When describing items that already have well-known names, the real estate industry enjoys inventing new, sometimes perplexing phrases. The phrase "great room" has become widely used yet is not always understood.

Although great rooms are not the same as front or living rooms, that does not imply that their functions are different.

In this post, we'll discuss what a great room is, what it is for, and more. So without further ado, let's get started!

A great room is simply a huge ground-floor space in or close to the heart of the house. Like a living room, it can include couches, comfortable seats, and a television where guests can gather. However, although a great room can function as a living room, a living room cannot always function as a great room because the area is larger than a standard living room.

As mentioned, a great room has a lot of available space which may contain various pieces of furniture and are organized into nooks and sections for multiple functions.

For instance, you might have a couch and comfy seats in a corner for family gatherings or around a fireplace for reading and resting. You could also have a bar for fun, coffee tables for dining, and specific places for kids to run and play in your great room when you have a great room.

This is because great rooms have open floor plans, which means no walls separate the various seating sections. As a result, the entire space appears spacious and inviting for multiple uses.

When it comes to great rooms, the most important thing to keep in mind is their various functions. A great room is well-suited for eating, relaxing, entertaining, living, and playing, whereas a living room can be a good spot to hang out or entertain guests.

Great rooms usually have short tables where people can sit, eat, or drink, but they're not meant to be dining rooms.

Since they are open-plan, it often leads into kitchens and eating rooms.

These are ideas you can consider if you're uncertain if a great room will take up too much space or how to make the most of that space.

You should make each great room feel different, even though they should be connected to the other rooms in your home. This can be done very well by choosing the specific transitions.

Changing the kitchen or dining room's lighting or flooring can also help maintain its ambiance. One quick way to tell that the space has changed is with roof beams and decorative arches.

There are many ways to divide a big room into different areas, each with its color scheme, wall trim, and furniture. The great room can feel cozier and easier to handle if warm colors are used around comfortable chairs and cool colors are used around larger sitting areas.

There's nothing worse than sitting against a wall and feeling like you're ten feet away from the nearest person. One of the best things about a great room is that it can have floating furniture. Opening sofas, tables, and chairs can make the space more inviting. This is especially true for great rooms with a lot of square footage.

If you want more natural light in your home, great rooms are a great way to do it while also using less electricity to light the room. That's because great rooms usually have big windows on the outside walls that let in a lot of light. In addition, there are no inner walls so the light can bounce freely.

Want to learn more about great rooms? Visit our website for free resources.

Is it possible to buy a home after foreclosure?

The answer is: yes!

Yes, it's possible; however, obtaining a mortgage can be challenging since lenders see foreclosure as a huge threat to your ability to repay the loan.

Nonetheless, there are ways how you can restore your credit history and prove to lenders that you are now a responsible borrower.

In this post, we'll answer questions on foreclosure, including how long you should wait before buying a home, how to get a mortgage, etc.

But first, let's start with the basics.

When a borrower defaults on a mortgage or other loan secured by a property, a lender may legally take possession of the property through a process known as foreclosure. The property may then be sold by the lender to recoup the unpaid balance.

Learn more about foreclosed properties by clicking this link.

Borrowers who have had their homes foreclosed on typically have to wait a certain amount of time before receiving a new mortgage loan from another institution. Extenuating circumstances, like a medical emergency, might shorten the time frame for some loan kinds.

Obtaining a conventional loan—one that mortgage market-makers like Fannie Mae or Freddie Mac will purchase—after a foreclosure can take up to seven years. According to Jilyn Crawford, senior loan officer and sales manager at American Family Funding in Santa Clarita, California, you might only need to wait three years if the foreclosure was caused by a medical condition or a loss of work.

Only two years must pass between foreclosure and applying for a new loan, according to the Department of Veterans Affairs (VA) for veterans and active military personnel. Keep in mind that if you are eligible for a VA loan, you will receive a home loan entitlement, which is the highest amount that the VA promises to reimburse the lender in the event of default. "In a foreclosure, I have seen veterans lose some of their entitlement, but they still have some remaining. Crawford says, "It's all about the foreclosed amount."

According to Crawford, if you have a foreclosure on your credit history, you must wait three years to be eligible for USDA loans, which are available mostly in rural regions.

According to Crawford, you may be eligible for another loan immediately following your foreclosure if you have a non-qualified mortgage (non-QM), or a loan that does not satisfy regulatory requirements. Keep in mind that compared to qualifying mortgages (QM), non-QM loans have different eligibility requirements, additional fees, and higher interest rates.

If you can convince a lender that you're prepared for homeownership, you can reapply for a mortgage even after a foreclosure:

Check for any past-due accounts forwarded to a collection agency by obtaining a complimentary copy of your credit report at AnnualCreditReport.com. It is helpful to contact the agency and attempt to work out a payment schedule if you are certain these accounts belong to you.

If you discover any mistakes on your credit report, collect supporting documentation and dispute it online, over the phone, or by mail with the relevant credit reporting company, such as TransUnion, Equifax, or Experian.

After a foreclosure, you will need to raise your credit score to purchase a home.

Make an effort to pay all bills on schedule. According to Crawford, it is extremely difficult to remove late payments from your credit report. If you don't frequently make late payments, you can try asking for a one-time goodwill adjustment, which most creditors would grant. To prevent forgetting to pay your bills, try setting them up for automatic payment.

