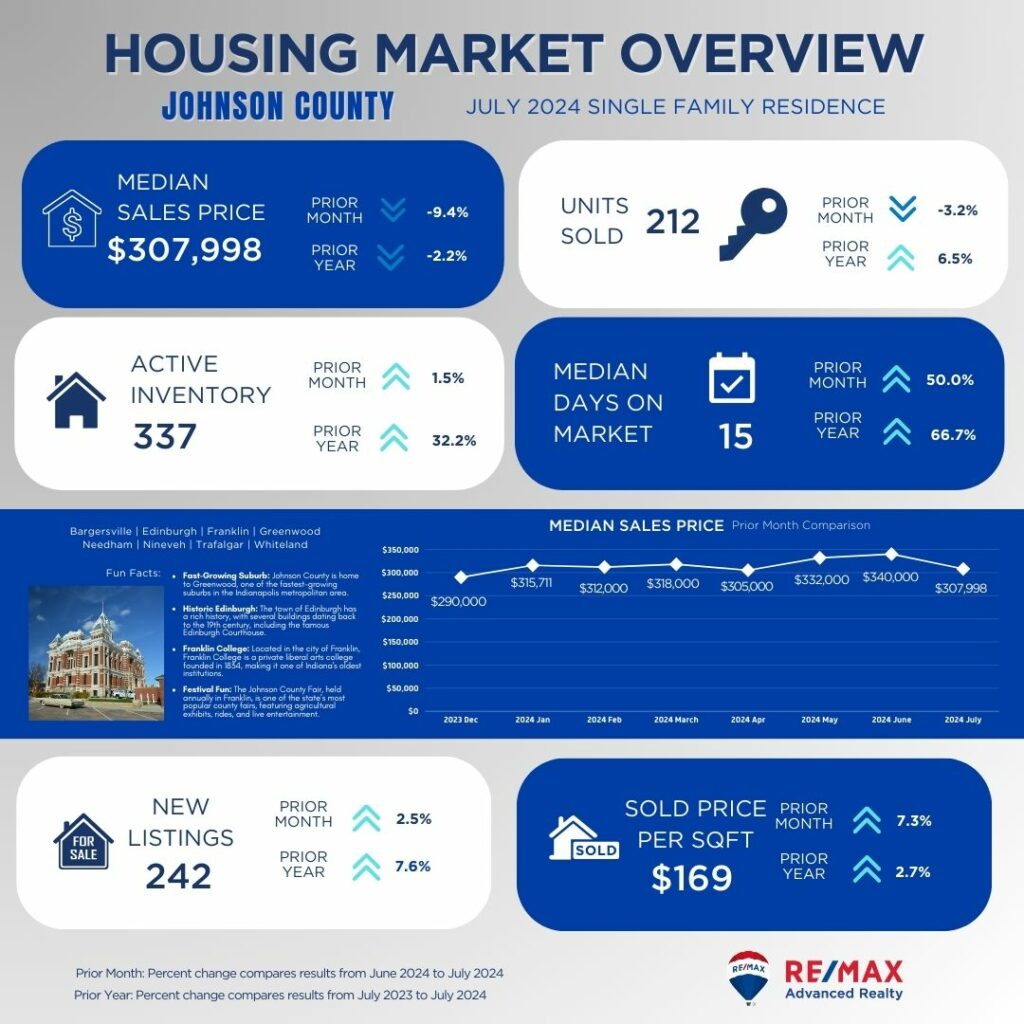

Johnson County

Johnson County’s market shows a decrease in median sales price to $307,998, down 9.4% from last month. Despite this, sales activity remains strong with a decrease in median days on market, indicating that homes are still selling relatively quickly. New listings have slightly increased, suggesting a steady flow of new properties coming onto the market.

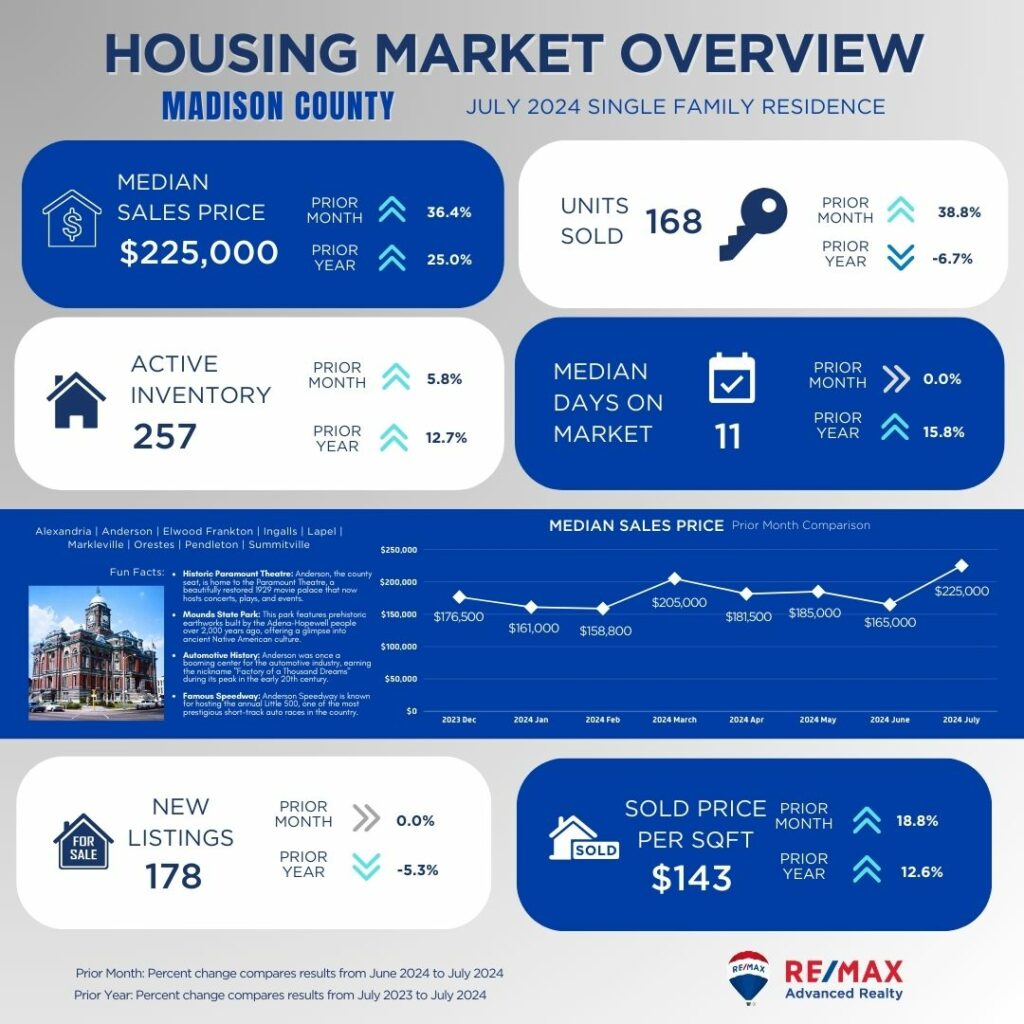

Madison County

Madison County is experiencing a strong market with a 36.4% increase in median sales price to $225,000. The number of units sold has also increased significantly, suggesting high buyer demand. The stable median days on market indicates that homes are selling at a consistent pace despite the rising prices.

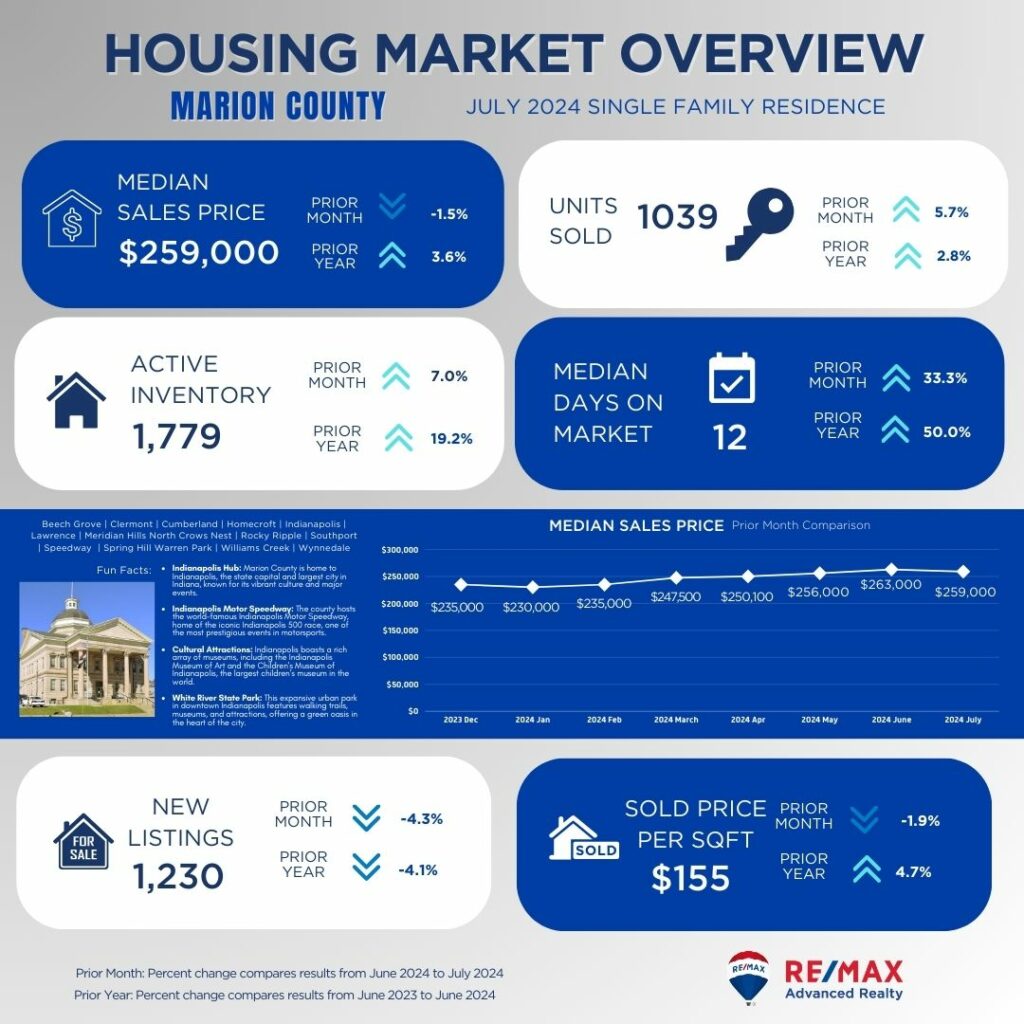

Marion County

Marion County’s median sales price is $259,000, showing a slight decrease from last month but an increase from last year. The large number of units sold and the increase in active inventory suggest a robust and active market. The decrease in median days on market to 12 days indicates that homes are selling relatively quickly in this large and diverse market.

