As we reach the midpoint of the year, the Central Indiana single-family homes market continues to display dynamic shifts across its counties. From the bustling urban landscapes of Hamilton County to the scenic retreats of Brown County, each area offers a distinct perspective on the current housing market. This is our interpretation based on the data provided by MIBOR Market Insights, examining trends observed from May 2024 to June 2024 and providing a comparative look at year-over-year data from June 2023 to June 2024. Whether you're a prospective buyer or seller, understanding these trends is essential for making informed real estate decisions in today's evolving market.

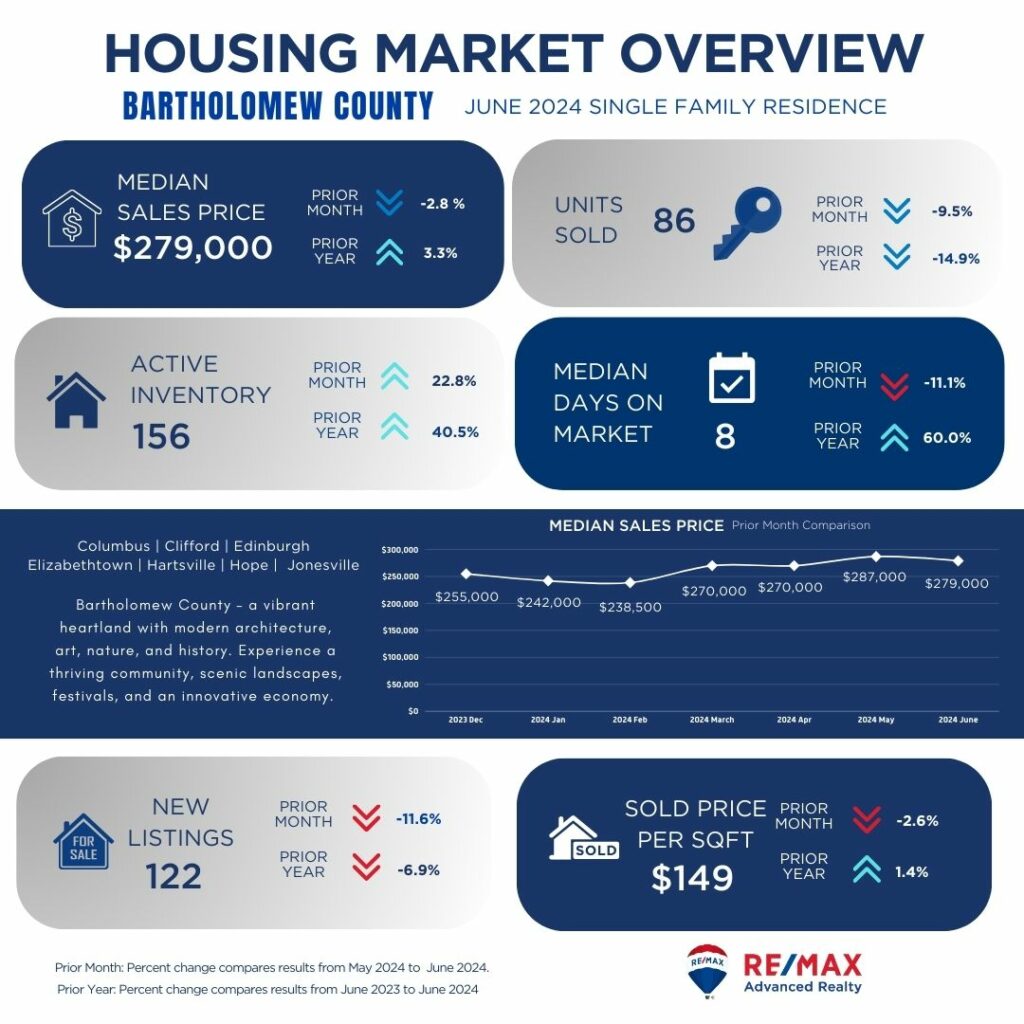

Bartholomew County shows a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The decrease in units sold suggests a slower market pace, providing buyers with more negotiating power. Active inventory has increased, offering buyers more choices, although fewer new listings may limit options. Properties are selling quickly with a low median days on market, indicating continued demand despite some price fluctuations.

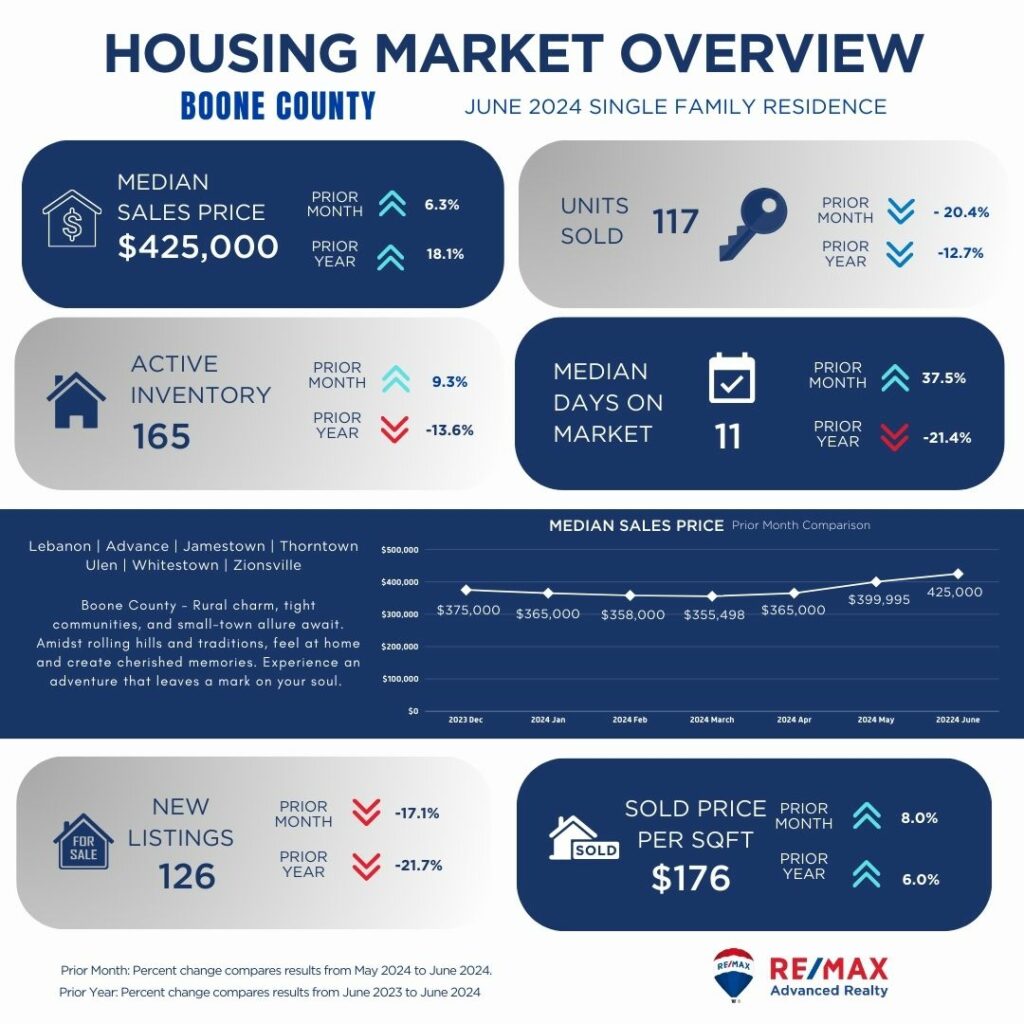

Boone County demonstrates a strong market with a significant increase in median sales price month-over-month and year-over-year, reflecting rising property values. However, the decrease in units sold indicates a slower market pace, potentially due to increased prices and limited inventory growth. Active inventory has risen slightly, but fewer new listings may constrain buyer options. Properties are selling quickly with a low median days on market and an uptick in price per square foot, suggesting continued demand in a competitive market.

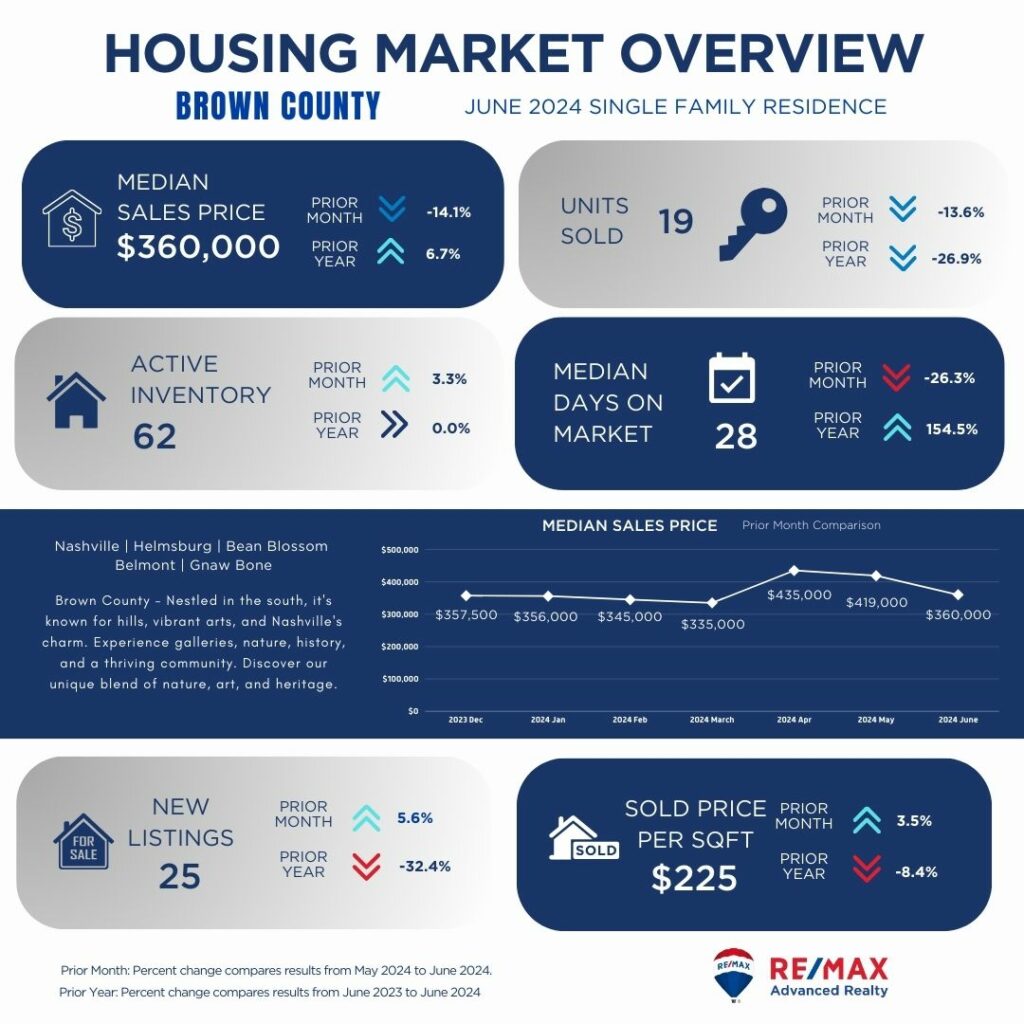

Brown County shows a mixed market with a notable decrease in median sales price compared to the previous month but an increase year-over-year. The decline in units sold suggests a slower market pace, which could provide buyers with more negotiating opportunities despite a stable inventory. Median days on market have decreased significantly, indicating properties are selling faster, but fewer new listings may limit buyer choices. Price per square foot has also decreased slightly, potentially offering buyers more affordable options in this market.