Try to pay more than the minimum amount owed on any credit cards you may have. Speak with the creditor and ask for a payment plan if you are temporarily unable to make the minimum payment.

Consistency in employment and income is often preferred by lenders. Finding a new work should be your top priority if you just got unemployed.

Be aware that your credit record, which contains details about the foreclosure, may be examined by your future employment. Generally speaking, this shouldn't affect your chances, but it can if you're applying for a position that directly involves money. It's vital to be open and honest about your efforts to overcome your previous credit setbacks.

You must demonstrate to a lender that you can repay the loan in the event of an emergency if you want to be eligible for another mortgage after foreclosure.

Crawford thinks it can be difficult, but if you can, reduce small expenses like eating out. Other options to save money include switching your cell phone or auto insurance plans, as well as canceling your cable TV or streaming subscription.

A new lender can be an ally while you work out how to purchase a home following foreclosure. Crawford advises looking for a lender who understands your circumstances or who offers a variety of options that can meet your needs. For example, choose a lender who specializes in VA loans if you're looking for one.

"All lenders are fishing in the same pond," according to Crawford. "The difference is in the loan officer and the knowledge that officer has," she added.

Reading customer reviews from different platforms is also helpful when you want to learn more about the lender's quality of service and experience.

Examine your finances and yourself before purchasing a new house following a foreclosure. Are you prepared to assume homeownership responsibilities once more? In addition to the monthly mortgage payment, consider the expenses associated with property ownership, such as maintenance and repairs. And think about the events that caused your previous house to be lost. Will they happen again?

Lastly, evaluate the local real estate market. Crawford advises, "You need to look at the state of the market at that time and whether a lender will work with you."

The benefits of homeownership are indisputable. However, there are instances where extending your rental period might help you pay off debt, improve your credit, and increase your assets. When you're ready, all of those factors will make buying a house after a foreclosure much less stressful.

If you want to learn more about foreclosure or homebuying transactions, click this for free resources.

Doorbell cameras are popular but does everyone, specifically real estate brokers, like them?

In this post, we'll find out what our real estate experts really think about these high-tech devices and whether they love or hate seeing these security gadgets on their listings.

When they see your camera, some folks might wonder why you feel the need for one. “Is it a deterrent for crime or a neighbor taking your morning newspaper?” says Coldwell Banker Warburg broker Steven Hoffman. "This could lead to buyers having unpleasant questions at the beginning of the home tour," she added.

Your camera may make your space feel more like a reality TV show than a home, according to Mihal Gartenberg, a Coldwell Banker Warburg broker. He explains that buyers may feel that they need to "be cautious about how they behave and, even more importantly, the things they say to each other about the home," which may make it more difficult to imagine themselves living there.

Broker Suzanne Weinstein believes that some homeowners face the risk of entering into an arrangement where the neighbors are already a little turned off by your presence. After all, nobody wants to start on the wrong foot. "Video-audio recording devices violate most proprietary leases that prohibit causing a nuisance or interfering with the quiet enjoyment (and right to privacy) of neighbors," she argues, pointing out that doorbell cameras such as Amazon Ring record private conversations.

According to Massachusetts real estate agent Jennifer Baptista, real estate brokers enjoy asking their clients about their initial impressions, but they are unable to do so when the homeowner is watching and listening. "It's challenging because I prefer to understand my clients' viewpoints in real-time," she adds, adding that she frequently loves to inquire about their "first impressions" as they approach the front door.

They can help homeowners feel a little more at ease about opening their homes to strangers, which is the major reason Heather Malone, who works with Coach Realtors on Long Island, doesn't mind seeing them at listings. "At times, a home may be showing when it is vacant, and it is always good to keep an eye on your asset when you’re not there," she explains.

Additionally, an agent and seller may decide to maintain a lockbox on the property. When this occurs and neither the seller nor the listing agent is present to show the house, it is beneficial to find out which agents were in and out of the property during that period and whether there were any problems when the seller returned home.

According to Mike Robinson of Century 21 AllPoints Realty in Connecticut, doorbell cameras make a nice parting gift, even though some real estate agents may have unfavorable opinions about them. He explains, "I give them as closing gifts because I deal with a lot of out-of-state buyers." “I am big on personal safety and security and figure if someone is new to a neighborhood, the best way to give them some peace of mind is the ability to watch their front door 24/7, no matter where they might be.”

Avoiding porch pirates is a top concern for many individuals since, as we can all agree, we spend a lot more time clicking "add to cart" these days than we do browsing the store's aisles. "In addition to addressing safety issues within the house, doorbell cameras also reduce package theft in the neighborhood as a whole," explains Jaime Jones and Julie Mariani Cassel of J+J Team Homes. 49 million Americans were robbed by porch pirates in the previous year. Last year, an estimated $2.4 billion worth of merchandise was stolen from porches across the United States.

According to Compass Broker Kimberly Jay, doorbell cameras have become very commonplace due to their affordability and popularity. Doorbell cameras are standard equipment in single-family homes, townhouses, and non-doorman buildings. "Anyone can buy one from a big box store for less than $100," she adds, adding that they can give the impression that the sellers are tech-savvy or intelligent.

How about you? What are your thoughts about the doorbell camera? Would you have that security device in your home or not?

