Whether you enjoy entertaining, lounging by the pool, or chasing the kids around the yard, a patio should not only look fantastic but also fulfill your family's needs. Even though the best patio design may change depending on the region, designers agree that there are several common patio design aspects they usually avoid (some of which will possibly surprise you).

Designers advise avoiding these six patio elements for a setting that is both practical and fashionable.

The majority of designers surveyed stated that heavy furniture sets were their biggest pet peeve when asked which patio aspects they disliked the most.

We're referring to the identical sets of coffee tables, accent chairs, and sectionals sold in every department shop. In store displays, they might look more attractive and luxurious but when you actually place them in your home, they are bigger than what you’ve expected.

Not only do large outdoor patio furniture sets physically overpower a room, but they can also be inconvenient and provide little adaptability. Rather, smaller sets and modular furniture are more practical and aesthetically pleasant, according to designers.

According to Jodi Peterman, CEO and owner of Erin Elizabeth Designs, using smaller seating options in conjunction with built-in benches or well-placed accent chairs preserves the space's purposeful design while maintaining usefulness.

When the weather warms up, it could be tempting to throw out any old rug on your patio, especially since a high-quality, weather-resistant rug can be exorbitant. Designers advise against placing rugs on your patio that aren't made to last the weather, though.

"It is crucial to get a long-lasting, all-weather rug that adds texture or color and ties everything together because these can look messy and wear out quickly," explains Elizabeth Vergara, CEO and founder of Vergara Homes.

Think about the money you'll save by purchasing high-quality rugs upfront rather than constantly replacing inferior ones.

Designers agree that good lighting doesn't just bring a room together, it also helps improve its functionality. However, many people still overlook having outdoor lighting on their patio.

If you want to maximize the look of your patio, adding string lights is an excellent start. Designer Chris Turner suggests not stopping there. He said that while string lights can significantly enhance a room, depending only on them can leave the room feeling unfinished.

In addition to string lights, think about adding pendant lights for your gazebo or covered patio, wall sconces on the side of the house, recessed lighting, or even a standing outdoor light fixture. It never hurts to have walkway lights surrounding the patio or along the pathways that lead to it.

Although we value stamped concrete patios since they are inexpensive and practical, we can't hold it against designers who have other ideas. Designers naturally favor natural materials, which they aim to mimic, but it is not a perfect replacement.

According to Turner, "stamped concrete can crack over time and frequently looks artificial."

To create a patio space that a designer will approve, choose high-quality materials like large-format pavers or natural stone. These choices are more timeless and long-lasting in addition to being more aesthetically pleasing.

Additionally, Turner disapproves of patios that combine too many various elements, including plastic, wood, and metal. This may result in a visually disorganized and unwelcoming area.

"It will look like a much more cohesive and inviting space if you can stick to one or two materials that complement the home's architecture," he says.

An inexpensive all-weather wicker patio furniture is not a good option, according to Peterman's opinion. Seemingly ubiquitous, this style of furniture is frequently less expensive than its metal and wooden counterparts. But in addition to seeming a little old, it is also short-lived.

According to her, "It was popular once, but low-quality versions fail quickly and show signs of aging after their first season."

"I choose powder-coated aluminum or natural teak, and sometimes concrete-wood combinations, when building an outdoor space because they improve with age instead of deteriorating," she says.

Homes were selling quickly a few years ago and receiving numerous offers that were significantly higher than their asking price. Customers seemed to be waiting in line at the door regardless of the pricing you set.

The housing market of today, however, is different. As inventory has increased, buyers are becoming more picky. Houses are remaining in place for a little while. Additionally, more vendors are being forced to lower their pricing.

How do you manage to win, then? Setting your home's initial price is the first step in the process. That is more important than ever today and has the power to make or break your business.

