Many buyers today ask themselves, "What are the things to think about when purchasing a home?" Because of the changing housing market trends and unstable economic situations, choosing wisely can be challenging.

Planning things well is important, especially since buying a home is a huge decision and investment. Here are things you need to know when purchasing a home in the current market and things you need to consider before signing a contract.

Acquiring a home involves more than just choosing the ideal layout and style—it also involves fitting in with the overall real estate market conditions. Understanding the subtleties of the ever-changing housing market of today can help you differentiate between a profitable investment and a possible risk.

The decision-making process is heavily influenced by the personal circumstances of the majority of prospective homeowners. Making sure your monthly payments are within your means is crucial because mortgage rates fluctuate.

However, in addition to monthly mortgage payments, these are the things to think about when purchasing a home such as the closing expenses, property taxes, and possible changes in house prices all impact your choice.

In these situations, your credit score plays a crucial role in figuring out what kind of mortgage loan you might be eligible for. Lenders typically offer more favorable terms to borrowers who have higher credit scores.

This implies that their purchasing power in the current market may be further increased by their eligibility for better loan options and reduced mortgage payments. You can also strengthen your negotiating position by making sure you pay your credit card bills on time and use credit cards sparingly.

Some locations have seen pressure on median home sale prices to rise, while others have an abundance of housing options as a result of a boom in inventory. Before agreeing to a contract, prospective buyers should investigate the housing inventory in different neighborhoods.

It may be quite helpful to have an experienced RE/MAX Advanced Realty real estate agent on your side, particularly while navigating the complexities of the housing market. Our team provides excellent service, making sure that prospective buyers are aware of everything from mortgage rates to credit score criteria to the current pace of the market.

Before buying a home, you must understand that there are a lot of things to think about. Knowing the real estate market and your finances can make all the difference.

Here is a brief guide to help prospective homeowners navigate the complex process.

Having a solid foundation of financial security is the first step on the path to house ownership.

It is essential to have a solid understanding of the real estate market to guarantee the success of your investment.

When deciding to purchase a home, your personal life and your goals for the future are important considerations.

An extensive local real estate market knowledge is essential to making the right decision.

Regarding the potential for appreciation of your investment, selecting the appropriate neighborhood can have a significant impact.

With their extensive market knowledge and expertise, real estate agents can help when you purchase a home.

Before purchasing a home, you must understand your lender's position.

Real estate may appear like a good investment, but personal investment techniques must be considered.

Buying a home is a big financial decision that can greatly impact your life. That said, it's important to learn about the current housing market trends and prices can influence your purchase in a buyer's or seller's market.

If you want to learn more about the real estate industry, we have a lot of resources you can use. Just visit our website or better yet, call us at 317-316-8224 so we can help answer your questions.

Hiring a professional "stager" to prepare your Indianapolis homes can be expensive, but if you know some tricks, you can make your property very appealing to potential buyers.

In this post, we are going to give you a few tips on how to improve your Indianapolis real estate with a very low investment.

Home staging is the art of getting your home ready before putting it on the market. This technique is done to increase the property's apparel and reduce the listing time by up to 50%.

The act of putting a property's best attributes on display and creating a welcoming and appealing environment for potential purchasers is known as home staging.

It entails several methods, including organizing, depersonalizing, organizing, and improving the space's aesthetic appeal.

Highlighting the property's advantages, realizing its full potential, and leaving a lasting impact on potential purchasers are the objectives.

Shorter Time In The Market: Compared to unstaged homes, well-staged homes typically sell more quickly. Presenting your home in the best possible light will draw in more interested parties and instill a feeling of urgency.

Emotional Bond: Staging forges an emotional bond between purchasers and the real estate. You may arouse favorable feelings in potential purchasers and help them see themselves living in the place by presenting a lifestyle and creating a welcoming atmosphere.

Enhanced Marketability: Staging makes your house stand out from the competition in a competitive market like Indianapolis. It draws in more potential buyers by making your house stand out in internet listings and during showings.

Higher Home Value: Homes that have been staged frequently sell for more money. Buyers are willing to spend extra for a well-staged home because they believe it to be more valuable.

Optimizing Space: By using staging, you can increase the impression of available space in your house. You may create the illusion of larger, more practical spaces by carefully placing furniture and using the right lighting.