With a solid checklist and smart planning, you can stay organized, reduce stress, and even enjoy the process a little (yes, really). Whether you’re moving across town or across the country, this moving checklist will help you start now—so you’re not scrambling later.

Start early, follow a plan, and you’ll thank yourself later.

Moving is a lot, but it doesn’t have to be a mess. With a timeline, a checklist, and a little planning, you’ll stay one step ahead—and that’s half the battle.

A well-written newsletter is vital for real estate agents who want to stay in close contact with their clients. When buying or selling a home, your audience will remain informed and involved, and they will consider whether you provide valuable content.

This post will talk about how email newsletters work and what should be included in them. These tips appeal to many readers and establish you as a reliable authority in your industry.

Real estate agents can interact with clients, develop prospects, and create lasting connections through email newsletters. Here's how it's so crucial that you include them as part of your marketing strategy:

Contact potential buyers, sellers, and previous clients directly to ensure your message gets to their email without using a third-party platform.

Share valuable and interesting content regularly to stay top of mind and build trust and confidence.

Showcase market updates, business trends, and your accomplishments to establish yourself as an expert in the field.

Leverage email campaigns' cost-effective characteristics to keep your budget under control while obtaining a high return on investment.

Ensure that everyone knows about the homes you're selling by letting them know about new listings, price drops, and future open houses.

Adding links to blog posts, community guides, and interesting material to your website or blog will help you get more viewers.

Sending different messages to different groups, such as buyers, sellers, and previous clients, can yield better results.

Use stories and referral prompts to remember satisfied clients to tell others about your services and boost word-of-mouth marketing.

You can keep improving your email marketing tactics by examining open rates, click-through rates, and engagement metrics and using A/B testing.

Planning your email marketing approach well can help your brand, make it easier to talk to customers, and grow your business. You need to use newsletters to stay competitive in today's digital-first real estate market and know how email newsletters work.

Here are the tips on what a newsletter should include to help you get started and keep your content fresh, interesting, and useful for your readers.

Inform them about your area's most recent sales, usual prices, and market trends. As a result, people who are thinking about buying or selling will come to you for advice.

To showcase your most recent listings, use eye-catching images, important information, and links to complete property pages. Provide details about future open houses to increase interest and traffic.

By highlighting regional celebrations, events, and news, you can keep your audience engaged and strengthen your position as a local authority. As part of a more comprehensive marketing plan, you can even organize your own events.

Provide people with up-to-date information on how to fix up and maintain their homes, like seasonal maintenance checklists or ways to save energy. This idea for an email newsletter is great for past clients who aren't actively looking for work right now, and it goes well with calls for referrals.

Showcase client endorsements or success stories on how you assisted sellers in maximizing their profit or buyers in finding their ideal house. Potential customers higher up your funnel seeking social evidence to aid their decision-making would see this as great.

Another excellent method to provide value for referral requests is to offer guidance on DIY projects, house staging, and decorating. Adding before-and-after pictures can be especially interesting.

Describe the exact areas where you work, including any amenities, schools, or other interesting features. Use geographic segmentation to ensure the information is relevant and include what makes each place unique.

Provide possible first-time buyers with information on how to get a mortgage, how the housing market is doing, and how to navigate the home-buying process.

Assist people who want to sell their homes by advising them on how to price, stage, and market them effectively.

Share your thoughts on the latest economic news with your audience, such as changes in mortgage rates or new laws affecting home ownership.

Be creative with your email newsletter by including holiday decorating tips, party planning ideas, or home improvement tips for the summer.

Provide information on investing in real estate, such as tips on renting property, ways to determine return on investment (ROI), and market predictions.

Show what you do as a real estate agent daily. You can make your brand more real by discussing your struggles, successes, and issues.

Use interactive content to engage clients, such as quizzes about the style of home they dream of or certain polls about homes for sale.

Go over your clients' interests, habits, and new home experiences. Highlight a client's backyard garden oasis or local cultural embrace. This strategy connects without focusing on buying or selling.

Offer incentives like staging discounts for seller leads or gift cards for previous client referrals. Encourage client's actions with incentives.

Responding to real estate queries like mortgage qualification, closing costs, and negotiation is an excellent plan for first-timers.

Break down real estate terminology with simple explanations and adjust jargon to your audience.

Include local businesses in your email to offer your support. This will boost neighborhood ties and expand your network.

Share your achievements, certificates, and personal milestones to engage with your audience.

Making engaging newsletters can be made easier with the use of artificial intelligence solutions like ChatGPT and email marketing systems that incorporate AI-powered capabilities. They can assist you with coming up with ideas for subjects, creating catchy subject lines, and producing well-written material that is suited to your target audience.

AI saves you time and guarantees that your newsletters stay interesting and current by offering editable templates, making your material easier to read, and even recommending the optimum times to send your emails.

A wide range of elements influence the dynamic and ever-changing real estate market. Seasonality is one of these elements that frequently goes unnoticed but can have a big influence on it. Both the availability and demand for real estate as well as the pricing at which they are purchased and sold can be impacted by the seasonality of the seasons. We'll go into great detail on how seasonality affects real estate pricing and what investors, buyers, and sellers need to think about when dealing with this part of the market.

Like many other businesses, real estate is subject to year-round changes. Although these variations can differ by region, some broad patterns can be seen, and they are frequently linked to the seasons.

