You’re all set to go for your much-awaited vacation.

Your OOTDs are ready.

You’ve also made sure your pets are in good hands while you’re gone and your plants are watered when you’re away.

In short, as John Denver sings: “all your bags are packed and ready to go”.

Whether it's an overnight or a weekend getaway or a week-long or even much longer trip, it's important to take extra security measures to secure your home's safety.

Here are some tips to help keep your abode safe before going on a vacation:

Install or set timers on interior lights

You have to give the impression that someone else is still in the house while you are away. Turning timers for interior lights, television, and radios will confuse burglars who always look for opportunities to initiate crimes.

Test smoke alarms

Make sure that all alarms are working and the batteries are all replaced. It is also best to put a fire extinguisher on hand in case it will be needed.

Unplug appliances to avoid power surge

Anything can happen and you never know when a power surge may occur, so it’s good to be prepared. Unplug all unnecessary non-timed appliances to make sure that they will not cause an accident while you’re away. You can also consider plugging them safely into a surge protector.

Alert the alarm company

Getting a security system makes your home much safer and gives you peace of mind. If you have an automatic security system, you may call the in-charge representative to let them know you’ll be away from home for a couple of days. Make sure to check the alarm and that it is set properly when you leave. As everything can be accessible, consider using remote monitoring with your smartphone or putting a video doorbell for some added protection in your home.

Securing your valuables

Before your getaway, make sure to put all your valuables like cash and jewelry in a safe place you only know. You can also put them in a home safe and avoid leaving them in plain sight where thieves and burglars can see them.

Set HVAC

Program your thermostat to lower the heat or air conditioning usage to your desired temperature. Also, don’t forget to change the battery.

Protect your pipes

Check your pipes if they are insulated, especially in vulnerable areas like basements. Setting your thermostat can help if you’re in a cold area. You may also ask a neighbor to turn on the faucet from time to time to avoid pipes freezing.

Consider a house sitter

You may also have the option to hire a house sitter that will look after your home while you’re away. They can also take care of your plants to water them and your pets in case you can’t bring them with you on your trip.

If you’re a social person, it’s enticing to share your adventure and travel on social media. However, posting too much information can lead to thieves knowing you’re not home. Hold back from publicly sharing any details of your trip until you have returned. Showing and sharing your vacation plans or location out loud leaves an opening for potential burglars.

If you like to post, remove geotags from your socials by turning them off on your phone’s settings. Switch your account exclusively to your friends only and not to the public.

Lock up doors, windows, and garage

Take time to install the best door lock that will provide the first line of protection for your home and secure other openings to prevent burglars from unlocking the door. Before you leave your home, see that all windows and doors are locked. In the garage area, disconnect the electric opener (for the automatic garage door) and place securely a padlock on the garage door track.

Garden care

To avoid any burglars from thinking there is no one in your home, think about having a local service to arrange lawn care while you’re away. While you’re at it, you may also ask to trim some of the branches. Don’t give them a chance to access your home by climbing onto the tree branches so you might want to consider pruning them.

Enlist your neighbor

If you have a trusted neighbor, tell them that you’ll be away for a vacation and ask them to keep an eye on your home. You may ask them to have their vehicle parked in your garage to keep burglars at bay. You may also request them to call the authorities if anything happens while you’re away.

Stop delivery of newspapers and mail

Request to have your mail deliveries on hold while you’re away. If you can’t make it, you can ask a neighbor to collect your mail and newspaper delivery on your behalf so it won't look like nobody’s around your home. Again, you don't want burglars to easily have a clue about your absence by the mounting newspapers on your doorstep.

Secure the outside of your home

Keep your grills and trash cans inside to avoid any accidents and damage to your home and property in case there would be severe weather like hurricanes and tornadoes.

Remove your spare keys

Don’t leave any spare keys behind when you take your vacation. It is best to leave it on your neighbor instead of hiding it in places you think are safe. Burglars nowadays will take it to the extent of searching long and hard until they find the keys and easily enter your home.

Check outside lighting

Invest in lights by buying and utilizing motion detector lights. Install and set timers for outdoor security lights. Keeping your lights turned on at night will make your home easily seen by burglars breaking into your home.

Additional tip: You may also consider purchasing the appropriate amount of home insurance for your needs, such as the renter's home insurance.

To make the most of your well-earned vacation, make sure you have enough systems in place to care for your home while you are gone. Whether you simply ask a neighbor to come in and pick up your newspaper or consider a home sitter, a few easy steps before you leave can allow you to return home the way you want it to be.

Owning a house is one of the largest single investments you’ll ever make, and it usually starts with house hunting.

When you buy real estate in Indiana, you’ll spend a lot of time, energy, and effort searching for the home you like. So before you close any deal, write down a list of potential questions and ask the owner before you decide to buy the property.

It’s always a good idea to do detective work and get some answers. It may not only give you peace of mind, but it will also save you from any financial problems in the future.

There are many reasons people move, such as the desire to move to a larger house, job relocation, moving to another state or country, life events, marriage, etc.

It’s good to ask this question though sometimes they won’t give you an honest answer, but it can still be helpful when you make room for negotiation.

Ask a utility to run a check and maintenance cost of the house. It’s hard to know the true cost of a house, so getting help from a knowledgeable person can save you every month.

By knowing your average water, electricity, and gas bill, you can determine if you can afford the house plus its monthly bills.

You can directly ask the seller or the real estate agent how long the house has been on the market. One of the reasons a house ends up staying on the market for long is because of its high price or because there’s something wrong with the property. The more the house spends on the market the more power you have to make room for negotiation to lower its asking price.

You can directly ask the seller or the real estate agent how long the house has been on the market.

One of the reasons a house ends up staying on the market longer than usual is either it's too expensive or the property itself. The more the house spends on the market, the more power you have to make room for negotiation to lower its asking price.