Professional Image: A home that has been staged expertly conveys that it has been well-kept and cared for. Customers may feel more confident because of the professionalism and attention to detail it exudes.

Potential Highlighting: Your property's potential is brought to life through staging. It encourages consumers to see the potential and see their own life in the house by assisting them in visualizing how they may use the space efficiently.

Replace old items with new ones. It is important to know that too much furniture will make your space smaller and it will contribute to the cluttering of your Indianapolis homes.

Minimalism is popular everywhere in the world. You would be surprised how bigger your home looks, just by getting rid of some excessive old furniture. By repositioning furniture in a cozy conversational way, your dayroom will benefit in both ways: visually and practically. It will make your place look bigger and it will also make your space more user-friendly by allowing your visitors to walk freely.

Use a variety of lighting, such as desk lamps, dayroom light stands, kitchen counter lights, overhead lights, etc.

Your house in Indianapolis would look more appealing and welcoming if you bring enough lighting to it. Of course, nothing beats the sunlight so be sure to open your windows and bring more natural light into your home.

Each color refers to something specific. If you paint your room green, it will reflect the color of nature. By painting the walls in the same color as your drapery, you are going to create an illusion of the space being bigger. If you like darker colors, it is recommended to use them in the bedroom or dining room, since the dark color creates some sense of more intimate and private space.

All the things made of wood will look like new if they are professionally painted. Repair your wooden sidewalk and door, and add some more wood where it would bring a cozier look. Some items, such as candles go well with wood. Meanwhile, you can have floors refinished if needed.

When it comes to stating your yard, use the same techniques utilized when staging indoors, such as:

You may also add exterior lighting and some pretty flowers that will reflect cheerful colors and bring a smile to your potential buyer’s face.

Get rid of excessive stuff in your closets, especially ones that don’t look presentable. Leave closets open and half empty.

By doing so – you will leave the impression that your home has more closet space than you need. If needed – rent some storage space. Believe it or not, some people even make final decisions based on closet space.

All of us love clean house, but some of us do not have time or will to keep up with it.

Hiring some cleaning professionals is not a big investment, but it will create an impression that your home in Indianapolis has been well maintained. Get a carpet cleaning done by professionals as well.

These are some of the tips we've used over the years to help our home sellers sell their homes fast. However, you have to know that each home is different; find out which techniques will work according to your situation, and feel free to explore more.

As always, we are more than happy to assist you so if you have any questions on selling or buying a home, you may drop them in the comments.

Thank you!

All sellers have in mind just one thing - how to sell their home at the highest possible price. We are not the only ones trying to sell Indianapolis homes. Each neighborhood has several houses for sale like the one we do. Competition is not always a bad thing, especially if it is healthy.

Let’s do a walk-through…

Take a pen and paper and go outside of the house. Write down everything that you would like to change in your garden. Old baskets should be replaced, chairs repainted and some sprinkles fixed. Take a walk through your home and try to notice all the things that you would otherwise notice if this is your first time visiting this place. We all get used to our living environment, so we no longer see old, rusty, broken things around us that will decrease the overall value of the property even if those things are not going to be sold with the house itself.

To make sure that you are 100% ready before selling your property, here are detailed steps you can consider for a successful home-selling transaction.

When opting to sell your house quickly while you're in the process of moving, the first thing you should do is research the current real estate market. You have an edge because of this while interacting with buyers and agents. You'll also be able to appropriately adjust your expectations. As you look into it, keep the following in mind:

Cost: How much do comparable homes in your neighborhood sell for? When looking into comparable homes, take into account the neighborhood, the house's age and condition, and other features like restaurants, schools, and other facilities. By calculating the price per square foot of comparable homes that have previously sold, you may determine the worth of your own house.

Time On The Market: You must be aware of how long it typically takes for a house in your community to sell. The amount of time a house is posted for sale until it sells is referred to as its "time on the market." You can better plan for the date of your simultaneous move and sale if you are aware of the market time.

What Kind Of Market Is It In Your Area: Is it a seller's or a buyer's market? You have to know this because your sales strategy will be influenced by the market type. You would have the most advantages when selling your house in a seller's market. A seller's market may result from a high level of demand and little availability. However, more variables might also be involved. There will be less time on the market and higher housing prices in a seller's market. But there are benefits to a buyer's market as well, given that you are selling as well as moving. Sellers are more eager to sell when the market is in their favor. Additionally, you'll have more wiggle flexibility to bargain for a lower cost.