Spring: In the real estate industry, spring is usually a busy time of year. Longer daylight hours and warmer temperatures encourage buyers to begin their home search. To avoid disturbance to the school year, families with children frequently choose to relocate during the summer. Because of this, demand is typically higher and prices are more expensive in the spring.

Summer: With many purchasers hoping to finalize agreements before the start of the following school year, the summer months remain a robust time for real estate. Nevertheless, the market might begin to cool off as the summer heat builds.

Fall: Although there may be a little less action in the fall than in the summer, it's still regarded as a rather lively season. Buyers who didn't find what they were searching for in the spring and summer can still be seeking, and the weather is frequently favorable.

Winter: The real estate market is typically at its slowest during the winter. Reduced daylight hours, holiday obligations, and colder temperatures might put off both buyers and sellers. It's important to remember, though, that some buyers intentionally look during this period in the hopes of discovering motivated sellers who are open to negotiation.

Let's examine the specifics of how seasonality affects real estate prices now that we have a general idea of how seasons might influence the market.

A major factor in influencing real estate prices is the law of supply and demand. Due to increased demand in the spring and summer, sellers may have the upper hand, which would raise prices. On the other hand, buyers might have more negotiating power in the winter, when demand is weaker, which could lead to lower prices.

The number of properties on the market may also be impacted by seasonality. There is more inventory to pick from in the spring and summer when more sellers market their houses. More competition among sellers may result from this, which could drive down prices. Due to fewer listings, buyers may have fewer options in the winter, which could result in higher pricing.

Seasons can also affect the psychology of buyers and sellers. For instance, when the weather is nice and the gardens are in full flower in the spring, purchasers might be more prepared to pay extra for a property. However, to speed up a transaction, dealers can be more inclined to bargain for lower pricing during the winter.

It's crucial to remember that each place may experience seasonality's effects differently. The seasonal variations might not be as noticeable in warmer regions as they would be in places with different seasons. For example, winter may be the busiest time of year for real estate in ski resort cities.

Having a solid understanding of seasonality can help real estate investors make wise choices. When the market heats up, purchasing in the off-season, when demand is weaker and prices are lower, might result in higher investment returns.

Buyers: When looking for a home, take your schedule and priorities into account. Although there might be more selections in the spring and summer, the winter months may provide greater bargains.

Sellers: Remember that you might get a higher price during the spring and summer months if you have the freedom to decide when to list your home.

A crucial but frequently disregarded element in the real estate market is seasonality. Knowing how it affects prices, supply, and demand can help investors, buyers, and sellers make wise choices.

Understanding the effects of seasonality can help you successfully navigate the real estate market, whether your goal is to buy your ideal house, sell a property, or make smart investments. Therefore, keep in mind that seasonal variations could influence your experience and results the next time you set out on a real estate adventure.

In today's competitive market, it's critical to optimize your home's value, and one of the best ways to do this is by implementing smart landscape design.

Enhancing the curb appeal gives potential homebuyers a good first impression. On top of making it more appealing, a beautiful, well-kept yard adds value to your home.

It doesn't matter how big or small your yard is; there are tips you can easily follow to turn it into a beautiful space. The best part is that you can find landscaping and gardening projects here that suit your needs and budget, so without further ado, let's get started!

As they say, "first impressions last." When a guest enters your home, the first thing they notice is the front entrance. That said, a welcoming environment is important as it sets the vibe for your entire home. A simple paint job can help!

Adding vibrant followers and plants helps increase your curb appeal, too. You can also use seasonal flowers and evergreen bushes to add color throughout the year. Including low-growing shrubs or blooming plants in the entrance can make your walkway even more welcoming.

Native plants are excellent for environmentally friendly landscaping. They require little maintenance and adapt well to the local climate. These plants are acclimated to the local soil, rainfall, and temperature fluctuations. This implies that you don't need to give them a lot of water, fertilize them frequently, or deal with pests as much.

Your landscaping's environmental impact can be reduced by using native species. You also benefit from their inherent strength. These plants can withstand local pests and illnesses better and typically require less water, making it easier for you to maintain your landscape.

Outdoor lighting is not just for safety and security; it also adds a touch of aesthetic appeal to your yard at night.

With good outdoor lighting, you, your family, and visitors can move around safely when driveways, pathways, and entryways are well-lit.

But safety isn't the only consideration. The design of your house can be enhanced by smart lighting. It can draw attention to important areas of your yard and give the scene more depth. To create a visually appealing and multi-layered lighting design, consider utilizing spotlights, path lights, and string lights.

These days, outdoor living areas are increasingly popular. A thoughtfully designed patio or deck can significantly raise the value of your house. These spaces let you party, unwind, and experience outdoor living without actually leaving your house. Your indoor space can be expanded with a patio or deck, allowing you to move with ease indoors and outdoors.

Consider including elements, like cozy patio furniture, outdoor kitchens, or fireplaces in your patio or deck design. These accessories can improve the utility and appeal of your outdoor area. Anyone wishing to purchase your house will find it more appealing as a result.

Many homeowners desire a lawn that is both attractive and healthy. Your grass will always receive enough water thanks to an irrigation system.

Since the irrigation system reduces the need for manual watering, you are already saving time and energy. Additionally, a properly built irrigation system irrigates your lawn uniformly. By doing this, too much or too little water is avoided.