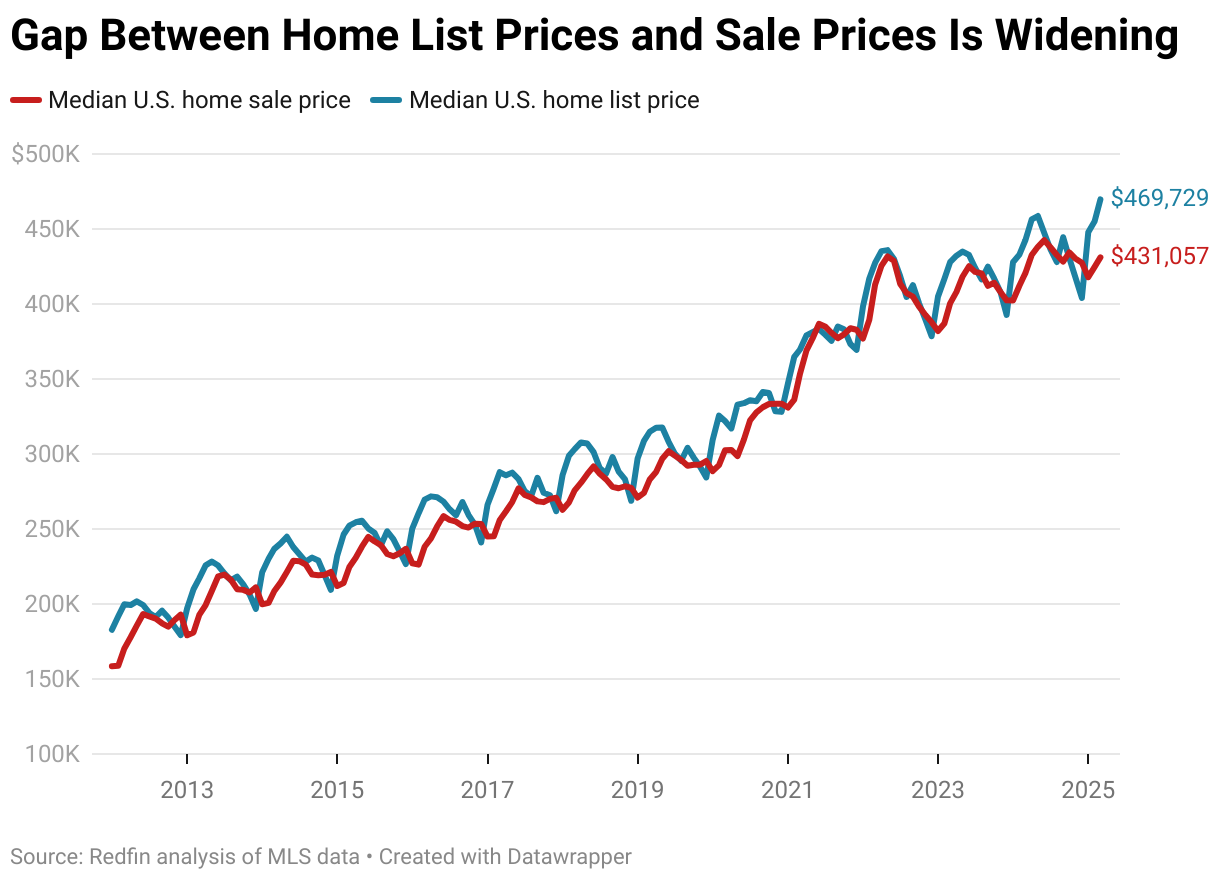

According to a recent Realtor.com survey, 81% of property sellers think they will receive at least their asking price. However, real sales data indicates that the difference between what buyers are ready to pay and what sellers expect is widening.

In actuality, 44% of recently sold homes sold for less than the asking price, according to an annual report from the National Association of Realtors (NAR). Additionally, before the house sold, one in three sellers had to lower their price at least once. It's an indication that expectations might not be entirely in line with the reality of today.

The Redfin graph below illustrates how asking prices (blue line) are increasingly higher than actual sales prices (green line):

This indicates that not all purchasers are prepared to pay the prices that many sellers are requesting. You can still sell for a high price, but you must start with a price that is in line with what buyers are prepared to pay in the current market.

Setting a high initial price for your home could seem like a good idea since it gives you more negotiating leverage. However, the truth is that a home that is too expensive may remain on the market and deter potential purchasers.

Buyers are intelligent. Upon seeing a house that has been abandoned for some time, they begin to question whether it is in good condition. Less interest, fewer showings, and ultimately a price reduction to get people's attention can result from that. In the words of Realtor.com:

Selling a house might be more difficult the longer it sits on the market.

If you price your home correctly, you still have a fantastic opportunity.

It's crucial to rely on an agent who is aware of local conditions when determining your asking price in order to avoid making this error.

The pricing sweet spot for your neighborhood will vary depending on where you reside, so your realtor will consider buyer patterns, inventory levels, and recent local sales.

It's also important to remember that throughout the last five years, property prices have increased by more than 57%. Therefore, you'll probably still be in a wonderful position financially even if you price a little lower than the amount you had in mind.

By working with a local real estate agent, you can increase the amount of interest in your home, prevent it from being on the market for too long, and increase the likelihood that you will receive a competitive offer.

The right pricing works in the current market. As Mike Simonsen, Founder of Altos Research, explains:

Final Note

Your selling opportunity hasn't altered, but the market has. You just need the correct pricing package. To find out what price will help your house sell quickly and for the most money, speak with a local real estate agent about current pricing in your neighborhood.

If you've always wanted a living room that seems luxurious, know that you can definitely accomplish this style on your own without breaking the bank. The secret is a few well-considered, expertly recommended improvements that will quickly transform your area into a "luxe" haven.

For a more sophisticated look, you should use these six easy yet effective suggestions from three interior designers.

Note: Don't be shocked if your friends and relatives begin to compliment you nearly right away.

You may simply add architectural flair to your home after you move in, even if it doesn't have much. Installing molding will also make your living room look much larger.

According to Rebecca Ward, the founder of Rebecca Ward Design, "Nothing says 'expensive' like adding molding to a feature wall. It’s a custom detail that adds an extra touch of intrigue and character to the space, but doesn’t have to cost a lot!"

If you like DIYing, you can install the molding yourself, which renters can appreciate as well. You can use temporary glue to apply renter-friendly picture frame molding, which you can then remove after your lease, according to several online tutorials.

Never undervalue the impact of adding some striking flora to your house. For a posh touch, Ward loves to place a potted tree in the living room.

"Live or faux, the green is an enriching neutral color for any palette," Ward states.

Consider alternatives to a typical terracotta planter and choose one that more closely matches your style. For the ideal vessel, you may also browse vintage stores. To make the arrangement look a little more authentic, you might also want to buy some moss to put on the top of your planter if you decide to go the false plant route.

According to Elissa Hall, co-creator of Sojourn Interiors and founder of EDH Interiors, adding a range of natural textures to a living room is crucial to creating an opulent appearance.

"Working in neutrals helps create that sumptuous, elegant feel," she claims.

To further add depth and visual intrigue that conjures quiet elegance, she suggests using elements such as stoneware, wood, wool, and other materials in the room.

Studio Burgoon founder Ali Burgoon Nolan concurs, pointing out the importance of layering textiles in particular.

"Mixing high-quality natural fibers like linen, nubby wool, or mohair through drapery, throw pillows, blankets, and upholstery creates a rich, collected look," she explains.

According to Nolan, you should use the same color scheme throughout your living area to avoid making it look overly busy even with so many distinct textures.

The secret to a living room that is well-designed? Hall explains that they pay great attention to scale. Making sure the furniture you choose fits your room properly will give the impression that you hired a professional designer, even if you did all the work yourself!

The designer advises adding lots of seating to a large living area, possibly in the form of a sectional sofa and a few poufs or accent chairs. Compact seating is necessary in small living areas. Hall advises going with luxurious furnishings, such as leather or velvet.