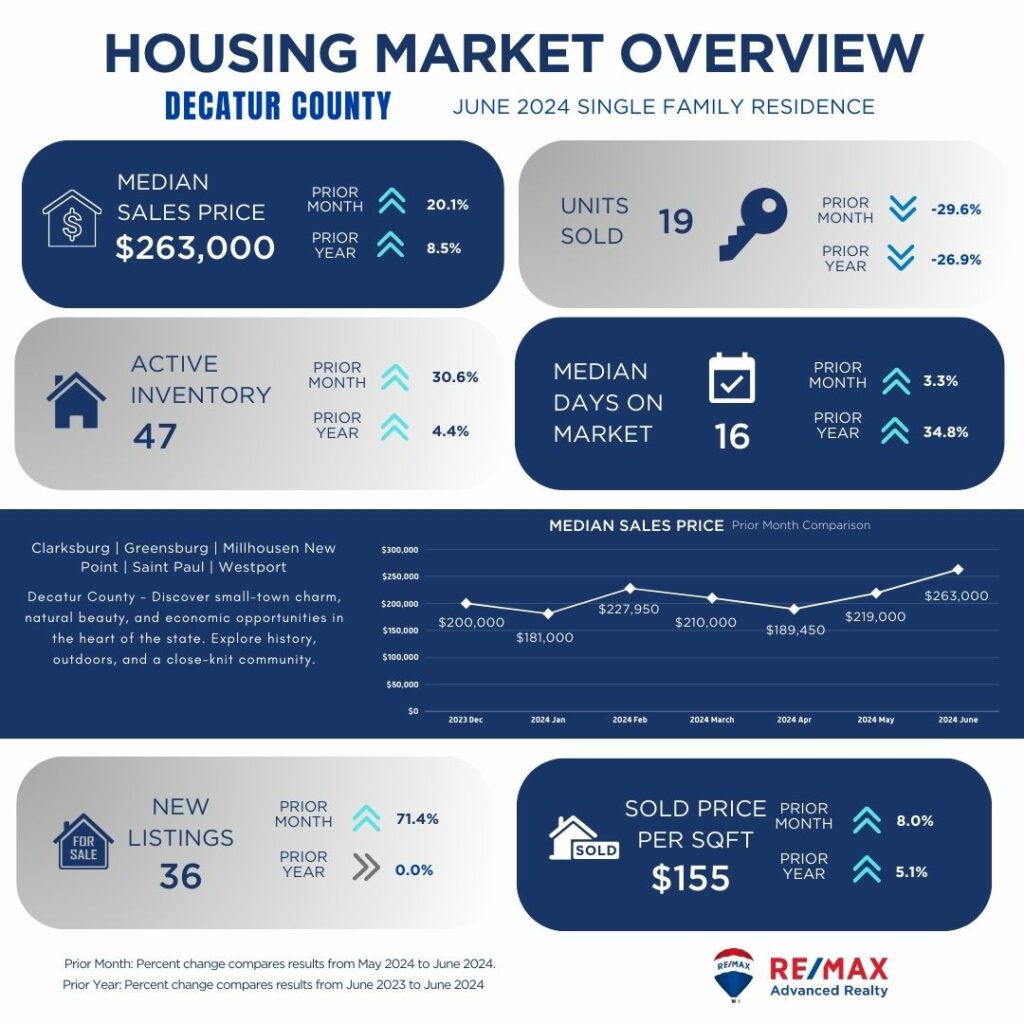

Decatur County displays a strengthening market with a substantial increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The increase in new listings further supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

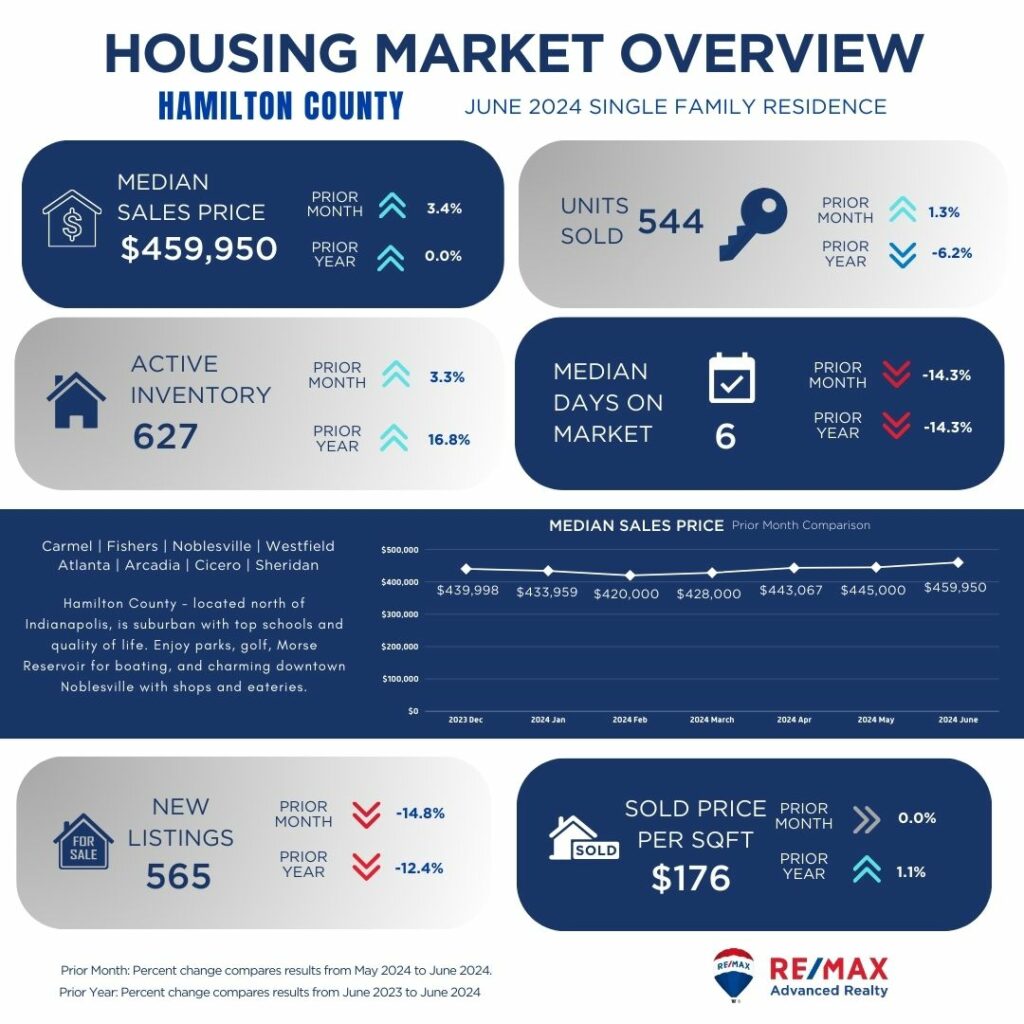

Hamilton County maintains a robust market with a slight increase in median sales price compared to the previous month and stable growth year-over-year. Despite a modest decrease in units sold, active inventory has grown, giving buyers more choices. Properties are selling quickly with a low median days on market, reflecting continued demand. However, fewer new listings may limit buyer options despite a stable price per square foot, indicating a balanced market with steady growth in property values.

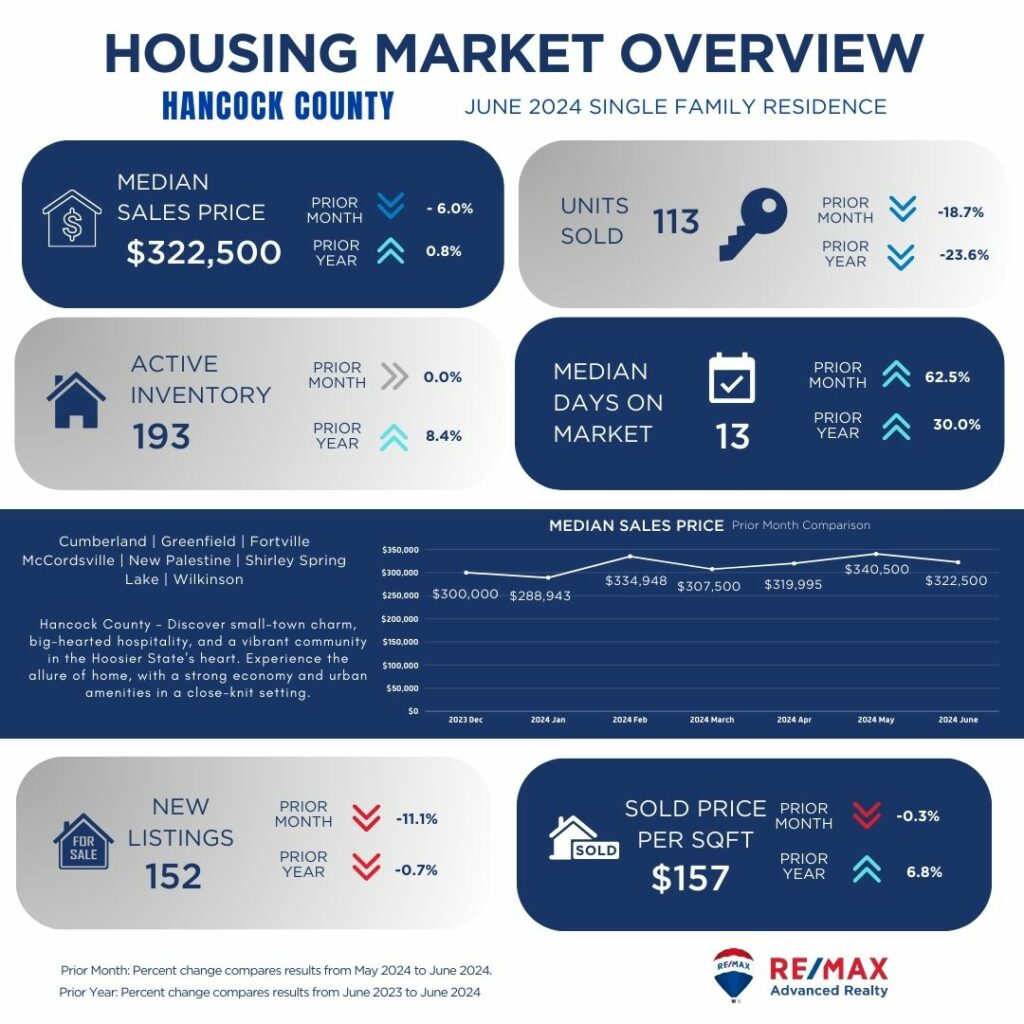

Hancock County shows a steady market with a decrease in median sales price compared to the previous month but a slight increase year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating power despite stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may limit buyer choices, although the slight decrease in price per square foot could offer opportunities for affordability.