These days, conserving water is crucial. Smart features are a common element of modern irrigation systems. Rain sensors and timers are among these features. They reduce waste, improve water use, and benefit the environment.

Edible gardens, sometimes known as kitchen gardens, have gained popularity recently. Living sustainably is becoming more and more popular. Imagine gathering fresh fruits, veggies, or herbs for your meals in your garden. Not only do you have a unique and fulfilling experience with a garden of your own, but you also have an abundant, aesthetically pleasing backyard.

Consider a few factors when designing your kitchen garden, such as the sunshine required by the plants, the product you wish to grow, and the kind of soil you have. An excellent option is a raised garden bed. They are simpler to maintain and provide excellent drainage.

A good landscape always includes a tree. They provide privacy, shade, and a pleasant appearance. A mature tree can significantly increase the value of your house as it makes your living area more appealing and pleasurable.

Trees can cool your house in the heat if you place them in the proper locations. Your air conditioning expenses may go down as a result.

Additionally, trees serve as organic privacy barriers. They help reduce noise and protect your home from intruders. When selecting trees, it's a good idea to consider their potential growth size and suitability for your local climate.

Paths and walkways are practical and improve the aesthetics of your landscape. They can connect various areas of your yard, facilitate visitor movement throughout your outdoor area, and enhance the overall appearance. People are encouraged to explore and take in your landscaping by these characteristics.

Consider selecting materials for your walkways and paths that complement the design of your house and the surrounding area. Flagstone, pavers, gravel, and stepping stones are popular options.

A fire pit is a wonderful place to gather with loved ones. It's also essential for maintaining safety and sustaining the fire.

Other than that, it provides warmth, a pleasant sensation, and everlasting enjoyment. Spending time with loved ones, sharing tales, and sitting around a roaring fire is a unique experience.

Make sure you have ample seats as you set up your fire pit area. To provide more seating, you could include features like benches or a wall.

Your landscape design might become more serene with the addition of water elements. The region is calmed by the gentle sound of flowing water. Blocking out loud noises might also be beneficial.

Small fountains and huge waterfalls are both options. Your budget and style can be accommodated by a variety of possibilities. You may enhance the beauty of your water feature by adding aquatic plants. Additionally, these plants provide a habitat for beneficial species, such as frogs and dragonflies.

Increasing the value of your house and attracting potential purchasers depend heavily on curb appeal. Because buyers notice your home's exterior and landscaping first, it's important to make a favorable impression. Not only does well-designed landscaping look good, but it may also make buyers feel proud and at ease. This emotional bond might inspire people to envision creating joyful memories in their new house.

In this part, we will talk about the importance of first impressions and some useful tips on choosing the right plants. By doing this, you can make your curb appeal more appealing to potential homeowners.

First impressions are crucial in the real estate industry. How prospective buyers initially feel about your property can have a big impact on what they think. This may have an impact on their decision to make an offer. It displays pride of ownership if the exterior is attractive and well-maintained. It implies that the interior is likewise taken care of. However, a disorganized and neglected front yard could give the impression to potential buyers that the house is not well-maintained and that costly repairs are required.

Buyers may remember the first few seconds they spend viewing your house. They can use this time to determine the worth of your property and whether they wish to explore more. An attractive exterior facilitates the development of an emotional connection. This increases the likelihood of a successful transaction and a positive viewing experience.

Finding the right plants to enhance the curb appeal of your home is important. It also contributes to the creation of a lovely landscape design. Consider your preferences, the style of your home, and the neighborhood before you visit the nursery as well as factors, like the type of soil, the amount of sunlight the plants will receive, and the size of the plants. They will thrive in the locations you designate in this manner.

Select a variety of deciduous and evergreen plants. Like shrubs, evergreens provide a pleasing backdrop and shape for vibrant flowers. In addition to offering stunning foliage in the fall, deciduous trees may offer shade throughout the sweltering summer months. In addition to lowering your workload, adding native plants will draw beneficial pollinators.

Homeowners today are more environmentally conscious; even when it comes to homes, they want it to reflect their values.

Eco-friendly landscaping benefits the environment plus, it also increases the value of your house. This is accomplished by drawing in eco-conscious customers, conserving water, and reducing maintenance expenses. You demonstrate that you take responsible ownership seriously by employing these landscaping techniques. You also improve the health and appearance of your property.

The advantages of implementing sustainable landscaping in your outside area are covered in this section. It provides easy ways to protect the environment and increase the value of your home.

Native plants have adapted and matured to thrive in particular environments. They are ideal for the soil and climate of the area. These plants require fewer pesticides, fertilizers, and water than non-native plants since they are accustomed to the local environment. Eventually, this saves you time, money, and effort while also making your work easier.

Native plants are often recommended by landscape designers and architects. In addition to its ecological advantages, they can attract beneficial insects and wildlife. For pollinators such as hummingbirds, butterflies, and bees, native plants provide both food and habitat. This contributes to the development of a robust ecosystem.

Water conservation is crucial for beautiful landscaping, particularly in areas with water constraints or drought. By adopting intelligent watering techniques, you may create a garden that thrives even in arid environments while conserving water. An effective irrigation system is a fantastic way to conserve water.