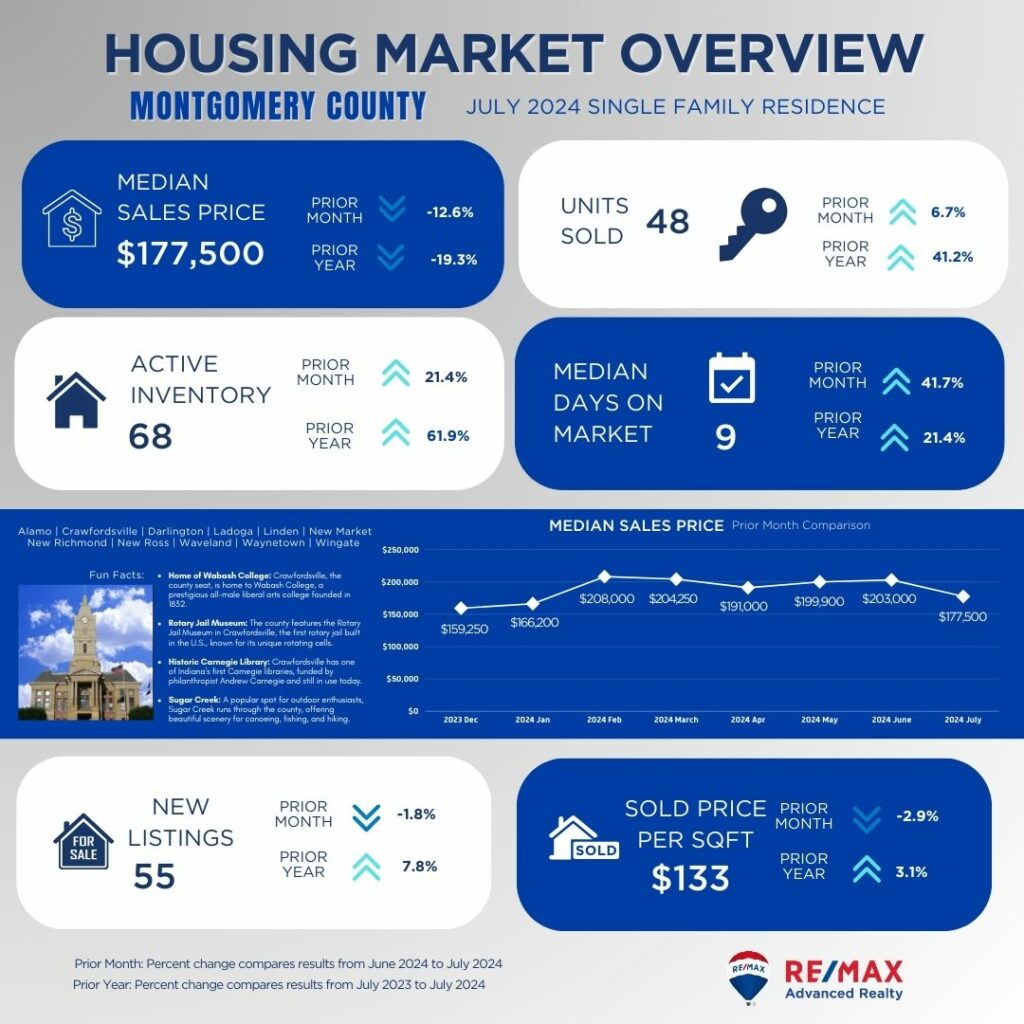

Montgomery County

Montgomery County shows a significant decrease in median sales price to $177,500, down 12.6%. Despite this, the number of units sold has increased, suggesting that lower prices are attracting more buyers. The decrease in median days on market indicates that homes are selling faster, likely due to the more attractive pricing.

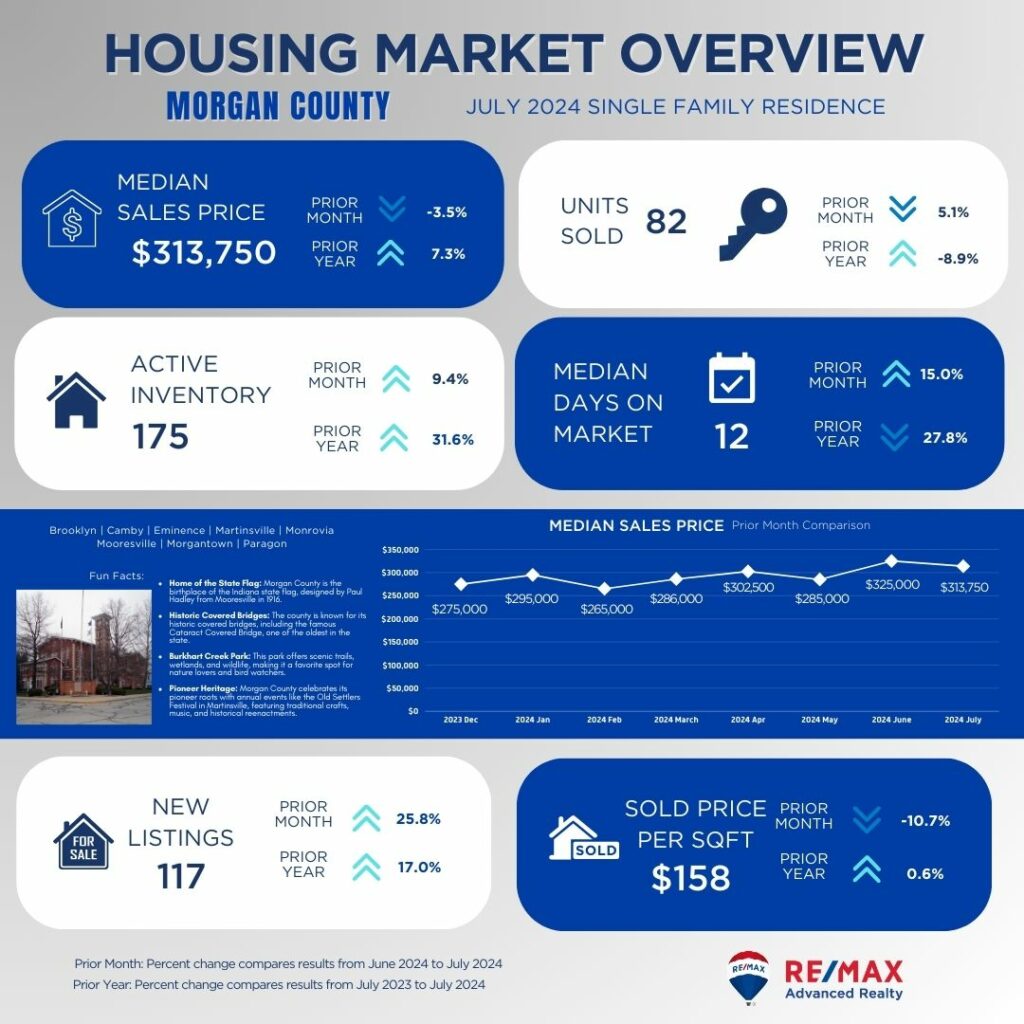

Morgan County

Morgan County has seen a decrease in median sales price to $313,750, down 3.5%. However, sales activity remains strong, and the decrease in median days on market suggests a quick turnover for homes in this area. The increase in active inventory and new listings may offer more options for buyers.

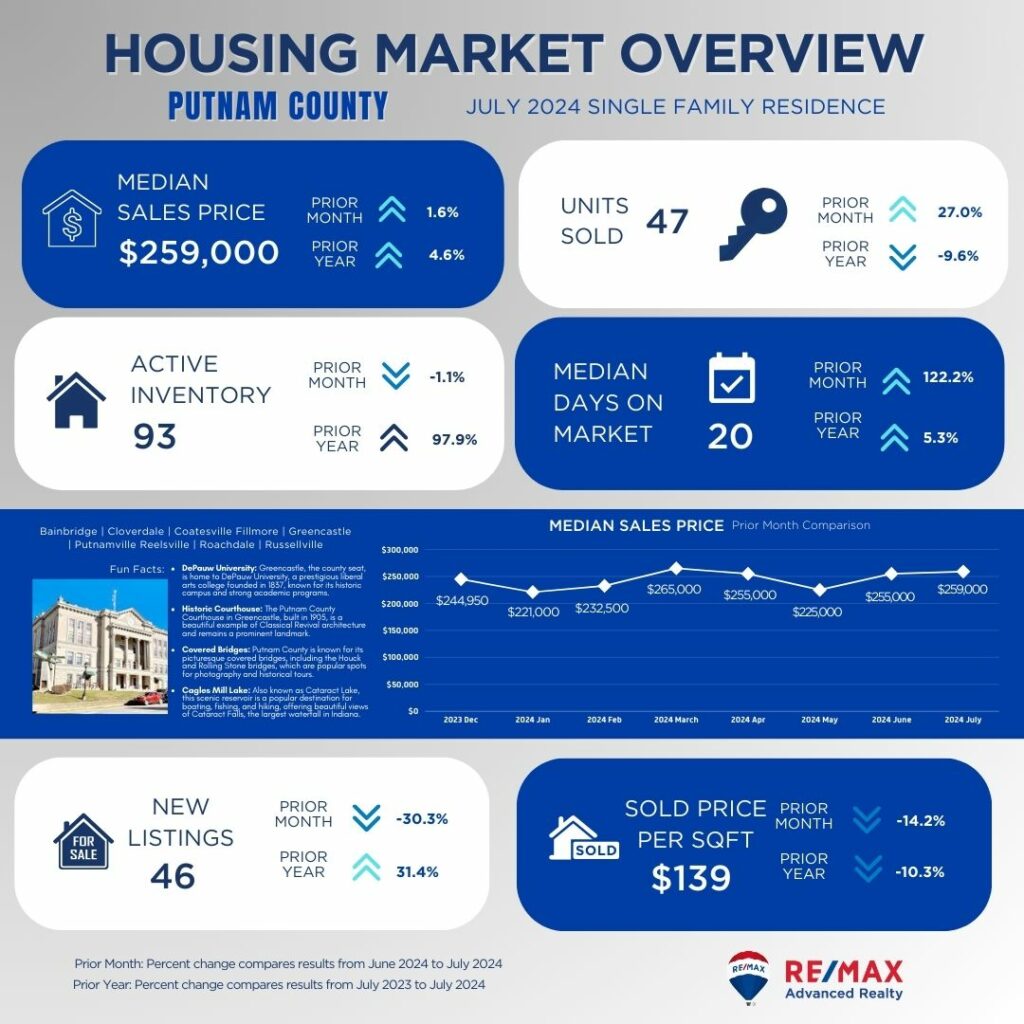

Putnam County

In Putnam County, the median sales price has increased slightly to $259,000. However, the significant decrease in new listings and increase in active inventory suggest a market adjusting to changes. The longer median days on market may indicate that homes are taking a bit longer to sell.

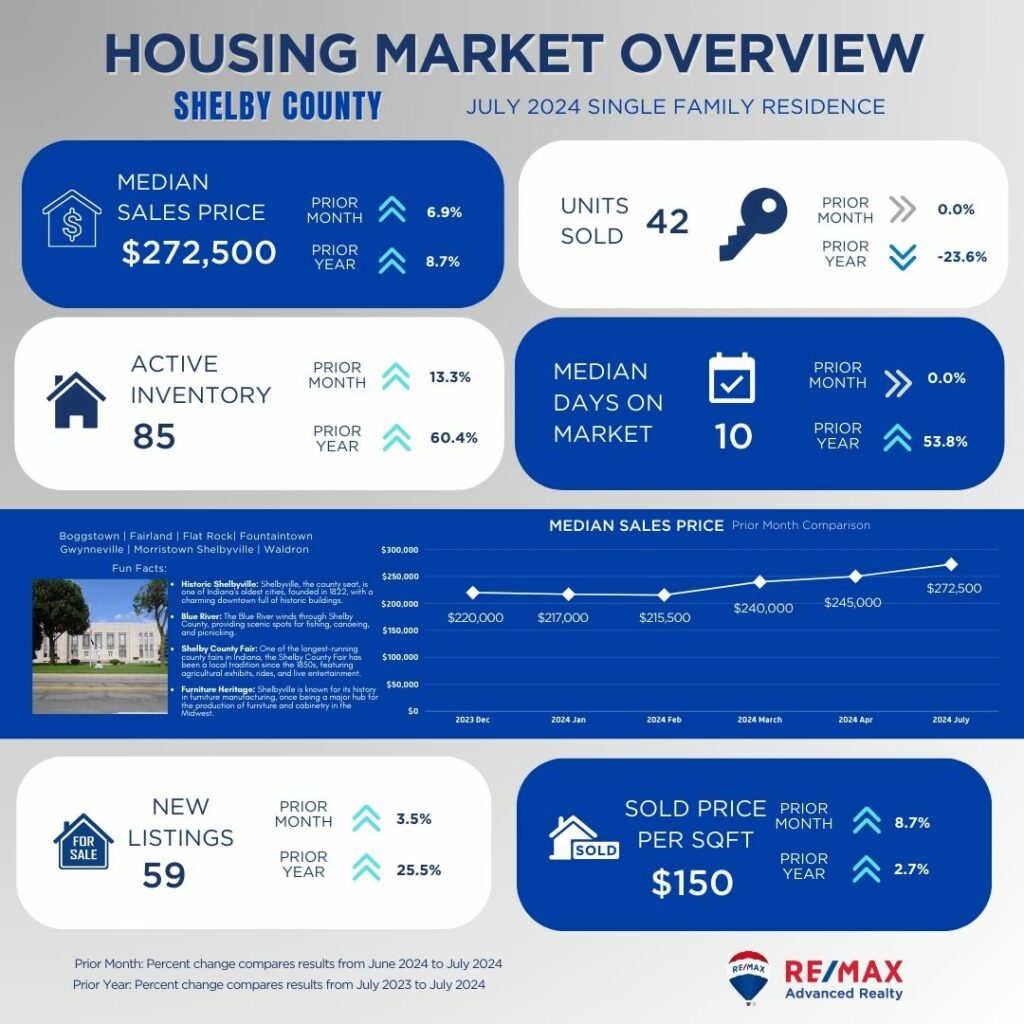

Shelby County

Shelby County has seen an increase in median sales price to $272,500, with a 6.9% rise from last month. Despite a slight decrease in the number of units sold, the increase in median days on market suggests that while prices are rising, homes are taking longer to sell.