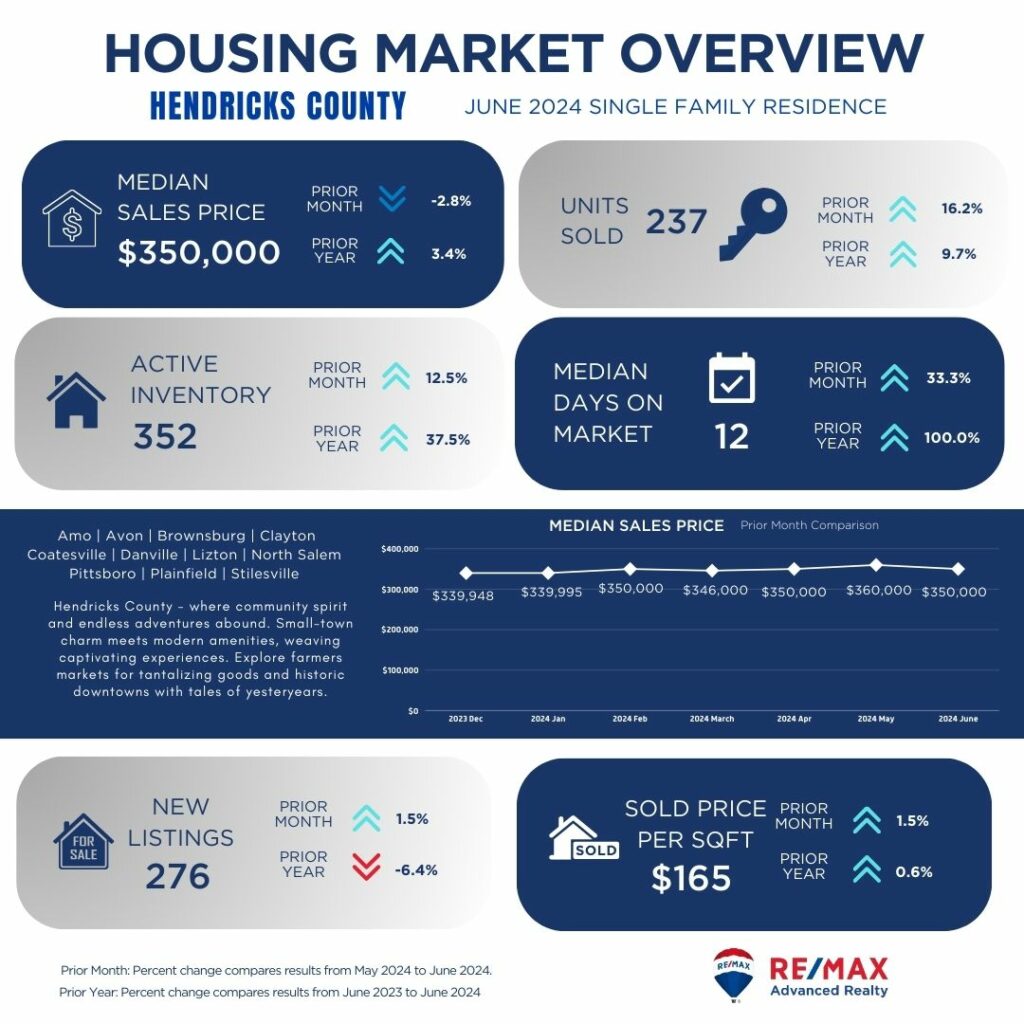

Hendricks County demonstrates a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The increase in units sold suggests continued demand, supported by a growing active inventory. Properties are selling quickly with a low median days on market, indicating a competitive market environment. The slight increase in price per square foot reflects rising property values, potentially benefiting sellers despite fewer new listings limiting buyer options.

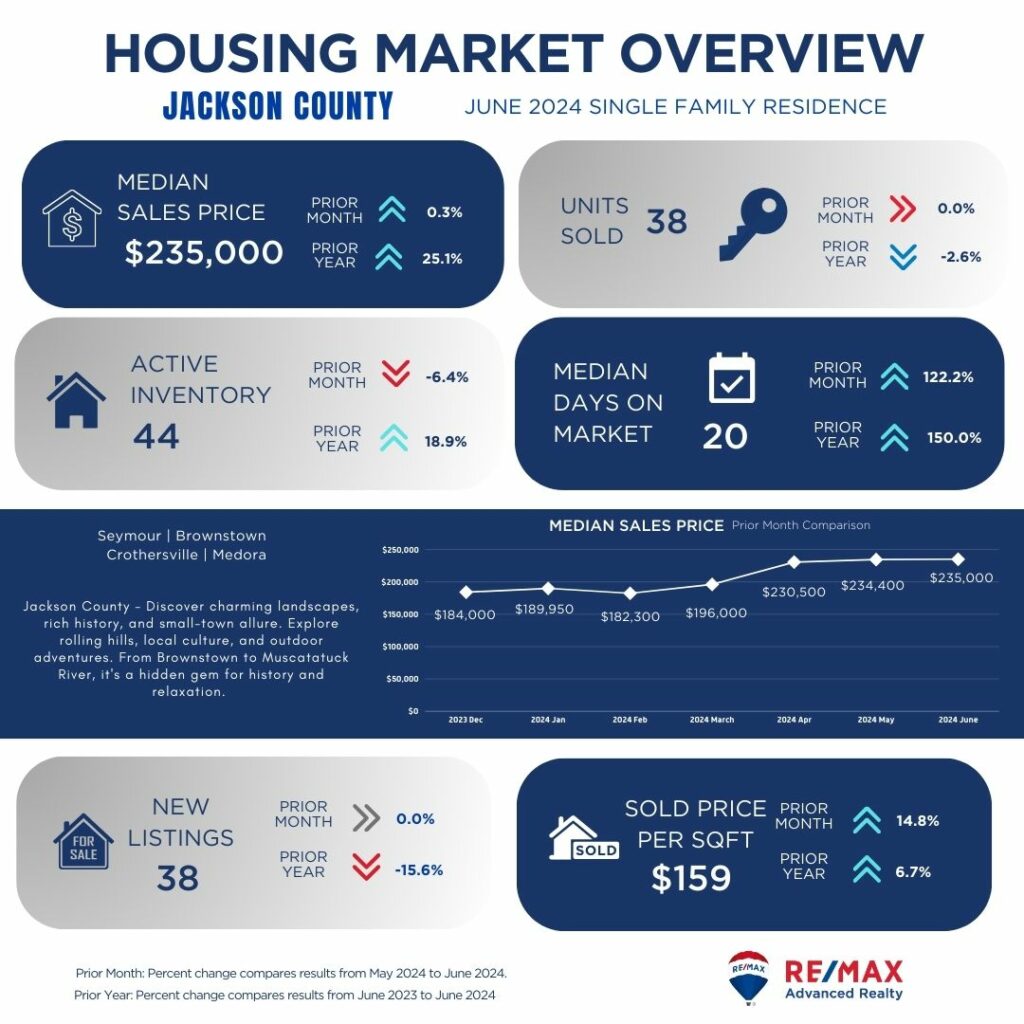

Jackson County shows a resilient market with a stable median sales price compared to the previous month and significant growth year-over-year. Despite a slight decrease in units sold, active inventory has remained stable, providing consistent buyer options. Properties are selling relatively quickly with a moderate median days on market, suggesting steady demand. However, fewer new listings may restrict buyer choices, although the increase in price per square foot indicates rising property values, benefiting sellers.

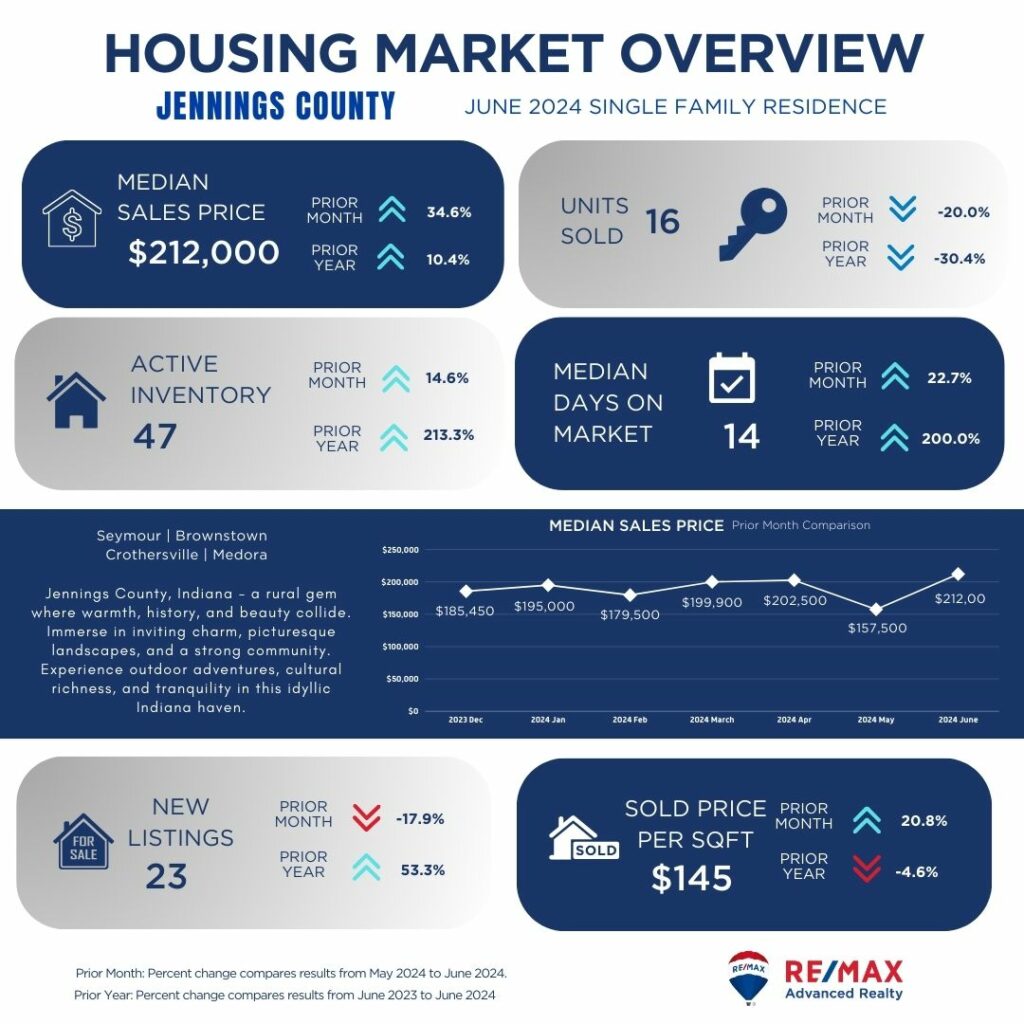

Jennings County displays a strengthening market with a notable increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded significantly, offering buyers more choices. Properties are selling relatively quickly with a moderate median days on market, indicating strong demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

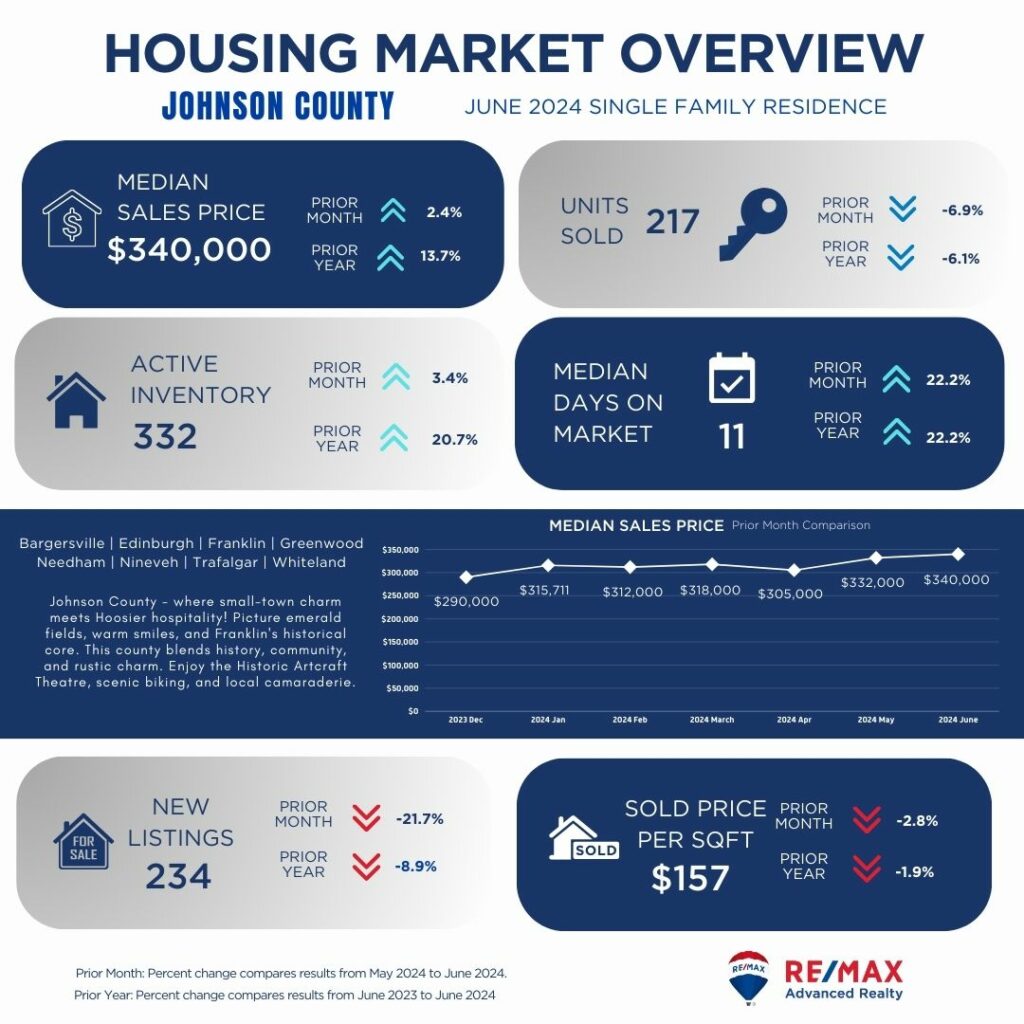

Johnson County maintains a stable market with a slight increase in median sales price compared to the previous month and steady growth year-over-year. Despite a decrease in units sold, active inventory has grown moderately, providing buyers with more options. Properties are selling quickly with a low median days on market, reflecting continued demand. Fewer new listings may limit buyer choices, although the stable price per square foot indicates a balanced market with steady property values.