If you know the previous price of the house, you can easily notice if the price has been marked up or down. Knowing how much the seller paid can help you make room for any negotiation. If they were able to buy it at a much lower price, you can lower your offer but make sure that it is still at a reasonable price. In case they didn’t tell you the price, you can always check the public records where the house is located.

The seller will not say it outright if there is anything wrong about the neighborhood, since this might affect the buyer's decision.

You can survey the area and try to understand your potential neighborhood. Observing is one of the keys to determining whether it's the right home for you or not.

Find out if it has a strong sense of community or there are any problems before going through the purchase. Visiting the local police department can also help you determine if it is a safe environment to live in or not.

Home sellers must tell you about any current problems with the house though it may vary from state to state. However, home sellers are not legally required to disclose issues if there are any.

You can enquire whether the seller has had to repair any issues with the house and how well the remedy worked, particularly if it is a former issue that has been resolved.

It also helps to know who completed the work in case a similar issue arises.

This is one of the most common questions to ask, but it is similar to asking why they are moving. Find out how long they have lived in the house and try to have them open up or share a memory of them in the house and observe if there are any signs that the house might not serve your needs.

How the house looks is important and so is asking about the age and condition of the house as this can help you prepare for any impending expenses.

Knowing how updated it is is necessary to repair or replace important components like the water tank, A/C unit, heating system, septic systems, plumbing, electrical systems, and appliances.

It is important to ask if there are any major repairs or renovations made to the house and who did it. You may also ask if it is DIY, with a licensed contractor or professional. Bad renovation, plumbing, or construction can end up wasting more money and exhaust you financially.

You don’t always have to dig for dirt. You can ask questions with a personal touch. Try to find out what the seller loves about their home. It can get the seller to talk about their home and the neighborhood. They can also talk about a specific place in the house or a favorite spot. You might learn something positive that you might not have known.

Getting a list of questions to ask before buying a house is important. You want to make sure about its history before anything else. Talking to the seller can help you learn exactly what you could be getting into.

Besides, having a real estate agent can also give you a handful of information in case you didn’t find the answers you want to know in the seller. Knowing the house will give you peace of mind and save you the hassle.

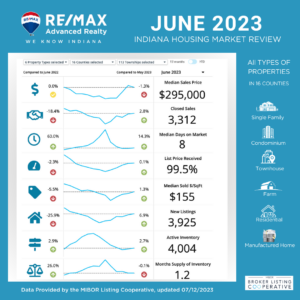

The real estate market in Bartholomew, Boone, Brown, Decatur, Hamilton, Hancock, Hendricks, Jackson, Jennings, Johnson, Madison, Marion, Montgomery, Morgan, Putnam, and Shelby counties continue to offer promising opportunities for buyers and sellers across all property types, including Single Family, Condominium, Townhouse, Farm, Residential, and Manufactured Homes. The data provided in this review has been sourced from the MIBOR Listing Cooperative, and while there are some fluctuations, there are still positive aspects to consider.

Overall, despite some fluctuations, the real estate market in these counties continues to present opportunities for buyers and sellers alike. The median sales price, though stable, reflects the attractiveness of the region, and the increase in closed sales and new listings indicate a healthy level of activity. With a relatively fast median days on market, sellers can expect reasonable offers, and buyers have a growing inventory to choose from. These factors combine to make it an opportune time to engage in real estate transactions in these counties.

For all your real estate needs in these vibrant markets, we encourage you to reach out to RE/MAX Advanced Realty. Our experienced agents are ready to assist you in navigating the current market trends, finding your dream property, or selling your existing home for the best possible price. Contact RE/MAX Advanced Realty today and let us help you make your real estate aspirations a reality.

In the first part, we learned some facts about Indiana, the average salary of those who live there, the status of the job market, its population, the cost of living, weather, and climate, and many more.

Now, we'll dive deeper into the Hoosier State and discover more things about this beautiful place.

The rate of violent crime in Indiana is slightly higher than the national average. According to recent data, there were approximately 400 violent crimes and approximately 2,600 property offenses per 100,000 persons. Indiana's violent crime rate is thus around 9% higher than the national average. Property crime was close to the national average.

On the other hand, the place offers some fantastic cities and villages. The Northwest Indiana region is home to nine of Indiana's top twenty safest cities. St. John was ranked first, Crown Point was ranked fourth, and Valparaiso was ranked fifteenth.

Because five distinct interstates intersect in Indianapolis, IN, Indiana is known as the "Crossroads of America." Indiana is the entryway from the east coast to the west coast. The rail system in the United States is vital to the highways that transport products. Indiana is home to several major freight rail lines. Indiana is home to rail intermodal, the Ohio River canal, and the Port of Indiana on Lake Michigan.

You will need a place to reside whether you are relocating to Indiana or visiting for another purpose. Indiana real estate, homes, and houses will continue to be in high demand in 2020. In 2019, the number of homes for sale in Indiana climbed by 3% to slightly more than 4%. Several factors are contributing to Indiana real estate's high demand and value growth.

Real estate values in Indiana rise as a result of both business and inhabitants. Indiana is a low-regulation, business-friendly state. The minimum wage is cheap, schools are excellent, and public services are extensive. Furthermore, tax rates in neighboring Illinois are encouraging more firms and residents to relocate to Indiana. Finally, Indiana has shown to be a secure, thriving state that is also a fantastic location to live.

Northwest Indiana real estate had some of the most significant improvements in 2019. Last year, the number of homes for sale in Northwest Indiana climbed by 5.6%. We anticipate that this tendency will continue. The most significant contributing elements are the increased number of residents from Illinois and the recent economic expansion in Northwest Indiana.

One advantage of residing in Indiana is the state's dedication to environmental preservation. Indiana is home to some spectacular natural places.

