As we reach the midpoint of the year, the Central Indiana single-family homes market continues to display dynamic shifts across its counties. From the bustling urban landscapes of Hamilton County to the scenic retreats of Brown County, each area offers a distinct perspective on the current housing market. This is our interpretation based on the data provided by MIBOR Market Insights, examining trends observed from May 2024 to June 2024 and providing a comparative look at year-over-year data from June 2023 to June 2024. Whether you're a prospective buyer or seller, understanding these trends is essential for making informed real estate decisions in today's evolving market.

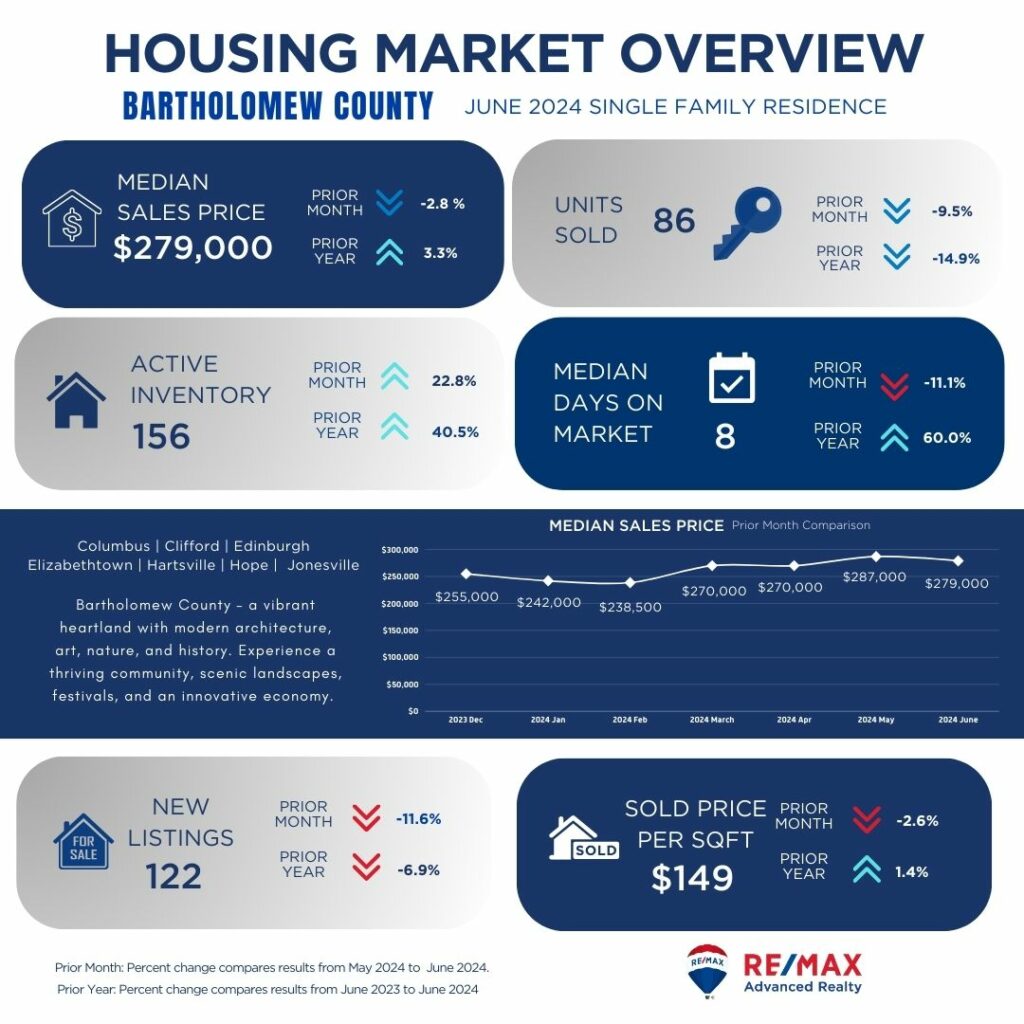

Bartholomew County shows a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The decrease in units sold suggests a slower market pace, providing buyers with more negotiating power. Active inventory has increased, offering buyers more choices, although fewer new listings may limit options. Properties are selling quickly with a low median days on market, indicating continued demand despite some price fluctuations.

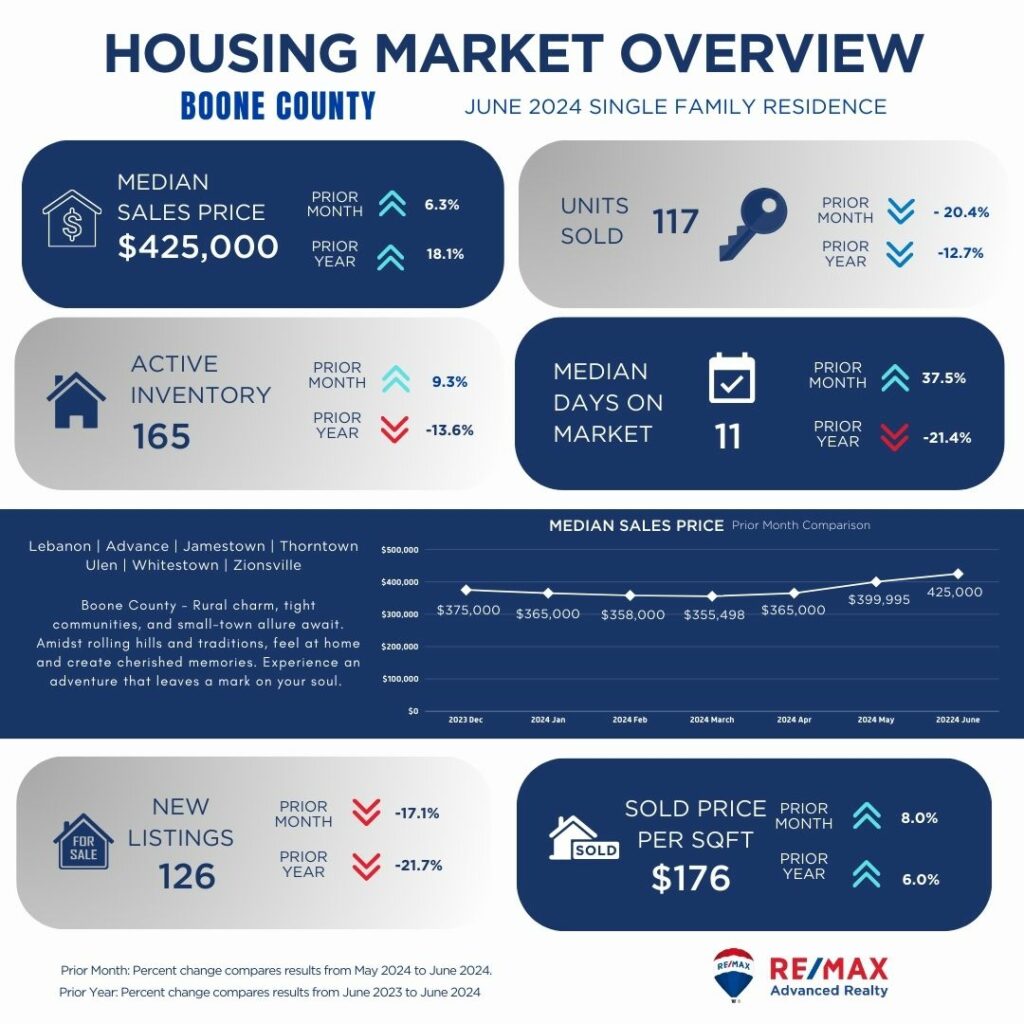

Boone County demonstrates a strong market with a significant increase in median sales price month-over-month and year-over-year, reflecting rising property values. However, the decrease in units sold indicates a slower market pace, potentially due to increased prices and limited inventory growth. Active inventory has risen slightly, but fewer new listings may constrain buyer options. Properties are selling quickly with a low median days on market and an uptick in price per square foot, suggesting continued demand in a competitive market.

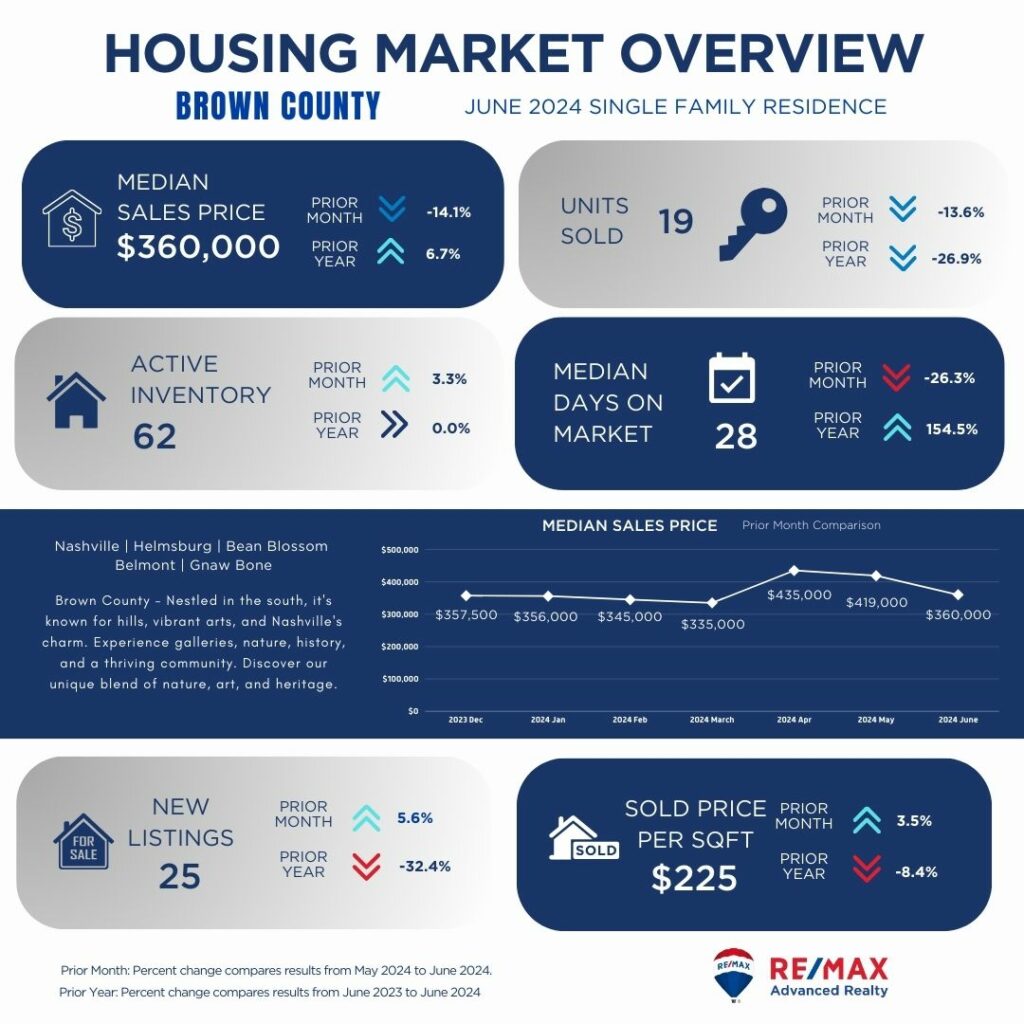

Brown County shows a mixed market with a notable decrease in median sales price compared to the previous month but an increase year-over-year. The decline in units sold suggests a slower market pace, which could provide buyers with more negotiating opportunities despite a stable inventory. Median days on market have decreased significantly, indicating properties are selling faster, but fewer new listings may limit buyer choices. Price per square foot has also decreased slightly, potentially offering buyers more affordable options in this market.

