Homes were selling quickly a few years ago and receiving numerous offers that were significantly higher than their asking price. Customers seemed to be waiting in line at the door regardless of the pricing you set.

The housing market of today, however, is different. As inventory has increased, buyers are becoming more picky. Houses are remaining in place for a little while. Additionally, more vendors are being forced to lower their pricing.

How do you manage to win, then? Setting your home's initial price is the first step in the process. That is more important than ever today and has the power to make or break your business.

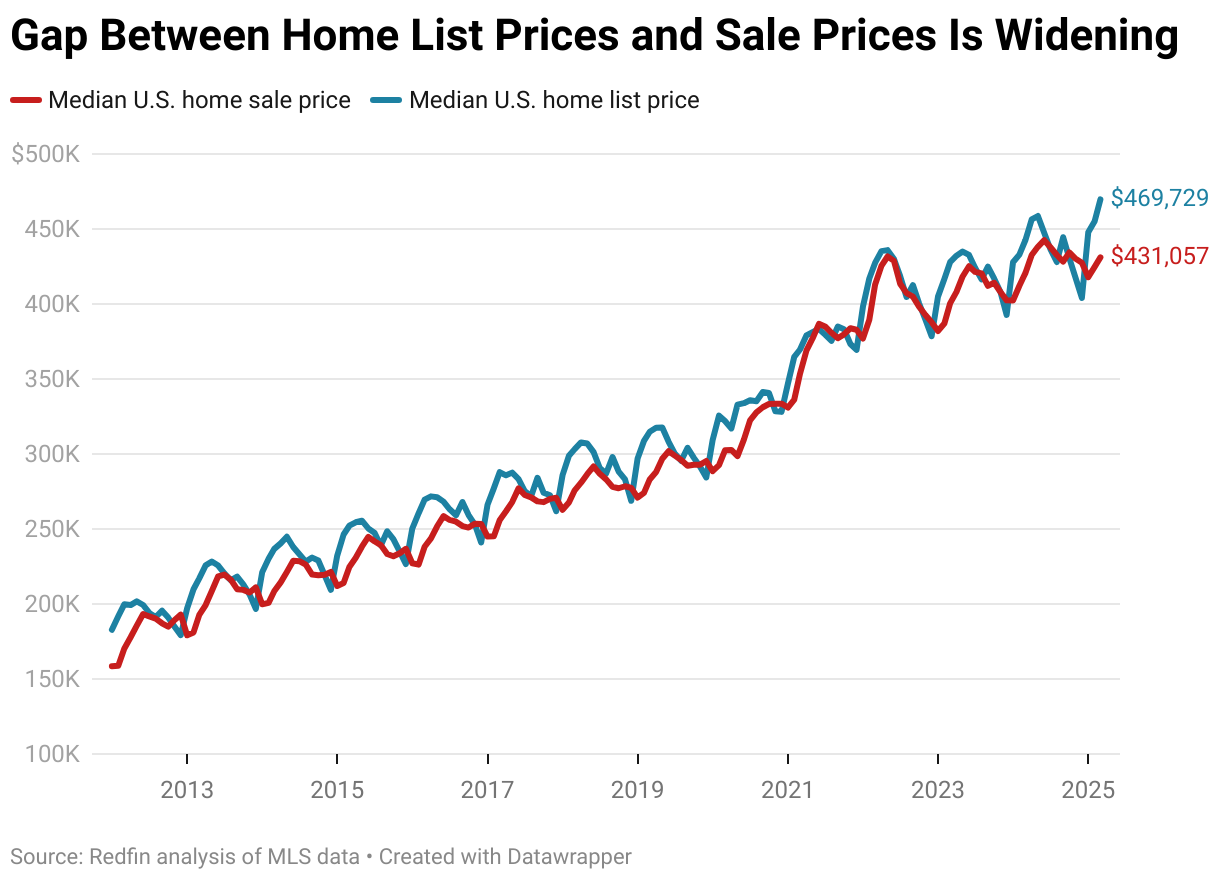

According to a recent Realtor.com survey, 81% of property sellers think they will receive at least their asking price. However, real sales data indicates that the difference between what buyers are ready to pay and what sellers expect is widening.

In actuality, 44% of recently sold homes sold for less than the asking price, according to an annual report from the National Association of Realtors (NAR). Additionally, before the house sold, one in three sellers had to lower their price at least once. It's an indication that expectations might not be entirely in line with the reality of today.

The Redfin graph below illustrates how asking prices (blue line) are increasingly higher than actual sales prices (green line):

This indicates that not all purchasers are prepared to pay the prices that many sellers are requesting. You can still sell for a high price, but you must start with a price that is in line with what buyers are prepared to pay in the current market.

Setting a high initial price for your home could seem like a good idea since it gives you more negotiating leverage. However, the truth is that a home that is too expensive may remain on the market and deter potential purchasers.

Buyers are intelligent. Upon seeing a house that has been abandoned for some time, they begin to question whether it is in good condition. Less interest, fewer showings, and ultimately a price reduction to get people's attention can result from that. In the words of Realtor.com:

Selling a house might be more difficult the longer it sits on the market.

If you price your home correctly, you still have a fantastic opportunity.

It's crucial to rely on an agent who is aware of local conditions when determining your asking price in order to avoid making this error.

The pricing sweet spot for your neighborhood will vary depending on where you reside, so your realtor will consider buyer patterns, inventory levels, and recent local sales.

It's also important to remember that throughout the last five years, property prices have increased by more than 57%. Therefore, you'll probably still be in a wonderful position financially even if you price a little lower than the amount you had in mind.

By working with a local real estate agent, you can increase the amount of interest in your home, prevent it from being on the market for too long, and increase the likelihood that you will receive a competitive offer.

The right pricing works in the current market. As Mike Simonsen, Founder of Altos Research, explains:

Final Note

Your selling opportunity hasn't altered, but the market has. You just need the correct pricing package. To find out what price will help your house sell quickly and for the most money, speak with a local real estate agent about current pricing in your neighborhood.

Whether you're craving a cozy retreat, a home filled with character, or a stylish modern escape, there's no better time to find a space where your heart truly belongs.

Your dream home is more than just a place to live—it's where memories are made, where laughter fills the rooms, and where every corner brings a sense of peace and comfort.

Imagine cozy evenings by the fireplace, lazy Sunday mornings with coffee on the porch, or hosting family gatherings in a space that feels just like you.

This February, fall head over heels for a new place to call your own. Browse through our featured listings, and discover a home that speaks to your heart, your lifestyle, and your future.

🏡 243 S Madison Ave, Greenwood | $2,399,000

Step into a piece of history with this iconic property. Originally built in 1850 and completely rehabbed to preserve its charm, this property offers nearly 2 acres in the heart of Old Town Greenwood. Perfect for an event center, bed and breakfast, or redevelopment, this is a rare opportunity to own a prime piece of land with unlimited potential.