The state's northern boundary is with Lake Michigan. You can visit the Indiana Dunes State Park and the Indiana Dunes National Park while you're here. You may relax on the beach, climb the sand dunes, or go for a trek through the woodlands along the lakefront.

Hoosier National Forest is located in the state's south. The United States manages this forest preserve. The Forest Service. The Hoosier National Forest encompasses about 200,000 acres of property in southern Indiana's Appalachian foothills.

Indiana's culture is diverse. There are several densely populated places in Indiana. Among these are Ft. Wayne, South Bend, Indianapolis, and the Northwest Indiana region all within commuting distance of Chicago, the third-largest city in the United States. These regions have the commerce, entertainment, and cuisine that you would expect to find in a bustling metropolis.

There are several smaller cities in between, separated by extensive farmland. This provides tremendous balance for Indiana people. Those who reside in the city might live a more urban lifestyle. People who live in the country might enjoy a calmer, more communal existence.

Indiana has a little bit of everything, so there is something for everyone. When you need a change of scenery, get in your car and drive down the highway (Indiana is known as America's Crossroads) to meet a new portion of this great state.

Here are some things to consider before relocating to Indiana.

Whether you're planning to move to Indiana or want to learn more about real estate in this area, our team at RE/MAX Advanced Realty - Indy Home Pros is more than willing to help.

With 8 years of average experience as a real estate agent, we ensure to make your relocation plan seamless and hassle-free.

Contact us by clicking this link!

It is simply a matter of being familiar with Indiana to determine whether or not it is a good decision to relocate there. This guide will help you get familiar with the state and determine whether Indiana is an appropriate area for you to reside.

Before you move to Indiana, you probably want to know how much money people in Indiana make. According to the latest recent data, the average wage in Indiana is over $47,000, and the average household income is around $55,000. Personal per capita income in Northwest Indiana is somewhat less than $46,000. The average salary in Indiana's capital, Indianapolis, is over $52,000, 10% higher than the state average. Learn more about the typical Indiana income across the state.

The state's job market provides an answer to the issue of why relocate to Indiana. Indiana is home to small, medium, and large firms. Indiana's key sectors include agriculture, energy, manufacturing, steel production, healthcare, and professional services. Manufacturing employs around 17% of all nonfarm employment. Major corporations are concentrated in medium and bigger cities. One of the advantages of relocating to Indiana is that the state has a lower unemployment rate than the national average.

Certain industries in Indiana are heavily concentrated in tiny geographic areas, which is a distinctive feature of the state's economy. Northwest Indiana, for example, is home to some of the major steel mills in the United States. More than half of the blast furnace capacity in the United States is located in Lake and Porter Counties.

Another example is that 80% of recreational vehicles (RVs) manufactured in the United States are constructed in Northeastern Indiana, in places like Goshen. Elkhart County is known as the "RV Capital of the World," whereas Warsaw, Indiana is known as the "Orthopedic Capital of the World" due to the presence of three large orthopedic medical equipment firms.

Here are some more details on the Indiana job market:

The population of Indiana is increasing. Indiana now has a population of approximately 6.79 million people. This is a 300,000 increase over 2010. More information about Indiana's current population can be found here. In addition, the Indiana University Kelly School of Business publication INContext offers an excellent chapter on Indiana's predicted population growth until 2050.

Many surveys have placed Indiana as one of the most affordable states to live in. Yes, our wages may be slightly lower than those in other states. We make up for it, however, with a low state-income tax rate, constitutionally protected property tax caps, near access to important resources, and a competitive business environment that welcomes new companies.

According to U.S. News & World Reports, Indiana is the third cheapest state. If you search the internet for this question, you will most likely discover multiple studies ranking Indiana as one of the top ten most affordable states.

The four seasons have been experienced in every section of the state. Winter, on the other hand, is a wildcard. Temperatures in the spring and fall are mild, with highs in the 50s and 60s and lows in the 40s. Summer brings days in the 70s, 90s, and even over 100 degrees. Winter is a wild card.

Indiana is a large state that stretches for 250 miles from north to south. The southern portion experiences snow and cold in the winter, as does the center section, albeit slightly more and slightly colder. Northern Indiana, on the other hand, has all the hallmarks of a hard midwestern winter.

Lows in the teens and single digits are common in Northern Indiana throughout the winter. Temperatures below zero are not uncommon. Northern Indiana has the most snow, and there is a phenomenon known as lake effect snow in a few select areas.

In essence, snow bands form off of a huge body of water, like Lake Michigan, and, if conditions are ideal, these bands will dump snow on a region. I have always resided in northern Indiana, which is one of the select locations where this occurs occasionally each year. Sincerely, there was a time when my neighborhood had a 20-inch snowfall in a single day. They had five inches at two miles. They had none five kilometers distant.

The educational system of Indiana is strong. In Indiana, approximately 87% of students complete high school. Of those, over 63% enroll in colleges right away. You may get more information on Indiana's schools here. The Indiana Department of Education works hard to make information about the state's public schools readily available.

Indiana's colleges and universities are among the best in the country. In the past, Purdue University excelled in the sciences and math, producing generations of graduates. Indiana University, Notre Dame, Ball State, Butler, and Valparaiso University are a few of the state's other prestigious universities.

These are just some of the basic things about Indiana. In our next post, we'll learn more about this beautiful Hoosier State.

Father's Day is a special occasion to honor and celebrate the incredible dads in our lives. If you're in Indianapolis or planning to visit the city, there are plenty of exciting activities to make this Father's Day memorable. Whether your father is a sports enthusiast, outdoor adventurer, history buff, DIY enthusiast, or nature lover, Indy has something for everyone. As Indy’s Leading Brokerage, RE/MAX Advanced Realty knows Indiana and what our beautiful state has to offer. Join us as we explore a range of fun-filled experiences to celebrate Father's Day in Indy.