As you consider these insights, remember that local market conditions can vary widely. If you’re thinking about buying or selling, it’s always a good idea to consult with a local real estate expert who can provide personalized advice based on your specific needs and goals. Reach out to Indy’s leading brokerage, RE/MAX Advanced Realty, at 317-298-0961 (West Office) and 317-881-3700 (Greenwood Office) to connect with experienced professionals who can help you navigate the current market trends and make informed decisions.

Indianapolis, the capital of the Hoosier state, is a dynamic city full of enjoyable surprises and one of the Midwest's most underappreciated travel destinations. With its stunning artwork, mouthwatering cuisine (don't miss the Indianapolis City Market), extensive history, and varied entertainment choices, the "Circle City" offers something exciting for every kind of traveler.

Discover the city's pulse through our curated guide to the best things to do in Indianapolis, Indiana, from iconic landmarks to hidden gems.

Whether you’re on a vacation or you just want to explore this beautiful city even more, here are activities, places, and many more you can add to your bucket list in Indianapolis.

1. Visit Monument Circle To See The Buzz

The limestone memorial is the city's focal point, hosting local food trucks and sunset light performances from its observation deck overlooking a traffic circle.

2. Families Should Visit The Indianapolis Children's Museum

Visit the Dinosaur Park, experience water, Dale Chihuly's Fireworks of Glass, and Riley Children's Health Sports Legends Experience. Don’t forget to see the Treasures of the Earth to learn about geology or watch a live, hilarious, informative theatrical presentation.

3. Ride The Indianapolis Cultural Trail

You may rent or ride a bike on Indy's Cultural Trail, an eight-mile paved path that passes some of the city's most famous sites. This tourist itinerary through six unique areas will highlight your trip whether you prefer art galleries, parks, monuments, museums, or gardens.

4. Discover Indiana's Rich History At The Indiana State Museum

Because of its popularity, the Indiana State Museum moved from Indianapolis City Hall to White River State Park. Its three floors exhibit ancient, contemporary, and natural science displays.

5. Visit The Indianapolis Zoo And Meet Some Wonderful Animals

Over 3,800 beautiful animals draw over a million visitors to White River State Park in Indianapolis. The Indianapolis Zoo transports you to childhood with its water lily pond, tranquil walks, and trainer shows.

6. Check Out The Museum At Indianapolis Motor Speedway

Fast-and-furious fans must visit the Indianapolis Motor Speedway Museum, the racing capital. The 2.5-mile oval track museum displays hundreds of late 1800s cars, motorcycles, engines, and artifacts on two floors.

7. Embrace The Fast Lane With An Indianapolis Motor Speedway Experience

After studying racing history, it's time to experience driving an open-wheel chassis Indycar. Race around the Oval or other city circuits at 180 mph on race day weekends and hold on.

8. Go To A Candlelight Concert For An Unforgettable Musical Experience

Book tickets to a fantastic Candlelit Concert to enter one of Indianapolis' top music venues and be dazzled by thousands of candles as the music engages the audience. Enjoy this date even if you're not traveling with your partner.

9. Visit The Lilly House And Gardens To Go Back In Time

Antique furnishings, classic artworks, and Victorian decor complement the majestic exterior of this French chateau-style early 20th-century country residence. To learn about living 100 years ago, join a guided tour of the meticulously restored Lilly House, a National Historic Landmark.

10. Visit The Kurt Vonnegut Museum And Library To Learn About A Fantastic Writer

Near the Canal Walk, this overlooked site examines the life, work, and times of one of America's best satirical novelists. Even if you're not a fan, an expert-led tour of the Kurt Vonnegut Museum and Library is the most excellent way to see its fascinating souvenirs and personal artifacts.

© my-indiana-home.com/indiana/discover-indianapolis-kurt-vonnegut-museum-and-library/

11. Visit The Indiana War Memorial To Pay Your Respects

The 1924 Indiana War Memorial Museum and Shrine honors World War I veterans and is another Downtown Indianapolis must-see. The Monument's 30,000-square-foot museum displays Revolutionary War military artifacts.

12. Discover The Thrill Of Sky Zone Trampoline Park

Hop around in the Freestyle Jump section as an adult to unwind. There are activities for everyone in your party, whether you'll be spending time with friends or family.

13. Explore The Arts At The Indianapolis Art Center

For over 100 years, this neighborhood gallery has collected the best modern and contemporary art and hosted seminars, workshops, and events. Check out the sculpture garden or a quiet cafe for lunch while seeing these pieces.

14. Challenge Yourself With Ax-Throwing

Like darts or bowling, Bad Axe Throwing Indy teaches hatchet throwing at wooden targets in a safe and fun environment. Safety-focused instructors can teach and organize competitive activities for a fun day with friends or a quirky date night. After reaching the bullseye, you can enjoy wines and refreshments.

15. The Natural Valley Ranch Is The Place To Saddle Up

Natural Valley Ranch in Hendricks County, a short drive from Indianapolis, includes different equestrian riding paths and a campground for city escapes. Summer offers guided woodland rides, first-timer teaching, White Lick Creek trots, and birthday celebrations.

16. Play And Fun Roller Skating

The Fun Factory is a beautiful destination for skating with friends, reliving nostalgia, and letting youngsters run off energy on one of their numerous themed nights. Arcade games, pizza nights, and skating lessons are available in addition to all-ages skating.

17. Explore Every Corner Of The Indianapolis Museum Of Art

Indianapolis Museum of Art has hosted unique exhibitions since 1883, delighting local art fans. Egyptian mummies, impressionist works, and the surrounding gardens can be explored for days by yourself or a guide.

18. Visit The Indiana Farmers Coliseum For Many Events And Sporting Contests

Sports, livestock, music, vehicle exhibits, and more are held at the Indiana Farmers Coliseum on the Indiana State Fairgrounds. Events await you whether you're traveling with friends or family.

19. Take A Stroll Beside The Central Canal

Central Canal runs through Downtown Indy and to the north, making it a popular workout and people-watching spot. The canal's view of downtown Indianapolis, the romantic sunset walk, and the many charming boutiques and restaurants off the main route make it a must-see for a late afternoon promenade.

20. Discover The Thrill Of Dragster Driving

Visit Lucas Oil Raceway to test your 2-seated Dragsters at over 140 mph. You'll have lifelong memories whether you choose the passenger or driver package or the 1/4 mile runs.

21. See Western Art And American Indian Art At The Eiteljorg Museum

This distinctive downtown Indianapolis museum showcases Native American paintings, sculptures, and jewelry on Washington Street near Military Park. The award-winning Eiteljorg Museum of American Indians and Western Art has something for everyone, from small children who love vibrant fine art to history lovers who love American forefathers' exciting stories.

22. Go Around Curves At K1 Speed

All go-kart fans can enjoy K-Speed Indy's indoor racing. With racing memorabilia, comfortable couches, and lots of food and drink, this venue is the most accessible place to get behind the wheel and the perfect place to bring friends and family for a day of high-speed fun. Go-karts can reach speeds over 45 mph.

23. Experience A Thrilling Journey In A Hot Air Balloon

You'll experience Monument Circle and Eagle Creek Park in a new light as you soar over the city skyline, the perfect mix of thrills and leisure. It may be hard to wake up before sundown, but as you fly across the sky and the urban environment turns into rolling fields and forests, you'll be glad you did.

© indyschild.com/indiana-hot-air-balloon-festivals/

24. Enjoy A Game Of Bowling

Bowling is a fun indoor sport for rainy days or hanging out with friends. With hundreds of lanes across the city, arcade games, and retro soundtracks, this iconic American sport offers limitless fun. Action Duckpin Bowl at Fountain Square has eight old-school duckpin lanes and a large restaurant.

25. View Outdated Treatments At The Indiana Medical History Museum

The Indiana Medical History Museum has some of the most bizarre medical artifacts and a crazy history. Autopsy tables, iron lungs, and chemical laboratory equipment are among the 15,000 exhibits about psychiatric care in this exhibition, and if that’s not enough to convince you to visit this place, we don’t know what else will.

26. Greatimes Family Fun Park Is A Must-See

On sunny days in Indianapolis, take kids to Greatimes Family Fun Park 15 minutes down I-65 from Downtown Indianapolis. This amusement park has bumper cars, go-karts, mini-golf, arcade games, and a large restaurant.

27. Make A Raucous At Lucas Oil Stadium

Downtown Indy's Lucas Oil Stadium is home to the Indianapolis Colts and a popular performance venue. Some of the nation's top football venues are in Indiana. Guided tours of the sport and stadium year-round and sell-out audiences draw many fans every match day.

28. Best Venues Serving The Best Live Music

If you want bands ranging from country to indie rock, check out the Emerson Theater's main stage performances. Visit Hi-Fi for a quiet musical evening, regardless of the style of music. If you want dance parties, burlesque performances, and live music, the Vogue Theatre is the place to go!

Other venues to check out include:

29. Visit Royal Pin To Play Laser Tag

Royal Pin sports ten pin lanes and a multi-level, black-lit Pirate's Quest Laser Tag. Two hours of competitive fun is accessible wherever you stay, with arcades, birthday parties, bookable corporate events, and three sites in Woodville, Western, Castlewood, and Beech Grove.

30. Ride the Indiana State Fair Midway Ferris Wheel

Usually running from July to late August, thrill-seeking families and individuals can visit the Indiana State Fair Midway near The Track of Champions from late July to late August. This famous fairground has amused travelers with over 100 rides on 11 acres, including roller coasters and Ferris wheels, since the mid-1800s. It's renowned for deep-fried food, carnival games, candy apples, and more.

31. Explore All Newfields Attractions

Newfields is "a place for nature and the arts," and Winterlights is a great place to stroll. Indianapolis has a beer garden, the Indianapolis Museum of Art, Lily House, Fairbanks Park, and numerous well-kept gardens.

32. Visit Victory Field To See A Baseball Game

The Indianapolis Indians play at Victory Field, a local landmark. West of downtown, White River State Park is accessible, a short walk from the canal, and usually entertaining.

33. Treat Yourself To A Spa Day

At Europe Day Spa, music and fragrance instantly relax clients for a 60-minute oil massage, exfoliating facial, or Sweden massage. Transformations Salon and Spa have the greatest facials, hair treatments, and European manicures. Give yourself a makeover to appear your best.

34. Zip Line At Go Ape

Eagle Creek Park's Go Ape high-ropes course, zip lines, swings, and obstacles 40 feet up in the deep woodland canopy are excellent for testing your boundaries.

© www.goape.com/go-ape-coming-to-arlington/

35. Escape To Eagle Creek Park And Nature Preserve

You can do more than Escape at Eagle Creek Park and Nature Preserve. Its 3,900 acres of lush woodlands make it one of the nation's largest city parks for animal viewing. Enjoy Rick's Boatyard Café after visiting the pool, dog park, golf course, and sailing club.

36. Experience The Thrill Of An NBA Game At Gainbridge Fieldhouse

Indy's family-friendly sports arenas are undiscovered gems. Well-deservedly, the Fieldhouse in Indianapolis' most famous building is the Pacers' home court. The 20,000-seat venue roars with Pacers yells and A-list musicians.

37. Discover Local History At The Indiana Historical Society

Discover Holocaust survivors, notable figures, and Indiana's role in shaping the nation at the Indiana Historical Society in the afternoon. Explore social services, women in Indiana, and Indianapolis' history.

38. Set Out For A Game Of Golf

Golf courses are within driving distance of most Indianapolis locations, offering plenty of beautiful fairways. Get your clubs and head to one of the city's top-class courses, such as The Brickyard Crossing, which overlooks Indy's racetrack, Highland Park Golf Course, Greenwood Hills, Maplewood, or South Grove.

39. Drumming At Rhythm! Discovery Center

As the world's largest interactive drum and percussion exhibit, Rhythm! Discovery Center guarantees family fun. With a few friendly educational sessions to augment the hands-on exhibits and musical instrument displays Downtown, you'll be banging and tapping away in no time.

