More and more individuals and business entities are becoming conscious of what's happening in the environment. Part of their effort includes adapting to changes that would support the health of the planet, such as making it more sustainable may surprise homeowners in particular.

Making a house more eco-friendly can lower monthly utility costs and increase its market value. Nearly 85% of American homeowners say they would someday like to live in a greener home, according to Realtor.com. Therefore, a home may have a larger return on investment for any implemented eco-friendly project if it caters to individuals included in this statistic.

Fortunately, many home upgrades have a significant environmental impact with little homeowner effort. Some of these include:

Many people lower their water expenses by replacing toilets and faucets with low-flow models that work without waste.

Other homeowners who have more time may install new flooring. Due to their low waste and environmental impact, reclaimed wood and bamboo are popular.

While some bathroom improvements may not enhance sustainability, many clever materials reduce waste. Recycling trash, buying used furniture, and using low-volatile organic compound paint is eco-friendly without losing quality.

While planning a DIY upgrade, assess the ability and materials needed to decide if professional help is required. Performing these undertakings alone can be dangerous and time-consuming. If in doubt, consult a pro for an excellent job.

What's outside matters just as much as what's inside when creating eco-friendly homes.

Lighting an outdoor space with inefficient light is a lost battle; however, solar-paneled pathway lights can recycle energy from sunlight. These fixtures can also bring ethereality to a garden while conserving money.

Sustainable outdoor furniture is also essential. Choose lightly used items from internet markets or thrift stores when in doubt. Certified wood and recycled plastic outdoor furniture are also available.

Any outdoor space can also use solar panels for higher expenditures. The initial installation may cost a couple of thousand dollars, but the utility expenses will drop afterward. Renewable energy, like solar panels, gets most of its power from the sun and stores it for a rainy day. Residents can pay for these panels monthly to own them and enjoy sustainable energy for life.

Composting is another option. Put organic materials and food waste here, which will break down into rich soil for cultivation. It lessens the need for artificial fertilizers and boosts curb attractiveness.

Home renovations like switching incandescent lighting with LEDs, which last longer, consume less energy, and cost less, can help lower electricity bills. More savings come from energy-efficient appliances. Over time, washing machines, dryers, and refrigerators have become more energy-efficient.

Older models are notoriously energy-wasting; therefore, decreasing utility bills through smart appliances will help offset higher initial costs. Moreover, checking energy leaks from poorly sealed windows, especially for heating and cooling helps. Older homes with excessive leakage should have their windows sealed or replaced.

Do you have more tips on how to save energy or turn your home into a sustainable one? Feel free to drop them in the comments!

Building a new home provides you with limitless possibilities which can both be amazing and overwhelming. That’s why it is crucial to have a professional realtor on your team who will make sure that your specific requirements and financial limitations are met throughout the process of turning your vision into a reality.

But here's a burning question: what to look for when choosing a realtor? What skills and qualities to consider to ensure your dream home can come true?

This article will guide you on how to choose the right realtor to assist you if you've decided to build a brand-new home.

Looking for a real estate agent in Indiana is not a problem since there are many you can find online or through a referral. What's challenging, however, is choosing the right one for you.

To start, find a realtor who is experienced and knowledgeable in the new construction field. One who will provide important insights and guidance in selecting long-term benefits of certain features of your homes, such as durability, impact on eventual resale, or timelessness.

Building your dream home is very exciting and you can be enticed to avail all the endless upgrade options which could lead you to overspend. Your realtor should be someone who can help you achieve your dream home while staying on budget.

One who has an industry insider perspective to act as your advocate, and help you spend your money wisely by educating you about the upgrades that are worth to help you prioritize.

The realtor you choose should be someone who has a strong foundation in the inner workings of various building companies and the way they do business. He/she must be able to understand your needs and provide appropriate recommendations for potential builders who will be able to match your needs.

The right location makes all the difference when choosing a place to live. Your realtor should be knowledgeable about the construction and available amenities, as well as the housing development and general community vibe in multiple areas to provide the most appropriate recommendations that best suit your lifestyle.

It is not a secret that you can choose to build your new home without working with a licensed realtor, and the main reason for hiring one is to have a representative who is in your best interest. That said, the realtor you choose when building your home must be someone well-equipped with the knowledge, skills, and attitude to effectively deal with any unexpected crisis that could arise in the process of building a new home.

Choosing a realtor with the skills and qualities mentioned above will ensure you get the most value for money with the least hassle and frustration.

If you are considering building a new home, reach out to us to speak with our new home-build specialists.