"Say yes to oversized art pieces for a luxurious look," Nolan advises.

"A statement piece, whether an oversized painting, a hanging tapestry or textile, or mixed media, adds instant sophistication and makes the space feel intentional," she explains.

Even better, Nolan advises against purchasing your large-scale artwork from a print shop or big box store and instead recommends choosing the original or vintage approach. According to Nolan, doing so will immediately increase the feeling of luxury.

A window without drapes may appear underdressed, but one with drapes has countless benefits. In addition to providing seclusion and a simple method of blocking out sunlight, window treatments will make your ceilings appear higher and your room appear more luxurious overall.

Julie Mitchiner of JAM Interior Design says that the best way to make a space appear more expensive is to add window curtains. According to her, "Window treatments, and particularly drapery, really add a finishing layer that makes a room feel more complete."

Don't worry if you're thinking about drapes and seeing dollar signs flashing in front of you. According to Mitchiner, custom drapes aren't necessary to create an opulent atmosphere. For a cozy, opulent style, choose velvet panels and begin with common areas such as your dining room and living room.

Is it possible to buy a home after foreclosure?

The answer is: yes!

Yes, it's possible; however, obtaining a mortgage can be challenging since lenders see foreclosure as a huge threat to your ability to repay the loan.

Nonetheless, there are ways how you can restore your credit history and prove to lenders that you are now a responsible borrower.

In this post, we'll answer questions on foreclosure, including how long you should wait before buying a home, how to get a mortgage, etc.

But first, let's start with the basics.

When a borrower defaults on a mortgage or other loan secured by a property, a lender may legally take possession of the property through a process known as foreclosure. The property may then be sold by the lender to recoup the unpaid balance.

Learn more about foreclosed properties by clicking this link.

Borrowers who have had their homes foreclosed on typically have to wait a certain amount of time before receiving a new mortgage loan from another institution. Extenuating circumstances, like a medical emergency, might shorten the time frame for some loan kinds.

Obtaining a conventional loan—one that mortgage market-makers like Fannie Mae or Freddie Mac will purchase—after a foreclosure can take up to seven years. According to Jilyn Crawford, senior loan officer and sales manager at American Family Funding in Santa Clarita, California, you might only need to wait three years if the foreclosure was caused by a medical condition or a loss of work.

Only two years must pass between foreclosure and applying for a new loan, according to the Department of Veterans Affairs (VA) for veterans and active military personnel. Keep in mind that if you are eligible for a VA loan, you will receive a home loan entitlement, which is the highest amount that the VA promises to reimburse the lender in the event of default. "In a foreclosure, I have seen veterans lose some of their entitlement, but they still have some remaining. Crawford says, "It's all about the foreclosed amount."

According to Crawford, if you have a foreclosure on your credit history, you must wait three years to be eligible for USDA loans, which are available mostly in rural regions.

According to Crawford, you may be eligible for another loan immediately following your foreclosure if you have a non-qualified mortgage (non-QM), or a loan that does not satisfy regulatory requirements. Keep in mind that compared to qualifying mortgages (QM), non-QM loans have different eligibility requirements, additional fees, and higher interest rates.

If you can convince a lender that you're prepared for homeownership, you can reapply for a mortgage even after a foreclosure:

Check for any past-due accounts forwarded to a collection agency by obtaining a complimentary copy of your credit report at AnnualCreditReport.com. It is helpful to contact the agency and attempt to work out a payment schedule if you are certain these accounts belong to you.

If you discover any mistakes on your credit report, collect supporting documentation and dispute it online, over the phone, or by mail with the relevant credit reporting company, such as TransUnion, Equifax, or Experian.

After a foreclosure, you will need to raise your credit score to purchase a home.

Make an effort to pay all bills on schedule. According to Crawford, it is extremely difficult to remove late payments from your credit report. If you don't frequently make late payments, you can try asking for a one-time goodwill adjustment, which most creditors would grant. To prevent forgetting to pay your bills, try setting them up for automatic payment.

Try to pay more than the minimum amount owed on any credit cards you may have. Speak with the creditor and ask for a payment plan if you are temporarily unable to make the minimum payment.

Consistency in employment and income is often preferred by lenders. Finding a new work should be your top priority if you just got unemployed.

Be aware that your credit record, which contains details about the foreclosure, may be examined by your future employment. Generally speaking, this shouldn't affect your chances, but it can if you're applying for a position that directly involves money. It's vital to be open and honest about your efforts to overcome your previous credit setbacks.

You must demonstrate to a lender that you can repay the loan in the event of an emergency if you want to be eligible for another mortgage after foreclosure.

Crawford thinks it can be difficult, but if you can, reduce small expenses like eating out. Other options to save money include switching your cell phone or auto insurance plans, as well as canceling your cable TV or streaming subscription.

A new lender can be an ally while you work out how to purchase a home following foreclosure. Crawford advises looking for a lender who understands your circumstances or who offers a variety of options that can meet your needs. For example, choose a lender who specializes in VA loans if you're looking for one.

"All lenders are fishing in the same pond," according to Crawford. "The difference is in the loan officer and the knowledge that officer has," she added.

Reading customer reviews from different platforms is also helpful when you want to learn more about the lender's quality of service and experience.

Examine your finances and yourself before purchasing a new house following a foreclosure. Are you prepared to assume homeownership responsibilities once more? In addition to the monthly mortgage payment, consider the expenses associated with property ownership, such as maintenance and repairs. And think about the events that caused your previous house to be lost. Will they happen again?

Lastly, evaluate the local real estate market. Crawford advises, "You need to look at the state of the market at that time and whether a lender will work with you."

The benefits of homeownership are indisputable. However, there are instances where extending your rental period might help you pay off debt, improve your credit, and increase your assets. When you're ready, all of those factors will make buying a house after a foreclosure much less stressful.

