Many things come to mind when thinking about selling a house, including timing, market circumstances, home remodeling costs, and proper sizing. Selecting a real estate agent to work with is one important choice. You must spend enough time choosing the best person to sell your home to.

In this post, we will talk about the different approaches to selling your house and the advantages of working with a real estate agent.

While listing their home for sale, homeowners have a few choices. The top options are as follows:

Closing and listing fees can be reduced when selling your own house, however, FSBO properties typically sell for much less than those listed with a real estate agent. FSBO properties typically get a lower asking price, and you'll be in charge of all real estate-related tasks.

You will be in charge of all showings, negotiations, contracts, inspections, and more when you list FSBO. Furthermore, you must comprehend the paperwork needed to sell a house. It's a significant task!

Certain organizations assist sellers in listing their houses for a fixed fee. Their compensation structure differs from that of standard brokerages, which receive a proportionately larger share of the home's purchase price than do discount agents.

While it may be quite tempting to market your house for less money, be sure to clarify what services you would be receiving. Certain brokerages provide fewer services and lower prices; others charge less for similar quality services.

Finding the right real estate agent to sell your home requires speaking with multiple agents from various brokerages.

These businesses provide speedy closing times along with instant cash for homes.

If you want a quick deal without having to deal with the inconvenience of listing your house for sale, this is the best alternative. The buying price is frequently less than what is offered on the open market, but for a seller whose primary objective is a speedy sale, that can be worth it.

On behalf of the homeowner, a licensed professional real estate agent oversees the entire selling process. To sell their house, 90% of homeowners work with a real estate agent.

Throughout the process, real estate agents offer thorough help, making sure that every element is performed accurately, from marketing to the final signature. Plus, houses sold through an agent typically fetch a higher price, so they're a great option.

While there are advantages and disadvantages to each choice, most homeowners find that dealing with a real estate agent provides greater balance, ease, comfort, and a better return on investment.

A real estate agent is your go-to expert for local knowledge, neighborhood advice, and contracts. Here's how they can help and why using an agent is the best course of action when selling your home:

Professional Guidance

Real estate transactions can be challenging to navigate. Title, escrow, several forms, disclosures, papers, and other financial entities are all involved. Having a real estate, who is aware of the demands in your area, helps you avoid expensive mistakes.

Practical Solutions To Boost ROI

To help you understand what is selling in the market, agents keep up with the latest statistics and trends in the industry. A real estate agent offers the greatest options to maximize your return on investment, ranging from utilities and contractors to zoning regulations and neighborhood amenities.

Your agent is well-versed in both the regional and local real estate markets. They offer advice on the best adjustments or upgrades to ensure your house sells quickly and for the best price because they know what buyers are looking for.

Negotiates For You

Once contracts are signed, a savvy real estate agent has a fiduciary duty to you. They help you make decisions that are in line with your long-term objectives, prioritize your interests and goals, make proposals, walk you through contracts, and more. It's similar to having an experienced coach at a crucial game; their goal is to see you through.

Selling a home is an overwhelming experience, regardless if it's the first or not. Other than all the things you have to go through as part of the home-selling transactions, it's challenging to disentangle the feelings associated with leaving your cherished, nostalgic house. For this reason, you require a person to take charge of the selling process.

An experienced real estate agent can guide you in the best course of action for achieving your financial goals while helping you through emotional ups and downs. That said, allow your agent to help you make decisions so you can focus on important things.

On closing day, it's acceptable to cry and experience the feelings associated with selling a house. Your real estate representative is available to handle the specifics and provide you with the comfort you require.

Provide Ethical Treatment

Real estate agents, like financial advisors, attorneys, and lenders, work as professionals.

You sign a contract with a real estate agent to have them behave in your best interests and to safeguard the public when you hire them. Find out whether an agent is a REALTOR® during your interview. To ensure the highest and best use of property and the broadest distribution of land ownership, this organization requires its members to follow the REALTOR® Code of Ethics.

Real estate agents may utilize tools to showcase their listings, such as the Multiple Listings Service. So far, this is still one of the best insider tools available to agents. To attract purchasers to your house, agents can list your property and give other agents useful information.

Social media, email marketing, and targeted internet advertisements can also have a big impact on how quickly and successfully a house sells, which raises the seller's net return on investment.

Bottom Line

Choosing the right selling strategy for your home is important as it will affect your financial situation. Although selling on your own or through an iBuyer may seem appealing, case studies and data indicate that working with a real estate expert frequently yields a superior net return on investment.

Real estate experts offer priceless services for a more successful and stress-free selling process, from pricing and marketing the property to negotiating offers and managing paperwork.

Remember that your house is more than simply a piece of real estate; it is a place full of memories and stories. Therefore, it's just fair to ensure that it goes to new owners who will treasure it just as much as you do.

Whether you're a real estate investor, a homeowner thinking about selling, or a prospective home buyer, knowing the trends in housing prices can alter everything. The correct insights from a chief economist can help you improve your financial situation, close profitable deals, and make well-informed judgments.

Knowledge is power in the unstable real estate market, and that's where we come in. This article will cover key indicators enabling you to spot potential price increases in real estate and take advantage of possibilities to buy a new property or maximize the value of your current residence.

It is important to keep an eye on housing market developments, including mortgage default rates and purchase prices, for several reasons.

First of all, it gives buyers and sellers knowledge of the typical and median values of homes in their neighborhood, empowering them to set reasonable expectations and make astute choices. It offers investors a tool for analysis to determine their possible return on investment.

A healthy real estate market and solid economic growth can be indicated by rising house prices, which makes investing in them an appealing proposition.

Furthermore, monitoring housing price trends can assist in forecasting future price increases. Noticing these tendencies early can give buyers an edge, allowing them to obtain houses before prices spike. Similarly, sellers who regularly monitor housing price trends can maximize both the price and timing of their sales.

It might be intimidating for some people to pay close attention to statistics and trends to see the warning indicators of an approaching increase in house prices. Making sense of the intricacies of the housing market can be facilitated by the professional analysis and assistance of an experienced real estate agent.

Making smart decisions based on anticipated future increases in house prices can be facilitated for investors, sellers, and prospective purchasers by utilizing this expertise.

Knowing when home prices are likely to rise—such as through the Case-Shiller and other house price indices—could have a big impact on your real estate tactics and choices.

One of the best predictors of rising home prices is a low inventory of homes. The fundamentals of supply and demand are at work when there are fewer houses available on the market than there are potential purchasers.

For the benefit of sellers, keeping tabs on the inventory of properties up for grabs might reveal information about the state of the property market. Increased competition among bidders for fewer available properties frequently results in bidding wars, which drive up prices.