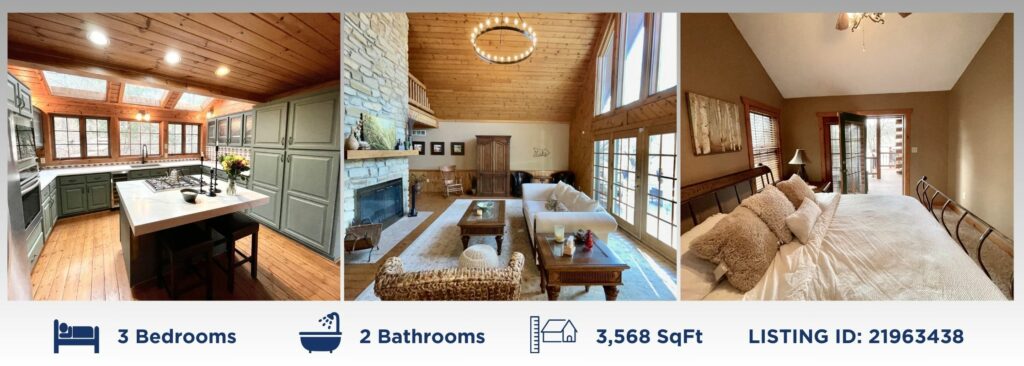

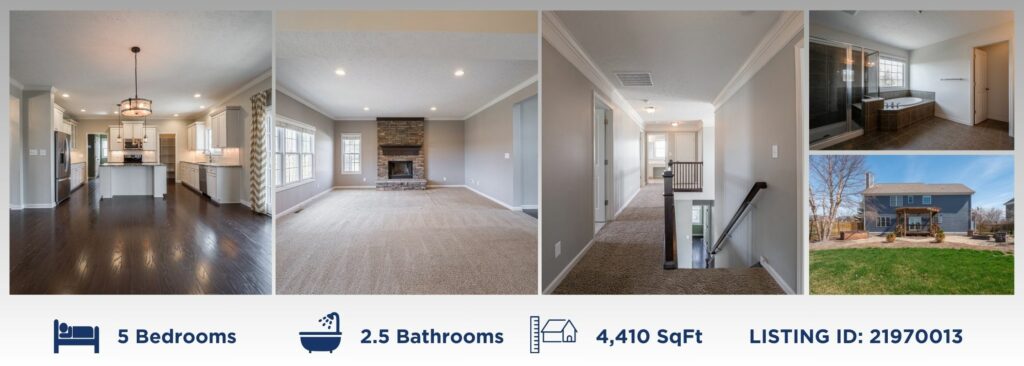

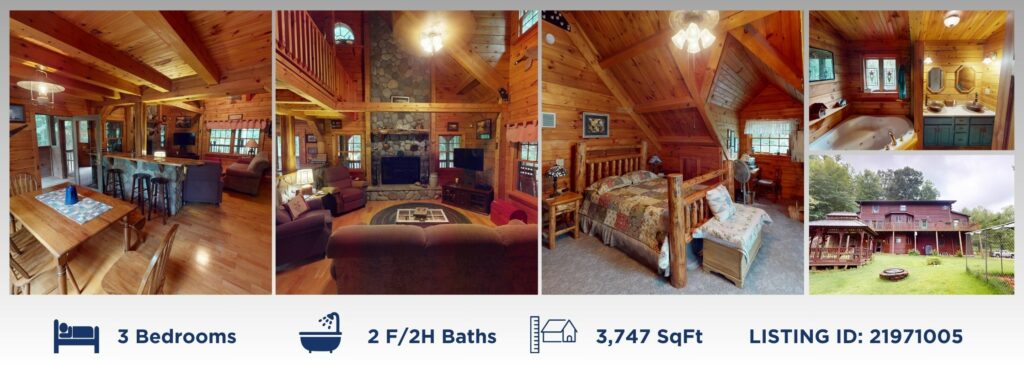

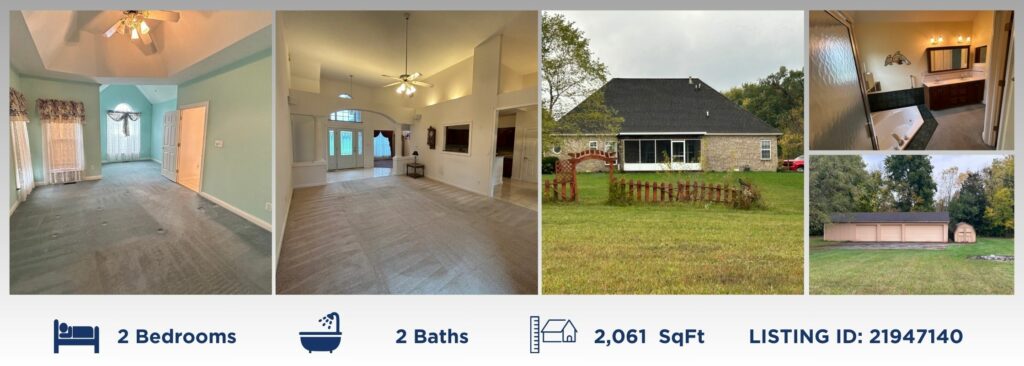

Are you in search of your dream home, one that offers luxury, comfort, and tranquility? Look no further than these exquisite properties, listed by our brokerage's agents, which epitomize upscale living. From stunning lakefront log homes to sprawling ranch estates, each of these residences promises a lifestyle of unparalleled sophistication and relaxation. Let's take a closer look at what makes each property unique:

Nestled on the shores of Lamb Lake, this beautiful log home exudes rustic charm and modern elegance. With over 100 feet of lakefront access and a boat dock just steps away, indulge in the serenity of lakeside living. The updated interior features hardwood flooring, a wood-burning fireplace, and a gourmet kitchen with quartz countertops and new appliances. With amenities like water-skiing, boating, and a private beach, every day feels like a retreat in this lakeside haven.

Listed by the Rob Campbell Team

Rob Campbell | 317-695-1315 | Joyce Campbell | 317-691-4627

Experience the best of country living in this stunning ranch estate situated on three manicured acres. The outdoor oasis boasts a heated saltwater pool, cabana, and spacious screened porch, perfect for enjoying the serene surroundings. Inside, the gourmet kitchen, spacious great room, and finished basement offer ample space for entertaining and relaxation. With updates including a new roof, HVAC system, and generator, this home combines luxury with peace of mind

Listed by the Rob Campbell Team

Rob Campbell | 317-695-1315 | Joyce Campbell | 317-691-4627

Welcome to modern elegance in the sought-after Rock Bridge neighborhood. This 5-bedroom home features a gourmet kitchen, great room with stone fireplace, and finished basement with theater equipment. Outside, the fenced backyard offers a pergola, hot tub, firepit, and lush landscaping, creating an idyllic setting for outdoor gatherings. With recent updates including a geothermal system and tankless water heater, this residence offers the perfect blend of luxury and functionality.

Listed by Ryan Hendren | (317) 985-4887

Escape to the tranquility of this custom-built log home nestled on nearly 16 wooded acres. From the soaring ceilings and stone fireplace to the wrap-around porch and screened gazebo, every detail exudes charm and elegance. With two master suites, a bonus room, and a spacious pole barn, this home offers endless possibilities for relaxation and recreation amidst nature's beauty.

Listed by Joy Hickman | (317) 414-0698

Embrace the charm of country living in this all-brick ranch nestled on nearly 5 acres. Custom features abound, from vaulted ceilings and gourmet kitchen to heated garages and storage barns. With ample space for a home-based business or automobile collection, this property offers the perfect blend of luxury and functionality.

Listed by Keith Turnbill | (317) 626-0800

Discover your own nature preserve in this secluded wooded retreat, just minutes from downtown Indianapolis. With spacious bedrooms, multiple living areas, and a screened porch overlooking the lush surroundings, this home offers the perfect blend of indoor and outdoor living. Recent updates including new flooring, HVAC system, and security features ensure comfort and peace of mind for years to come.

Listed by Dana Wright | (317) 200-9090

From lakeside retreats to sprawling estates, these luxury properties offer the perfect blend of elegance, comfort, and tranquility. Contact us today to schedule a private tour and experience the epitome of upscale living firsthand. Your dream home awaits!

Green roofs provide both a natural and symbolic breath of fresh air in the busy concrete jungles that are today's cities. These inventive installations improve urban landscapes and the environment by decreasing heat, stormwater runoff, and air pollution.

This post will discuss how green roofs work, enabling city people to develop thriving green areas on top of their structures. The below ideas will show you how to grow beautiful green roofs and how they benefit the environment and community, whether you're a seasoned gardener or a beginner.

Plant-filled green roofs are also called living roofs. They are environmentally friendly and encourage sustainable development. Creating a green roof requires a waterproofing membrane, root barrier, drainage layer, growing medium, and vegetation. Green roofs' main goals are sustainable energy, stormwater management, and a healthy environment.

Green roof vegetation and substrate absorb precipitation, lowering pressure on drainage systems and flooding danger. As insulation, green roofs reduce heating and cooling needs, minimizing building energy consumption. They improve air quality and mitigate climate change by catching pollutants and carbon dioxide.

Meanwhile, rooftop gardens extend green roofs into outdoor living spaces for cultivation, recreation, and community participation. Beyond ecological benefits, rooftop gardens emphasize social and economic benefits.

Rooftop gardens are communal and entertainment settings. Sitting places, strolling trails, and playgrounds can be added to these gardens to create relaxing, social, and community spaces. It can also be a place where residents relax and connect by providing a break from city life.

Urban agriculture should be done outside to encourage sustainable food production. On your rooftop patio, grow fruits, veggies, and herbs in raised beds or containers. Use composting to recycle organic waste and feed plants.