If you want to learn more about foreclosure or homebuying transactions, click this for free resources.

Doorbell cameras are popular but does everyone, specifically real estate brokers, like them?

In this post, we'll find out what our real estate experts really think about these high-tech devices and whether they love or hate seeing these security gadgets on their listings.

When they see your camera, some folks might wonder why you feel the need for one. “Is it a deterrent for crime or a neighbor taking your morning newspaper?” says Coldwell Banker Warburg broker Steven Hoffman. "This could lead to buyers having unpleasant questions at the beginning of the home tour," she added.

Your camera may make your space feel more like a reality TV show than a home, according to Mihal Gartenberg, a Coldwell Banker Warburg broker. He explains that buyers may feel that they need to "be cautious about how they behave and, even more importantly, the things they say to each other about the home," which may make it more difficult to imagine themselves living there.

Broker Suzanne Weinstein believes that some homeowners face the risk of entering into an arrangement where the neighbors are already a little turned off by your presence. After all, nobody wants to start on the wrong foot. "Video-audio recording devices violate most proprietary leases that prohibit causing a nuisance or interfering with the quiet enjoyment (and right to privacy) of neighbors," she argues, pointing out that doorbell cameras such as Amazon Ring record private conversations.

According to Massachusetts real estate agent Jennifer Baptista, real estate brokers enjoy asking their clients about their initial impressions, but they are unable to do so when the homeowner is watching and listening. "It's challenging because I prefer to understand my clients' viewpoints in real-time," she adds, adding that she frequently loves to inquire about their "first impressions" as they approach the front door.

They can help homeowners feel a little more at ease about opening their homes to strangers, which is the major reason Heather Malone, who works with Coach Realtors on Long Island, doesn't mind seeing them at listings. "At times, a home may be showing when it is vacant, and it is always good to keep an eye on your asset when you’re not there," she explains.

Additionally, an agent and seller may decide to maintain a lockbox on the property. When this occurs and neither the seller nor the listing agent is present to show the house, it is beneficial to find out which agents were in and out of the property during that period and whether there were any problems when the seller returned home.

According to Mike Robinson of Century 21 AllPoints Realty in Connecticut, doorbell cameras make a nice parting gift, even though some real estate agents may have unfavorable opinions about them. He explains, "I give them as closing gifts because I deal with a lot of out-of-state buyers." “I am big on personal safety and security and figure if someone is new to a neighborhood, the best way to give them some peace of mind is the ability to watch their front door 24/7, no matter where they might be.”

Avoiding porch pirates is a top concern for many individuals since, as we can all agree, we spend a lot more time clicking "add to cart" these days than we do browsing the store's aisles. "In addition to addressing safety issues within the house, doorbell cameras also reduce package theft in the neighborhood as a whole," explains Jaime Jones and Julie Mariani Cassel of J+J Team Homes. 49 million Americans were robbed by porch pirates in the previous year. Last year, an estimated $2.4 billion worth of merchandise was stolen from porches across the United States.

According to Compass Broker Kimberly Jay, doorbell cameras have become very commonplace due to their affordability and popularity. Doorbell cameras are standard equipment in single-family homes, townhouses, and non-doorman buildings. "Anyone can buy one from a big box store for less than $100," she adds, adding that they can give the impression that the sellers are tech-savvy or intelligent.

How about you? What are your thoughts about the doorbell camera? Would you have that security device in your home or not?

In today's competitive market, it's critical to optimize your home's value, and one of the best ways to do this is by implementing smart landscape design.

Enhancing the curb appeal gives potential homebuyers a good first impression. On top of making it more appealing, a beautiful, well-kept yard adds value to your home.

It doesn't matter how big or small your yard is; there are tips you can easily follow to turn it into a beautiful space. The best part is that you can find landscaping and gardening projects here that suit your needs and budget, so without further ado, let's get started!

As they say, "first impressions last." When a guest enters your home, the first thing they notice is the front entrance. That said, a welcoming environment is important as it sets the vibe for your entire home. A simple paint job can help!

Adding vibrant followers and plants helps increase your curb appeal, too. You can also use seasonal flowers and evergreen bushes to add color throughout the year. Including low-growing shrubs or blooming plants in the entrance can make your walkway even more welcoming.

Native plants are excellent for environmentally friendly landscaping. They require little maintenance and adapt well to the local climate. These plants are acclimated to the local soil, rainfall, and temperature fluctuations. This implies that you don't need to give them a lot of water, fertilize them frequently, or deal with pests as much.

Your landscaping's environmental impact can be reduced by using native species. You also benefit from their inherent strength. These plants can withstand local pests and illnesses better and typically require less water, making it easier for you to maintain your landscape.

Outdoor lighting is not just for safety and security; it also adds a touch of aesthetic appeal to your yard at night.

With good outdoor lighting, you, your family, and visitors can move around safely when driveways, pathways, and entryways are well-lit.

But safety isn't the only consideration. The design of your house can be enhanced by smart lighting. It can draw attention to important areas of your yard and give the scene more depth. To create a visually appealing and multi-layered lighting design, consider utilizing spotlights, path lights, and string lights.

These days, outdoor living areas are increasingly popular. A thoughtfully designed patio or deck can significantly raise the value of your house. These spaces let you party, unwind, and experience outdoor living without actually leaving your house. Your indoor space can be expanded with a patio or deck, allowing you to move with ease indoors and outdoors.

Consider including elements, like cozy patio furniture, outdoor kitchens, or fireplaces in your patio or deck design. These accessories can improve the utility and appeal of your outdoor area. Anyone wishing to purchase your house will find it more appealing as a result.

Many homeowners desire a lawn that is both attractive and healthy. Your grass will always receive enough water thanks to an irrigation system.

Since the irrigation system reduces the need for manual watering, you are already saving time and energy. Additionally, a properly built irrigation system irrigates your lawn uniformly. By doing this, too much or too little water is avoided.