Low inventory levels can be caused by several things. There may be a shortage of homes if the economy is doing well and there is a rise in consumer confidence and expenditure. On the other hand, current homeowners might be reluctant to sell while the economy is uncertain, which would make the inventory scarcity worse.

The United States Census Bureau's most recent report provides a clear illustration of this correlation. Major markets such as San Francisco and San Antonio had record low home inventories as of the previous month. As a result, prices have increased for several months running, with median prices in certain metropolitan statistical regions rising by more than 10%.

Thus, low inventory levels are an unmistakable indicator of rising home prices. To forecast changes in home prices, buyers, sellers, and investors need to closely monitor the amount of housing inventory in their respective areas.

Similarly to, monitoring recently completed residential developments and building projects might provide information about impending changes in the inventory. An increase in construction could suggest a future gain in inventory, which might balance demand and slow price increases, while a slowdown could imply the reverse.

Additionally, it's important to keep an eye on changes and patterns in the availability of various housing types, including single-family homes, apartments, and condominiums. Different housing demand patterns may have an impact on price trends in these different market groups.

The growing demand for homes is another obvious indicator of rising housing costs. This demand may be fueled by several sources, including:

For example, a surge in millennials nearing prime home purchasing age might greatly increase demand for property.

Furthermore, when the economy improves and more people can afford homes, demand will rise. Samples of these improvements include declining unemployment rates and rising disposable income.

According to a National Association of Realtors poll, young millennials will make up 70% of first-time home purchasers in 2020. As a result, there have been noticeable growth rates in median home prices throughout the United States.

San Francisco and San Antonio are two excellent instances of this pattern. The flourishing IT industry in San Francisco and the expanding economic opportunities in San Antonio have drawn a wave of young professionals. Due to the increasing demand for homes brought about by this inflow, real estate prices have skyrocketed.

The kinds of homes in demand also alter as a result of this demographic transition. For instance, millennials may like condos or townhouses with lots of amenities in urban areas, which would lead to a higher growth in price in this market than in traditional single-family homes.

Furthermore, migratory patterns have a big influence on housing demand, which affects house prices. For example, the popularity of remote work may encourage people to move from expensive metropolitan areas to more reasonably priced suburban or rural locations, which may have an impact on housing demand and, in turn, pricing in these places.

One of the main causes of rising property prices is low borrowing rates. There is an inverse link between mortgage rates and house prices: prices usually increase when mortgage rates are low due to increased demand for housing.

Low interest rates encourage prospective buyers to enter the market by making mortgage payments more reasonable.

The pool of potential buyers is also increased by low borrowing rates. A larger range of people may afford homes as monthly payments drop. As a result, more people can obtain mortgages, which increases competition and drives up housing costs.

Although they are still cheap, mortgage rates in the current market are higher than they were a year ago. The Primary Mortgage Market Survey from Freddie Mac indicates that 30-year fixed-rate mortgages rose 1.45% over the previous year.

Mortgage rates can be greatly impacted by prospective monetary policy changes, such as modifications to the Federal Reserve's interest rate schedule. Following these changes in macroeconomic policy can provide important insights into future patterns in mortgage rates and how they will probably affect home values.

Mortgage rates can be impacted by events and indicators related to the global economy, such as GDP growth and inflation. Gaining a more comprehensive comprehension of the worldwide economic scenario might offer further perspective and insight into prospective shifts in property prices.

The direction of home prices is strongly influenced by economic data. Rising job prices are frequently preceded by positive developments in income levels, consumer confidence, and job growth.

Growth in employment affects demand, which in turn affects home prices. Strong employment growth increases the number of people with steady earnings who can buy a home, which raises demand and prices.

For instance, Austin has seen a notable increase in jobs recently, particularly in the technology industry. The population of Austin is increasing as more individuals relocate there in pursuit of work. The housing market has been severely strained by this population increase, which has resulted in a scarcity of available properties and significant price increases.

Income levels are also quite important. The average and median prices in a property market rise as a result of people being able to purchase more expensive homes.

Another important metric is consumer confidence. People are more likely to buy homes when they feel upbeat about the status of the economy and their financial situation. According to the Conference Board, American consumers are more confident. This heightened self-assurance may raise demand for and, thus, the price of the home.

Inflows of capital into the real estate market may indicate a bullish feeling and possibly indicate an upward trend in prices. This dynamic is influenced by institutional investors, individual investors, and real estate investment trusts (REITs). An increase in real estate investment could be interpreted as a sign of growing market confidence and could raise house values.

Locally, a rise in real estate investments could be a sign that a neighborhood is being targeted for development or gentrification, which might lead to a rise in housing costs.

Housing prices can rise significantly as a result of gentrification and urban development projects. These programs sometimes entail enhancing and repairing previously underutilized sites to increase their appeal to prospective purchasers.

Urban development initiatives have the potential to improve an area's quality of life by introducing additional facilities, services, and transit choices. For example, over the past ten years, several development projects in Chicago's Cook County have rejuvenated various neighborhoods and raised home prices.

Housing costs can also soar due to gentrification, a type of urban development in which affluent individuals relocate into an economically underprivileged neighborhood. Property values increase when more wealthy people move there, which frequently results in a sharp spike in housing costs.

For instance, throughout the past 20 years, gentrification has significantly increased in Brooklyn districts like Williamsburg and Bushwick. As these neighborhoods saw urban development and drew in young professionals and artists, housing costs skyrocketed.

Similarly, by affecting the availability of new housing, zoning laws, and restrictions can affect house costs. More stringent regulations may prevent new construction, decrease the supply of homes, and raise housing expenses. Thus, keeping an eye out for modifications to local zoning laws and regulations might provide crucial insights about potential future trends in house prices.

Plans for the expansion of public transportation and infrastructure can potentially predict future rises in housing costs. New roads, train lines, or educational facilities are examples of projects that might improve a neighborhood's appeal and possibly raise property values.

One of the main causes of rising property prices can be rising construction expenses. Land, labor, and materials are all included in these expenditures, all of which have increased recently.

The lack of workers in the construction industry has led to an increase in labor prices. The cost of labor has gone up due to an aging workforce and a dearth of fresh workers, which has an impact on overall building expenses.

There is a severe labor shortage in the United States construction business right now. Numerous variables, such as the age at which many experienced workers are retiring and the dearth of younger individuals entering the skilled trades, are contributing to this shortfall.

Another important consideration is material costs. Building supplies have seen sharp price rises, from steel to concrete to lumber, mostly due to trade tariffs and supply-chain bottlenecks.

For instance, according to the National Association of Home Builders, the cost of building a new single-family home increased by an estimated $36,000 in just one year, from April 2020 to April 2021, due to a threefold increase in lumber costs.