Sustainable rooftop greenhouses mix agriculture and design. These unique structures allow rooftop farming of fresh produce. Sustainable design improves rooftop greenhouses' environmental performance. Install rainwater collecting, solar panels, and composting facilities to lessen your roof decking's ecological impact.

Hang baskets, pots, and cascading vines from pergolas or trellises. These designs produce a green curtain effect and provide visual appeal to the rooftop deck or patio, making it a beautiful green retreat. Rooftop greenhouses improve energy efficiency, air quality, and food sustainability using vertical space and modern growing methods.

Create rooftop greenhouses with giant planters or raised beds. Easy maintenance, plant selection, and transportation are possible with this strategy. It works for studio apartment rooftop terraces with weight limits or limited space.

Plant local herbs and medicinal plants on your rooftop patio. Put culinary, medicinal, and fragrant herbs in separate sections. Practice and wellness are combined in this design.

Native plants thrive in local climates, require less care, and shelter wildlife. Ecological balance and indigenous plant conservation are achieved using this method.

Make rooftop gardens into sustainable and learning areas. Signage, information boards, and interactive displays could explain rooftop gardens, native plants, and other eco-friendly techniques.

Make the rooftop terrace a relaxing urban home. Create a soothing atmosphere with fountains or tiny ponds. Plants, trees, and water elements make these gardens a welcome respite from the city. They help preserve urban biodiversity by housing birds, butterflies, and other animals.

Creating a rooftop garden outdoor living space lets you relax, connect with nature, and enjoy the scenery. Select comfortable and sturdy outdoor furniture that matches your style and preferences, offers comfy seats and shade structures, and adds fragrant plants to enhance the sensory experience, illumination, and relaxation. For extra coziness, add plush cushions and pillows.

A rooftop terrace seamlessly connects indoor and outdoor living spaces. Residents may rest, party, and enjoy city views in its adaptable outdoor living and dining area. Rooftop terraces offer a retreat from the city with lounge seats, dining areas, and hot tubs. Design your roof decks for inspiration, socializing, and outdoor activities. It can create relaxing lounges or dining areas beneath covered pergolas.

Conclusion

Rooftop makeovers serve as an inspiration for creative design concepts and upcoming advancements in the building sector. Green areas are being incorporated into building designs by architects and urban planners, who are putting sustainability and the welfare of the community first.

In the ever-changing real estate market, homeowners often end up with lots of questions than before, such as "How can I sell my home faster?"

If you're one of these home sellers or you're just curious about the best ways to put your home on the market, then you're in the right place!

In this post, we will cover the best ways to sell your home to maximize your return on investment, whether you're moving for work, downsizing, or simply needing a change.

Just how hard is it to sell a home?

All you have to do is tell everyone you know that you're selling your property and/or take photos and videos and post it online.

If only it's that easy. Selling a home is more than just putting your house on social media or telling your family and friends about it. It's a long excruciating process that may need a few boosts or guidance to be executed quickly and properly.

Here are some things to do to sell your home:

An agent's market knowledge helps you price your property competitively. They ensure your home is priced correctly in the market using their hyperlocal experience. A good agent brings in stagers and photographers to make your home appear its best in online advertising and open houses.

A real estate agent's services provide the following advantages:

The possible disadvantages of having a real estate agent are:

As the name implies, FSBO is a homeowner-driven technique where the property owner acts as a real estate agent. They individually schedule and manage property visits. Homeowners also ensure essential documentation meets local and state requirements.

Advantages of FSBO use include:

Using FSBO may present the following difficulties:

Homeowners can market their houses on internet marketplaces, thanks to real estate digitalization. Buyers and sellers can easily use many popular platforms.

The advantages of utilizing online marketplaces are:

The possible disadvantages of using this are:

Auctions sell properties to the highest bidder after a fast-paced bidding procedure. Online platforms, independent auction houses, and real estate corporations can hold these auctions. Traditionally, bidders attend live auctions at an auction house or property.

Advantages of real estate auctions include:

Using auctions may present the following possible disadvantages:

Selling your home can be tricky; luckily, there are many ways how to do it. Here are more tips for selling your home:

Homes are bought outright by cash buyers without mortgages. This unusual strategy appeals to homeowners seeking speed and ease. People, real estate investment corporations, and specialized companies may buy family houses, apartments, and rental properties for their diversified investment portfolios.

Advantages of this method include:

The following potential risks could arise from using this method:

Real estate methods like lease options and rent-to-own benefit buyers and sellers. The agreement's terms and conditions usually differ. Rent-to-own tenants must buy the property or forfeit their rent premiums after renting it for a defined period.