These days, conserving water is crucial. Smart features are a common element of modern irrigation systems. Rain sensors and timers are among these features. They reduce waste, improve water use, and benefit the environment.

Edible gardens, sometimes known as kitchen gardens, have gained popularity recently. Living sustainably is becoming more and more popular. Imagine gathering fresh fruits, veggies, or herbs for your meals in your garden. Not only do you have a unique and fulfilling experience with a garden of your own, but you also have an abundant, aesthetically pleasing backyard.

Consider a few factors when designing your kitchen garden, such as the sunshine required by the plants, the product you wish to grow, and the kind of soil you have. An excellent option is a raised garden bed. They are simpler to maintain and provide excellent drainage.

A good landscape always includes a tree. They provide privacy, shade, and a pleasant appearance. A mature tree can significantly increase the value of your house as it makes your living area more appealing and pleasurable.

Trees can cool your house in the heat if you place them in the proper locations. Your air conditioning expenses may go down as a result.

Additionally, trees serve as organic privacy barriers. They help reduce noise and protect your home from intruders. When selecting trees, it's a good idea to consider their potential growth size and suitability for your local climate.

Paths and walkways are practical and improve the aesthetics of your landscape. They can connect various areas of your yard, facilitate visitor movement throughout your outdoor area, and enhance the overall appearance. People are encouraged to explore and take in your landscaping by these characteristics.

Consider selecting materials for your walkways and paths that complement the design of your house and the surrounding area. Flagstone, pavers, gravel, and stepping stones are popular options.

A fire pit is a wonderful place to gather with loved ones. It's also essential for maintaining safety and sustaining the fire.

Other than that, it provides warmth, a pleasant sensation, and everlasting enjoyment. Spending time with loved ones, sharing tales, and sitting around a roaring fire is a unique experience.

Make sure you have ample seats as you set up your fire pit area. To provide more seating, you could include features like benches or a wall.

Your landscape design might become more serene with the addition of water elements. The region is calmed by the gentle sound of flowing water. Blocking out loud noises might also be beneficial.

Small fountains and huge waterfalls are both options. Your budget and style can be accommodated by a variety of possibilities. You may enhance the beauty of your water feature by adding aquatic plants. Additionally, these plants provide a habitat for beneficial species, such as frogs and dragonflies.

Increasing the value of your house and attracting potential purchasers depend heavily on curb appeal. Because buyers notice your home's exterior and landscaping first, it's important to make a favorable impression. Not only does well-designed landscaping look good, but it may also make buyers feel proud and at ease. This emotional bond might inspire people to envision creating joyful memories in their new house.

In this part, we will talk about the importance of first impressions and some useful tips on choosing the right plants. By doing this, you can make your curb appeal more appealing to potential homeowners.

First impressions are crucial in the real estate industry. How prospective buyers initially feel about your property can have a big impact on what they think. This may have an impact on their decision to make an offer. It displays pride of ownership if the exterior is attractive and well-maintained. It implies that the interior is likewise taken care of. However, a disorganized and neglected front yard could give the impression to potential buyers that the house is not well-maintained and that costly repairs are required.

Buyers may remember the first few seconds they spend viewing your house. They can use this time to determine the worth of your property and whether they wish to explore more. An attractive exterior facilitates the development of an emotional connection. This increases the likelihood of a successful transaction and a positive viewing experience.

Finding the right plants to enhance the curb appeal of your home is important. It also contributes to the creation of a lovely landscape design. Consider your preferences, the style of your home, and the neighborhood before you visit the nursery as well as factors, like the type of soil, the amount of sunlight the plants will receive, and the size of the plants. They will thrive in the locations you designate in this manner.

Select a variety of deciduous and evergreen plants. Like shrubs, evergreens provide a pleasing backdrop and shape for vibrant flowers. In addition to offering stunning foliage in the fall, deciduous trees may offer shade throughout the sweltering summer months. In addition to lowering your workload, adding native plants will draw beneficial pollinators.

Homeowners today are more environmentally conscious; even when it comes to homes, they want it to reflect their values.

Eco-friendly landscaping benefits the environment plus, it also increases the value of your house. This is accomplished by drawing in eco-conscious customers, conserving water, and reducing maintenance expenses. You demonstrate that you take responsible ownership seriously by employing these landscaping techniques. You also improve the health and appearance of your property.

The advantages of implementing sustainable landscaping in your outside area are covered in this section. It provides easy ways to protect the environment and increase the value of your home.

Native plants have adapted and matured to thrive in particular environments. They are ideal for the soil and climate of the area. These plants require fewer pesticides, fertilizers, and water than non-native plants since they are accustomed to the local environment. Eventually, this saves you time, money, and effort while also making your work easier.

Native plants are often recommended by landscape designers and architects. In addition to its ecological advantages, they can attract beneficial insects and wildlife. For pollinators such as hummingbirds, butterflies, and bees, native plants provide both food and habitat. This contributes to the development of a robust ecosystem.

Water conservation is crucial for beautiful landscaping, particularly in areas with water constraints or drought. By adopting intelligent watering techniques, you may create a garden that thrives even in arid environments while conserving water. An effective irrigation system is a fantastic way to conserve water.

Plants that require the same amount of water should be in a group. This improves the irrigation system's performance. Mulching plants is also beneficial. It prevents weed growth, maintains soil moisture, and stabilizes soil temperature, all of which reduce water evaporation. To avoid wasting water, frequently inspect your irrigation system for leaks or other issues.

Nowadays, having an outdoor living space is considered a necessity rather than a luxury. They provide a tranquil setting for unwinding and taking in the scenery without leaving the comforts of home. The desire for homes with comfortable outside spaces has increased in the real estate market. This modification demonstrates how much these areas can increase the value of real estate. In addition to making your life better, well-designed outdoor living areas can increase the number of potential purchasers.