🏡 11383 Sea Side Ct, Fishers | $824,000

A stunning 5-bedroom, 3.5-bath home in Bayview Estates, just steps from Geist Reservoir! Built for entertaining, with a spacious open concept, gourmet kitchen, and walk-out basement featuring a wet bar. Perfect for creating unforgettable moments with family and friends.

🏡 4104 W Fox Trl, Trafalgar | $549,900

For nature lovers, this custom-built home on 1.75 acres offers not just a home but a lifestyle. Enjoy full lake privileges, a cozy fireplace, and an expansive screened balcony—perfect for those seeking a peaceful retreat surrounded by nature’s beauty.

🏡 8836 Hornady Ct, Indianapolis | $425,000

This 4-bedroom home features stunning pond views, a spacious kitchen, and a fully finished basement. Ready for entertaining, with cozy family areas and plenty of room to host guests, making it the perfect backdrop for any occasion.

🏡 612 Reunion Ln, Greenwood | $424,498

A sun-filled 4-bedroom, 2.5-bath home with a vegetable garden, spacious basement, and warm, inviting character. This home offers the perfect mix of peaceful relaxation and entertaining possibilities—ideal for making memories.

Whether you're looking for more space, a fresh start, or the perfect cozy retreat, your dream home is out there—and we’re here to help you find it.

Don’t let the love month pass without taking the next step toward a home that truly fits your lifestyle.

If these listings aren’t quite what you’re looking for, let’s find the one that is.

We’re ready to create a customized home search and guide you every step of the way to make sure you find the perfect match.

📩 Let’s get started—tell us what you need, and we’ll help you find the home that checks all the boxes.

If you're one of the millions of individuals who hope to buy a house in the future, you've undoubtedly spent a significant amount of time browsing homes and pricing online and wondering, "How can anybody afford to buy a home in today's market?"

Given the recent spikes in both loan rates and property prices, it is sensible to ask this topic. Even in these difficult circumstances, however, there is a way forward, and with a little forethought and preparation, you may get closer to your goal.

Here are some pointers and techniques to get you there.

Make sense of what you can afford by using an affordability calculator.

You can determine how much you can afford to pay for a home based on your income, debts, and the amount of money you've saved for a down payment by using an affordability calculator, which is a terrific place to start.

With such data, you can find a price for a property that is inside your budget as well as the monthly costs associated with purchasing a home at that price.

Find out the most recent estimate of what you can afford in the market.

You can refine your estimate by using an affordability calculator to provide a more precise, up-to-date assessment of your purchasing power. Based on your inputs, such as your credit score, consider your unique financial situation along with the state of the market and mortgage interest rates. With that knowledge, you can decide more readily if a house you've got your eye on RE/MAX fits within your projected budget.

Find out how your debt affects a lender's decision to provide you with a mortgage.

It's useful to know how much debt you have before it prevents you from obtaining a mortgage to purchase a property because debt can be a dream-crusher. The lenders will determine the monthly mortgage payment by relying on your debt-to-income ratio (DTI) or the percentage of your monthly income.

Lenders can more accurately assess your ability to pay back your other recurrent debts and make timely monthly payments on a house loan if they are aware of this percentage.

To receive an estimate of the total cost to purchase a property in your price range, use a mortgage calculator.

If you think you know what kind of house you want or can afford, utilize a mortgage calculator to see how your monthly payment may vary based on your down payment amount and the current mortgage interest rates.

To find out more about your financial circumstances, become pre-qualified.

A lender can determine how much you can pay based on your credit score, assets, and self-reported income when you are pre-qualified.

Most lenders let you pre-qualify online without having an impact on your credit score. To narrow down your search to properties in your price range, you can provide your agent with proof of your pre-qualification.

Speak with a loan officer to learn how your affordability is affected by various mortgage alternatives.

Experts in mortgages and loan officers can assist you in determining your affordability by examining several financing possibilities. Whether you're just starting your search or have already located a house you want to put an offer on, they can also help you with the loan application process.

Additionally, they can guide typical problems, such as whether it's possible to purchase a home while having student loan debt.

Improve your credit score.

How much interest you pay on your mortgage is mostly determined by your credit score. You can be eligible for a reduced rate if your credit score improves, which will result in lower monthly payments throughout the loan.

credit score

Based on how long you want to live there, use the Rent vs. Buy Calculator to determine if you can afford a property.

Think about your plans and how buying a home might fit into them over the next few years. Purchasing could be more expensive than renting if you have another relocation planned shortly.

Work with a knowledgeable agent who can assist you in locating offers in your area and crafting the finest proposal.

Being familiar with the neighborhood real estate market and the relative worth of each house on the market makes your agent an invaluable asset. Purchasing a house is a team sport and your agent can assist you in finding a property and drafting an offer that takes into account the state of the local real estate market, the state of the property, and the seller's intentions to reduce the asking price.

Using a home search checklist, set expectations and make any necessary modifications.

An excellent place to start is by being clear about what you want and don't want in a home and community. When searching for a place to call home, utilize this printable house-hunting checklist to help you stay focused and organized.

Extend your search to encompass alternative housing markets that could present more attractive offers within your budget.

The cost of homes varies across the United States, so if you reside in an expensive location and have flexibility in where you live, you might want to look at areas where costs are more in line with your means.

RE/MAX provides a snapshot of the most affordable house prices each month by updating market data on key metro areas around the nation regularly. Check out local market trends to examine pricing trends, the percentage of homes selling at or below list price, the percentage of properties with price reductions, and the speed at which homes are selling in particular markets for comprehensive information on key metro areas.

Think of a fixer-upper.

If you can perform the work yourself or have the money to hire someone else, estate sales and older properties in need of renovations might be of value. You can even live in the house and gradually make changes if you have the time and resources.

Consider house hacking.

To help with mortgage payments, buyers are being more frugal with how they live in their properties and use them to make money. Certain individuals lease certain areas of their houses, including their backyards, garages, and swimming pools. Another option is to purchase a multi-family home, like a duplex, which would enable you to live in one unit and rent out the other.

Consider unconventional approaches to saving for a down payment.

According to Zillow, a growing number of buyers—including those who are adding down payment cash to their wedding gift registries—are using loans and presents from family and friends to purchase a property. Some purchasers reduced their spending.

Look into first-time homebuyer or low-down payment possibilities.

You might be qualified for down payment aid, depending on your circumstances and place of residence. Additionally, there are programs for first-time home buyers that let you make a smaller down payment; however, making a less than 20% down payment frequently necessitates obtaining private mortgage insurance, which raises the monthly payments.

Find ways to reduce the cost of purchasing, including any hidden expenses.

The type of home you buy may have a big impact on your expenses. For example, there are certain residences with high homeowner association dues that might increase your monthly expenses. Additionally, local variations exist in property taxes, which are determined by the value of the homes. When shopping, it helps to account for those expenses so you can determine whether you can save money by narrowing your search.