Due to increased demand and unavailability, land costs are also rising, especially in urban statistical regions, which raises the cost of building new residences.

Prices for single-family homes may increase as a result of builders passing on rising construction expenses to purchasers. Conversely, if expenses are too high, builders might decide to build fewer homes, which would result in a lack of properties on the market and potentially raise prices as a result of heightened buyer competition.

On the other hand, technological developments in the building industry or improved productivity may be able to restrain the growth of building expenses.

Technology advancements like 3D printing and prefabrication may shorten construction schedules and lower costs, which would indirectly affect home prices. Monitoring these movements in the business can provide information about future patterns in house prices.

Construction prices can be impacted by changes in labor legislation, raw material pricing rules, or the cost of borrowing for construction companies. Keeping an eye on these factors can give you more perspective to predict how property values will change.

Making educated judgments as a buyer can be facilitated by being aware of these indicators of impending price rises. If you're thinking about getting into the real estate market, consulting with an expert real estate agent could be helpful as they can offer in-depth analyses of the most recent developments in the industry.

Key Lessons

As we've seen, several crucial indicators suggest home prices are growing. These include low levels of inventory, rising home demand, affordable mortgage rates, positive economic indicators, gentrification, urban growth, and rising building prices.

It is essential for anyone thinking about purchasing or selling a house to comprehend these trends and signs. By keeping an eye on these indicators, you can determine the direction of the market and modify your approach accordingly.

It might be helpful for buyers to choose the ideal moment to enter the market by knowing when prices are likely to rise. Sellers can use this information to determine when to list a property for the highest price.

Rising home prices have effects that go beyond specific purchasers and sellers. This data can be used by financial institutions and investors to evaluate the risks and possibilities associated with possible investments.

Similarly, decision-makers might utilize these data to guide housing policy and urban development plans.

It will be essential to remain knowledgeable and flexible as housing markets change to effectively navigate these shifts. However it can be difficult to comprehend the intricacies of the home market, and expert real estate advice can be very helpful.

Our team at RE/MAX Advanced Realty can offer insights and guidance specific to your requirements and the state of the market, whether you're looking to purchase or sell.

Visit our website now to look for Indiana properties and register to receive notifications when new listings are added. After all, being aware of home market trends will enable you to make the best financial decisions possible since knowledge truly is power.

These are some of the most common queries that investors, sellers, and purchasers have about real estate housing pricing.

The average price of residential properties is tracked over time by the U.S. housing price index. The "repeat-sales method," which is widely accepted and used by a variety of institutions, including governmental and private organizations, is used to compute it.

Numerous organizations, such as the Federal Housing Finance Agency (FHFA HPI) and the CoreLogic S&P Case-Shiller index, frequently release the U.S. Housing Price Index.

According to the most recent data, there has been an increase in housing prices in the United States, even though they vary based on many criteria. This may be caused by several things, including the recent entry of millennials into the property market and an increase in the number of people purchasing real estate.

The lack of available properties, rising construction costs, low lending rates, and changing demographics are the main causes of housing prices and rents growing faster than inflation. In certain urban areas, economic expansion has also raised demand for housing, which has raised rents and prices even more.

House prices usually fall when the housing market collapses. The effect on rentals, however, might differ based on a variety of variables, such as the degree of housing demand, the number of rental homes available, and the state of the local economy.

Sometimes rent increases don't correspond with changes in home values. Even in the event of a severe downturn in the property market, landlords might be reluctant to lower rent right away or trapped into long-term rental agreements.

Due to the numerous variables involved, forecasting future trends in the housing market can be difficult. Nonetheless, keeping an eye on important home price indicators like:

These can all offer perceptions of possible pricing changes in the future.

Leave a comment below or call us at 317-316-8224 today!

History, mystery, and timeless charm are all interwoven within Indiana culture. This state encourages you to live in America's vibrant past, where the sounds of Abraham Lincoln's childhood explorations still echo through the fields and woodlands.

In these smaller, less well-known cities, you can enjoy a cup of coffee in the morning at a café that has been around for generations, stroll down brick-lined streets that pioneers once walked, or experience the silent excitement of an evening march under the stars, which brings back memories of a bygone era. Make sure to put these eight hidden jewels on your bucket list because the lakeside hideaways that border the hamlets surrounded by forests are not to be missed.

Due to its location in the scenic Brown County of South Central Indiana, this Nashville has established a reputation as a tranquil haven, in contrast to its namesake in Tennessee. Originally called Jacksonburg, the town was established in 1836 and evolved into the Brown County Art Colony, a haven for artists because of its breathtaking views, rustic elegance, and simplicity that still inhabits the town today.

The best season to visit Nashville is fall because the landscape's visual feast peaks during this season. Nature and regional celebrations like Halloween work together to saturate the town and its surroundings with vivid hues during this time of year, providing tourists with an amazing exhibition of natural and man-made creativity. The town is home to the Brown County Art Gallery, which has a sizable collection of local artwork that reflects the history and culture of the area.

The town's artistic appeal is enhanced by the Steele State Historic Site, which offers a close-up view of the life and work of a well-known Hoosier Group artist. With its log homes and artisan demonstrations, Pioneer Village provides a living history experience for people who yearn for a closer bond with the past. Nashville appeals to nature enthusiasts and art lovers since the Brown County State Park is conveniently located near the town center and offers a wealth of hiking, camping, and horseback riding options.

(Brown County Art Colony - browncounty.com)

(Brown County Art Colony - browncounty.com)

In Madison's vast Historic District, which is located along the picturesque banks of the Ohio River, more than 130 structures that bear witness to the city's rich architectural history are painstakingly conserved and listed on the National Register of Historic Places. The Lanier Mansion State Historic Site is a feature of Main Street, which takes tourists back in time.

One of the best examples of Greek Revival architecture in the Midwest, this estate was built in 1844 and provides guided tours that explore the region's rich history. The Madison Regatta, a world-class hydroplane speedboat race that turns the riverbank into a center of activity every July, adds even more life to the town's historical tale.

The town's well-preserved antebellum buildings and landmarks, such as the Shrewsbury-Windle House and the J.F.D. Lanier State Historic Landmark, which provides a window into 19th-century American frontier life, demonstrates its ongoing ties to its early history.

Clifty Falls State Park provides peaceful trails and stunning waterfalls ideal for unhurried exploration for individuals who enjoy the outdoors. Events such as the RiverRoots Music & Folk Arts Festival and the Madison Chautauqua Festival of Art not only spotlight local artists but also introduce guests to the vibrant local culture. These are packed into Madison's calendar for those who enjoy the arts.