Outdoor living spaces have evolved significantly. Nowadays, homeowners transform their backyards into entertaining areas that complement their lifestyle. They desire outdoor spaces that bridge the gap between interior and outdoor living. This makes the transition between houses and the natural world seamless. Features like fire pits, comfortable seats, and outdoor kitchens have therefore gained popularity.

Weather-resistant furniture, outdoor lighting, and sound systems are becoming more and more necessary as a result of the trend of combining interior and outdoor areas. These components contribute to the practicality and friendliness of outdoor spaces. You may improve your enjoyment of your outside space and raise the value of your house in the real estate market by incorporating these trends.

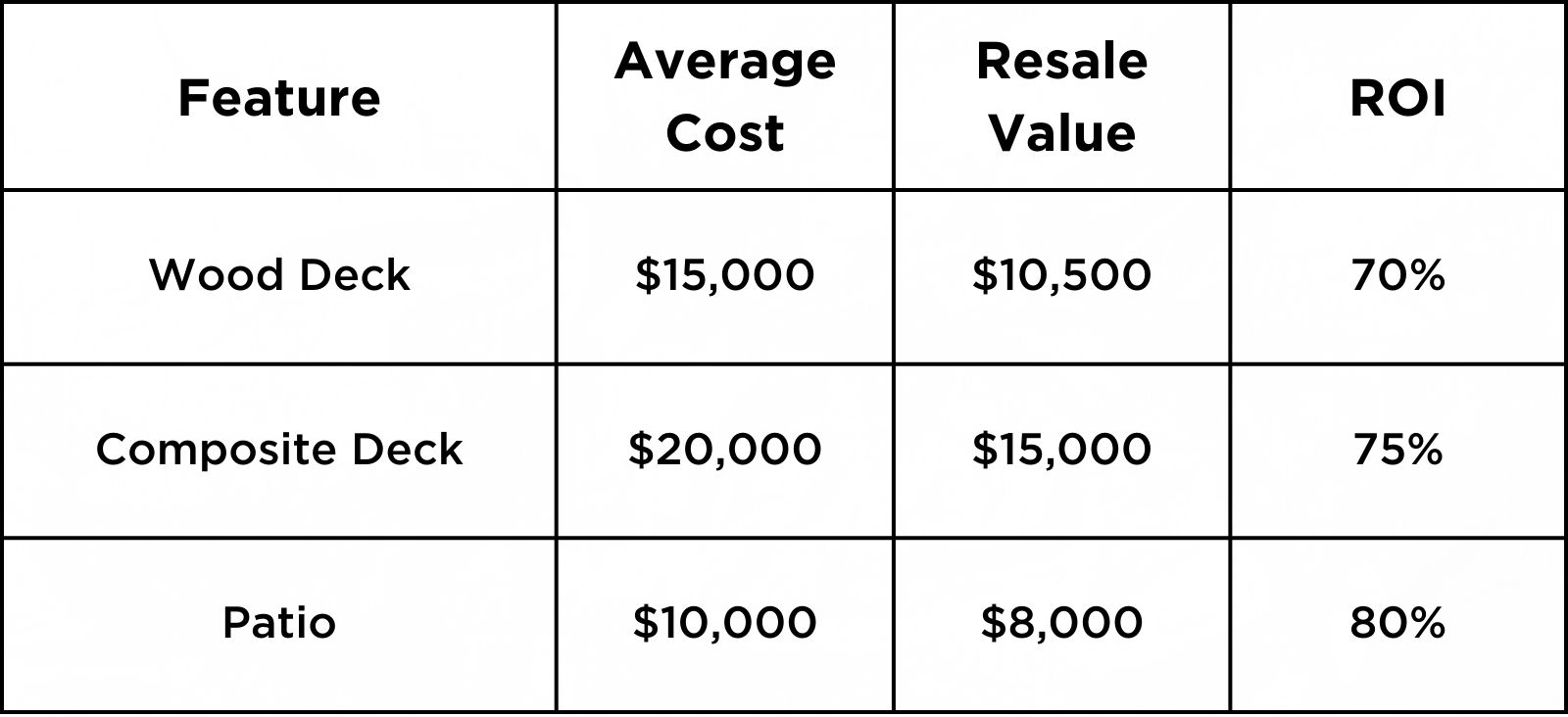

For homeowners who want to improve their outside living space and increase the value of their house, investing in a deck or patio is a smart move. Particularly in areas where outdoor living is highly desired, real estate brokers frequently highlight the substantial return on investment that accompanies a well-built deck or patio. When they sell their house, homeowners should anticipate receiving a sizable return on their investment, according to the National Association of Realtors (NAR).

In addition to expanding your living area, adding a deck or patio improves the curb appeal of your home and boosts its attractiveness to potential purchasers.

In addition to being aesthetically pleasing, landscaping is essential for functional reasons. Adding practical upgrades can significantly increase the value of your house. To solve issues, provide seclusion, and create a more comfortable outdoor space, useful landscaping entails utilizing hard surfaces and plants in clever ways. Your home's market worth increases when you concentrate on these factors since you not only make it more useful but also draw in potential purchasers.

Below, we'll talk about the importance of trees and shrubs in landscaping as well as tips for enhancing privacy that can raise the aesthetic appeal and market value of your house.

Shrubs and trees are essential to any well-designed landscape. In addition to adding beauty and structure, they raise the value of your house. The ecosystem can benefit from tree planting. They offer shade, lower noise levels, and enhance air quality. Energy expenses can be further reduced with this hue. In real estate, mature trees are very significant.

Shrubs are versatile in landscape design because of their wide range of sizes, forms, and colors. They can be used as privacy hedges, to soften the appearance of your house, or as striking garden accents. They also increase the value of real estate.

For your outdoor area to seem serene and isolated, privacy is crucial. In addition to being aesthetically pleasing, landscaping can assist increase the privacy of your property. Utilizing these components in your landscape design enhances your home's aesthetics, functionality, and value in addition to keeping strangers out. This is a plus for buyers since they typically search for privacy.