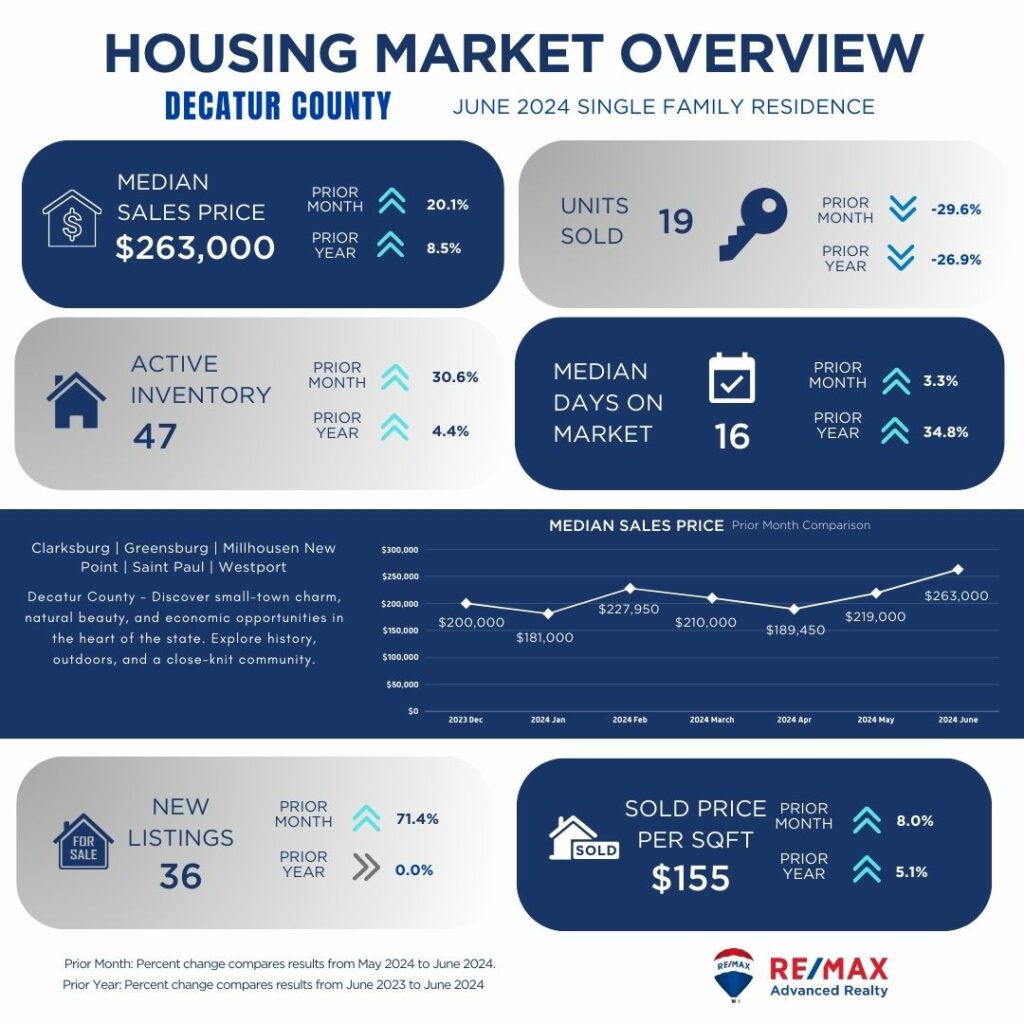

Decatur County displays a strengthening market with a substantial increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The increase in new listings further supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

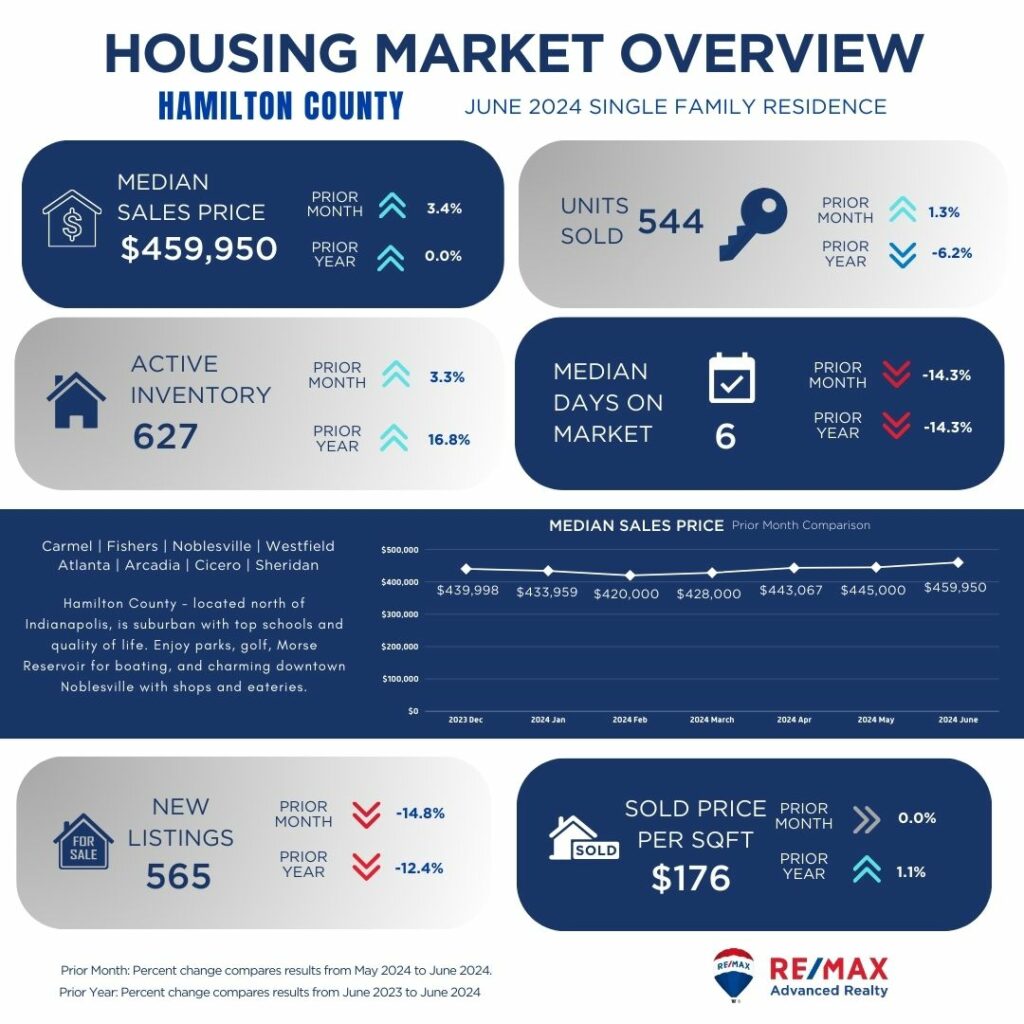

Hamilton County maintains a robust market with a slight increase in median sales price compared to the previous month and stable growth year-over-year. Despite a modest decrease in units sold, active inventory has grown, giving buyers more choices. Properties are selling quickly with a low median days on market, reflecting continued demand. However, fewer new listings may limit buyer options despite a stable price per square foot, indicating a balanced market with steady growth in property values.

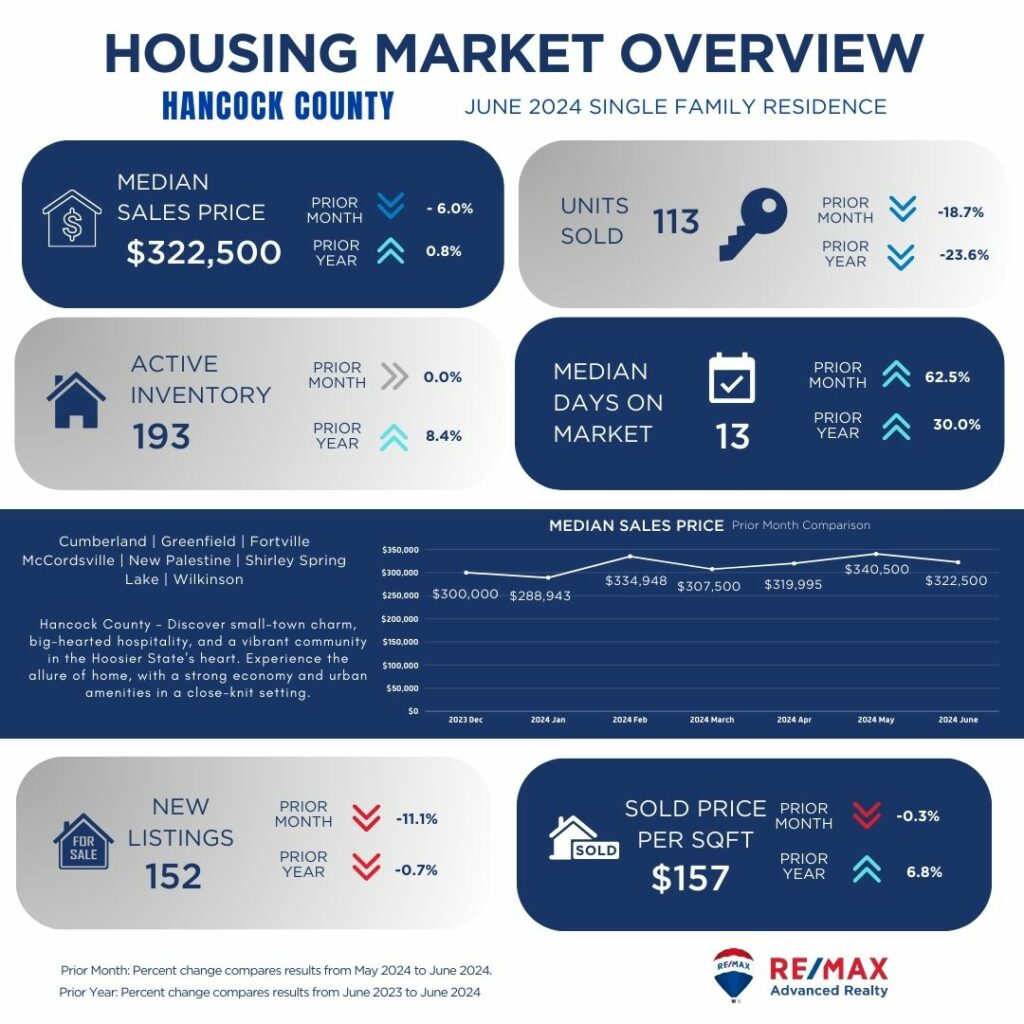

Hancock County shows a steady market with a decrease in median sales price compared to the previous month but a slight increase year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating power despite stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may limit buyer choices, although the slight decrease in price per square foot could offer opportunities for affordability.