The advantages of rent-to-own and lease options are:

The ret-to-own and lease options may present the following difficulties:

Home Staging

Furniture and decor are arranged to highlight the property's best qualities and appeal to a broad audience during home staging. Removing family images while arranging the home helps buyers visualize themselves there.

The following are some of its advantages:

Virtual Tours

New virtual tours let purchasers tour homes from their screens. These 360-degree 3D digital walkthroughs let customers explore every corner of a house.

The following are some of its advantages:

Conclusion

Selling a home is a significant decision that needs careful planning. All these things to do to sell your home methods will help you if you want to sell your home. It's crucial to realize that no approach works for everyone. Each selling strategy has pros and cons. Those are the best options on how to sell your home but they will rely on your tastes and market knowledge.

Gone are the days when traditional roofing materials included asphalt and concrete tiles; now, there's a new competitor that focuses on using sustainable energy -- solar roofs.

A huge number of homeowners seeking energy efficiency end up choosing solar roofs because of several reasons. For one, it combines innovation and functionality, and two, it helps lower electric bills and carbon footprint.

In this post, we'll dive deeper into how solar roofs work, their pros and cons, and things to consider if you plan to install one in your home.

Like a typical roof, it protects the home and its dwellers against weather-related issues, including rain, wind, and snow. However, it's more than that as it can produce its energy.

PV panels or solar shingles are directly incorporated into the roof to harness sunlight's power—a smooth, appealing, energy-generating roof.

Solar roofs generate electricity using cutting-edge technologies. These roofs use monocrystalline or polycrystalline silicon solar cells in solar panels or tiles.

When sunlight hits these cells, an exciting process happens. Electric current flows from your solar roof's photovoltaic (PV) tiles when sunlight strikes them and is absorbed by solar cells. Your solar inverter receives this direct current (DC) energy and transforms it into alternating current (AC) energy, which powers your house.

AC powers most homes and appliances. An inverter converts DC electricity into AC before usage. Usable electricity can run home appliances or be supplied back into the grid, resulting in electricity bill credits. Solar technology in roofing materials like tiles and shingles lets homeowners preserve their home's appearance without installing cumbersome solar panels.

Solar roofs benefit both homes and the environment; plus, it's aesthetically appealing. Below are some advantages of solar roofs:

Today's climate-conscious world emphasizes the importance of renewable energy sources. Installing a solar roof benefits the environment in more ways than one:

Solar roofs seem to make a lot of financial sense, in addition to the obvious benefits they provide to the environment:

The installation of a solar roof allows households to achieve greater energy autonomy:

One of the major drawbacks of solar energy is the high initial costs of the equipment and installation. However, leasing options can lower your initial expenses if money is a concern. Should you decide to purchase, you will have to occupy your house for a certain amount of years until the system becomes self-sufficient. Renters are less suitable for this long-term investment than property owners.

One of the main drawbacks of solar energy has been the brief drop in energy production during inclement weather. However, because of advancements in battery technology, the impact of days with minimal solar energy is decreasing.

Alternatives to outdated solar energy storage technologies, such as lead-acid batteries, are emerging. Higher power at a reduced cost is provided by lithium-ion batteries. Batteries built with nickel have an incredibly long lifespan. New technologies promise large-scale and long-lasting power storage, such as flow batteries.

When it comes to solar roofs, orientation matters. Your roof won't be able to collect enough solar energy if it isn't facing the sun. Flat roofs are typically less effective than roofs that tilt toward the sun.

Solar panel installation is facilitated by roofing materials including metal, tiles, and asphalt shingles. The cost of installation might be higher if your space is constructed of different materials. The capacity of roofs to hold solar panels contributes to their energy-efficient characteristics.

Installing a solar roof benefits the environment and your finances as well. However, to know if a solar roof is worth it for you and your home, you have to consider a few things first:

Before adding solar panels or tiles, check your roof's support. Considering the roof's condition can prevent future issues and prolong the life of your solar system. Normally, it's better for new roofs.

Some roofing materials need to be more suitable for solar installations. If you have a concrete tile roof or a steel roofing tile, visit a roofing and solar firm to understand the installation consequences. Traditional asphalt roofs are usually compatible. The roof design, slope, and orientation also affect solar system effectiveness.

Solar roofs are expensive, so evaluate all costs:

Solar roofs work best when tailored to your home's energy needs:

Local laws can differ; therefore, it's essential to know what the rules are where you live:

As with any significant home upgrade, installing a solar roof is just the beginning. To extend the life of your investment, you have to take care of it just like your other assets.

Low-maintenance solar roofing. Basic tasks can optimize system performance:

Knowing your warranty and repair needs can prevent problems:

Solar roofs are more than just eco-friendly—they represent the future of clean energy and sustainable living. The move toward renewable energy sources like solar power is vital to meeting the world's energy needs sustainably.

Have you heard of the term "dry closing" before?