Planting hedges is a fantastic technique to create a natural screen. Evergreens that provide year-round privacy, such as holly, boxwood, and arborvitae, are good choices for hedges. For more privacy, you might also install climbing vines on a wall or fence. Consider creating a vertical garden or living wall for a more organic look. In addition to providing privacy, this gives your outdoor area a distinctive and pleasant appearance.

To sum up, landscaping may significantly raise the curb appeal and value of your house. You may do this by including functional outside areas, native plants, outdoor lighting, and a cozy front entry. These adjustments can improve the aesthetics and environmental friendliness of your house. Your yard can become more charming and serene by adding water features, fire pits, and lovely walkways.

In addition to improving the appearance of your house, smart landscaping can also increase its value. For a higher return on your investment, use native plants to benefit the ecosystem and adhere to outdoor living trends. Create neat and beautiful landscaping that reflects your personal style and raises your home's worth.

Placing a "For Sale" sign in the yard and waiting for offers isn't the only thing involved in selling a house. You need a strategy if you want to sell it for top dollar. These ten professional-backed suggestions will help you increase the value of your home and draw in the right purchasers, whether you live in Indiana or elsewhere.

Let's get started!

Have you ever driven by a house and made an instant judgment? The same is true for buyers. The good news? A few minor adjustments can have a big effect.

Local Tip: Homes with excellent curb appeal in Indiana neighborhoods like Indianapolis and Fishers typically sell more quickly and for more money.

Buyers don't want to see that pile of mail on the counter or your enormous collection of fridge magnets. They want to visualize a place they can live in.

Here are the things you can do:

Before selling, not every improvement is worthwhile. Although a complete kitchen makeover is unnecessary, minor adjustments might yield significant benefits.

Have you ever noticed how welcoming model homes feel? That is all because of staging. Although hiring a professional is not necessary, a little work goes a long way.

We understand that everyone wants to sell their house for the most money. However, putting a home on the market for too long might make it stale, and overpricing will turn off buyers.

Work with a local expert or real estate agent (a.k.a. US) to price it competitively from the start rather than setting your sights too high and running the danger of price reductions later.

The days of just posting a listing on real estate websites and moving on are long gone. Your house needs to look amazing online if you want high-ball offers.

Consider these:

We understand that having strangers wander through your house at unexpected times is bothersome. However, your chances of receiving a fantastic offer increase with the number of showings.

The shaky stair railing or the leaking faucet will be noticed by buyers. Fix the simple things now rather than waiting for a house inspection to reveal problems.

A house with lower utility costs is a big selling point. That said, make sure to emphasize any energy-saving improvements you've made in your listing, such as:

Customers searching for long-term savings may be won over by these minor features!

Without a doubt, you can sell your house on your own, but do you really want to handle all the paperwork, negotiations, pricing, and marketing by yourself?

An experienced agent, like us here at RE/MAX Advanced Realty, is aware of:

With the proper team by your side, selling your house doesn't have to be a daunting task. RE/MAX Advanced Realty can assist you whether you want to identify the ideal community for your next move, enhance the value of your house, or make the selling process go smoothly.

Are you prepared to move forward? For a free home appraisal and customized selling plan, get in touch with us right now! Let's discuss your objectives and come up with a plan that will get you the best deal.

As a first-time home buyer, buying a home is one of the milestones and achievements of our lives. However, before we move forward with purchasing a home, we have to be aware of and comprehend a few of the processes and the financial implications of doing so. You should know what questions to ask a first-time home buyer.

So here’s what to ask as a first-time homebuyer, regardless of whether you are a current owner who wants to sell or finance a property.

Here are five questions a first-time homebuyer should ask before considering buying a property:

Owning a home is a long-term commitment. According to recent studies, the average buyer anticipates remaining in their new house for thirteen years before selling it. Even though it allows you to accumulate equity and can provide you with tax benefits, there are risks associated with owning a property.

Even though property is typically regarded as an asset that increases in value over time, the value of homes is directly related to the state of the economy. To make a successful first step toward purchasing a home, getting your financial house in order is essential. Have you given any thought to whether or not you will be able to pay everything on time? Have you been able to prepare a budget for costs that were not anticipated?

The listed price of a property is not the only factor to consider when determining how much of a home you can afford. Interest rates, taxes, house insurance, income, debt, and future monthly costs are other elements that will impact your monthly payment. Here are just a few examples. First and foremost, it is essential to have a comprehensive understanding of the situation, even though several "affordability" calculators are available.

Ever heard of the "Four C's of Loan Credit"? Lenders determine mortgage loan terms based on several factors. Consider reviewing your past financial actions and educating yourself on the criteria lenders use to establish the terms of your loan.

The information in your credit report and your credit score are two of the most important elements that determine whether or not you will be approved for a mortgage and what interest rate. When was the last time you reviewed your credit report?

Regardless of your current homeownership stage, expanding your knowledge about what to ask as a first-time home buyer and crucial financial questions when purchasing a home will guide you in making a decision that will benefit you in the long run.

Selling your Indianapolis house quickly is not impossible; there are numerous strategies you can try to meet your real estate goal. Surprisingly, hiring a real estate agent may not be one of these strategies.

In Indiana, for instance, you are not required by law to sell your property through the services of a real estate agent or realtor.

In reality, using real estate brokers usually leads to longer, more drawn-out sales and a loss of income. Additionally, depending on real estate brokers may lead to other possible hazards if you need to sell your Indianapolis house quickly.

You save money: You will keep between 3 and 10% of the proceeds from the sale of your house if you choose not to work with a real estate agent. This may not seem like much, but it might mean the difference between paying for your children's first or second year of college, purchasing a new car, or making a down payment on a new house.