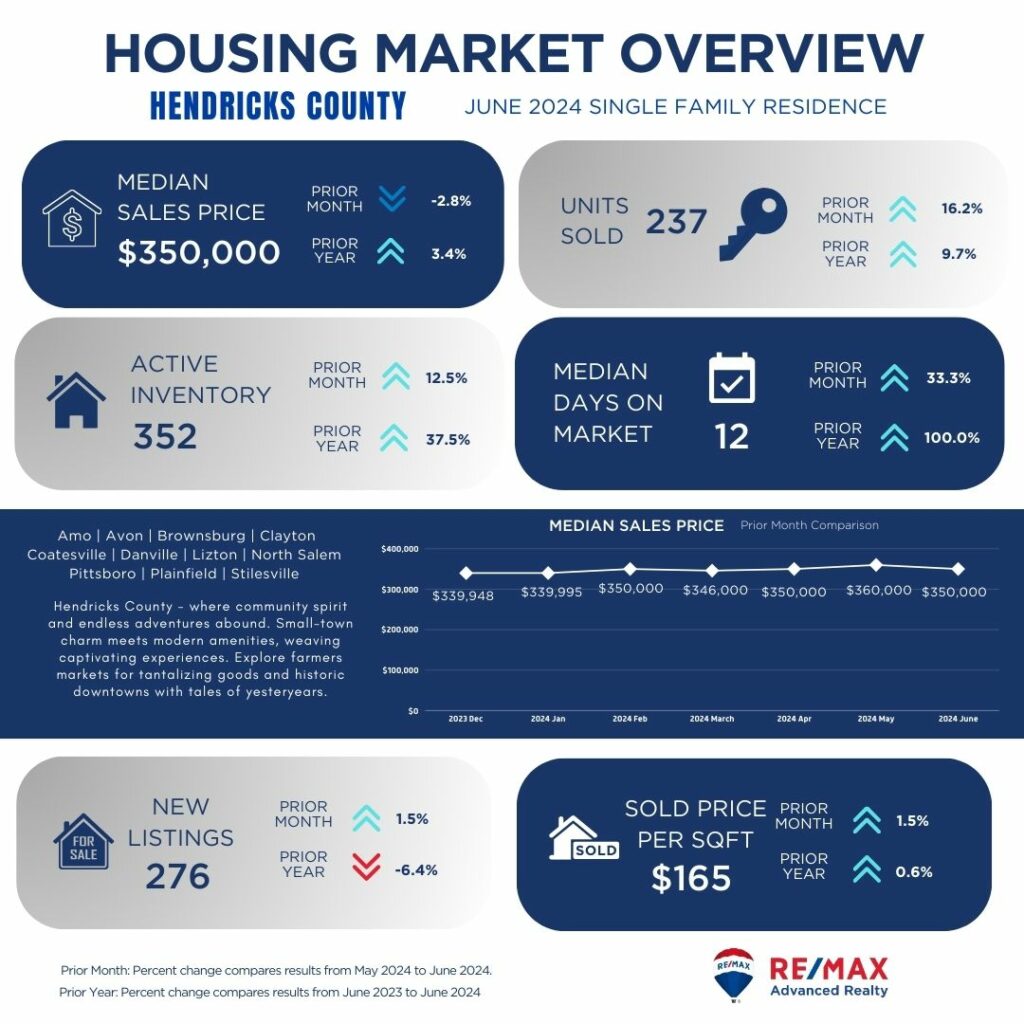

Hendricks County demonstrates a stable market with a slight decrease in median sales price compared to the previous month but a modest increase year-over-year. The increase in units sold suggests continued demand, supported by a growing active inventory. Properties are selling quickly with a low median days on market, indicating a competitive market environment. The slight increase in price per square foot reflects rising property values, potentially benefiting sellers despite fewer new listings limiting buyer options.

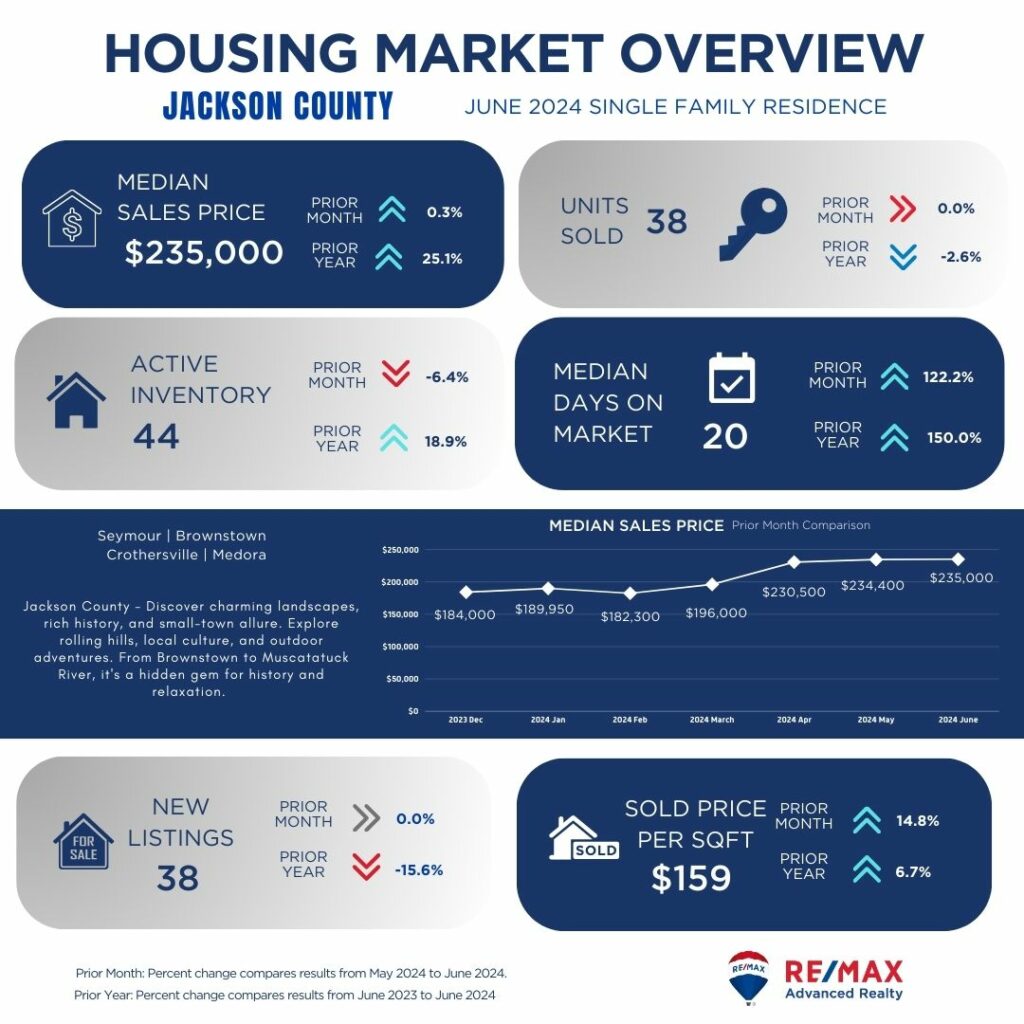

Jackson County shows a resilient market with a stable median sales price compared to the previous month and significant growth year-over-year. Despite a slight decrease in units sold, active inventory has remained stable, providing consistent buyer options. Properties are selling relatively quickly with a moderate median days on market, suggesting steady demand. However, fewer new listings may restrict buyer choices, although the increase in price per square foot indicates rising property values, benefiting sellers.

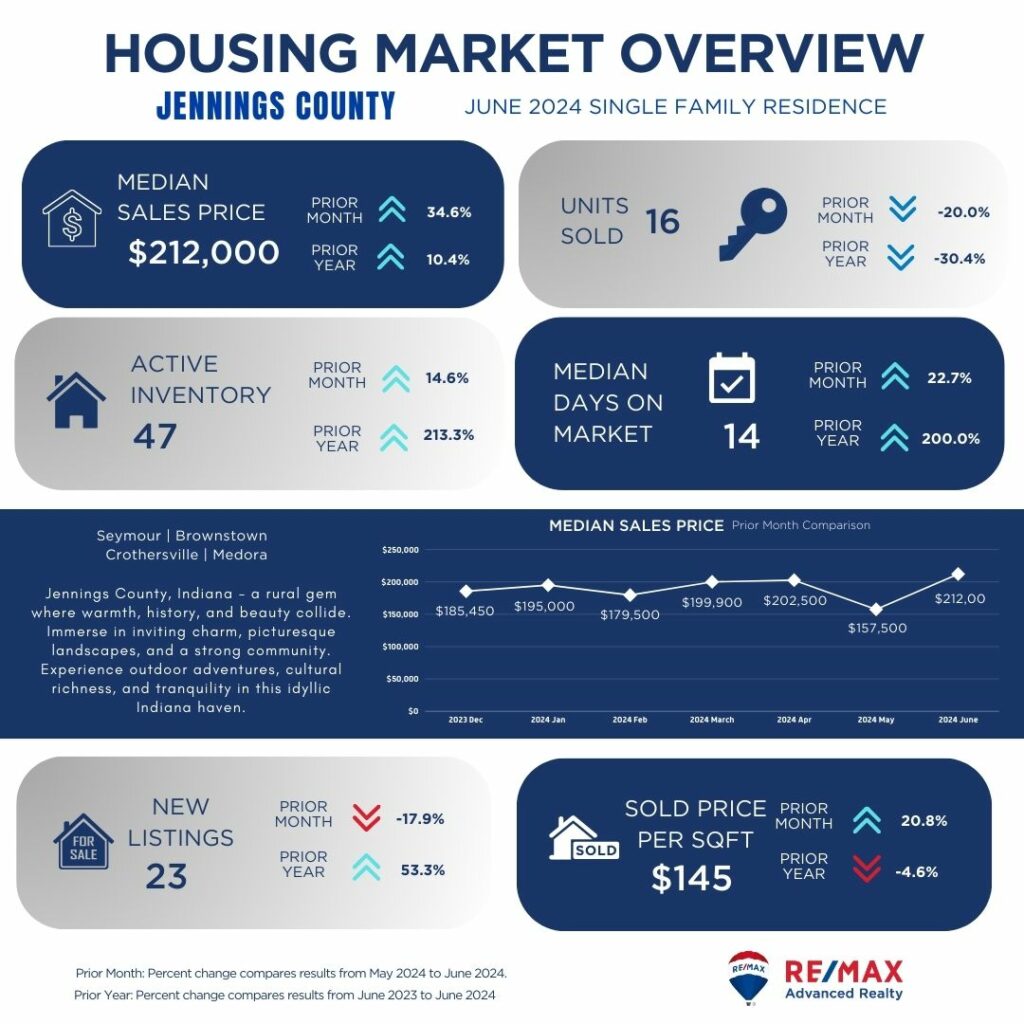

Jennings County displays a strengthening market with a notable increase in median sales price month-over-month and year-over-year. Despite a decrease in units sold, active inventory has expanded significantly, offering buyers more choices. Properties are selling relatively quickly with a moderate median days on market, indicating strong demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