The next action you should take is to learn everything you can about your property. You can work out your house's price by working with a real estate agent. You will have an advantage with customers if you have hard data upfront. Additionally, since your agent won't need to do as much legwork, the sale of your home will proceed more quickly.

Having an appraisal of your home helps you determine a fair price for it. Pre-approved loan buyers will be fully aware of the price range they can afford. Thus, they will find this information to be quite beneficial. Furthermore, having an inspection completed will expedite the negotiation process because buyers—and you—will already be aware of all the issues with the property.

Knowing your purpose in selling your home will help you decide what you can live without during the selling and purchase process. While sharing this information with your realtor can help them better understand your unique requirements, you should not disclose this information to sellers when you are viewing homes for purchase. It's possible you won't receive the best bargain if they know what you can settle for.

Make sure the agent you choose is open to listening to you and comprehending what you are looking for. Go with someone knowledgeable about your community and the neighborhood you wish to move in.

Following your assessment, you ought to have a clear understanding of what needs to be fixed and what can wait. Additionally, your agent may assist you in determining which repairs, if any, will yield the best return on your investment. Find out from your agent which repairs will add the most value to the home and which, if skipped, won't have a significant impact on the sale price.

Repairs are an integral part of getting your home in Indianapolis ready for sale, and so are interior staging and landscaping. When staging, keep it simple and clutter-free. Anything overly imaginative or detailed could make it harder for your buyers to envision themselves living there; instead, provide them with a blank canvas! Also for unique areas, make sure your furniture is positioned to use every available space.

Being a wise home seller means:

The timing of selling your old house and purchasing a new one is the most difficult component. Although it is ideal for both closings to occur on the same day or within a few days of one another, this is certainly not always the case. For this reason, we suggest not signing on to your new home until after someone has signed to your previous one. From a financial standpoint, it makes more sense to book a hotel room for a few days or weeks rather than making two mortgage payments at once, etc. If there is no other means to own two residences at the same time, bridge financing is one alternative.

This might be a lot, especially when it’s your first time selling your home; however, as long as you are working with the right real estate agent, you can make the entire home-selling transaction easier and faster.

Contact us to learn how we can help put property on the market! Call us at 317-316-8224 today!

If you want to remodel your home by taking a loan, make sure to spread payments according to your paying-off capability.

After you decide that it’s time to look into some home improvements as well as upgrading your living environment, you can do so in many ways, from bathroom repairs to adding an extension to your current space of living.

But first, let's tackle the basics.

A home improvement loan is a type of personal loan specifically used for repairs, home maintenance, and other esthetic or functional enhancements.

Loans for home renovations can be used for everything -- from minor upgrades like changing the kitchen sink to major renovations like redoing every room. For homeowners, obtaining a home repair loan is a desirable alternative since it typically has fixed interest rates and repayment schedules. While keeping up with your loan repayments, you can forecast and control your monthly financial flow.

Like other kinds of loans, you get a lump sum that you can use for renovation-related expenses, such as:

You will then repay it with a fixed interest rate over some time. That said, you have to know if borrowing a home improvement loan is what you need at the moment. It can be expensive, depending on the interest rate you'll get, but if it will improve your quality of life, it can be worth it.

Remodeling is not just a small change that is going to make you temporarily happy, but a strategic step towards raising the value of your home, especially if you are planning to sell your property shortly.

We should notice the difference when it comes to the financial side of home improvement. While decorating the home can be done without so much financial investment, some major technical improvements such as central heating could cost you significant investment.

So before signing up for a home improvement loan, figure out how much you need first. Make sure that the amount you’re going to borrow is enough to cover your estimated expenses; however, don’t go more than what you need or can afford to avoid being trapped into debt.

If you have some experience in home remodeling that would be beneficial in the sense of saving some money, while it is highly advised to hire a good tradesman and have a walk-through with him to see what needs to be done in the house.

He will be able to provide you with a quote for the job that you guys are planning to get done. It is also important to know the difference between a “quote” and an “estimate”. Quotes are a more set type of investment evaluation, with précised amounts for each part of the job, including material and labor, while estimates can only give you an approximate amount. Do not limit yourself to only one tradesman, but have at least a few of them come over and give you their offers.