Plants that require the same amount of water should be in a group. This improves the irrigation system's performance. Mulching plants is also beneficial. It prevents weed growth, maintains soil moisture, and stabilizes soil temperature, all of which reduce water evaporation. To avoid wasting water, frequently inspect your irrigation system for leaks or other issues.

Nowadays, having an outdoor living space is considered a necessity rather than a luxury. They provide a tranquil setting for unwinding and taking in the scenery without leaving the comforts of home. The desire for homes with comfortable outside spaces has increased in the real estate market. This modification demonstrates how much these areas can increase the value of real estate. In addition to making your life better, well-designed outdoor living areas can increase the number of potential purchasers.

Outdoor living spaces have evolved significantly. Nowadays, homeowners transform their backyards into entertaining areas that complement their lifestyle. They desire outdoor spaces that bridge the gap between interior and outdoor living. This makes the transition between houses and the natural world seamless. Features like fire pits, comfortable seats, and outdoor kitchens have therefore gained popularity.

Weather-resistant furniture, outdoor lighting, and sound systems are becoming more and more necessary as a result of the trend of combining interior and outdoor areas. These components contribute to the practicality and friendliness of outdoor spaces. You may improve your enjoyment of your outside space and raise the value of your house in the real estate market by incorporating these trends.

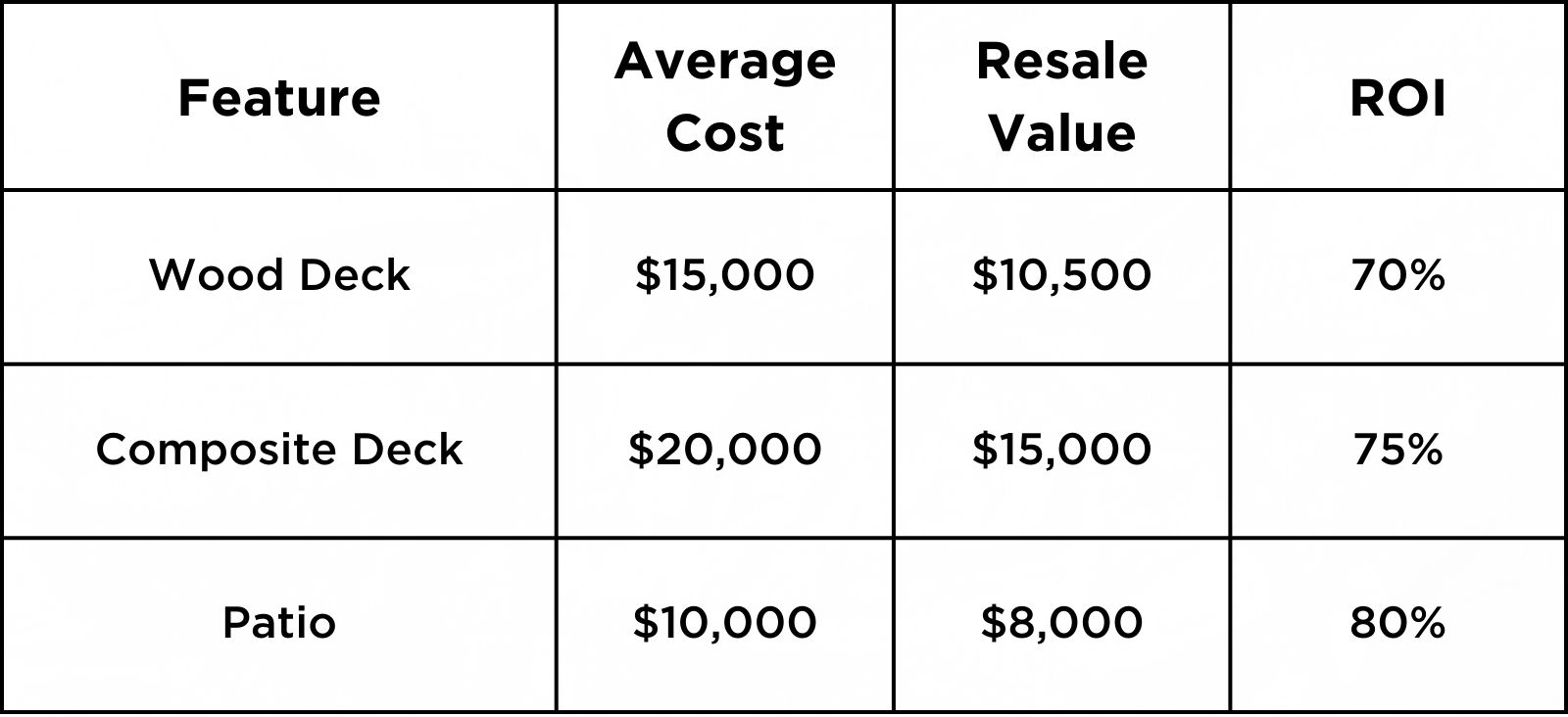

For homeowners who want to improve their outside living space and increase the value of their house, investing in a deck or patio is a smart move. Particularly in areas where outdoor living is highly desired, real estate brokers frequently highlight the substantial return on investment that accompanies a well-built deck or patio. When they sell their house, homeowners should anticipate receiving a sizable return on their investment, according to the National Association of Realtors (NAR).