Sports Enthusiasts

For Sports Loving Dads, Indianapolis is a city that offers a range of exciting destinations and activities. From iconic stadiums to interactive museums and thrilling sporting events, Indy has something to satisfy every sports enthusiast.

Here are some of the top places to consider visiting in Indianapolis for dads who love sports.

Start your sports adventure by visiting Lucas Oil Stadium, the home of the Indianapolis Colts (NFL). Take a guided tour of the stadium to explore behind-the-scenes areas, including the playing field, locker rooms, and press box. It's a fantastic opportunity to experience the energy of an NFL stadium and learn more about the team's history

If your dad is a basketball enthusiast, make sure to catch a game or attend a basketball event at Bankers Life Fieldhouse. This is the home of the Indiana Pacers (NBA) and the Indiana Fever (WNBA). Enjoy the thrilling atmosphere of professional basketball and cheer for the home team as they showcase their skills.

For dads with a passion for motorsports, a visit to the Indianapolis Motor Speedway is a must. Explore the Speedway's Hall of Fame Museum, which houses an extensive collection of race cars and memorabilia from the Indy 500 and other prestigious races. Don't forget to take a tour of the iconic track itself to experience the thrill of this legendary venue.

Baseball-loving dads will appreciate a trip to Victory Field, home of the Indianapolis Indians (Triple-A baseball). Enjoy a day at the ballpark, savoring classic ballpark snacks while watching the game. The stadium offers an excellent view of the downtown skyline, adding to the overall ambiance.

Indianapolis Motor Speedway Museum

Within the Indianapolis Motor Speedway complex, the Indianapolis Motor Speedway Museum is a treasure trove for sports-loving dads. Explore exhibits dedicated to the history of auto racing, featuring iconic race cars, artifacts, and interactive displays. It's a chance to dive deep into the sport and learn about its evolution.

Outdoor Adventurers

For fathers who are passionate about the great outdoors, Indianapolis offers a treasure trove of exciting activities and breathtaking landscapes to explore. Whether dad is an avid hiker, a thrill-seeking kayaker, or simply love to soak in the beauty of nature, Indy has something for every outdoor enthusi

ast dad.

Hiking at Turkey Run State Park

Embark on an adventure amidst sandstone gorges, waterfalls, and picturesque trails at Turkey Run State Park. Discover hidden caves, cross wooden footbridges, and soak in the stunning natural scenery. Pack a picnic and enjoy a scenic lunch surrounded by breathtaking views.

Canoeing or Kayaking on the Tippecanoe River

Experience the thrill of paddling through Indiana's scenic waterways on the Tippecanoe River. Enjoy the tranquility as you navigate gentle currents, observe the vibrant flora and fauna, and create lasting memories with your family.

Outdoor Escapade at Go Ape

Treat dad to an unparalleled outdoor experience at Go Ape. Get ready to embark on an exhilarating journey through the treetops, conquering daring obstacles and exploring the forest from a whole new perspective. With multiple ziplines offering breathtaking heights, this adventure is sure to make your dad's heart race with excitement.

Go Biking on the Monon Trail

Rent bicycles and explore the scenic 26-mile Monon Trail that winds through Indianapolis. Pedal through vibrant neighborhoods, lush parks, and charming towns, witnessing the city's rich history and stunning natural landscapes. There are plenty of rest stops, eateries, and attractions along the way.

History Buffs

For history-loving fathers, Indy offers a treasure trove of captivating historical sites and attractions. From immersive exhibits to magnificent landmarks, this vibrant city in Indiana provides endless opportunities to step back in time and explore the rich tapestry of its past.

Here are some of the must-visit destinations in Indy that are sure to ignite the passion for history in any dad's heart.

Visit Conner Prairie

Nestled on 1,000 acres of picturesque land, Conner Prairie is a living history museum that allows visitors to experience Indiana's history firsthand. Take a stroll through the 19th-century Prairie Town, interact with costumed interpreters, and engage in hands-on activities that bring the past to life. Whether it's milking a cow, cooking over an open fire, or exploring a Native American wigwam, Conner Prairie offers an immersive experience that both dads and their families will cherish.

Tour the Indiana State Capitol

A visit to the Indiana State Capitol is a must for any history enthusiast. Marvel at the grandeur of this iconic building, designed in the neoclassical style, as you explore its halls and chambers. Guided tours provide fascinating insights into Indiana's government and the state's rich political history. Admire the beautiful artwork, intricate architecture, and learn about the significant events that have shaped the Hoosier State.

Visit the Indiana Military Museum

For dads with an interest in military history, the Indiana Military Museum is a true gem. This expansive museum houses an extensive collection of military artifacts spanning different time periods, from the American Revolution to the present day. Explore exhibits featuring tanks, aircraft, uniforms, weapons, and more, while gaining a deeper appreciation for the sacrifices made by our brave servicemen and women.

Explore the Indiana Historical Society

The Indiana Historical Society offers a captivating journey through Indiana's past. With engaging exhibits, interactive displays, and thought-provoking programs, this institution brings history to life in a dynamic way. Discover Indiana's diverse cultural heritage, delve into the stories of notable Hoosiers, and gain insights into the state's pivotal role in American history. The Indiana Historical Society regularly hosts special events and lectures, providing even more opportunities for dads to deepen their historical knowledge.

Discover Historic New Harmony

Step into a different world as you visit Historic New Harmony, a charming town known for its utopian experiments and intellectual heritage. Explore the meticulously preserved buildings, stroll along the picturesque streets, and immerse yourself in the unique atmosphere that inspired great minds such as Robert Owen and Thomas Say. Historic New Harmony offers a tranquil escape and a chance to reflect on the fascinating social experiments and intellectual pursuits that unfolded here.