Once you have offers from contractors in writing and you know how much it takes to get the job done - it is time to look for funding. Since most of us do not have substantial savings for these types of projects, we decided to go with loan providers that offer loans that are going to be put toward home improvements.

As well all know, they do not work for free, so interest will be applicable in this case. Since this is going to be an important financial decision, make sure you can afford the loan before you take one on. While there are many different types of loans available on the market, when it comes to a home improvement loan, it is typical that this type of loan is an unsecured personal loan, which means that is not secured against an asset such as your property and most of the time should be repaid within 24 to 48 Months.

For larger home improvements that need an increased amount of funding, some homeowners consider tapping into their property’s equity to fund home improvement.

When you apply, lenders will check your employment status and income. Having the necessary paperwork together in advance helps expedite the application process. Unlike a home equity loan or home equity line of credit, a home renovation loan does not require a home evaluation because there is no home equity involved.

Once you’re done selecting a lender, you must fill out an official application. While most loan providers allow you to apply online, you may need to apply in person at smaller banks or credit unions. After submitting your application, you can hear back the same day and get funded in as little as one to seven business days.

A home repair loan typically does not qualify for tax deductions for interest paid.

On the other hand, you might be able to lower your tax liability by updating your home with energy-efficient improvements. A 30% tax credit, up to $1,200 a year, is offered to homeowners who upgrade their homes with energy-efficient features including windows, doors, and central air conditioning as part of the Inflation Reduction Act of 2022, or IRA. A 30% extra tax credit is available for the purchase and installation of solar panels.

These are the basic things you need to know about home improvement loans. If you have more questions on this topic or any home-related inquiries, we are more than happy to answer them. Leave a comment or send us an email at dennis@indyhomepros.com so we can assist you!

It's thrilling to look for a new home, especially when you discover what appears to be the ideal one. However, looks can be deceiving.

The largest problems in a house can be hidden from view if you don't know what to look for. And if you don't exercise caution, you can eventually wind up with a lemon of a new home that will end up costing you far more than you anticipated.

Avoid falling in love with a house before you have all the information, especially any warning signs. Maintaining composure and being vigilant can help you make a more informed choice and ensure that your new house is worth every penny.

Below are the top real estate red flags that might tip off buyers when hunting for a new property.

The most prominent red flags in real estate are listing prices that might seem too good to be true. This usually means sellers are extra-motivated in selling their home, which should make you question why.

They may need to sell soon for financial, personal, or career relocation reasons, or the home may be in bad shape. Ask your Realtor about the too-good-to-be-true price.

With many online real estate marketplaces, purchasers may easily research a property's history. If the home's sellers have lived there for two years or less, you might want to question their short tenure. Another problem might be if the home has had too many homeowners in the past as this might suggest that something is wrong with the property.

One of the approaches is to reach out to the listing agent to learn why the sellers are moving.

Is your Realtor the listing agent for the house you wish to buy as well? In that case, we recommend looking for a different buyer's agent who can prioritize and protect your interests during the entire real estate transaction. Ultimately, the goal of a listing agent is to maximize the seller's home's value, which is not in your best interest as the buyer. This is because the listing agent may lose sight of what's best for their buyers. After all, they want to close the deal quickly.

This might not sound like a big deal but this red flag should not be ignored.

As a potential home buyer, you might want to ask why the listing has a few photos. In today's digital age, it's not challenging to take images, so having a few or none at all might suggest that there might be something wrong with the listing.

Before taking a tour of the house, we advise you to ask your Realtor to find older pictures of the property from earlier postings. If any rooms were omitted from the advertisement, be sure to inquire as to why with the sellers.".

Is the house near a busy highway or road? If yes, the listing images will likely attempt to hide this by adjusting the angles so potential viewers won't see the road.

Therefore, before you visit the house, look up the address on Google Maps. Homes next to or on major highways and roads usually have a harder time selling. One reason is that homeowners have to deal with pollution and health issues in addition to noise and traffic.

Renovations are good; however, if it's too much, it might indicate inconsistent renovations and adjustments. Permit requirements and rules change. If multiple owners have altered the home, some work may have been illegal.

Do you notice several other houses on the same block listed as "For Sale"? There might be a reason for that. If there was ever a real estate red flag, it would be a mass evacuation from the street.