Less time and money spent on repairs before the sale: All real estate agents are quite particular about the state of properties they represent. They believe you must spend thousands of dollars on repairs when your property exhibits symptoms of aging and wear and tear to ensure that it remains appealing to all prospective buyers. However, that isn't the case when you sell your property to non-traditional buyers.

Your capacity to sell rapidly increases: You can sell your house considerably faster when you don't use real estate agents than if you rely on selling to a certain demographic and using conventional methods. Unbelievably, several businesses purchase homes for their full retail value in your neighborhood. Therefore, if this kind of technique allows you to sell rapidly, why worry about a longer selling period?

Less haggling and hassle: Once more, the objective of any real estate agent is to make sure your house sells for the best price. Why does this happen? It's simple: rather than receiving a portion of your profits, they get a proportion of the entire sale price. This is also the reason that the majority of these real estate brokers engage in negotiations with several prospective purchasers, prolonging the closing period and typically failing to maximize earnings for homeowners.

There are numerous more non-traditional approaches you may use to sell your house in Indianapolis that will increase sales in almost any condition and save you time, money, and problems. Avoid the misconception that hiring a real estate agent is necessary, as there are numerous advantages—discussed above—that can help you sell your house more quickly and with better outcomes than you might think.

Nonetheless, you also have to know that there are reasons why most homebuyers choose to work with a real estate agent.

Acts as your personal mentor: Several paperwork, reports, disclosures, and other financial and legal documentation are usually needed when purchasing a home. A skilled real estate agent will be aware of what your market demands, saving you time and money. Additionally, a real estate transaction involves a lot of jargon, so you want to engage with a professional who knows the language.

Provide unbiased facts and viewpoints: A professional real estate agent will help you achieve your buying goals while staying within your budget by providing objective guidance during the home hunt. When you have inquiries concerning contractors, zoning regulations, utilities, neighborhood amenities, and other topics, agents are a valuable resource.

Offer more search capabilities: You wish to have access to every opportunity. Your agent can assist you in assessing all current properties that fit your criteria, notify you of listings that will soon be available for purchase, and give you information on recent sales through a collaborative system known as the multiple listing service. By assisting you in sorting through houses that are no longer for sale but are still showing up on public websites, your agent can also save you time.

Power to negotiate: Every real estate transaction involves several variables, including price, repairs, and the date of ownership. A real estate expert working on your behalf will consider the deal from your point of view, assisting you in negotiating a purchase agreement that satisfies your requirements and allows you to conduct due diligence before committing to the deal.

Give up-to-date experience: The majority of people only purchase a small number of homes throughout their lives, typically delaying purchases for several years. Laws and rules are subject to change, even if you have previously purchased a home. Throughout their careers, real estate professionals may deal with hundreds or thousands of transactions.

Adhere to fair and ethical treatment: When talking to agents, ask if they are a member of the National Association of REALTORS® or a REALTOR®. The REALTOR® Code of Ethics, which is founded on professionalism, serving customers' interests, and public protection, must be followed by every member.

While working with a realtor to sell your home is not necessary, it might be practical to weigh the pros and cons first as this might not only help you save money but also time and effort.

Ask friends or family members who have experience working with a realtor and those who sold their home without any help so you'll have more ideas about what's best for you.

Working with a real estate agent to help you with the home-buying process is one of the most important pieces of the puzzle. The question is: "How are these agents compensated, and who foots the bill?

Enter buyer agency compensation.

Historically, sellers pay these expenses, but with the NAR settlement, things have changed, and now the process is entirely negotiable and more open between buyers and sellers.

The buyer's agent is in charge of protecting and defending the buyer's interests during the home-buying process.

A buyer's agent sets up showings, assists customers in locating appropriate properties, and offers guidance on pricing and market circumstances. In addition to helping the buyer in managing counteroffers and making offers, they also lead the buyer through the negotiating process.

Plus, the buyer's agent helps with important tasks including scheduling inspections, going over documents, and overseeing the closing procedure. Their ultimate objective is to assist the customer in getting the best bargain while ensuring a seamless transaction.

The commission a buyer's agent receives for representing the buyer in a real estate transaction is referred to as buyer agency compensation. This compensation is based on the services the agent performs, including searching for properties, negotiating offers, and helping the buyer with the closing process.

Buyers must now consent to their agent's fee before viewing properties after the NAR settlement, making it a more open and negotiated part of the deal.

The buyer's agency compensation has always been negotiable, even though historically sellers have tended to pay it as part of the deal.

Sellers are now more conscious of their ability to bargain over whether or not to pay the buyer's agent fee, thanks to recent changes in the real estate sector.

Depending on the details of the agreement, buyers might be required to pay the commission or contribute to it. Both sides must negotiate this price during negotiations, even though it is still typical for purchasers to insist that sellers manage this cost.

How buyer agency compensation is handled in a real estate transaction depends on several things.

One of the most essential factors is the current market conditions. In a seller's market when there is competition, buyers can be more inclined to pay their agent's compensation to strengthen their offer. In contrast, sellers could offer to cover the cost in a buyer's market to entice purchasers. Other important considerations are local laws and customs. While it might be more flexible in some jurisdictions or regions, it is more typical for sellers to pay the buyer's agency costs in others.

Negotiations may also be impacted by the property's size and price; larger, more expensive residences may provide more room for fee negotiations. Lastly, how commissions are handled might be influenced by the agents' tactics and expertise.

Expert agents frequently possess a superior understanding of what terms are negotiable and how to organize a transaction to best serve their customers. Navigating buyer agency compensation requires an understanding of these aspects and dealing with an experienced agent who is up to date on local market trends and rules.

Bottom Line

In real estate deals, buyer agency compensation is essential. Both buyers and sellers talk about who pays the charge during negotiations because it might be influenced by variables including local laws and market conditions.

Working with an expert agent will ensure getting the best deal and going through a seamless home-buying transaction.

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224