DIY Enthusiasts

If your dad loves to roll up his sleeves and get creative with DIY projects, Indianapolis offers a plethora of opportunities for him to indulge in his passion. From unique materials to hands-on classes and inspiring workshops, Indy is a DIY enthusiast's haven.

Visit the Indianapolis ReStore

The Indianapolis ReStore is a treasure trove for any DIY enthusiast. It's a nonprofit home improvement store that sells donated new and gently used items at a fraction of their original cost. From furniture to appliances, building materials to home décor, your dad will find a wide range of unique materials and items that can fuel his creativity. Explore the store together, and you might stumble upon some hidden gems for your next DIY project.

Explore the Indianapolis Art Center

For dads who enjoy working with their hands and exploring different artistic mediums, the Indianapolis Art Center is a must-visit destination. This vibrant art center offers a variety of hands-on classes, including woodworking, pottery, metalworking, and more. Sign up for a class together and let your dad unleash his creativity under the guidance of experienced instructors. It's a wonderful opportunity to learn new skills and bond over a shared passion.

Nature Lovers

If your dad is a nature lover, Indy is the perfect destination to spend quality time together amidst breathtaking natural landscapes and serene surroundings.

Visit the Indianapolis Zoo

Visit the Indianapolis Zoo

The Indianapolis Zoo is a haven for animal enthusiasts and nature lovers alike. Take your dad on a captivating journey through diverse animal exhibits that showcase creatures from around the world. From majestic elephants and playful dolphins to colorful birds and endangered species, the zoo offers a unique opportunity to connect with wildlife. Additionally, don't miss the chance to explore the tranquil White River Gardens, where beautifully landscaped gardens and serene water features create a peaceful atmosphere.

Stroll through the White River State Park

For a leisurely escape into nature, head to the White River State Park. This expansive urban park offers a variety of trails that wind along the banks of the White River, providing stunning views of the water and surrounding greenery. Take a leisurely stroll with your dad, breathe in the fresh air, and enjoy the peaceful ambiance. The park also hosts concerts, festivals, and outdoor activities throughout the year, adding to the vibrant atmosphere.

Explore Holliday Park

Holliday Park is a hidden gem nestled in the heart of Indianapolis. Treat your dad to a memorable hiking experience as you meander through picturesque woodlands, marvel at towering trees, and discover beautiful wildflowers. The park is home to an impressive nature center that offers educational exhibits and programs. Spend some time connecting with nature and wildlife, and perhaps even catch a glimpse of local wildlife such as deer or owls. The serene surroundings will provide a perfect backdrop for father-child conversations.

Discover Fort Harrison State Park

For dads who enjoy outdoor adventures, Fort Harrison State Park is a must-visit destination. This expansive park offers a range of recreational activities, including hiking, fishing, biking, and golfing. Explore the scenic trails that wind through forests, fields, and along the banks of Fall Creek. Engage in friendly competition with your dad on the golf course or cast a line and try your luck at fishing. The park's natural beauty and tranquil atmosphere make it an ideal place for bonding and creating lasting memories.

And there you have it, folks! We've reached the end of our exhilarating blog journey exploring the myriad ways to celebrate Father's Day in Indiana. It's time to put those creative gears in motion and plan an extraordinary day for your dad. Whether it's an adrenaline-pumping adventure, a relaxing outdoor escapade, or a thrilling sports experience, Indiana has got you covered!

But wait, we've got a little something extra to spice things up! If you've been daydreaming about finding the perfect home for your family, why not turn this Father's Day celebration into a chance to explore real estate opportunities in Indiana? And who better to assist you in this exciting journey than the experts at RE/MAX Advanced Realty!

Imagine surprising your dad with an unforgettable day and then revealing your plans for a future filled with cherished memories in your dream home. RE/MAX Advanced Realty's team of dedicated real estate agents is ready to guide you through the process, helping you find the perfect property that suits your family's needs and desires.

So, as you embark on a Father's Day adventure to remember, keep in mind the fantastic real estate options waiting for you in Indiana. Reach out to RE/MAX Advanced Realty today and let their expertise turn your homeownership dreams into a reality.

Now go on, celebrate Father's Day in style, create lifelong memories, and embrace the thrilling possibilities that await you and your family in the beautiful state of Indiana. Happy Father's Day to all the incredible dads out there!

Remember, the greatest gift you can give your dad is your time, love, and a future filled with joy and togetherness. Cheers to all the superhero dads who make our lives extraordinary!

Curious about escrow – how it works, its benefits, the fees that come after, and more? If yes, this article might help whether you’re an Indiana real estate agent or a home buyer / seller.

A homeowner's insurance and property tax escrow account functions similarly to a savings account.

Escrow accounts are typically used by homeowners who have mortgages on their homes. You, the homeowner or borrower, deposit money into an escrow account kept by your lender each month. Your homeowner's insurance and property taxes are paid with the funds in the account. Your lender will make the necessary payments to your homeowners insurance provider and the local taxing authority on your behalf.

Your lender will be given instructions on how to determine the monthly payment you must make to your escrow account.

Your lender received the homeowner insurance quote from the business you wanted to employ when you bought your house. The lender's personnel researched the taxes and noted the rate. To correspond with the twelve months of the year, they then divide this number by 12. Your payment for principal and interest is increased by this sum. Indeed, lenders have the option to charge more.

Your lender is permitted to impose an overage or a buffer fee. To prepare for rises in the price of insurance or taxes is the reason this would occur. This was acknowledged by the Real Estate Settlement Procedures Act (RESPA), but it also imposed restrictions on your lender. Only a sum that is one-sixth more than the actual insurance and tax obligations for any given year may be retained by your lender. This cushion occasionally becomes excessively large. If so, your lender will offer you a refund to give you the money that was improperly held in escrow.