Are you thinking about relocating to Indianapolis? From a vibrant arts and culture scene to a wide range of suburbs and communities to fit any lifestyle, this vibrant city in the center of Indiana has a lot to offer.

But before you start packing your bags, you need to know what to expect when you move to Indianapolis. The good thing is, you don't need to go all over the Internet or ask around; we have compiled everything about the Hoosier state in this post so sit back, relax, and continue reading.

The capital and largest city of Indiana in the Midwestern United States is Indianapolis, also referred to as Indy. With over 800K residents, it is the 16th most heavily populated city in the US.

With a total area of over 372 square miles (963 square kilometers), the city ranks third in size among Midwestern cities, behind Detroit and Chicago.

With a rich history, a flourishing arts and culture scene, an abundance of open space, some of the state's largest parks, and a strong sports culture, it is a diverse and energetic city. It also has several distinctive neighborhoods.

Modern, recently constructed homes as well as antique homes with exquisite architecture are among the many different types of Indianapolis real estate available for purchase. Indianapolis has a median home price of about $200K and an average apartment rent of $1,155, both of which are less than the national average.

However, costs differ significantly based on the type of property and neighborhood. Single-family homes in highly desirable districts can command a premium price, while townhomes and condos in Indianapolis' high-rise structures are typically more reasonably priced. Additionally, coworking spaces might be costly. Among the most sought-after communities in Indianapolis are:

The cost of living in Indianapolis is comparatively low compared to other major American cities. Transportation, housing, and utility prices are lower than the national average. About $57,000 is the median household income, which is a little less than the national median.

Indianapolis is significantly less expensive than the state of Indiana when it comes to individual living expenses. For instance, grocery prices in Indianapolis are roughly 2% less than the state average.

Mortgage rates and rental prices are likewise quite low, albeit they are still more than in other Indiana areas. However, some costs, including entertainment and eating out, may cost more than the state average.

Students of all ages can choose from a wide range of educational alternatives in the Indianapolis area. There is no lack of elementary, middle, or high schools, and there are numerous public, private, and parochial school systems.

Serving more than 30,000 children in 70 schools, the Indianapolis Public Schools (IPS) district is regarded as one of the best in the state. There are numerous public charter schools and magnet schools with different curricula and programming.

Numerous colleges and universities are also located in Indianapolis. Among these are the University of Indianapolis, Butler University, Marian University, and Indiana University-Purdue University Indianapolis (IUPUI).

These respectable regional and national educational institutions provide a range of courses in fields like business, medicine, and the arts.

With different industries and national corporations guaranteeing a large number of job possibilities and a low unemployment rate, Indianapolis boasts a strong and diverse economy.

Eli Lilly & Company, Cummins Inc., Rolls-Royce, Salesforce, Infosys, and Indiana University Health are just a few of the major employers in the city. This indicates that there are lots of chances for professional advancement.

With several large automotive and aerospace businesses having a considerable presence and providing numerous job possibilities, manufacturing is an especially important industry in Indianapolis.

With numerous sizable hospital systems and medical facilities spread out around the city, the healthcare sector is also a significant employment. The technology industry is expanding quickly, as seen by the numerous startups and well-known tech firms that have opened headquarters in Indianapolis in recent years.

Indianapolis is well-known for various things, including its thriving arts and entertainment scene and its renowned motor race, the Indy 500.

Numerous famous sports teams and landmarks may be found in the city. Its distinctive personality is derived from these trademarks, which also improve the standard of living for both locals and tourists.

Due to its strategic location and easy access to major highways and interstates, Indianapolis is known as the "Crossroads of America."

It is a good starting place for road trips and travels throughout the Midwest because it is situated at the intersection of numerous important highways, such as Interstate 65, Interstate 70, and Interstate 74.

Indianapolis is also the location of the Indianapolis International Airport, which provides nonstop indirect direct flights to over 50 locations in the US and abroad.

Because of its strategic location and well-developed transportation system, Indianapolis is known as "Crossroads City," a center for the distribution, logistics, and transportation sectors.

Having a car is crucial if you're thinking about relocating to Indianapolis. You might be startled to learn that you need a car to travel and conduct errands if you're moving from New York City or another country. There are very few if any, pathways in the vast city of Indianapolis.

Furthermore, compared to certain other large metropolitan areas, the city's public transit system is not as well-established.

Many locals think owning a car makes daily mobility easier and more convenient, even if there are few public transportation choices, such as buses and a limited light rail system. This is particularly true if you have to commute to work or live outside of the municipal limits.

As previously stated, gridlock and traffic congestion are prevalent in Indianapolis because it is a "Crossroads City." The city has found it difficult to meet the needs of its transportation infrastructure as a result of an expanding population and rising commuter numbers. Longer commutes, more traffic accidents, and heightened annoyance among locals are the results of this.

The city is carrying out several projects, such as constructing additional bike lanes and pedestrian walkways, to enhance traffic flow and lessen congestion. However, since this is a continuous process, budget for your daily commute and be ready to sit in traffic.

One of the unique aspects of living in Indianapolis is being able to experience the four distinct seasons throughout the year. The city experiences pleasant spring and fall seasons, cold winters, and warm summers due to its humid continental climate.

Although there aren't many natural catastrophes in Indianapolis, be ready for the odd severe weather occurrence. During several seasons of the year, tornadoes, thunderstorms, and severe snowfall are all likely, so prepare for emergencies and keep emergency supplies on hand.

Many professional and collegiate sports teams call Indianapolis home, making it one of the largest sports cities. Major sporting events including the Super Bowl, the NCAA Final Four, and the Indianapolis 500 are held there every year, contributing to the vibrant sports environment. Among Indianapolis' best stadiums are:

The Indianapolis Colts (NFL), Indiana Pacers (NBA), Indianapolis Indians (MLB), and Indy Eleven (USL) are among the professional sports teams based in Indianapolis.

Additionally, there are several successful collegiate athletic programs, such as the Indiana Hoosiers and Butler Bulldogs. The hundreds of thousands of sports fans who congregate in the city each season will make you feel welcome if you're a sports enthusiast.

An annual motor racing event, the Indianapolis 500 takes place at the Indianapolis Motor Speedway in Indianapolis, Indiana. It's a distinctive and legendary event intricately linked to Indianapolis' character and culture.

The Indy 500 race, a part of the IndyCar Series and features fast open-wheel vehicles racing around a 2.5-mile oval course, is held on the Sunday before Memorial Day. It is a must-see for car racing enthusiasts.

Because of its rich and varied past, Indianapolis has acquired several nicknames over the years, each a unique facet of its personality and identity.

These include "The Circle City," "The Crossroads of America," "Indy," and "Naptown," all of which are referred to with affection by both locals and tourists.