If yes, but you're not certain what it means or if it's your first time hearing it, then you're in the right place.

Dry closing is when all the papers are signed, and payment is sent, but the ownership transfer doesn't happen immediately because of an unfinished business. In simple terms, it's when a buyer and seller agree to close on a house before any money has been handed in.

In this post, we'll discuss what dry closing is about, why it occurs, what makes the seller agree to this as well as other frequently asked questions about it.

A dry closing differs from a "normal" wet closing simply because the seller is paid after the buyer fulfills the mortgage criteria and the closing documents are signed.

Dry closings occur only when the buyer and seller agree on the same thing. When events arise that ordinarily lead to a buyer or seller pulling out of the sale, they are designed to keep the transaction moving forward. Lastly, just a few states allow dry closings.

When selling a house, people expect closing payments. Most states mandate a 'wet close' for all real estate transactions.

Every closure should be wet, but the lengthy and challenging process may prevent the buyer from paying on closing day. The parties can wait two or three business days for the earnest cash rather than dissolve and fight over the deal.

The buyer or lender usually causes a dry closing since the buyer's finances to pay for the selling are delayed. This could be due to a payment glitch that takes time for the lender to fix, the buyer needing to meet an outstanding condition to get a mortgage, or the seller having a similar issue with their property that prevents a sale condition from being met.

Dry closings keep deals alive and ensure buyers get houses and sellers get money. Thus, dry closing may be preferable to wet closing, which fails if the seller doesn't obtain their money on closing day.

Dry closings do not necessarily mean the buyer is untrustworthy. Deals sometimes need to be corrected, and funding arrives late. That means it will come so close first and retrieve your money a few days later.

To answer this, you must consider the role of the lender. Overall, they have a huge influence on real estate closing. A buyer seeking a home from a seller rarely has the money to pay. So they borrow money from lenders to be able to purchase the property.

The buyer puts the property as collateral for the loan, so the lender may repossess it and get their money back if things go wrong. Thus, the lender pays the seller, not the buyer. If the lender delays sending the loan to the buyer, a dry closing may be beneficial while the lender resolves its concerns.

While the buyer and lender are typically the source of a dry closing in real estate, the seller may sometimes be the one to force a post-closure funding delay.

After a dry closing, sellers should not relinquish their home's title. Keep the title and key until they have money. In the odd event that finance fails, it can be difficult to reclaim the title from the buyer if the transfer is already completed.

Dry closing is when a buyer and seller agree to close on a house before cash is exchanged, with the seller paid once the buyer meets mortgage requirements and signs closing documents. The seller's credibility is rarely involved in this situation, which usually requires buyer financing delays.

Though it delays seller payment by a few days, a dry closing can keep deals alive and go forward. Providing funds and causing delays are vital to the lender. At a dry closing, sellers should keep ownership until payment is made to avoid financing issues.

In Part 1, we’ve shared tips on how to make open houses more inviting, such as using signages, creating shareable videos, putting balloons in mailboxes, and more.

Now, let us dive deeper into the art of attracting buyers during an open house.

If the home you're showing is vacant, virtually staging a few or all rooms will be one of the best open house ideas to inspire buyers to imagine it furnished. If the house has a lot of stuff, colorful purple walls, carpets, or other old-fashioned features, virtual staging might show the owner what it would appear like with a few improvements or a neutral color scheme. Put a photo of the altered area on an easel or display a QR code in a few key rooms to link with a gallery of staged photos online.

One way to not only get attention but keep you in your prospect’s mind is to customize. Attach personalized labels with your contact details and logo to the water or bubbly drink bottles you offer.

Seek out co-branding options with a local restaurant, bakery, or deli. To attract prospective buyers, tiny local shops can display little savory snacks or cupcakes alongside their menus, business cards, or coupons.

Have a coworker, intern, or other person at the open house answer guests' inquiries, ask the proper leading questions, conduct personal guided tours, and watch for particularly interested buyers to follow up with. Get your helper to match up names on the sign-in sheet with interest levels, so you can customize follow-up for promising leads.

The lender can instantly pre-approve prospective purchasers and inform them of the monthly payment amount before they leave the property, allowing the buyer to ascertain their affordability immediately.

Prepare small bags to give with various treats that visitors can take with them. Gift bags are great open-house ideas for promotional products like refrigerator magnets or keychains. Add a packaged cookie from a local bakery and ask nearby shops for samples or coupons.

A raffle is a great way to get visitors to your open house. Think of items like fanny packs, baseball caps, duffel bags, or portable Bluetooth speakers that you can buy in large quantities and mark with your promotional logo. Local businesses may donate a prize if you put their advertising materials in the goodie bags or educational packets. Include a social media and invitation that mentions the raffle.

Listing agents usually welcome other agents' open houses, especially if they're across town. Ask for your open house signs to promote your brand in the community and provide the listing agent an enticing referral fee for every client you secure from the event.