(Lanier Mansion State Historic Site - wikipedia.com)

Shipshewana is a treasure trove of natural beauty and cultural legacy in addition to being a place to escape to a simpler way of life. The town's focal point is the Menno-Hof Amish/Mennonite Information Center, an essential educational resource that provides engaging tours and interactive displays that delve into the rich histories, values, and lifestyles in Amish and Mennonite communities.

Through these encounters, tourists might have a profound understanding of the community's commitment to tradition and simplicity, which are qualities that are becoming more and more uncommon in the modern world.

From May through September, the town also has the biggest flea market in the Midwest, offering a wide variety of products from regional craftspeople. From specialized delicacies to handcrafted objects that are not unique but also represent Amish craftsmanship.

Take a trip along the Pumpkinvine Nature Trail to discover Indiana's vast natural surroundings. This picturesque trail, which winds through verdant fields and forests that change with the seasons and provide vivid displays of color and animals, provides a close-up look at Indiana's pastoral beauty.

The town's attraction as a peaceful retreat is heightened by the surrounding Shipshewana Lake Park, which provides opportunities for fishing and quiet introspection by the water.

Shipshewana's natural beauty and slow-paced lifestyle make it an unspoiled destination, whether you choose to bike along the paved paths, explore the local market, or take a leisurely carriage ride.

(Menno-Hof Amish_Mennonite Information Center - visitshipshewana.org)

New Harmony, one of America's daring social experiments, is a testament to the dream of living in a perfect, utopian setting.

With its exquisitely preserved buildings and common areas, New Harmony, which was first founded by the Harmonie Society in 1814 and later modified by Robert Owen into a model of equality and communal life, provides a window into a singular historical narrative.

The town's design not only pays homage to its history but also exudes a contemporary charm that encourages tourists to stroll around with its cobblestone streets and brick walkways.

Notably, the Roofless Church, created by architect Philip Johnson, offers a barrier-free space for worship exposed to the sky above and perfectly embodies the town's spirit of transparency and introspection.

New Harmony has a unique combination of natural beauty and historical richness because of this as well as the tranquil Wabash River, which provides peaceful picnic areas and strolls along its banks.

It is home to barely 700 people celebrating and retaining its German history through lively local celebrations like the yearly Oktoberfest and Kunstfest, which turn the town into a bustling center of cultural interchange every fall.

Both tourists and academics interested in learning about this small community's history and culture are drawn to these events because they provide a sample of local customs and crafts. The town's reputation as a tranquil getaway is further enhanced by the positive reviews given to the New Harmony Inn and other nearby lodging establishments for their friendliness.

(New Harmony - wikipedia.com)

Established within the bustling Wabash and Erie Canal, Roanoke was a crucial port for barge captains traversing the vast waterway between the Ohio River and the Great Lakes.

Due to the well-preserved architecture from its early years, Roanoke has kept its historical appeal. The town's village-like atmosphere and architectural legacy entice tourists to explore its streets, where history comes to life and becomes visible.

A distinct sense of place that is becoming more and more uncommon in contemporary metropolitan areas is fostered by the town's commitment to preserving its original buildings and layout.

The lively community and the pride with which they uphold their historical traditions demonstrate how the area has grown from a minor lock halt to a flourishing small town. Roanoke is a calm haven for people who value the elegance of the past combined with the peace of small-town life. Not only is it physically preserved, but it also embodies the ethos of a town that cherishes its history and the slower pace of life that enables locals and tourists to genuinely interact with one another and history.

(Roanoke - discoverroanoke.org)

The center of Zionsville's charm is Main Street, which features charming brick pavement bordered by distinctive stores, art galleries, and welcoming cafés that encourage slow exploration.

Visitors are immersed in a scene that combines authentic historical details with lively local life as they meander along this welcoming boulevard. The town's appeal as the ideal setting for weekend retreats or tranquil day outings is increased by the well-preserved medieval structures and profusion of urban trees.

A delightful walking experience is also provided by the Traders Point Eagle Creek Rural Historic District, which highlights the town's dedication to conserving its architectural legacy while offering a verdant, natural environment that promotes outdoor recreation.

The annual Zionsville Fall Festival and the Christmas in the Village parade are highlights of the town’s social calendar, delivering a taste of local customs and festive cheer. These activities, coupled with the weekly Zionsville Farmers Market, give opportunities for visitors to indulge in local vegetables and artisan products, supporting the small-town economy and building a feeling of community involvement.

With one of the biggest collections of antique fans in the world, the oddball AFCA Antique Fan Museum offers an interesting distraction for anyone with specialized interests.

The Auburn Cord Duesenberg Automobile Museum, the city's main attraction, is more than just a collection of old vehicles; it is a celebration of Auburn's crucial role in the American auto industry.

Auburn, known as the "Home of the Classics," offers an untouched piece of Americana. The museum, which features the opulent Cord and sophisticated Duesenberg models, is housed in the Auburn Automobile Company's original Art Deco headquarters and is a veritable gold mine of the automotive inventions that defined an age. These well-known companies perfectly capture the glitz and inventiveness of early American automobiles. Visitors may get a deep look into a bygone age of luxury and flair thanks to Auburn's commitment to conserving this heyday of automobile design and the museum's stunning architecture.

Additionally, Auburn's yearly Auburn Cord Duesenberg Festival serves as a showcase for the city's thriving community. Every summer, this well-known occasion turns the city into a bustling center of parades, vehicle exhibits, and auctions honoring its rich automotive heritage. Visitors are treated to a picturesque setting created by the festival and the town's many other historical attractions, including the Neoclassical DeKalb County Courthouse.

With its charming shops and historic landmarks, such as the Auburn Community Mausoleum and the Eckhart Public Library and Park, the city's walkable downtown further encourages exploring. Auburn is the perfect place for people looking for both historical depth and relaxed appeal in an untouched environment because of its exceptional ability to combine its vibrant automobile culture with easily accessible, pedestrian-friendly metropolitan areas.

(Auburn Cord Duesenberg Automobile Museum - automobilemuseum.org)

The first state capital, Corydon, is now a treasure. The historic significance of Corydon, which is only 25 miles west of Louisville, Kentucky, is evident in its well-preserved downtown area, which is on the National Register of Historic Places.

Visitors can explore several noteworthy locations here, including the Constitution Elm Memorial, the Kintner-McGrain House, and the Old Capitol, which was the state's government center from 1816 to 1825.

From Corydon's early 19th-century beginnings to its involvement in the Civil War, each landmark contributes to the city's rich history. The town is also bustling with cultural events that reflect its history, such as reenactments of the Battle of Corydon, the only Civil War battle known to have taken place in Indiana, and customs like the Halloween Parade and Friday night band concerts that bring tourists into the town's sense of community and historical pride.