Despite not being as well known as other American culinary hotspots, Indianapolis has quietly established a flourishing food scene that merits notice.

The city is known for its distinctive fusion of regional and global flavors, as well as its dedication to ethical sourcing and sustainability. Living in the city gives you access to a wide variety of dining alternatives and coffee shops, whether you're in Fountain Square or Downtown Indianapolis.

The flat topography, sometimes known as "The Flatlands," is one of the most distinctive features of Indianapolis and the surrounding area.

Indianapolis and the surrounding areas are nearly completely free of notable elevation variations, in contrast to other regions of the nation that are marked by mountains, hills, or valleys. This results in lovely grounds ideal for riding, strolling, and running.

Indianapolis offers many amenities and opportunities of a major metropolis while maintaining the feel of a small town. Indianapolis doesn't move as quickly as other large cities, despite having several cultural districts and a lot to see and do.

Additionally, crime rates aren't as high there. As a result, it appeals to those who wish to get away from the hustle and bustle of larger cities or who want a more relaxed lifestyle.

With abundant family-friendly facilities and events, Indianapolis is an excellent city to raise a family. There is always something to do in Indianapolis that is appropriate for both parents and children, from parks and playgrounds to museums and cultural events.

The city also boasts top-notch public schools that are frequently ranked among the best in the state. Families may feel more connected and supported because of the community's strength and compassion.

From little gift shops to enormous malls, Indianapolis is a shopping haven with a wide range of alternatives for customers of all interests and price ranges.

A variety of high-end designer labels, chain stores, and local shops can be found in the city's numerous sizable shopping malls, including the Fashion Mall at Keystone and the Circle Centre Mall.

Shopping in the city's unique neighborhoods is highly specialized and includes

With so many festivals and events all year long, Indianapolis is a festival lover's dream come true.

With carnival rides, live entertainment, interactive exhibits, and an abundance of food and drink sellers, some of the most well-liked events are the Indiana State Fair, Jazz Fest, Indy Music Fest, and Indy Pride Festival.

Throughout the year, several wine and beer festivals showcase regional wineries and breweries that carry both domestic and foreign brands.

A unique and vibrant weekly event, First Fridays takes place in the Fountain Square district of Indianapolis. It unites the neighborhood and honors regional skill and inventiveness.

The event offers live music, food vendors, beers on tap, and other activities in addition to the art exhibits, all of which contribute to the vibrant and joyous environment.

If you're interested in war history, you'll love Indianapolis, which has several war memorial monuments, such as the War Memorial Plaza, American Legion Mall, Vietnam War Memorial, and USS Indianapolis Memorial, which honor the sailors who died when the ship sank during World War II.

To assist you in making an informed choice, we have investigated and addressed a few frequently asked topics regarding relocating to Indianapolis.

Indianapolis is worth taking into consideration if you're searching for a reasonably priced city with significant job development, a welcoming atmosphere for families, and a thriving cultural scene.

With its diverse economy, rich sports heritage, lively festival scene, family-friendly atmosphere, and reasonably priced cost of living, Indianapolis is undoubtedly a great city to call home.

A family-friendly atmosphere, a diversified economy, a great sports heritage, a thriving festival scene, and an inexpensive cost of living are some advantages of residing in Indianapolis.

Generally speaking, a salary between $50,000 and $60,000 may support a comfortable quality of life in Indianapolis, though this varies in several circumstances.

Naptown is the moniker that has remained with Indianapolis because of its reputation for having a calm, relaxed vibe.

Examine the cost of living, employment market, educational system, and transit choices in Indiana before relocating. Indianapolis has a great sports history, a diverse economy, and a family-friendly atmosphere.

Yes, there is snowfall in Indianapolis, Indiana, throughout the winter months; on average, about 25 inches fall there each year.

A thriving festival scene, a rich sports history, a family-friendly atmosphere, and a diverse real estate market are just a few of Indianapolis' many attractions. It is a wonderful destination to visit, live, and work because of its distinct charm and personality.

You can get assistance navigating the complicated world of real estate transactions from a local real estate expert. They can assist you in making well-informed investment selections and provide insightful information about the local real estate market.

Speaking of real estate experts, our team at RE/MAX Advanced Realty is known for providing the best services in real estate, whether it's an inquiry about a home you want or actually buying or selling a home, we're just a message away!

Click this link to get started.

According to a 2022 survey, 78% of buyers utilized a mortgage to finance their house purchase, with 28% reporting being denied financing at least once before being granted. Qualifying for a mortgage can be difficult, so it's critical to do some preliminary planning to ensure a smooth closing process.

To maximize your chances of successfully qualifying for a mortgage, take some preliminary actions to get your finances in order. Here are some recommendations to help you prepare for the mortgage qualification procedure.

All home loans require a minimum credit score to qualify. Take the time to verify your credit score before beginning the qualification procedure to avoid surprises. It won't lower your score to check your credit.

If your score is lower than you thought, there are various ways to increase it, such as paying off credit card debt and increasing your credit limit. A credit counselor can also evaluate your credit with you and help you find strategies to improve it. Most localities also offer non-profit credit services. Avoid any firms that charge a fee to "make bad credit go away," or make similar promises.

In addition to monitoring your credit score, you should analyze your whole credit history. Once every 12 months, you are entitled to a free credit report from each of the three main credit bureaus.

Visit annualcreditreport.com to view your credit report. Pay particular attention to errors in your report, such as missed payments made on time or inaccurate account information. Credit reporting inaccuracies are widespread and can be rectified by submitting a request to each credit bureau. Because your credit report influences your credit score, it's vital to ensure it's correct before applying for a mortgage.

Your lender will also compute your debt-to-income ratio (DTI) as part of the mortgage qualification process, so know yours in advance.

The DTI ratio compares your overall indebtedness to your total monthly income. This helps lenders determine how much money is available in your monthly budget to repay your loan. To determine your DTI, sum up your minimum recurring monthly debt payments (such as credit card minimum payments and vehicle loans). Next, divide the total monthly loan payment amount by your gross monthly income.

It's a fantastic idea to make a budget and take a close look at your money when you're ready to apply for a mortgage. You should also prioritize down payment savings and learn about general savings tactics for other home-buying expenses.

Every mortgage has specific requirements that must be met. The most popular loan form is a conventional loan; other options include FHA loans, which are popular among first-time home purchasers; VA loans, which are available to veterans and military service members; and USDA loans, which are intended for rural areas. Additionally, there are special loans for investment properties and jumbo loans for homes that exceed conforming loan limitations.

Most lenders will consider your entire household income when determining whether to approve you for a specific loan amount to ensure that you are not taking on more debt than you can manage. This covers base compensation (either a salary or an hourly wage), commissions, bonuses, overtime pay, revenue from side jobs, self-employment income, and more. Except in cases where you're attempting to qualify for a USDA loan, there isn't an income cap necessary to be eligible for a mortgage. The only kind of mortgage that has income restrictions based on where the financed property is located is the USDA loan.