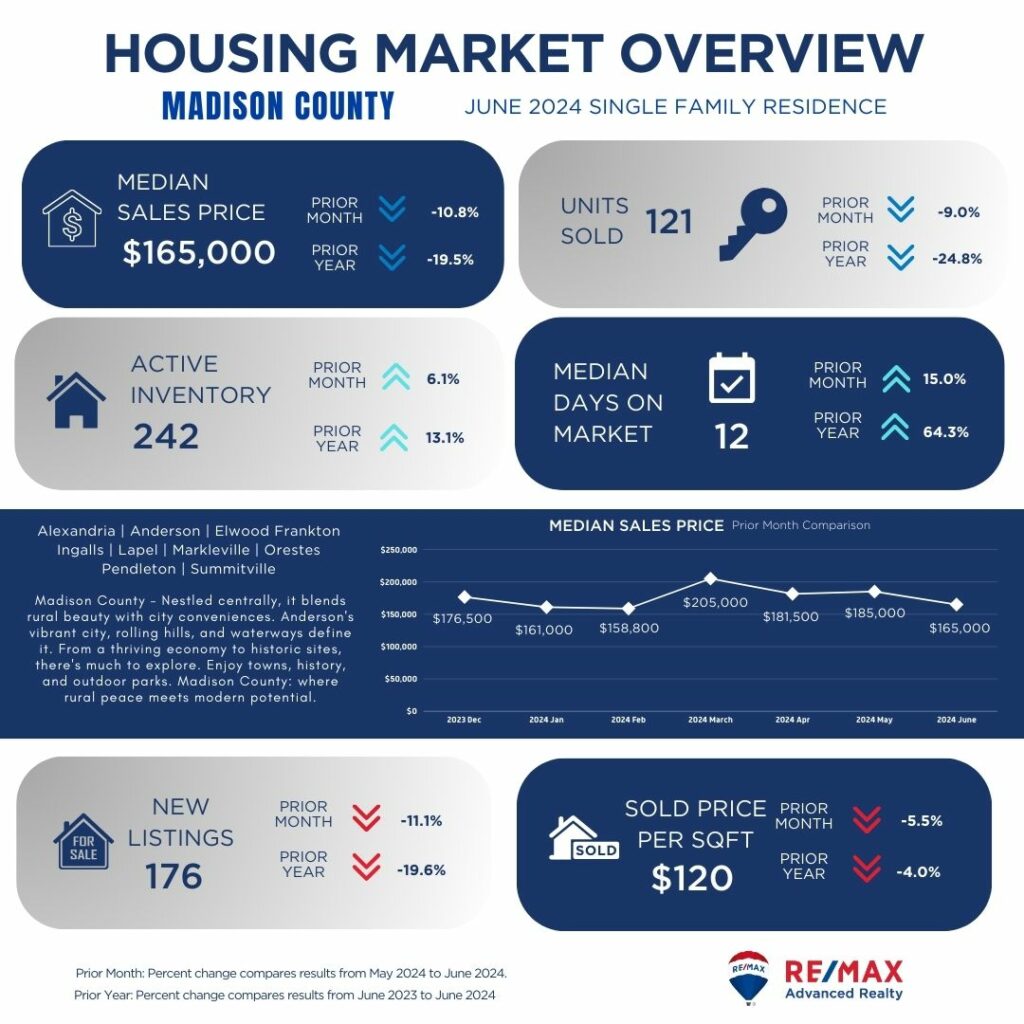

Madison County shows a varied market with a decrease in median sales price compared to the previous month and year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating opportunities despite a stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may constrain buyer options, although the slight decrease in price per square foot could offer affordability in this market.

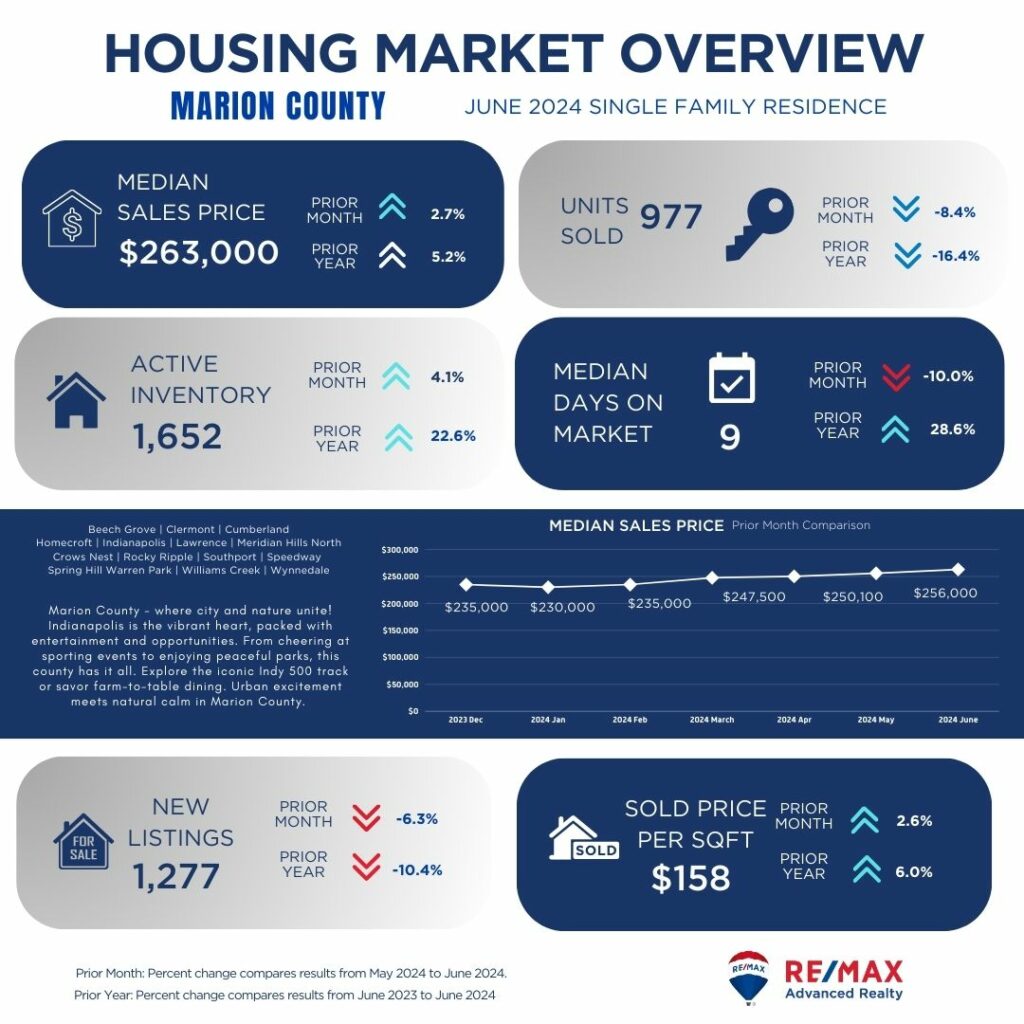

Marion County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, reflecting consistent demand. However, fewer new listings may limit buyer options, although the stable price per square foot indicates a balanced market with steady property values.

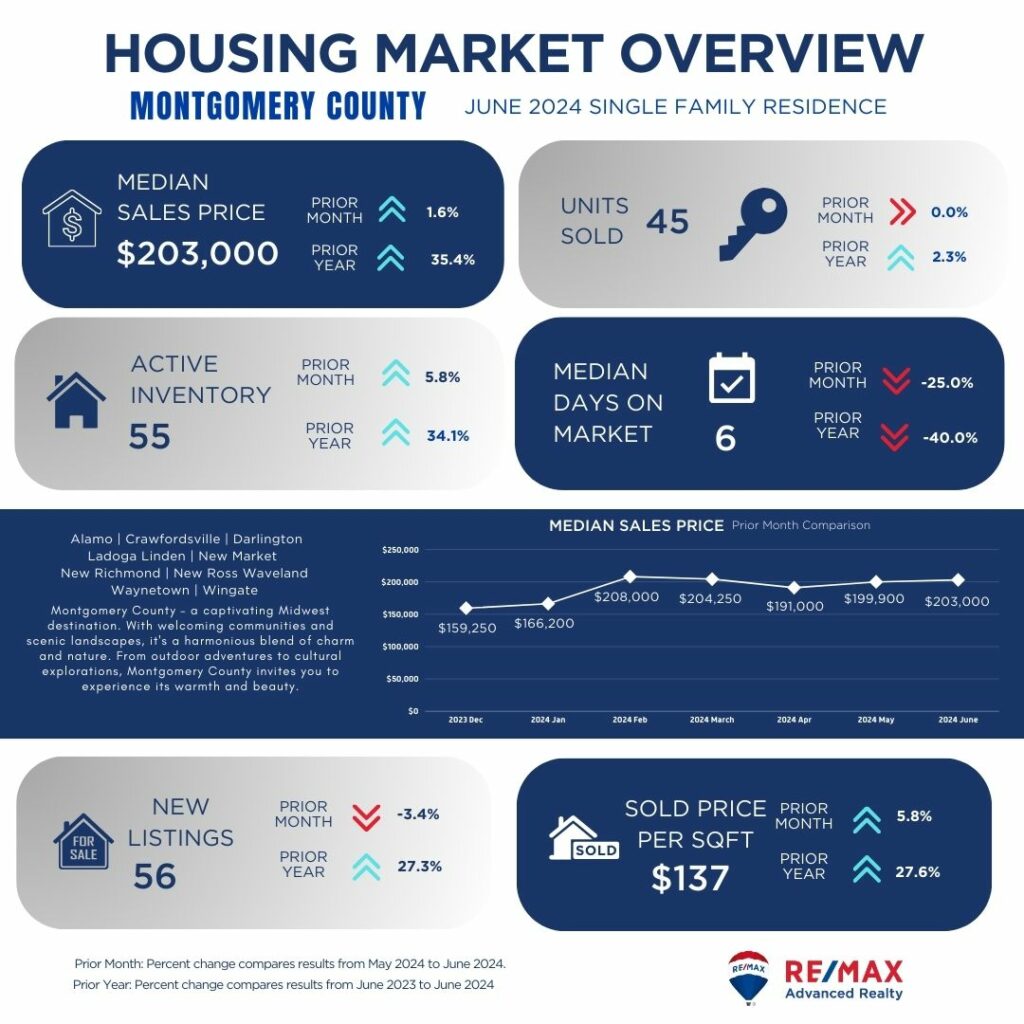

Montgomery County shows a stable market with a slight increase in median sales price compared to the previous month and strong growth year-over-year. Despite a slight decrease in units sold, active inventory has grown, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating steady demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