Adventurers can enjoy hiking, horseback riding, ziplining, and mountain biking at the Harrison-Crawford State Forest and O'Bannon Woods State Park, two state parks and natural reserves that are accessible from the town.

The longest cave system in Indiana, Indiana Caverns, as well as other well-known caverns including Wyandotte Cave and Squire Boone Caverns, are located in Corydon, providing spelunking enthusiasts with some of the best spelunking experiences in the Midwest. The town's historical charm and these natural features combine to make for an engaging combination of education and adventure.

(Harrison-Crawford State Forest - discoversouthernindiana.com)

Which of these small towns have you been to or are planning to visit? We'd love to hear your thoughts in the comments!

When selling your home, timing is crucial. Although spring and summer are often the busiest times for house sales, October still presents a distinct set of opportunities and difficulties.

However, is it really a wise decision to sell your house in the fall?

To help you with this, we've gathered all the pros and cons and other necessary details you need when listing your home during this time of year.

The fact that purchasers are typically more serious is one of the main advantages of selling in the fall. At this point in the year, buyers are frequently keen to get a deal before the holidays or the new year. These driven customers are more inclined to act quickly, which could lead to a quicker sale.

The real estate market tends to cool off in the fall, as opposed to the spring and summer. Your property is more likely to stand out when there are fewer houses for sale. For sellers hoping to draw in serious purchasers, this decrease in competition might be a big benefit.

Beautiful curb appeal is naturally complemented by the fall season. Cooler weather and the rich hues of fall foliage may create a welcoming and comfortable house atmosphere. Your home's overall appeal can be improved during this time with small details like warm lighting, seasonal decorations, and a well-kept yard.

You might discover that you have more negotiating power because there are fewer houses for sale. Given their restricted options, buyers in the fall might be more accommodating with bids. Better terms and conditions for your sale may result from this.

There are often fewer buyers searching in the fall, even though they could be motivated. Your pool of possible purchasers may be reduced because many are busy with back-to-school activities, impending holidays, and winter preparations.

Depending on where you live, the fall weather can be erratic and possibly start to snow before your house sells. The presence of rain, wind, or chilly weather can dissuade potential buyers from viewing your home by making open houses and showings less inviting.

There may be less natural light available during showings because the days are shorter in the fall when daylight savings time ends. Potential buyers could not fully appreciate your home's best qualities if they are visiting in the evening or after work. To make up for the shortened daylight hours, make sure your house has adequate lighting.

As the fall season moves into the holidays, many shoppers shift their attention to family gatherings, holiday shopping, and travel arrangements. This might cause delays in decision-making, with some consumers waiting until after the holidays to make a purchase.

Here are some pointers to think about to increase your chances of a successful fall house sale:

Take advantage of the fall season by arranging your house to create the warm, inviting ambiance that prospective buyers frequently seek at this time of year. Warm colors, comfortable textures, and seasonal décor can help prospective buyers picture themselves living in your house and make it feel welcoming.

Your yard may suffer from falling leaves and colder temperatures. Be sure to maintain a clean and debris-free yard. To make a visually appealing façade that attracts buyers, rake leaves, trim bushes, and think about adding fall flowers.

Setting your home's price correctly from the start is critical because there are fewer buyers on the market. Together with your real estate agent, determine a fair price for your house based on current market conditions. In the fall market, overpricing may make your house sit on the market for longer than anticipated.

Due to their hectic schedules, buyers might not be able to visit homes as often in the fall. To draw in more buyers, be adaptable with showings, provide virtual tours if you can, or allow weekend and nighttime visits.

Bottom Line

Selling a home in the fall has its own advantages and disadvantages. Those who are looking for properties are frequently more driven to close before the holidays, even if there may be fewer buyers on the market. Additionally, you may benefit from less competition, which helps your listing stand out easily.

However, if you want a quick sale, it might be hampered by inclement weather, shortened days, and holiday diversions. You may maximize the fall real estate market and possibly secure a successful sale by being aware of these elements and preparing your house appropriately.

As always, we're more than happy to assist you whether you're buying or selling a home in the fall. Just leave a comment or email us at dennis@indyhomepros.com today!

Every seller wants to sell their home as soon as possible, for the best price, and with the fewest hassles. Likely, you're not much different.

However, did you realize that the asking price for your house is one of the main factors that could put your success in jeopardy? One of the most important aspects of selling your home is setting a fair price.

So how can you tell if you're falling short? Here are four indications that buyers may be turned off by your high asking price, along with the reason why consulting your real estate agent is the best course of action.

A lack of showings is one of the most obvious indicators that your home might be overpriced. It may be a glaring sign that the pricing isn't what buyers are expecting if it's been on the market for a few weeks and very few people have gone to look at it, or worse, you haven't had any bids.

Since long-term buyers can quickly identify—and discount—a home that appears to be overvalued.

You may rely on your real estate agent's experience to guide you through this process and get advice on potential strategies to attract more buyers, such as lowering your asking price.

You might need to change directions if the remarks from the prospective purchasers you do have after the showings aren't too positive. Remarks from viewings are a crucial component of knowing how potential buyers view your home.

If customers frequently comment that it's too expensive in comparison to other properties they've visited, you should reevaluate your pricing approach.

For you, your realtor will compile and evaluate this input so you may see how your home compares to others on the market. To better support your asking price, they can also recommend staging adjustments or particular enhancements, or they can suggest one that is in line with what buyers demand these days.

As the National Association of Realtors (NAR) explains: “Based on all the data gathered, agents may make adjustments to the initial price recommendation. This could involve adjusting for market conditions, property uniqueness, or other factors that may impact the property’s value.”

In the end, this lack of interest will cause it to remain on the market without receiving any significant bites. Buyers are more likely to have concerns about it and wonder whether there is a problem with it the longer it remains on the market.

A lengthy listing duration indicates that your home is stale, which makes it even more difficult to sell, especially in the current market with rising inventory.

In addition to showing you what strategies have worked for past sellers, your real estate agent can offer you insight into how quickly other homes in your neighborhood are selling. In this manner, you can jointly determine whether there is anything you would like to change.

According to a Bankrate article: “Check with your agent about the average number of days homes spend on the market in your area. If your listing has been up significantly longer than average, that may be a sign to reduce the price.”

This is the final one to be cautious with. Similar homes in the neighborhood selling more quickly than yours are a dead giveaway that something is wrong. This may be the result of factors like antiquated features, a less appealing location, or a lack of updates -- or simply because the price is too high.

Your realtor will inform you of any changes necessary to make your home more competitive, as well as information about your competitors. They'll provide guidance on minor improvements that can improve the curb appeal of your house or how to modify your approach to take into account the current state of the market.