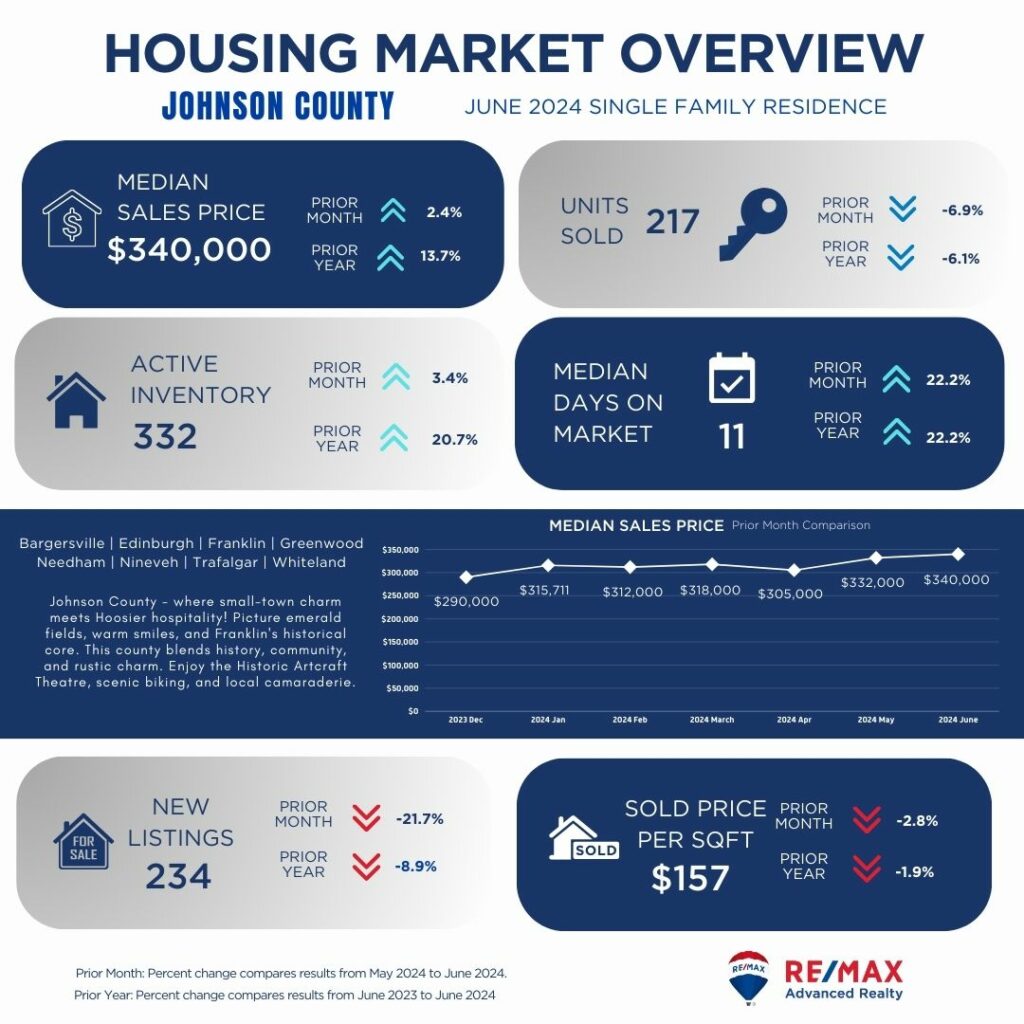

Johnson County maintains a stable market with a slight increase in median sales price compared to the previous month and steady growth year-over-year. Despite a decrease in units sold, active inventory has grown moderately, providing buyers with more options. Properties are selling quickly with a low median days on market, reflecting continued demand. Fewer new listings may limit buyer choices, although the stable price per square foot indicates a balanced market with steady property values.

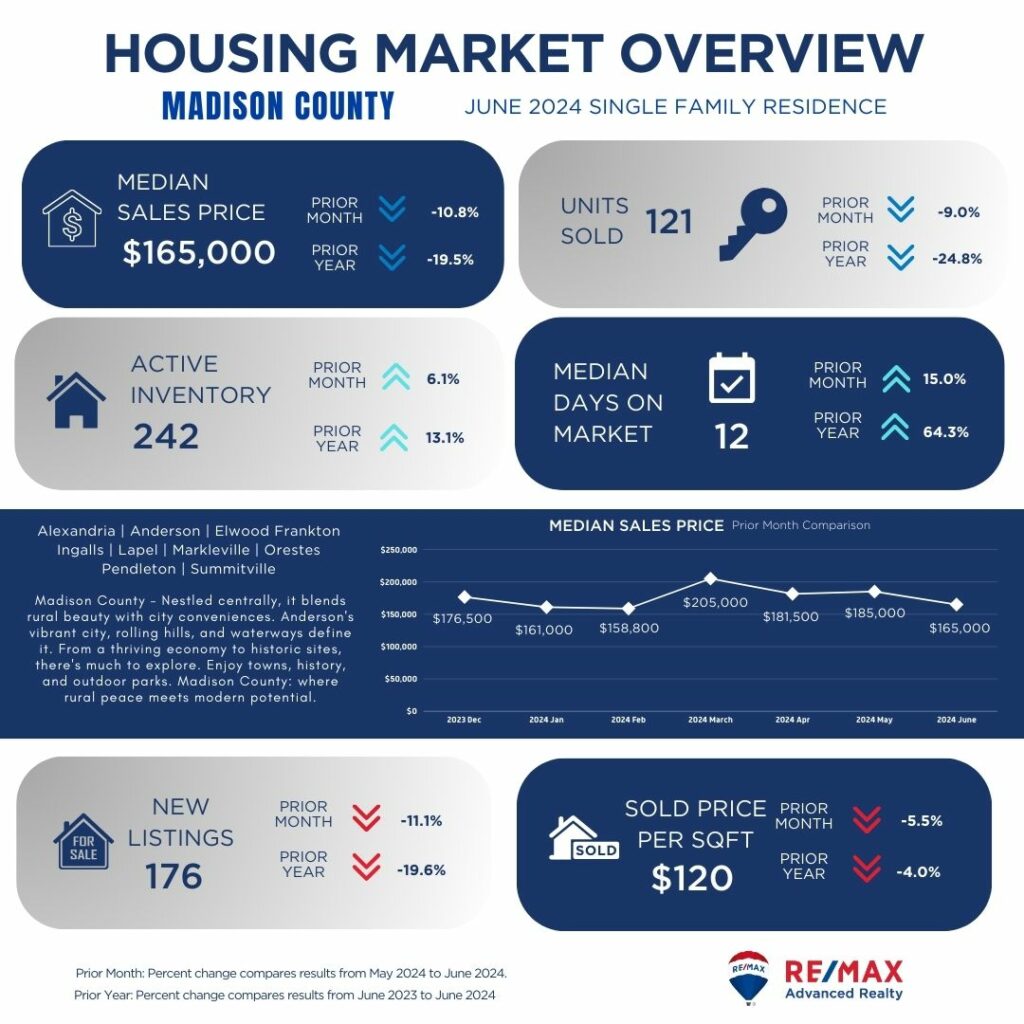

Madison County shows a varied market with a decrease in median sales price compared to the previous month and year-over-year. The decline in units sold suggests a slower market pace, potentially giving buyers more negotiating opportunities despite a stable active inventory. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. Fewer new listings may constrain buyer options, although the slight decrease in price per square foot could offer affordability in this market.

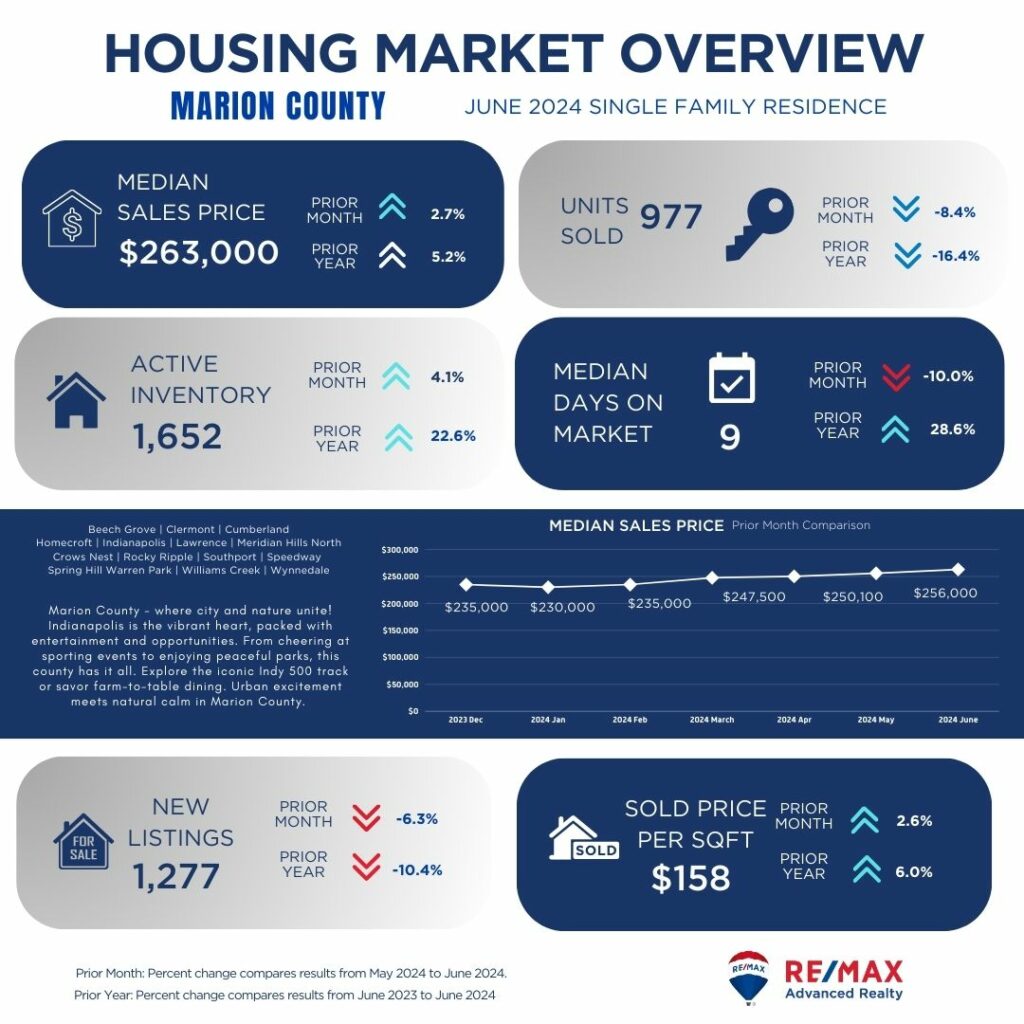

Marion County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, reflecting consistent demand. However, fewer new listings may limit buyer options, although the stable price per square foot indicates a balanced market with steady property values.