40. Drive To historic Conner Prairie

The beloved Living History Museum in Indianapolis, Conner Prairie, is only 40 minutes away by vehicle in picturesque Hamilton County. There's always something going on there. This 800-acre National Historic Landmark has the William Conner residence, Indian campgrounds, a corn maze, and a petting zoo.

41. Scavenger Hunt Around Town

A fun method to discover the city and many hidden gems that other tourists overlook is through scavenger hunts. They check off Indianapolis's attractions, raise your heart rate, and put your problem-solving abilities to the test. By deciphering hints and puzzles on your phone, you can find photo ops, interesting competitions, and local knowledge.

42. Shiver During An Indiana Ghost Walk

If you like ghosts and scary stories, visit one of Indianapolis' ghost walks to explore the city's dark side. With many weekly tours available, visitors can explore the ghostly past at their leisure, from the Allison Mansion and Central State Hospital to the Indianapolis Athletic Club.

43. Annual Indiana State Fair Monster Truck Show

At the August Indiana State Fair, witness the best monster trucks. These gigantic animals dominate the dirt with roaring motors, shredding tires, and mud-flying. The adrenaline rush at a monster truck exhibition is tremendous, whether it's your first or fifth.

44. Visit Holliday Park

The trees, paths, and wildlife of Holliday Park make it a great place to wander on a warm afternoon. Visitors to this urban park on the White River enjoy its 95 acres of wooded walks, child-friendly playgrounds, and 13,000-square-foot Nature Center year-round. The 19th-century ruins draw history buffs and photographers year-round, but the fall hues are stunning.

© polis.indianapolis.iu.edu/holliday-park/

45. Go To The Catacombs

An exclusive underground tour of this historic high-trafficked path, now a maze of tunnels and chambers accessible from Market and Delaware streets' northeast corner, reveals the city's hidden mysteries. In the late 1880s, catacombs were used to convey and store items from the above market before being abandoned.

46. Enjoy One Of The Area's Many Waterparks

Freedom Springs Water Park in Greenwood offers a lazy river, three water slides, and a kiddie play zone. Slides, an obstacle course, an adults-only hot tub, and a water playground are at Big Splash Adventure Water Park & Hotel. Splashin' Safari Water Park at Holiday World offers roller coasters and a wave pool, while Kokomo Beach Family Aquatic Center is a local favorite.

47. Discover College Spirit At The NCAA Hall Of Champions

America loves college sports, and White River State Park is the most fantastic place to learn about All 24. You may witness the tremendous tales and artifacts that made these universities and colleges renowned. Famous collegiate sports teams, players, mascots, and more are displayed in the Hall.

48. Visit Indianapolis City Market For Food And Souvenirs

In Indianapolis City Market, you can grab a beer and enjoy live music, shop for fresh meats and soaps from local artisans, buy flowers, or try international cuisine from food stands. Friendly locals lead group tours of this historic monument, teaching visitors about the Market's rich history and revealing hidden jewels.

49. Get A New Craft With GRT Glass Design

GRT Glass Design makes functional and beautiful hand-blown glass art. They offer workshops for all ages and experience levels to participate in the process, not just a gallery and workshop. You may always examine their unique finished creations at the on-site shop.

50. Booking A Beef & Boards Dinner Theatre Table

At Beef & Boards Dinner Theatre, you may enjoy comedy, drama, and more. Try Broadway classics like Kinky Boots, Phantom of the Opera, or holiday shows like It's A Beef & Boards Christmas.

51. Attend Ruoff Music Center Concerts

Ruoff Music Center, a 6,000-seat theater, attracts residents and celebrities in country, rock, pop, and R&B music. Locals prefer lawn seating for theater shows for many reasons, including the significant price drop and more room to dance and leap to your favorite songs.

52. Eat At Harry And Izzy's Steakhouse

Harry and Izzy's Steakhouse has three locations and a rotating menu. Its 1930s speakeasy vibe makes every visit a delicious new experience. The restaurant serves fresh food in every dish, including fried ravioli, sliders, creme brûlée, and a delightful steak menu.

53. Wine-Taste To Get Buzzed

Visitors may not know that Indiana has over 30 wineries, but residents are glad to tell them. Vet-owned B Legendary Wine Boutique and Peace Water Winery are popular. Try Urban Vines Winery & Brewery for tastings of their best, organic, and award-winning wines. Easley Winery offers white, sparkling, and rose wines. Buck Creek Winery is an award-winning winery.

These are just some of the weirdest, craziest, yet most exciting things you can do at the beautiful Indianapolis. Feel free to share with us if you’ve done any of these or if you have other recommended places we can add to this list.