Pricing your home correctly is crucial, and a realtor is your best ally for getting it right. Here's why:

With a realtor's expertise, you can confidently price your home to sell fast and at the best value.

Appropriately pricing a house is a combination of science and art. It requires a thorough comprehension of consumer psychology and the market.

Your agent is the best person to consult when the price isn't attracting buyers for advice on what to do next.

And when you want the best, our team at RE/MAX Advanced Realty is one call away. Dial 317-316-8224 so we can assist you today!

For those who have started to browse our website on homes for sale, as well as properties in the surrounding area, there are massive advantages to viewing homes that you are considering in person. Although virtual tours and online profiles can provide exceptional detail regarding the homes you view, they cannot reveal everything. Instead, getting an up-close look at a single-family house or luxury townhome can paint a picture of what it would be like to live on the property.

You have two choices for in-person property viewing: private tours and open houses. Each has its own set of advantages and disadvantages. To help you know which suits your current needs, we've provided the main pros and cons below.

PRO: You'll be able to see the neighborhood up close

The chance to tour the area is one of the key benefits of going to an open house. Realtors frequently invite neighbors and other community members to open house events.

This allows potential buyers to interact with possible neighbors and obtain unbiased perspectives about what it's like to live in the community. The number of residents who attended but are not interested in purchasing the property can vary depending on the area's size and layout. There is very little likelihood of meeting your new neighbors on a private tour.

There's freedom to come and go during the designated event times at open houses. You are free to take a break, go for a tour of the area, and then return to speak with the realtor. On the other hand, private tours are by appointment only, therefore this is not a possibility.

CON: The event can be super busy

There are advantages to meeting possible new neighbors, but there are drawbacks to large gatherings. This is particularly true for properties in high demand since they can draw dozens of potential buyers to a single open house.

Private tours are frequently the better option if you are someone who doesn't like crowds. On the other hand, if a private tour isn't offered for a certain house, make an effort to go to weeknight open houses. These only draw serious purchasers and are typically less crowded than weekend open houses.

PRO: No pressure to make an offer

Attending an open house is a low-stress endeavor. There are a lot of people there, so it's easy to come and go without getting seen (if desired). You can feel much less anxious about the scenario because you do not receive the personalized attention that you would in a private tour.

This is particularly beneficial for those who are just beginning the home-buying process and are unsure of their future residence. You made up your mind not to like the house? Not an issue. There will be many other people there who will probably fall in love with the property.

Ask questions as they come up during your self-guided tour, which you can take at your own speed.

PRO: Receive one-on-one attention the entire time

When it comes to house tours, are you the type of person who prefers a more exclusive, posh experience? Making reservations for private property visits is, without a doubt, your best option.

You will have one-on-one attention from an agent the entire time your reservation is made. You can ask as many questions as you'd like, and there's no danger of getting lost in the crowd. To increase your chances of having your offer accepted while you are contemplating a home, it is essential to arrange a private tour.

If you don't like the feeling of being rushed, private tours offer a laid-back setting where you can examine each area at your leisure, pose questions, and get a sense of the overall design.

In the end, choosing a proactive tour will help you feel less stressed during this hectic period of your life. During a private tour, a professional real estate agent will never make you feel rushed or constrained by their schedule.

Cons: Not ideal for first-time homebuyers

Have you just started looking for a place to buy? If so, there's a chance you don't currently have an agent you can work with to arrange a private trip. You need to make an appointment with an agent for a private home tour before you are allowed to visit the property.

Taking a personalized tour could seem like a high-pressure commitment, even if you have an agent already. People who are just beginning the process of becoming homeowners might want greater liberty and flexibility to come and go as they choose, without having to respond.

Pro: Establish a connection with your realtor

Having the chance to get to know your realtor is just another fantastic advantage of setting up one or more private visits. You can begin establishing a rapport with your selected real estate agent after just one trip.

This will help your realtor understand your tastes and personality better, which will ultimately help them choose the kind of house you are most interested in. You will consequently be matched with your ideal Indiana home faster.

If you're looking for the best realtor in your area, we have one for you! Just let us know where you're from and your concern -- buying or selling a home and we'll guide you.

Leave a comment or send us an email to get started: dennis@indyhomepros.com

The housing market in Central Indiana for September 2024 shows a mixed yet steady landscape compared to the same period last year. According to data from MIBOR BLC®, the median sales price remained unchanged at $300,000, reflecting stability in home values across the region. While this price point held steady year-over-year, it did show a slight decline from August, signaling a brief pause in upward trends observed earlier in the year.

Sales Activity and Inventory Shifts

Closed sales saw a modest uptick compared to September 2023, indicating continued buyer interest despite market fluctuations. New listings, however, experienced a small dip, suggesting that fewer homes were being put on the market as sellers may be taking a more cautious approach. This decrease in new inventory, paired with relatively steady prices, points to a market where demand is still robust but options for buyers are slightly more limited.

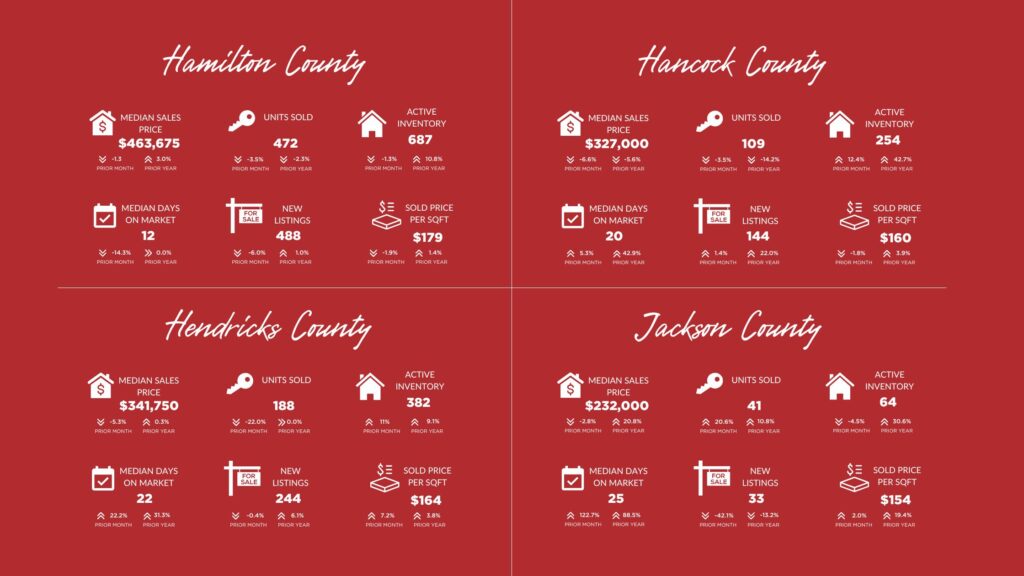

County-by-County Breakdown

In a closer look at county data, many areas in Central Indiana saw notable shifts:

What’s Ahead for the Market?