When you notice that several of your neighbors have listed their house, be careful to inquire as to why.". This can be a sign of a problem, or it might just be a coincidence. In any case, find out the truth before buying a house on the street.

Is it obvious that this is a flip? Make sure to find out who remodeled the house if the developer bought and made renovations before listing it for sale. Keep in mind that savings may have been made on renovation costs, particularly if the developer had no intention of residing in the house. For example, even though the makeover might have improved the house's appearance, it might not have enhanced the most vital parts, such as the HVAC system, plumbing, roof, and electrical wiring.

Is the house under contract and then all of a sudden back on the market? That might be a bad sign.

A house that comes back on the market even just after closing a deal may indicate there is a problem with the residence or the home inspection went wrong. Unfortunately, this happens frequently. For instance, there's an infestation or electrical issues. Although repairable, the costs might be too high.

They say, "Where there is smoke, there is fire."

Pay notice if you detect an unpleasant smell coming from a house. This suspicious incident can be an indication of poor home maintenance.

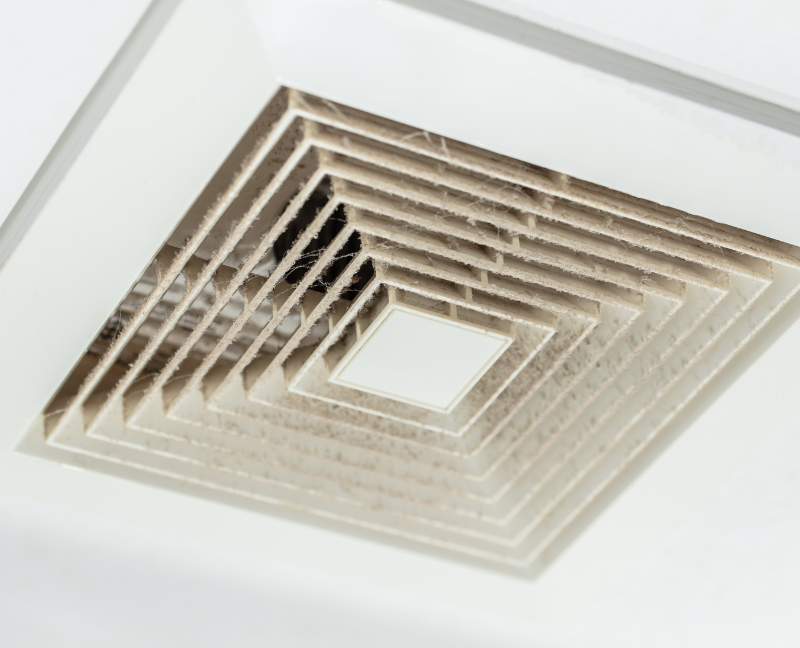

Unpleasant smells may be signs of plumbing, HVAC, mold, water damage, vermin, or inadequate ventilation in a house.

Take Note

First things first: Never skip a home inspection, regardless if you notice any red flags or not. This way, you'll know what's wrong before buying the property.

If the inspection report indicates issues, purchasers can decide whether to fix them before buying.

Can you think of other red flags when buying a home? Do you have any relevant experience you can share? If yes, we'd love to hear your thoughts in the comments!

When looking for Indianapolis homes for sale, it's important to keep an eye out for problems that may cost an arm and a leg to repair once you've purchased the property. The first thing you need to do before committing to buying a home is to have it examined by a licensed home inspector that you trust.

An inspector will alert you to any major issues that might prevent you from buying a home as well as minor issues that you might be willing to fix yourself after the purchase. With a report on the current state of the home in hand, you'll be more prepared to negotiate with the seller, and you'll also have the information you'll need to walk away from a property that will demand costly fixes.

Types of repairs that you should probably try to avoid include major issues that can affect the livability or safety of the home. For example, replacing the roof can be an extremely costly repair that might need to be done before you're able to move in. Major plumbing fixes can also be expensive and painful to deal with.

Considering this, don't forget to have someone look at the pipes before making any final decisions about buying a home. You'll also want to have your inspector thoroughly go over the foundation of the property. If there is a crack in the foundation, the cost to repair it will usually be quite significant. On the other hand, if not repaired, it can pose serious problems for your home in the future.