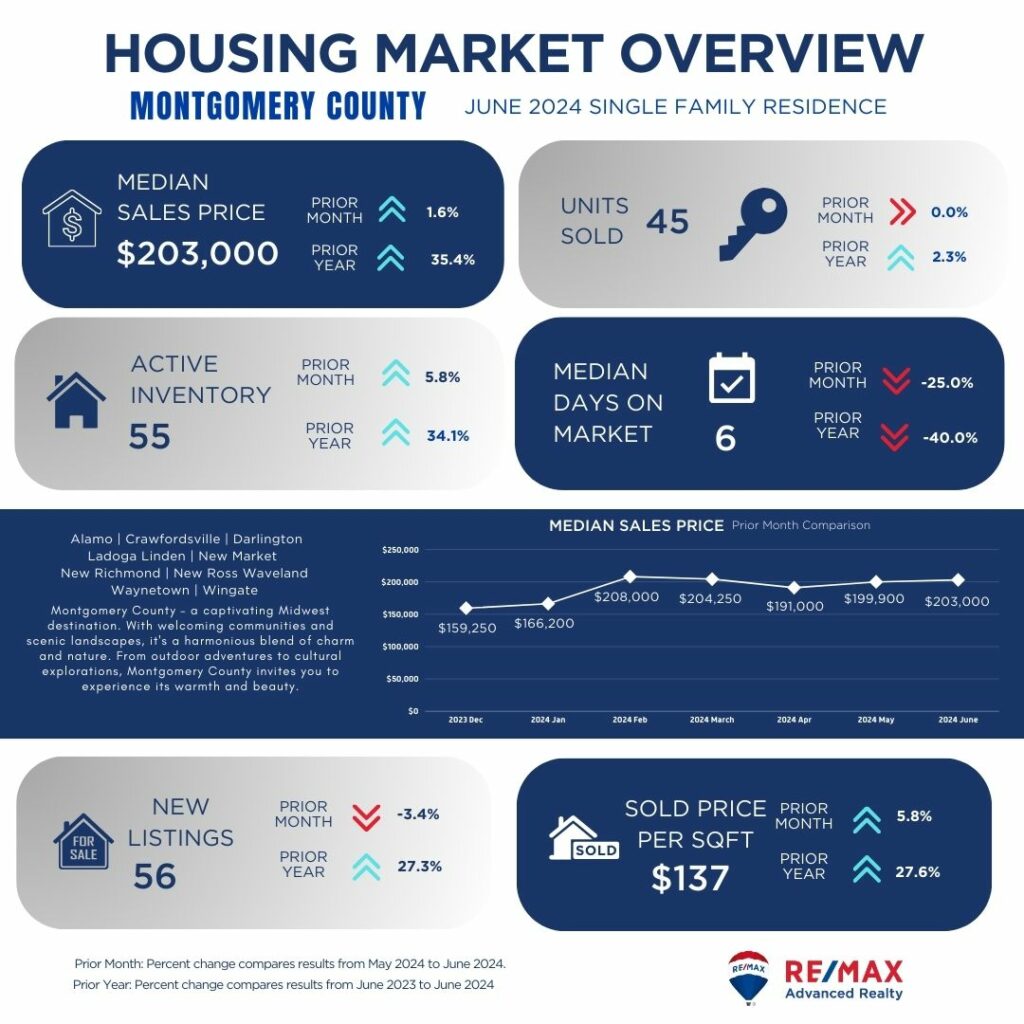

Montgomery County shows a stable market with a slight increase in median sales price compared to the previous month and strong growth year-over-year. Despite a slight decrease in units sold, active inventory has grown, offering buyers more options. Properties are selling relatively quickly with a low median days on market, indicating steady demand. The increase in new listings supports market activity, although the rise in price per square foot suggests increasing property values, potentially benefiting sellers.

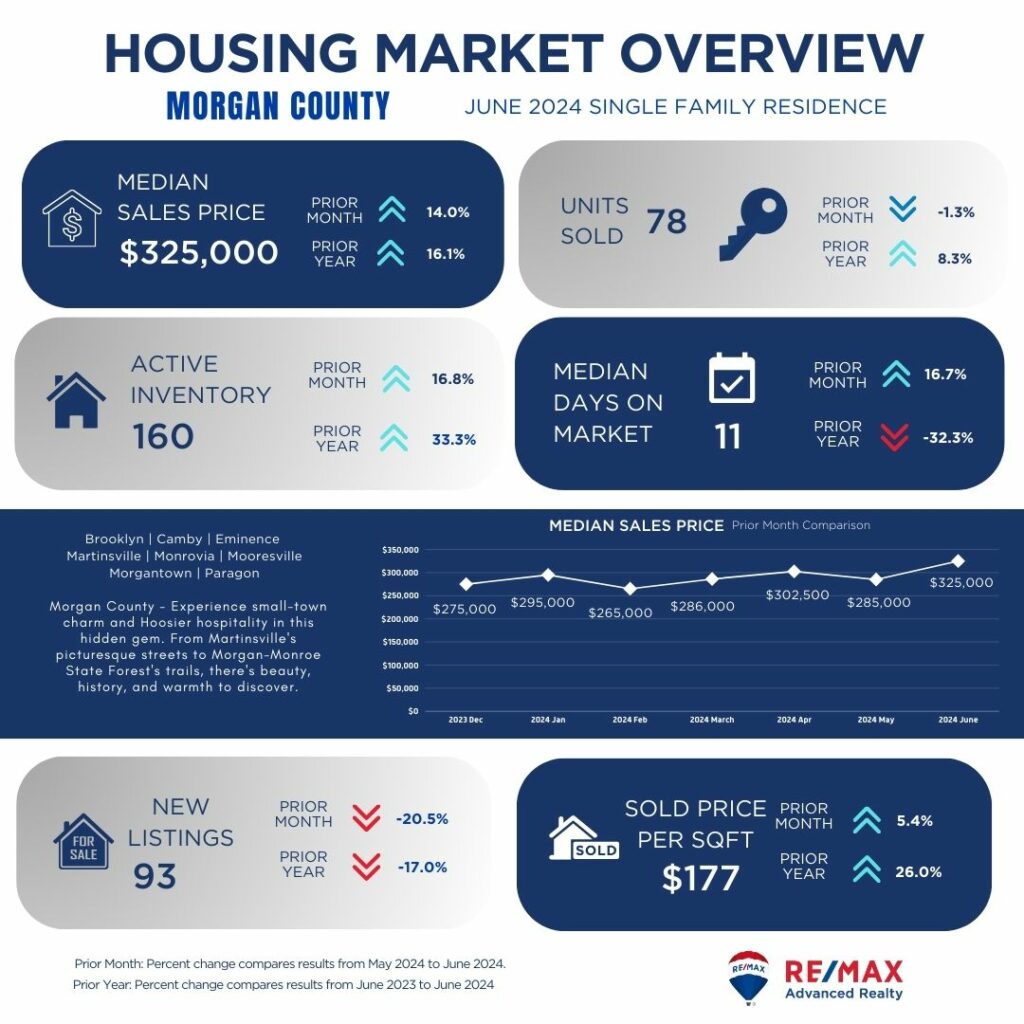

Morgan County displays a robust market with a notable increase in median sales price month-over-month and year-over-year. Despite a slight decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a low median days on market, indicating strong demand. The decrease in new listings may limit buyer options, although the increase in price per square foot reflects rising property values, potentially benefiting sellers.

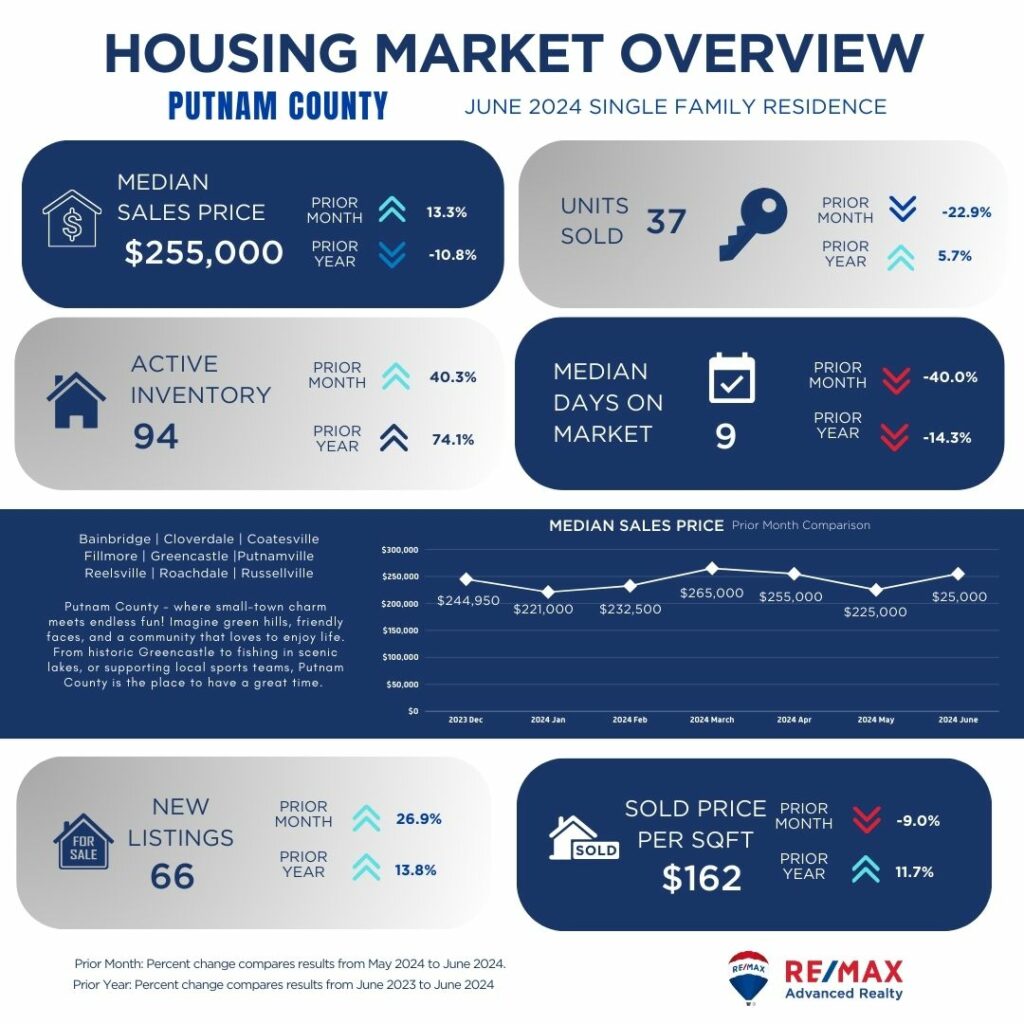

Putnam County shows a stable market with a slight increase in median sales price compared to the previous month and a decrease year-over-year. Despite a decrease in units sold, active inventory has grown significantly, offering buyers more options. Properties are selling relatively quickly with a moderate median days on market, indicating steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially attracting buyers.

Shelby County demonstrates a stable market with a slight increase in median sales price compared to the previous month and moderate growth year-over-year. Despite a decrease in units sold, active inventory has expanded, providing buyers with more choices. Properties are selling relatively quickly with a moderate median days on market, reflecting steady demand. The increase in new listings supports market activity, although the decrease in price per square foot suggests affordability, potentially benefiting buyers.

As we conclude our county-by-county analysis of the Central Indiana single-family homes market, it's evident that each area presents unique opportunities and challenges for buyers and sellers alike. From the rapid pace of Hamilton County to the steady resilience of Boone County and beyond, understanding these trends is crucial in navigating your real estate journey.

Looking ahead, the remainder of the year promises to be dynamic, with shifting market conditions influenced by economic factors and buyer-seller dynamics. Whether you're considering buying, selling, or investing in Central Indiana real estate, our team at RE/MAX Advanced Realty is here to provide expert guidance and support.

Explore our listings, connect with our experienced agents, and let us help you achieve your real estate goals in this competitive market. Contact us today to schedule a consultation and take the next step towards finding your dream home or maximizing your property's value. Trust RE/MAX Advanced Realty for insightful market analysis and personalized service, ensuring a smooth and successful real estate experience.

Are you dreaming of living on your own property?

If yes, you’re not alone.

In our network alone, we know a lot of people who want to have their own home. It’s no surprise though; there are a lot of advantages when you become a homeowner. However, there are several factors to consider while making such a big decision. So before you choose a new home, be sure to read this post first.

In this article, we will talk about what problems to look for when buying a house. From structural issues to hidden flaws, knowing what issues to check can save you time, money, and headaches.

Before rushing into something, especially one that’s as huge as buying a home, it’s important to thoroughly inspect it. Some of the problems include:

When a door refuses to close, it's likely because the frame has moved and the door is no longer square. To get the door to close in certain cases, the homeowners might have chopped a small piece from the door. Therefore, be cautious if you see some trim removed from its top or bottom. Although the door may shut correctly, the issue that caused the shifting still persists.

The majority of poured concrete foundations will eventually develop hairline fractures, although they are not a sign of an issue. However, it's a good idea to have a foundation contractor look at the region if a crack is bigger than 1/2 inch. This also applies to cracks that seem to have been fixed lately. Large fissures may be a sign of a shaky foundation.