According to MIBOR CEO Shelley Specchio, favorable mortgage rates have fueled buyer interest since the start of the summer, with the market showing signs of resilience. However, recent economic reports suggest continued unpredictability in the months ahead. As mortgage rates adjust based on broader economic factors, potential buyers and sellers will need to remain agile.

The market's path toward more favorable conditions remains in flux, but with inventory slowly increasing and demand holding steady, the outlook for Central Indiana real estate remains cautiously optimistic as we approach the end of 2024.

For more detailed insights or personalized market advice, reach out to RE/MAX Advanced Realty's local experts to guide you through the current housing trends in your area.

The number of multigenerational households in our nation has steadily increased over the past several years. This lifestyle is becoming a popular long-term choice for families as more multigenerational floor plan options become available. The majority of families think that splitting household expenses is advantageous, in addition to making purchases easier in the current market. Choosing the right property is the first step in preparing for a multigenerational lifestyle, which is necessary for a successful long-term scenario.

For the greatest experience, we have compiled a list of the most crucial factors to consider when choosing and personalizing your new custom home.

But before that, here are some facts regarding the increase in multigenerational living in America:

One in four Americans currently reside in a multigenerational household, according to a recent survey. Seventy percent of those Americans say they want to do so in the long run. The advantages of cohabitation as a family are as follows:

Going back, here are six essential design concepts to bear in mind if you're prepared to begin creating your own multigenerational house.

Fostering close family ties is one of the primary advantages of living in a multigenerational house, and this typically takes place in a great room.

Families will get together in the great room throughout the day, so having adequate space is crucial. Large great room designs with adjacent outdoor living spaces and spacious kitchens are among our most popular open-concept floor plans. These layouts are excellent since they have a kitchen island and the extra perk of formal and/or informal dining. When necessary, these areas frequently serve as private or work areas.

For multigenerational households, having a master (principal suite) on the main floor is the ideal choice due to the privacy it provides for adult household members.

It would be advantageous to choose a layout with a primary suite on the main level if your family includes taking care of an elderly parent.

This feature is built into the majority of our multigenerational plans, but if you choose a plan without it, we can customize it for you.

Everyone needs privacy occasionally, regardless of how much they love their family. Whether you're on a video call for work or just chatting privately with a friend, your plan should have specific areas for these kinds of interactions.

Adding a separate entrance is a simple approach to foster independence in your shared home if your Primary Suite is on the main floor. For adult family members who might have different schedules than the rest of the family, it also provides an additional degree of seclusion.

Make sure your home is accessible if you live with people who have mobility issues and your family is multi-generational. Keep in mind that even though your elderly parents can currently climb stairs and move around with ease, that might not be the case in the future.

The secret to making all of this work is communication. Get your family together and discuss what is most important to each of you. It can be thrilling to build a custom dream home for several generations, but it's crucial to ensure that everyone's needs are met within realistic limits.

The deciding members of the family should be happy with the final layout, even though it's likely that they won't agree on every aspect.

Need help looking or building your multi-generational home? Our team at RE/MAX Advanced Realty is here to assist you. Call us at 317-316-8224 today and we’ll guide you all through the process.

As summer draws to a close, the country's housing market, which has recently favored sellers, shifts into a "neutral" state as October approaches, placing buyers and sellers on an even playing field. Orphe Divounguy, Senior Economist at Zillow®, says that a more balanced market would probably have fewer buyers. If you want to sell in the fall, you might wonder what constitutes a "neutral market."

According to him, the type of market highlights how crucial it is to determine the ideal list price because, in contrast to other listings, those that are priced competitively and effectively advertised get under contract in an average of just eighteen days.

Setting a price for a property that will sell strategically is never simple, but it can be particularly difficult in the fall when buyers with financial difficulties still struggle with affordability. In July, over 25% of sellers nationwide (i.e., the greatest percentage in the last five years) lowered their prices for the spring-summer selling season.

Divounguy claims that sellers "haven't gotten the memo quite yet." He also said that: "They're still listing their homes too high. That's why you're seeing more price cuts on these homes. And the homes that are mispriced are staying on the market longer."

In addition to learning how much to charge for a home, sellers and prospective buyers have a lot to consider this autumn, from the very variable local market circumstances to concerns about the direction of mortgage rates. Here are our predictions for the fall selling season of 2024:

Fall is typically the slowest season for house sales, partly because parents with young children tend to put off house hunting after the school year begins. According to Zillow data, consumers withdrew from house hunting earlier this year than usual. This decreased competition across the country and forced sellers to lower their asking prices and make concessions to draw in buyers.

The retreat affects inventories, which rose in July in all but five of the major metro areas that Zillow economists examined. It's also having an impact on property values, which just marginally increased in July, per a recent Zillow research.

According to Zillow's projection, home values will rise by 1% nationally over the next 12 months, which is a significant deceleration from previous years, according to Divounguy.

"While price growth could continue to ease somewhat, I don't expect big price declines," Divounguy says. "TWe’ll need to see a big increase in inventory to see a large decline in home values. Recent small improvements in affordability could bring back more buyers than sellers, which could slow the increase in housing inventory, and prevent the market from cooling further."

The number of available homes in the US will drop by 4.5 million in 2022, per Zillow research. Apart from their scarcity, the annual production of new residences has not kept pace with the rate of construction. Even while buyers find it difficult to pay, sellers should expect steady home values for the foreseeable future as a result of the shortage.

It is generally anticipated that the Federal Reserve Board will lower its main policy rate in September and maybe later. The Fed's projections may already be reflected in current mortgage rates, though.

He believes that long-term economic variables like inflation and the state of the economy as a whole are often taken into account by lenders when setting interest rates. Therefore, even while the expectation of Fed rate cuts may be influencing mortgage rates at the moment, additional declines in mortgage rates are unlikely if economic growth continues to be robust.

Despite a decline from the 2.8% seasonally adjusted rate seen in the second quarter, the US economy's third-quarter seasonally adjusted annual growth rate is 2%.

Although it has somewhat improved, most prospective purchasers still face significant barriers due to housing affordability. Home prices may rise as more purchasers try to take advantage of the recent rate reduction.

Additionally, since interest rates aren't going to continue dropping, buyers will probably continue to feel pressured by the combination of high house prices, higher-than-usual interest rates, and the necessity of saving money for a down payment.

Because of the budget issue, consumers are searching for the greatest offers.

Well-priced and well-marketed properties continue to sell quickly, even if the majority of listings decline. Properties that sold in July took just 18 days to go pending, which is six days less than a year ago but still quicker than before the outbreak.