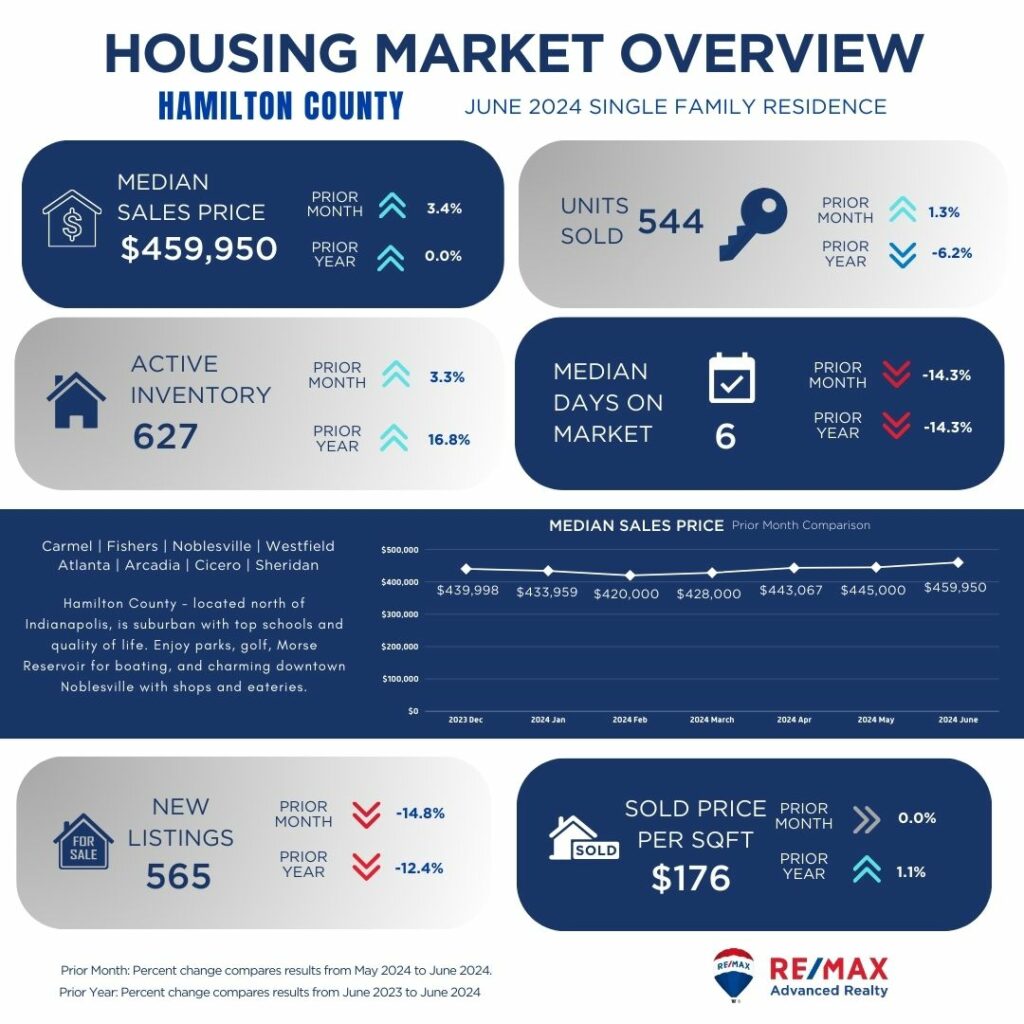

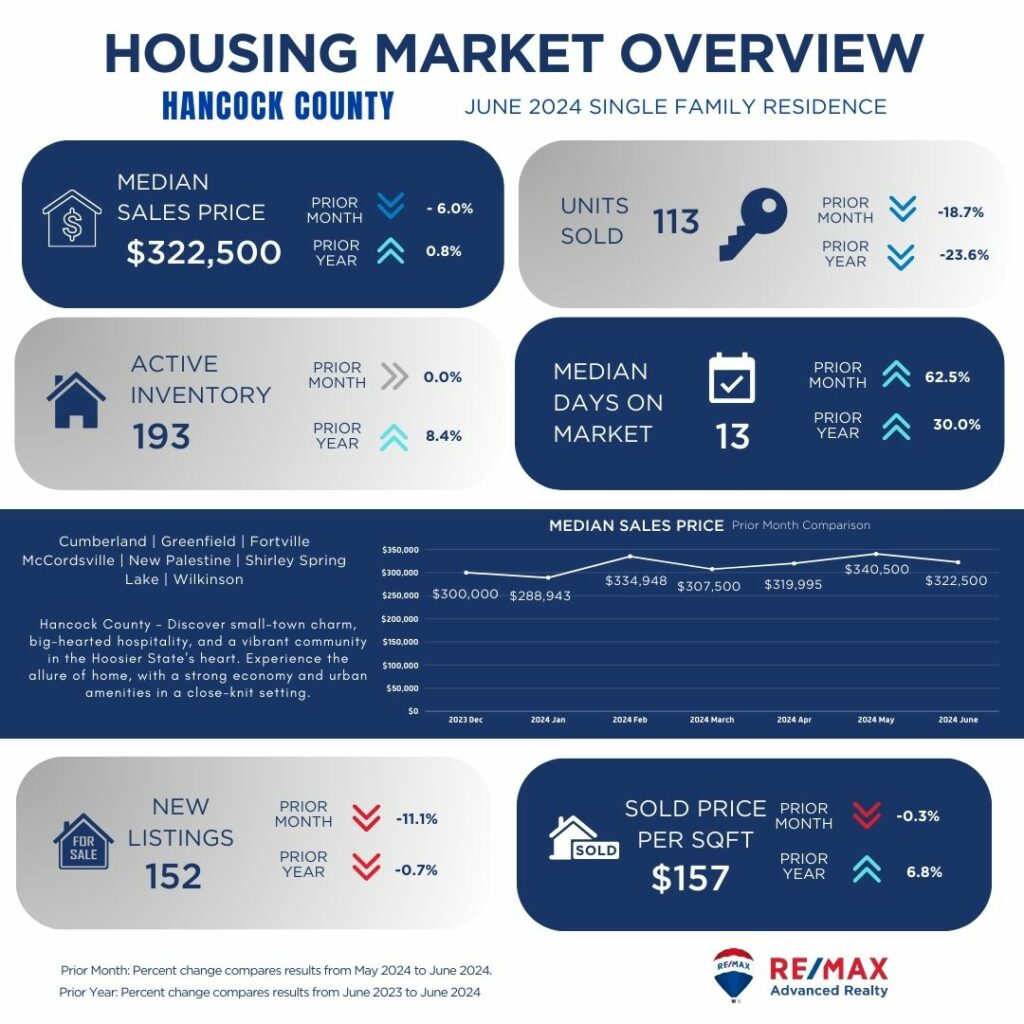

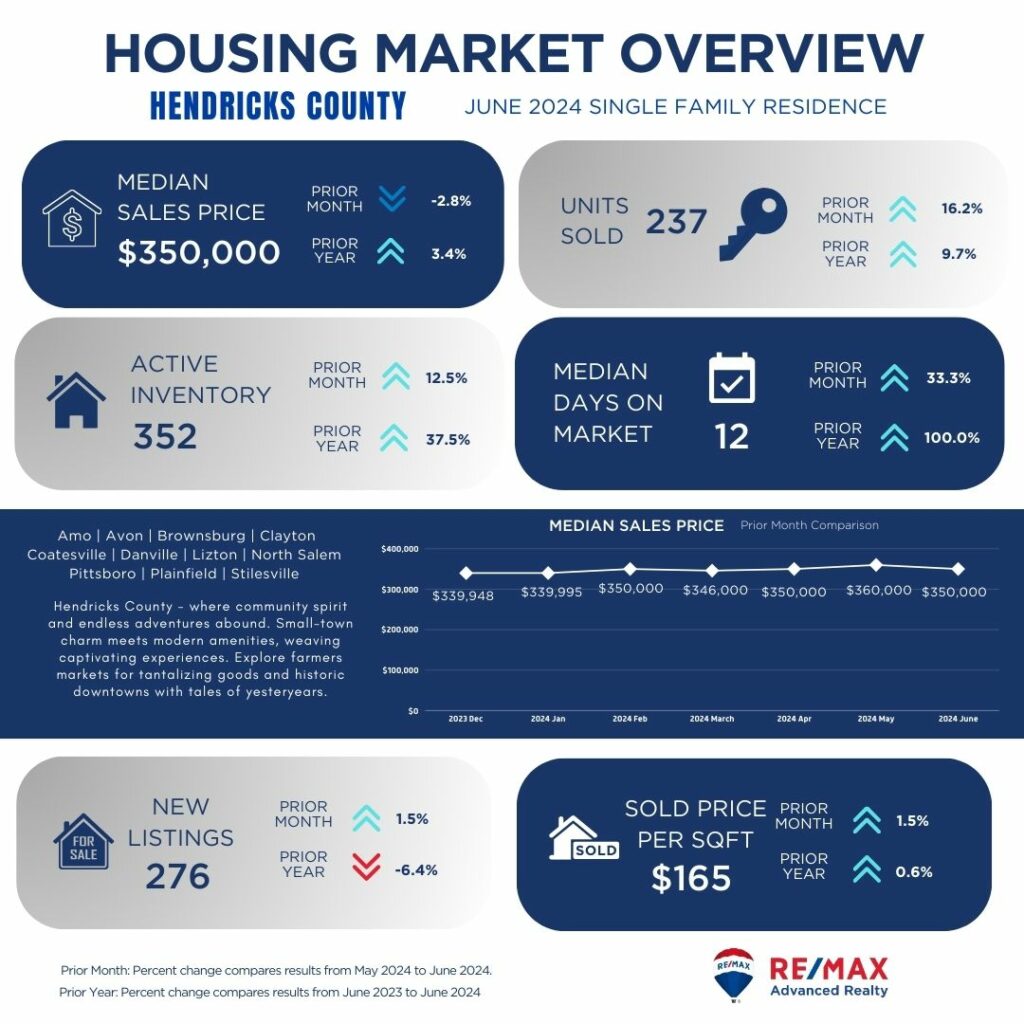

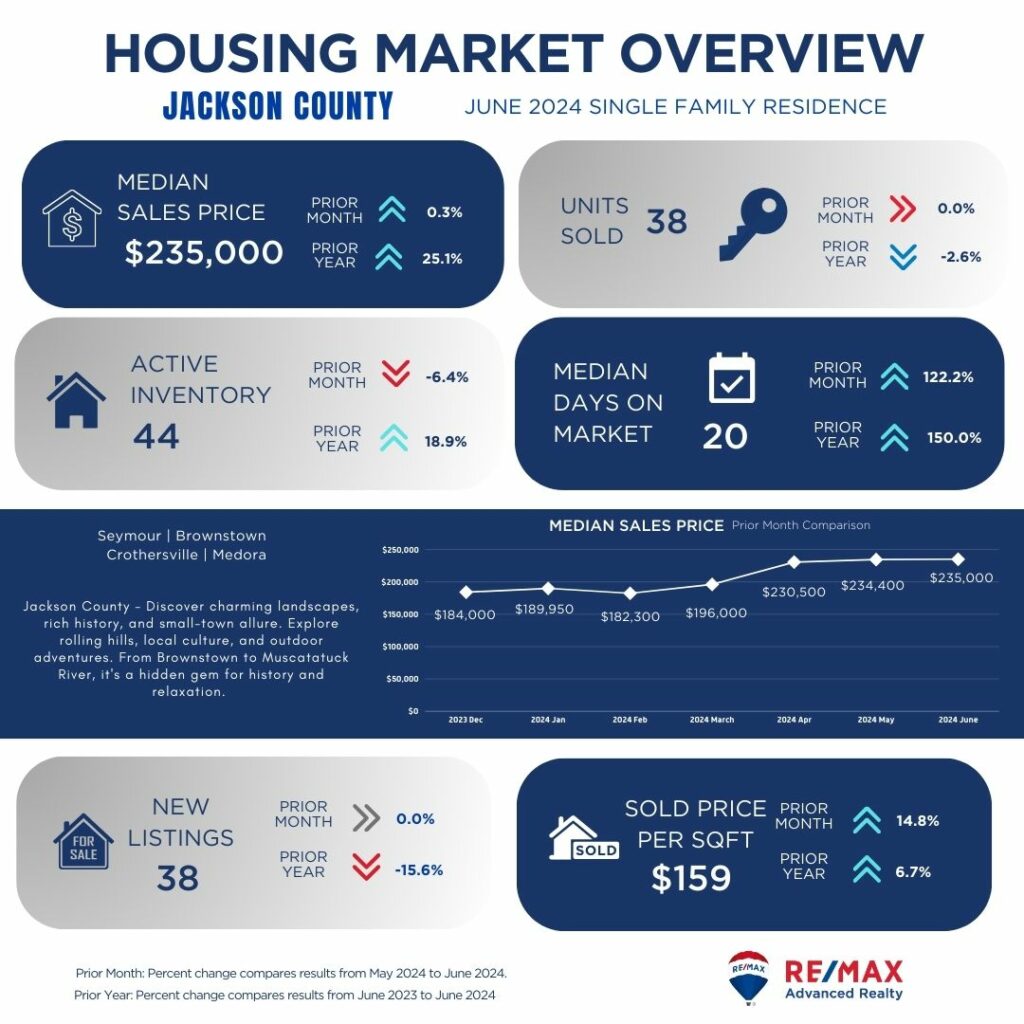

As we reach the midpoint of the year, the Central Indiana single-family homes market continues to display dynamic shifts across its counties. From the bustling urban landscapes of Hamilton County to the scenic retreats of Brown County, each area offers a distinct perspective on the current housing market. This is our interpretation based on the data provided by MIBOR Market Insights, examining trends observed from May 2024 to June 2024 and providing a comparative look at year-over-year data from June 2023 to June 2024. Whether you're a prospective buyer or seller, understanding these trends is essential for making informed real estate decisions in today's evolving market.

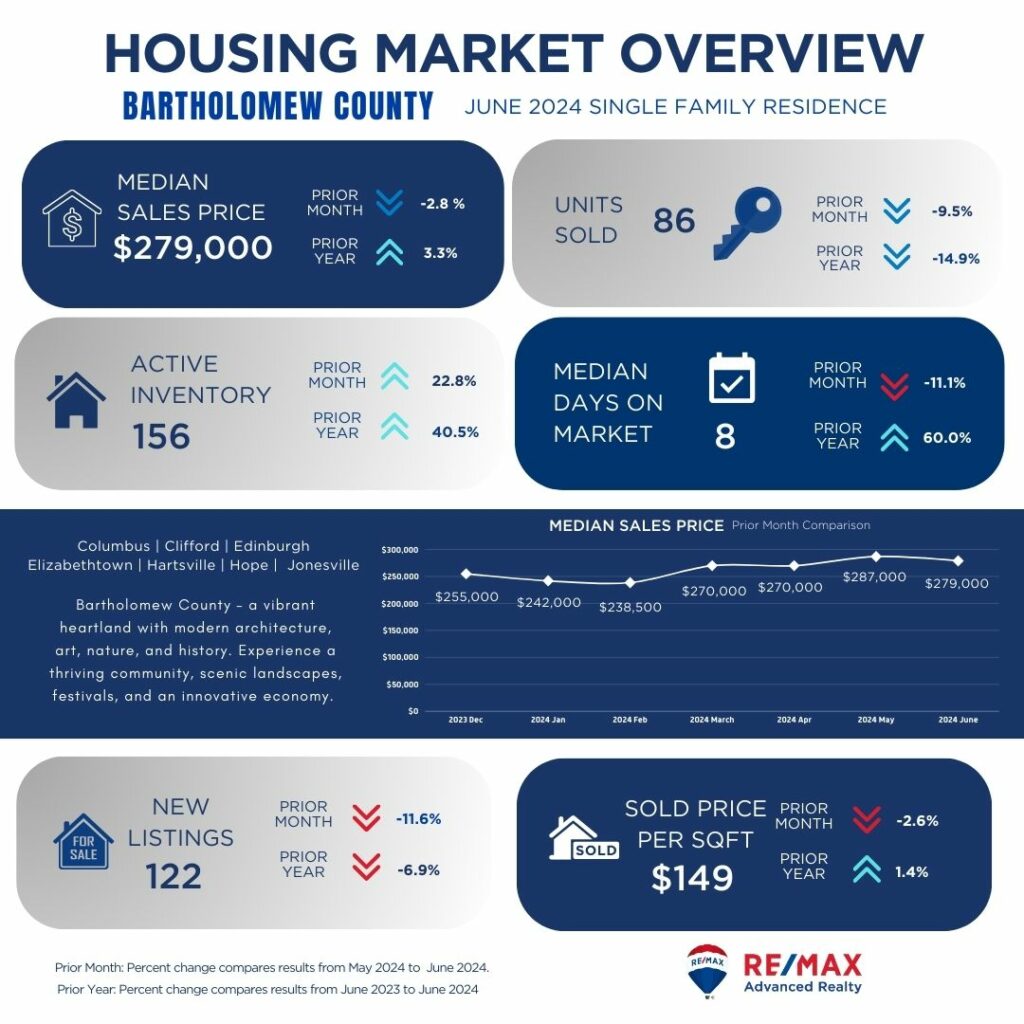

Bartholomew County shows a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The decrease in units sold suggests a slower market pace, providing buyers with more negotiating power. Active inventory has increased, offering buyers more choices, although fewer new listings may limit options. Properties are selling quickly with a low median days on market, indicating continued demand despite some price fluctuations.

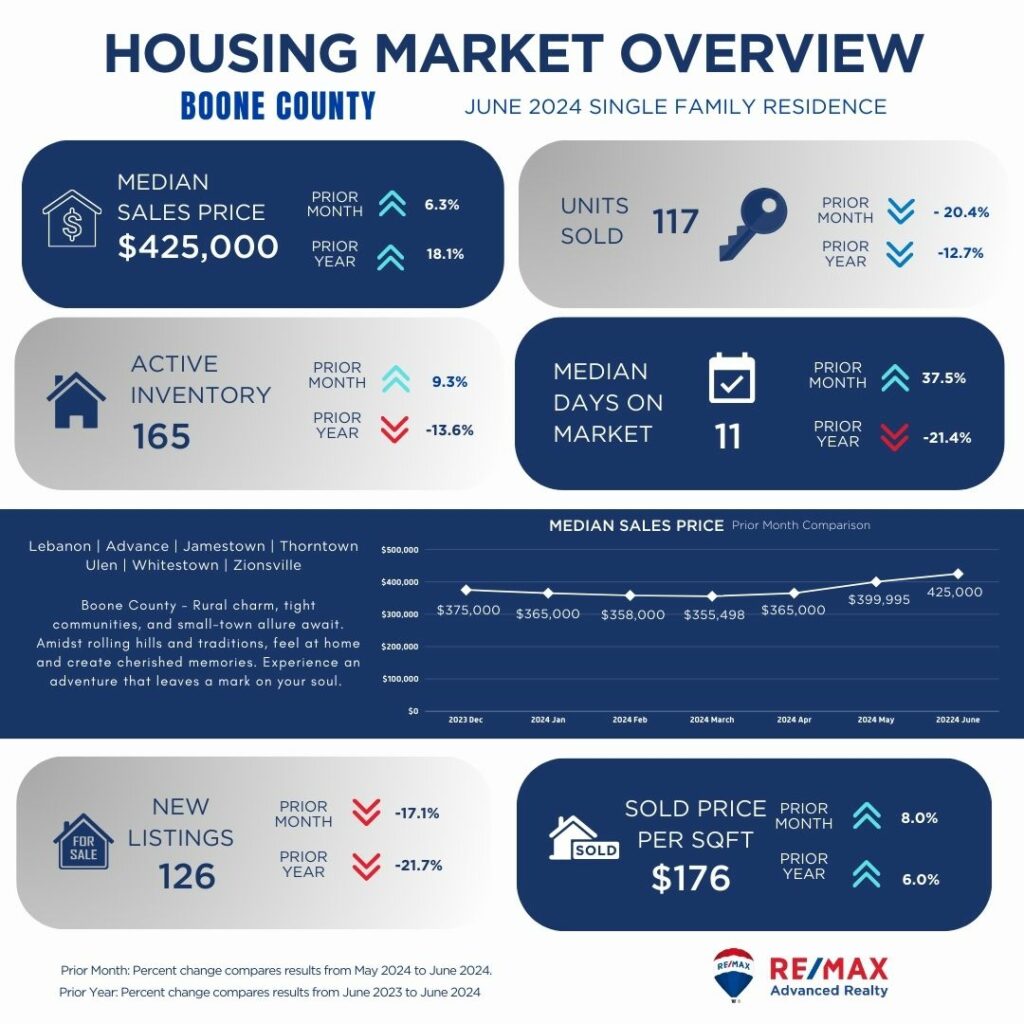

Boone County demonstrates a strong market with a significant increase in median sales price month-over-month and year-over-year, reflecting rising property values. However, the decrease in units sold indicates a slower market pace, potentially due to increased prices and limited inventory growth. Active inventory has risen slightly, but fewer new listings may constrain buyer options. Properties are selling quickly with a low median days on market and an uptick in price per square foot, suggesting continued demand in a competitive market.