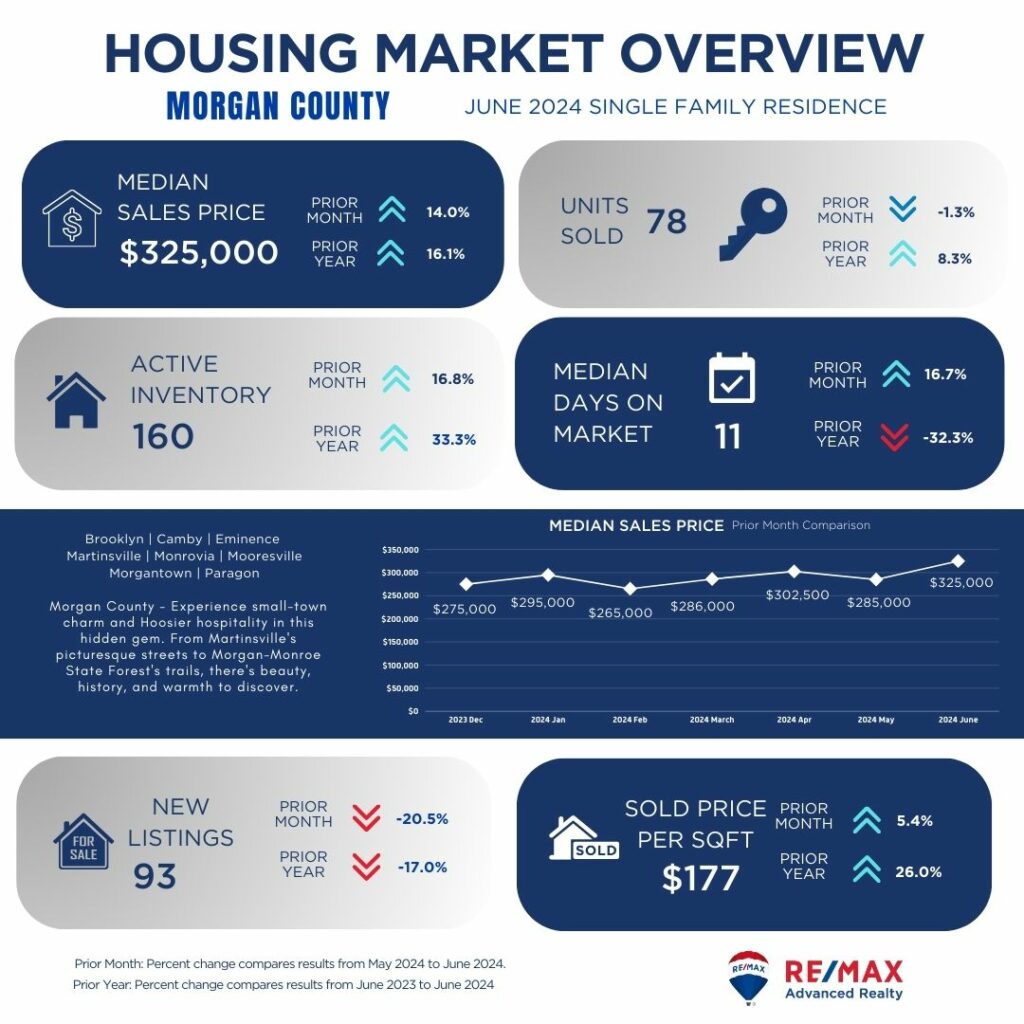

Morgan County displays a robust market with a notable increase in median sales price month-over-month and year-over-year. Despite a slight decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The decrease in new listings may limit buyer options, although the increase in price per square foot reflects rising property values, potentially benefiting sellers.

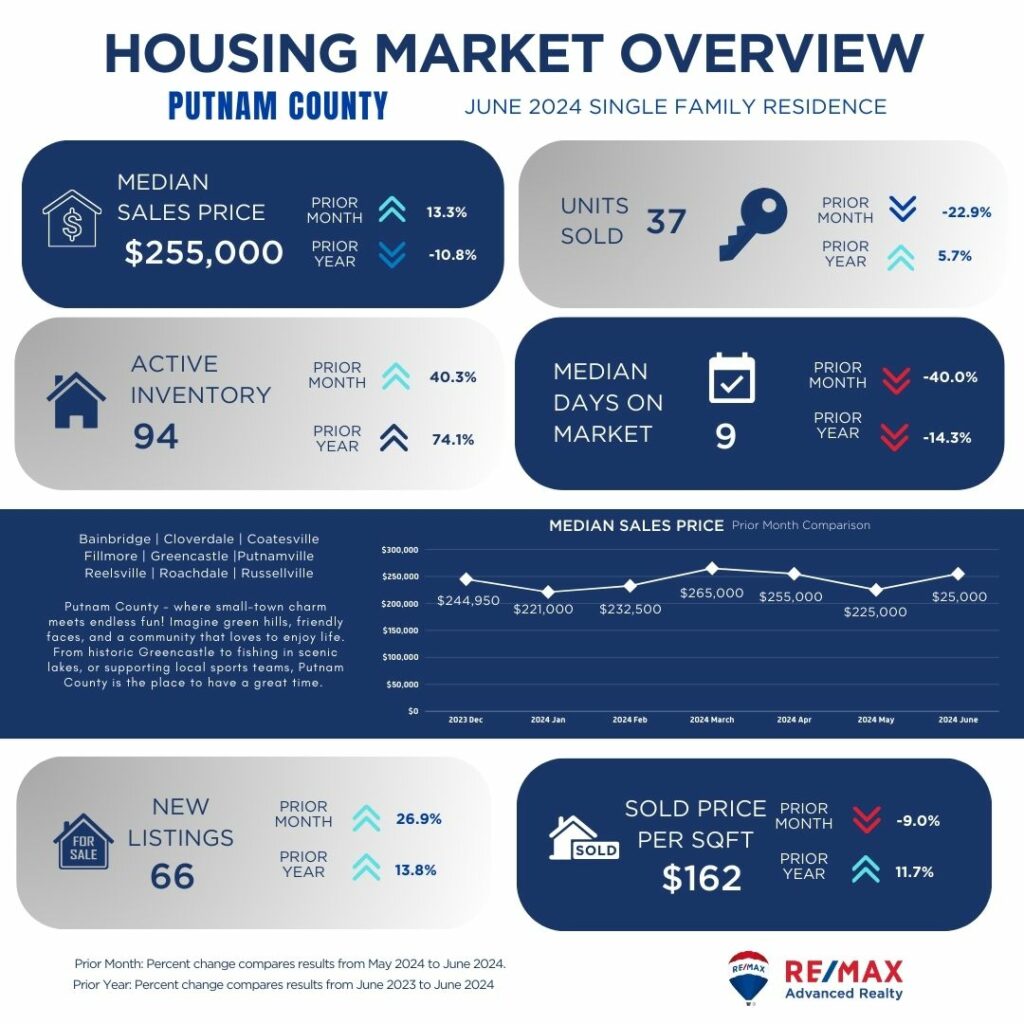

Putnam County shows a stable market with a slight increase in median sales price compared to the previous month and a decrease year-over-year. Despite a decrease in units sold, active inventory has grown significantly, offering buyers more options. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially attracting buyers.

Shelby County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a moderate median days on market, reflecting steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially benefiting buyers.

As we conclude our county-by-county analysis of the Central Indiana single-family homes market, it's evident that each area presents unique opportunities and challenges for buyers and sellers alike. From the rapid pace of Hamilton County to the steady resilience of Boone County and beyond, understanding these trends is crucial in navigating your real estate journey.

Looking ahead, the remainder of the year promises to be dynamic, with shifting market conditions influenced by economic factors and buyer-seller dynamics. Whether you're considering buying, selling, or investing in Central Indiana real estate, our team at RE/MAX Advanced Realty is here to provide expert guidance and support.

Explore our listings, connect with our experienced agents, and let us help you achieve your real estate goals in this competitive market. Contact us today to schedule a consultation and take the next step towards finding your dream home or maximizing your property's value. Trust RE/MAX Advanced Realty for insightful market analysis and personalized service, ensuring a smooth and successful real estate experience.

Are you dreaming of living on your own property?

If yes, you’re not alone.

In our network alone, we know a lot of people who want to have their own home. It’s no surprise though; there are a lot of advantages when you become a homeowner. However, there are several factors to consider while making such a big decision. So before you choose a new home, be sure to read this post first.

In this article, we will talk about what problems to look for when buying a house. From structural issues to hidden flaws, knowing what issues to check can save you time, money, and headaches.

Before rushing into something, especially one that’s as huge as buying a home, it’s important to thoroughly inspect it. Some of the problems include:

When a door refuses to close, it's likely because the frame has moved and the door is no longer square. To get the door to close in certain cases, the homeowners might have chopped a small piece from the door. Therefore, be cautious if you see some trim removed from its top or bottom. Although the door may shut correctly, the issue that caused the shifting still persists.

The majority of poured concrete foundations will eventually develop hairline fractures, although they are not a sign of an issue. However, it's a good idea to have a foundation contractor look at the region if a crack is bigger than 1/2 inch. This also applies to cracks that seem to have been fixed lately. Large fissures may be a sign of a shaky foundation.

While most mold isn't as dangerously deadly as, say, Stachybotrys, breathing in mold spores can cause headaches, respiratory ailments, and other ailments. Additionally, mold growth may be a sign of structural issues with a home. If you detect the smell of mold, look for leaks in crawl spaces and basements, under sinks, and around windows. Wood members, drywall, and carpets are examples of construction materials that may need to be replaced if a leak has been present for a long time.

It is advisable to identify the symptoms prior to making an offer because the existence of live termites has the potential to jeopardize a housing contract. Little mounds of microscopic brown droppings on the ground close to a wall are one obvious sign. Additional indicators include the sound of hollow wood and the existence of mud tubes on a foundation. Because termites reside underground, they dig tiny mud tunnels along walls and foundations to shield themselves from sunlight while they go from their underground nests to the wood they are eating.

Building supplies and water don't mix. Over time, the slow leakage of water from a window or roof can cause structural wood members to deteriorate. Water stains that have a brown or yellow tint could indicate a plumbing issue on a higher floor. Don't make an offer until you have an idea of the source of the leak and the extent of the harm it has caused.

No matter how charming and comfortable the home is, a drooping ceiling is a cause for concern. Even a small amount of sag in the ceiling can indicate a structural movement that is causing the drywall to come free from the ceiling joists, an insect infestation that is gnawing away at the joists, or a roof leak. Whatever the reason, the cost of repair may be high.

Put this one firmly under the category of "buyer beware! While many individuals are competent at doing small repairs around the house, very few are qualified to build an addition that complies with building requirements. An addition constructed by the homeowner without the local building authority's supervision may have structural, electrical, and plumbing flaws.

Not every fresh coat of paint signals a problem. Actually, before offering their homes for sale, sellers frequently paint the walls a fresh coat. However, if fresh paint appears out of place, as in a room where only one wall has been painted, you should question its application. Spot painting may be an indication that the seller is attempting to hide a wall flaw, like a water stain.

The homeowner may be attempting to mask the smell of something else, such as pet urine-saturated carpeting or mold growing beneath the sink, if you walk into a house and are immediately hit by a strong scent of air freshener or if essential oil diffusers are steaming away in every room. urge for a second showing and urge the seller not to use air freshener before you come if you're interested in the place.

A yard should slope away from the home by at least 2 percent in order to keep water away from the foundation wall. After it has rained, drive by the house you like. Puddles of standing water could indicate a drainage issue in the yard. The most dangerous puddles are those that are close to the foundation since even the smallest crack might allow water that flows along a foundation wall to seep into a basement.

While the typical AC unit lasts 10 to 12 years, furnaces typically last 15 to 18 years. HVAC (heating, ventilation, and air conditioning) units lose efficiency as they get closer to the end of their useful lifespan. Because of this, operating them will cost you more in energy expenses, and they might not adequately heat or cool the house. Additionally, there's a potential that one or both of them will completely stop functioning, in which case you'll have to pay to replace them.

The most crucial consideration when purchasing a home is, as real estate brokers like to say, "location, location, location." If a number of properties in the neighborhood are for sale, this may be a sign of a problem with the location, such as an increase in crime or a proposed landfill nearby. Include investigating the community as a regular aspect of your house search.

It pays to properly inspect the roof because replacing a roof is an expensive project that can cost anywhere from $6,000 to $20,000 or more, depending on the size of the roof and the type of roofing materials used. The roof may need to be replaced if there are any of the following symptoms: exposed nail heads, missing or broken shingles, or shingles that curl up at the corners. A roofer with experience will be able to confirm.