In addition to expanding your living area, adding a deck or patio improves the curb appeal of your home and boosts its attractiveness to potential purchasers.

In addition to being aesthetically pleasing, landscaping is essential for functional reasons. Adding practical upgrades can significantly increase the value of your house. To solve issues, provide seclusion, and create a more comfortable outdoor space, useful landscaping entails utilizing hard surfaces and plants in clever ways. Your home's market worth increases when you concentrate on these factors since you not only make it more useful but also draw in potential purchasers.

Below, we'll talk about the importance of trees and shrubs in landscaping as well as tips for enhancing privacy that can raise the aesthetic appeal and market value of your house.

Shrubs and trees are essential to any well-designed landscape. In addition to adding beauty and structure, they raise the value of your house. The ecosystem can benefit from tree planting. They offer shade, lower noise levels, and enhance air quality. Energy expenses can be further reduced with this hue. In real estate, mature trees are very significant.

Shrubs are versatile in landscape design because of their wide range of sizes, forms, and colors. They can be used as privacy hedges, to soften the appearance of your house, or as striking garden accents. They also increase the value of real estate.

For your outdoor area to seem serene and isolated, privacy is crucial. In addition to being aesthetically pleasing, landscaping can assist increase the privacy of your property. Utilizing these components in your landscape design enhances your home's aesthetics, functionality, and value in addition to keeping strangers out. This is a plus for buyers since they typically search for privacy.

Planting hedges is a fantastic technique to create a natural screen. Evergreens that provide year-round privacy, such as holly, boxwood, and arborvitae, are good choices for hedges. For more privacy, you might also install climbing vines on a wall or fence. Consider creating a vertical garden or living wall for a more organic look. In addition to providing privacy, this gives your outdoor area a distinctive and pleasant appearance.

To sum up, landscaping may significantly raise the curb appeal and value of your house. You may do this by including functional outside areas, native plants, outdoor lighting, and a cozy front entry. These adjustments can improve the aesthetics and environmental friendliness of your house. Your yard can become more charming and serene by adding water features, fire pits, and lovely walkways.

In addition to improving the appearance of your house, smart landscaping can also increase its value. For a higher return on your investment, use native plants to benefit the ecosystem and adhere to outdoor living trends. Create neat and beautiful landscaping that reflects your personal style and raises your home's worth.

Placing a "For Sale" sign in the yard and waiting for offers isn't the only thing involved in selling a house. You need a strategy if you want to sell it for top dollar. These ten professional-backed suggestions will help you increase the value of your home and draw in the right purchasers, whether you live in Indiana or elsewhere.

Let's get started!

Have you ever driven by a house and made an instant judgment? The same is true for buyers. The good news? A few minor adjustments can have a big effect.

Local Tip: Homes with excellent curb appeal in Indiana neighborhoods like Indianapolis and Fishers typically sell more quickly and for more money.

Buyers don't want to see that pile of mail on the counter or your enormous collection of fridge magnets. They want to visualize a place they can live in.

Here are the things you can do:

Before selling, not every improvement is worthwhile. Although a complete kitchen makeover is unnecessary, minor adjustments might yield significant benefits.

Have you ever noticed how welcoming model homes feel? That is all because of staging. Although hiring a professional is not necessary, a little work goes a long way.

We understand that everyone wants to sell their house for the most money. However, putting a home on the market for too long might make it stale, and overpricing will turn off buyers.

Work with a local expert or real estate agent (a.k.a. US) to price it competitively from the start rather than setting your sights too high and running the danger of price reductions later.

The days of just posting a listing on real estate websites and moving on are long gone. Your house needs to look amazing online if you want high-ball offers.

Consider these:

We understand that having strangers wander through your house at unexpected times is bothersome. However, your chances of receiving a fantastic offer increase with the number of showings.

The shaky stair railing or the leaking faucet will be noticed by buyers. Fix the simple things now rather than waiting for a house inspection to reveal problems.

A house with lower utility costs is a big selling point. That said, make sure to emphasize any energy-saving improvements you've made in your listing, such as:

Customers searching for long-term savings may be won over by these minor features!

Without a doubt, you can sell your house on your own, but do you really want to handle all the paperwork, negotiations, pricing, and marketing by yourself?

An experienced agent, like us here at RE/MAX Advanced Realty, is aware of:

With the proper team by your side, selling your house doesn't have to be a daunting task. RE/MAX Advanced Realty can assist you whether you want to identify the ideal community for your next move, enhance the value of your house, or make the selling process go smoothly.

Are you prepared to move forward? For a free home appraisal and customized selling plan, get in touch with us right now! Let's discuss your objectives and come up with a plan that will get you the best deal.

For real estate agents looking to build lasting relationships, encourage client loyalty, and set up future business chances, email marketing is a vital tool. But what distinguishes emails that have a real impact?

This article offers practical advice on how to write emails that are above and beyond the norm by fusing techniques to turn leads into devoted customers with content that is packed with value. These strategies and editable templates will make your emails stand out, whether you're using them to promote engagement, nurture your audience, or demonstrate your expertise.

Below are the techniques you may consider to do on how to engage clients in your email:

Before you start creating any email, take the time to identify and know your target audience. Who are they? Are they first-time homebuyers, seasoned investors, or sellers getting ready to list some of their real estate?

Making your message fit their needs increases the likelihood that they will find it helpful and interact with it.