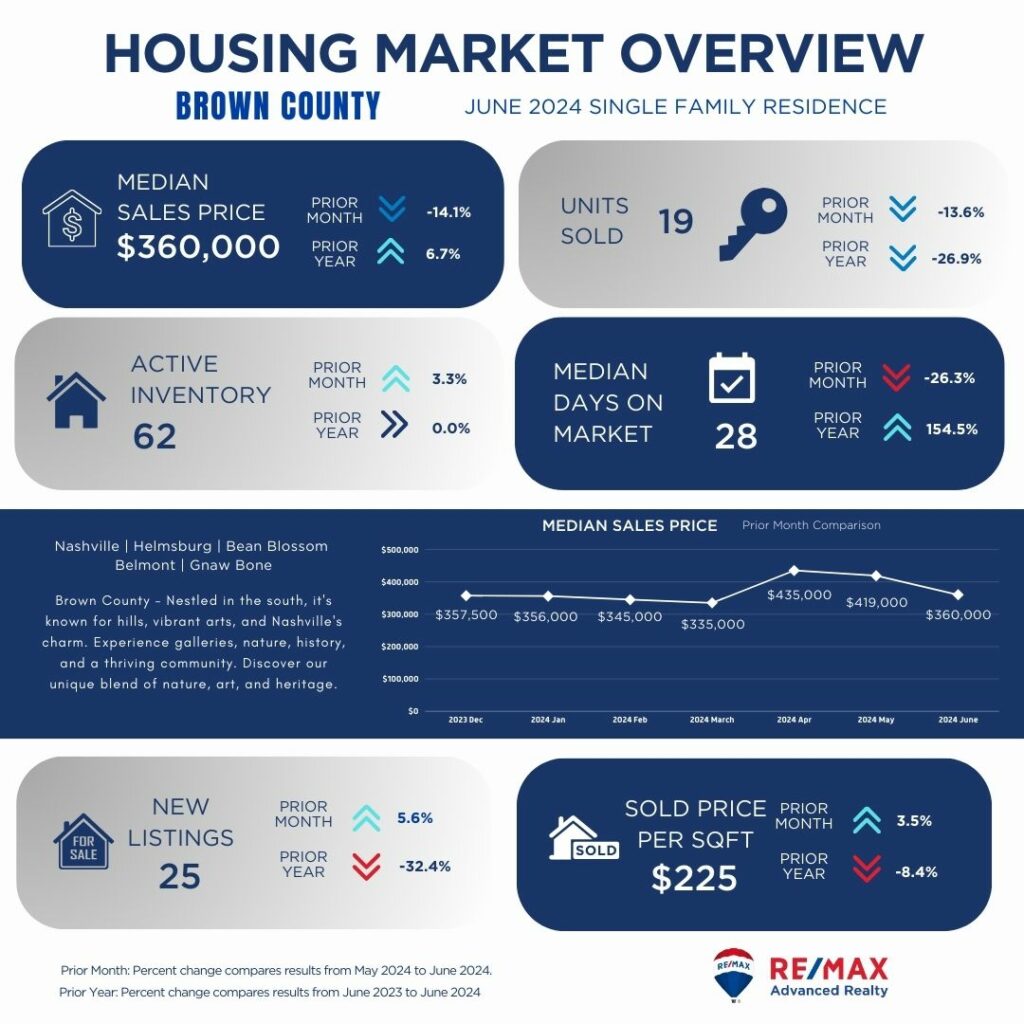

Brown County shows a mixed market with a notable decrease in median sales price compared to the previous month but an increase year-over-year. The decline in units sold suggests a slower market pace, which could provide buyers with more negotiating opportunities despite a stable inventory. Median days on market have decreased significantly, indicating properties are selling faster, but fewer new listings may limit buyer choices. Price per square foot has also decreased slightly, potentially offering buyers more affordable options in this market.

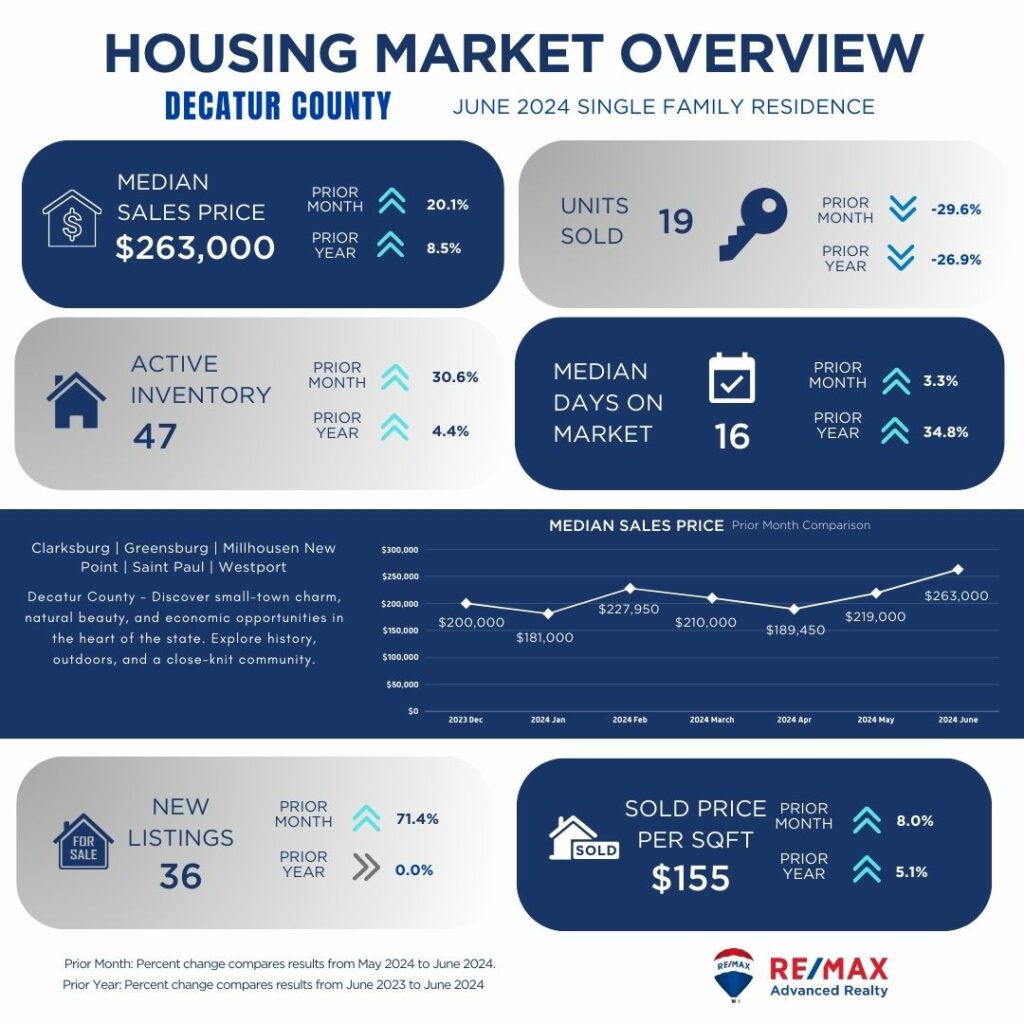

Decatur County displays a strengthening market with a substantial increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The increase in new listings further supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

Hamilton County maintains a robust market with a slight increase in median sales price compared to the previous month and stable growth year-over-year. Despite a modest decrease in units sold, active inventory has grown, giving buyers more choices. Properties are selling quickly with a low median days on market, reflecting continued demand. However, fewer new listings may limit buyer options despite a stable price per square foot, indicating a balanced market with steady growth in property values.

Hancock County shows a steady market with a decrease in median sales price compared to the previous month but a slight increase year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating power despite stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may limit buyer choices, although the slight decrease in price per square foot could offer opportunities for affordability.

Hendricks County demonstrates a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The increase in units sold suggests continued demand, supported by a growing active inventory. Properties are selling quickly with a low median days on market, indicating a competitive market environment. The slight increase in price per square foot reflects rising property values, potentially benefiting sellers despite fewer new listings limiting buyer options.

Jackson County shows a resilient market with a stable median sales price compared to the previous month and significant growth year-over-year. Despite a slight decrease in units sold, active inventory has remained stable, providing consistent buyer options. Properties are selling relatively quickly with a moderate median days on market, suggesting steady demand. However, fewer new listings may restrict buyer choices, although the increase in price per square foot indicates rising property values, benefiting sellers.

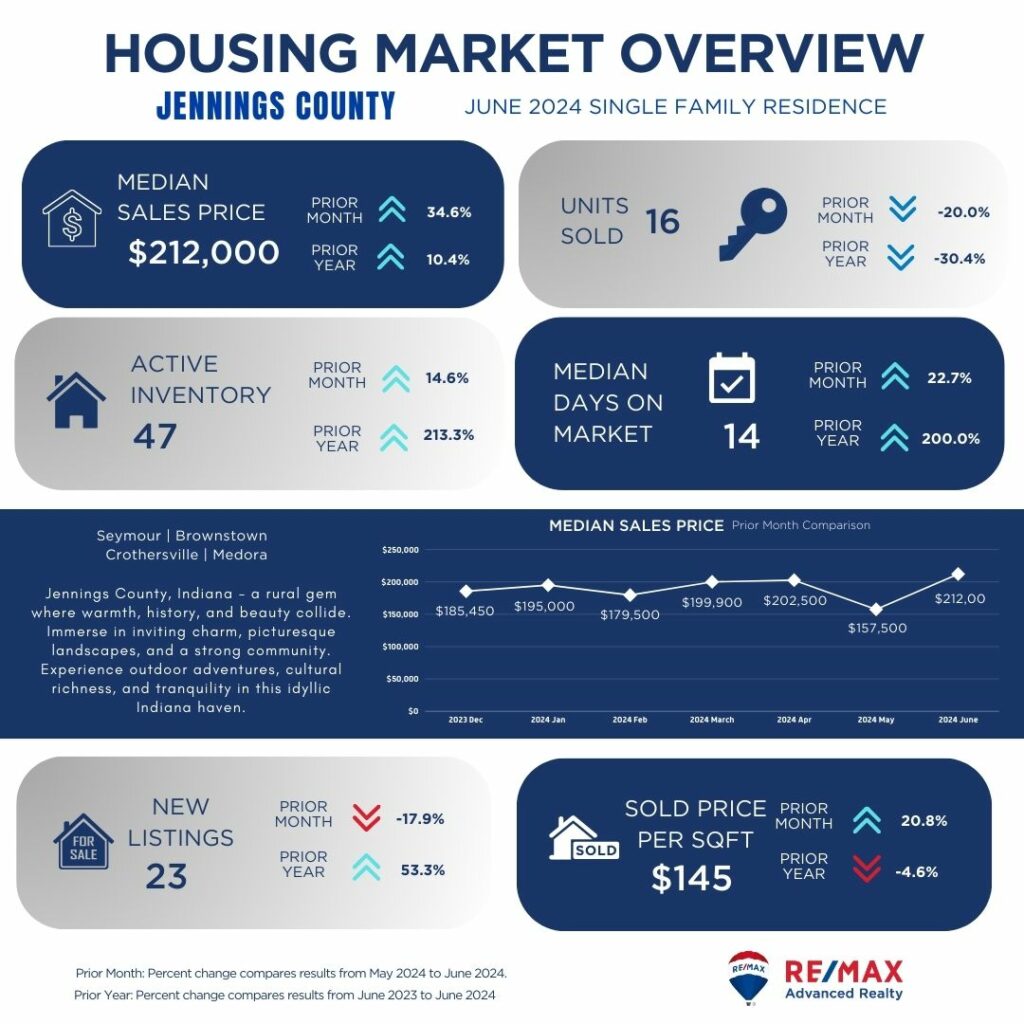

Jennings County displays a strengthening market with a notable increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded significantly, offering buyers more choices. Properties are selling relatively quickly with a moderate median days on market, indicating strong demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