While most mold isn't as dangerously deadly as, say, Stachybotrys, breathing in mold spores can cause headaches, respiratory ailments, and other ailments. Additionally, mold growth may be a sign of structural issues with a home. If you detect the smell of mold, look for leaks in crawl spaces and basements, under sinks, and around windows. Wood members, drywall, and carpets are examples of construction materials that may need to be replaced if a leak has been present for a long time.

It is advisable to identify the symptoms prior to making an offer because the existence of live termites has the potential to jeopardize a housing contract. Little mounds of microscopic brown droppings on the ground close to a wall are one obvious sign. Additional indicators include the sound of hollow wood and the existence of mud tubes on a foundation. Because termites reside underground, they dig tiny mud tunnels along walls and foundations to shield themselves from sunlight while they go from their underground nests to the wood they are eating.

Building supplies and water don't mix. Over time, the slow leakage of water from a window or roof can cause structural wood members to deteriorate. Water stains that have a brown or yellow tint could indicate a plumbing issue on a higher floor. Don't make an offer until you have an idea of the source of the leak and the extent of the harm it has caused.

No matter how charming and comfortable the home is, a drooping ceiling is a cause for concern. Even a small amount of sag in the ceiling can indicate a structural movement that is causing the drywall to come free from the ceiling joists, an insect infestation that is gnawing away at the joists, or a roof leak. Whatever the reason, the cost of repair may be high.

Put this one firmly under the category of "buyer beware! While many individuals are competent at doing small repairs around the house, very few are qualified to build an addition that complies with building requirements. An addition constructed by the homeowner without the local building authority's supervision may have structural, electrical, and plumbing flaws.

Not every fresh coat of paint signals a problem. Actually, before offering their homes for sale, sellers frequently paint the walls a fresh coat. However, if fresh paint appears out of place, as in a room where only one wall has been painted, you should question its application. Spot painting may be an indication that the seller is attempting to hide a wall flaw, like a water stain.

The homeowner may be attempting to mask the smell of something else, such as pet urine-saturated carpeting or mold growing beneath the sink, if you walk into a house and are immediately hit by a strong scent of air freshener or if essential oil diffusers are steaming away in every room. urge for a second showing and urge the seller not to use air freshener before you come if you're interested in the place.

A yard should slope away from the home by at least 2 percent in order to keep water away from the foundation wall. After it has rained, drive by the house you like. Puddles of standing water could indicate a drainage issue in the yard. The most dangerous puddles are those that are close to the foundation since even the smallest crack might allow water that flows along a foundation wall to seep into a basement.

While the typical AC unit lasts 10 to 12 years, furnaces typically last 15 to 18 years. HVAC (heating, ventilation, and air conditioning) units lose efficiency as they get closer to the end of their useful lifespan. Because of this, operating them will cost you more in energy expenses, and they might not adequately heat or cool the house. Additionally, there's a potential that one or both of them will completely stop functioning, in which case you'll have to pay to replace them.

The most crucial consideration when purchasing a home is, as real estate brokers like to say, "location, location, location." If a number of properties in the neighborhood are for sale, this may be a sign of a problem with the location, such as an increase in crime or a proposed landfill nearby. Include investigating the community as a regular aspect of your house search.

It pays to properly inspect the roof because replacing a roof is an expensive project that can cost anywhere from $6,000 to $20,000 or more, depending on the size of the roof and the type of roofing materials used. The roof may need to be replaced if there are any of the following symptoms: exposed nail heads, missing or broken shingles, or shingles that curl up at the corners. A roofer with experience will be able to confirm.

Some sellers offer their properties "As Is" for good reason—they just don't want to deal with potential issues that could come out during an expert inspection. In essence, they are saying that they will not foot the bill to address any issues that arise. You can still have the house inspected, which is a good idea, but if the inspector discovers mold, termites, or other issues and you decide to move forward with the purchase, you will be responsible for paying for any repairs

A house's duration on the market before it sells might vary depending on a number of factors, but the average period from listing to closure is 68 days, according to real estate expert Zillow. In general, steer clear of a house that has been on the market for months or years; speak with a real estate agent about the typical time in your neighborhood. There's a good chance it has undiscovered issues that would be costly to fix.

Examine the underside of the roof eaves (the soffits) from the outside of the house. One or more intake vents should be visible to you. Extra exhaust vents ought to be placed at the top of gable walls, on the face of the roof close to the ridge, and along the roof's ridge. An attic's decking (or roof sheathing) and shingles themselves may sustain damage in the summer heat if there is insufficient ventilation.

During an open house, potential buyers try to determine whether a house is a good fit for them by asking questions such as "Is the kitchen large enough?" or "Does it have enough bedrooms?" Do the bathrooms require remodeling? However, it's important to remember that a home must do more than merely fulfill a list of requirements. Ultimately, for the majority of people, it represents their largest investment yet. It needs to be in good shape as well.

The usual listing contract contains a disclosure form where the seller is required to detail all known problems of the house in order to aid potential purchasers in assessing the condition of a property. However, it's possible that not all of the flaws are disclosed by the seller, and some sellers may purposefully leave out issues in the hopes that you won't see them. Click through to discover some frequent warning signs that should cause you to reconsider your purchase in order to avoid unforeseen maintenance costs.

Before you jump to make an offer on a house that is priced much below market value, find out why. If the septic system overflows the day you move in and raw sewage fills your shower, you won't be getting a great deal. Often, really cheaply priced homes have costly issues that need to be fixed. To ensure that you know exactly what you're receiving before you buy, take the time to employ experienced inspectors.

Purchasing a home through a for-sale-by-owner (FSBO) may seem like a great way to save a few thousand dollars in agent costs, but you may wind up having more difficulty than you anticipated. Because real estate transactions are complicated, you risk purchasing a home with significant issues with the deed or the construction if you don't have an agent to walk you through the process. Make sure you speak with a real estate attorney before placing an offer on a for sale by the owner (FSBO).

Floors that are slightly uneven can be attributed to normal settling, but if the slope is apparent, it may indicate a foundation issue, a damaged floor joist, or rotten support beams. If there are one or more sloping levels in the house, it makes sense to have a structural engineer inspect the property because fixing structural issues can run into thousands of dollars.

Inspecting a home thoroughly might sound like a daunting task; however, spending enough time to look for issues can save you from high expenses and stressful situations.

Whether you're buying your first house or your third, purchasing real estate will always be stressful. Why? Because there will always be a challenge in the real estate market, such as home prices that are beyond reach, increased mortgage rates, and a shortage of inventory.

Knowing what is ahead and surrounding yourself with experienced individuals who can offer guidance are the keys to making it less frightening.

In recent years, there has been a great deal of fluctuation in the property market. If you're attempting to purchase a property, it's crucial to understand the current status of the housing market since it will affect your capacity to make a successful bid. That said, before you start your journey to buying a home, take some time to educate yourself about the current state of your local market.

A rise in the supply of homes would lessen the pressure on home prices to rise by counteracting the demand from buyers. In addition to lowering the entire upfront costs, a lower home price may also result in a cheaper mortgage payment.

List the things you need and want in your dream home as well as the community you want to live in so you can focus on your search.

Use reputable real estate websites, such as Realtor.com, Redfin, Zillow, RE/MAX, and Trulia to get a sense of the kind of homes that fit your requirements. Take note of the home prices to see if they are within your means. If not, you might have to narrow down your search parameters or make some compromises.

One of the largest financial commitments you will ever make is purchasing a home, so before you start looking at properties, keep your finances in order.

Understand your current financial situation. To assess whether you can afford to make monthly mortgage payments, mortgage lenders will examine your cash reserves, income, and debts as well as obtain a copy of your credit report. A FICO score of 620 or above is typically required by lenders to approve a conventional loan.

You may check your credit report for free from each of the three major credit reporting bureaus: Equifax, TransUnion, and Experian every week at AnnualCreditReport.com. Requesting reports from each agency is a good idea, and you should carefully check over them as there may be inconsistencies or errors in the material.

Look for local real estate brokers and arrange for introductory calls or meetings. It's a good idea to interview a few and choose the agent that is educated about the area you're looking to buy into and suits your personality and communication style. A good real estate agent will assist you learn about the home-buying process, highlight discrepancies between pricing and expectations, and provide you with previously unconsidered information.

Don't just get prequalified, get pre-approved. What's the difference, you ask?

A mortgage pre-approval is a comprehensive process where a lender verifies financial information, such as W-2s, tax returns, pay stubs, assets, and credit to determine what loans you could be approved for, the amount you can borrow, and what your interest rate could be. Prequalification is more similar to an approximate estimate of what you can borrow. This might assist you in determining how much you can pay and show home sellers your seriousness about making the purchase.

In difficult economic times, having a solid credit history and financial profile is especially crucial, as lenders are less inclined to take on customers who pose a larger risk of loan default.

Along with encouraging you to search online for additional properties you might be interested in, your real estate agent will probably show you listings that fit your needs and budget. Although in-person tours are preferred by most buyers, if you are unable or unwilling to see the property, you can still obtain a virtual tour.

No matter what you choose, virtual or personal home viewings, start looking early to stay ahead of the competition. Once the prices decrease, home buyers will start to go out, look for homes, and close deals if you haven't started yet, someone else might have the home you always wanted.

It's time to discuss placing an offer with your agent when you've located the place you want to call home.

To help you decide how much you think the house is worth, check the sale prices of nearby comparable homes that have previously sold. A list of real estate comparables (comps) that illustrate the prices paid by buyers for comparative, previously sold properties in the same neighborhood can be compiled by your agent. This may help you determine the appropriate amount to offer.

When you submit your offer, the seller has three options: accept, reject, or counter. During the pandemic, buyers could not afford to negotiate and sellers maintained control. The good news is that the market is currently somewhat more balanced now compared to the previous years.

Buyers can bargain more to get the best deal possible within their budget, but note that the price of the listings—especially the expensive ones—determines the outcome.

Earnest money is deposited with a third party, such as a real estate broker, law firm, or title business, once your offer is accepted. This money is kept in escrow until closing and can be used toward your down payment or closing fees. Known as a good faith deposit, earnest money signifies your seriousness as a buyer and is often between 1% and 5% of the total cost of the home.

Now that the sale is on hold, it's time to start the due diligence procedure, which includes the home inspection. A house inspection is a qualified inspector's visual evaluation of the property's condition, and the results can assist buyers in making better decisions.

If your purchase offer contains a condition for a house inspection, you may choose to walk away from the deal entirely or bargain for repairs.

You should submit your mortgage application as soon as possible after you get into a contract. Choose a lender who best meets your needs by shopping around and comparing mortgage offers. Your interest rate and the amount you qualify for will be estimated by your lender.

After you're pre-approved, your lender might also provide you with a mortgage rate lock, which is normally good for 60 days or occasionally longer. When interest rates are expected to rise, a rate lock is an excellent idea. However, you cannot simply switch to a lower interest rate if rates fall.

To make sure the agreed-upon sale price is equal to the property's market value, your lender will usually need an appraisal of the asset. The appraisal is frequently included in the overall amount of closing expenses for a house.

A few days before closing, conduct a final walkthrough. This will help you verify that the house is in good condition and/or in the same condition as when the offer was made. For homes that have issues, this will also help confirm if the agreed repairs have been made.

The actual closing process is quite simple and calls for signatures attesting to the ownership transfer. Depending on your state, you may sign documents in person with a representative of your title insurance firm or electronically, if that is permitted.