Some sellers offer their properties "As Is" for good reason—they just don't want to deal with potential issues that could come out during an expert inspection. In essence, they are saying that they will not foot the bill to address any issues that arise. You can still have the house inspected, which is a good idea, but if the inspector discovers mold, termites, or other issues and you decide to move forward with the purchase, you will be responsible for paying for any repairs

A house's duration on the market before it sells might vary depending on a number of factors, but the average period from listing to closure is 68 days, according to real estate expert Zillow. In general, steer clear of a house that has been on the market for months or years; speak with a real estate agent about the typical time in your neighborhood. There's a good chance it has undiscovered issues that would be costly to fix.

Examine the underside of the roof eaves (the soffits) from the outside of the house. One or more intake vents should be visible to you. Extra exhaust vents ought to be placed at the top of gable walls, on the face of the roof close to the ridge, and along the roof's ridge. An attic's decking (or roof sheathing) and shingles themselves may sustain damage in the summer heat if there is insufficient ventilation.

During an open house, potential buyers try to determine whether a house is a good fit for them by asking questions such as "Is the kitchen large enough?" or "Does it have enough bedrooms?" Do the bathrooms require remodeling? However, it's important to remember that a home must do more than merely fulfill a list of requirements. Ultimately, for the majority of people, it represents their largest investment yet. It needs to be in good shape as well.

The usual listing contract contains a disclosure form where the seller is required to detail all known problems of the house in order to aid potential purchasers in assessing the condition of a property. However, it's possible that not all of the flaws are disclosed by the seller, and some sellers may purposefully leave out issues in the hopes that you won't see them. Click through to discover some frequent warning signs that should cause you to reconsider your purchase in order to avoid unforeseen maintenance costs.

Before you jump to make an offer on a house that is priced much below market value, find out why. If the septic system overflows the day you move in and raw sewage fills your shower, you won't be getting a great deal. Often, really cheaply priced homes have costly issues that need to be fixed. To ensure that you know exactly what you're receiving before you buy, take the time to employ experienced inspectors.

Purchasing a home through a for-sale-by-owner (FSBO) may seem like a great way to save a few thousand dollars in agent costs, but you may wind up having more difficulty than you anticipated. Because real estate transactions are complicated, you risk purchasing a home with significant issues with the deed or the construction if you don't have an agent to walk you through the process. Make sure you speak with a real estate attorney before placing an offer on a for sale by the owner (FSBO).

Floors that are slightly uneven can be attributed to normal settling, but if the slope is apparent, it may indicate a foundation issue, a damaged floor joist, or rotten support beams. If there are one or more sloping levels in the house, it makes sense to have a structural engineer inspect the property because fixing structural issues can run into thousands of dollars.

Inspecting a home thoroughly might sound like a daunting task; however, spending enough time to look for issues can save you from high expenses and stressful situations.

Whether you're buying your first house or your third, purchasing real estate will always be stressful. Why? Because there will always be a challenge in the real estate market, such as home prices that are beyond reach, increased mortgage rates, and a shortage of inventory.

Knowing what is ahead and surrounding yourself with experienced individuals who can offer guidance are the keys to making it less frightening.

In recent years, there has been a great deal of fluctuation in the property market. If you're attempting to purchase a property, it's crucial to understand the current status of the housing market since it will affect your capacity to make a successful bid. That said, before you start your journey to buying a home, take some time to educate yourself about the current state of your local market.

A rise in the supply of homes would lessen the pressure on home prices to rise by counteracting the demand from buyers. In addition to lowering the entire upfront costs, a lower home price may also result in a cheaper mortgage payment.

List the things you need and want in your dream home as well as the community you want to live in so you can focus on your search.

Use reputable real estate websites, such as Realtor.com, Redfin, Zillow, RE/MAX, and Trulia to get a sense of the kind of homes that fit your requirements. Take note of the home prices to see if they are within your means. If not, you might have to narrow down your search parameters or make some compromises.

One of the largest financial commitments you will ever make is purchasing a home, so before you start looking at properties, keep your finances in order.

Understand your current financial situation. To assess whether you can afford to make monthly mortgage payments, mortgage lenders will examine your cash reserves, income, and debts as well as obtain a copy of your credit report. A FICO score of 620 or above is typically required by lenders to approve a conventional loan.

You may check your credit report for free from each of the three major credit reporting bureaus: Equifax, TransUnion, and Experian every week at AnnualCreditReport.com. Requesting reports from each agency is a good idea, and you should carefully check over them as there may be inconsistencies or errors in the material.

Look for local real estate brokers and arrange for introductory calls or meetings. It's a good idea to interview a few and choose the agent that is educated about the area you're looking to buy into and suits your personality and communication style. A good real estate agent will assist you learn about the home-buying process, highlight discrepancies between pricing and expectations, and provide you with previously unconsidered information.

Don't just get prequalified, get pre-approved. What's the difference, you ask?

A mortgage pre-approval is a comprehensive process where a lender verifies financial information, such as W-2s, tax returns, pay stubs, assets, and credit to determine what loans you could be approved for, the amount you can borrow, and what your interest rate could be. Prequalification is more similar to an approximate estimate of what you can borrow. This might assist you in determining how much you can pay and show home sellers your seriousness about making the purchase.

In difficult economic times, having a solid credit history and financial profile is especially crucial, as lenders are less inclined to take on customers who pose a larger risk of loan default.

Along with encouraging you to search online for additional properties you might be interested in, your real estate agent will probably show you listings that fit your needs and budget. Although in-person tours are preferred by most buyers, if you are unable or unwilling to see the property, you can still obtain a virtual tour.

No matter what you choose, virtual or personal home viewings, start looking early to stay ahead of the competition. Once the prices decrease, home buyers will start to go out, look for homes, and close deals if you haven't started yet, someone else might have the home you always wanted.

It's time to discuss placing an offer with your agent when you've located the place you want to call home.

To help you decide how much you think the house is worth, check the sale prices of nearby comparable homes that have previously sold. A list of real estate comparables (comps) that illustrate the prices paid by buyers for comparative, previously sold properties in the same neighborhood can be compiled by your agent. This may help you determine the appropriate amount to offer.

When you submit your offer, the seller has three options: accept, reject, or counter. During the pandemic, buyers could not afford to negotiate and sellers maintained control. The good news is that the market is currently somewhat more balanced now compared to the previous years.

Buyers can bargain more to get the best deal possible within their budget, but note that the price of the listings—especially the expensive ones—determines the outcome.

Earnest money is deposited with a third party, such as a real estate broker, law firm, or title business, once your offer is accepted. This money is kept in escrow until closing and can be used toward your down payment or closing fees. Known as a good faith deposit, earnest money signifies your seriousness as a buyer and is often between 1% and 5% of the total cost of the home.

Now that the sale is on hold, it's time to start the due diligence procedure, which includes the home inspection. A house inspection is a qualified inspector's visual evaluation of the property's condition, and the results can assist buyers in making better decisions.

If your purchase offer contains a condition for a house inspection, you may choose to walk away from the deal entirely or bargain for repairs.

You should submit your mortgage application as soon as possible after you get into a contract. Choose a lender who best meets your needs by shopping around and comparing mortgage offers. Your interest rate and the amount you qualify for will be estimated by your lender.

After you're pre-approved, your lender might also provide you with a mortgage rate lock, which is normally good for 60 days or occasionally longer. When interest rates are expected to rise, a rate lock is an excellent idea. However, you cannot simply switch to a lower interest rate if rates fall.

To make sure the agreed-upon sale price is equal to the property's market value, your lender will usually need an appraisal of the asset. The appraisal is frequently included in the overall amount of closing expenses for a house.

A few days before closing, conduct a final walkthrough. This will help you verify that the house is in good condition and/or in the same condition as when the offer was made. For homes that have issues, this will also help confirm if the agreed repairs have been made.

The actual closing process is quite simple and calls for signatures attesting to the ownership transfer. Depending on your state, you may sign documents in person with a representative of your title insurance firm or electronically, if that is permitted.

The actual closing procedure only requires signatures attesting to the transfer of ownership and is rather straightforward. You may sign documents electronically if allowed by your state, or in person with a representative of your title insurance company.

We hope that we've helped you understand the process you need to go through when buying a home. As always, our team at RE/MAX Advanced Realty is here to help. Just send us a message or leave a comment if you have questions about purchasing a property.

One of the most important phases in the home-buying process is closing because it's at this point that the buyer and seller exchange possession of the property. Unless they are performing a dry closing, the seller will often get payment for their house.

When a real estate closing is finished without any money being transferred—including closing costs—it is referred to as a "dry closing." Generally speaking, when the funds are approved but non-transferable, dry closings expedite the closing process for a home or property.

A dry closing will be started by the seller or the buyer, and it commonly happens when the funds are delayed. For instance, the buyer may still need to fulfill a last requirement, which could take some time to accomplish, even though the money for the mortgage has been authorized.

Alternatively, there can be a problem with the property that the seller is attempting to resolve. The buyer and seller decide on a dry closure as an alternative to postponing or canceling the transaction.

A wet closing involves paying the money for the sale of the house all at once and completing the real estate deal. Every real estate contract is signed, and the money is distributed right away. All 50 states allow this kind of closing, which is the most popular.

A dry closing, on the other hand, allows the buyer and seller more time to finish the real estate transaction. They proceed through closing, but until the money is sent, the deal isn't finished. Furthermore, a dry closing is only permitted in some states.

These are the states that allow dry closing:

There are times when a dry closing is more convenient for all parties. However, consenting to a dry closing entails a certain level of risk. This could consist of:

Is it ever a good idea to have a dry closing, assuming that's legal in your state? Perhaps, in light of your circumstances. Dry closings are a way to keep the real estate deal going forward in the event of problems.

Accepting a dry closing offers the lender an extra few days to smooth things out if the money transfer is taking longer than anticipated. Please ensure that you understand the dangers before consenting to a dry closing.

There's no guarantee that the real estate deal will fail if you're contacted regarding a dry closing. In fact, a dry closing can keep things going so that everyone concerned gets what they desire. However, you have to understand what it really means first, what to expect when you choose it, and if it’s the right choice for your situation.

"Make money buying real estate."

"Now's the best time to buy a home."

"Buy houses for pennies on the dollar."

These are the kinds of remarks that people typically relate to foreclosures on real estate. In reality, foreclosures on real estate rarely result in instant financial success. Of course, there are great deals to be taken advantage of but still, it's not gonna offer easy money to anyone. Nonetheless, you can get those possible benefits through a lot of effort and devotion.

In this post, we'll answer the following questions:

What does foreclosure mean?

What are the pros and cons of buying a foreclosed property?

What are the steps in buying a foreclosed property?

So without further ado, let's get started.

Homeowners rarely buy a home outright or in cash. To finance the purchase, they typically obtain a mortgage from a bank or other lender. After that, it is the buyer's responsibility to pay the lender on time.

However, buyers occasionally miss these installments. The University of Illinois lists the following as typical causes:

Divorce resulting in financial strain

Huge medical expenses, especially when the homeowner is uninsured or underinsured

Death of the primary income earner

Loss of source of income (example: job or business)

Liens are legal devices included in all mortgage transactions. The lender's monetary interest in the house is safeguarded by a lien. If the borrower defaults on the loan, it enables the institution to take possession of the asset.

Banks typically assist financially troubled homeowners in attempting to resolve their issues. If those don't work, the bank will use the mortgage contract's lien to foreclose on the house and seize possession of it.

The bank will then either sell the house directly or put it up for auction. There are situations where the present owner will close a short sale. Through this procedure, a buyer can purchase the house at market value, even if that sum is insufficient to pay off the remaining mortgage balance.

Now, the event where the lender or the banker seizes the home, that's is called foreclosure.

Buying a foreclosed home has the following advantages:

Without a doubt, foreclosures typically come with a lower price tag or are priced below market value than other types of real estate. This is because the lenders who set their prices just want to get rid of the property faster.