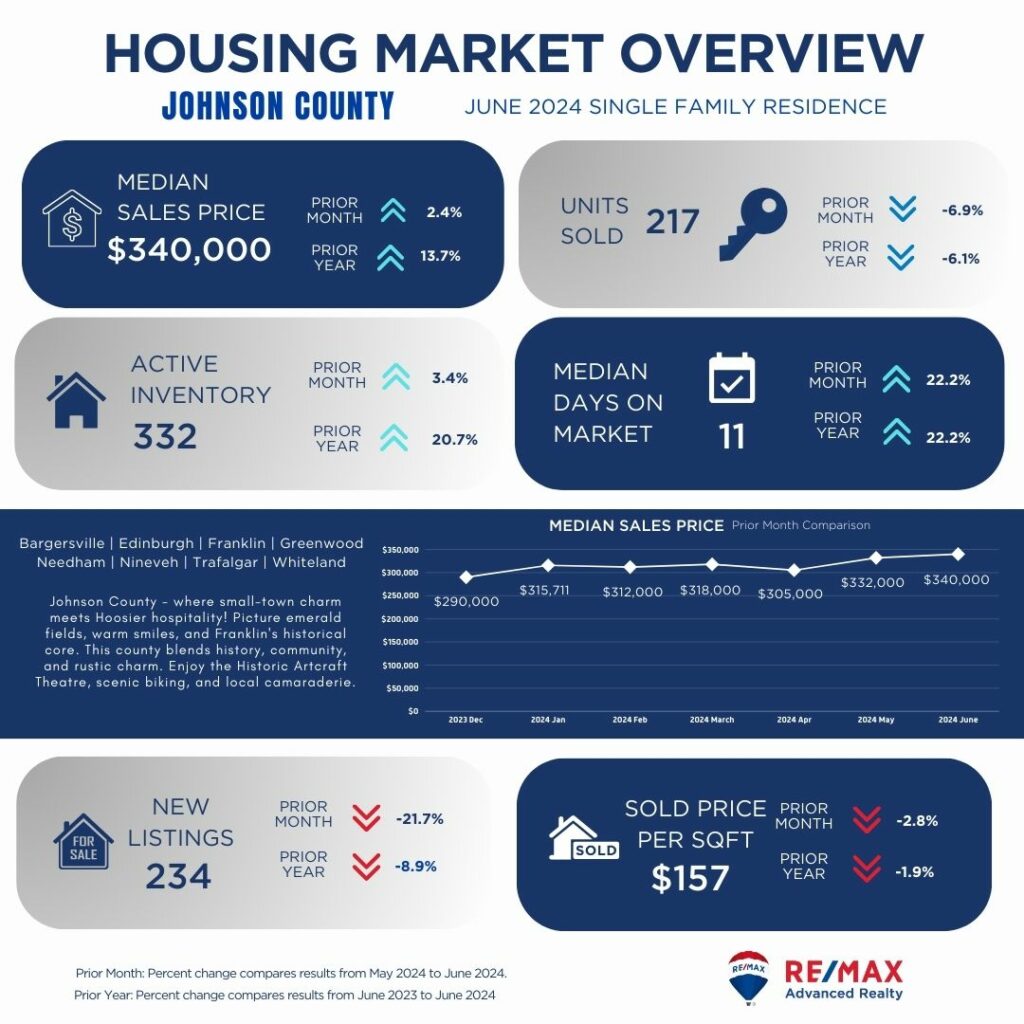

Johnson County maintains a stable market with a slight increase in median sales price compared to the previous month and steady growth year-over-year. Despite a decrease in units sold, active inventory has grown moderately, providing buyers with more options. Properties are selling quickly with a low median days on market, reflecting continued demand. Fewer new listings may limit buyer choices, although the stable price per square foot indicates a balanced market with steady property values.

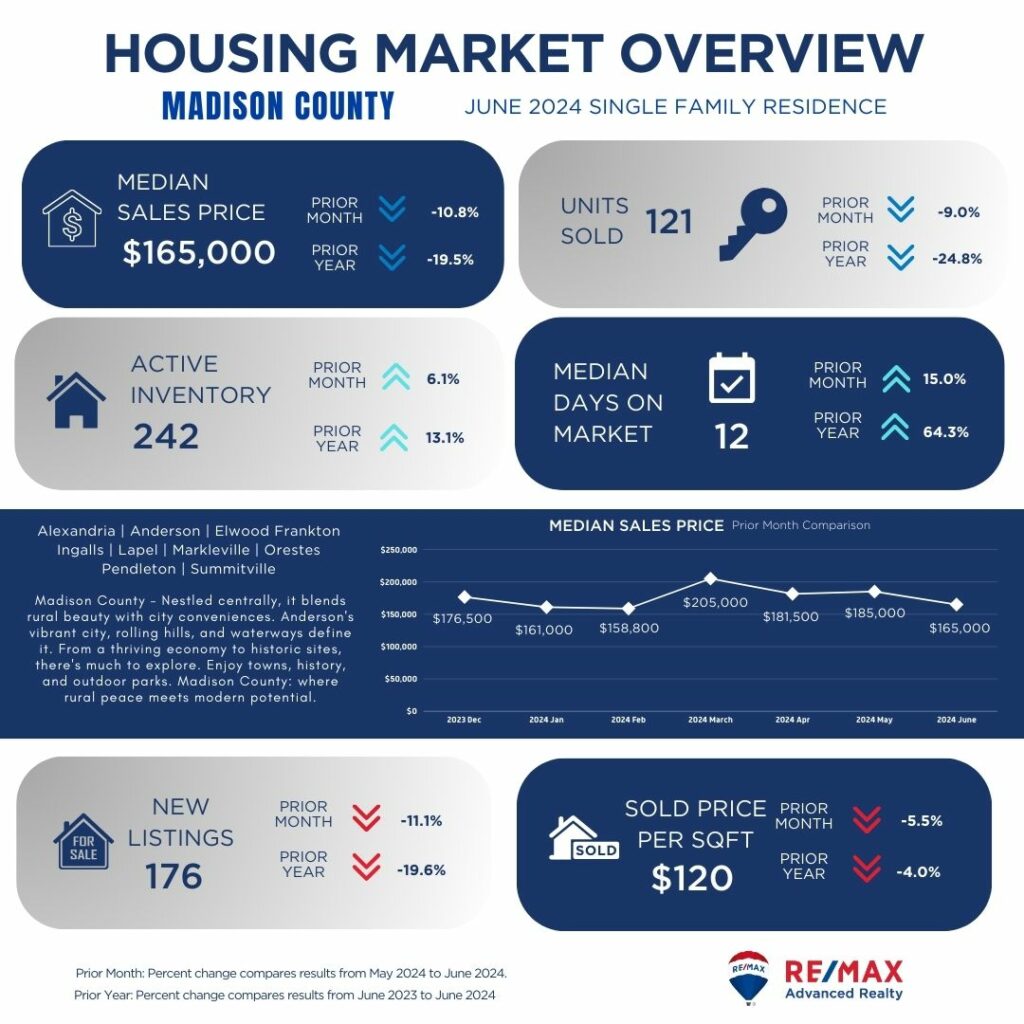

Madison County shows a varied market with a decrease in median sales price compared to the previous month and year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating opportunities despite a stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may constrain buyer options, although the slight decrease in price per square foot could offer affordability in this market.

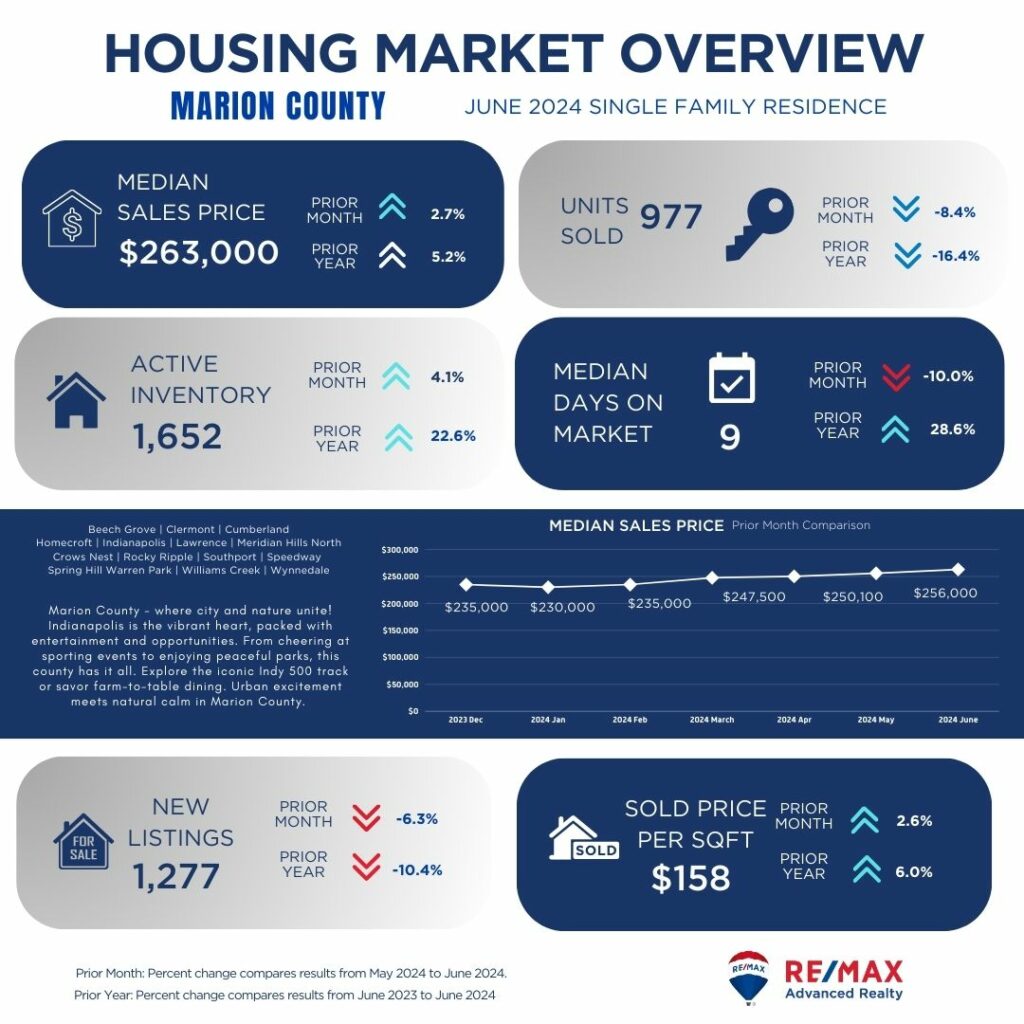

Marion County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, reflecting consistent demand. However, fewer new listings may limit buyer options, although the stable price per square foot indicates a balanced market with steady property values.