Remember, a home doesn't need to be in absolutely perfect condition in order to be a good buy. Some buyers like finding fixer-uppers that they can make their own. For example, if you are interested in building the kitchen of your dreams, it may not matter what the kitchen looks like right now, but only how much space it has to offer.

If you're not particularly interested in performing any serious remodels, look for homes that are in good shape and won't require much work to make beautiful. For example, repainting the walls and updating the fixtures are both relatively low cost and simple tasks that can dramatically improve the look and character of a home.

Nonetheless, here are the most common problems to look for when purchasing a new property:

Starting outside and going inside, – from ground up to the ceiling and roof, check every corner of the home properly. Although you’re likely to work with a professional, you can come up with a rough idea of the home’s condition. It might help asking yourself these questions;

Are there visible cracks?

What is the condition of the wall?

Does the interior look compromised?

Are there broken pipes?

What is the condition of the roof?

Make a list of all the possible questions before visiting the property and answer each as you examine the home meticulously.

All rooms in the house, including the kitchen, bathroom, and storeroom, should have adequate ventilation and airflow. A healthier and happier family and fewer microbiological growth result from the house staying fresh and having less moisture growth inside.

Make sure you inspect a home's plumbing system when you go to inspect it. Although they are hidden gems within the house, they are a crucial and indispensable component of a cozy living space. Issues might arise from outdated plumbing systems in older homes. One possible cause could be a leak in the plumbing system or rust. Verify that the water is flowing properly and that all of the plumbing lines are in good shape. Additionally, you might look for potential plumbing errors if it's a new house.

Ensure that the house receives enough sunshine. Sunlight is crucial for maintaining a fresh atmosphere in the home. It keeps your home odor-free and naturally eradicates germs and other microorganisms. In addition, it promotes healthy plant growth in your garden and keeps the house warm in the winter.

Verify if the house has enough water supplies. Water is essential to every home. The main sources of water were once hand-dug wells, but nowadays the main sources are government water delivery lines and well drilled wells. It will be tough to obtain clean water at your home if these are not included in the house you buy.

If you’re looking to purchase Indianapolis Homes, it’s always wise to work with an experienced real estate agent, like the agents at RE/MAX Advanced Realty. By working with us, you’ll not only find homes that are well-suited to your individual needs, but also avoid properties that demand costly fixes and repairs.

Typically, a traditional house is constructed of brick or stone, has a roof that is designed to keep the rain out of the building, and includes an electrical system. But as millennials enter the home market, the standards are starting to shift, and they are spearheading the development of "wellness-minded" structures.

Although they initially cost slightly more than traditional homes, eco-friendly homes ultimately save you money. It provides quality living space and more benefits for you and the environment.

Beyond the immediate advantages of reduced environmental impact, these homes offer a compelling offer for homeowners: long-term cost savings through eco-friendly ways to save money.

Eco-friendly homes are designed to be as self-sufficient as feasible and have as little impact on the environment as possible.

Sustainable houses use a variety of natural resources, including earth, wind, and light, to minimize their carbon footprint and drastically cut down on the amount of heat and electricity that a homeowner uses.

As we grapple with climate change, resource shortages, and environmental damage, eco-friendly homes are a practical solution. While the upfront costs may seem significant, the "eco-friendly ways to save money" offers that can lead to substantial savings over the property's lifespan.

Eco-friendly homes provide a high-quality living space and help you to save money. An environmentally friendly structure can reduce the amount of water and energy used by 30–50% and 30–70%, respectively. Living in a green building can save money on power and air conditioning.

A well-designed space, for instance, requires less air conditioning. When accounting for these savings, green buildings can be significantly less expensive. More green materials and consultants are currently needed.

Thus, although an eco-friendly home may seem expensive, you shouldn't be worried. Building full-cycle costs increase insignificantly. Eco-friendly insulation and hypo-thermal glass cost 5-8% more. The increased cost can be recouped in 3-5 years due to considerable savings.

Eco-friendly homes aren't limited to those who build themselves. Builders are offering more "eco-friendly" apartments and villas as awareness develops.

Living and working in an eco-friendly environment will gain popularity as customers learn about its benefits.

Eco-friendly buildings are rated on numerous criteria before being green:

Sustainable homes are not a carbon footprint lifestyle statement. Many builders use green ratings and certificates to market their properties.