Compared to regular residences, foreclosure properties may have a different bidding and purchasing procedure. But if the property isn't being sold in a cash-only auction, you might be able to get a loan to buy a foreclosed home.

One may obtain a traditional loan or one backed by the government through the Department of Veterans Affairs (VA), Federal Housing Administration (FHA), or S. financing from the United States Department of Agriculture (USDA) if the house is livable.

Lending secured by the government helps lower the cost of becoming a homeowner. However, the property needs to match the loan's minimal property requirements to be eligible for the loan.

Buying a foreclosed home has the following disadvantages:

There might be a chance that the foreclosed home you're buying has been neglected by its former owners. If that's the case, you might need to not only check the problems but also, spend money to fix them.

Take Note: The primary goal of the lender is to get their money back as soon as possible, which nearly always entails an as-is selling.

If you don't have a lot of money to spend on repairs, you shouldn't purchase a foreclosure.

Just because a house is foreclosed upon legally does not mean it is abandoned. Squatters may be drawn to foreclosed properties since they are sometimes vacant for months or even years. You have the right to evict a squatter who occupies the house if they do. However, evicting them may not be easy. Sometimes, it might take months to complete the eviction and you have to spend thousands of dollars for legal costs.

Here are some questions people commonly ask before purchasing a foreclosed property:

Purchasing a repossessed property comes with risks related to neglect, damage, and property degradation. On the other hand, buying a foreclosed home is beneficial since it lets you save money because you are getting the house at a reduced price.

When determining whether a foreclosure is the best option for you, consider your financial circumstances and ability to make repairs. Because the property might require more work than you anticipated, weigh the risks involved in your investment. Consider all the options carefully before determining if purchasing a foreclosed home is a wise move for you.

Whether purchasing a foreclosed home is a wise investment depends in part on your real estate investing objectives.

For those looking to purchase a home at a reduced price or below market value or keen to restore and customize a property, purchasing a foreclosure may present a special opportunity.

However, you should also consider the disadvantages it might have, such as the amount you might spend fixing the property.

Nonetheless, knowing whether it's the right property for you or not depends on your real estate goals and circumstances. If you decided to pursue a foreclosed property, we’ve written a detailed guide on what to expect when buying a foreclosed home.

No-wake lakes in Indiana offer peaceful boating for water enthusiasts. Flint Lake, Lake of the Four Seasons, and others have "no-wake" policies to keep boat speeds low for kayaking, paddleboarding, and fishing.

The limits protect the ecology, reduce shoreline erosion, and provide a peaceful setting for residents and visitors to enjoy the scenery and pleasure without high-speed watercraft.

The calm charm and conservation efforts of Northwest Indiana's no-wake lakes attract nature enthusiasts and those seeking a quieter, more relaxing boating experience in dramatic scenery.

In the first and second parts, we discussed what are the lakes in northwest Indiana and the Indiana all-sports lakes. So, in this last part, we will tackle what are the no-wake lakes in Indiana.

No-wake lakes, such as Fish Lake in Walkerton, Indiana, give prospective homeowners the chance to live near water and take in the tranquil serenity of the outdoors.

The advantages of this are that no-wake lakes in Northwest Indiana, like Flint Lake and Lake of the Four Seasons, are ideal for kayaking, row boating, or pontoon rides, offering a tranquil, serene environment, making them better suited for individuals seeking a peaceful and quiet setting rather than those desiring high-speed recreational activities, providing better options for those who want to enjoy fishing on a calm lake.

The disadvantage of this is that the popular no-wake lakes such as Flint Lake and Lake of the Four Seasons restrict boating to non-motorized boats, trolling motors, or slow pontoon boats, typically situated in more rural areas, often featuring lakefront homes for sale, making them highly sought-after destinations for those seeking a serene, rural lifestyle within a no-wake lake community.

The following is a list of lakes in Indiana that are considered to be no-wake zones;

Upper and Lower Fish Lakes make up Fish Lake, which is two lakes. Both Upper and Lower Fish Lakes are 273 acres. No-wake lakes prohibit motor boats: trolling or low-horsepower outboard bass boats and pontoons. Lake fishing is permitted.

Few amenities near Fish Lake. This is because the lake is rural. Laporte, 9 miles northwest, and Walkerton, 7 miles southeast of Fish Lake, have various facilities.

Two-bedroom, one-bathroom homes with 1,200 square feet are common in Fish Lake. Those houses offer great value for a Northwest Indiana riverfront home.

(c)

Three lakes comprise the Valparaiso Chain of Lakes, located on the northern edge of Valparaiso, Indiana. There are no wakes in any of these lakes. On the lake, pontoons, non-motorized watercraft, and bass boats with small motors are permitted.

Lake fishing is allowed. Despite being close to one another, the three lakes are not connected. Only two miles north of Valparaiso is the Valparaiso Chain of Lakes. With a population of over 35,000, Valparaiso is a thriving city where you may enjoy all the conveniences of a lake property.

Valparaiso Chain of Lakes waterfront properties are priced widely. Walden, a Valparaiso lakeside luxury area, is famous. Larger, luxurious residences with many bedrooms, bathrooms, and features are available here. Buyers might discover a Valparaiso Chain of Lakes house within their budget.

(c)

So, where in Northwest Indiana is the ideal place to purchase a lake house? Well, just like when choosing a location or property, you have to determine what kind of lake life you want to have. Consider the unwritten rule in purchasing a home, which is to buy a house that meets your needs and preferences and will serve you the best. Nonetheless, here are the most common desired lake life you can check out:

If you've always wanted to live by the lake, Northwest Indiana has many lakefront properties to choose from. The price range, atmosphere, and features vary greatly so if you need help zeroing in on the best options for you, our team at RE/MAX Advanced Realty is here to help!

Call us today or send us a message to get started!

Choosing to become a homeowner might be one of the most thrilling experiences of your life. It's crucial to reflect on a few things and learn how to strike a balance between your requirements and goals as well as your budget before moving forward. To help you choose the ideal property at a price you can afford, we've put together important tips on house hunting that helped our clients find their dream homes.

Following these house-hunting tips can help you start and feel assured. Here are the five best tips when house hunting you may consider:

Determine how much you can afford to spend on a home before you start looking. To determine how much of a mortgage payment you would be comfortable with, use a budget calculator. Remember that there are other expenses you will have to pay each month as a homeowner besides your mortgage. Don't forget to include the following in your budget:

To determine your monthly payments depending on variables such as the cost of the house, the down payment, the length of the loan, and the interest rate on the mortgage, use a mortgage calculator.

Make sure you obtain a preapproval letter—as opposed to a prequalification letter—to receive first mortgage approval. Examining prequalified versus preapproved is important.

Prequalification letter: Based on an oral confirmation of your income and credit score, a lender will tell you roughly how much you can pay when they declare you're prequalified for a given amount.

Preapproval letter: A mortgage lender's preapproval letter outlines the maximum loan amount you are eligible for. Because lenders base their calculations on official documentation, such as your bank records, W-2s, and credit reports, it carries more weight than a prequalification letter.

Many real estate agents won't work with you until you have initial mortgage approval, even if you have a prequalification letter.

Prioritizing may be necessary when looking for a home to ensure you get off to a good start. We advise you to start making a list of every space you envision for your home. After that, list the characteristics you wish each room to have, room by room.

These qualities could be divided into three groups: deal-breakers, nice-to-haves, and must-haves. After you've finished designing each area, think about the essentials and luxuries for the entire house.

A must-have is something you absolutely cannot live without in your house and is one of the items you will use to weed out properties that are unfit for habitation. For example, you might require plenty of garage space for extra storage, a well-lit room for your remote home office, or three bedrooms to accommodate your family.

You'll be able to sort through real estate listings more quickly if you have a list of necessities. Perhaps you've found what appears to be the ideal house in every sense, but it's miles away from the closest school and lacks a backyard. For those who have a large family, small children, and a dog, having access to outside space and being close to a school will be essential.

However, you might want to keep the house on your list as a prospective alternative if it doesn't currently contain one of your must-haves but has the room or remodeling potential to make it happen.

Goodies are desires, not necessities. These are the kinds of characteristics you'd like to have in your house but aren't really that important. A spiral staircase, a firepit, modern appliances, or a backyard pool may be features you'd like to see in your new house, but overall, these are probably not must-haves.

Having a list of desirable features is advantageous since it can aid in your decision-making process once you've reduced the number of residences on your shortlist.

Get a sense of the local real estate market by looking through homes for sale on the internet or via a mobile app. Websites dedicated to house hunting can help you get a closer look at what your area's typical home sells for and a more accurate notion of the kind of property you can afford.

You can investigate possible communities for schools, shops, crime rates, and other factors by conducting online research on properties. Applications can facilitate process optimization by offering arranged access to listings.

Make a price comparison between your budget and what you see in the market. Next, jot down a few addresses and get in touch with your realtor or the real estate firms that represented the houses you've had your eye on.

A reputable real estate agent, often known as a REALTOR®, is an authority in your community and can ease the stress and anxiety associated with house hunting. In addition to helping you focus your search and show you more properties than you could possibly see on your own, they may also assist you make the most financial decisions.

Instead of only attempting to steer you toward the largest sale and commission, a competent real estate agent or REALTOR® will also carefully examine your unique needs when they select properties to show you.

A professional who has completed the required licensure exams to conduct real estate business in your state is known as a real estate agent.

On the other hand, Members of the National Association of REALTORS® are licensed real estate brokers or REALTORS®. They have to be in the market, have a current real estate license, follow a tight code of ethics, and have a spotless record of professional conduct.

Both can be quite beneficial while looking for a home. Collaborate with a real estate agent that holds the designation of Certified Buyer Representative (CBR) or Accredited Buyer's Representative® (ABR®). A professional with a real estate broker license, which indicates they have completed further real estate coursework, is another option for you to think about.

Prior to making a decision, interview a few prospects and request recommendations from prior house buyers. Given the amount of time you will be spending together, pick an agent whose personality complements yours and be up forward about your wants and expectations.

A lot of sellers let anyone to come inside and take a tour of their homes during open houses. Additionally, you can schedule in-person showings with your preferred real estate agent.

Be a little curious when you're looking at a house. Verify the functionality of kitchen appliances, showers, toilets, and outlets. If you choose to purchase the house, make a mental list of any repairs or replacements you might wish to request from the seller.

Finding the right house takes time and effort. However, you can make it seamless and less stressful by considering the basics, such as determining your budget, acquiring mortgage approval from your lender, and even working with a real estate agent.

If you need help with house hunting in Indiana, our team at RE/MAX Advance Realty is just a message away! Call us now at 317.298.0961 or leave a comment to get started.

For lakefront living, northwest Indiana Lakes has beautiful Lake Michigan waterfront houses for sale that you can consider. These properties along the shoreline offer quiet and recreation along with stunning views. Meanwhile, lakeside life provides boating, water sports, and sunset strolls.

From modest cottages to magnificent houses, the region's real estate market offers a distinct seaside experience. However, if you're looking specifically for Indiana all-sports lakes, this post is made specially for you!

Boaters often find their nirvana on Indiana all-sports lakes like Pine Lake, located in LaPorte County, Indiana. However, it might be a living hell for people who are looking for nothing more than peace.

Therefore, it's important to weigh its pros and cons first before moving to this area.

The disadvantages of living on Indiana all-sports lakes are that Northwest Indiana Lakes, featuring lakefront homes for sale, offer vibrant recreational opportunities; however, they might experience congestion during high-traffic summer weekends and holidays, potential interruptions due to varying lake usage, and noise from boats and bustling lake activity.

Below are the Northwest Indiana Lakes that offer water sports and activities;

Pine Lake is clean, public, and allows boating. It has many shoreline real estate opportunities. Pine Lake is open to boating, non-motorized watercraft, and fishing. Pine Lake is an all-sports, recreational lake with faster motorboats.

Parks, parking, and the lake are near LaPorte, Indiana, a thriving 22,000-person community. In LaPorte, you may find lake house amenities. Pine Lake waterfront homes usually have docks in the back. Rent dock space at a small marina on the east side of the lake. Lastly, the lake's south end has a public boat launch.