It is important to lenders that you have a reliable source of income so they can pay your mortgage each month. For the majority of loan kinds, two years of employment history are required. USDA loans only need a 12-month minimum work history, although the prior two years of employment history may still be examined by lenders. Depending on the kind of military service, VA loans can require borrowers to serve for a certain number of days. You will explain any gaps in your work history for all loan kinds.

The minimal credit score needed to be eligible for a mortgage differs depending on the kind of loan and the specific lender. In general, you'll get better loan terms and a cheaper interest rate the higher your credit score is.

A credit score of 720 or over is considered desirable for purchasing a home, although buyers with a score of 670 may typically still anticipate a reasonable rate.

To find out if you meet debt-to-income (DTI) requirements, your monthly gross income is compared to the entire amount of your monthly recurring debts. Every loan type has a maximum allowable DTI ratio that varies. A DTI of up to 50% may still be acceptable to qualify for a mortgage, although anything under 36% is usually regarded as favorable.

Try reducing your obligations by paying off high-interest credit cards and reducing the amount of balances you carry each month if your debt-to-income ratio is too high. Your combined debt-to-income ratio can be balanced by adding a co-signer with modest debt.

You might be able to contribute as little as 0% to 3% of the home's buying price, depending on the lending program. The median mortgage buyer contributed between 10 and 19% of the total purchase price, with somewhat more than half (58%) of mortgage purchasers reporting contributing less than 20%. The majority of mortgage applicants (63%) save money for a down payment over time.

VA and USDA are examples of government-backed programs that do not demand a down payment, while other loan types, such as second-home mortgages, have greater minimum requirements.

After deciding on the kind of loan you want to take out, you must collect the necessary paperwork. When navigating this to-do list, your loan officer or lender might be a useful resource.

You will need to present documentation of a reliable source of income. Pay stubs from the previous two months as well as two years' worth of IRS W-2 forms are often included. For military income and benefits, Leave and Earnings Statements (LES) are acceptable forms of documentation. Additional paperwork, such as tax reports and profit and loss statements, is needed for self-employed people.

To confirm your employment, your lender will get in touch with your company directly, therefore you will need to give them your name and phone number. They might also request copies of your most recent pay stubs and an employment verification letter.

Your lender may want documentation of your assets to substantiate your ability to pay the down payment and closing expenses. Mixtures, liquids, and non-liquids are conceivable categories for assets. An asset is deemed liquid if it can be quickly turned into cash, such as checking, savings, and investment accounts. A bank statement might be used as evidence of your liquid assets.

If you receive money as a gift, you might need to show documentation proving the giver did not borrow money from you and that the money was transferred into your bank account.

The liquidation of non-liquid assets is required before they can be applied to a down payment and closing expenses. Non-liquid assets are valuables you own and can sell for fair market value, such as art, cars, real estate holdings, and 401(k) accounts. Typically, a bill of sale and other supporting documentation are needed to convince lenders that you were paid. Liquidating before applying for a mortgage makes the qualification process considerably simpler, even though you can do it during the underwriting process.

You will be asked to present government-issued identification, such as a passport or driver's license, to verify that you are who you say you are. You can verify your name and birthday with a social security card and another type of ID if you don't have these forms of identification.

You should choose a lender that best suits your needs in terms of affordability, such as one that provides low interest rates, manageable monthly payments, and loan choices that are advantageous to you as the buyer.

You should also think about how comfortable you are and how much assistance each lender provides. For example, if you're a first-time home buyer, you might find it helpful to have a lender who takes you step-by-step through the mortgage application process. These are a few of the methods you will interact with lenders.

For the mortgage process, a pre-qualification or pre-approval is a helpful place to start. When you're ready to make an offer, you can get pre-approved after becoming pre-qualified as soon as you start your property search.

When you are pre-approved, you can compare rates, terms, and lender fees before choosing a particular lender or loan arrangement. If you're just beginning to consider getting a mortgage, the quickest and most straightforward method to find out how much you might be able to borrow is to get pre-qualified.

To properly begin the qualification procedure, you must submit a loan application. Usually, you can complete this online, and your lender can assist you in making sure you do it right. You can compare your options by applying for a mortgage with multiple lenders before deciding which one to work with.

You must complete the necessary loan application documentation with your selected lender to obtain a mortgage. You'll need a purchase contract and the property's address to accomplish this. Stated differently, you will finish this phase once you have negotiated a price with a seller and found a property.

You might have more questions about mortgages, and we're more than happy to help you with that. Comment your questions below or send us a message. For now, we have gathered the most often-asked queries regarding mortgage qualification.

You can be eligible for a mortgage as long as you fulfill the minimal requirements for the loan program and lender of your choice. Minimum credit score, maximum debt-to-income ratio, minimum down payment, income restrictions, and work history verification are a few examples of requirements.

The requirements are different from one lender to another, but in general, you'll need a stable job history, decent credit, a low debt-to-income ratio, and funds for a down payment.

Not sure if you can get a mortgage or not? One of the best things to do is to do a pre-qualification with a loan provider. There's no commitment or obligation when you want to pre-qualify; your credit score will not be affected as well. It can be a useful tool to estimate the maximum amount you could borrow. Not comfortable talking to a lender just yet? Calculate your approximate monthly mortgage payments.

History, mystery, and timeless charm are all interwoven within Indiana culture. This state encourages you to live in America's vibrant past, where the sounds of Abraham Lincoln's childhood explorations still echo through the fields and woodlands.

In these smaller, less well-known cities, you can enjoy a cup of coffee in the morning at a café that has been around for generations, stroll down brick-lined streets that pioneers once walked, or experience the silent excitement of an evening march under the stars, which brings back memories of a bygone era. Make sure to put these eight hidden jewels on your bucket list because the lakeside hideaways that border the hamlets surrounded by forests are not to be missed.

Due to its location in the scenic Brown County of South Central Indiana, this Nashville has established a reputation as a tranquil haven, in contrast to its namesake in Tennessee. Originally called Jacksonburg, the town was established in 1836 and evolved into the Brown County Art Colony, a haven for artists because of its breathtaking views, rustic elegance, and simplicity that still inhabits the town today.

The best season to visit Nashville is fall because the landscape's visual feast peaks during this season. Nature and regional celebrations like Halloween work together to saturate the town and its surroundings with vivid hues during this time of year, providing tourists with an amazing exhibition of natural and man-made creativity. The town is home to the Brown County Art Gallery, which has a sizable collection of local artwork that reflects the history and culture of the area.

The town's artistic appeal is enhanced by the Steele State Historic Site, which offers a close-up view of the life and work of a well-known Hoosier Group artist. With its log homes and artisan demonstrations, Pioneer Village provides a living history experience for people who yearn for a closer bond with the past. Nashville appeals to nature enthusiasts and art lovers since the Brown County State Park is conveniently located near the town center and offers a wealth of hiking, camping, and horseback riding options.