Zillow data also indicates that greater sale premiums are associated with contemporary characteristics that distinguish a home as either brand new or recently updated. Small upgrades that give your house a "new construction" appearance, marketing resources like virtual floor plans and 3D home tours on your listing, and well-thought-out pricing may make a big impact.

The local situation is contradictory, even though the national market is no longer a seller's market. Certain markets still favor sellers, while others favor buyers.

Discuss the plan of action based on the state of the local market with a real estate agent.

An experienced real estate agent in your area may assess your house to see what it might bring in light of the neighborhood's characteristics and the prices at which previously sold comparable properties in the area.

Take note of the cost.

As mentioned above, well-priced and well-maintained homes still sell rapidly, but if there aren't many sales in your region to compare prices to, it may be difficult to determine the proper price.

Think about making accommodations.

If sellers make accommodations that enable purchasers to reduce their monthly mortgage payments, they could do so faster. According to the National Association of Home Builders, 61% of builders make compromises to succeed in this market without having to lower costs.

“If builders are offering incentives to buyers, then sellers should probably do the same to keep well-priced homes moving,’’ advises Divounguy.

What are your thoughts? Feel free to share them in the comments!

The real estate industry is only one of the many industries artificial intelligence (AI) has changed. AI is becoming a vital tool for real estate agents, investors, buyers, sellers, and other stakeholders due to its capacity to analyze enormous volumes of data, automate procedures, and offer insightful analysis.

However, there’s still an unanswered question going on for a long time: will AI replace realtors and their services? The short answer is no.

Instead, AI complements what they offer, thus providing a positive effect on both the real estate industry and customers.

The capacity of AI to process and analyze enormous volumes of data is one of its most important benefits in the real estate industry.

AI algorithms can be used by real estate brokers to gather and evaluate demographic data, property data, market trends, and other pertinent information. They obtain important knowledge about pricing, demand trends, investment possibilities, and property comparisons by doing this.

To determine a property's fair market value, artificial intelligence can gather enormous volumes of data from a variety of sources, including past transactions, the characteristics of the property, and the state of the market.

AI-enabled tools can spot developing markets, forecast changes in real estate values, and make data-driven investment choices. Artificial intelligence can be useful in predicting future trends in the residential and commercial real estate markets, even though it is not a crystal ball.

Platforms with AI capabilities have greatly enhanced the home-search experience for investors and buyers alike. These services generate individualized property recommendations based on local data, historical trends, and user preferences through machine learning algorithms.

To make the process of finding a property easier, artificial intelligence can consider a variety of aspects, including location preferences, desired amenities, budget, and more. For buyers, investors, homeowners, and even real estate brokers helping their customers, this new technology saves time and effort.

AI is not the enemy in real estate. Artificial intelligence can be a huge asset in giving investors, house sellers, and purchasers a more accurate and tailored experience. Furthermore, artificial intelligence can be used by real estate firms to customize their services to meet the unique needs of each customer.

The way properties are marketed using augmented reality (AR) and virtual reality (VR) technologies has been completely transformed by artificial intelligence. By using virtual tours, potential investors and purchasers can inspect homes from a distance, which can save time and money.

Using floor plans and other information, AI technology can also create 3D models and renderings of properties, providing investors and buyers with a realistic representation of the area. Before in-person visits, this immersive experience helps you refine possibilities and make educated judgments during the home hunt.

When looking for a home in a new real estate market, prospective buyers from out of state can benefit greatly from virtual tours. While taking a virtual tour of the property cannot substitute seeing it in person, AI can assist prospective buyers learn about the essential features of the house.

Accurate property pricing is essential for real estate agents and sellers. To identify the best pricing tactics, AI algorithms can examine past data, market trends, property features, and regional considerations.

Before the development of artificial intelligence, property values were manually determined using data from previous sales in the area. However, AI in real estate can produce more accurate property prices, benefiting both buyers and sellers, thanks to machine learning and predictive modeling.

Real estate experts and agents may forecast property demand, find possible buyers, and suggest competitive prices by leveraging predictive analytics technologies. Sellers can improve their listings, draw in more potential customers, and close deals more quickly with the help of AI-powered pricing tools.

AI is automating a lot of the work in property management and making it more efficient. Intelligent systems are capable of optimizing building operations, detecting maintenance difficulties, and monitoring and controlling energy consumption. This not only saves money but also makes the occupants happier.

AI-powered software simplifies administrative work, keeps track of lease agreements, oversees maintenance, and offers individualized tenant services to real estate brokers handling numerous properties.

These astute technological developments free up professionals' time and resources so they can concentrate on higher-value tasks.

Although artificial intelligence (AI) has great promise for the future of many industries, including real estate, it is unlikely to displace the real estate industry entirely for several reasons.

Complex decision-making procedures involving real estate transactions call on human judgment and experience.

Artificial Intelligence (AI) might be able to evaluate data and offer insights, but it is unable to comprehend the complex desires and feelings of consumers and sellers. AI cannot easily replace the individualized counsel, bargaining skills, and recommendations that real estate brokers provide.

Property transactions are frequently emotional and private affairs. Consumers like the personal touch and credibility that real estate brokers provide.

An AI system won't be able to build the same kind of connection or offer the emotional support that customers frequently need in these kinds of interactions.

The real estate markets in different places differ significantly. Real estate brokers are extremely knowledgeable about local amenities, zoning laws, market trends, and particular communities.

To give clients reliable counsel and guidance, localized expertise is essential. Without access to complete and current data, AI systems may find it difficult to reproduce this expertise.

Outstanding communication and negotiating abilities are necessary while negotiating the parameters of a real estate transaction. Real estate brokers are skilled negotiators who can speak up for the interests of their clients.

Even if AI is capable of using data analysis to recommend negotiation tactics, it might not have the interpersonal abilities needed to handle difficult discussions.

Both substantial financial outlays and legal requirements are present in real estate purchases. Real estate brokers are frequently relied upon by clients to guarantee a seamless and compliant transaction.

Real estate agents have a fiduciary commitment to their customers. This entails controlling any risks, maintaining confidentiality, and safeguarding their interests. In these transactions, the human aspect fosters confidence and establishes accountability.

Artificial Intelligence (AI) has revolutionized the real estate industry, offering advantages to consumers, sellers, investors, and professionals alike.

Artificial intelligence (AI)-powered technologies have completely changed the real estate industry, from data analysis and market insights to virtual tours and predictive analytics. Even if artificial intelligence (AI) makes decisions easier, increases productivity, and streamlines procedures, it is unlikely to completely replace the function of real estate experts.

After all, nothing beats an amazing real estate agent.

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224