See if two or three local real estate agents want to collaborate on a multiple-house open showing. Plan and advertise the event jointly and create buzz on your social media channels.

Invite local real estate brokers to a private preview. In addition to networking with local industry people, this event can lead to future open house collaboration.

Send them a personalized video follow-up message with their name and an outline of the property's essential features. Messages can be sent after the open house if well-attended, but interested parties should be prioritized.

Reconnect with every individual who was reached. Call them to inquire about their experience, or if they have given you their agent's business card, call the agent to find out what they had to say.

This is one of the most underrated yet effective ways to make an open house more inviting: bake cookies. Instead of buying them, ask the current homeowner if you can use their oven for baking the goods. If you bake late enough, the house will still smell amazing when guests arrive. Just make sure you leave enough time for kitchen cleanup afterward.

A Thank You card can keep the property—and its owner's name and contact information—on a hot prospect's mind. Select a home-themed thank you card or one with a more profound message. You can even provide a photo of the deck view they loved to a Card. Whatever design you choose, write a note and immediately send the card an email or text message.

Executing great open house ideas, such as freshly made cookies and virtual staging, can increase the attraction of your house to potential purchasers. In addition, giving customized follow-ups, partnering with nearby businesses, and offering branded drinks are among the best open house ideas to impress and engage buyers.

As more people choose to work from home, there is a greater demand than ever for a dedicated, fashionable home office. The thing is, it's not just about the aesthetics; it's about the increased productivity with the best home office spaces that showcase your personality.

This post will help you understand the importance of organizing a home office and how to design it.

As office trends shift toward remote work, having adequate floor space for a dedicated office space influences purchasing decisions. Homeowners are no longer pleased with a dark and dreary basement workstation. Instead, remote work requires homeowners to convert a visible location into a dedicated and functional home office space.

This change emphasizes the need to incorporate functional workplace design ideas into your environment. A well-planned office arrangement not only provides comfort during lengthy work hours but also improves the entire appearance of your home.

A rising number of professionals, particularly in crowded locations such as San Francisco, recognize the need to provide specialized space. It's not just about the square footage; it's about designing an area that reflects current workplace design trends while also creating a functional and stylish ambiance.

Working in an isolated but pleasant place improves well-being. To make this statement a reality, here are eight elements you should have in your home office to increase productivity:

Choosing the proper desk chair is an important step in planning any workplace environment. It doesn't matter if it's traditional or contemporary since both designs have their advantages. Aside from the looks, the focus is on comfort and ergonomics.

Investing in an ergonomic chair is essential. It's a critical piece in the home office setup. It's beneficial to the body without the need to sacrifice style.

So, why choose an ergonomic chair?

The purpose of an ergonomic chair is to provide comfort and support your body's posture. It allows you to:

Meanwhile, choosing an adjustable desk allows you to alternate between sitting and standing, which is beneficial for your health.

Any office design relies on lighting. It improves mood, productivity, and eyesight. Instead of fluorescent or overhead lighting, natural light is warmer and friendlier. Working near a window might be relaxing if you have a window overlooking a beautiful skyline or a quiet neighborhood.

Adjustable task lighting can illuminate a work surface without wasting energy or emitting heat. A suitable desk or floor lamp helps you focus the light if you work late or on gloomy days. A lighting professional might recommend desk lamps or overhead lighting for a relaxing atmosphere.

Decluttering boosts productivity and reduces stress. It creates a setting that eliminates distractions and stimulates creativity without compromising personal style, not just white walls or floor space.

There are creative storage solutions that can make your workspace appealing and functional at the same time. You can look at Pinterest for ideas on how to design your area or check our blog posts.

You can also learn how to manage your cable to improve workspace safety and efficiency.

Your workspace is more than functional—it shows your style and imagination. Your routine might be inspired by adding meaningful aspects. Imagine creating an energizing and motivating workplace.

Quality tech equipment and an efficient home office go together. High-speed internet powers modern home offices. Real-time project management, cloud-based collaborations, and online meetings require a strong internet connection.

An excellent internet connection and providers are essential for success. A powerful computer, ergonomic keyboard, and high-resolution monitor boost productivity. One voice command might control your office lights, thermostat, and coffee maker.

It's essential to have a peaceful workspace. Work productivity and concentration are hampered by noise, therefore soundproofing your office from noise is a wise move. Acoustic panels or foam tiles can greatly minimize street and family noise.

Modern office workers, especially those without a dedicated workplace area, love noise-cancelling headphones. These headphones provide an instant quiet zone for work and concentration. Headsets help create quiet time to focus and increase productivity.