(Brown County Art Colony - browncounty.com)

(Brown County Art Colony - browncounty.com)

In Madison's vast Historic District, which is located along the picturesque banks of the Ohio River, more than 130 structures that bear witness to the city's rich architectural history are painstakingly conserved and listed on the National Register of Historic Places. The Lanier Mansion State Historic Site is a feature of Main Street, which takes tourists back in time.

One of the best examples of Greek Revival architecture in the Midwest, this estate was built in 1844 and provides guided tours that explore the region's rich history. The Madison Regatta, a world-class hydroplane speedboat race that turns the riverbank into a center of activity every July, adds even more life to the town's historical tale.

The town's well-preserved antebellum buildings and landmarks, such as the Shrewsbury-Windle House and the J.F.D. Lanier State Historic Landmark, which provides a window into 19th-century American frontier life, demonstrates its ongoing ties to its early history.

Clifty Falls State Park provides peaceful trails and stunning waterfalls ideal for unhurried exploration for individuals who enjoy the outdoors. Events such as the RiverRoots Music & Folk Arts Festival and the Madison Chautauqua Festival of Art not only spotlight local artists but also introduce guests to the vibrant local culture. These are packed into Madison's calendar for those who enjoy the arts.

(Lanier Mansion State Historic Site - wikipedia.com)

Shipshewana is a treasure trove of natural beauty and cultural legacy in addition to being a place to escape to a simpler way of life. The town's focal point is the Menno-Hof Amish/Mennonite Information Center, an essential educational resource that provides engaging tours and interactive displays that delve into the rich histories, values, and lifestyles in Amish and Mennonite communities.

Through these encounters, tourists might have a profound understanding of the community's commitment to tradition and simplicity, which are qualities that are becoming more and more uncommon in the modern world.

From May through September, the town also has the biggest flea market in the Midwest, offering a wide variety of products from regional craftspeople. From specialized delicacies to handcrafted objects that are not unique but also represent Amish craftsmanship.

Take a trip along the Pumpkinvine Nature Trail to discover Indiana's vast natural surroundings. This picturesque trail, which winds through verdant fields and forests that change with the seasons and provide vivid displays of color and animals, provides a close-up look at Indiana's pastoral beauty.

The town's attraction as a peaceful retreat is heightened by the surrounding Shipshewana Lake Park, which provides opportunities for fishing and quiet introspection by the water.

Shipshewana's natural beauty and slow-paced lifestyle make it an unspoiled destination, whether you choose to bike along the paved paths, explore the local market, or take a leisurely carriage ride.

(Menno-Hof Amish_Mennonite Information Center - visitshipshewana.org)

New Harmony, one of America's daring social experiments, is a testament to the dream of living in a perfect, utopian setting.

With its exquisitely preserved buildings and common areas, New Harmony, which was first founded by the Harmonie Society in 1814 and later modified by Robert Owen into a model of equality and communal life, provides a window into a singular historical narrative.

The town's design not only pays homage to its history but also exudes a contemporary charm that encourages tourists to stroll around with its cobblestone streets and brick walkways.

Notably, the Roofless Church, created by architect Philip Johnson, offers a barrier-free space for worship exposed to the sky above and perfectly embodies the town's spirit of transparency and introspection.

New Harmony has a unique combination of natural beauty and historical richness because of this as well as the tranquil Wabash River, which provides peaceful picnic areas and strolls along its banks.

It is home to barely 700 people celebrating and retaining its German history through lively local celebrations like the yearly Oktoberfest and Kunstfest, which turn the town into a bustling center of cultural interchange every fall.

Both tourists and academics interested in learning about this small community's history and culture are drawn to these events because they provide a sample of local customs and crafts. The town's reputation as a tranquil getaway is further enhanced by the positive reviews given to the New Harmony Inn and other nearby lodging establishments for their friendliness.

(New Harmony - wikipedia.com)

Established within the bustling Wabash and Erie Canal, Roanoke was a crucial port for barge captains traversing the vast waterway between the Ohio River and the Great Lakes.

Due to the well-preserved architecture from its early years, Roanoke has kept its historical appeal. The town's village-like atmosphere and architectural legacy entice tourists to explore its streets, where history comes to life and becomes visible.

A distinct sense of place that is becoming more and more uncommon in contemporary metropolitan areas is fostered by the town's commitment to preserving its original buildings and layout.

The lively community and the pride with which they uphold their historical traditions demonstrate how the area has grown from a minor lock halt to a flourishing small town. Roanoke is a calm haven for people who value the elegance of the past combined with the peace of small-town life. Not only is it physically preserved, but it also embodies the ethos of a town that cherishes its history and the slower pace of life that enables locals and tourists to genuinely interact with one another and history.

(Roanoke - discoverroanoke.org)

The center of Zionsville's charm is Main Street, which features charming brick pavement bordered by distinctive stores, art galleries, and welcoming cafés that encourage slow exploration.

Visitors are immersed in a scene that combines authentic historical details with lively local life as they meander along this welcoming boulevard. The town's appeal as the ideal setting for weekend retreats or tranquil day outings is increased by the well-preserved medieval structures and profusion of urban trees.

A delightful walking experience is also provided by the Traders Point Eagle Creek Rural Historic District, which highlights the town's dedication to conserving its architectural legacy while offering a verdant, natural environment that promotes outdoor recreation.

The annual Zionsville Fall Festival and the Christmas in the Village parade are highlights of the town’s social calendar, delivering a taste of local customs and festive cheer. These activities, coupled with the weekly Zionsville Farmers Market, give opportunities for visitors to indulge in local vegetables and artisan products, supporting the small-town economy and building a feeling of community involvement.

With one of the biggest collections of antique fans in the world, the oddball AFCA Antique Fan Museum offers an interesting distraction for anyone with specialized interests.

The Auburn Cord Duesenberg Automobile Museum, the city's main attraction, is more than just a collection of old vehicles; it is a celebration of Auburn's crucial role in the American auto industry.

Auburn, known as the "Home of the Classics," offers an untouched piece of Americana. The museum, which features the opulent Cord and sophisticated Duesenberg models, is housed in the Auburn Automobile Company's original Art Deco headquarters and is a veritable gold mine of the automotive inventions that defined an age. These well-known companies perfectly capture the glitz and inventiveness of early American automobiles. Visitors may get a deep look into a bygone age of luxury and flair thanks to Auburn's commitment to conserving this heyday of automobile design and the museum's stunning architecture.

Additionally, Auburn's yearly Auburn Cord Duesenberg Festival serves as a showcase for the city's thriving community. Every summer, this well-known occasion turns the city into a bustling center of parades, vehicle exhibits, and auctions honoring its rich automotive heritage. Visitors are treated to a picturesque setting created by the festival and the town's many other historical attractions, including the Neoclassical DeKalb County Courthouse.