(c)

Being further east than Pine Lake, Hudson Lake is an all-sports lake that won't be as crowded as others. This lake allows motorboats, bass boats, and pontoons. Water skiing, tubing, kayaking, and fishing are lake activities.

Also prohibited: motorized watercraft. A 1,200-person town, Hudson Lake. Around 1,800 people live in nearby New Carlisle. Hudson Lake is a South Shore Commuter Rail stop. This link connects this hamlet to downtown Chicago and South Bend.

Hudson Lakefront residences exist. Some homes have five or more bedrooms over 5,000 square feet, while others have two bedrooms and one bathroom.

(c)

Shorewood Forest near Valparaiso, Indiana, has upscale houses and Lake Louise, a private lake. Shorewood Forest is great for daily boating recreation. Private Lake Louise. Lake access is available to residents and guests with a residency.

The lake is all-sports with careful management. Bass boats, jet skis, pontoons, and motorboats are allowed. Kayaks are permitted, but not motorized boats. A bustling 35,000-person Valparaiso, Indiana, borders the area. Every city amenity is in Shorewood Forests. Additionally, the community offers a splash pad, pool, sports courts, walking trails, beach, and dog park.

Shorewood Forest seems like home, not lake life, despite the lake being the neighborhood jewel. Year-round inhabitants predominate. Many enormous homes are in this neighborhood. Homes average four bedrooms, three bathrooms, and approximately 3,700 square feet.

(c)

Central Lake County, Indiana's Cedar Lake is an all-sports public lake. Closer towns with additional facilities include Crown Point, Indiana. Cedar Lake is a lake for various activities. Motorboats, bass boats, jet skis, and pontoons are allowed. Lake non-motorized boating is allowed. Fishing is permitted. Several medium-sized cities nearby provide greater shopping and other facilities.

Cedar Lake homes for sale vary in size, features, and price. The range of Cedar Lake homes available year-round includes two-bedroom, one-bathroom homes on 1/10 acre lots to luxury homes with over five bedrooms and over 5,000 square feet. Most Cedar Lake, IN homes have three bedrooms and three bathrooms.

(c)

The Lake Dalecarlia Property Owners Association manages the private, all-sports reservoir lake. Motor boats, pontoons, and bass boats are allowed on Lake Dalecarlia. Everyone must follow the property owners association's boating restrictions.

Crown Point, 7 miles north, is a medium-sized city with all amenities. Lake Dalecarlia prohibits non-resident boating. The Lake Dalecarlia Property Owners Association requires watercraft registration.

Searching for Lake Dalecarlia, Indiana, lakefront homes only yields residences. Homes ranged from 1,000 square feet of two-bedroom, one-bathroom to 3,440 square feet of six-bedroom, four-bathroom Lots averaging 6,000–12,000 square feet.

(c)

Lake Bass is a public all-sports lake. Motorboats, pontoons, jet skis, and non-motorized watercraft are allowed. Fishing is permitted. Bass Lake is rural; therefore, shopping and conveniences are scarce. About 4,000 people live in Knox, Indiana, 4 miles north of Bass Lake.

Knox, Indiana, has Bass Lake lakefront houses. Bass Lake waterfront homes often include three or four bedrooms and two to three baths. Homes average 2,100–2,400 square feet. There are also many smaller and larger homes. Lots are more significant than in many lakefront communities.

(c)

The second-largest lake in Indiana is Lake Maxinkuckee. This NW Indiana public all-sports recreation area has homes for sale. Motorboats, pontoons, jet skis, and non-motorized watercraft are allowed on Lake Maxinkuckee, an all-sports lake.

Culver, Indiana, has 1,353 residents. The village has restaurants, parks, and a marina. The town hosts the world-renowned Culver Military Academy. Plymouth, Indiana, 13 miles north of Culver, has additional amenities.

Northwest Indiana's most costly lakefront residences are on Lake Maxinkuckee. The most prominent homes can cost more than Lake Michigan lakefront residences. Lake homes vary in size and features. East-side Lake Maxinkuckee homes are among the most expensive.

(c)

These are just some of the all-sports lakes you can check out when you want a lakefront property as your next home. We’ve created another post with all the information you need about no-wake lakes in Northwest Indiana so be sure to visit our website today!

Planning to move to Indiana or do you just want to know the Hoosier State even more? If yes, then allow us to give you more idea of what Indiana is like.

Other than The Indy 500, its vast farmlands, agricultural products, and the University of Notre Dame, Indiana is also home to beautiful lakes.

So if you're planning to relocate to a lakefront property, it's good news as there are tons of locations to choose from.

Life on a large lake is risky, and getting on the water may be difficult. However, it comes with some advantages too, so before you decide to buy a lakefront property, weigh its pros and cons first.

If you're eyeing a home along Lake Michigan in Indiana, there are various communities in the Northwest to choose from, each offering something unique:

About sixty miles southeast of Chicago's downtown lies the 32,000-person city of Michigan City. Along Lake Shore Dr., waterfront real estate buyers can find beachfront Michigan City homes for sale.

Only seven Lake Michigan lakefront home transactions, ranging in price from $725,000 to $3,000,000, have been recorded to the GNIAR MLS since 2021.

From west to east, there are three distinct neighborhoods in Michigan City, Indiana, that provide waterfront real estate for sale: Sheridan Beach, Shoreland Hills, and Duneland Beach.

Washington Park and the Michigan City Marina are the nearest locations to Sheridan Beach. Homebuyers may anticipate a completely beachside setting here, along with easy walking access to parks, the marina, the Michigan City Zoo, and a few local eateries.

Shoreland Hills is located further east and is not close to any amenities by foot. Still, there are actually very few lakeside residences that are listed as being in Shoreland Hills.

Last but not least, purchasers might discover a Michigan City lake house in Duneland Beach for sale. Except for one thing, all of the properties in Duneland Beach are waterfront. Indeed, they are lakefront, but they are situated on the south side of Lake Shore Drive since the beach is owned by the neighborhood association, which has a building prohibition. Duneland Beach lakeside homes are, well, lakefront, but you have to cross the street to get there. From properties along Lake Shore Dr., there are unimpeded views of the lake since you see across the bare beach that you and approximately 150 other residents jointly own.

(c)

In the Indiana bedroom community of Long Beach, buyers can find homes for sale that are located on Lake Michigan. This community also has 2.3 miles of Lake Michigan shoreline. This encompasses Moore Road and Lake Shore Drive from about west of Blanchard Ct. Michigan City, which encircles Long Beach to the west, south, and east, has all the amenities that are required. Long Beach is a good place to seek a lakeside house for sale in Michigan City.

Six Lake Michigan beachfront Long Beach houses, with prices ranging from $1,225,000 to $2,290,000, have sold through the GNIAR MLS since 2021. Long Beach waterfront properties for sale usually offer 2,300 to 5,000 finished square feet, three bedrooms, and two bathrooms. The dimensions of lots vary from 7,000 to 25,000 square feet.

(c)

Beverly Shores in north east Porter County offers Lake Michigan lakefront residences. This 600-person bedroom community is called Beverly Shores. Connected to downtown Chicago by the South Shore Commuter Rail Line, it has minimal amenities; however, Michigan City and Chesterton have everything.

Purchasing a waterfront property in Beverly Shores, Indiana, is less expensive than Long Beach or Michigan City. The waterfront in Beverly Shores was selling for between $522,000 and $875,000; however, this is not true lakefront real estate.

The houses near the lake in Beverly Shores are all located on the south side of Lake Front Drive, which runs parallel to the lake. You must therefore go across the beach and cross the roadway to get to the ocean. In essence, residences on the lake do not actually own the lakefront.

A marina is not present in Beverly Shores. Alternatively, locals can take a boat out from Michigan City's marina, which is about four miles distant. On the other hand, Beverly Shores is close to several protected areas, such as Indiana Dunes National Park. For those who enjoy the outdoors, this adds significantly to the value of Beverly Shores, Indiana, real estate.

(c)

About 1,200 people live in Ogden Dunes, Northwest Porter County, 40 miles from downtown Chicago. A bedroom community surrounds Lake Michigan, Ogden Dunes has trails, parks, and protected places nearby. The South Shore Commuter Rail Line stops at Ogden Dunes. Chesterton and Portage, Indiana, offer more amenities.

In Ogden Dunes, Indiana, real estate buyers can acquire lakefront homes on Lake Michigan. Recently, the price range for beachfront properties in Ogden Dunes was $860,000 to $1,250,000.

Shore Drive runs parallel to the shoreline, and on its northern side are lakefront residences. However, in Ogden Dunes, erosion has reduced the amount of beach in recent years.

Ogden Dunes does not have a marina where one could launch a boat onto Lake Michigan.

(c)

In Gary, Indiana, there is a neighborhood called Miller Beach on the northeast side. This is where purchasers may find beach houses for sale in Miller.

The population of Miller Beach ranges between 9,000 to 10,000. Because Miller Beach has so few amenities in reality, Gary and Portage, Indiana, subsidize the region. There is a stop on the South Shore Rail Line that connects Miller Beach to downtown Chicago. The Loop is 35 miles southeast of Miller Beach. The Miller Beach marina is nonexistent.

Depending on its size and amenities, lakefront Miller Beach real estate often sells for between $600,000 and $1,400,000.

These are just some lakefront locations in Indiana. Watch out as we list down the All-Sports Lakes in Northwest Indiana.

(c)

Are you ready to upgrade your kitchen into a haven for anybody who enjoys cooking? If yes, do not look any further!

If you're considering renovating your kitchen, you should know what styles are trendy right now for this room that serves as the center of your home. Whether you want to make significant changes to your kitchen or a few adjustments, these creative renovation kitchen ideas will motivate you to think outside the box.

Here are nine renovation kitchen ideas you can think of if you want to upgrade your kitchen:

In recent years, many homeowners are choosing to open up the space in their kitchens. An entirely open-concept kitchen, where no wall divides the kitchen from an adjacent space, is the preferred design for 64% of homeowners remodeling their kitchens. Enhancing entertainment potential and increasing functionality are the two most often mentioned reasons for designing an open-concept area.

There are a lot of renovation kitchen ideas that involve substantial structural work, but most of them are centered on changing the room's design. 45% of homeowners upgrading their kitchens redesign the layout, and 43% modernize their systems. Alterations to the ceiling height and reorganization of the flooring are two examples of these modifications.

Appliances that are equipped with high-tech features are becoming increasingly popular among homeowners. Some homeowners upgrading their homes prefer home appliances connected to Wi-Fi.

In comparison, some choose devices that can be operated using a smartphone or tablet. Meanwhile, some homeowners would replace all their appliances simultaneously during a makeover rather than just a handful.

The most frequent reason given by homeowners renovating their kitchens is to meet the needs of elderly family members. A few suitable kitchen modifications for the age include rounded counters, pullout cabinets, more lighting, broad drawer pulls, and non-slip flooring.

During a renovation, many homeowners change the backsplash in their kitchen. Engineered quartz is the most preferred material for backsplashes, followed by ceramic or porcelain tile. However, natural stone materials like granite, quartzite, and marble are equally popular among homeowners.

A larger kitchen island gives you more room for cooking and hosting guests, so many homeowners choose to expand their islands. Forty-two percent of homeowners remodeling their kitchens design seven-foot or longer kitchen islands.

More color will be in the kitchen this year, especially on cabinets. Kitchen cabinets in wood and green are growing, but white is still the most popular. Wood tones are most famous for bottom cabinets, followed by blue for island cabinets.

Organization is becoming increasingly important because people desire kitchens that are functional for them. Cutlery and utensil organizers, spice racks, and cookie sheet organizers are among the features that are becoming more and more popular.

Your kitchen's lighting creates a mood. Recessed lighting is still homeowners' first option when remodeling their kitchens. Some homeowners choose pendant lights, although under-cabinet lights are also trendy.

Check out these best kitchen renovation ideas to turn your kitchen into a gastronomic paradise. Elegant rustic themes to sophisticated modern designs fit any taste. Prepare to maximize the renovation kitchen ideas' beauty, functionality, and personal style.

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224