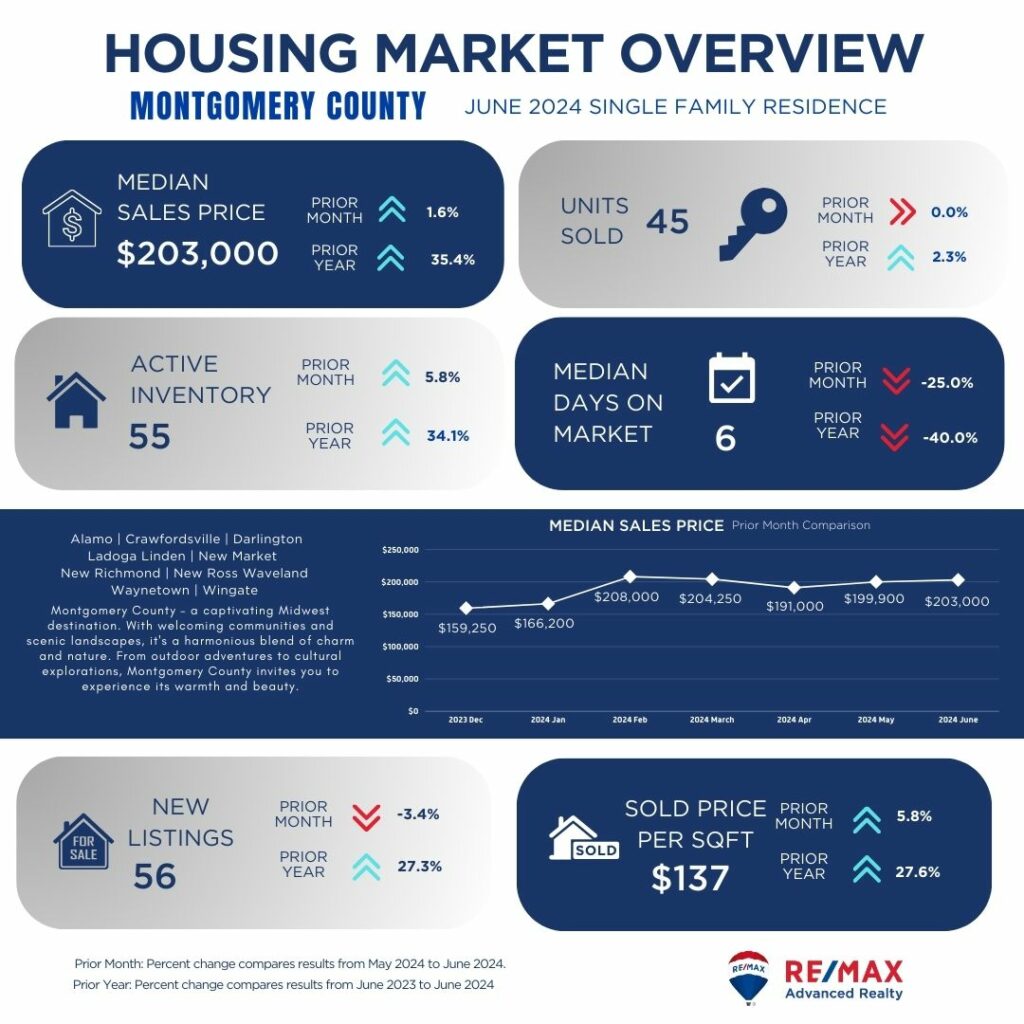

Montgomery County shows a stable market with a slight increase in median sales price compared to the previous month and strong growth year-over-year. Despite a slight decrease in units sold, active inventory has grown, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating steady demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

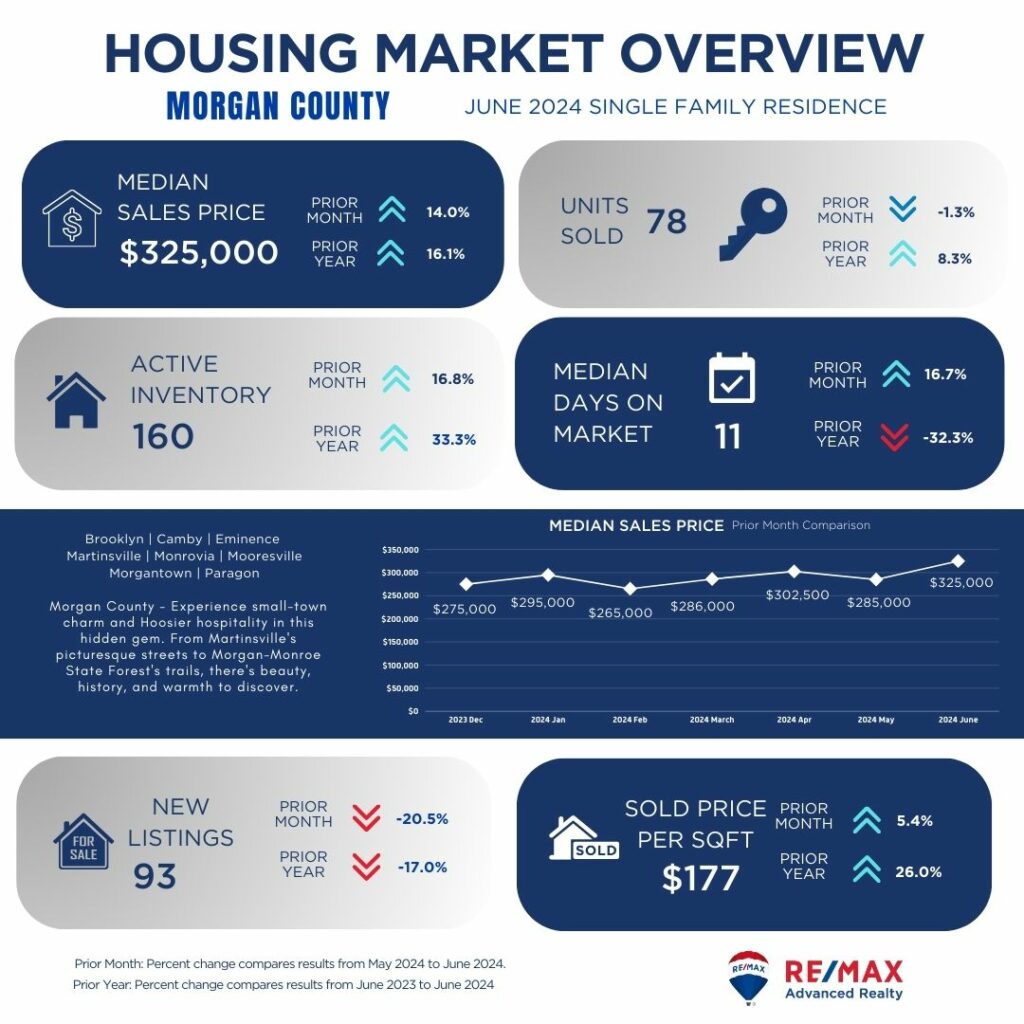

Morgan County displays a robust market with a notable increase in median sales price month-over-month and year-over-year. Despite a slight decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The decrease in new listings may limit buyer options, although the increase in price per square foot reflects rising property values, potentially benefiting sellers.

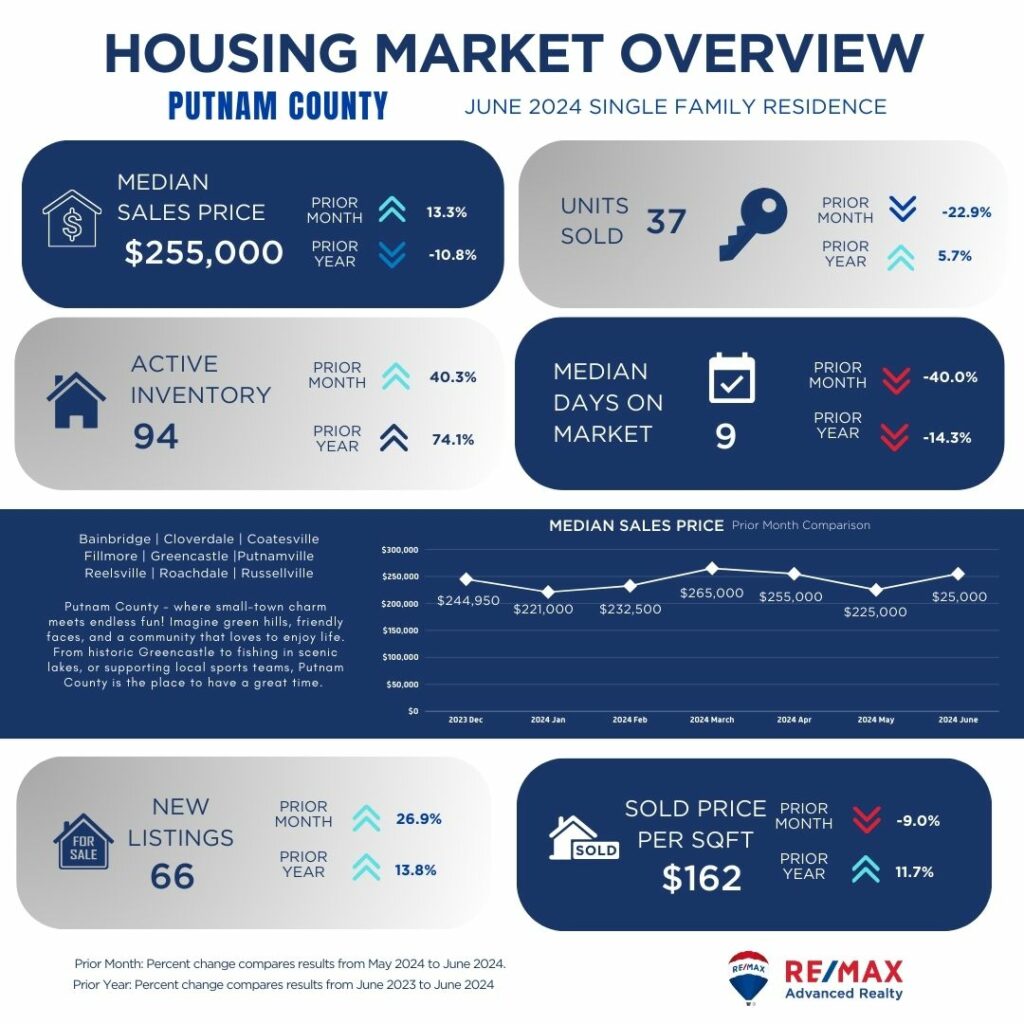

Putnam County shows a stable market with a slight increase in median sales price compared to the previous month and a decrease year-over-year. Despite a decrease in units sold, active inventory has grown significantly, offering buyers more options. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially attracting buyers.

Shelby County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a moderate median days on market, reflecting steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially benefiting buyers.

As we conclude our county-by-county analysis of the Central Indiana single-family homes market, it's evident that each area presents unique opportunities and challenges for buyers and sellers alike. From the rapid pace of Hamilton County to the steady resilience of Boone County and beyond, understanding these trends is crucial in navigating your real estate journey.

Looking ahead, the remainder of the year promises to be dynamic, with shifting market conditions influenced by economic factors and buyer-seller dynamics. Whether you're considering buying, selling, or investing in Central Indiana real estate, our team at RE/MAX Advanced Realty is here to provide expert guidance and support.

Explore our listings, connect with our experienced agents, and let us help you achieve your real estate goals in this competitive market. Contact us today to schedule a consultation and take the next step towards finding your dream home or maximizing your property's value. Trust RE/MAX Advanced Realty for insightful market analysis and personalized service, ensuring a smooth and successful real estate experience.

2024 Survey Confirms High Productivity of RE/MAX Agents and Teams

In a significant testament to their dedication and expertise, RE/MAX professionals have once again demonstrated exceptional performance in the real estate industry. The 2024 RealTrends Verified agent and team rankings highlight nearly 2,500 RE/MAX pros for their outstanding productivity based on home sales in 2023. Notably, our brokerage proudly celebrates the achievement of two of our stellar teams making it to this prestigious list.

The RealTrends Verified rankings, previously known as “America’s Best,” identify the top U.S.-based real estate agents and teams who have significantly exceeded national production norms. Out of nearly 22,000 qualified professionals, almost one of every eight is a RE/MAX affiliate, showcasing the broad impact and reach of RE/MAX in the real estate market.

To earn a spot on this list, individual agents needed to close at least $16 million in sales volume or 40 transaction sides in 2023. Teams qualified by achieving a minimum of $24 million in sales volume or 60 transaction sides.

RE/MAX Agents and Teams: Excellence in Action

Amy Lessinger, President of RE/MAX, lauds the continuous success of RE/MAX agents, attributing it to their commitment to high standards and professional excellence. “RE/MAX agents continue to succeed in part because of the high standards and values they set for themselves. They are committed to providing their clients with unparalleled service and expertise, and this recognition underscores that dedication to professional excellence,” she states.

Lessinger further emphasizes the local market knowledge and personalized solutions that RE/MAX agents bring to their clients. “RE/MAX agents understand their local markets and have the skills to offer personalized solutions and strategic advice to their clients,” she continues. “As these reports illustrate, RE/MAX affiliates are a great choice for buyers and sellers who value experience, productivity, and results.”

We are thrilled to congratulate two remarkable teams from our brokerage who have earned their place in the 2024 RealTrends Verified rankings:

These achievements reflect the hard work, dedication, and superior service that our teams provide to their clients. We are incredibly proud of their accomplishments and their contribution to the overall success of our brokerage.

As we celebrate these significant achievements, we remain committed to supporting our agents and teams in their pursuit of excellence. Congratulations once again to The Craftsman Group and The Indy Home Pros Team for their impressive rankings in the 2024 RealTrends Verified list. Here’s to continued success and many more milestones ahead!

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224