Many property purchasers want to have an escrow account. You benefit from the escrow account because it is a terrific instrument for creating a budget for future costs.

The local government may seize your property if you don't pay your property taxes. Additionally, insurance shields your house from disasters. Each year, a fee must be paid for each of these. The escrow account allows you to make regular payments for these costs throughout the year rather than receiving a sizable charge every year that you might or might not be ready for. It is a great method to stay up to date on the costs involved in house ownership.

Cash to close is a term that your real estate agent may use to describe the sum of the down payment, prepaid interest, title costs, loan origination fees, and impounds.

Homeowners insurance and property taxes are impounded items, also referred to as escrow items. Most frequently, at the closing table, you will buy your full first year's worth of homeowner insurance. The title firm will also collect additional premium payments for an additional two to four months. In terms of taxes, the title company will gather two to five months' worth of property taxes, depending on when the taxes are due again. The lender will receive these overages and deposit them in your escrow account.

You'll receive a monthly mortgage statement. A line item for escrow items, such as the property taxes and insurance, will probably be visible if you look. This comes in addition to your other expenses, such as principal and interest payments.

Your house payment can increase if your taxes or insurance go up. Instead, if these decrease, your mortgage payment would as well. Once more, your lender must abide by RESPA and is only permitted to collect an excess of no more than one-sixth of the actual amount payable for taxes and homeowners insurance for the year.

Escrow accounts are utilized to regularly cover homeowner insurance premiums and property tax obligations for your home. Escrow accounts are beneficial. It is a terrific way to stay on track with your spending plan and prevent worrying about receiving a huge bill in the mail. Additionally, because your lender handles the payment distribution, you won't fall behind on your property taxes or risk having your homeowners insurance lapse as a result of missing payments.

If you're planning to sell or buy real estate in Indiana or want to learn more about escrow, our team at RE/MAX Advanced Realty - Indy Home Pros is here to help. Call us at 317-298-0961 to get started.

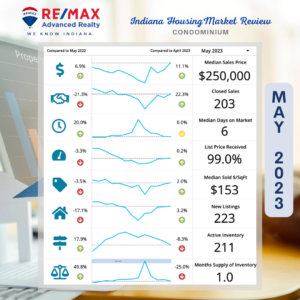

The real estate market in Indiana continues to demonstrate positive growth and resilience, as indicated by the market data report for May 2023. Analyzing the data for both single-family homes, condos, and all property types across all 16 counties, we can gain valuable insights into the current state of the market. In this blog, we will interpret the data and highlight the significant trends that potential buyers and sellers should be aware of. Furthermore, we will discuss the importance of considering these trends and fluctuations when analyzing the housing market. Let's dive in!

CONDOS

The condo market in Indiana has shown promising signs of growth, with several key metrics indicating positive trends:

Median Sales Price:

The median sales price for condos in May 2023 was $250,000, marking an 11.1% increase compared to April 2023 and a 6.9% increase compared to May 2022. This upward trajectory reflects a robust market and increasing property values.

Closed Sales:

Despite a decrease of -21.3% compared to May 2022, May 2023 saw a remarkable 22.3% increase in closed sales compared to April 2023, reaching a total of 203 closed transactions. This suggests a strong buyer demand and an active condo market.

Median Days on Market:

The median days on the market for condos remained steady at 6 days, indicating consistent buyer interest and a balanced market. Although this represents a 20.0% increase compared to May 2022, it's important to note that condos are still selling relatively quickly.

List Price Received:

Condo sellers received 99.0% of their list price in May 2023, signifying a strong market where sellers have negotiating power. Compared to April 2023, there was a slight increase of 0.2%, although there was a decrease of -3.3% compared to May 2022.

Median Sold Price per SqFt:

The median sold price per square foot for condos in May 2023 was $153. This represents a 2.0% increase compared to April 2023, demonstrating growing property values. However, there was a slight decrease of -3.5% compared to May 2022.

New Listings and Active Inventory:

May 2023 witnessed 223 new listings for condos, showing a 3.2% increase compared to April 2023. However, when compared to May 2022, there was a decline of -17.1%. The active inventory of condos decreased by -8.3% compared to April 2023 but increased by 17.9% compared to May 2022.

Months of Supply of Inventory:

The months of supply of inventory for condos in May 2023 was 1.0, reflecting a -25.0% decrease compared to April 2023. However, there was an increase of 49.8% compared to May 2022, indicating a balance between supply and demand.

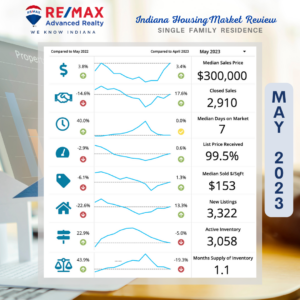

SINGLE-FAMILY HOMES

The single-family home market in Indiana also shows promising trends, demonstrating stability and growth:

Median Sales Price

The median sales price for single-family homes in May 2023 was $300,000, indicating a 3.4% increase compared to April 2023 and a 3.8% increase compared to May 2022. This showcases a consistent upward trajectory in home values.

Closed Sales

May 2023 recorded 2,910 closed sales of single-family homes, representing a substantial 17.6% increase compared to April 2023. However, there was a decrease of -14.6% compared to May 2022, highlighting the year-over-year fluctuations.

Median Days on Market

Similar to condos, the median days on market for single-family homes remained unchanged at 7 days compared to April 2023. Nevertheless, there was a 40.0% increase compared to May 2022, suggesting a slightly longer selling period.

List Price Received

Sellers received 99.5% of the list price for single-family homes in May 2023, indicating a seller's market and strong buyer interest. This represents a 0.6% increase compared to April 2023, although a decrease of -2.9% compared to May 2022.