A well-designed office includes spaces for short breaks to keep the mind sharp and creativity flowing. Each office needs a comfortable area. The home office should be designed as a place to relax, whether in a bean bag or an ergonomic chair. A coffee station or mini-fridge is a great office addition. Adding plants and soothing decor to your workspace provides a retreat.

Adaptability is crucial in changing times. Your space must adapt whether you change careers, technology, or office design. If your workplace design is good and your work needs to be altered, it can adapt rapidly. Many professionals are considering hybrid work arrangements due to the global shift toward remote employment.

Today's professionals need to know how to design office space at home to be more productive. Proper lighting, organization, and design boost performance.

It also implies using technology, soundproofing, design concepts, and ergonomics to increase performance.

Want more ideas on how to level up your home? If yes, click this link today!

If you like historic homes, these billionaire and celebrity luxury homes will captivate you. These most luxurious celebrity homes in the wealthiest neighborhoods have lavish features, vast layouts, and intelligent designers. This 2024 listing was once owned or rented by celebrities and might be your next home.

Billionaire, celebrity, and sports legend property deals have made history. Several celebrity luxury homes will be available 2024 for individuals seeking luxurious homes with incredible stories.

Here, you'll find the ten most luxurious celebrity homes on the market, each boasting unmatched grandeur and style.

Billy Joel, known for classics like "Uptown Girl" and "Vienna," is trendy among real-estate fans. The musician is selling his big Long Island property for USD 49 million. The 26-acre beachfront estate has five bedrooms and eight baths. One of the most luxurious celebrity homes is Middlesea, near the shore. Currently, purchasers cannot view the real estate listing online.

Carolina Wozniacki and David Lee's South Florida property is one of the most sought-after celebrity luxury homes for sale. The USD 42 million Miami penthouse has five bedrooms, six bathrooms, and a rooftop pool. Oprah and Julia Roberts live near the penthouse. Glass pocket doors, 18-foot ceilings, and a bar and screening room make the duplex sumptuous. The celebrity-owned house's subtle elegance is alluring.

Alec Baldwin put his elegant Hamptons real estate for sale and made a walkthrough video. Last September, the big home was marketed for USD 22.5 million; now, the farmhouse-style estate with modern touches costs USD 18.995. Seven bedrooms and nine bathrooms in 1,276 square feet make up the 1740 beach mansion. This mansion was found in East Hampton's Amagansett area.

Producer Andrew Scheinman of Seinfeld, When Harry Met Sally, and other A-list projects listed his luxurious homes for USD 17.75 million. Los Angeles' 7,200-square-foot home has six bedrooms and nine bathrooms. The second-floor balcony overlooks the Los Angeles skyline and ocean, ideal for sun-kissed shots. Entertainment features like a home theater and an infrared sauna are very extravagant.

Full House star and The Row co-founder Ashley Olsen is selling her NYC house for $7.25 million. 2 bedrooms, 2.5 bathrooms, and a gourmet kitchen with top-of-the-line appliances are in this big oak-framed, double-paned home. Elegant Olsen's loft has a custom-milled dressing area and white wood cabinets. Classic architecture and superb location make the property an excellent value.

The Oscar-winning actress put her Los Angeles home up for sale recently, unlike some celebrity luxury homes now for sale. This property, which Stone acquired for USD 2.3 million in 2019, is currently listed for USD 3.95 million. The actress meticulously renovated the 100-year-old mansion into a luxury home. Within a week of being listed, the house reportedly found a buyer; however, the realtor's listing indicates that the sale is still pending.

Jeffrey Bezos' Bellevue mansion is ideal. Houses for succeeding in a historical setting cost $2.3 million. One of the most talked-about properties for sale this year is this one. 1954, 1,540-square-foot house, renovated in 2001, has three bedrooms and two bathrooms. This house has natural and illuminating skylights.

James Bond actor Roger Moore occasionally rented this 1930s Gloucestershire country house. The 4,875-square-foot country home has six bedrooms, five bathrooms, and a vast outbuilding, making it appealing to families. The 2.8-acre property costs GBP 2.1 million. The house has been renovated since 1935 to make it more modern. Despite updated conveniences, the estate retains its country charm.

Whitney Rose, from Real Housewives of Salt Lake City, put her 6,100-square-foot Utah home for sale for USD 2.1 million. The show was filmed at the Daybreak Lake property, with various seating spaces, a beautiful patio, and a backyard with a fire pit and mountain views. Offices, a speakeasy bar in the basement, a gym, and a spa are also in the multistory house.

After 55 years, Ernest Hemingway's Gold Coast Chicago apartment is listed for US$2 million. A year after their 1921 honeymoon, Ernest Hemingway and Hadley Richardson filled the flat with memories. Currently, there are two studios and a five-bedroom central house unit—a garage-equipped three-bedroom, one-bath coach home.

Which celebrity homes do you like the most? Feel free to share your thoughts in the comments!

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224