With its charming shops and historic landmarks, such as the Auburn Community Mausoleum and the Eckhart Public Library and Park, the city's walkable downtown further encourages exploring. Auburn is the perfect place for people looking for both historical depth and relaxed appeal in an untouched environment because of its exceptional ability to combine its vibrant automobile culture with easily accessible, pedestrian-friendly metropolitan areas.

(Auburn Cord Duesenberg Automobile Museum - automobilemuseum.org)

The first state capital, Corydon, is now a treasure. The historic significance of Corydon, which is only 25 miles west of Louisville, Kentucky, is evident in its well-preserved downtown area, which is on the National Register of Historic Places.

Visitors can explore several noteworthy locations here, including the Constitution Elm Memorial, the Kintner-McGrain House, and the Old Capitol, which was the state's government center from 1816 to 1825.

From Corydon's early 19th-century beginnings to its involvement in the Civil War, each landmark contributes to the city's rich history. The town is also bustling with cultural events that reflect its history, such as reenactments of the Battle of Corydon, the only Civil War battle known to have taken place in Indiana, and customs like the Halloween Parade and Friday night band concerts that bring tourists into the town's sense of community and historical pride.

Adventurers can enjoy hiking, horseback riding, ziplining, and mountain biking at the Harrison-Crawford State Forest and O'Bannon Woods State Park, two state parks and natural reserves that are accessible from the town.

The longest cave system in Indiana, Indiana Caverns, as well as other well-known caverns including Wyandotte Cave and Squire Boone Caverns, are located in Corydon, providing spelunking enthusiasts with some of the best spelunking experiences in the Midwest. The town's historical charm and these natural features combine to make for an engaging combination of education and adventure.

(Harrison-Crawford State Forest - discoversouthernindiana.com)

Which of these small towns have you been to or are planning to visit? We'd love to hear your thoughts in the comments!

When selling your home, timing is crucial. Although spring and summer are often the busiest times for house sales, October still presents a distinct set of opportunities and difficulties.

However, is it really a wise decision to sell your house in the fall?

To help you with this, we've gathered all the pros and cons and other necessary details you need when listing your home during this time of year.

The fact that purchasers are typically more serious is one of the main advantages of selling in the fall. At this point in the year, buyers are frequently keen to get a deal before the holidays or the new year. These driven customers are more inclined to act quickly, which could lead to a quicker sale.

The real estate market tends to cool off in the fall, as opposed to the spring and summer. Your property is more likely to stand out when there are fewer houses for sale. For sellers hoping to draw in serious purchasers, this decrease in competition might be a big benefit.

Beautiful curb appeal is naturally complemented by the fall season. Cooler weather and the rich hues of fall foliage may create a welcoming and comfortable house atmosphere. Your home's overall appeal can be improved during this time with small details like warm lighting, seasonal decorations, and a well-kept yard.

You might discover that you have more negotiating power because there are fewer houses for sale. Given their restricted options, buyers in the fall might be more accommodating with bids. Better terms and conditions for your sale may result from this.

There are often fewer buyers searching in the fall, even though they could be motivated. Your pool of possible purchasers may be reduced because many are busy with back-to-school activities, impending holidays, and winter preparations.

Depending on where you live, the fall weather can be erratic and possibly start to snow before your house sells. The presence of rain, wind, or chilly weather can dissuade potential buyers from viewing your home by making open houses and showings less inviting.

There may be less natural light available during showings because the days are shorter in the fall when daylight savings time ends. Potential buyers could not fully appreciate your home's best qualities if they are visiting in the evening or after work. To make up for the shortened daylight hours, make sure your house has adequate lighting.

As the fall season moves into the holidays, many shoppers shift their attention to family gatherings, holiday shopping, and travel arrangements. This might cause delays in decision-making, with some consumers waiting until after the holidays to make a purchase.

Here are some pointers to think about to increase your chances of a successful fall house sale:

Take advantage of the fall season by arranging your house to create the warm, inviting ambiance that prospective buyers frequently seek at this time of year. Warm colors, comfortable textures, and seasonal décor can help prospective buyers picture themselves living in your house and make it feel welcoming.

Your yard may suffer from falling leaves and colder temperatures. Be sure to maintain a clean and debris-free yard. To make a visually appealing façade that attracts buyers, rake leaves, trim bushes, and think about adding fall flowers.

Setting your home's price correctly from the start is critical because there are fewer buyers on the market. Together with your real estate agent, determine a fair price for your house based on current market conditions. In the fall market, overpricing may make your house sit on the market for longer than anticipated.

Due to their hectic schedules, buyers might not be able to visit homes as often in the fall. To draw in more buyers, be adaptable with showings, provide virtual tours if you can, or allow weekend and nighttime visits.

Bottom Line

Selling a home in the fall has its own advantages and disadvantages. Those who are looking for properties are frequently more driven to close before the holidays, even if there may be fewer buyers on the market. Additionally, you may benefit from less competition, which helps your listing stand out easily.

However, if you want a quick sale, it might be hampered by inclement weather, shortened days, and holiday diversions. You may maximize the fall real estate market and possibly secure a successful sale by being aware of these elements and preparing your house appropriately.

As always, we're more than happy to assist you whether you're buying or selling a home in the fall. Just leave a comment or email us at dennis@indyhomepros.com today!

Every seller wants to sell their home as soon as possible, for the best price, and with the fewest hassles. Likely, you're not much different.

However, did you realize that the asking price for your house is one of the main factors that could put your success in jeopardy? One of the most important aspects of selling your home is setting a fair price.

So how can you tell if you're falling short? Here are four indications that buyers may be turned off by your high asking price, along with the reason why consulting your real estate agent is the best course of action.

A lack of showings is one of the most obvious indicators that your home might be overpriced. It may be a glaring sign that the pricing isn't what buyers are expecting if it's been on the market for a few weeks and very few people have gone to look at it, or worse, you haven't had any bids.

Since long-term buyers can quickly identify—and discount—a home that appears to be overvalued.

You may rely on your real estate agent's experience to guide you through this process and get advice on potential strategies to attract more buyers, such as lowering your asking price.

You might need to change directions if the remarks from the prospective purchasers you do have after the showings aren't too positive. Remarks from viewings are a crucial component of knowing how potential buyers view your home.

If customers frequently comment that it's too expensive in comparison to other properties they've visited, you should reevaluate your pricing approach.

For you, your realtor will compile and evaluate this input so you may see how your home compares to others on the market. To better support your asking price, they can also recommend staging adjustments or particular enhancements, or they can suggest one that is in line with what buyers demand these days.

As the National Association of Realtors (NAR) explains: “Based on all the data gathered, agents may make adjustments to the initial price recommendation. This could involve adjusting for market conditions, property uniqueness, or other factors that may impact the property’s value.”