Subject Line: Start your journey to becoming a homeowner here

Body:

Hi [First Name],

Buying a first-time home may be both thrilling and challenging. I'm here to assist you at any time. I can help you find the ideal neighborhood and understand your budget.

Are you ready to proceed? Let's arrange a time to discuss your goals and how I may help you reach them. To select a time slot in my calendar, go here [Link to scheduling tool] or respond to this email with a time that works for you.

Best regards,

[Your Name]

[Your Contact Information]

Ensure that your emails are easy to read and have a clear goal. Avoid unnecessarily complicated language and professional jargon. Instead, use concise sentences and portion out the information into easily digestible portions.

Subject Line: New homes in your favorite neighborhood

Body:

Hi [First Name],

I have found a few new properties in [neighborhood] which match your interests. If you want to set up a tour, please contact me immediately, as these houses won't be on the market for long.

[Link to listing]

[Link to listing]

[Link to listing]

Let me know if these don't meet your needs, and I'll try to find something better.

Best regards,

[Your Name]

[Your Contact Information]

Personalization is essential when it comes to establishing trust and rapport. In addition to addressing the recipient's unique needs or problems, you should include their name and refer to earlier exchanges. Making your emails stand out by including personal touches is possible.

Subject Line: Cheers to your first anniversary at home!

Body:

Hi [First Name],

Wow, it's already been a year since you moved in. I remember your excitement about [Home or Neighborhood Feature]. How is everything going?

I hope it's been even better than you thought it would be. Do not hesitate to reach me if you need assistance with the market or want to know how much your home is worth.

I hope you have many more years of joy in your house!

Best regards,

[Your Full Name]

[Your Contact Information]

Every email should include a clear and doable next step. Whether scheduling a meeting, browsing listings, or downloading market research, you should make it simple to interact with potential customers.

Subject Line: What to expect from your [Month] market update

Body:

Hi [First Name],

Making the best choices in the ever-changing real estate market requires staying informed. These are this month's highlights for [City/Region]:

Average Home Price: $[#]

Inventory Levels: [#] homes on the market

Average Time on Market: [#] days

Are you interested in how these trends affect your real estate goals? Let's talk about how I can guide you through this market.

You can schedule a meeting whenever convenient by clicking this link to the scheduling tool or responding to this email with a time and day that works for you.

Looking forward to hearing from you,

[Your Name]

[Your Contact Information]

Real estate agents can significantly expand their businesses by emailing their clients in the real estate field, which will help them learn how to engage clients. You can write emails that convert, provided you have a clear grasp of your target, maintain clarity, add personal touches, and optimize for interaction.

Working with a real estate agent to help you with the home-buying process is one of the most important pieces of the puzzle. The question is: "How are these agents compensated, and who foots the bill?

Enter buyer agency compensation.

Historically, sellers pay these expenses, but with the NAR settlement, things have changed, and now the process is entirely negotiable and more open between buyers and sellers.

The buyer's agent is in charge of protecting and defending the buyer's interests during the home-buying process.

A buyer's agent sets up showings, assists customers in locating appropriate properties, and offers guidance on pricing and market circumstances. In addition to helping the buyer in managing counteroffers and making offers, they also lead the buyer through the negotiating process.

Plus, the buyer's agent helps with important tasks including scheduling inspections, going over documents, and overseeing the closing procedure. Their ultimate objective is to assist the customer in getting the best bargain while ensuring a seamless transaction.

The commission a buyer's agent receives for representing the buyer in a real estate transaction is referred to as buyer agency compensation. This compensation is based on the services the agent performs, including searching for properties, negotiating offers, and helping the buyer with the closing process.

Buyers must now consent to their agent's fee before viewing properties after the NAR settlement, making it a more open and negotiated part of the deal.

The buyer's agency compensation has always been negotiable, even though historically sellers have tended to pay it as part of the deal.

Sellers are now more conscious of their ability to bargain over whether or not to pay the buyer's agent fee, thanks to recent changes in the real estate sector.

Depending on the details of the agreement, buyers might be required to pay the commission or contribute to it. Both sides must negotiate this price during negotiations, even though it is still typical for purchasers to insist that sellers manage this cost.

How buyer agency compensation is handled in a real estate transaction depends on several things.

One of the most essential factors is the current market conditions. In a seller's market when there is competition, buyers can be more inclined to pay their agent's compensation to strengthen their offer. In contrast, sellers could offer to cover the cost in a buyer's market to entice purchasers. Other important considerations are local laws and customs. While it might be more flexible in some jurisdictions or regions, it is more typical for sellers to pay the buyer's agency costs in others.

Negotiations may also be impacted by the property's size and price; larger, more expensive residences may provide more room for fee negotiations. Lastly, how commissions are handled might be influenced by the agents' tactics and expertise.

Expert agents frequently possess a superior understanding of what terms are negotiable and how to organize a transaction to best serve their customers. Navigating buyer agency compensation requires an understanding of these aspects and dealing with an experienced agent who is up to date on local market trends and rules.

Bottom Line

In real estate deals, buyer agency compensation is essential. Both buyers and sellers talk about who pays the charge during negotiations because it might be influenced by variables including local laws and market conditions.

Working with an expert agent will ensure getting the best deal and going through a seamless home-buying transaction.

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224