Median Sold Price per SqFt

The median sold price per square foot for single-family homes in May 2023 was $153, exhibiting a 1.3% increase compared to April 2023. However, there was a decrease of -6.1% compared to May 2022.

New Listings and Active Inventory

May 2023 saw 3,322 new listings for single-family homes, reflecting a 13.3% increase compared to April 2023. Nevertheless, there was a decline of -22.6% when compared to May 2022. The active inventory for single-family homes decreased by -5.0% compared to April 2023 but increased by 22.9% compared to May 2022.

Months of Supply of Inventory

The months of supply of inventory for single-family homes in May 2023 was 1.1, indicating a -19.3% decrease compared to April 2023. However, there was an increase of 43.9% compared to May 2022, suggesting a more balanced market.

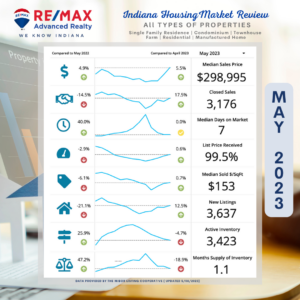

The Overall Housing Market in Indiana:

Considering all property types, the housing market in Indiana demonstrates positive trends:

Median Sales Price

The median sales price for all property types in May 2023 was $298,995, representing a 5.5% increase compared to April 2023 and a 4.9% increase compared to May 2022. This suggests overall growth and a healthy market.

Closed Sales

May 2023 experienced 3,176 closed sales for all property types, showing a significant 17.5% increase compared to April 2023. However, there was a decrease of -14.5% compared to May 2022, reflecting year-over-year variations.

Median Days on Market

The median days on market for all property types remained consistent at 7 days, compared to April 2023. However, there was a 40.0% increase compared to May 2022, indicating a slightly longer selling period.

List Price Received

Sellers received 99.5% of the list price for all property types in May 2023, signifying a robust market. This represents a 0.6% increase compared to April 2023, although a decrease of -2.9% compared to May 2022.

Median Sold Price per SqFt

The median sold price per square foot for all property types in May 2023 was $153, showing a 0.7% increase compared to April 2023. However, there was a decrease of -6.1% compared to May 2022.

New Listings and Active Inventory

May 2023 witnessed 3,637 new listings for all property types, reflecting a 12.5% increase compared to April 2023. However, there was a decline of -21.16% compared to May 2022. The active inventory for all property types decreased by -4.7% compared to April 2023 but increased by 25.9% compared to May 2022.

Months of Supply of Inventory

The months of supply of inventory for all property types in May 2023 was 1.1, indicating a -18.9% decrease compared to April 2023. However, there was an increase of 47.2% compared to May 2022, suggesting a more balanced market.

Overall Market Analysis

The market data for May 2023 provides an optimistic outlook for Indiana's real estate market. The consistent increase in median sales prices for condos, single-family homes, and all property types - Town House, Farm, Residential, Manufactured Homes indicates a healthy and thriving market. Although fluctuations in closed sales, new listings, and active inventory are observed, these variations are part of the dynamic nature of the real estate landscape.

While the median days on the market have increased, suggesting a slightly longer selling period compared to the previous year, it is crucial to note that the market remains active, and properties are being sold. This sustained interest and demand in the real estate market ensure a steady flow of transactions.

Considering the positive trends and fluctuations in Indiana's real estate market, it is essential for potential buyers and sellers to analyze the data and make informed decisions. Whether you are interested in condos, single-family homes, or any other property type, reaching out to an experienced real estate agent can provide valuable insights tailored to your specific needs and goals.

Contact Indy’s Leading Brokerage today to gain a deeper understanding of the thriving housing market in Indiana and explore the opportunities available to you. With a roster of top-notch realtors at RE/MAX Advanced Realty, you can be assured to have an expert and experienced to guide you through the nuances of the market and help you make informed decisions. Don't hesitate to reach out to us and embark on your real estate journey with confidence.

Greenwood Office: 317.881.3700

65 Airport Pkwy #140, Greenwood, IN 46143

West Office: 317.298.0961

8313 W 10th St, Indianapolis, IN 46234

When it comes to owning a home, one of the most exciting decisions to make is choosing its style. With a multitude of architectural designs to consider, finding the perfect match can be a thrilling and rewarding process. In this blog post, we'll delve into some popular home styles to help you explore the possibilities and discover the one that resonates with your personal taste and lifestyle.

Traditional Charm

For those who appreciate timeless elegance, traditional homes offer a classic appeal. Think of Colonial, Victorian, Tudor, or Craftsman styles, each with its unique characteristics and period influences. From symmetrical facades and decorative details to grand front porches and ornate woodwork, traditional homes exude a sense of history and sophistication.

Embracing Contemporary

If sleek lines, open spaces, and a focus on modern aesthetics captivate your imagination, contemporary homes might be the perfect fit. With an emphasis on clean design, natural light, and efficient use of space, these homes often incorporate materials like glass, concrete, and steel. Contemporary architecture seamlessly blends the indoors with the outdoors, creating an inviting and harmonious living environment.

The Allure of Modern

Minimalist enthusiasts gravitate towards modern homes, renowned for their simple geometric forms and functionality. These dwellings feature open floor plans, ample natural light, and a strong connection to the surrounding landscape. Flat roofs, large windows, and a minimalist aesthetic create a sense of spaciousness and calm. For those seeking a harmonious fusion of simplicity and style, modern homes are an excellent choice.

Single-Story Serenity

For those who prefer a single-level living experience, ranch-style homes provide a comfortable and accessible option. With their low profiles, open layouts, and easy access to outdoor spaces, ranch homes offer a relaxed and convenient lifestyle. They often boast wide front porches and embrace a variety of architectural influences, making them a popular choice for homeowners of all ages.