Not all "green" or "eco-friendly" properties are because they have lawns and gardens; many small and mid-sized builders term their projects eco-friendly.

Checking rating agency certification when buying a "green" home will assist you in spotting a greenwash.

Here are the several eco-friendly ways to save money:

Eco-friendly homes provide quality living space and lower utility bills while saving money over time. In addition, having an environmentally friendly home can help you obtain financing at more favorable interest rates.

These eco-friendly ways to save money encompass features like sustainable building materials, renewable energy sources, and effective insulation, among other eco-friendly cost-saving measures.

There are several important factors to consider when purchasing a new home. Whether you're looking for a place to start a family, a place where your family can grow, or a place to meet your needs as your children grow up and move on, you'll want to weigh your family's needs as well as your tastes and desires before making your home-buying choice.

The first consideration you'll want to take into account is the location of your new home. If you have children or will have children soon, you'll want to make sure that your home is located within the boundaries of the best school districts.

You'll also want to consider the proximity of your new home to places like parks, grocery stores, shopping, nightlife, your work, and any nearby family or friends.

A RE/MAX Advanced Realty agent can help you make sense of all the neighborhoods that you're considering and provide you with insider advice regarding which areas might be best suited to your family's needs.

Once you've got your neighborhood picked out, you'll want to find a home that's big enough for your family. You'll want to consider the lot size as well as the size of the actual house. A big yard is great both for having a place for your kids to play safely and to give you the extra space you might need to add an extension to your house if you'd like.

Whether you're looking for a cozy two-bedroom or a sprawling five-bedroom home, your real estate agent can help you find all of the perfect Indianapolis homes for sale that might be right for you.

When looking for a new home, choosing the appropriate price range is crucial since you might pass up the ideal property. Additionally, you don't want to waste time viewing properties that fall short of your requirements since they are beyond your price range.

Finding no home at all because the price range you selected was not right is the only thing worse than finding your ideal house and learning the seller won't budge on price.

You'll also want to be sure to choose a well-constructed house. If you have the time to renovate a fixer-upper home, you'll certainly be making a good investment. But if you're like most families, you'll want to choose a house that is safe, sturdy, and ready to meet all of the needs of your family.

Having an agent on your side when you make your purchase will give you the confidence of knowing that your future home has been properly inspected and that all the right questions have been asked before you make your final decision.

The resale value of a property is important when buying new or pre-owned for several reasons. First off, the value of a house with strong resale value will usually exceed the amount of your loan. As a result, your net worth rises and you can use the equity in your house to refinance into a better loan or take out more loans for improvements and remodels.

Second, if you experience financial difficulties and must sell your house, you're more likely to acquire a selling price that is higher than the loan amount if your property has a high resale value. This would enable you to settle the debt and have money left over to deal with other financial difficulties or buy a more reasonably priced home.

Finding the ideal house will be made easier if you have a firm understanding of each of these aspects. You can figure out all of your needs and what you can afford by working with a reliable real estate agent. In this manner, your search will be restricted to only the houses that best fit your requirements.

Looking for a home in Indianapolis for your family? Check out these properties near you. You may also call us at 317-316-8224 if you have questions on home buying or selling.

More people are adopting sustainability as a lifestyle, not simply as a catchphrase. As homebuyers seek eco-friendly homes, this shift in consciousness is affecting the real estate market.

In today's market, marketing eco-friendly homes requires knowledge. In this blog post, we will talk about sustainable home living, eco-friendly housing amenities, and how real estate agents may market and sell eco-friendly homes effectively.

The trend toward sustainable home living has significantly increased in recent years. For instance, homebuyers consider a property's ecological footprint, location, and visual appeal. Growing market segments now prioritize eco-friendly features, decreased waste, and energy efficiency. The needs of environmentally concerned purchasers are changing, and real estate brokers need to understand this and modify their approaches accordingly.

Understanding a home's eco-friendly features is crucial when marketing it. This knowledge allows real estate agents to communicate these features' benefits to potential buyers effectively.

Essential components include:

ENERGY STAR and LEED certifications are two examples of certifications that can provide concrete validation of a property's commitment to social and environmental responsibility.