The actual closing procedure only requires signatures attesting to the transfer of ownership and is rather straightforward. You may sign documents electronically if allowed by your state, or in person with a representative of your title insurance company.

We hope that we've helped you understand the process you need to go through when buying a home. As always, our team at RE/MAX Advanced Realty is here to help. Just send us a message or leave a comment if you have questions about purchasing a property.

There is a growing need for eco-friendly, energy-efficient homes in this era of increased environmental consciousness. More and more purchasers are looking for properties that support sustainable and healthy living, are in line with their values, and provide long-term cost savings. Fortunately, building environmentally friendly, energy-efficient houses is now simpler than ever, thanks to technological developments and building techniques.

In this post, we'll understand the benefits of living in an eco-friendly home as well as its positive effects on both the homeowners and the environment.

Eco-friendly properties are mainly about creating a positive impact on the environment, but other than that, it's about aesthetics.

They contribute to reduced carbon emissions, conservation of natural resources, improved air and water quality, and preservation of biodiversity. Using renewable energy and energy-efficient technologies, eco-friendly properties play a significant role in minimizing climate change.

Additionally, eco-friendly properties conserve resources. Installing water-saving fixtures, rainwater harvesting systems, and energy-saving appliances saves up to 30% and 20-30%, respectively.

Eco-friendly properties also prioritize air and water purity. They improve indoor air quality and discharged water with modern ventilation, air filtration, and wastewater management systems.

The use of sustainable landscaping and green spaces in eco-friendly properties promotes biodiversity. Urban ecological equilibrium is maintained by native plant species and rooftop gardens.

Overall, environmentally conscious homebuyers seek eco-friendly properties due to the growing focus on sustainability. They are a good investment for a cleaner future because they cut carbon emissions, conserve resources, enhance air and water quality, and preserve biodiversity.

Eco-friendly properties boost the real estate industry financially and environmentally. These homes serve as great investments by helping owners save money on energy.

Solar panels, LED lights, and smart thermostats can reduce electricity costs in eco-friendly dwellings by 30% or more—your ethical investment in a sustainable future rewards you with financial security.

Eco-friendly homes and appliances qualify for tax breaks, and renewable energy technologies like solar panels receive financial incentives. Due to limited supply and rising buyer demand, these homes may command a 10% premium above conventional residences, delivering significant returns on investment.

Due to their durability and sustainable materials, eco-friendly properties require less maintenance and repair. This saves money on maintenance over time, making such homes financially beneficial. That said, buying eco-friendly properties benefits both the environment and the wallet.

Aside from creating a more appealing and healthy living environment, they provide homeowners considerable health advantages.

Here are the benefits of eco-friendly properties on health:

Pollution and insufficient ventilation cause poor indoor air quality in conventional dwellings. Eco-friendly properties reduce dangerous pollutants by using low-VOC materials and modern ventilation systems. Air filtration systems in these properties remove allergens, dust, and other contaminants, improving indoor air quality.

Eco-friendly homes use non-toxic materials during construction. They avoid formaldehyde, lead, and asbestos. Rooftop gardens and native plant species preserve urban ecological balance. Non-harmful materials eliminate the risk of long-term health concerns and allergies associated with conventional dwellings.

Comfort and well-being are prioritized in eco-friendly properties. Improving insulation, soundproofing, and natural illumination makes life more comfortable. Eco-friendly features also encourage natural and biophilic design, which reduces stress, boosts productivity, and improves health.

Eco-friendly properties conserve resources, reduce carbon footprints, improve air and water quality, and preserve wildlife. They also provide energy savings, tax benefits, property value increases, and long-term maintenance and repair savings.

The above information can answer why eco-friendly properties are the best option for buyers. Buyers should explore green investments due to their advantages and growing sustainability interests. Eco-friendly homes save money, the environment, and health.

One of the most important phases in the home-buying process is closing because it's at this point that the buyer and seller exchange possession of the property. Unless they are performing a dry closing, the seller will often get payment for their house.

When a real estate closing is finished without any money being transferred—including closing costs—it is referred to as a "dry closing." Generally speaking, when the funds are approved but non-transferable, dry closings expedite the closing process for a home or property.

A dry closing will be started by the seller or the buyer, and it commonly happens when the funds are delayed. For instance, the buyer may still need to fulfill a last requirement, which could take some time to accomplish, even though the money for the mortgage has been authorized.

Alternatively, there can be a problem with the property that the seller is attempting to resolve. The buyer and seller decide on a dry closure as an alternative to postponing or canceling the transaction.

A wet closing involves paying the money for the sale of the house all at once and completing the real estate deal. Every real estate contract is signed, and the money is distributed right away. All 50 states allow this kind of closing, which is the most popular.

A dry closing, on the other hand, allows the buyer and seller more time to finish the real estate transaction. They proceed through closing, but until the money is sent, the deal isn't finished. Furthermore, a dry closing is only permitted in some states.

These are the states that allow dry closing:

There are times when a dry closing is more convenient for all parties. However, consenting to a dry closing entails a certain level of risk. This could consist of:

Is it ever a good idea to have a dry closing, assuming that's legal in your state? Perhaps, in light of your circumstances. Dry closings are a way to keep the real estate deal going forward in the event of problems.

Accepting a dry closing offers the lender an extra few days to smooth things out if the money transfer is taking longer than anticipated. Please ensure that you understand the dangers before consenting to a dry closing.

There's no guarantee that the real estate deal will fail if you're contacted regarding a dry closing. In fact, a dry closing can keep things going so that everyone concerned gets what they desire. However, you have to understand what it really means first, what to expect when you choose it, and if it’s the right choice for your situation.

Whether you want extra money or more property, renting out your house might be a good start. While renting your home may seem like a fun career, you might want to know that the landlord has many responsibilities.

This is the first thing you should understand before investing in rental property and earning revenue.

In this post, we'll know:

This will help determine if renting and managing properties is good for you.

Before listing a home, here are the things you need to do first:

State regulations vary on security deposits, eviction notices, rental applications, and lease terms. Be sure to follow your state's landlord-tenant laws before renting a home.

Find out what the Fair Housing Act and equal opportunity housing legislation mean and contact your local housing authority. These regulations protect you against discrimination when renting or purchasing a property.

You should check your rental property's construction codes. These rules create safe, habitable homes for tenants.

Before considering when to rent out your house:

Landlord insurance is beneficial in many ways, such as when covering:

Setting a fair rent is another crucial step when renting out your house. To earn from renting the house:

Consider employing a property manager if you manage many rental homes. Property managers are in charge of continuing maintenance, security, and upkeep of properties in addition to daily repairs.

They can be helpful, especially when you want someone knowledgeable to handle your place and/or you're busy doing it. However, before you hire, you also have to consider the cost of working with one. Since you are going to use their service, you will have to pay them.

If it's costly, you can always manage your property, but consider the responsibilities; you must be available if something goes wrong at your rental home. Becoming your property manager may be wise if you're prepared to handle these calls and feel competent to fix any issues.

A landlord-tenant lease agreement specifies property rental terms. Your lease agreement should mention your rental property and any rules renters must obey.

In the lease agreement, know what to do on rental terms such as:

Explain all rental policies to tenants so they know the do's and don'ts while renting your home.

The rental process also includes choosing a monthly rent collection method. As rent payments become more accessible, this method will be streamlined. Mailing or dropping off paper checks might seem more convenient to landlords, but tenants may not have the time. Talk to the tenants and establish a straightforward approach to collecting monthly rent.

Advertising your home to potential tenants is a crucial step when making a list of what to do to rent out a house.

Word-of-mouth marketing is one approach to spreading the word about your rental property.

Another way is to contact your family, friends, and coworkers renting or knowing a tenant as well as putting your rental listing on social media or online rental property listing services.

Include all the property details potential tenants need in your online listing: bedrooms, bathrooms, rent, property age and condition, amenities, and other features. You must also provide high-quality images of the entire rental house.

After receiving interest from tenants, screen them to ensure they know when to rent your house. Other ways of tenant screening that you might want to consider include:

You or the property manager may request a move-out inspection. When a tenant leaves, this inspection checks the home to help landlords decide whether to return the whole security deposit or not.

You may require some inspections before renting out your home. An inspection where the landlord and tenant discuss the house's condition is required. This allows the landlord to record the home's condition before the renter moves in. Some landlords inspect the property regularly to ensure its condition.

Sign the lease and receive the security deposit when all inspections are complete. Your tenants will receive keys and discuss a move-in date.

The rental agreement covers:

Good tenant relations make renting your house easier. When there's mutual respect with tenants, they might be more motivated to pay rent on time and respect your property. That said, keep a cordial, communicative connection to give your tenants a safe and comfortable home.

If you're considering renting out your house, figure out the advantages and disadvantages to you and your property. Also, evaluate your finances and your capability to know if you're ready for the extra duties. After all, it may be worth the effort if you make a lot of money renting out your house, especially if you rent out numerous properties.

Choosing to become a homeowner might be one of the most thrilling experiences of your life. It's crucial to reflect on a few things and learn how to strike a balance between your requirements and goals as well as your budget before moving forward. To help you choose the ideal property at a price you can afford, we've put together important tips on house hunting that helped our clients find their dream homes.

Following these house-hunting tips can help you start and feel assured. Here are the five best tips when house hunting you may consider:

Determine how much you can afford to spend on a home before you start looking. To determine how much of a mortgage payment you would be comfortable with, use a budget calculator. Remember that there are other expenses you will have to pay each month as a homeowner besides your mortgage. Don't forget to include the following in your budget:

To determine your monthly payments depending on variables such as the cost of the house, the down payment, the length of the loan, and the interest rate on the mortgage, use a mortgage calculator.

Make sure you obtain a preapproval letter—as opposed to a prequalification letter—to receive first mortgage approval. Examining prequalified versus preapproved is important.

Prequalification letter: Based on an oral confirmation of your income and credit score, a lender will tell you roughly how much you can pay when they declare you're prequalified for a given amount.

Preapproval letter: A mortgage lender's preapproval letter outlines the maximum loan amount you are eligible for. Because lenders base their calculations on official documentation, such as your bank records, W-2s, and credit reports, it carries more weight than a prequalification letter.

Many real estate agents won't work with you until you have initial mortgage approval, even if you have a prequalification letter.

Prioritizing may be necessary when looking for a home to ensure you get off to a good start. We advise you to start making a list of every space you envision for your home. After that, list the characteristics you wish each room to have, room by room.

These qualities could be divided into three groups: deal-breakers, nice-to-haves, and must-haves. After you've finished designing each area, think about the essentials and luxuries for the entire house.

A must-have is something you absolutely cannot live without in your house and is one of the items you will use to weed out properties that are unfit for habitation. For example, you might require plenty of garage space for extra storage, a well-lit room for your remote home office, or three bedrooms to accommodate your family.

You'll be able to sort through real estate listings more quickly if you have a list of necessities. Perhaps you've found what appears to be the ideal house in every sense, but it's miles away from the closest school and lacks a backyard. For those who have a large family, small children, and a dog, having access to outside space and being close to a school will be essential.

However, you might want to keep the house on your list as a prospective alternative if it doesn't currently contain one of your must-haves but has the room or remodeling potential to make it happen.

Goodies are desires, not necessities. These are the kinds of characteristics you'd like to have in your house but aren't really that important. A spiral staircase, a firepit, modern appliances, or a backyard pool may be features you'd like to see in your new house, but overall, these are probably not must-haves.

Having a list of desirable features is advantageous since it can aid in your decision-making process once you've reduced the number of residences on your shortlist.