Craftsman's Delight

Craftsman-style homes celebrate craftsmanship, natural materials, and intricate detailing. These charming dwellings showcase exposed woodwork, unique architectural elements, and cozy front porches. With their warm and inviting atmosphere, Craftsman homes pay homage to traditional craftsmanship while providing a cozy and welcoming ambiance.

Mediterranean Flair

Transport yourself to the coastal regions of Spain, Italy, or Greece with a Mediterranean-style home. With stucco exteriors, red tile roofs, and arched windows, these homes radiate a sense of warmth and exoticism. Mediterranean architecture often emphasizes outdoor living spaces, allowing you to enjoy the beauty of nature from the comfort of your own home.

Timeless Colonial

Drawing inspiration from the American colonial period, Colonial-style homes exude a sense of grandeur and elegance. These symmetrical homes feature formal layouts, classic facades, and often boast charming details like columns, shutters, and central chimneys. Colonial homes offer a nod to history while providing a timeless and sophisticated living experience.

Victorian Grace

For those who adore ornate detailing and intricate woodwork, Victorian-style homes capture the imagination. With their steep roofs, vibrant colors, and elaborate exteriors, Victorian homes are a true testament to architectural artistry. Bay windows, turrets, and decorative trimmings create a whimsical and romantic atmosphere that enchants homeowners and visitors alike.

Mid-Century Modern Cool

If you have a fondness for the mid-20th century aesthetic, then mid-century modern homes may be your calling. These homes feature clean lines, large windows, and an emphasis on integrating with the surrounding natural environment. With open floor plans and a harmonious indoor-outdoor flow, mid-century modern homes exude a cool and timeless charm.

Farmhouse Comfort

Embracing a rustic and cozy feel, farmhouse-style homes evoke a sense of rural charm and simplicity. These dwellings often feature large front porches, pitched roofs, and an emphasis on functionality. Barn doors, exposed beams, and natural materials enhance the farmhouse aesthetic, creating a warm and inviting retreat.

Choosing a home style is a deeply personal decision, influenced by individual preferences, lifestyle requirements, and aesthetic inclinations. Exploring the diverse array of home styles available allows you to find the perfect match that reflects your unique personality and creates a sanctuary that you'll be proud to call home. Whether you're drawn to the timeless elegance of traditional homes, the clean lines of contemporary architecture, or the rustic charm of farmhouse living, the world of home styles has something for everyone. So, go forth, explore, and discover the home style that resonates with your dreams and aspirations.

If you're ready to embark on the journey of finding your dream home, we invite you to reach out to RE/MAX Advanced Realty. Our team of experienced real estate professionals is dedicated to assisting you every step of the way. Contact us today to schedule a consultation and let us help you navigate the exciting world of real estate.

June is a special month for all aspiring and existing homeowners as it marks National Homeownership Month. It is a time to celebrate the joys and benefits of owning a home, and to recognize the significant role homeownership plays in our lives. From providing stability and security to offering financial advantages and a sense of pride, owning a home is a milestone worth commemorating. In this blog, we will explore the numerous reasons why homeownership is worth celebrating and how it can positively impact your life.

Stability and Security:

One of the primary benefits of homeownership is the stability and security it brings. When you own a home, you have a place to call your own, creating a sense of stability for you and your family. You can establish roots in a community, build relationships with neighbors, and enjoy the peace of mind that comes with having a permanent place to call home.

Building Equity:

Unlike renting, homeownership allows you to build equity over time. Equity is the difference between the market value of your home and the outstanding balance on your mortgage. As you make mortgage payments and your home's value appreciates, your equity grows. This equity can be a valuable asset that contributes to your overall net worth and can be used for future investments or financial endeavors.

Homeownership often comes with various tax benefits. Many countries provide tax deductions on mortgage interest payments and property taxes. These deductions can help reduce your overall tax liability and provide significant savings. It's essential to consult with a tax professional to understand the specific tax advantages available in your region.

Investment Potential:

Real estate has historically been a sound long-term investment. Owning a home allows you to benefit from potential appreciation in property value over time. While there are no guarantees, many homeowners have experienced substantial returns on their investment when selling their homes. Homeownership offers an opportunity to build wealth and financial stability for the future.

Customization and Personalization:

One of the significant advantages of owning a home is the ability to personalize and customize your living space. Unlike renting, where restrictions may limit your ability to make changes, homeownership allows you to create a home that reflects your personal style and preferences. You can renovate, remodel, and make improvements according to your needs and tastes, turning a house into a true home.

Pride of Ownership:

The sense of pride and accomplishment that comes with owning a home is immeasurable. It represents a significant milestone in one's life and often brings a deep sense of fulfillment. Homeownership offers a place where you can create lasting memories, celebrate milestones, and establish a sanctuary that is uniquely yours.

Community Involvement:

Homeownership often fosters a stronger connection to the community. As a homeowner, you become invested in the neighborhood, local schools, and the overall well-being of the area. You have a stake in the community's success and can actively participate in local events and initiatives. This involvement creates a sense of belonging and contributes to the overall vibrancy of the neighborhood.

Stability in Monthly Payments:

When you have a fixed-rate mortgage, your monthly housing payments remain consistent over the loan term. Unlike rental payments that can increase over time, homeownership provides stability in monthly expenses. This stability makes budgeting easier and provides peace of mind, allowing you to plan for other financial goals.

Long-Term Financial Planning:

Owning a home can be an integral part of a long-term financial plan. It provides an asset that can contribute to your overall financial goals, such as retirement planning or generational wealth. As you build equity and pay down your mortgage, you are investing in your future and creating a valuable asset that can support you.

Whether you're a first-time buyer or considering upgrading to a new home, National Homeownership Month celebrates the many benefits and joys of owning a home and RE/MAX Advanced Realty is here to help you achieve all your real estate goals. . Happy Homeownership Month!

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224