The real estate industry has recently seen green certifications emerge as powerful marketing tools. Real estate agents need to be aware of the significance of several certifications. A property's marketability can be improved by understanding the prerequisites and benefits of any recognized certification, such as LEED or ENERGY STAR. Highlighting these certifications in marketing materials and property listings in a competitive real estate market may attract environmentally conscious buyers and set a house apart.

Eco-friendly homes for sale require appealing marketing. Listings of properties are needed to promote environmentally friendly characteristics and to include images of high quality that are conscious of the environment.

Producing specific marketing materials highlighting the advantages of the house's environmental attributes, such as reduced energy bills and small carbon emissions, may also be an effective way to attract buyers worried about the environment's future.

Many purchasers need to fully understand the long-term benefits of environmentally friendly features. To fulfill their educational responsibilities, real estate brokers should explain how features such as solar panels, energy-efficient windows, and smart home technologies contribute to the preservation of the environment and result in cost savings over time. By providing information about decreased utility bills and their favorable environmental impact, it is possible to demonstrate attractive selling factors.

Real estate agents who want to specialize in environmentally friendly properties should make a deliberate effort to cultivate relationships with businesses that create and develop sustainable structures. Establishing these relationships demonstrates a dedication to environmentally responsible behaviors and allows access to a consistent supply of ecologically friendly dwellings. Participating in networking events within the community of sustainable builders can provide access to one-of-a-kind listings and opportunities for collaboration.

Sustainable home living is changing the real estate industry and real estate agents, home sellers, and home buyers must learn to adapt.

To effectively sell eco-friendly homes, agents must know green features, certifications, marketing, buyer education, and strategic collaborations with sustainable builders. They must also know how to prioritize sustainability to meet market needs and promote a greener real estate sector.

Community gardens and real estate are integrating beyond greenery in metropolitan areas. Adding green spaces to real estate developments improves aesthetics and benefits people and the community as cities grow.

One crucial aspect to consider is the environmental benefits offered by community gardens. Are community gardens good for the environment? In this post, we will help you understand what community gardens do in the environment.

"Are community gardens good for the environment?" -- that's one of the frequently asked questions about community gardens. To answer this, you must first understand what a community garden is.

A community garden is a piece of land cultivated by a group of people. Vegetables and flowers are usually grown here individually or collectively. As a result, it helps improve physical and mental health and nutrition in the community.

A green revolution is quietly growing in urban settings with skyscrapers and busy streets. Growing concrete jungles requires additional green places. Amid urban chaos, communal gardens promote sustainability, community solidarity, and property values.

As green oases in urban settings, community gardens profoundly affect mental health, encourage sustainability through operations, and are increasingly valued as eco-amenities by real estate developers.

Community gardens bring nostalgia and nature to city dwellers, providing a refuge from city life. The emotional allure of these natural areas goes beyond aesthetics, affecting well-being and belonging.

Community gardens are essential for promoting mental and emotional health, creating a sense of community by bringing people into contact with nature in urban areas, and encouraging personal growth narratives through shared gardening experiences.

Community gardens increase real estate values and resident well-being. Developers realize that community gardens can boost property prices and increasingly embrace green facilities.

Growing community gardens are being used as selling factors in marketing efforts, and the demand for homes close to green areas is a sign of beneficial effects on property values, in line with real estate trends emphasizing sustainability and green living.

Community gardens serve as a platform for sustainable practices and allow locals to cultivate their food. These green areas become centers of environmentally conscious activities that improve the environment and teach the local population sustainable living practices, such as composting and rainwater collection.

Community gardens are essential to urban farming and self-sufficiency. They promote sustainability in urban environments through educational initiatives, rainwater gathering, composting, waste reduction, and water-saving techniques.

Keeping real estate and green spaces in balance is tricky as demand rises. Collaborative urban planning efforts, encouraging developers to include green amenities, and encouraging community involvement in decision-making processes are all necessary to balance the requirements of inhabitants and the demands of real estate development.

Community gardens in real estate serve emotional, social, and environmental demands in the ever-changing metropolitan setting. Green spaces and real estate create value in urban environments and a more sustainable and peaceful future.

The effects of community gardens on urban real estate include increased property values, environmental sustainability, and communal well-being. Developers are interested in how community gardens provide value, livability, and resilience to urban surroundings.

As we cross the urban jungle, you may know how these community oases affect property values and quality of life. Solutions must balance concrete with vegetation to preserve urban ecosystems for the next generations.

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224