Get a sense of the local real estate market by looking through homes for sale on the internet or via a mobile app. Websites dedicated to house hunting can help you get a closer look at what your area's typical home sells for and a more accurate notion of the kind of property you can afford.

You can investigate possible communities for schools, shops, crime rates, and other factors by conducting online research on properties. Applications can facilitate process optimization by offering arranged access to listings.

Make a price comparison between your budget and what you see in the market. Next, jot down a few addresses and get in touch with your realtor or the real estate firms that represented the houses you've had your eye on.

A reputable real estate agent, often known as a REALTOR®, is an authority in your community and can ease the stress and anxiety associated with house hunting. In addition to helping you focus your search and show you more properties than you could possibly see on your own, they may also assist you make the most financial decisions.

Instead of only attempting to steer you toward the largest sale and commission, a competent real estate agent or REALTOR® will also carefully examine your unique needs when they select properties to show you.

A professional who has completed the required licensure exams to conduct real estate business in your state is known as a real estate agent.

On the other hand, Members of the National Association of REALTORS® are licensed real estate brokers or REALTORS®. They have to be in the market, have a current real estate license, follow a tight code of ethics, and have a spotless record of professional conduct.

Both can be quite beneficial while looking for a home. Collaborate with a real estate agent that holds the designation of Certified Buyer Representative (CBR) or Accredited Buyer's Representative® (ABR®). A professional with a real estate broker license, which indicates they have completed further real estate coursework, is another option for you to think about.

Prior to making a decision, interview a few prospects and request recommendations from prior house buyers. Given the amount of time you will be spending together, pick an agent whose personality complements yours and be up forward about your wants and expectations.

A lot of sellers let anyone to come inside and take a tour of their homes during open houses. Additionally, you can schedule in-person showings with your preferred real estate agent.

Be a little curious when you're looking at a house. Verify the functionality of kitchen appliances, showers, toilets, and outlets. If you choose to purchase the house, make a mental list of any repairs or replacements you might wish to request from the seller.

Finding the right house takes time and effort. However, you can make it seamless and less stressful by considering the basics, such as determining your budget, acquiring mortgage approval from your lender, and even working with a real estate agent.

If you need help with house hunting in Indiana, our team at RE/MAX Advance Realty is just a message away! Call us now at 317.298.0961 or leave a comment to get started.

Are you ready to upgrade your kitchen into a haven for anybody who enjoys cooking? If yes, do not look any further!

If you're considering renovating your kitchen, you should know what styles are trendy right now for this room that serves as the center of your home. Whether you want to make significant changes to your kitchen or a few adjustments, these creative renovation kitchen ideas will motivate you to think outside the box.

Here are nine renovation kitchen ideas you can think of if you want to upgrade your kitchen:

In recent years, many homeowners are choosing to open up the space in their kitchens. An entirely open-concept kitchen, where no wall divides the kitchen from an adjacent space, is the preferred design for 64% of homeowners remodeling their kitchens. Enhancing entertainment potential and increasing functionality are the two most often mentioned reasons for designing an open-concept area.

There are a lot of renovation kitchen ideas that involve substantial structural work, but most of them are centered on changing the room's design. 45% of homeowners upgrading their kitchens redesign the layout, and 43% modernize their systems. Alterations to the ceiling height and reorganization of the flooring are two examples of these modifications.

Appliances that are equipped with high-tech features are becoming increasingly popular among homeowners. Some homeowners upgrading their homes prefer home appliances connected to Wi-Fi.

In comparison, some choose devices that can be operated using a smartphone or tablet. Meanwhile, some homeowners would replace all their appliances simultaneously during a makeover rather than just a handful.

The most frequent reason given by homeowners renovating their kitchens is to meet the needs of elderly family members. A few suitable kitchen modifications for the age include rounded counters, pullout cabinets, more lighting, broad drawer pulls, and non-slip flooring.

During a renovation, many homeowners change the backsplash in their kitchen. Engineered quartz is the most preferred material for backsplashes, followed by ceramic or porcelain tile. However, natural stone materials like granite, quartzite, and marble are equally popular among homeowners.

A larger kitchen island gives you more room for cooking and hosting guests, so many homeowners choose to expand their islands. Forty-two percent of homeowners remodeling their kitchens design seven-foot or longer kitchen islands.

More color will be in the kitchen this year, especially on cabinets. Kitchen cabinets in wood and green are growing, but white is still the most popular. Wood tones are most famous for bottom cabinets, followed by blue for island cabinets.

Organization is becoming increasingly important because people desire kitchens that are functional for them. Cutlery and utensil organizers, spice racks, and cookie sheet organizers are among the features that are becoming more and more popular.

Your kitchen's lighting creates a mood. Recessed lighting is still homeowners' first option when remodeling their kitchens. Some homeowners choose pendant lights, although under-cabinet lights are also trendy.

Check out these best kitchen renovation ideas to turn your kitchen into a gastronomic paradise. Elegant rustic themes to sophisticated modern designs fit any taste. Prepare to maximize the renovation kitchen ideas' beauty, functionality, and personal style.

Many buyers today ask themselves, "What are the things to think about when purchasing a home?" Because of the changing housing market trends and unstable economic situations, choosing wisely can be challenging.

Planning things well is important, especially since buying a home is a huge decision and investment. Here are things you need to know when purchasing a home in the current market and things you need to consider before signing a contract.

Acquiring a home involves more than just choosing the ideal layout and style—it also involves fitting in with the overall real estate market conditions. Understanding the subtleties of the ever-changing housing market of today can help you differentiate between a profitable investment and a possible risk.

The decision-making process is heavily influenced by the personal circumstances of the majority of prospective homeowners. Making sure your monthly payments are within your means is crucial because mortgage rates fluctuate.

However, in addition to monthly mortgage payments, these are the things to think about when purchasing a home such as the closing expenses, property taxes, and possible changes in house prices all impact your choice.

In these situations, your credit score plays a crucial role in figuring out what kind of mortgage loan you might be eligible for. Lenders typically offer more favorable terms to borrowers who have higher credit scores.

This implies that their purchasing power in the current market may be further increased by their eligibility for better loan options and reduced mortgage payments. You can also strengthen your negotiating position by making sure you pay your credit card bills on time and use credit cards sparingly.

Some locations have seen pressure on median home sale prices to rise, while others have an abundance of housing options as a result of a boom in inventory. Before agreeing to a contract, prospective buyers should investigate the housing inventory in different neighborhoods.

It may be quite helpful to have an experienced RE/MAX Advanced Realty real estate agent on your side, particularly while navigating the complexities of the housing market. Our team provides excellent service, making sure that prospective buyers are aware of everything from mortgage rates to credit score criteria to the current pace of the market.

Before buying a home, you must understand that there are a lot of things to think about. Knowing the real estate market and your finances can make all the difference.

Here is a brief guide to help prospective homeowners navigate the complex process.

Having a solid foundation of financial security is the first step on the path to house ownership.

It is essential to have a solid understanding of the real estate market to guarantee the success of your investment.

When deciding to purchase a home, your personal life and your goals for the future are important considerations.

An extensive local real estate market knowledge is essential to making the right decision.

Regarding the potential for appreciation of your investment, selecting the appropriate neighborhood can have a significant impact.

With their extensive market knowledge and expertise, real estate agents can help when you purchase a home.

Before purchasing a home, you must understand your lender's position.

Real estate may appear like a good investment, but personal investment techniques must be considered.

Buying a home is a big financial decision that can greatly impact your life. That said, it's important to learn about the current housing market trends and prices can influence your purchase in a buyer's or seller's market.

If you want to learn more about the real estate industry, we have a lot of resources you can use. Just visit our website or better yet, call us at 317-316-8224 so we can help answer your questions.

Hiring a professional "stager" to prepare your Indianapolis homes can be expensive, but if you know some tricks, you can make your property very appealing to potential buyers.

In this post, we are going to give you a few tips on how to improve your Indianapolis real estate with a very low investment.

Home staging is the art of getting your home ready before putting it on the market. This technique is done to increase the property's apparel and reduce the listing time by up to 50%.

The act of putting a property's best attributes on display and creating a welcoming and appealing environment for potential purchasers is known as home staging.

It entails several methods, including organizing, depersonalizing, organizing, and improving the space's aesthetic appeal.

Highlighting the property's advantages, realizing its full potential, and leaving a lasting impact on potential purchasers are the objectives.

Shorter Time In The Market: Compared to unstaged homes, well-staged homes typically sell more quickly. Presenting your home in the best possible light will draw in more interested parties and instill a feeling of urgency.

Emotional Bond: Staging forges an emotional bond between purchasers and the real estate. You may arouse favorable feelings in potential purchasers and help them see themselves living in the place by presenting a lifestyle and creating a welcoming atmosphere.

Enhanced Marketability: Staging makes your house stand out from the competition in a competitive market like Indianapolis. It draws in more potential buyers by making your house stand out in internet listings and during showings.

Higher Home Value: Homes that have been staged frequently sell for more money. Buyers are willing to spend extra for a well-staged home because they believe it to be more valuable.

Optimizing Space: By using staging, you can increase the impression of available space in your house. You may create the illusion of larger, more practical spaces by carefully placing furniture and using the right lighting.

Professional Image: A home that has been staged expertly conveys that it has been well-kept and cared for. Customers may feel more confident because of the professionalism and attention to detail it exudes.

Potential Highlighting: Your property's potential is brought to life through staging. It encourages consumers to see the potential and see their own life in the house by assisting them in visualizing how they may use the space efficiently.

Replace old items with new ones. It is important to know that too much furniture will make your space smaller and it will contribute to the cluttering of your Indianapolis homes.

Minimalism is popular everywhere in the world. You would be surprised how bigger your home looks, just by getting rid of some excessive old furniture. By repositioning furniture in a cozy conversational way, your dayroom will benefit in both ways: visually and practically. It will make your place look bigger and it will also make your space more user-friendly by allowing your visitors to walk freely.

Use a variety of lighting, such as desk lamps, dayroom light stands, kitchen counter lights, overhead lights, etc.

Your house in Indianapolis would look more appealing and welcoming if you bring enough lighting to it. Of course, nothing beats the sunlight so be sure to open your windows and bring more natural light into your home.

Each color refers to something specific. If you paint your room green, it will reflect the color of nature. By painting the walls in the same color as your drapery, you are going to create an illusion of the space being bigger. If you like darker colors, it is recommended to use them in the bedroom or dining room, since the dark color creates some sense of more intimate and private space.

All the things made of wood will look like new if they are professionally painted. Repair your wooden sidewalk and door, and add some more wood where it would bring a cozier look. Some items, such as candles go well with wood. Meanwhile, you can have floors refinished if needed.

When it comes to stating your yard, use the same techniques utilized when staging indoors, such as:

You may also add exterior lighting and some pretty flowers that will reflect cheerful colors and bring a smile to your potential buyer’s face.

Get rid of excessive stuff in your closets, especially ones that don’t look presentable. Leave closets open and half empty.

By doing so – you will leave the impression that your home has more closet space than you need. If needed – rent some storage space. Believe it or not, some people even make final decisions based on closet space.

All of us love clean house, but some of us do not have time or will to keep up with it.

Hiring some cleaning professionals is not a big investment, but it will create an impression that your home in Indianapolis has been well maintained. Get a carpet cleaning done by professionals as well.

These are some of the tips we've used over the years to help our home sellers sell their homes fast. However, you have to know that each home is different; find out which techniques will work according to your situation, and feel free to explore more.

As always, we are more than happy to assist you so if you have any questions on selling or buying a home, you may drop them in the comments.

Thank you!

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224