In the end, this lack of interest will cause it to remain on the market without receiving any significant bites. Buyers are more likely to have concerns about it and wonder whether there is a problem with it the longer it remains on the market.

A lengthy listing duration indicates that your home is stale, which makes it even more difficult to sell, especially in the current market with rising inventory.

In addition to showing you what strategies have worked for past sellers, your real estate agent can offer you insight into how quickly other homes in your neighborhood are selling. In this manner, you can jointly determine whether there is anything you would like to change.

According to a Bankrate article: “Check with your agent about the average number of days homes spend on the market in your area. If your listing has been up significantly longer than average, that may be a sign to reduce the price.”

This is the final one to be cautious with. Similar homes in the neighborhood selling more quickly than yours are a dead giveaway that something is wrong. This may be the result of factors like antiquated features, a less appealing location, or a lack of updates -- or simply because the price is too high.

Your realtor will inform you of any changes necessary to make your home more competitive, as well as information about your competitors. They'll provide guidance on minor improvements that can improve the curb appeal of your house or how to modify your approach to take into account the current state of the market.

Pricing your home correctly is crucial, and a realtor is your best ally for getting it right. Here's why:

With a realtor's expertise, you can confidently price your home to sell fast and at the best value.

Appropriately pricing a house is a combination of science and art. It requires a thorough comprehension of consumer psychology and the market.

Your agent is the best person to consult when the price isn't attracting buyers for advice on what to do next.

And when you want the best, our team at RE/MAX Advanced Realty is one call away. Dial 317-316-8224 so we can assist you today!

For those who have started to browse our website on homes for sale, as well as properties in the surrounding area, there are massive advantages to viewing homes that you are considering in person. Although virtual tours and online profiles can provide exceptional detail regarding the homes you view, they cannot reveal everything. Instead, getting an up-close look at a single-family house or luxury townhome can paint a picture of what it would be like to live on the property.

You have two choices for in-person property viewing: private tours and open houses. Each has its own set of advantages and disadvantages. To help you know which suits your current needs, we've provided the main pros and cons below.

PRO: You'll be able to see the neighborhood up close

The chance to tour the area is one of the key benefits of going to an open house. Realtors frequently invite neighbors and other community members to open house events.

This allows potential buyers to interact with possible neighbors and obtain unbiased perspectives about what it's like to live in the community. The number of residents who attended but are not interested in purchasing the property can vary depending on the area's size and layout. There is very little likelihood of meeting your new neighbors on a private tour.

There's freedom to come and go during the designated event times at open houses. You are free to take a break, go for a tour of the area, and then return to speak with the realtor. On the other hand, private tours are by appointment only, therefore this is not a possibility.

CON: The event can be super busy

There are advantages to meeting possible new neighbors, but there are drawbacks to large gatherings. This is particularly true for properties in high demand since they can draw dozens of potential buyers to a single open house.

Private tours are frequently the better option if you are someone who doesn't like crowds. On the other hand, if a private tour isn't offered for a certain house, make an effort to go to weeknight open houses. These only draw serious purchasers and are typically less crowded than weekend open houses.

PRO: No pressure to make an offer

Attending an open house is a low-stress endeavor. There are a lot of people there, so it's easy to come and go without getting seen (if desired). You can feel much less anxious about the scenario because you do not receive the personalized attention that you would in a private tour.

This is particularly beneficial for those who are just beginning the home-buying process and are unsure of their future residence. You made up your mind not to like the house? Not an issue. There will be many other people there who will probably fall in love with the property.

Ask questions as they come up during your self-guided tour, which you can take at your own speed.

PRO: Receive one-on-one attention the entire time

When it comes to house tours, are you the type of person who prefers a more exclusive, posh experience? Making reservations for private property visits is, without a doubt, your best option.

You will have one-on-one attention from an agent the entire time your reservation is made. You can ask as many questions as you'd like, and there's no danger of getting lost in the crowd. To increase your chances of having your offer accepted while you are contemplating a home, it is essential to arrange a private tour.

If you don't like the feeling of being rushed, private tours offer a laid-back setting where you can examine each area at your leisure, pose questions, and get a sense of the overall design.

In the end, choosing a proactive tour will help you feel less stressed during this hectic period of your life. During a private tour, a professional real estate agent will never make you feel rushed or constrained by their schedule.

Cons: Not ideal for first-time homebuyers

Have you just started looking for a place to buy? If so, there's a chance you don't currently have an agent you can work with to arrange a private trip. You need to make an appointment with an agent for a private home tour before you are allowed to visit the property.

Taking a personalized tour could seem like a high-pressure commitment, even if you have an agent already. People who are just beginning the process of becoming homeowners might want greater liberty and flexibility to come and go as they choose, without having to respond.

Pro: Establish a connection with your realtor

Having the chance to get to know your realtor is just another fantastic advantage of setting up one or more private visits. You can begin establishing a rapport with your selected real estate agent after just one trip.

This will help your realtor understand your tastes and personality better, which will ultimately help them choose the kind of house you are most interested in. You will consequently be matched with your ideal Indiana home faster.

If you're looking for the best realtor in your area, we have one for you! Just let us know where you're from and your concern -- buying or selling a home and we'll guide you.

Leave a comment or send us an email to get started: dennis@indyhomepros.com

The housing market in Central Indiana for September 2024 shows a mixed yet steady landscape compared to the same period last year. According to data from MIBOR BLC®, the median sales price remained unchanged at $300,000, reflecting stability in home values across the region. While this price point held steady year-over-year, it did show a slight decline from August, signaling a brief pause in upward trends observed earlier in the year.

Sales Activity and Inventory Shifts

Closed sales saw a modest uptick compared to September 2023, indicating continued buyer interest despite market fluctuations. New listings, however, experienced a small dip, suggesting that fewer homes were being put on the market as sellers may be taking a more cautious approach. This decrease in new inventory, paired with relatively steady prices, points to a market where demand is still robust but options for buyers are slightly more limited.

County-by-County Breakdown

In a closer look at county data, many areas in Central Indiana saw notable shifts:

What’s Ahead for the Market?

According to MIBOR CEO Shelley Specchio, favorable mortgage rates have fueled buyer interest since the start of the summer, with the market showing signs of resilience. However, recent economic reports suggest continued unpredictability in the months ahead. As mortgage rates adjust based on broader economic factors, potential buyers and sellers will need to remain agile.

The market's path toward more favorable conditions remains in flux, but with inventory slowly increasing and demand holding steady, the outlook for Central Indiana real estate remains cautiously optimistic as we approach the end of 2024.

For more detailed insights or personalized market advice, reach out to RE/MAX Advanced Realty's local experts to guide you through the current housing trends in your area.

8313 W. 10th St

Indianapolis IN 46234

dennis@indyhomepros.com

317-316-8224